On this Page:

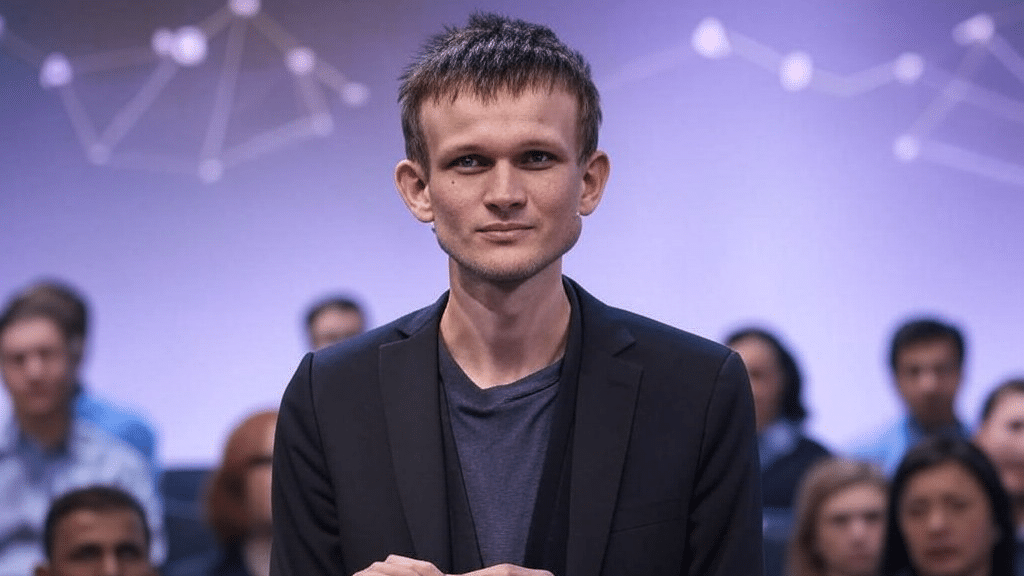

As of 2025, Vitalik Buterin’s net worth is estimated to exceed $1 billion. Despite his role in co-founding Ethereum, he is not as wealthy as some might assume, largely due to his extraordinarily generous philanthropy.

Buterin’s net worth often fluctuates dramatically because crypto assets, which make up the vast majority of his portfolio, are extremely volatile. Unlike many other high-net-worth individuals, Buterin doesn’t fancy investments in stocks or private equity outfits.

In 2022, Vitalik Buterin’s net worth took a significant hit due to the crypto market downturn. Roughly a year earlier, he was named the world’s youngest billionaire by Forbes with a net worth of $1.46 billion as the price of Ether surged past $3,000. Despite a few setbacks for Ethereum, he is still worth over $1 billion.

Breaking Down Vitalik Buterin’s Net Worth in 2025

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| ETH holdings | $730 million |

| Bitcoin holdings | Undisclosed |

| USDC holdings | Undisclosed |

Vitalik Buterin’s Net Worth Over the Years

| Year | Net Worth |

|---|---|

| 2021 | $1.4 billion |

| 2022 | $550 million |

| 2023 | $600 million |

| 2024 | $960 million |

| 2025 | $1+ billion |

Vitalik Buterin Net Worth: Early Life and Education

Vitalik Buterin was born Vitaly Dmitrievich Buterin on January 31, 1994, in Kolomna, Russia. His father, Dmitry Buterin, was a computer expert, inspiring Vitalik to dive into the same general field at a young age. Vitalik would later tell Michael Perklin, the head of security at Ledger Labs, that his father taught him about Bitcoin in 2011. His mother, Natalia Ameline, worked as a financial consultant at the time.

The family’s time in Russia was short, as his father had to move to Canada to search for greener pastures when Vitalik was only six years old. By this point, Vitalik was already showing signs of brilliance.

After his family relocated to Canada, he was enrolled in an elementary school. In grade three, Buterin was drafted into a special class for talented kids. There, he was taught mathematics, programming, and economics. Young Buterin quickly realized that his particular skills and talents made him stand out to his mates and teachers. Naturally gifted with numbers, he could easily perform calculations in his head and add three-digit numbers with remarkable speed.

“When I was in grade five or six, I just remember quite a lot of people were always talking about me like I was some kind of math genius. And there were just so many moments when I realized, like, okay, why can’t I just be like some normal person and go have a 75% average like everyone else.” – Buterin told Wired.

He later studied at the Abelard School, a private high school in Toronto. After he graduated high school, Buterin proceeded to the University of Waterloo, where he took advanced courses and worked as a research assistant for the brilliant cryptographer Ian Goldberg, who designed Off-the-Record Messaging.

Buterin’s success in school didn’t end there. In 2012, he won a bronze medal in the International Olympiad in Informatics in Italy.

After winning a medal at the International Olympiad, Vitalik Buterin embarked on an international tour in 2013. He visited various developers who are also passionate about coding in other countries. By this point, Bitcoin and the concept of cryptocurrencies had already piqued his interest. His writing career required that he devote more of his time, luring him away from his academic pursuits.

That year, Buterin returned from his tour and published the whitepaper that would make him a billionaire in just a few years: the Ethereum Whitepaper.

In 2014, he won a grant of $100,000 from the Thiel Fellowship, a scholarship scheme established by venture capitalist Peter Thiel. Upon receiving the grant, Vitalik dropped out of university to focus more on the early stages of Ethereum and his writing career.

Even though he is a former college dropout, Vitalik Buterin has held an honorary doctorate from the University of Basel’s Faculty of Business and Economics since November 2018.

Vitalik Buterin’s Net Worth: Child Genius Turned Crypto King

Buterin’s friends and family knew that he was destined for greatness long before he published the whitepaper that would go on to change the world. The idea of creating Ethereum came to him while in school, and it only took him a few years to turn it into a reality. Let’s dive into how Buterin became a self-made billionaire.

Bitcoin Magazine

Vitalik Buterin couldn’t stop thinking about Bitcoin ever since his father told him about it in 2011.

At first, he was curious about how Bitcoin managed to gain value without traditional backing, prompting him to keep exploring to understand the technology behind it. As time went on, he discovered more and more about Bitcoin, but he still lacked both the physical and financial resources to pursue his ambitions.

Despite the financial constraints, Vitalik Buterin refused to give up. Instead, he focused on writing articles about Bitcoin, exploring its technological and political aspects more than any other writer or pundit at the time.

Eventually, Buterin was approached by a blog owner who offered to pay him five (5) BTC per article. Soon after he met Mihai Alisie, the pair launched Bitcoin Magazine, one of the first publications dedicated to the crypto industry.

After co-founding Bitcoin Magazine in 2011, Buterin and his team launched a print edition the following year. He was still at university at the time and took on the role of head writer as a side project. During this time, Buterin traveled extensively, meeting crypto developers and interviewing them. His passion for blockchain and the potential of decentralized systems kept growing and ultimately led him to drop out of university to pursue his dreams.

The Beginning of Something New

As one of the premier experts on cryptocurrency, Vitalik Buterin realized that every single cryptocurrency at the time was limited to just one or two particular use cases. He knew that a generalized blockchain, capable of all of the most popular use cases in crypto and more, could take the crypto market to new heights that no one thought was possible.

It took Buterin just a few years to work out the best way to build such a generalized blockchain network. By late 2013, he had landed on using a basic Turing-complete programming language.

In programming parlance, a Turing-complete programming language allows a computer to solve any problem once it has the appropriate algorithm and necessary amounts of time and memory. It would be a basic foundation that other programmers could build on top of to create nearly any kind of functionality that they could imagine by coding and deploying smart contracts (a combination of algorithms and apps).

At around this time, Buterin reached out to Jed McCaleb, a co-founder of Ripple, to ask for a job. He was accepted, but the employment failed to materialize because Buterin couldn’t secure a visa to work in the United States. In hindsight, this setback pushed him to pursue his own vision, so he was able to fully commit to the development of Ethereum and eventually become a billionaire.

A few years later, in 2016, Vitalin Buterin held a position on the editorial board of the scholarly journal Ledger, sharing content on blockchain technology and cryptocurrency.

The Early Stages of Ethereum

Vitalik Buterin first revealed his revolutionary plan with a first draft of his awe-inspiring white paper in 2013, electrifying the entire cryptocurrency and cryptography communities to no end. Describing the concept of the network, Buterin defined Ethereum as a generalized medium for building decentralized applications. He argued against the model of Bitcoin and other early crypto projects that focused on money alone and that there were countless other valuable use cases to be discovered.

The central argument of the paper revolved around the need for a more robust language for application development. In his mind, Bitcoin and its competitors were too laser-focused on the basic monetary aspects of cryptocurrency and cryptography, overlooking the sheer potential that the field held.

On January 26, 2014, during the North American Bitcoin Conference in Miami, Vitalik Buterin announced Ethereum during a 30-minute speech. Just a few months later, Buterin’s idea started to catch fire soon after he released the full Ethereum white paper.

Vitalik Buterin quickly recruited a handful of the top minds in the field to help bring his idea to life, including Gavin Wood, Charles Hoskinson, Mihai Alisie, Amir Chetrit, Jeffrey Wilckle, Joseph Lubin, and Anthony Di Lorio. The group rented a house in Miami, using it as a base for the initial development of Ethereum.

Six months later, the team met again in Zug, Switzerland. During the meeting, Vitalik Buterin told other partners that the project should not be profit-oriented. This led to a disagreement that triggered the departure of Charles Hoskinson. Hoskinson went on to establish IOHK and eventually developed Cardano (ADA).

The official development of the underlying software of Ethereum began in early 2014 through a company in Switzerland called Ethereum Switzerland GmbH. Mihai Alisie provided his experience from years as a successful entrepreneur to help set up Ethereum’s legal and financial foundation.

Gavin Wood, a brilliant English computer scientist and the CTO of the Ethereum Foundation, was tasked with designing the network’s executable smart contract functionality and the first Ethereum testnet. Once the team was happy with the results, it was incorporated into the Ethereum Yellow Paper, detailing what they called the Ethereum Virtual Machine.

In July and August 2014, the Ethereum Foundation launched a crowdfunded sale of Ethereum tokens to fund the project’s development. The sale allowed participants to buy Ethereum’s native token, Ether, with Bitcoin for an average price of $0.30 cents per token. The project quickly gained relevance, thanks to its pioneering technology, and it managed to raise about $18 million in Bitcoin (worth over $3 billion today.

While the sale was deemed a major success, questions about the project’s security and scalability surfaced in these early stages. These questions would go on to haunt Buterin and Ethereum for many years to come.

The Growth and Expansion of Ethereum

Within 18 months in 2014 and 2015, the team developed various codenamed prototypes of Ethereum as part of their proof-of-concept series. With the release of “Olympic,” the last public beta pre-release prototype, the team opened a bug bounty program with a 25,000 ETH bounty to stress test the network.

Ethereum officially launched on July 30, 2015. with its crowdfunded sale of Ether tokens. The very first block mined on Ethereum, also known as the genesis block, contained 8,893 transactions (mostly crowdfund sales).

In 2016, the Ethereum Decentralized Autonomous Organization (DAO) was created, raising an impressive $150 million through a crowd sale to fund its development. However, in June of the same year, the project faced a potentially fatal setback as hackers were able to exploit the DAO’s code and steal $50 million from it.

The Ethereum community was immediately split on what they should do about the hack. Some wanted to hard-fork the network by reverting the network to the block before the hack (and fixing the exploit), splitting it into two separate networks. Critics of this plan argued that it went against the whole point of cryptocurrencies: decentralization.

The DAO eventually decided to go ahead with the hard fork and recover the stolen funds. The controversial decision led to a split in the network, resulting in two separate blockchains – Ethereum (ETH) and Ethereum Classic (ETC), the latter of which maintained the original chain. ETC still exists to this day, but it is worth a small fraction of Ethereum’s market cap.

Reaping the Rewards

Ethereum continued to gain more acceptance in the crypto industry year after year, mostly thanks to its blossoming ecosystem of decentralized applications. Naturally, this caused Vitalik Buterin’s net worth to soar. In January 2018, ETH became the second-largest crypto in terms of market capitalization, behind Bitcoin, and it has held that spot ever since.

More recently, Ethereum has started to gain momentum within traditional investing and payments circles. In March 2021, Visa, the dominant payment merchant, began settling stablecoin transactions using Ethereum. In April of the same year, JP Morgan Chase, UBS, and MasterCard invested $65 million into ConsenSys, a software development company that builds Ethereum-related infrastructure.

Later that year, the network experienced two upgrades codenamed Berlin and London, reducing transaction fees and enabling new types of transactions.

Plans to transition ETH from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism (along with various other upgrades) emerged as part of a major rehaul dubbed Ethereum 2.0. This upgrade introduced three key improvements: Proof-of-Stake consensus, Sharding (which sped up transactions), and a new Beacon chain (to improve network efficiency).

These changes were officially implemented across multiple smaller upgrades through 2022 and 2023, improving the network’s security, decentralization, efficiency, transaction costs, and more.

Ethereum Today

These days, Ethereum remains the second-largest cryptocurrency by market capitalization. The token reached its all-time high of over $4,800 in November of 2021 with a market cap of $570 billion. While it reached over $4,000 twice in 2024, it hasn’t been able to reach any closer to a new high since.

Crypto Projects Featuring Vitalik Buterin

Vitalik Buterin didn’t just build the Ethereum network. He was also a major driving force behind the sprawling ecosystem of decentralized apps (dApps). Ethereum now boasts over 230 million active users and 4,000 dApps, offering all kinds of functionality, from non-fungible tokens (NFTs) to decentralized lending and borrowing.

Buterin was even featured in a popular NFT collection that celebrates his contributions to the concept of web3 quadratic funding, a brilliant method used to distribute funds based on community support. While it was designed by Metalabel in collaboration with Gitcoin, it was approved by Buterin himself. Every NFT in the collection is enveloped with a virtual copy of Buterin’s signed 2018 whitepaper envisioning quadratic funding: “Liberal Radicalism: A Flexible Design for Philanthropic Matching Funds.”

In November 2024, the co-founder of Ethereum proposed a new concept called “Infofinance,” which aims to transform prediction markets into sources of reliable information. We don’t yet know what impact the idea will have but there is no doubt that Buterin will continue to be a pioneering figure in the cryptocurrency community.

Vitalik Buterin’s Other Ventures and Investments

Over the years, Buterin has served on the boards of numerous crypto companies. At the time of writing, he currently holds eight different board and advisor roles for companies like Kyber Network, Fenbushi Capital, Augur, WeTrust, and Aion.

In addition to this, Buterin has personally invested in at least 10 different companies including Polymarket, Truemarket, Rarimo Foundation, RISE Labs, MegaETH, Nocturne Labs, Aztec, Starkware Industries, New Ealam, and Swift Solar.

Vitalik Buterin Net Worth: Crypto and NFT Holdings

As one of the most influential figures in the crypto industry, behind only Satoshi Nakamoto, Vitalik Buterin’s net worth has skyrocketed since he discovered Bitcoin in 2011. For example, he reportedly kept most of the BTC he earned as a freelance writer, earning 5 BTC per article (worth about $29 each at the time).

While he almost certainly made a pretty penny from Bitcoin, a massive portion of his net worth is in Ethereum. He revealed his main Ethereum wallet so anyone can check how much Ethereum he owns at any given time (assuming he doesn’t have large holdings in non-public wallets). At the time of writing, he is holding at least 278,524 ETH, worth well over $750 million.

Buterin staked his massive stack of Ethereum, earning him at least 2% APY.

Over the years, Buterin has diversified his crypto holdings to a small degree, swapping ETH for USDC and a handful of other tokens. In 2023, Buterin decided to further diversify his personal crypto portfolio by swapping 210 ETH worth $325,000 for USDC stablecoin. He also revealed that Bitcoin (and every other crypto) makes up less than 10% of his portfolio in a recent Tweet.

“I’m under 10% in BTC,” he responded to an X user. “But then again, I’m under 10% in anything that’s not ETH.”

In 2018, Buterin shared that he had invested in Bitcoin Cash, Bitcoin, Dogecoin, and Zcash. It is unclear whether or not he still holds these assets today. As of today, he holds $21.7 million in USDC and $782,000 in KNCL, according to the on-chain data analysis firm Nansen.

Vitalik Buterin is also a major investor in NFTs. He scooped up 400 NFTs worth 32 ETH in 2024 for $107,000. His Quadratic Funding Collection has amassed millions of dollars of trading volume since its launch as well, though we don’t know how much he has made from the project.

Vitalik Buterin’s Philanthropic Efforts and Awards

Vitalik Buterin is one of the most generous philanthropists in the crypto community and has given a massive portion of his net worth to various charities. Amid the COVID-19 pandemic, he donated $1.2 billion, mostly in the Shiba Inu meme coins, to India’s COVID-19 relief initiative.

Here are some of his largest philanthropic donations to date:

- 13,292 ETH to GiveWell, a non-profit-oriented charity foundation

- 1,000 ETH and 430 billion Dogelon Mars tokens to the Methuselah Foundation. This foundation was established to design programs capable of enhancing the longevity of people.

- 1,050 ETH to the Machine Intelligence Research Institute, a project that is committed to ensuring that AI has a positive effect on society.

- $532,000 worth of ETH to the Effective Altruism Fund’s Animal Welfare Fund

Buterin has also been actively supporting Ukraine in the war against Russia. Ukraine has received over $184 million in crypto donations, including $5 million that came directly from Buterin.

In recognition of his work in blockchain development and scientific innovation, Vitalik Buterin has won numerous awards for his contributions to scientific innovations, including blockchain development. In 2014, he was awarded the World Technology Network (WTN) prize for IT development. In the same year, he was also conferred with the Thei Fellowship Award for bringing his technical idea to life.

In 2024, Buterin became a potential Nobel Prize contender thanks to his contributions to crypto.

What Lessons Can We Learn From Vitalik Buterin’s Success?

Vitalik Buterin has significantly impacted the world of crypto, most notably as the co-founder of Ethereum. His journey from a curious teenager to one of the biggest figures in blockchain technology demonstrates technical brilliance in combination with commitment to one’s passion. Despite the many challenges and fluctuations in ETH’s market capitalization, Buterin has remained steadfast in his dedication to his ingenious vision.

Additionally, his philanthropic efforts underscore Buterin’s belief in using his influence and wealth for the greater good. Today, Buterin is a key player in the crypto industry, as well as someone millions of people look up to.

FAQs

What is Vitalik Buterin known for?

Vitalik Buterin is most famous for his co-founding of Ethereum, the famous decentralized blockchain network.

What is Vitalik Buterin’s net worth in 2025?

As of February 2025, Buterin’s net worth is estimated at over $1 billion, largely derived from his holdings in Ethereum.

What’s Ethereum’s market cap today?

As of February 2025, Ethereum’s market capitalization is around $319 billion, with each coin trading at around $2,639.53.

Has Vitalik Buterin invested in other cryptocurrencies?

Yes. Buterin has made investments in Bitcoin and Dogecoin, as well as other coins and NFTs. Still, Ethereum constitutes the majority of his crypto portfolio.