Propelled by strong demand for its Ryzen CPUs and Radeon GPUs, Advanced Micro Devices (AMD) has been riding high in recent years. Indeed, in 2019 the Silicon Valley-based semiconductor company was the best performer on the S&P 500 Index.

While AMD continues to perform well and eat into Intel’s market share, a recent outlook statement dimmed expectations somewhat, anticipating diminished consumer demand in the second half of 2020. Nonetheless, while the realities of the post-pandemic market are reflected in AMD’s conservative forecast, the company has performed extremely well over the last 12-months and certainly warrants consideration.

This guide will explain how to buy AMD stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy AMD Stock

If you’re looking to invest in AMD, we recommend creating a stock account with one of our recommended brokers. For traders outside the United States, our recommended choice eToro. If you’re inside the US or Canada, we recommend you go with Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

Having launched in 2007, eToro has built its success on an innovative social trading platform and is now one of the world’s leading online stockbrokers. Combining slick, approachable UX with high end functionality and a comprehensive choice of trading methods. In our eToro review it meets the needs of both rookies and seasoned traders.

If you’re looking to invest in AMD, eToro offers a variety of options. You can choose to purchase the underlying asset by opening a long position, or take advantage of eToro’s CFD trading option. This opens up the possibility of opening a short position if you think AMD’s price is set to drop and adding leverage to your trade to increase its value.

eToro’s pricing is very reasonable – there is no commission or stamp duty on stock purchases. It's also a regulated platform with a host of licenses from the likes of ASIC, CySEC, and FCA, which should leave you in little doubt that you’re in safe hands.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy AMD Stock? Points to Consider

Whether you’re buying AMD or other stocks, such as NVIDIA stock, we always recommend taking a closer look at the company fundamentals, historic price movements and forecasts before you invest any money with an online stockbroker.

AMD business model and share price history

AMD comprises two principal segments: The Computing and Graphics segment and the Enterprise, Embedded and Semi-Custom segment.

The Computing and Graphics segment includes desktop and notebook processors and chipsets, discrete GPUs and professional graphics. The Enterprise, Embedded and Semi-Custom segment includes server and embedded processors, semi-custom SoC products, development services, technology for game consoles and licensing portions of its intellectual property portfolio.

The last few years have seen, AMD’s revenue climb consistently, putting a sizable dent in Intel and Nvidia’s market share and helping the company become the best performer on the S&P 500 Index in 2019.

AMD’s total revenue crept up from $5.25 billion in 2017 to $6.73 billion in 2019, driven largely by the impressive sales of its Ryzen and Epyc processors. Indeed, AMD’s recent success owes everything to its Computing and Graphics segment, which contributed $1.44 billion in revenue in the first quarter of 2020. Other areas of the business were less impressive – Enterprise, Embedded and Semi-Custom revenue was $348 million, down 21% year-over-year.

AMD overperformed ahead of the Coronavirus crisis and benefited from increased demand for computers among home workers in the early stages of the pandemic. Consequently, there was plenty of anticipation leading up to the chipmaker’s April 28th earnings report. The results were solid, matching estimates, but the outlook was somewhat underwhelming, falling below analyst predictions in anticipation of tough market conditions in the second half of the year.

Lisa Su, AMD CEO, explained the uncertain forecast: “While demand indicators across commercial, education and data center infrastructure markets are strong, we expect some softness in consumer demand in the second half of the year depending on how overall macro-economic conditions evolve.”

While AMD’s earnings continue to meet expectations, the lackluster forecast resulted in a 4% fall in AMD’s stock price.

AMD stock dividend information

Unlike most of its peers in the semiconductor sector, AMD doesn’t pay a dividend or buy back stock.

AMD stock forecast and prediction

AMD’s cautious outlook for the second half of 2020 has dampened enthusiasm for this stock and most analysts seem to regard it as more of a hold than a buy right now.

The median 12-month forecast of 34 analysts, as reported by CNN, is $52.75. This represents a 5.01% decrease on AMD’s current price of $55.53 (28/4/2020). The highest estimate was $66.00 while the lowest estimate was $8.00.

How to Buy AMD Stock on eToro

Assuming you have a funded broker account, follow these simple steps to buy AMD stock on our recommended online stockbroker, eToro.

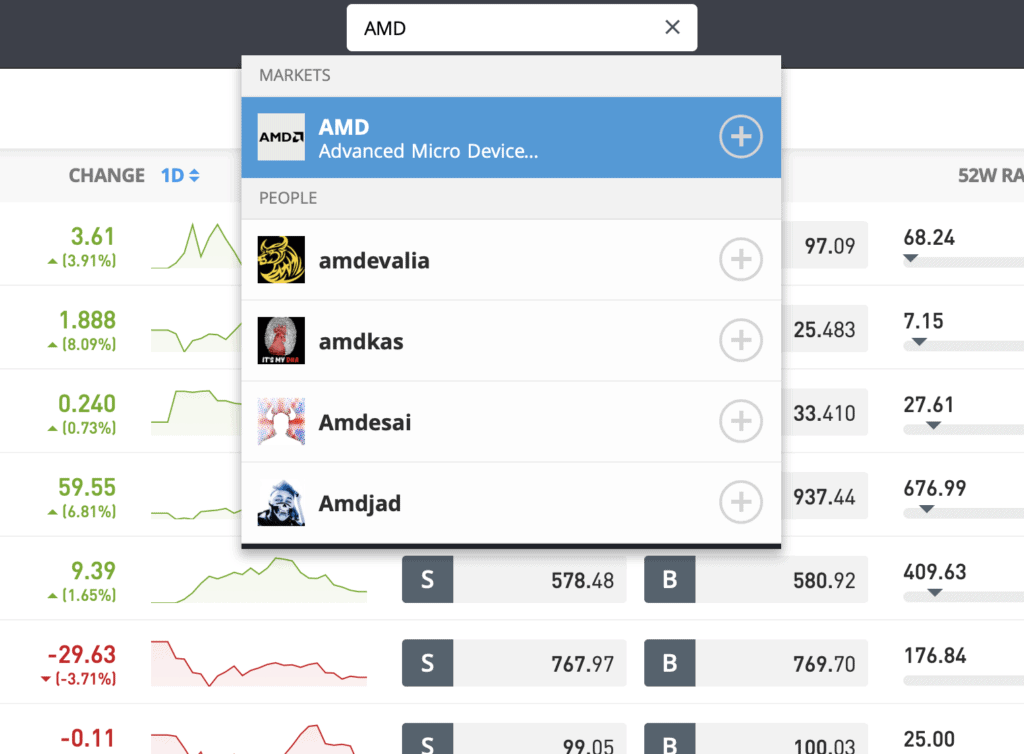

Step 1: Search for AMD (AMD) Stock

Look up AMD by typing the ticker symbol AMD into the search box.

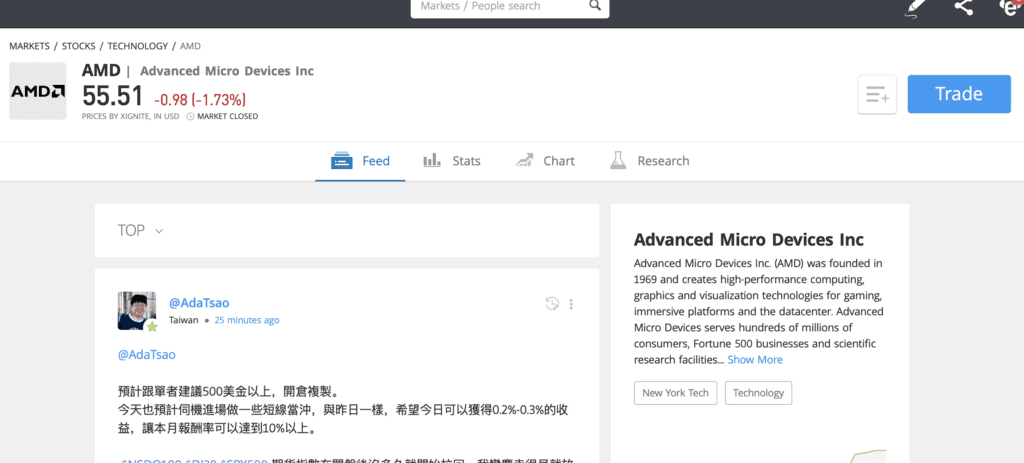

Step 2: Click on trade

Click Trade in the top right corner of the AMD page.

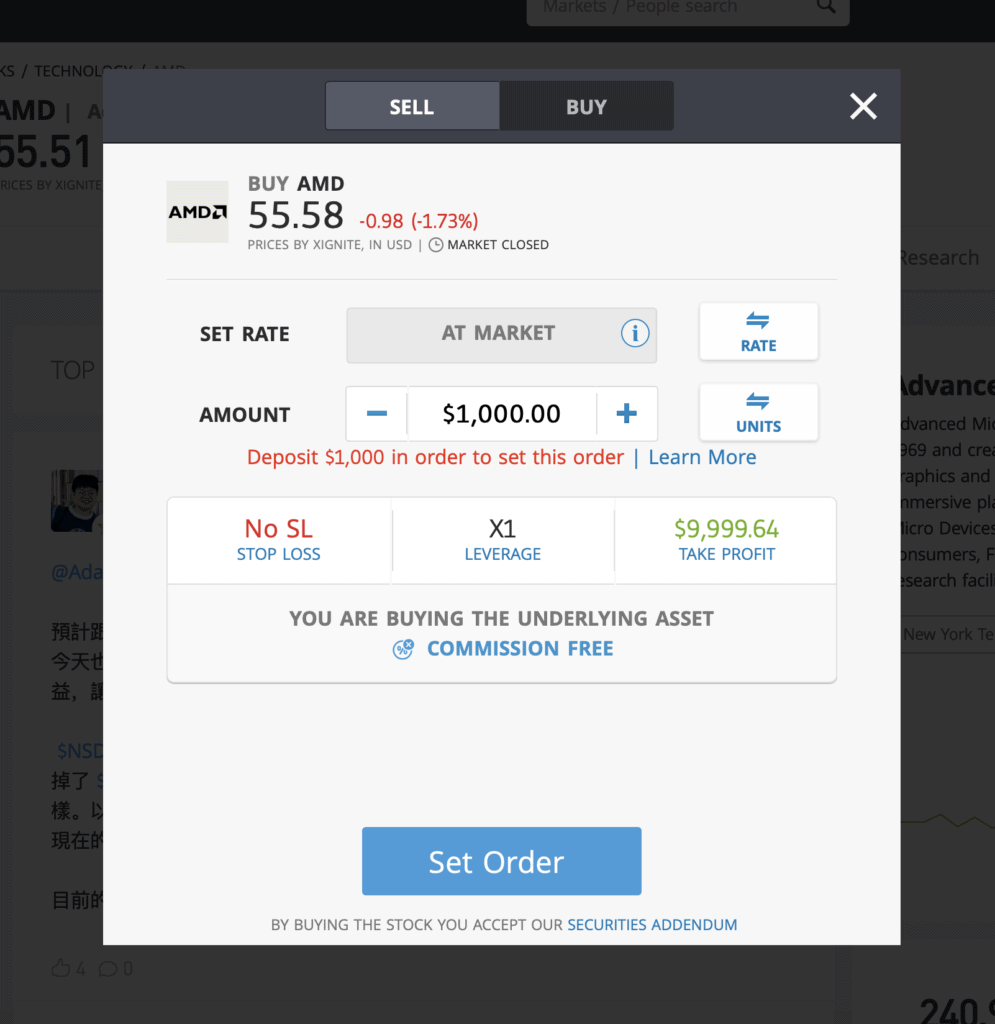

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. If you want to trade AMD CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in AMD Shares – Final Thoughts

It’s hard not to be impressed by AMD’s recent performance. 40% year-on-year revenue growth shows that the company’s Computing and Graphics segment is continuing to achieve great results. With new Zen 3 CPUs and RDNA 2 graphics cards set for release later this year, this looks likely to continue.

Other areas of the business are less buoyant, however, and the company’s trepidatious outlook statement has definitely dampened expectations. AMD’s long-term prospects are good, but it may have to weather a decline in demand over the coming months.

If you do want to buy AMD stock, simply register at one of our recommended brokers to get started. For traders outside the US, eToro is our recommended platform. If you do live in the US, we suggest you use Stash Invest.

FAQs

Should I buy AMD stock or wait?

While the long-term outlook for AMD is encouraging, we don’t anticipate much upside over the coming months.

What are the fees when buying AMD stock?

Zero-commission stock and ETF trading is available to European clients on eToro. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy AMD stock.

Is there an AMD stock price prediction?

Analysts estimate a median 12-month forecast of $52.75, which represents a 5.01% decrease on AMD’s current price of $66.61.

What does the AMD stock dividend pay?

AMD doesn’t pay a dividend to shareholders.