Low-cap cryptocurrencies are tokens with market capitalizations of less than $1 billion and are typically early-stage projects, niche crypto assets, or meme coins. Compared to mid- and high-cap crypto, which have valuations of $1 to 10 billion and over $10 billion, respectively, low-cap tokens have the most risk but can offer significantly higher returns.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

current price: $0.0017 | raised: $39,661,135 | Learn more | ||

| 2 |

|

current price: $0.09 | raised: $50,542 | Learn more | ||

| 3 |

|

$0.0(5)22 | -6.01% | $108,947,898 | $549,052 |

$0.0(5)22

―

$0.0(5)23

|

| 4 |

|

$0.08 | -10.94% | $80,511,481 | $10,250,062 |

$0.08

―

$0.09

|

| 5 |

|

current price: $0.0025 | raised: $6,222,885 | Learn more | ||

| 6 |

|

$0.0(4)41 | 2.46% | $36,720,578 | $1,180,348 |

$0.0(4)40

―

$0.0(4)43

|

| 7 |

|

current price: $0.0038 | raised: $10,071,613 | Learn more | ||

| 8 |

|

$0.0(3)44 | -8.38% | $30,825,803 | $1,724,460 |

$0.0(3)44

―

$0.0(3)48

|

| 9 |

|

current price: $0.06 | raised: $483,110 | Learn more | ||

| 10 |

|

$0.06 | -15.17% | $20,998,659 | $1,473,139 |

$0.06

―

$0.07

|

| 11 |

|

$0.0(6)63 | -2.81% | $20,851,397 | $50,764 |

$0.0(6)55

―

$0.0(6)65

|

| 12 |

|

$0.02 | -12.75% | $20,561,265 | $15,531,221 |

$0.02

―

$0.02

|

| 13 |

|

$0.0047 | -2.16% | $18,570,886 | $213,518 |

$0.0047

―

$0.0049

|

| 14 |

|

$0.0014 | -4.78% | $13,904,493 | $230,299 |

$0.0014

―

$0.0014

|

| 15 |

|

$0.02 | -2.29% | $8,449,746 | $145,144 |

$0.02

―

$0.02

|

| 16 |

|

$0.03 | 0.62% | $5,716,354 | - |

$0.03

―

$0.03

|

| 17 |

|

$1.00 | -0.02% | $5,617,000 | $25,874 |

$1.00

―

$1.00

|

| 18 |

|

$1.00 | 0.10% | $4,717,338 | $482,899 |

$0.99

―

$1.00

|

| 19 |

|

$1.00 | 0.02% | $4,559,349 | $1,077 |

$1.00

―

$1.00

|

| 20 |

|

$1.09 | -0.02% | $3,480,475 | $10,958 |

$1.08

―

$1.09

|

| 21 |

|

$19.94 | 8.03% | $2,238,353 | $6,468 |

$16.42

―

$20.33

|

| 22 |

|

$0.0017 | -14.92% | $1,747,730 | $1,274,687 |

$0.0017

―

$0.0021

|

| 23 |

|

$0.0(8)33 | -8.31% | $1,406,515 | $40,879 |

$0.0(8)30

―

$0.0(8)36

|

| 24 |

|

$0.03 | -5.55% | $1,242,557 | - |

$0.03

―

$0.03

|

| 25 |

|

$0.02 | -1.48% | $1,055,441 | - |

$0.02

―

$0.02

|

| 26 |

|

$0.99 | -7.48% | $989,675 | $1,088 |

$0.98

―

$1.08

|

| 27 |

|

$0.0023 | -7.94% | $773,381 | - |

$0.0023

―

$0.0026

|

| 28 |

|

$0.0(3)75 | -22.07% | $754,976 | $106,844 |

$0.0(3)74

―

$0.0010

|

| 29 |

|

$0.0053 | - | $458,363 | $56,633 | - |

| 30 |

|

$0.0095 | -3.08% | $355,891 | - |

$0.0095

―

$0.02

|

| 31 |

|

$0.0047 | -0.76% | $320,792 | - |

$0.0034

―

$0.0048

|

| 32 |

|

$0.0014 | -50.57% | $86,696 | - |

$0.0013

―

$0.0028

|

| 33 |

|

$0.01 | -5.03% | $68,902 | - |

$0.0096

―

$0.01

|

Solaxy

SOLX 🔥Selling Fast 🎯presale stageSnorter Bot

SNORT ⭐New 🎯presale stageVVS Finance

VVSMoonbeam

GLMR

BTC Bull

BTCBULL Top Meme Coin 🎯presale stageMESSIER

M87

Mind of Pepe

MIND ⏳Presale Ending Soon 🎯presale stageWojak

WOJAK

SUBBD

SUBBD 🎯presale stageDragonchain

DRGNIlluminatiCoin

NATIpippin

PIPPINSTRIKE

STRIKEDione

DIONELion Cat

LCATHUSD

HUSDHermetica USDh

USDHNectar

NECTVai

VAIHigh Yield USD (Base)

HYUSDHacash Diamond

HACDLarge Language Model

LLMToad (SOL)

$TOADJarvis

JARVISLA

LASoul Scanner

SOULGiveth

GIVAnti Rug Agent

ANTIRUGMetaverse ETP

ETPBismuth

BISGarlicoin

GRLCVega Protocol

VEGAMonkex

MONKEXIn this article, we explain the investment potential of tokens with low market valuations, breaking down their advantages and risks. We’ll also cover the best low-cap crypto to buy and discuss how to find promising projects among the thousands of tokens in the market. Let’s begin.

Best Low-Cap Crypto to Buy

Below, we’ll highlight five promising low-cap cryptocurrencies in 2025 that are gaining attention for their unique use cases and growth potential.

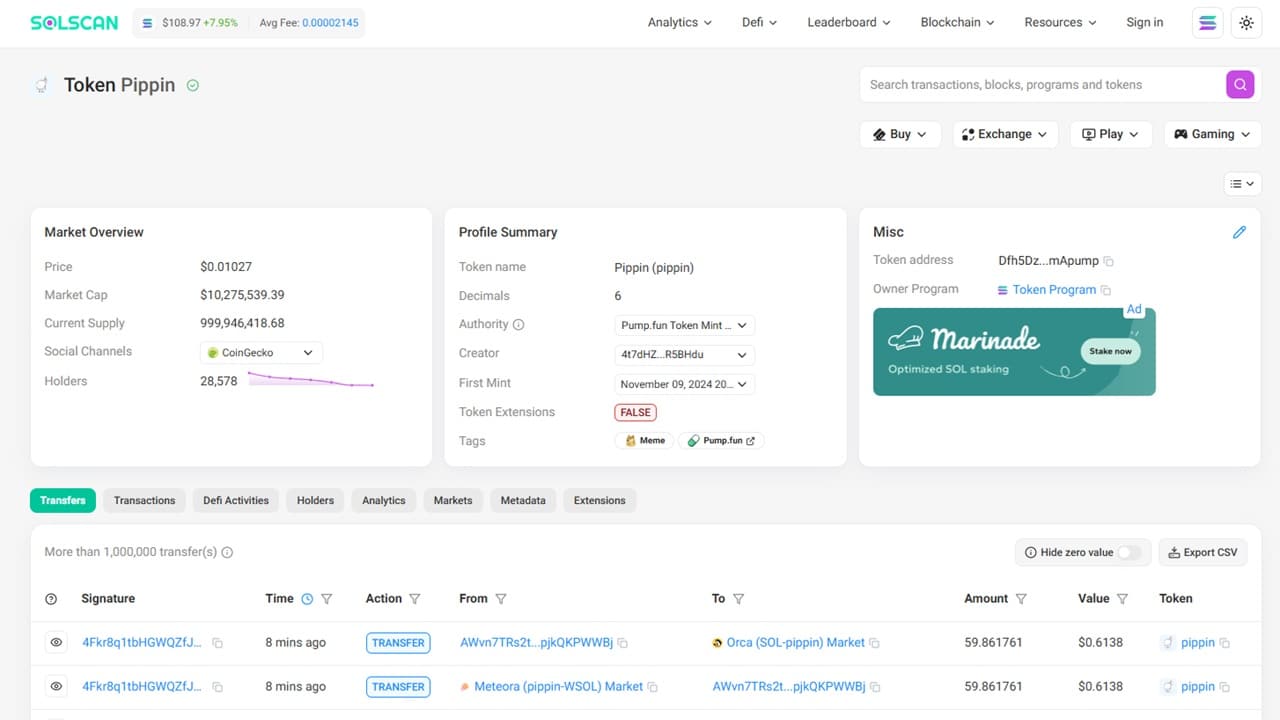

1. Pippin ($PIPPIN)

pippin Price Chart

(PIPPIN)pippin (PIPPIN)

Pippin ($PIPPIN) is an AI meme coin launched on Solana in 2024. It’s the community token of the autonomous Pippin AI agent, built upon the pioneering BabyAGI framework. Both Pippin and BabyAGI were designed by Yohei Nakajima, a leader in AI venture capital and recognized by famous investors like Jeff Bezos and Mark Andreessen.

Inspired by AI-generated SVGs, Pippin is now a fully autonomous digital being with a significant following on social media platforms, notably X. The AI influencer periodically posts on X without human intervention and has experimented with image creation, animation, and live streaming.

During the AI agent meme token bull run, Pippin skyrocketed by over 20,000% in less than two weeks. Back then, its market cap peaked at nearly $250 million, as many analysts predicted AI agent coins to outperform meme coins in 2025. Since then, Pippin’s token price has corrected back to levels before it shot up.

Still, Pippin is listed on several centralized exchanges (CEXs), including HTX, Bitget, LBank, and Gate.io, and decentralized exchanges (DEXs) like Raydium, Meteora, and Orca. According to Solscan, there are nearly 30,000 unique $PIPPIN holders. Recent trading activity has been dwindling, but the AI agent crypto has already paved the way for other autonomous digital platforms.

Find out more about Pippin

2. IlluminatiCoin ($NATI)

IlluminatiCoin Price Chart

(NATI)IlluminatiCoin (NATI)

IlluminatiCoin ($NATI) is an Ethereum-based meme coin inspired by secret societies, mysticism, and occult symbols. It’s inspired by ancient symbolisms of power, such as the Owl of Minerva. IlluminatiCoin invites users to purchase $NATI tokens and join its exclusive group of enlightened members.

The crypto project had a stealth launch in 2024, meaning it was listed on a DEX without a presale, has zero taxes, burnt LP (liquidity pool) tokens, and features a renounced smart contract. Of the total token supply of 33 trillion $NATI, 92% was added to the liquidity pool, and the project claims to be built on community-driven development.

Additionally, IlluminatiCoin has integrated with Verus, a Layer-1 blockchain protocol known for its PBaaS (Public Blockchains as a Service) model, which helps developers create scalable and interoperable blockchains in minutes. Based on the project’s roadmap, NATI aims to be part of the Verus CurrencyBasket feature, which could potentially increase the meme coin’s visibility.

According to Etherscan, IlluminatiCoin still has room for growth and adoption, with over 1,750 token holders. However, the meme coin is not yet widely available, being live on only the Bilaxy centralized exchange and the Uniswap decentralized exchange.

Find out more about IlluminatiCoin

3. Vega Protocol ($VEGA)

Vega Protocol Price Chart

(VEGA)Vega Protocol (VEGA)

Vega Protocol ($VEGA) is the native token for the Vega decentralized derivatives trading platform. Founded in 2018, the DeFi (decentralized finance) platform started public testnet operations in 2020, allowing users to experiment with Vega Protocol’s initial features. In 2023, the DEX was deployed on the Alpha Mainnet.

$VEGA served as the DEX’s native governance and utility token, enabling holders to propose and vote on creating new markets, fee structures, and other future project decisions. For early distribution, $VEGA was launched as an ERC-20 token and is planned to be bridged to the native Vega chain.

Users could stake their $VEGA tokens to help secure the network and earn subsequent rewards for contributing to the PoS (proof of stake) blockchain. Additionally, the crypto would incentivize liquidity providers on specific markets through a rewards protocol.

In September 2024, the Vega community made an almost unanimous on-chain decision to retire the project and use all remaining resources to help maintain the core protocol software. Following this, Nebula, an independent platform built with Vega’s open-source program, was built and has over 1.2 million tokens claimed.

Find out more about Vega Protocol

4. Jarvis ($JARVIS)

Jarvis Price Chart

(JARVIS)Jarvis (JARVIS)

The Jarvis Network is another DeFi protocol on our list, and its native crypto, Jarvis ($JARVIS), provides the platform’s governance and rewards utility. Built to bridge the gap between TradFi (traditional finance) and Web3, Jarvis allows users to trade real-world assets like fiat currencies directly on the blockchain.

Its flagship product, Synthereum, is a mechanism that enables individuals to mint and exchange synthetic fiat currencies called $jFIATs. These are backed by crypto collateral, such as the stablecoin USD Coin ($USDC). They track the price of fiat currencies, which can be used for payments, trading, and yield farming.

$JARVIS recently replaced the former $JRT native token. Based on the Jarvis Network website, $JARVIS token holders can vote on the platform’s future by staking and locking the cryptocurrency to acquire $veJARVIS. In turn, $veJARVIS is held so that users can participate in the governance protocol and earn staking rewards from the network’s revenue.

Moreover, $veJARVIS holders get boosted rewards for providing liquidity on the platform and whenever they borrow assets within the Jarvis Network. With the additional delegation utility, individuals with $veJARVIS tokens can delegate their voting rights to more active members, increasing their voting power on the network.

Find out more about Jarvis

5. Moonbeam ($GLMR)

Moonbeam ($GLMR) is a Layer-1 blockchain that provides Ethereum operability within the Polkadot ecosystem. The native utility token, $GLMR, can be used to pay for on-chain smart contract executions and network fees on the Moonbeam chain. Holders can also participate in the network’s governance protocol, allowing them to vote on key decisions and upgrades on the blockchain.

What started as an experimental project, Moonbeam publicly launched its Mainnet in January 2022 and has since facilitated hundreds of innovative projects. Based on the platform’s most recent milestones, it has enabled over 20 million total EVM transactions, 777,000 new accounts, and more than 200 dApps (decentralized applications)

Instead of using the traditional PoS consensus mechanism, Moonbeam uses a hybrid protocol based on the DPoS (delegated proof-of-stake) model and further built upon Polkadot’s NPoS (nominated proof-of-stake) concept, which uses collators instead of conventional validators. However, $GLMR holders can still stake tokens to support the network and earn staking rewards.

Out of all the low-cap cryptocurrencies on our list, only GLMR is listed on Binance, the largest centralized exchange in the world. The L1 token is also live on MEXC, OKX, ByBit, and other CEXs.

Find out more about Moonbeam

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

How We Chose the Best Low-Cap Crypto

In our search for the best low-cap crypto projects, we evaluated each token based on its real-world use cases, transparency, and potential growth indicators. As a result, our analysis prioritized certain fundamentals for a well-rounded assessment of each crypto’s value proposition.

Market Potential

When reviewing low-cap blockchain projects, one of the most critical factors is how the crypto addresses a real need, whether in the blockchain ecosystem or beyond. Coins that support DeFi applications, cross-chain interoperability, and protocol innovations are likely to gain more long-term traction than those without a clear use case. However, some projects like meme coins may showcase growth through other means.

Market trends, including transformation technologies like artificial intelligence, Web3, and DeFi solutions, have also influenced our selections. Low market cap tokens aligned with fast-growing trends may be positioned for potential breakthroughs in the future. Having a clear function and being part of a growing sector in the crypto market helps set the runway towards broad market adoption.

Community Engagement

Another strong indicator of sustainable growth is community activity and involvement. For low-cap tokens, active social media channels with engaged forums and other initiatives show genuine interest in the project.

Furthermore, the quality of the community’s engagement also matters. Coins with organic traction were prioritized, where user interaction is driven by enthusiasm and not just paid promotions. This support also tends to help stabilize token prices during periods of high volatility and market corrections.

Loyal members of low-cap cryptocurrencies can also lead to new user acquisition and great visibility. Flourishing communities feature many user-generated creations, discussions, and educational content that can help newcomers learn more about the project. Often, projects encourage token holder involvement through tokenized governance, which is another plus.

Security and Tokenomics

As we’ll mention later, scams and rug pulls are some of the highest risks in low-market-cap crypto. We focused on projects with clear and accessible documentation, including whitepapers and open-source code. These factors show how accountable the developers are and let potential investors know exactly what they’re getting into.

Tokenomics, which is the way a token is utilized and distributed, is another factor that we consider. Low-cap tokens with overly centralized supply or unclear allocations pose long-term risks to investors, making them less attractive prospects on our list.

Token utility also plays a significant role in our assessment, especially for cryptocurrencies with multiple use cases beyond pure speculation. Whether as a community token, governance, or rewards, these functions help a crypto hold more of its value over time.

Historical Price Performance

While a successful past performance doesn’t guarantee future gains, a token’s price history can still offer value context. We looked at whether a token is trading well below its all-time highs without any major changes in fundamentals—a sign it might be undervalued. Small-cap coins with solid products that experienced a temporary price drop may deserve a second look.

We also analyzed long-term price action, as tokens that have repeatedly fallen and broken past previous all-time highs can indicate a loyal community of holders that continue to invest in the cryptocurrency despite highly unstable market periods.

Exchange Listings

Where a token is listed can explain a lot about its legitimacy and stability, especially for those with smaller market valuations. While a DEX listing shows a crypto’s grassroots in the market, going live on centralized exchanges typically means that the project underwent a vetting process and has broader liquidity access.

Moreover, cryptocurrencies listed on multiple exchanges can add to the token’s overall price stability since it’s exposed to many users across platforms. Even upcoming or rumored listings can serve as price catalysts, especially when larger exchanges like Binance, Coinbase, and Kraken are involved.

What Are the Benefits of Investing in Low-Cap Crypto?

Many crypto investors are drawn to low-cap coins because of their unique opportunities. These lesser-known tokens often have higher volatility, but they also have the potential to offer significant returns for short and long-term strategies.

Potential for High Growth

Since many low-cap cryptocurrencies remain under the radar, early investors can buy into these projects before they achieve mainstream market adoption. For instance, Sui (SUI) was valued at less than $1 billion from its launch in 2023 until its over 500% price surge in 2024, reaching a $13.7 billion market cap.

Another small-cap crypto that experienced huge gains is Pepe ($PEPE), a meme token created in 2023 and inspired by the iconic Pepe the Frog internet meme. In 2024, PEPE was up by over 1,500%, hitting a $9 billion valuation. Today, it’s one of the top Ethereum meme coins and is listed on nearly all major cryptocurrency exchanges.

Several factors can contribute to the rapid price increases observed in low-cap coins. Active community engagement, endorsements from famous crypto investors, and listings on major exchanges can trigger upward momentum. Such is the case with speculative assets, which many investors consider small market-cap tokens to be.

Sometimes, even a single social media announcement by a popular crypto influencer or a large internet trend can cause a price rally. This was the case when Tesla billionaire Elon Musk publicly posted his support for Dogecoin ($DOGE), causing the crypto to surge by 14,000% in a few days.

Lower Entry Costs

Low-cap crypto assets typically trade at a fraction of the cost of high-cap coins like Bitcoin ($BTC) or Ethereum ($ETH). Most small altcoins are worth pennies, while $BTC and $ETH carry thousand-dollar price tags. Cryptocurrencies available at lower price points are more approachable, especially for first-time investors with limited capital.

Additionally, a low-cap token’s affordability allows investors to purchase large quantities of tokens. For example, a $100 investment might get you a fraction of BNB ($BNB), but the same amount could buy thousands of low-cap cryptocurrencies.

Most cryptocurrencies are designed to be fractionalized, meaning they can be broken down into smaller parts that investors can own. While this means that cryptocurrency price isn’t a significant barrier to entry, owning a complete token can be more emotionally satisfying for participants.

Niche and Innovative Projects

Investors seeking exposure to more innovative cryptocurrencies often find potentially disruptive projects and technologies in low market cap tokens. Many are early-stage or experimental crypto platforms with upcoming features that have yet to be tested at scale.

Unlike established tokens, these low-cap crypto projects are still building their communities, infrastructure, and underlying utility. In evolving categories like AI coins, small-cap altcoins could develop breakthrough technologies that could help propel the entire blockchain industry forward.

One previous low valuation cryptocurrency fuelling innovation is Render ($RENDER). For most of 2022 and 2023, the token had a low market valuation, but the project had many use cases in artificial intelligence, decentralized computing, and machine learning. By 2024, its market cap increased tenfold, as Render became a leading crypto within the AI space.

For some investors, buying niche and technology-focused cryptocurrencies goes beyond potential returns. Many want to support new advancements in the broader crypto space, from eco-friendly token initiatives to greater transparency and security. If these projects succeed, they could lead to more investments in other cryptocurrencies.

What Are the Risks of Investing in Low-Cap Crypto?

Now that we’ve covered the benefits and opportunities in low-cap cryptocurrencies, we need to explain the risks. Understanding these can help you make more informed decisions when evaluating small-value crypto projects.

High Volatility

Compared to high-cap coins like Bitcoin and Ethereum, low-cap tokens tend to be far more volatile. Due to their smaller market size and lower trading volume, these cryptocurrency prices can swing dramatically within hours or even minutes. High volatility poses both opportunity and serious risk, especially for investors without a clear strategy.

Pump-and-dump schemes are also more common in low-cap tokens, where it only takes a few large transactions to cause substantial price movement. During these schemes, coordinated buys (pump) start to inflate a token’s price artificially, often associated with social media hype. Once the price peaks, early promoters immediately cash out (dump), leaving newer buyers with heavy losses.

Because of these risks, investors must assess whether a low-cap token’s price swings reflect real market adoption or speculation. While this may be challenging, recognizing unnatural price spikes or sudden influencer interest can help avoid volatility traps and pump-and-dump schemes. Long-term investors could benefit more from projects that show consistent progress and community growth.

Lower Liquidity

With fewer buyers and sellers, low-cap coins have more liquidity risks than mid and large-cap tokens. Because of the limited trading volume, buying or selling even a modest amount of the cryptocurrency can impact its market price.

In low-liquidity markets, crypto exchanges tend to implement large spreads between buy and sell orders, leading to slippage losses and reduced returns. When this happens, the final executed price significantly differs from the intended price. For instance, a trader buying $1,000 worth of a token on a low-volume pair might push the price up several percentage points, resulting in an average cost far above the original quote.

Liquidity slippage risks are amplified when traders try to exit positions during huge market sell-offs. In these cases, individuals can lose even more value from their tokens as they cash them out at a value substantially lower than the initial selling point.

Another issue is the risk associated with trading on small or obscure exchanges. Many low-cap tokens are listed only on decentralized platforms or minor centralized exchanges, which may lack stronger security, customer support, or volume. Always check a token’s trading volume and the credibility of the platforms it’s listed on.

Increased Risk of Scams and Rug Pulls

Cryptocurrencies, regardless of market cap, are largely unregulated. While many government agencies like the U.S. Securities and Exchange Commission (SEC) are developing new regulatory approaches, crypto scams still remain, especially among low market value tokens.

One of the most common scams is the rug pull, where developers suddenly withdraw all funds from a liquidity pool and abandon the project. This leaves other stakeholders’ tokens essentially worthless.

In early 2025, the SEC charged blockchain engineer Eric Zhu with perpetrating a rug pull scam with the GME (GME) meme coin. In the scam, Zhu unlawfully took control of crypto assets valued at around $533,000, contributing to a 12% decrease in the value of the low-cap crypto.

Due diligence is critical before investing, ensuring investors look for signs of potential high-risk projects. Anonymous teams with no track record, vague documentation, unrealistic promises, and excessive marketing without real functionality are all red flags to look out for. A low-cap project may easily gain short-term attention, but long-term sustainability often depends on consistent development, transparency, and a real use case.

Where to Buy and Trade Low-Cap Cryptos

Finding the right platform to buy, trade, and manage low-cap cryptocurrencies is just as important as choosing which tokens to invest in. Whether you use decentralized or centralized exchanges, each option comes with its own advantages, limitations, and requirements.

Decentralized Exchanges (DEXs)

Decentralized exchanges allow users to trade tokens among other DeFi activities while keeping direct control over their crypto assets. For low-cap crypto, DEXs are often the first platforms where these digital assets go live, making them essential for early access. Since anyone can list a token, DEXs offer many new projects, but investors should practice extra caution.

Some of the most popular DEX platforms with low-cap coin listings include:

- Uniswap (Ethereum-based): One of the most popular DEXs, known for housing large liquidity pools and access to various ERC-20 tokens from meme coins to innovative projects.

- PancakeSwap (BNB Chain-based): Ideal for trading low-cap BEP-20 tokens, offering faster and cheaper transactions than Ethereum-based DEXs.

Other DEXs with small-cap crypto listings include Sushi Swap, LFG (formerly Trader Joe), and Raydium, which are niche platforms on alternative networks like Avalanche, Solana, and Arbitrum.

Users need a decentralized crypto wallet to connect to a DEX and retain control over their digital assets. While installing and creating the wallet requires some effort, linking it to a DEX is straightforward and does not require a KYC (Know Your Customer) or sign-up process.

On the downside, anyone can list a token on a DEX, making them full of unverified projects and potential scams that traders may fall for. Decentralized exchanges also rely on user-sourced liquidity, which can be minimal for low-cap tokens.

Despite the risks, DEXs are still the first platforms where many legitimate crypto projects start. Those willing to do their own research and due diligence may find valuable small-cap tokens before they go live on major centralized exchanges and gain traction.

Centralized Exchanges With Low-Cap Listings

For newer traders and those looking for a more user-friendly experience, several centralized exchanges feature low-cap cryptocurrencies. CEXs make the overall trading process easier, providing fiat-to-crypto services, deeper liquidity, and more customer support. However, they often require KYC verification and have a more limited selection of small-cap tokens.

Some top CEXs with low-cap token listings include:

- KuCoin: A trusted exchange that offers a wide selection of cryptocurrencies. It often lists promising projects earlier than other platforms and features a beginner-friendly interface.

- Gate.io: This CEX is known for including more niche tokens, including many low-cap and pre-launch projects. In total, it offers over 3,800 cryptocurrencies across various networks.

- MEXC: A popular crypto trading platform that often focuses on newer crypto assets that are not yet listed on mainstream exchanges. Supports crypto derivatives trading.

One thing to keep in mind when using CEXs is that not all tokens have deep liquidity. Even if a crypto is listed, it might only be paired with Tether (USDT) or BTC, limiting trader options. Before making a low-cap crypto investment on the platform, check the volume and buy-sell spread on the token pair.

Centralized exchanges also hold your crypto funds until you withdraw them to your decentralized wallet, so if the exchange collapses, you risk losing your tokens. In the fall of the FTX exchange, users lost their entire life savings and investments held on the platform.

Still, many investors prefer the convenience and structure offered by CEXs. Using secure and established exchanges and upholding best practices like using two-factor authentication can help mitigate security risks and foster a smoother trading experience with peace of mind.

Strategies for Trading Low-Cap Cryptos

Using well-designed strategies can help users better navigate small-cap cryptocurrencies, increasing their chances of earning. While returns are never guaranteed, creating a clear game plan enables better risk-to-reward management.

Short-Term vs. Long-Term Holding

Consider your time horizon before entering a low-cap crypto position. Some users opt to buy and sell tokens within hours to a day, while others look to hold their crypto for years. Each approach requires different tactics and risk levels, so deciding how long you plan on keeping your positions will shape your entry, exit, and amount of capital to invest.

Here’s a closer look at what short-term trading and long-term holding entail:

- Short-Term Trading: Relies on technical analysis to make a profit from short price surges, often susceptible to volatility risks. Strategies include swing trading (lasting a few days to weeks), scalping (minutes to hours), and day trading (within the day).

- Long-Term Investing: Typically based on project fundamentals, utility, and market growth potential. To minimize the effects of market volatility, many investors use the DCA (dollar-cost average) strategy, where a fixed amount is periodically invested in the asset.

Traders often use a combination of both strategies, splitting their portfolio into both long-term investments and short-term trades. Regardless of strategy, users should maintain proper discipline as emotional decisions can lead to panic-selling, overtrading, and other common trading pitfalls.

Risk Management Tips

The crypto market as a whole is generally considered volatile and unstable, making low-cap tokens especially high-risk assets. One of the most effective ways to protect your capital is by setting clear stop-loss and take-profit levels for every position. This can be set on CEXs, DEXs, and some crypto wallets, and helps automate your strategy for better adherence.

A stop-loss ensures that investors close a trade when the price drops below a specific value, limiting how much they’re willing to lose. On the other hand, take-profits help lock in gains once the token reaches the target price. Using both of these tools is key in managing risks, which are amplified in cryptocurrencies with low valuations.

Finally, we recommend token diversification to reduce the chances of a single small-cap crypto wiping out your entire portfolio. Instead of making a large investment in just one crypto asset, try spreading it across multiple promising projects. This also increases your exposure to multiple sectors and categories, further improving your overall chances of success.

Low-Cap Crypto FAQ

What is considered a low-cap cryptocurrency?

Many investors consider low-cap cryptocurrencies as tokens with small market capitalizations, usually worth under $1 billion.

Why do investors look for low-cap cryptos?

Low-cap cryptos are popular digital assets because of their significant upside potential and high volatility. These high-risk, high-reward tokens appeal to investors interested in increasing their risk appetites, diversifying their portfolios, or starting a short-term trading strategy.

What are the risks of investing in low-cap cryptocurrencies?

Cryptocurrencies with low market capitalizations are more susceptible to substantial price swings because their valuations are mainly based on speculation. Additionally, these tokens have inherently lower liquidity, and can be potential scams for investors as they are barely known.

Can low-cap cryptos experience massive price increases?

Due to their small valuations, low-cap tokens can experience significant price surges, which can lead to substantial gains for investors who make the right decisions. However, because of their highly volatile nature, these token prices may drop just as quickly as they rise.

How do I find promising low-cap crypto projects?

Investors can find low-cap crypto projects with high potential through decentralized exchanges (DEXs) like Uniswap and Pancakeswap and centralized exchanges (CEXs) that have low-cap listings like KuCoin, Gate.io, and MEXC.

What are the best exchanges to trade low-cap cryptos?

The best exchanges for trading low-cap cryptocurrencies vary depending on the investor’s needs. DEXs often feature early-stage tokens unavailable on CEXs, providing a first-mover advantage. Meanwhile, CEXs typically offer higher liquidity and listings that have undergone some degree of vetting, reducing the risks of scams.

How can I tell if a low-cap crypto is a scam?

Red flags indicating a low-cap token is a scam include shady developers, no third-party smart contract audits, poor token distribution, and unsustainable tokenomics.

References

- These Cryptocurrencies—From Dogecoin To XRP—Outperformed Bitcoin In 2024 (Forbes)

- Render Network (Render Network)

- Meme Coins Will Lose Market Share to AI Agent Coins in 2025, According to Dragonfly VC Predictions (Yahoo Finance)

- Pippin (pippin) | Solscan (Solscan)

- Vega Protocol is Live on Alpha Mainnet! | by Vega Protocol | Vega Protocol (Vega Protocol)

- SEC.gov | Crypto Task Force (U.S. SEC)

- SEC.gov | Eric Zhu (U.S. SEC)

- The Collapse of FTX: What Went Wrong With the Crypto Exchange? (Investopedia)