On this Page:

That said, figuring out how to start crypto trading can be overwhelming, especially for new investors. In this crypto trading guide, we will break down all the essentials, from crypto trading basics to the most popular crypto trading strategies for beginners.

By the end of this article, you’ll better understand how trading cryptocurrency works, how to analyze crypto charts, avoid common mistakes, and much more.

Key Takeaways

- Start small and only use money you can afford to lose. Crypto prices can change fast, so don’t risk more than you’re comfortable with.

- Decide when to buy, when to sell, and how much you’re willing to lose, and stick to it.

- Basic tools like support/resistance lines and price trends can help you make better trading decisions, so learn to read charts.

How Does Crypto Trading Work? Understanding the Basics

Before diving head-first, it’s essential to understand the basics of crypto trading.

1. What Is Crypto Trading?

Crypto trading involves buying and selling cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others to make a profit. It operates 24/7, unlike stock markets. There is no opening or closing bell, which makes it accessible at any time, even on holidays. Naturally, the goal of crypto trading is to buy low and sell high for a profit. While this is an extremely simple concept, it’s not always easy to execute successfully.

Cryptocurrencies are also generally significantly more volatile than most other speculative assets, including stocks, making it a high-risk, high-reward market. With the right timing and strategy (and a bit of luck), it’s possible to book massive profits quickly, but the same volatility means that losses can pile up just as fast, if not faster.

2. Key Concepts in Crypto Trading

Crypto trading is much more complex than merely buying and selling. There are quite a few key concepts that you should know about before you start trading, such as order types, trading pairs, and bid and ask prices.

Order Types

Here are the order types that you should understand before you start trading cryptos:

- Market Order: A market order is the simplest type of trade order. This involves instructing the platform you’re using to trade to simply buy or sell cryptocurrency at whatever the current market price is. A market order can be executed quickly, allowing you to act on an entry or exit position with minimal delay. However, they are imprecise and not ideal for volatile assets like cryptos.

- Limit Order: This type of order allows you to purchase or sell cryptocurrency at a specific price, known as a “limit price.” A buy limit order will only execute when at or below the limit price, and a sell limit order will only execute at or above the limit price.

- Stop-Loss Order: A stop-loss order is one of several risk management tools you can use to limit potential losses on a trade. It instructs your trading platform to sell a specific asset if its price falls below a specified threshold.

- Take-Profit Order: A take-profit order is another essential risk management tool you can use to help lock in gains. It tells your trading platform to automatically sell a specific asset once it hits a target level that you have set. This is an especially powerful tool in the crypto market, allowing you to secure profits without having to actively monitor price movements 24/7.

Trading Pairs

In cryptocurrency trading, transactions are generally done in pairs. A crypto trading pair usually consists of either a cryptocurrency and a traditional currency (buying BTC with USD) or two different cryptocurrencies (purchasing ETH with BTC or USDT, for example). Trading pairs are typically expressed with each element separated by a slash like BTC/USD or ETH/BTC.

Bid & Ask Prices

If you have ever negotiated with a buyer or seller, you already understand bid prices and ask prices at a basic level. These two values form the basis of any market transaction, whether you are trading physical goods or digital assets.

- Bid Price: The bid price is the highest price a buyer is willing to pay for a specific asset. It represents an offer to buy said asset, usually at or below the current market price.

- Ask Price: The ask price is the lowest price a seller is willing to accept. It represents an offer to sell, generally at or above the current market price.

When you place a market sell order on a crypto exchange, you agree to sell your asset or assets at the current bid price. When you place a market buy order, you agree to buy at the current ask price. The difference between the bid and the ask prices is called the spread, and its size can impact trading efficiency and costs.

Liquidity

Liquidity refers to the ease with which you can buy or sell an asset (like a cryptocurrency) without significantly affecting its price. The more liquid an asset is, the faster and more efficiently you can trade it. There are numerous factors that affect the liquidity of a digital asset, including:

- Trading volume: This is often one of the biggest factors that affect liquidity. Higher trading volume usually translates to more buyers and sellers, making it easier to enter or exit a position quickly.

- Market sentiment and price trends: Positive price trends often attract buyers, while negative price trends encourage selling, both of which can increase liquidity.

- Exchange fees: Transaction fees charged by crypto exchanges can impact trading behavior. If fees are high (or inconsistent), traders may wait until they drop, reducing liquidity.

Understanding all of these concepts is crucial when learning how to trade cryptocurrency, especially for beginners.

How to Start Crypto Trading for Beginners: A Step-by-Step Guide

Step 1: Choose a Crypto Trading Platform

To start trading, you’ll need to sign up on a reputable cryptocurrency exchange. Here are some top exchanges:

| Exchange | Best For | Pros & Cons |

|---|---|---|

| Kraken | Low fees, learning about crypto trading | Pros: Low fees for beginner traders, great educational resources, 300+ cryptocurrencies available. Cons: Not available in all U.S. states, no options trading. |

| Coinbase | Beginners & HODLers | Pros: Wide variety of supported coins in a simple interface. Cons: High fees compared to other platforms, no margin or options trading. |

| Gemini | Experienced traders, high security | Pros: Strong security, FDIC insurance for uninvested cash, regularly audited. Cons: Fewer coins, high fees unless using ActiveTrader. |

| Crypto.com | Mobile trading | Pros: Intuitive mobile app for buying, selling, and spending crypto. Cons: Limited customer support, UI complaints from users. |

Step 2: Create and Verify Your Account

- Sign up on an exchange and complete KYC verification: KYC stands for “Know Your Customer.” It’s a standard process where exchanges verify your identity to comply with AML (anti-money laundering) and CTF (counter-terrorism financing) regulations. Reputable exchanges typically require this step, so it’s generally smart to avoid exchanges that don’t require this type of verification.

- Enable two-factor authentication (2FA) for extra security: 2FA or MFA (multi-factor authentication) is likely the most important step you can take to secure your crypto exchange accounts. It adds additional security to your account by requiring a second method of authentication beyond a password. Note that SMS-based MFA is generally considered less secure than authenticator apps like Google Authenticator or Authy due to the risk of SIM-swap attacks.

Step 3: Fund Your Trading Account

Next, you will need to fund your trading account. You can:

- Deposit fiat currency (USD, EUR, etc.) via bank transfer, debit card, credit card, or a supported payment app like PayPal. Once the deposit goes through, you can start trading crypto. Some exchanges, including Coinbase, also allow you to buy crypto with a credit or debit card directly.

- Deposit crypto from another crypto wallet if you wish to consolidate digital funds in a single exchange or use one cryptocurrency to purchase another.

Step 4: Plan a Trading Strategy and Place Your First Trade

Before you get ahead of yourself and start trading, you should ideally work out your goals and risk tolerance. It’s smart to consider what kinds of trades you want to make, which assets you want exposure to, and how much money you can afford to lose before diving in.

Spot trading is the simplest form of trading, where you buy and sell cryptocurrencies instantly at current market prices. The general goal with spot trading is buying at a lower price and selling at a higher price, thereby booking a profit. You can also spot trade crypto ETFs through your regular brokerage app.

- Best for: Beginners and HODLers. HODL is a tongue-in-cheek acronym that stands for “Hold On for Dear Life.” This refers to crypto investors that resist the urge to sell their crypto at the first price increase, instead opting to play the long game in the hope of even better returns on their investment.

- Example: If someone purchased 1 Bitcoin back in 2015 when the price was around $400 and held onto it until now, they would book a significant profit if they chose to sell now. Of course, it doesn’t always work out that way.

- Risk Level: The risks of spot trading cryptocurrencies are still high, though it is generally significantly less risky than margin trading.

Margin trading allows traders to borrow funds (leverage) to increase their position size, amplifying potential profits but also increasing risk. Because margin trading uses borrowed funds, this approach can magnify positive returns but can also magnify losses. The higher the margin you use (some platforms offer up to 100x), the riskier it is.

- Best for: Experienced traders who understand risk management.

- Example: Using 5x leverage, a $1,000 trade becomes a $5,000 position.

- Risk Level: Margin trading is extremely risky, especially in crypto. Most retail-focused crypto margin trading platforms automatically liquidate your position before losses exceed your initial margin. This means that you are unlikely to lose more than you put in, but you can still lose it all quickly if the market moves against you.

Futures trading involves speculating on the future price of a cryptocurrency without actually owning the asset. Traders can go long (betting the price will go up) or short (betting the price will go down), often using leverage to amplify potential returns.

Futures trades are based on contracts that obligate the trader to settle the position at a set price on or before a set date (except for perpetual contracts, which never expire). If the market moves against your trade, you may be forced to close the position at a loss or meet margin requirements to avoid liquidation.

- Best for: Traders with strong technical analysis skills and a deep understanding of market trends.

- Example: If Bitcoin is at $40,000, you can open a long futures contract predicting it will reach $45,000. If the price indeed climbs, you can close the position for a profit based on the difference between the entry and exit prices, magnified by any leverage used.

- Risk Level: Very high—futures trading can lead to significant losses if the market moves against you. It is especially risky because it is incredibly difficult to accurately predict short-term price movements in volatile assets. Using leverage makes it even riskier.

Best Crypto Trading Strategies for Beginners

There is no perfect one-size-fits-all crypto trading strategy. You have to choose the best strategy for you, depending on your goals, risk tolerance, and time commitment. Here are some of the most popular strategies used by beginners to get started.

1. HODLing (Long-Term Investing)

HODLing involves buying and holding cryptocurrencies for long periods of time. The term comes from a typo on a BitcoinTalk thread that went viral many years ago, and it has been a mainstay in the crypto community ever since. This strategy is for those who strongly believe that the crypto market’s bullish boom-and-bust cycles will continue to produce new highs over time and can afford to ride out a currency’s market volatility, investing for the long haul.

Because cryptocurrencies are still an emerging industry, HODLers often believe that as the tech progresses and new use cases are developed, adoption will continue to rise over time. Naturally, no one knows for sure whether it will continue to grow at such a rapid pace.

Risk: There are more than 9,000 cryptocurrencies active in the marketplace. Very few of these will likely stand the test of time, and even the largest cryptos might not continue to grow. Currently, the top 20 cryptocurrencies make up 90 percent of the industry’s market capitalization.

2. Dollar-Cost Averaging

Dollar-cost averaging is a popular crypto trading strategy where investors invest set amounts of money at regular intervals, no matter how volatile the markets are. The goal is to slowly acquire more of the underlying asset when prices are low and less when they are high.

One advantage of this method is that it can reduce emotional decision-making in response to price swings and help smooth out the impacts of short-term volatility. DCA is often used as a part of a HODLing strategy, building up your stockpile slowly but surely. It is particularly popular with beginners because of its simplicity.

3. Day Trading

Day trading involves buying and selling assets within the same day, aiming to capitalize on short-term price movements. The nature of day trading requires quick decision-making, technical analysis skills, fundamental analysis skills, and constant vigilance to spot price movements.

Experts generally agree that day trading isn’t a great choice for most beginners due to the immense difficulty of predicting short-term price movements, high risks, high skill requirements, and low success rates. A tiny fraction of day traders actually make money. In fact, a recent study found that 97% of day traders who traded for 300 or more days lost money.

Risk: High due to market volatility.

4. Swing Trading

Like stock markets, crypto markets move in cycles where prices oscillate based on a wide variety of factors. Swing trading attempts to predict price swings based on past oscillation patterns. Swing traders hold trades for days to weeks in an attempt to take advantage of these price swings. Because this involves longer periods than day trading, swing trading often doesn’t require the same level of 24/7 monitoring that day trading does.

Risk: High if trends are misread or if the market moves unexpectedly.

5. Trend Trading

Trend trading focuses on identifying the direction of market trends and trading accordingly. It is similar to swing trading, though timeframes are often longer as it targets broader trends. There are essentially infinite different strategies and indicators that you can use to try to identify market trends, but two of the most popular are moving averages and RSI indicators.

- Moving averages: Trend-following indicators that help identify the general direction of an asset’s price by averaging out its movements over a set period, attempting to smooth out the noise.

- Relative strength index (RSI): A momentum indicator that attempts to show whether an asset might be overbought or oversold by measuring how quickly and dramatically its price has moved recently. Generally, an RSI of 70 or higher indicates that it may be overbought, and an RSI of 30 or lower indicates that it might be oversold.

Risk: High if you are wrong or the market moves unexpectedly.

6. Scalping

Scalping involves making frequent small trades throughout the day to profit from tiny movements in a cryptocurrency’s price. Scalpers typically execute far more trades than day traders or swing traders, often dozens or even hundreds of trades per day. Scalpers tend to concentrate on currencies that have high volatility and liquidity. When analyzing price movements, scalpers tend to use short time frame charts ranging from 5 to 30 minutes to quickly and precisely identify entry and exit points.

Risk: Requires high attention, quick decision-making, and a deep understanding of short-term price action.

Each strategy comes with its own advantages and risks, so it’s essential to choose the best crypto trading strategy for you based on your goals, experience, skillset, time commitment, and risk tolerance.

Technical Analysis for Beginners

Technical analysis can be a useful skill to help make informed trading decisions, though the extent of its value is controversial among experts. Crypto price charts provide a visual representation of historical market data, helping traders to spot patterns, analyze market behavior, and potentially time their trades better.

Key Indicators for Beginners

Here are some of the most popular indicators that crypto traders use when analyzing a crypto price chart:

Moving averages (MA) help smooth out pricing data to help traders identify the direction of a trend. This can help predict when a price trend is going to reverse itself.

This is Moving Averages 101💰💰

Moving Averages are a great tool for beginner Swing Traders. I made these graphics to help you guys understand how to use MAs

Lmk if you have any questions‼️ pic.twitter.com/EoscAjJ707

— ThiccTeddy (@ThiccTeddy) February 13, 2025

Relative Strength Index (RSI) is a momentum indicator that attempts to indicate when an asset is overbought or oversold. When the RSI is above 70, it means the market could be overbought. If it’s below 30, it could indicate an oversold market. Traders often use RSI in conjunction with moving averages to help predict reversals in pricing trends.

Support and Resistance Levels:

- Support, also called the “floor,” is the price level where an asset tends to stop dropping due to a sudden concentration of demand.

- Resistance is the opposite of support. It is the price level where selling pressure rises, often acting like a kind of ceiling that prevents further price increases.

Traders often watch these levels closely to help decide when to buy or sell based on expected reversals. For example, a trader might expect the price of Bitcoin to drop once it hits a resistance level. Of course, these levels don’t hold forever, and they shouldn’t be considered foolproof by any means.

Tho, I haven't fully understood this part, gradually m grabbing it

What to understand on support & resistance levels when the market are making moves pic.twitter.com/CXp1z5p9DZ

— Kelvin FE (@Klvinfx) February 27, 2025

Chart Patterns to Watch

Traders who use technical analysis to inform their trades also often look for specific patterns that pop up in price charts often. Here are some of the most popular patterns to watch out for:

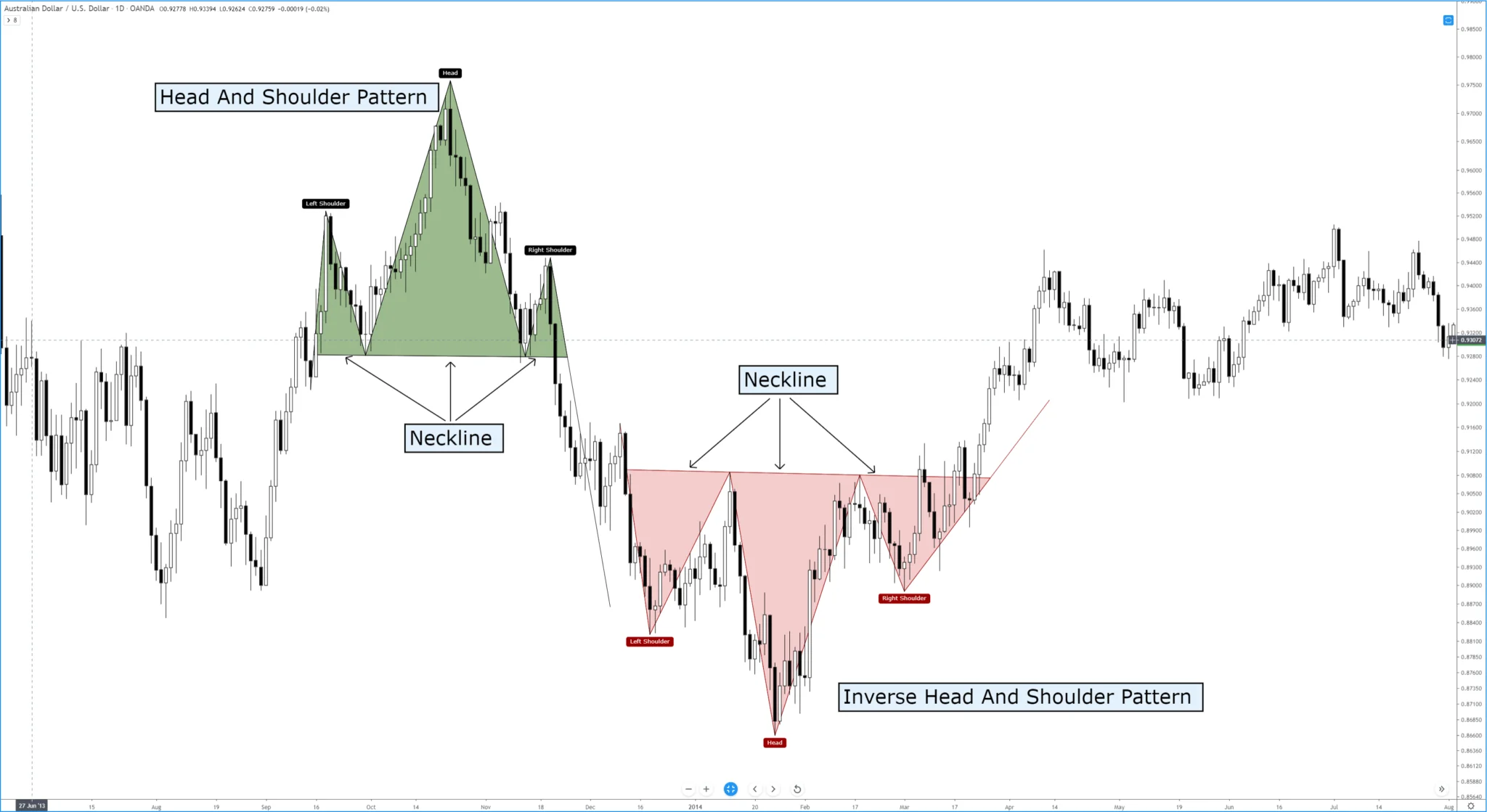

Head & Shoulders: A head and shoulders chart pattern predicts both downward and upward trend reversals. The pattern displays as three peaks, with the taller peak (the head) between the two smaller peaks (the shoulders). The second shoulder peak signals the beginning of the trend reversal.

Double-Top/Bottom: A double-top pattern is formed by two consecutive rounding tops, which some traders believe signals an end to an upward trend. Conversely, a double-bottom pattern is formed by two consecutive rounding bottoms and is the inverse of a double-top pattern. This can be a predictor of a bullish reversal.

Double Bottom Vs Double Top Patterns. pic.twitter.com/6Jb91aQh1B

— Market Rebellion (@zakayonoel37) February 1, 2025

Ascending/Descending Triangles: The ascending or descending triangles are some of the easiest popular patterns that traders analyze. If the chart trend forms triangles that ascend, this could be an indicator of the continuation of an upward trend. If the reverse is true (downward triangles), this could be an indicator of a downward trend.

4/ Triangles are continuation patterns that can be either symmetrical, ascending, or descending. They signal a consolidation of price before a potential breakout in the direction of the trend. pic.twitter.com/39NVWmBZgW

— Young Finance (@finance_young) February 7, 2023

Crypto Trading Tips for Beginners: Mistakes to Avoid

Crypto trading is a complex and risky task, so it is vital to know which mistakes to avoid. Some of the most common tips include:

- While you are still learning, most investing experts suggest starting small or even paper trading to avoid making silly mistakes.

- Try to stick to your trading strategy and avoid emotion-driven trading.

- Avoid excessive leverage, as it tremendously increases your risk and magnifies losses.

- Don’t invest the money you can’t afford to lose.

- Don’t ignore risk management. You can set profit targets, stop-loss orders, and exit plans to help protect your portfolio and keep emotions out of your decision-making.

For beginners, understanding how to avoid these crypto trading mistakes is essential to long-term success.

Final Thoughts Before You Start Crypto Trading

Crypto trading can be exhilarating and incredibly profitable, but it also comes with massive risks, especially for beginners. It is far too easy to lose your entire investment if you make the wrong mistakes. That’s why understanding common mistakes, fundamentals, technical analysis, trading strategies, and risk tolerance is so important.

There is no single “correct” way to trade crypto and no free lunches. Every trader has to figure out what strategies work the best for them and their portfolios and that takes time. You can start small and educate yourself along the way, avoiding risky strategies like margin trading or day trading, at least until you better understand the risks and the market in general.

FAQs

What is the best crypto trading strategy for beginners?

There is no single best crypto trading strategy for beginners, but some of the safer strategies include dollar-cost averaging and 'HODLing.'

Which crypto exchange is best for beginner traders?

While some crypto exchanges like Coinbase and Kraken have especially simple user interfaces and trading features, most large centralized exchanges offer everything a beginner trader needs.

Can you make money trading crypto as a beginner?

Yes, but it requires education, discipline, and a risk management strategy. Remember that there will always be a risk of losses.

Why is analyzing charts important?

Chart analysis can help you identify trends, spot possible price reversals, and track the performance of digital currencies over time.

Can I make a lot of money using scalping?

While you can make money using the scalping method of trading, it is no small task, and it takes a ton of time and commitment to profit in the long run.