While the Coronavirus pandemic has been a disaster for many businesses and a huge inconvenience for most others, there are undoubtedly some companies to whom the crisis has presented an opportunity. Amazon, Netflix and Clorox immediately spring to mind as winners in the Coronavirus economy. Slack Technologies is another such company.

With so many employees forced to work from home, many remote worker solutions are enjoying an unprecedented boom, and Slack’s smart collaborative platform definitely falls into that category. But does this popular Software-as-a-Service innovation have the potential to be a long-term success?

This guide will explain how to buy Slack stock, take a look at the best stockbrokers and consider the Tech company’s prospects going forward.

On this Page:

Where to Buy Slack Stock

If you want to invest in Slack Technologies (WORK) stock, we recommend creating a stock account with one of our recommended brokers. If you’re outside the United States, select eToro. If you’re inside the US or Canada, choose Stash Invest.

”1.

” image0=”” pros1=”800+ stocks to buy outright or trade as CFDs” pros2=”Beginner-friendly stock trading platform” pros3=”0% commission on stock trading” cons1=”$5,000 account minimum for CopyPortfolios” cons3=”” cta-label=”Visit eToro Now” cta-url=”https://insidebitcoins.com/visit/etoro-stocks” disclaimer-text=”75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.” paragraphCount=”1″]

Should I Buy Slack Stock? Points to Consider

Before you buy Slack stock, or other stocks like Microsoft stock, we always recommend making sure you have a sound understanding of the investment you’re making. Taking a closer look at the company fundamentals and researching historic price movements and forecasts can help you decide whether it’s the right stock for you. Here are a few points to consider when buying and selling Slack stock.

Slack business model and share price history

Slack’s name is an acronym of the rather less snappy ‘Searchable Log of All Conversation and Knowledge’. It first emerging in 2013 as an internal communications system developed by Stewart Butterfield for his former company, Tiny Speck. It set out to allow users to create collaborative channels that can be set up for different projects and teams. It also integrates stock trading apps, of which there are already thousands, that can be used to improve productivity and communications in numerous ways.

It proved to be a rapid success, attracting 8,000 users within 24 hours of its launch in 2013. By February 2015, 10,000 new daily active users were signing up each week and the platform boasted more than 135,000 paying customers. That year, Slack reached 1 million “simultaneously connected” users. By March 10th 2020, that figure had grown to 10 million. One week later it had leapt to 11 million, then 12.5 million the following week. It’s clear to see the impact of the Coronavirus pandemic on Slack’s userbase.

To get an idea of Slack’s profitability – a question that has troubled the markets – we can look at its fiscal year fourth quarter 2020 results, released on March 12th. Slack’s revenue grew 49% year-over-year to $181.9 million, while calculated billings grew 47% year-over-year to $254.7 million. The signs are encouraging; it has gained 25% more paying customers and subscription-based revenue topped $630 million for its most recent fiscal year, up 57% on 2019.

Slack’s biggest challenge is perhaps the competition it faces from Microsoft Teams, which launched in 2017 and closely resembles Slack (which Microsoft considered buying for $8 billion). However, Slack has the advantage of superior customization which should enable businesses to create a more bespoke solution than Teams is likely to allow.

Slack stock dividend information

Slack doesn’t currently pay shareholders a dividend and it isn’t clear if there are plans to do so in the future.

Slack stock forecast and prediction

The average 12-month stock forecast according to 23 Wall Street analysts is $28.95, this represents an 8.94% increase on the current price of $26.58. The consensus is that WORK is a buy stock, but only just.

Of those analyst ratings, there’s currently 1 sell rating, 9 hold ratings and 13 buy ratings, with a high target price of $44.00 and a low target of $14.00.

How to Buy Slack Stock from eToro

Providing you have a funded online broker account, follow these simple steps to buy Slack stock on our recommended stockbroker, eToro.

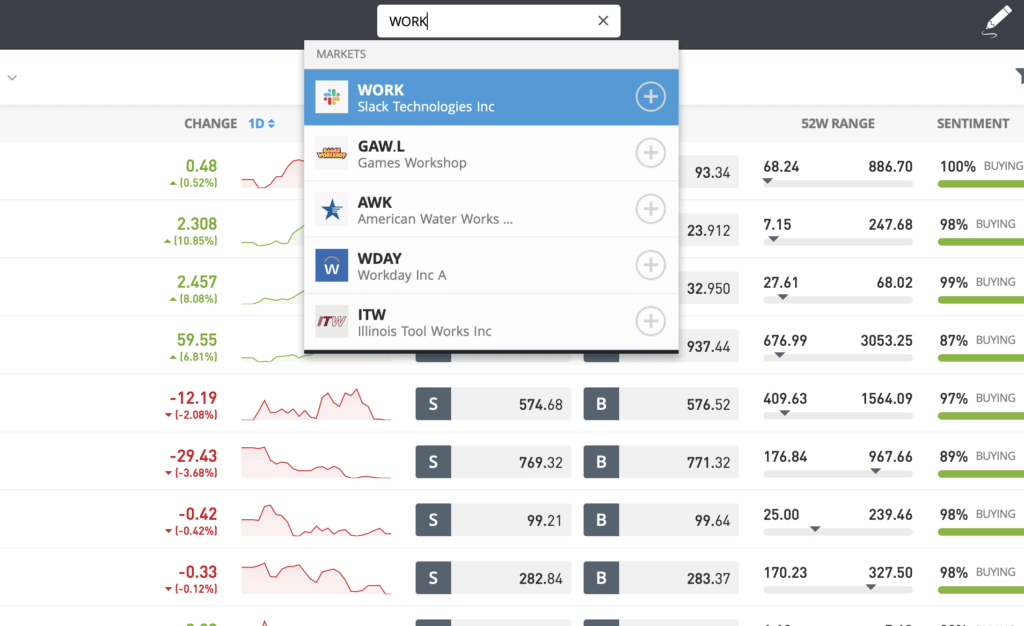

Step 1: Search for Slack (WORK) Stock

Look up Slack by typing the ticker symbol WORK into the search box.

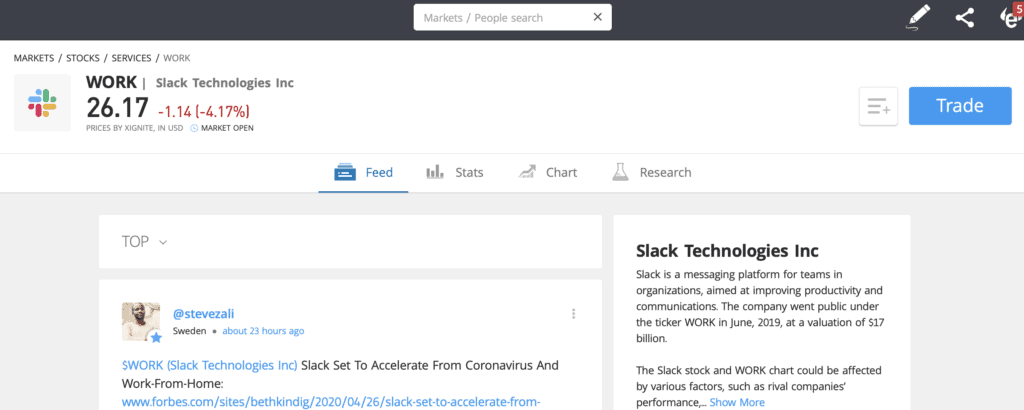

Step 2: Click on trade

Click Trade in the top right corner of the Slack page.

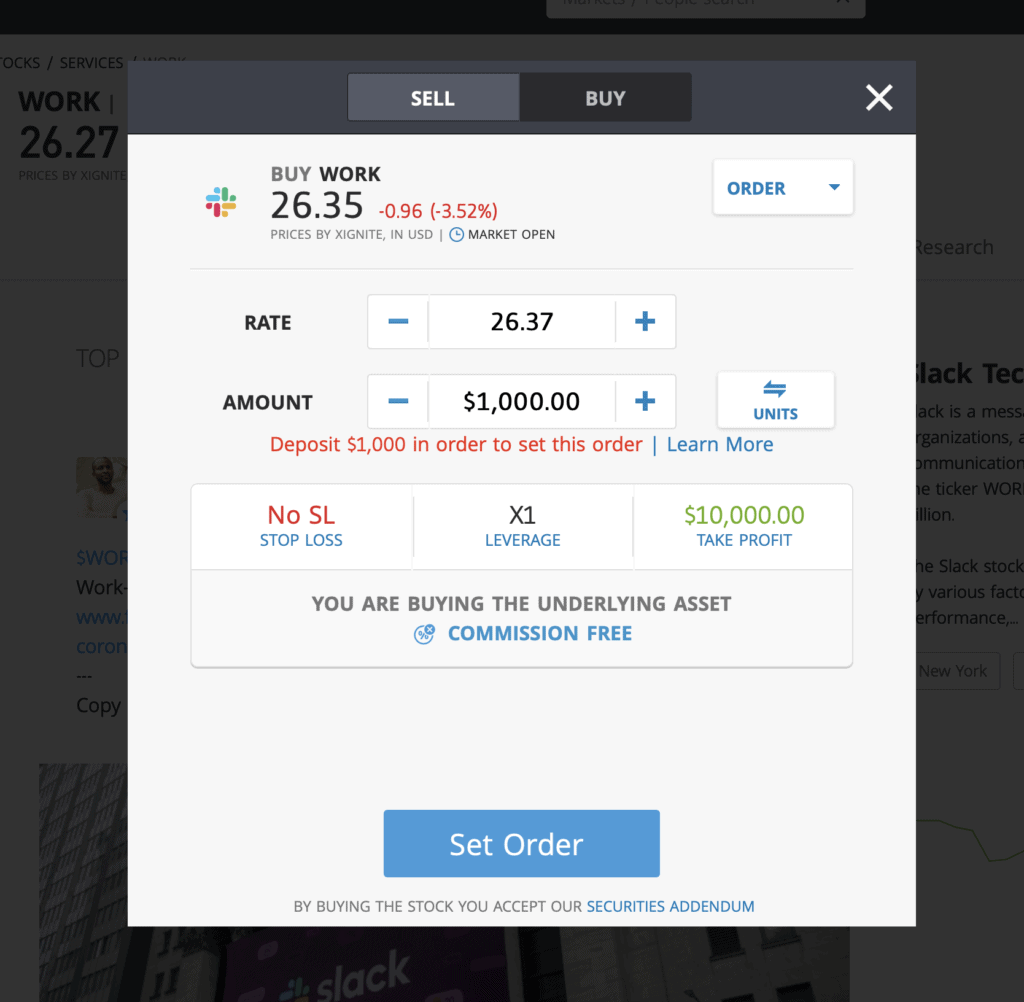

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. If you want to trade Slack CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Slack Shares – Final Thoughts

There are good reasons to have reservations about Slack. Direct competition with Microsoft’s Teams platform presents a sizable obstacle and the company still isn’t profitable, despite significantly increased customer growth and revenue this year.

But it’s worth keeping in mind that profit was never likely at this stage. We’re encouraged by the progress Slack has made and the number of businesses that have made it integral to workplace communication. This type of platform looks like the future and Slack has a very good chance of maintaining its position as a market leader.

If you want to buy Slack stock, simply sign up to one of our recommended online stockbrokers to get started. If you’re not in the US, then we advise going with Toro. For US stock traders, we suggest you create a Stash Invest account.

Read more:

FAQs

Should I buy Slack stock or wait?

All things considered, we think Slack is a buy stock right now and, on balance, analysts seem to agree.

What are the fees when buying Slack stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy WORK stock.

Is there a Slack stock price prediction?

23 Wall Street analysts have given WORK an average 12-month target price of $28.95, an 8.94% increase on the current price of $26.58.

What does the Slack stock dividend pay?

Slack doesn’t currently pay a dividend to shareholders.