Coinbase is one of the first go-to platforms for beginners and early adopters when buying Bitcoin. Interest in Coinbase is also a general indicator of the sentiment about cryptocurrency.

However, Coinbase has its negatives, including debit card fees, customer support, and KYC compliance requirements, and there are better alternatives to Coinbase out there some more experienced traders have moved over to in 2024.

This guide will review some of these alternatives and explain why they may be better than Coinbase regarding features, ID documents needed, regulatory transparency, and availability.

Best Coinbase alternatives – Reviews

Since Coinbase has some disadvantages regarding high transaction fees and poor customer service, it becomes essential to look for other alternatives. Here, we have reviewed some of the best alternatives to Coinbase that are better than this crypto exchange regarding regulatory transparency, transaction fees, payment options, availability of altcoins, etc.

1. Best Wallet – User-Friendly Crypto Wallet that makes buying and trading crypto easy

Best Wallet stands out as a top alternative to Coinbase for crypto enthusiasts looking for a streamlined and secure buying experience. Launched with a focus on user accessibility, Best Wallet simplifies the process of purchasing cryptocurrencies, offering seamless on and off-ramps to convert fiat to crypto and vice versa. With over 20 trusted onramp providers, including Stripe and Revolut, users can fund their accounts easily through various payment methods, ensuring a hassle-free experience.

One of its standout features is the Upcoming Tokens section, which allows users to browse, buy, and claim promising ICO projects directly within the app. Additionally, Best Wallet supports cross-chain swaps, enabling users to diversify their portfolios efficiently without navigating multiple exchanges. The platform’s intuitive interface caters to both beginners and seasoned investors, making it easy to track investments and manage assets.

Best Wallet prioritises security, employing advanced measures to protect user funds while maintaining compliance with regulatory standards. With its combination of user-friendly features and robust security, Best Wallet is an excellent alternative for anyone looking to explore the cryptocurrency market beyond Coinbase.

2. Kraken – Reputed Exchange with Seven Fiat Currencies

Kraken has created a name for itself over the years due to the excellent services it provides in the cryptocurrency domain. The exchange was created in 2011 and was officially launched in 2013. In its long tenure, Kraken has seldom had any significant issues. It has positioned itself as one of the top choices for trading or investing in cryptocurrencies. It is currently the sixth largest crypto exchange in the world after Binance and Coinbase in terms of volume traded.

The exchange is headquartered in San Francisco but has offices worldwide. The company caters to over 8 million traders and investors globally and has partnered with some of the most prominent financial and blockchain players. While it had been introduced initially as a Bitcoin-first exchange, the platform now hosts over 120 cryptocurrencies and features several advanced trading options.

The number of fiat currencies supported on Kraken is seven, which is relatively more when compared to most of its counterparts. Regarding stablecoins, Kraken hosts three significant options- USDC, DAI, and USDT. Kraken doesn’t fall behind when it comes to security too. It offers safe coin storage, with 95% of offline deposits in cold storage units spread worldwide and promising platform security. Servers are constantly checked upon and are under 24-hour surveillance.

FinCEN regulates the exchange in USA and FinTRAC in Canada. It has regular audits and can be considered a safe option for traders and investors who wish to hold their tokens safely in a centralized exchange.

3. eToro – Overall Best Coinbase Alternative

eToro.com is one of the most popular crypto trading platforms in the US and worldwide that offers traders and investors a unique trading experience with its premium features. With more than 20 million members globally, this exchange hosts the world’s largest trading and investing community of experienced and knowledgeable investors who have often surpassed market benchmarks.

Suppose you want to diversify your investment portfolio; in that case, eToro is the perfect trading platform for you as it supports more than 2000 different financial assets, including currencies, ETFs, and stocks on its platform.

To enhance the user’s trading experience, the eToro platforms offer advanced features such as Smart Portfolios and a Copy trader function.

Innovative Portfolios on eToro are groups of financial assets strategically grouped around a common theme. Similarly, the Copy Trader function feature allows beginners to understand the nuances of crypto trading by copying the trading moves of experienced investors.

eToro provides crypto trading with an almost nil trading commission compared to other crypto exchanges. The platform also does not charge any additional expenses from its users through hidden fees. It also has advanced security measures in its place to ensure the protection of users’ financial and personal data.

eToro offers excellent customer support to all crypto enthusiasts, where every trade-related query gets resolved in almost no time. You can get your favorite crypto assets from this platform using a variety of payments, including bank transfers, e-wallets, debit cards, credit cards, etc.

This platform is also user-friendly and is easily accessible to all traders and investors in the form of mobile applications available on Google Play (for Android users) and the App Store (for iOS users). Considering all these reasons, eToro is the perfect destination for crypto trading.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

4. Margex – Offering Bitcoin Trading with Up To 100x Leverage

Margex is a crypto trading platform considered one of the easiest ways for beginners to enter the crypto market. Advertising itself as a boutique platform for crypto and forex trading, it offers numerous features that discerning investors seek, such as faster trading execution, liquidity from multiple providers, and low fees. With over 55 cryptocurrencies available, it is an ideal platform for beginners.

To date, Margex has accumulated over 500,000 registered users, executing more than 180,000 trades daily. Despite its reach in over 153 countries, Margex has maintained a spotless record, having never lost client funds, a testament to its strong emphasis on high-level security features.

The platform also supports social trading, with over 100,000 pro traders available for users to follow. To date, more than 500,000 trades have been copied, with the top five traders highlighted on the homepage.

In addition to trading, Margex offers staking options and a referral program for users. Its robust price alert system further enhances the user experience by making trading more efficient.

Margex’s user interface is designed to be simple and intuitive, with a mobile app that’s easy for everyone to use. The platform requires only a $10 minimum deposit to get started.

5. Uphold – An All-Around Crypto Exchange

Thanks to its advanced security system, low fees, and active and passive earning possibilities, Uphold has emerged as one of the most perfect alternatives to Coinbase. The exchange entered the global crypto market in 2015 and quickly gained traction, garnering the trust and patronage of over 10 million users spread across 150 countries worldwide.

Built on the principles of transparency, Uphold publicly updates its reserve every 30 seconds, allowing users to track its assets and liabilities. More so, the platform leaves no stone unturned when it comes to security, combining various firewalls, advanced encryption, and a multi-layer defense system to keep users and their assets safe.

Unlike most of its peers, Uphold has a self-custody option; Vault that allows users to take full control of their assets. By having their assets in custody, users are protected against hackers and security breaches that have rocked most centralized exchanges.

Meanwhile, at its core, Uphold provides access to more than 300 cryptocurrencies along with traditional currencies and precious metals. Also, thanks to its flexible listing policy, the platform is one of the best places to find newly launched tokens with explosive potential.

Also, Uphold offers considerably low fees, charging 0.8% as its maker fee and 1.5% as its taker fee. Similarly, withdrawals on the platform are entirely free except the ones initiated through debit cards.

There is also a “Baskets” solution on Uphold, streamlining the process of crafting a diversified investment portfolio. From the big three spanning BTC, ETH, and XRP to meme tokens and top cryptos in cutting-edge sectors like AI and metaverse, Uphold positions investors for more stable and potentially rewarding income.

Investors can also take advantage of its interest-driven programs like USD interest accounts and staking to expand their income streams.

6. MEXC – High-Security Features and Fast Transactions

MEXC emerges as a compelling alternative to Coinbase for investors seeking a reliable broker in the crypto sphere. This platform has garnered widespread attention due to its robust security measures, expansive range of cryptocurrencies, and advanced functionalities, making it a standout choice among global investors. Established in 2018 and headquartered in Seychelles, MEXC has swiftly ascended to become one of the fastest-growing crypto exchanges globally, presently securing a spot within the top 20 exchanges based on trading volume.

During the previous bullish market cycle, MEXC gained significant traction as investors sought trustworthy avenues to diversify their crypto portfolios, featuring both mainstream and lesser-known digital assets. Notably, the platform boasts an extensive array of over 1700 tokens, appealing to individuals seeking a consolidated platform to manage multiple cryptocurrencies simultaneously.

With a user base exceeding 10 million across 170 countries, MEXC has established a robust global network. This widespread reach facilitates the creation of diverse communities within the platform’s social media channels, enabling users from various corners of the world to engage and interact. Moreover, its low-fee model stands out as a pivotal factor for investors aiming to minimize transaction costs.

MEXC has solidified its status as a go-to platform for purchasing cryptocurrencies, primarily due to its user-friendly interface and seamless navigation. For those in search of a secure and top-tier exchange platform akin to Coinbase, MEXC emerges as a promising choice to consider.

7. OKX – Offers Advanced Financial Analysis Tools

For the millions of crypto traders in more than 200 countries, OKX offers a variety of financial assets. There are numerous cryptocurrencies accessible on the exchange, such as purchase Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Shiba Inu (SHIB), EOS, and Litecoin (LTC), and it allows both spot and derivatives trading services.

The exchange offers a multi-currency auto-borrow functionality enabling advanced and experienced crypto traders to utilize their cash most efficiently and an industry-first Unified Account platform facilitating margin pooling across various accounts. Moreover, users can take money out whenever they need to use our real-time settlement option.

The platform offers a broad range of choices for trading cryptocurrencies, including spot trading, margin trading, DEX trading, options, quick trade, and perpetual swap. The exchange also has a low fee structure and zero deposit fees, making it profitable for users to trade cryptocurrencies on this platform.

You can get many video tutorials and beginner guides on OKX’s webpage under the “Learn” option. In addition to it, OKX allows you to register as an OKX broker with timely publications and market analyses. Through staking OKB, the native token of OKX, users can farm DeFi tokens as a portion of the Jumpstart Mining program.

The exchange has an excellent customer support program that is available 24/7 for resolving users’ queries. It offers advanced financial services like OKX mining pool and algo-order options, giving it an upper hand over its competitors. Overall, it is a decent crypto exchange for every crypto investor.

On a side note, OKX also has a DEX platform for those unable to use its CEX.

8. Bybit – Offers Leverage Trading

With over 1.6 million users across various countries, Bybit is recognized as the best crypto exchange for futures trading and for buying spot currencies in one place. It is currently among the top five crypto exchanges and gives its customers the best possible trading experience by adopting a customer-centric approach in its strategies. One benefit of using Bybit is that no KYC (know-your-customer) procedure is required.

Unless you want to withdraw more than 2 BTC in a day, which is more than most traders require, you do not need to submit a copy of your license or passport for identity verification. As a tier 1 exchange, Bybit offers myriad services to investors or traders, including limit, conditional, market, and partial orders. Another exciting factor about the platform is its sign-up bonus, a whopping 5030 USDT.

Unlike eToro, the services provided by this reputable exchange are based on maker/taker fees rather than a buy-sell spread. Fees for spot trading are approximately 0.1 per cent, and rebates for limit orders in margin trading are approximately 0.025 per cent. Similarly, when compared with Binance, Bybit provides the ‘lowest spread,’ with a maker rebate.

The exchange supports many crypto assets on its platform, including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Tezos, Chainlink, Cardano, Polkadot, etc. It also provides the facility of a demo account along with some educational materials through which users can learn how to buy, sell, and exchange cryptocurrencies quickly on this exchange.

The exchange is not highly recommended for spot trading, and customers’ data gets shared with third parties for marketing purposes. Still, this exchange is freely accessible to all cryptocurrency enthusiasts via mobile apps and desktop-based programs.

Bybit offers high leverage, low trading fees, and a market maker rebate. Along with fewer transaction fees, Bybit is regarded as the most preferred platform for trading crypto derivatives because it has an insurance cover designed to safeguard its users in the event of a loss.

9. Binance – Widest Range of Digital Assets

Binance is the world’s leading cryptocurrency exchange in terms of trading volume. It provides all its users with a fantastic crypto trading experience cheaply. Users are not supposed to pay transaction fees when purchasing on this exchange, boosting their earnings without imposing high costs.

Binance employs a volume-based pricing system; all its customers can access the MetaTrader 4 trading platform. This application provides real-time updates on all trends, trades, and alerts. The MT4 Binance trading platform’s fame can be linked to the fact that it is one of the most straightforward and reputable ways to conduct business on the Forex market.

Using this trading platform allows one to understand the nuances of the trading process and helps one get a better understanding of the trade. Customers on Binance can use the “Expert advisors” option to receive investment suggestions from professional investors to enhance efficiency.

Binance supports leveraged spot and margin trades. Its supremacy among crypto exchanges is evidenced by its platform having the most altcoins, including Binance Coin, Dogecoin, Ripple, Ethereum, Cardano, Litecoin, and 100+ other cryptocurrencies. Further, Binance is in the process of applying for UK regulation.

10. KuCoin – Wider Range of Low Marketcap Altcoins

KuCoin is an excellent choice for all newcomers due to its high level of liquidity, large user base, diverse selection of supported assets and services, and low trading fees. Aside from the advantages mentioned above, this cryptocurrency exchange offers customers an excellent crypto trading experience and low trading and withdrawal fees.

Founded in 2017, enthusiasts recognize this exchange as a one-stop solution for all crypto operations. Suppose you want to diversify your investment portfolio. In that case, you can do it conveniently through this reputable exchange, as it offers hundreds of crypto assets on its platform, including Bitcoin, Ethereum, Tether, Binance Coin, Cardano, XRP, USD Coin, Dogecoin, etc.

KuCoin is known for providing its clientele with a user-friendly experience, making it much easier for newbies to start trading in cryptocurrencies. It offers various virtual currency services, including a fiat onramp, a peer-to-peer (P2P) marketplace, crypto staking, a margin trading exchange, a futures trading exchange, non-custodial trading, crypto lending, and much more.

If you want to create passive income, this platform allows you to do so via the crypto staking tool. To ensure the complete security of your crypto assets, KuCoin’s systems include wide-ranging security features such as dynamic multifactor authentication and multi-level encryption.

KuCoin offers its users excellent 24/7 customer support to resolve trade-related concerns or queries. The only limitations of this exchange include limited payment options and a limited collection of educational resources. It has fewer transaction and withdrawal fees and offers the feature of a demo trading account where beginners can learn the art of real-time trading and get themselves adjusted to this exchange.

11. Gemini – Featuring a Simplified UI

Gemini is one of the most robust yet simple-to-use Coinbase alternatives available on the market. Driven by a desire to cater to all types of traders, this cryptocurrency exchange, founded in 2014 by Cameron and Tyler Winklevoss, has remained one of the most reliable platforms for over a decade.

The services offered by Gemini are standard and include a secure way to buy, sell, store, and convert cryptocurrencies. The platform features advanced trading capabilities, a mobile app, derivatives trading, and is available in more than 70 countries worldwide.

As a regulated cryptocurrency exchange, Gemini boasts a unique tool known as ActiveTrader. Defined as the future of crypto trading, ActiveTrader is a high-performance platform offering over 100 trading pairs, dual markets, and derivatives, allowing users to trade within microseconds.

Gemini has also partnered with top liquidity providers and offers a comprehensive API suite for users who want to engage more deeply with its ecosystem.

Thanks to its services, Forbes named Gemini the Best Advisor of 2024. This recognition is partly due to its simplified UI, which was designed to ensure that the platform is accessible to the widest possible audience.

12. PrimeXBT – Seamless User Experience

PrimeXBT is one of the most dynamic Coinbase alternatives available, offering a comprehensive platform for CFD, crypto, and crypto futures trading. Its simplified UI provides users with tools to track the prices of their favorite assets and an Economic Calendar to keep them updated on the latest developments in the cryptocurrency space.

The platform supports copy trading services, enabling beginners to follow in the footsteps of experienced traders. PrimeXBT also offers a practice trading account, providing users with a free $10,000 to learn about crypto trading in a risk-free environment.

PrimeXBT is a valuable resource for learning about crypto, featuring comprehensive market research, educational resources, and the latest market news. For those who find trading terminology complex, a detailed trading glossary is available.

The platform is also a hub for promotions, offering bonuses and trading contests for users. Additionally, users can join the affiliate program to further boost their earnings.

With over 1 million users, PrimeXBT has garnered positive reviews on TrustPilot. Its copy trading feature is rated 4.5 out of 5 stars based on 85 reviews.

13. Crypto.com – Includes NFT Marketplace

Crypto.com brings multiple investment avenues to the screen of every investor, including crypto trading, staking, NFTs, and much more. This exchange provides over 150 different currencies, reasonable fees, and decent discounts to those users who own a significant amount of Crypto.com Coin (CRO).

Crypto.com was founded in 2016 to cater to the needs of investors with its one-of-a-kind package of cryptocurrency-related financial products. Now, it operates in more than 90 countries and has a customer base of over 10 million users.

This decentralized exchange offers cryptocurrency credit cards, crypto wallets, and a marketplace for NFTs. The exchange also allows its users to stake their cryptocurrency or keep it in a Crypto.com wallet for a set period of time to earn up to 14.5 percent interest.

Crypto.com is easily accessible to all its users through a mobile app available for download on Android and iOS devices. If you’re used to trading stocks through a mobile app, you’ll probably find the experience simple and intuitive. Users have to pay only 0.4% of fees on their trades if the total monthly trading volume is less than $25,000.

Crypto.com uses advanced security measures, such as two-factor authentication (2FA) and whitelisting, to protect its customer accounts from hacking or security failure. This exchange employs stringent compliance monitoring and keeps user deposits in offline cold storage to save them from hacks or external cyber-attacks.

Customer support services on this exchange are not satisfactory as many complaints have been mentioned about slow and low-quality responses from the technical team. Similarly, trading fee reductions can be difficult for a standard user to navigate. Keeping aside all these limitations, Crypto.com is a good alternative for all those who want to use an exchange as a one-stop solution for their every requirement.

14. Bitfinex – Also offers Margin Trading

Bitfinex is a popular cryptocurrency exchange that is known for its low fees. This significant crypto exchange offers diverse cryptocurrencies and trading options, such as paper trading, derivates, spot trading, margin accounts, and more. Bitfinex, with its user-friendly features, caters to the requirements of every beginner and expert.

Bitfinex has a haunted past where it has faced severe allegations related to regulatory transparency, including various Commodity Futures Trading Commission fines. The most serious charge against this crypto exchange includes the allegation of deceiving investors made by the New York Attorney General’s Office. Bitfinex incorrectly stated that reserves fully backed the Tether stable coin.

The New York Attorney General concluded that Bitfinex and Tether deceived clients and markets by exaggerating Tether reserves and concealing losses. Bitfinex has also been fined for running an unlicensed exchange and promoting unauthorized off-exchange transfers. Considering these past events and allegations of wrongdoings, investors may be concerned about the cryptocurrencies traded on this exchange.

Bitfinex has comparatively fewer trading fees, with most trades costing less than 0.20 percent. Bitfinex’s trading platform is simple to use, and professional traders will enjoy the features and options it provides. Users can test their investment strategy without investing their real money with a free paper trading account.

This account will provide new users access to the features of the Bitfinex exchange, with some play money deposited in their account. Bitfinex employs some industry-standard methods for ensuring the complete safety of its user accounts and investments.

It uses high-level security mechanisms like two-factor authentication, withdrawal protection features, cold storage, etc., to keep your crypto coins secure.

Overall, if its management ensures its regulatory transparency, Bitfinex could become a key player in the crypto space.

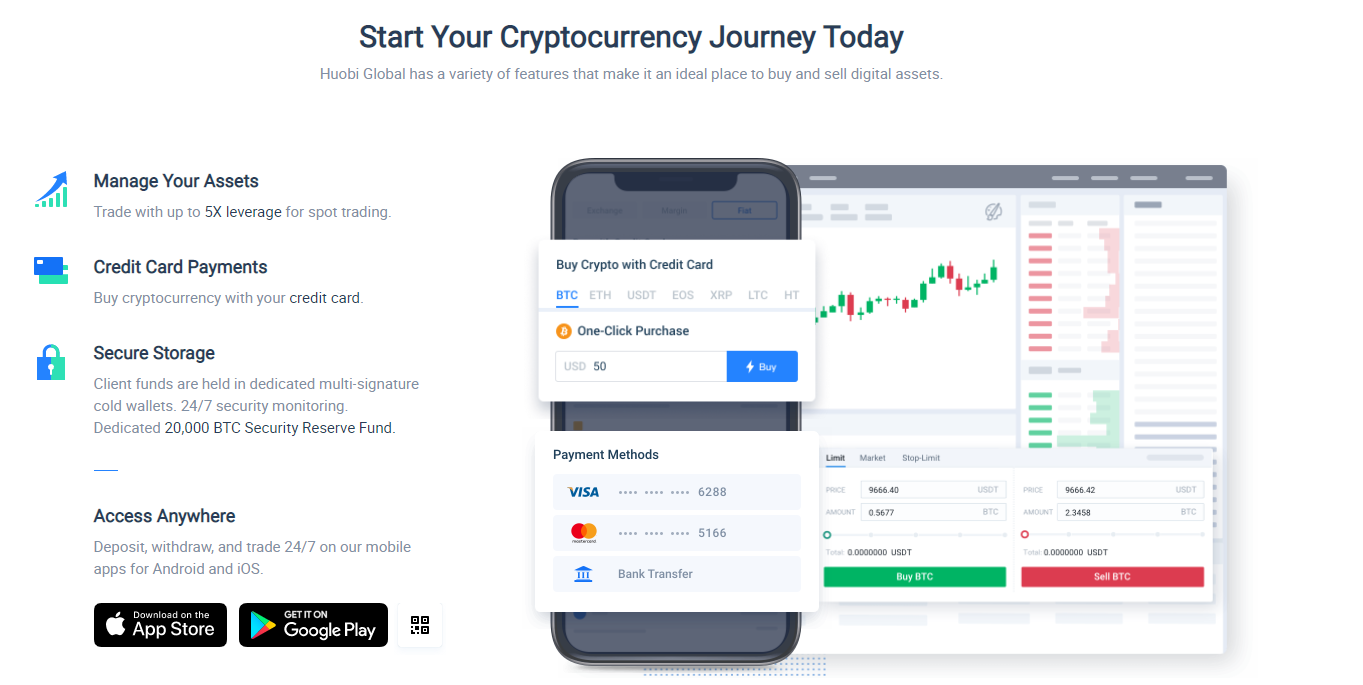

15. Huobi- Offers a Unique Huobi Token

Huobi (now HTX) is another popular Coinbase alternative. The platform was launched in 2013 and has been a competitive, reputed player in the crypto market ever since. Huobi allows its customers to buy/sell/stake/borrow a variety of cryptocurrencies, making this an investing-trading hub.

The base fee is merely 0.2% (maker-taker), and Huobi Token holders may avail of several offers and discounts on the trading fees.

Its platform hosts almost 400 cryptocurrencies, making it a hot pick for most traders looking for range and diversification. Huobi offers both spot and margin trading- derivatives on leverage (upto 5x); this is an advantage it has over many other players in the field.

A particular advantage for beginners or short-term traders that Huobi offers is its liquidity. Huobi has close to 1000 Global Trading Pairs, including ETH/USDT and BTC/USDT pairs making this platform a popular choice. The payment methods are flexible- from Bank Account, PayPal, SWIFT, etc., facilitating Crypto to Crypto and Crypto to FIAT.

A unique feature of Huobi is that it provides the trader with a free trading bot using GRID strategy, which can be operated on Manual or AI modes. The Huobi Trading Bot has consistently ranked in the top 20 trading bots in the world and has cemented its position in the cryptocurrency exchange market.

The Huobi DeFi Wallet is a professional multi-chain light wallet that manages various assets. A wallet is a convenient option for many traders due to its ease of use, attentive design, and convenience.

It supports all ERC20 tokens and top coins like BTC, ETH, EOS, TRX, USDT, etc. Users constantly have sole control and access over their own private keys handling their assets.

Along with OTC trading, Huobi has launched its own native token- HADAX. Huobi Autonomous Digital Asset Exchange (HADAX) is the first. The autonomous feature of this function allows users and developers to vote on the nature of altcoins that are listed and traded on the platform.

The P2P platform also focuses on high-security measures such as multi-signature cold wallets, 24/7 security monitoring, and a dedicated 20,000 BTC Security Reserve Fund. New users are also entitled to an exciting Welcome Bonus of $300, which they may even avail on the Huobi Mobile App listed on Google Play and the App Store.

How we Analysed the Best Coinbase Alternatives

Cryptocurrency trading is a novel area of business. New companies and crypto exchange platforms are cropping up all the time, and Coinbase came into prominence as possibly the go-to solution. But we set out to choose the best alternative to Coinbase, through a checklist of analysis points.

Finding the right trading platform becomes important because many crypto exchanges are always coming up in the market.

Safety and Security

We prioritize the safety and security standards offered by any crypto exchange. We consider whether any recognized global body regulates a crypto exchange and if that platform has a track record of high-level usability, supplemented by training materials.

Trading volume analysis

Our researchers also analyze trading volumes as it comes out as a credible indicator compared to the reported activity of crypto markets.

Supported cryptocurrencies

We also examined how many crypto assets are supported on the platforms. We focused on platforms that become real industrial players, providing the most liquid assets while diversifying into newly created digital coins and tokens with trading gains.

Fee and other charges

Fees were also important, noting that spread fees and lower trading and deposit fees make choices like eToro superior to Coinbase.

So overall, we compare trading fees, deposit fees, withdrawal fees, and other related charges among the platforms and ensure that users are offered the best Coinbase alternatives that provide crypto trading services with reasonable trading fees and other charges.

Compare Top Coinbase Alternatives

What are some advantages of Coinbase?

Coinbase is a renowned crypto exchange that simplifies buying, selling, and exchanging cryptocurrency. With over 56 million users, Coinbase makes purchasing Bitcoin as simple as purchasing stock through an online broker.

This registered, well-regulated crypto exchange has a global presence in over 100 countries, making it one of the largest crypto exchanges in the world.

Below we have highlighted some advantages of Coinbase:

User-friendly interface

As a beginner, learning the art of crypto trading becomes challenging. Coinbase makes it easy for you to buy, sell, or exchange cryptocurrencies quickly through its user-friendly interface.

Its main website and application are straightforward to operate. Android and iOS users could easily download its application from Google Play and the App Store.

Supports over 100 cryptocurrencies on its platform

You should consider distributing funds among various cryptocurrencies to diversify your investment portfolio. As an investor, choosing Coinbase as your crypto exchange is preferable as it supports a diverse range of cryptocurrencies on its platform.

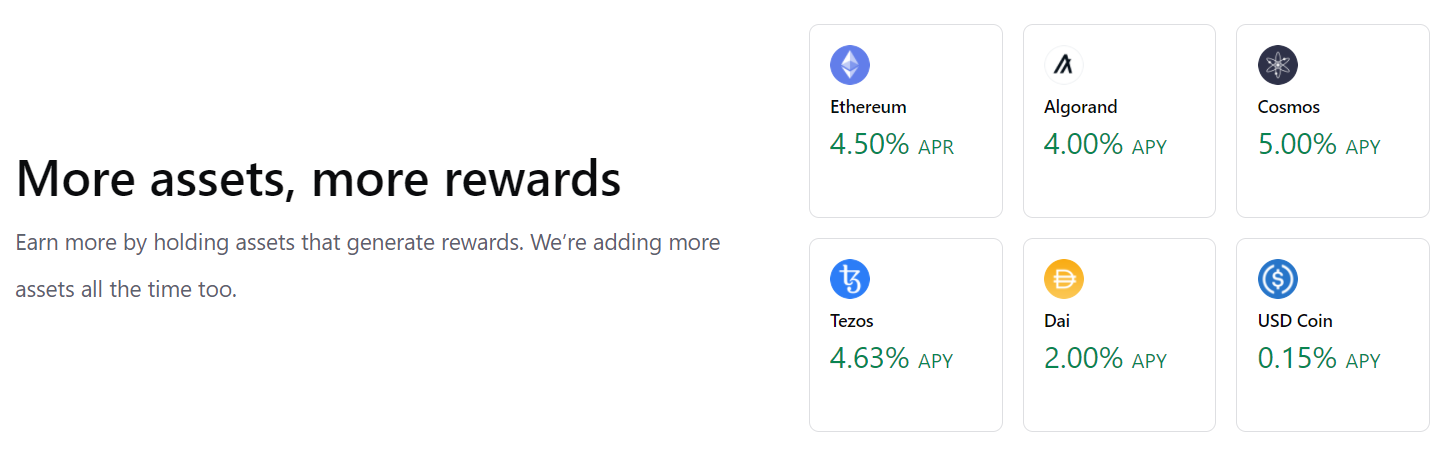

Staking options available on Coinbase

This leading exchange offers many cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash, Aave, Cardano, USD Coin, Dash, Dogecoin, etc. You can also stake multiple cryptocurrencies such as Ethereum, Cosmos and others.

High-level security system

If you trade on an unregulated or unprotected cryptocurrency exchange, your investment is vulnerable to malware, hacks, and security flaws. As a result, to keep their investment safe, users should always choose crypto exchanges with advanced security systems.

That is why Coinbase employs industry-leading security measures to safeguard your crypto deposits. The exchange employs bank-level encryption and security for its website. Security measures like two-factor authentication ensure no third party can access your trading account without your permission.

Variety of payment options

Using various payment methods, you can now invest in your favorite cryptocurrency at this reputable crypto exchange. Coinbase accepts multiple payment methods, including bank transfers, debit/credit cards, wallets, etc.

Get crypto while learning about crypto

‘Coinbase Earn’ enables eligible customers to learn about various cryptocurrencies through educational content and earn a portion of that cryptocurrency simply for doing so. Coinbase Earn is straightforward, educational, and rewarding.

You’ll be rewarded with a small amount of that cryptocurrency by watching videos about your favorite cryptocurrency and taking a short quiz to test your knowledge.

Coinbase learning platform

This feature is available for users of many countries, including Austria, Australia, Belgium, Bulgaria, Canada, the United Kingdom, the United States, etc.

What are some of the disadvantages of Coinbase?

Coinbase has a few drawbacks that the company is working on improving. We think both new and experienced traders should know about these.

High transaction fees

Transaction fees are high on the primary Coinbase platform. The exchange charges a 3.99% fee when using a debit card and a 0.5 taker fee spread when buying and selling crypto on its exchange Coinbase Pro; there can also be slippage when using market orders.

“The base rate for all purchase and sale transactions in the United States is 4%,” per Coinbase. But the fees vary depending on your location and payment method.

On the other hand, Coinbase Pro charges fewer fees for its transactions from the users.

To prevent high trading fees, trade on the Coinbase Pro platform and use limit orders, not market orders – the maker fee is 0.1% – and use bank transfers to buy crypto on Coinbase.

Slow customer support

A good crypto exchange is dedicated to providing excellent customer service. For healthy business growth, every customer problem must be solved on time. As a result, every investor desires exchanges that focus on resolving customer issues on time.

Coinbase ‘Contact us‘ section

Coinbase needs to make the service even better. Though it seeks to address customer queries through email, social media platforms, or a form on its website, customer satisfaction from all these measures is not up to the mark. Existing customer feedback indicates poor customer service and minor assistance navigating scams, hacked accounts, and locked accounts.

Selfie and other KYC compliance documents

Users must undergo a rigorous KYC process to avail themselves of some platform features. You cannot deal with fiat unless you have undergone the KYC process.

To purchase any crypto-asset, you must furnish details like ID, pictures, and other documents at Coinbase. This disadvantages Coinbase against other crypto exchanges offering trading services with reasonable identity verifications.

- High trading fees of 0.5% for both maker and taker

- Long waiting times for deposits

- Limited technical analysis tools

Below we outline the best alternatives to Coinbase, and offer varied brokerages for an optimal trading experience. A Coinbase alternative for buying crypto, or for more active trading, can avoid the setbacks specific to Coinbase.

Coinbase News – Latest Updates in 2024

- Coinbase exchange is featured in a Superbowl ad, and the Coinbase site briefly crashes

- Coinbase partners with OneRiver to create a new institutional platform

- Coinbase files to form a PAC ahead of 2022 midterms

- New York City mayor to receive BTC and ETH as salary through Coinbase

- The Coinbase NFT wallet is upgraded

Coinbase Alternatives – the Verdict

Using Coinbase to buy cryptocurrency can come with high fees if users buy with a debit card, or use market orders on Coinbase Pro.

The exchange also requires a selfie ID, is known to lock accounts – search Reddit for Coinbase locked account, and there are many discussion threads – and asks for extra KYC (know your customer) compliance documents from verified traders with a high trade volume. That can include your income, employment etc., and where your trading funds are sourced.

Coinbase customer support can be slow to respond to queries. NB, some scam accounts on Twitter pretend to have Coinbase support or can get Coinbase accounts unlocked – these fake profiles are imposters. Some users fall victim to these scams as the official Coinbase support is slow to reply.

This guide recommends Best Wallet as possibly the best alternative to Coinbase. It offers a simpler approach to buying cryptocurrencies and doesn’t have any complex UI to go through.

Best Wallet - Manage Your Crypto

- Access DeFi and Web3 Dapps Across Multiple Chains

- Comes With Your Own OpenAI Powered Chat Bot Assistant

- Get Early Access to Upcoming Token Launches & ICOs

- Integrated Decentralized Exchange To Buy & Trade Crypto

- Store Crypto And NFTs With Industry Leading Security

FAQs

There are multiple tools to directly exchange cryptocurrency, with varying fees and limitations. Sites include Bitpanda, Changelly, Binance and others.

Coinbase is the owner of Bitlicense, the New York requirement for crypto trading. Fulfilling the requirements of this business license are expensive and add to the high costs for Coinbase.

Cryptocurrency is inherently risky, and Coinbase has gone through multiple disruptions, including a lagging site during periods of high demand; high wallet fees; price pumps and price instability. Holding coins on Coinbase is risky, and there are reports of personal accounts being drained of funds.

The geographic outreach and availability of eToro makes it suitable for US-based traders and buyers, relying on spread fees instead of a trading fee schedule. The best current alternative to Coinbase right now is eToro, which evolved to serve most of the demands of crypto-curious traders.

Coinbase expanded into multiple coins and tokens in 2019. However, for US-based traders, not all available assets are freely accessible, and some are not available for trading. Unlike eToro, Coinbase limits retail traders and newcomers from some markets, which are only reachable on Coinbase Pro.

Most platforms offer the chance to actively trade, instead of making a single exchange. Coinbase is tailored to newcomers acquiring some crypto assets as a hedge or a risky bet. Platforms like eToro offer a gateway into trading, with a risk-free demo account. Trading is much riskier, and this makes eToro a better alternative to Coinbase, due to its wider international base of traders and less liquidity disruptions. Are there any sites like Coinbase?

Why is Coinbase so expensive?

Is Coinbase unsafe?

What is the best alternative to Coinbase with lower fees for US buyers?

What assets are available on Coinbase that are not offered through other providers?

What is the difference between a crypto exchanger and a trading platform?