Coca-Cola (KO) is the leading maker of soft drinks, juices, teas and other beverages, commanding a 30 percent share of the $1.6 billion global non-alcoholic beverage market. As the global soft drink market grows at a pokey 3 percent a year, the company is rapidly expanding into healthier beverage markets with double digit growth. After several years of slowing revenue, product innovation and acquisitions are helping Coca-Cola sell the world more Cokes, and drinks infused with health and energy boosters.

If you want to invest in a leading beverage maker increasing share in all its markets, this guide will explain how to buy Coca-Cola stock, evaluate the best Coca-Cola stockbrokers, and assess how its aggressive acquisition strategy will affect the stock value.

On this Page:

Best U.S. Platform to Buy Coca-Cola Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in Coca-Cola and found Stash is the broker offering the best platform, lowest fees and most appealing bonus. Click the link below and get started with just $5 today.

Best Non-U.S. Platform to Buy Coca-Cola Shares

We found the following platform to be best-suited to traders outside the U.S. looking to invest in Coca-Cola, offering competitive spreads and 0% commissions. Click the link below to start trading Coca-Cola with this trusted, regulated broker.

How to buy Coca-Cola shares

Although the process of signing up with a broker, depositing funds, and it’s super easy to buy stocks in Coca-Cola, we’ve outlined a step-by-step guide for those of you that need a bit of help. We’ve opted to show you the process with the broker eToro as an example, but a similar process will apply to most brokers.

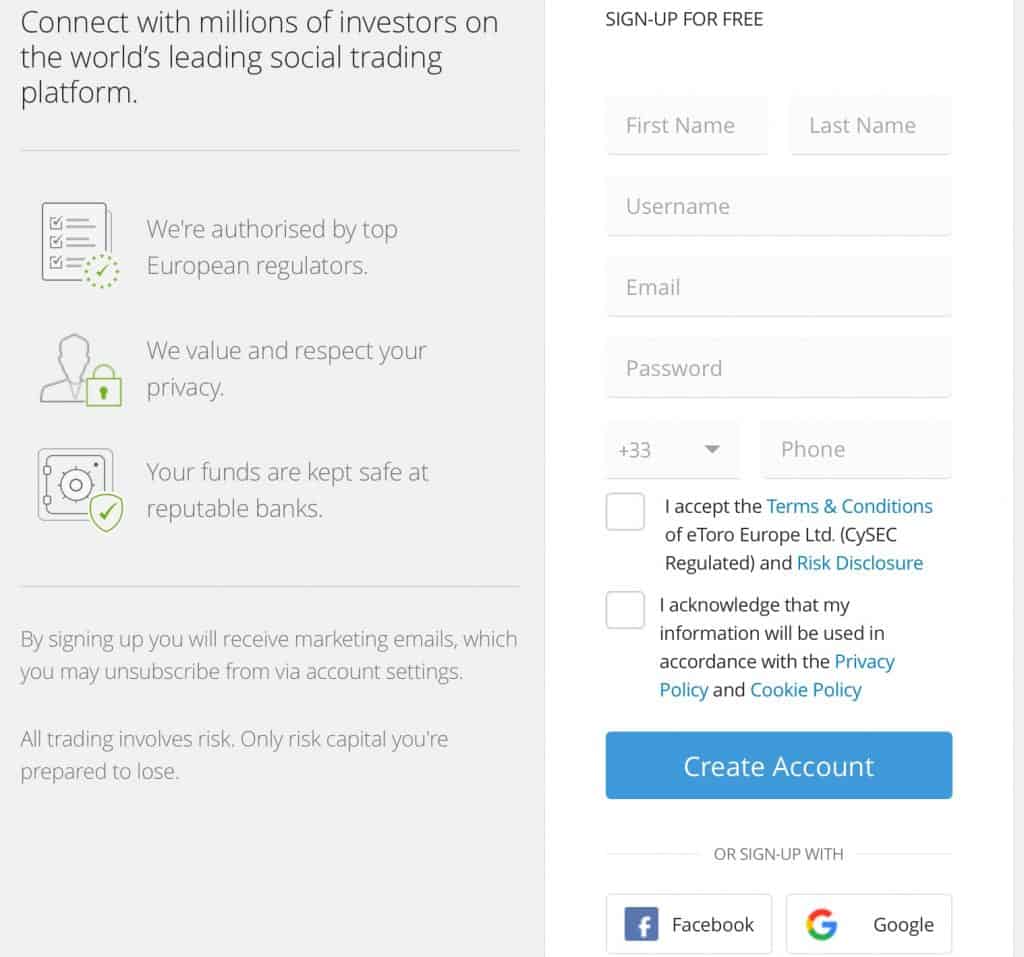

Step 1: Register your account with eToro

The first step to invest in KO shares is to sign up to our recommended broker eToro. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile.

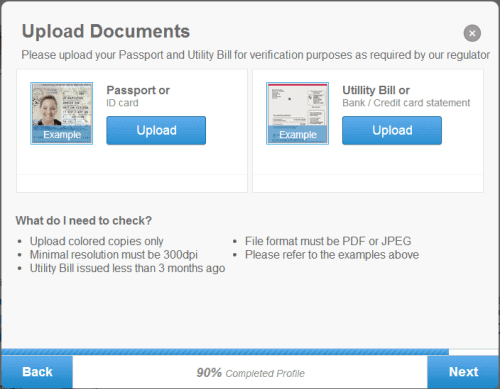

Step 2: Verify your identity

Attach and submit proof of identity for verification.

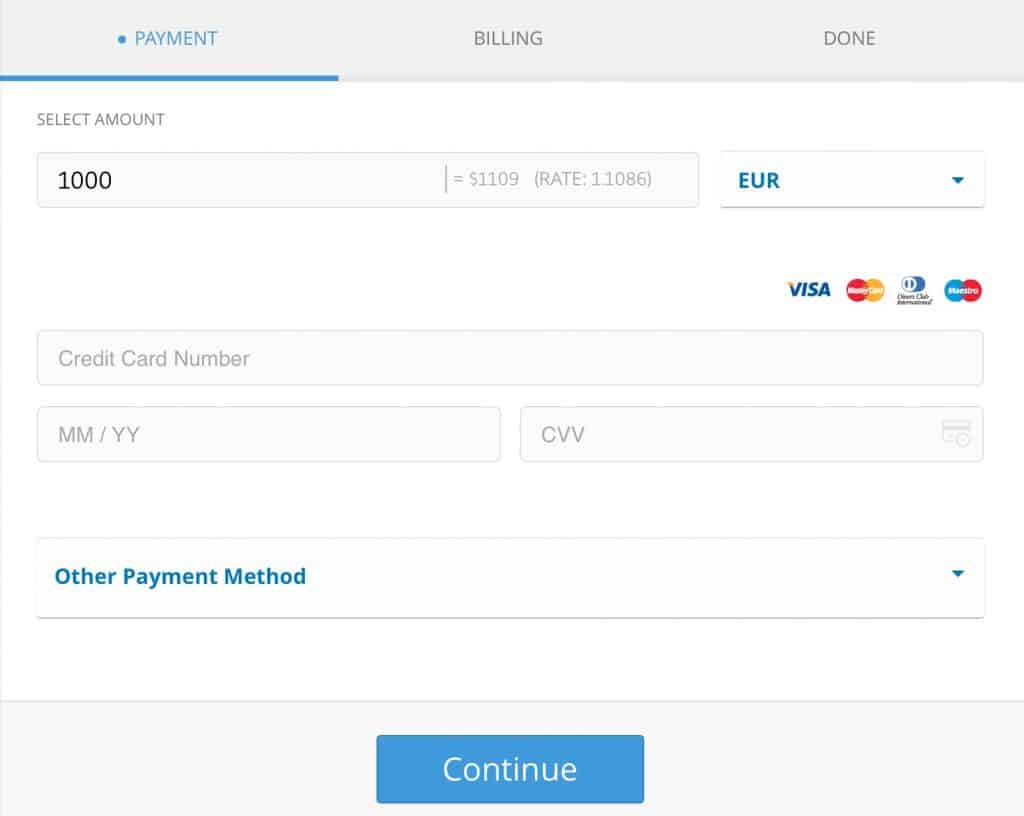

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

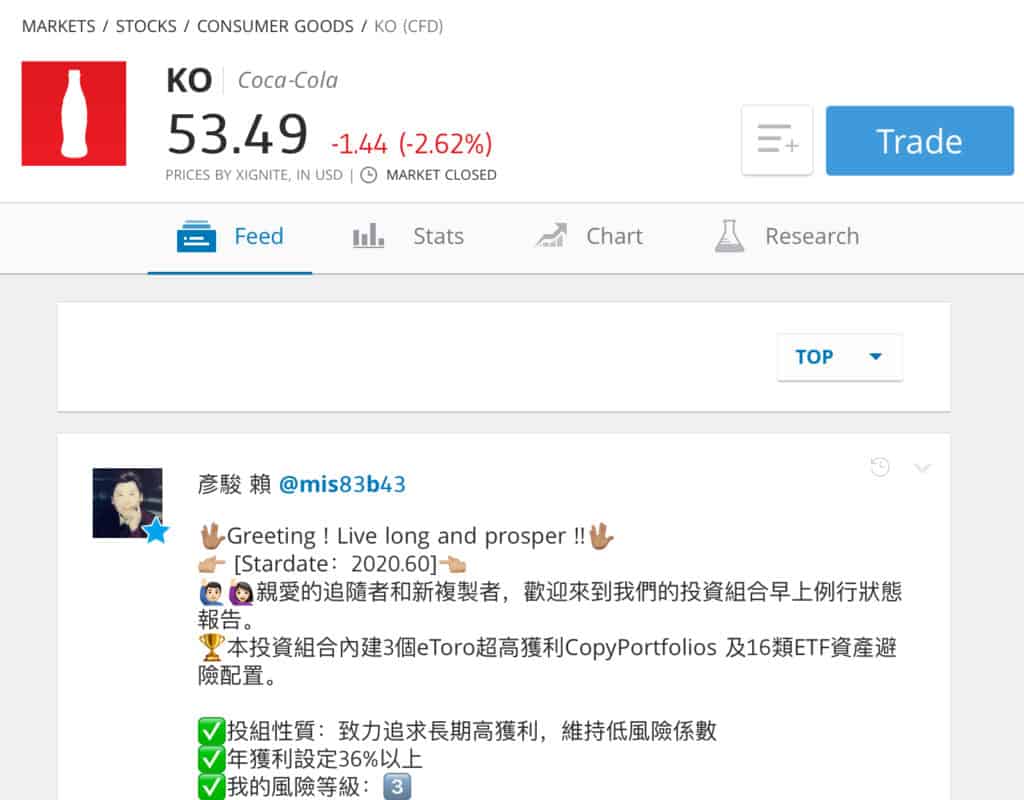

Step 4: Trade Coca-Cola stock

On eToro, you can invest in Coca-Cola through direct trading or social investing. Social investors can choose portfolios to copy based on performance and a risk score assigned to every trader portfolio on a scale of 1–6, 6 representing the highest risk. Following is an example of how to buy Coca-Cola stock.

Step 4A: Place a Coca-Cola stock trade

To buy KO shares, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The KO stock profile page provides social feeds, stats, charts and research. Social feeds provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

75% of retail CFD accounts lose money.

Coca-Cola Stock: Current Prices and Summary

Over the last five years, Coca-Cola’s stock has generated an annual return of 6.8 percent versus 10.2 percent for the S&P 500. Declining revenues over this period left a bad taste in investors’ mouths. In comparison to its industry, though, the S&P Food & Beverage Select Industry Index (of which KO stock is a top 10 holding by weighting) returned a more moderate 3.4 percent over the same period.

But this consistent dividend payer has rewarded investors well in good and bad times. With dividends reinvested, Coca-Cola returned 10.8 percent, reflecting a 5-year average dividend growth rate of 4.9 percent. Over the last year, KO shares have been given a boost by higher Coke sales and healthier drinks, returning 21 percent, in line with its 20-year average of 20.9 percent.

What can we expect for the stock price going forward? Analysts have a median Coca-Cola stock price forecast of $64 (high $66, low $60), a 16.5 percent premium over the current stock price of $54.90.

A Brief Overview of the History of Coca-Cola

The secret formula for Coca-Cola was originally concocted in 1886 by pharmacist John S. Pemberton for medicinal purposes and contained cocaine, which was later removed. The syrup was sold to another pharmacist Asa Griggs Candler who formed the Coca-Cola Company in 1891. The growth by acquisition spree started in 1946 with the purchase of Fanta followed by Minute Maid in 1960. More recent acquisitions have focused on healthier drinks, including juice, plant-based, kombucha, and sports drinks. Coca-Cola’s largest acquisition was the $5.2 billion purchase of the Costa coffee chain in 2018.

Other brands produced in-house have been market successes, including Sprite, Powerade, and NutriBoost – a fast-growing brand in Asia. Diet Coke was launched in 1982, and has become the third most popular soft drink worldwide, while the launch of New Coke in 1985 was one of Coca-Cola!’s most expensive failures. The artificial sweeteners in Diet Coke have been linked to cancer, requiring the company to change the sweetener three times.

The company went public in 1919. Today, Coca-Cola has number one market share in four out of five of its markets, remaining number two in energy drinks behind Pepsi’s Gatorade, and is one of the most valuable brands in the world.

Coca-Cola Shares Forecast 2020–2024

As the beverage industry settles into a 3 percent growth phase, Coca-Cola is focused on creating more value from its products by innovating and buying up smaller competitors. The healthier drink strategy includes changing the secret recipe of Coca-Cola. Coca-Cola is infusing Coke with electrolyzers for the energy drink market; and waters, teas and juices with antioxidants, alkaline, vitamins and plants.

The question is, does Coca-Cola have the financial strength to maintain its aggressive acquisition strategy. According to management, its acquisition war chest will be flush with cash. The company plans to generate $8 billion in cash flow through operations and capital investments this year. The 2020 forecast is for revenues to grow 5 percent and operating income 8 percent. Earnings per share are expected to grow 7 percent to $2.25.

2020 – Smaller packages pack sales punch

Since Coca-Cola announced its 2020 forecasts, the coronovirus has been menacing sales of its number two software drink, Diet Coke. The company expects supply interruptions of non-sugar sweeteners to slow production throughout the year. Coca-Cola has a 65 percent sparkling soft drink market share. Coca-Cola’s smaller 250 ml cans and bottles of Coca-Cola coukd,help offset these losses. The smaller packages now equal 12 percent of single serve sales. The outlook for Coca-Cola stock is low-to-median.

2021 – Healthy and premium drinks

Coca-Cola is introducing more healthier drinks, its highest growth segment. Natural spring water has been selling at a 5-year CAGR of 10 percent. Juices, smoothies and teas are growing in the double digits. The health conscious consumer is willing to pay a premium for Coca-Cola’s Organic, Fair Trade, and Rainforest Alliance certified products. Strong demand for Fused Tea helped the company beat revenue forecasts in 2019. New flavours and no sugar lines are being introduced. The outlook for Coca-Cola stock is median-to-high.

2022 – Powering up sports and energy drinks

Relegated to second place behind Gatorade since its introduction in 1998, Coca-Cola has several new products launching to topple the 69 percent market share of Pepsi’s Gatorade. Powerade is adding 50 percent more electrolyzers and Coke Energy is now on grocery shelves.

The outlook for Coca-Cola stock is low-to-median.

2023 – Coffee chains, and more

Coca-Cola is after a piece of Starbucks’ market. The coffee shop business is growing at 6 percent annually. In 2018, it paid $4.9 billion for Starbucks’ biggest competitor, UK coffee shop chain Costa. It plans to expand into at-home and vending formats. On the same them, Coke with coffee will begin selling around mid-year. The outlook for Coca-Cola stock is median-to-high.

2024 – The acquisition spree continues

Part of Coca-Cola’s strategy is to conquer these new markets through acquisition. Examples of buys contributing to earnings are soy-based drinks in Latin America (AdeS) and non-dairy drinks in China (Culiangwang). Transforming its U.S. bottling businesses into franchises is another future source of cash flow. Beyond 2020, Coca-Cola foresees stronger operating performance generated earnings-per share growth of 7–9 percent. The outlook for Coca-Cola stock is median-to-high.

Should you Invest in Coca-Cola?

As the company that wants the world to ‘refresh’ refreshes its own business, it is gaining financial strength. Coca-Cola reported its eight consecutive quarter of positive net income growth ending 2019, ending 2019 with a 38.6 percent increase to $8.9 billion for the year. This performance was despite a 44 percent steady slide in revenues over five years to $31.9 billion. As Coca-Cola gained share in all markets, revenues rebounded 14.9 percent to $36.6 billion.

With such strong operating performance, Coca-Cola’s biggest worry is convincing investors that it is growing value through its capital investment. Coca-Cola’s 12-month return on equity (ROE) is 49.6 percent, substantially above the beverage industry’s 12 percent.

Pros of investing in Coca-Cola stock

Cons of investing in Coca-Cola

Conclusion

Should you buy Coca-Cola stock? Sales of Coca-Cola’s healthier drink product mix are growing at more than double the rate of its soft drinks. As these higher margin beverage markets become a larger percent of revenues, Coca-Cola has the opportunity to continue to grow profits. After 56 years of paying increasing dividends, currently $0.41, investors are assured a growing dividend payout.

Another great option is to buy Amazon stocks, or to buy Tesla stocks, just make sure you do your research first.

If you want to buy stock in Coca-Cola, we recommend doing so via a regulated online broker such as eToro.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

FAQs

Neither. As a value investor, Warren Buffet is a buy-and-hold investor who accumulated undervalued Coca-Cola shares in the 1980s and 1990s. By 1994, he owned 100 million KO shares. After stock splits, he currently holds 400 million shares – a top 10 holding in his portfolio. Buffet has never sold a KO share. One share of KO bought for $51.50 in 1994 would be worth $792.71 today, an 11 percent annual return. After 4 stock splits, that share is worth $3,166.84.

Using the discounted cashflow (DCF) valuation method, the results can vary greatly based on forecasts of Coca-Cola’s future cash flows. Current valuations range from $19.11 (gurus focus.com) to $60.63 (mpcapital.ai). At a current share price of $53.33, Coca-Cola is overvalued in the first case and undervalued in the latter case.

The margin of safety is the intrinsic value minus the stock price. In the above case, an intrinsic value of $60.63 and a stock price of $53.33, the stock is trading at a discount of 13.7 percent. A value investor seeks a discount of at least 10 percent, and therefore may consider buying KO shares at the current discount.

The following dividend aristocrat ETFs hold KO shares in a portfolio diversified across industries: ProShares S&P 500 Dividend Aristocrats ETF (NOBL), SPDR S&P Dividend ETF (SDY).

You can buy KO shares from online stockbrokers such as eToro. eToro provides an intuitive trading platform that make it easy to buy and sell stocks. After signing up online, type in the KO ticker, place your order and you will become an owner of Coca-Cola shares. Is Warren Buffet buying or selling Coca-Cola shares?

Is Coca-Cola currently undervalued?

What is Coca-Cola’s margin of safety?

What dividend aristocrat ETFs hold Coca-Cola?

Where and how can you buy Coca-Cola stock?