On this Page:

Coinbase is one of the largest crypto exchanges, with over 100 million verified users and several billion dollars in daily trading volume. It’s also the go-to custodian for institutional investors, thanks to its strong reputation with US regulators.

Coinbase is the Holy Grail for most cryptocurrencies, with listing approvals often resulting in an extended pricing rally. This means buying newly listed tokens early can yield tremendous profits, if you’re smart and lucky enough to get in early.

Read on to discover potential upcoming Coinbase listings for 2025. Learn how Coinbase decides which projects to list and how to find approved cryptocurrencies before they’re announced.

What are upcoming Coinbase listings?

Coinbase is a regulated crypto exchange suitable for every trading profile. Beginners will like its user-friendly dashboard, available on desktop browsers and as a mobile app. First-time investors can easily purchase cryptocurrencies with local currencies. Coinbase supports debit/credit cards, PayPal, and bank transfers for added convenience.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$8.87 | -0.41% | $8,181,920,659 | $4,823,740 |

$8.71

―

$9.05

|

| 2 |

|

$0.0055 | 0.05% | $502,866,797 | $2,455,920 |

$0.0054

―

$0.0057

|

| 3 |

|

$0.40 | 1.83% | $385,700,554 | $86,516,147 |

$0.39

―

$0.41

|

| 4 |

|

$0.04 | 2.45% | $267,916,360 | $2,590,175 |

$0.04

―

$0.04

|

| 5 |

|

$0.01 | 1.52% | $193,799,023 | $12,786,100 |

$0.01

―

$0.01

|

| 6 |

|

$6.15 | 1.02% | $189,385,626 | $21,343,468 |

$5.91

―

$6.25

|

| 7 |

|

$0.38 | 1.67% | $104,973,441 | $11,835,815 |

$0.37

―

$0.39

|

| 8 |

|

$0.11 | 7.53% | $57,610,653 | $16,557,582 |

$0.10

―

$0.12

|

| 9 |

|

$0.03 | 0.51% | $46,624,921 | $118,628 |

$0.03

―

$0.03

|

| 10 |

|

$0.10 | 3.66% | $24,570,667 | $23,603,914 |

$0.09

―

$0.10

|

LEO Token

LEOTelcoin

TELMANTRA

OMTheta Fuel

TFUELRavencoin

RVNVana

VANACARV

CARVMerlin Chain

MERLQANplatform

QANXBubblemaps

BMTCoinbase is also popular with seasoned traders. Its “Advanced’ platform supports charting tools, custom orders, and perpetual futures in select countries. Coinbase is also the preferred exchange for institutional investors, including OTC (over-the-counter) and custodial services. All things considered, Coinbase is one of the most popular exchanges globally.

Therefore, securing a “Coinbase listing” is crucial for crypto projects. This means the respective tokens are added to the Coinbase exchange, providing exposure to more than 100 million verified traders. Coinbase also benefits from substantial trading volumes. While still a fraction of Binance (we explore upcoming Binance listings elsewhere), Coinbase averages several billion dollars daily.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

History suggests that new Coinbase listings often generate hype near-instantly. The project can see an immediate price jump and rally once Coinbase makes the announcement on social media. People buy the token expecting it to rise and, when paired with other tier-one listings, can take cryptocurrencies to the mainstream arena.

However, it’s important to remember that Coinbase is very selective in which cryptocurrencies it lists. It provides loose guidance on its listing criteria, such as technical security, supply dynamics, and utility within the project’s ecosystem. Put otherwise, Coinbase exchange listings are often reserved for cryptocurrencies with use cases.

Crucially, discovering upcoming Coinbase listings early, while difficult, can yield attractive gains. You’ll have a first-mover advantage, securing purchases before the listing announcement is made. We’ve already done the research and analysis, so read on to see which Coinbase new listings could be confirmed in 2025.

What are the signs that a coin could be Coinbase listed?

So, you’re looking to discover upcoming Coinbase listings early. We’ll now discuss research strategies used by seasoned traders, allowing you to evaluate potential listings before Coinbase announces them.

High trading volume on other major exchanges

Coinbase is in the business of making money. Like most exchanges, its primary revenue source is trading commissions. It earns fees whenever users either buy coins, and sell cryptocurrencies. Considering its high fee structure and over 100 million users, these commissions generate billions of dollars in income annually.

As such, it makes sense that Coinbase looks at high-volume cryptocurrencies on other exchanges. Not just centralized competitors like Binance and Kraken but also decentralized exchanges (DEXs) like Uniswap and Raydium. For instance, suppose one of the top trending coins is generating over $100 million in daily trading volume.

However, that project isn’t listed on Coinbase, meaning it’s missing out on significant trading commissions. It could, therefore, consider adding the cryptocurrencies to its exchange platform. In doing so, it gets a slice of the commissions available and takes market share from its competitors.

When analyzing trading volumes for potential upcoming Coinbase listings, many data aggregation platforms can be used. For instance, CoinGecko offers a user-friendly way to sort cryptocurrencies by the 24-hour trading volume. However, platforms like Kaiko and Nomics provide more advanced and institutional-grade data.

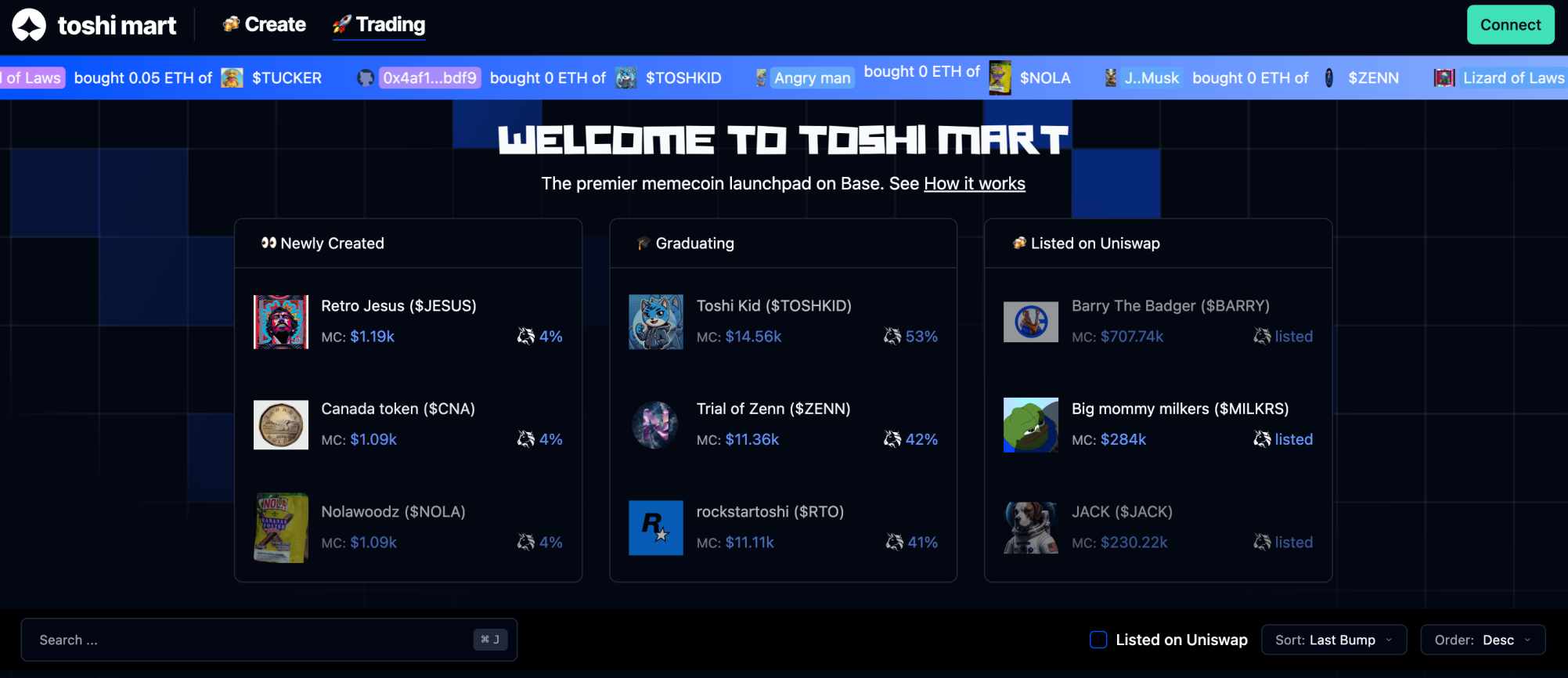

In addition to multiple volume time frames and trends, these platforms show order book depth, liquidity metrics, and even fake volumes. Alternatively, DEX Screener and DEXTools are ideal for analyzing DEX data. Toshi, for instance, recently secured a Coinbase listing, even though the majority of its trading volume was on Uniswap.

Strong community support and social media presence

Coinbase likes cryptocurrencies with a strong community. Looking for trends and increased social engagement is a solid strategy. A good starting point is X, often referred to as “Crypto Twitter”. Begin with the fundamentals – see how many X followers the project has and how frequently it posts. Now, analyze engagement levels.

For instance, how many views, likes, and comments do posts generally get? Is this proportional to the number of followers?

- Consider a crypto project with 50,000 followers, averaging just 2,000 views per post.

- Community engagement is almost non-existent, meaning its social presence could be artificially inflated by bots.

- Conversely, suppose the same project regularly gets over 100,000 views, with each post attracting hundreds of shares and comments.

- Not only will this please the X algorithm (meaning it shows the project to more people) but Coinbase could take notice.

Coinbase is also active on Reddit, with a dedicated subreddit showing over 393,000 members. Therefore, exploring popular cryptocurrencies on Reddit with strong community support makes sense. You can also evaluate Telegram and Discord for additional insights. Importantly, community support also extends to token holder data.

Dune Analytics is a great option here, with holder trends available for the most active blockchains. For instance, upcoming Coinbase listings are often given to projects with tens of thousands of unique holders.

This signals a strong and loyal following, likely on a global basis. Analyzing trends is also important. For example, it’s a good sign if the number of token holders has increased for 30 consecutive days. This highlights a growing community.

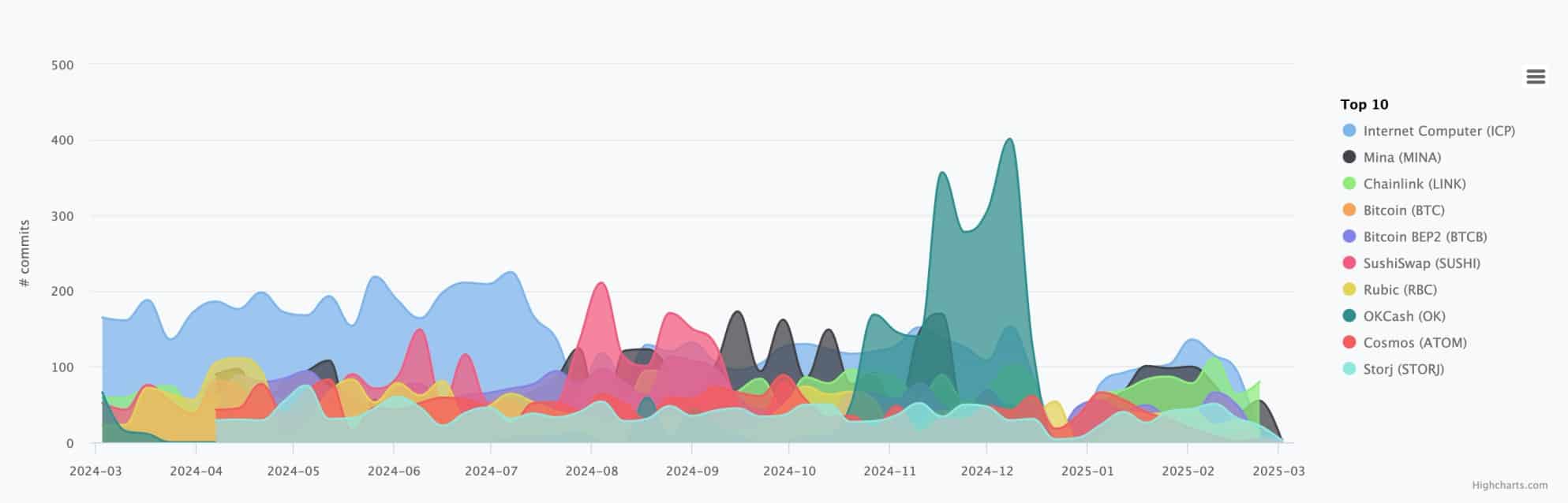

Developer activity and technological innovations

Coinbase frequently lists cryptocurrencies with innovative products and services, offering something “unique” to the broader Web 3.0 ecosystem. Researching innovative blockchain startups is, therefore, one of the best ways to find upcoming Coinbase listings early.

For example, you’ll notice that most layer-1 cryptocurrencies can be traded on Coinbase. This is also the case for layer-2 solutions like Optimism, Aritrum, and Immutable. In terms of where to look, GitHub is a great option.

Explore projects with a strong following, including frequent comments from the developer community. You can also explore CryptoMiso for even deeper GitHub trends, including cryptocurrencies with the most mentions. We’d also suggest analyzing trends on DappRadar.

For instance, look for trending narratives, such as decentralized finance (DeFi) or blockchain gaming. You can then see which projects are the most active, whether that’s by total value locked (TVL), daily active users, or transactional volumes. Ultimately, the top trending projects could be offering something innovative, meaning Coinbase could take notice.

Partnerships and institutional backing

Coinbase has a strong regulatory framework and existing relations with large financial institutions. It’s also a publicly listed company, with Coinbase stocks trading on the NASDAQ exchange. As such, upcoming Coinbase listings are often secured for projects with institutional backing.

This provides cryptocurrencies with a stamp of approval, considering how extensive the pre-vetting process is. For example, Polygon, a popular layer-2 solution listed on Coinbase, raised hundreds of millions of dollars from institutional investors.

Examples include SoftBank Vision Fund 2, Tiger Global, and Galaxy Digital. While institutional investments are often made via private sales, they’re typically publicly accessible information. Look for press releases or news articles to get a first-mover advantage.

Moreover, cryptocurrencies receiving institutional backing often have contacts within the Coinbase team, meaning a higher chance of securing a listing. Another strategy is to look for projects securing notable partnerships.

Coinbase favors cryptocurrencies that bridge the gap between the real world and the Web 3.0 ecosystem. For example, Stellar was one of the first blockchain projects to secure institutional partnerships, such as IBM, MoneyGram, and Circle. Stellar is listed on the biggest exchanges, including Coinbase.

Recently rumored coins for a Coinbase listing

Now we’ve explained how to discover upcoming Coinbase listings early, let’s explore some key contenders. The following projects could be the next cryptocurrencies to explode on Coinbase.

1. Leo

The first potential Coinbase listing to explore is UNUS SED LEO (Leo Token). While Leo Token boasts a market capitalization of several billion dollars, it’s yet to trade on the Coinbase exchange. This project was created by iFinex, owned by the same company behind Tether and Bitfinex.

Its primary function is to offer Bitfinex traders reduced commissions, similar to BNB and Binance. Leo Token is also a deflationary asset, increasing scarcity over time. It achieves this through regular buybacks funded by Bitfinex trading revenues. The purchased tokens are “burned”, meaning they’re removed from the supply.

LEO Token Price Chart

(LEO)LEO Token (LEO)

In terms of price performance, Leo Token was initially launched in 2019 at just over $1. It has enjoyed a steady upward trajectory since its inception. Today, it trades about 900% higher. However, Leo Token suffers from ultra-low trading volumes when compared to its large market capitalization. This could impact its ability for a Coinbase listing.

Find out more about Leo Token:

2. MANTRA

The next potential Coinbase listing is MANTRA. It’s a layer-1 blockchain designed specifically for RWA (real-world asset) tokenization. This is a high-growth crypto narrative with growing interest from the institutional crypto space. Conventional assets, such as real estate or government-backed bonds, can be tokenized on the MANTRA blockchain.

In doing so, both retail and institutional clients can access and trade these assets more conveniently and cost-effectively. MANTRA also offers cross-chain functionality, including Ethereum, Polygon, and BNB Chain. This enables RWA assets to trade across competing blockchain ecosystems.

MANTRA Price Chart

(OM)MANTRA (OM)

Importantly, unlike other RWA initiatives, MANTRA was developed with regulatory compliance in mind. This is where the broader digital assets industry is moving, so being complaint-ready is a major benefit. MANTRA’s native token, OM, is one of the best-performing cryptocurrencies in recent times. Gains of over 2,000% have been secured in the prior year.

Find out more about MANTRA:

3. Ravencoin

Launched in 2018, Ravencoin is an established layer-1 blockchain leveraging the proof-of-work (PoW) consensus mechanism. Unlike Bitcoin’s PoW system, Ravencoin is considerably faster and more energy-efficient, with transactions taking just a minute to reach finality. Ravencoin’s main use case is for asset tokenization.

Ravencoin Price Chart

(RVN)Ravencoin (RVN)

Its beginner-friendly interface makes it seamless to tokenize real-world items, from collectibles and luxury watches to financial securities. Tokenized assets are backed by NFTs, making them tradable and secure. For example, consider a small business owner wanting to raise capital.

It could create 100 tokens, each representing 1% of company ownership. 30 tokens could be sold, allowing the business owner to retain 70% of its equity. This eliminates third parties, reducing friction, fees, and regulatory red tape. Ultimately, some experts claim that Ravencoin could be one of the best new coins on Coinbase, with a listing long overdue.

Find out more about Ravencoin:

4. Telcoin

Another established project that could be one of the next Coinbase listings is Telcoin. Launched in 2017, Telcoin operates in the global remittances niche. It combines cross-border transactions with blockchain technology, ensuring speed, security, transparency, and cost-effectiveness.

Specifically, Telcoin allows users to transfer funds via traditional telecom networks. This market is particularly strong in emerging economies, where mobile payments often replace traditional banking services. Telcoin’s main competitors are legacy remittance providers like MoneyGram and Western Union.

Telcoin Price Chart

(TEL)Telcoin (TEL)

Unlike these providers, Telcoin also offers DeFi products like lending and staking. Telcoin also offers a user-friendly app for iOS and Android, making payments even more seamless for beginners. Multi-currency stablecoins are another feature, with support for GBP, CAD, AUD, HKD, ZAR, JPY, and more.

Find out more about Telcoin:

5. Theta Network

Theta Fuel backs the Theta Network, another layer-1 blockchain with a growing ecosystem and solid use cases. This ecosystem is designed specifically for content delivery and video streaming. Here’s how it works: Participants share their excess computing power and bandwidth with Theta Network.

In turn, participants earn Theta Fuel based on the resources provided. This ensures end users can watch video streams without constant connection issues. It also enables everyday consumers to earn passive income by utilizing their spare resources. Theta Network also removes censorship risks, considering its content is permanently secured on the blockchain.

Theta Fuel Price Chart

(TFUEL)Theta Fuel (TFUEL)

Moving onto the valuations, Theta Fuel trades at a small fraction of its 2021 highs. It also has a relatively modest market capitalization. Even so, Coinbase favors legitimate projects offering real-world solutions. Therefore, Theta Fuel could be one of the upcoming Coinbase listings in 2025.

Find out more about Theta Fuel:

How we chose the best potential Coinbase listings

We’ve revealed potential upcoming Coinbase listings to watch. Now, we’ll explain our research methodology. This will help you make informed decisions and discover potential listings independently.

Contract security

First, Coinbase states that cryptocurrencies will only be considered if they have robustly secure smart contracts. At a minimum, this means the smart contract should be gone through a rigorous security audit. This should be from a reputable blockchain security firm, such as CertiK.

Coinbase will rarely consider projects that have previously witnessed a hack or security breach. Nor will it consider listings with weak security defenses or potential vulnerabilities. According to our research, cryptocurrencies with transaction taxes won’t pass the security phase either. This is because Coinbase can’t implement taxes on buy and sell orders, as it’s a spot exchange.

Regulatory compliance

Not only is Coinbase a heavily regulated exchange in the US but it also serves institutional clients. The latter includes financial institutions and hedge funds wanting significant crypto exposure and custodianship. Coinbase can only consider cryptocurrencies that are regulatory compliant with existing US laws.

In simple terms, projects that could be defined as securities won’t become upcoming Coinbase listings. Otherwise, Coinbase could once again have legal issues with the SEC.

This wouldn’t only be unfavorable for Coinbase but the broader crypto industry. Regulatory compliance means that certain crypto niches won’t be eligible for a listing. For instance, cryptocurrencies offering gambling services, privacy coins, or anything else that branches the current legal frameworks.

Strong demand

We also focused on cryptocurrencies that already boast strong demand on other exchanges. Although specific minimums aren’t provided, Coinbase wants cryptocurrencies that have sufficient trading volumes. Otherwise, it doesn’t make sense to add the respective tokens, as limited demand means limited commission revenues.

For instance, Coinbase isn’t going to list a meme coin with daily trading volumes of under $50,000. It will, however, consider meme coins with daily volumes of several million dollars. Coinbase will perform extensive research to ensure volumes are legitimate. Many cryptocurrencies use automated bots to artificially inflate volume figures.

This won’t be tolerated by Coinbase, considering it’s an unethical practice. Coinbase will also assess what other exchanges the project is currently listed on. If it trades on key competitors, such as Kraken or Binance, this could motivate Coinbase to approve the project. Coinbase will analyze order books, liquidity, and other core trading metrics as part of the decision-making process.

Supply dynamics

Upcoming Coinbase listings typically have fair supply dynamics, ensuring tokens are distributed and held across a broad community. It prefers that the vast majority of new tokens are in the public float, rather than being held by founders or early venture capitalist (VC) backers.

- For example, suppose the project has a total supply of 1 billion tokens.

- 50% is owned by VCs who invested via a private sale.

- The VC tokens will be unlocked in several months, meaning they’ll likely be sold.

- Coinbase might not feel comfortable listing this particular project, considering the price could collapse once the unlocks begin.

That said, like many coin listing preferences, supply requirements aren’t set in stone. For instance, the best crypto exchanges, including Coinbase, listed OFFICIAL TRUMP. This is Donald Trump’s official meme coin launched days before his 2025 inauguration.

80% of OFFICIAL TRUMP’s supply is held by the Trump team, with multiple unlocks planned this year. Nonetheless, Coinbase listed it anyway, presumably because it’s a mainstream meme coin generating significant trading commissions.

Use cases

Having explored the best new crypto on Coinbase, we found that many projects offer real use cases. The tokens should ideally offer value within the respective ecosystem rather than just being a speculative investment. For example, we mentioned earlier that Toshi is a new cryptocurrency released on Coinbase in 2025.

Considered one of the top meme coins on the Base network, Toshi built use cases for its community. This includes a decentralized autonomous organization (DAO) and a token launcher platform. Without these utility features, Toshi might have struggled to achieve a Coinbase listing. This is why an increasing number of meme coins are developing token use cases.

What are the benefits of a Coinbase listing?

We’ve explored what factors are considered for upcoming Coinbase listings, including smart contract security, regulatory compliance, trading volume, and use cases. Next, we’ll discuss the benefits of being listing on Coinbase.

Access to a global user base

Cryptocurrencies on Coinbase have access to a substantial user base. Coinbase has over 100 million verified users, meaning they’ve completed a KYC (know-your-customer) process. Most Coinbase users are retail clients who prefer buying cryptocurrencies with simple payment methods, such as credit cards and e-wallets.

This is hugely beneficial for crypto projects. After all, DEXs can’t accept fiat money, limiting exposure to experienced traders who already own cryptocurrencies.

Increased liquidity and trading volume

Coinbase is also one of the biggest exchanges for liquidity and trading volume. Over $6 billion was traded in the past 24 hours, behind only Crypto.com and Binance. This means being listed on Coinbase can attract serious buying pressure. Some of the biggest investors, including institutions, use Coinbase, so there’s plenty of accessible capital.

New Coinbase listings also benefit from smoother trading conditions, as per the premium liquidity available. This includes reduced slippage, a common issue when trading on DEXs. Traders can place larger orders without significantly impacting the price. This also leads to improved market depth and, oftentimes, lower volatility levels.

Boost in market credibility and trust

Upcoming Coinbase listings don’t only benefit from increased exposure, higher volumes, and premium liquidity. Accepted projects also receive an immediate stamp of approval. For example, Coinbase CEO Brian Armstrong notes that at least a million new cryptocurrencies are being launched weekly.

Currently, there are about 12 million cryptocurrencies in total, meaning the markets are now highly saturated. Of this amount, just 284 cryptocurrencies are listed on Coinbase. Put otherwise, less than 0.003% of the broader crypto markets successfully achieve a Coinbase listing.

Therefore, a Coinbase approval shows that the project is credible and legitimate. It would have passed substantial verification checks before being added. This could attract a new wave of investors and long-term holders. It might also allow the project to form new partnerships with real-world companies and even lead to additional listings from other tier-one exchanges.

Potential price surge following the listing announcement

Seasoned investors will often immediately buy new Coinbase listings as soon as the announcement is made. History suggests that the respective crypto project will witness a price surge. This means buying early can yield the biggest upside. Specific gains will depend on many factors, such as the market capitalization.

For instance, smaller-cap cryptocurrencies will often grow by several hundred percent after a Coinbase listing. However, larger-cap cryptocurrencies typically produce more modest gains. Broader market conditions also play a role. Being listed on Coinbase during “altcoin season” is the most ideal scenario.

Sentiment is high, meaning investors are more willing to make speculative decisions, like buying cryptocurrencies because they secured a Coinbase listing. Conversely, achieving a listing during a bear market can have little, if any, impact on the token price. Investors should consider these metrics wisely, as there’s no guarantee a pricing rally will follow a listing announcement.

What are the risks of Coinbase listing rumors?

Coinbase listing rumors are pure speculation. Only Coinbase can announce an approved project. Leaks can result in the listing decision being cancelled. Let’s take a closer look at the key risks of predicting upcoming Coinbase listings.

Dangers of trading based on rumors

Buying cryptocurrencies because they’re rumored to be listed on Coinbase isn’t a smart move. The crypto markets are filled with misinformation, with projects often claiming to be close to a listing approval. This can artificially create hype, leading people to invest in the project without any firm evidence.

The key risk is that you build exposure to a token that never achieves a Coinbase listing, let alone any other tier-one exchanges. The best practice is to make investment decisions based on independent research. This means focusing on factors that are important to Coinbase, such as volume, use cases, and supply dynamics, rather than rumors.

Historical examples of pump-and-dump schemes

Scam projects can also artificially pump their token price, claiming it’s due to an incoming Coinbase listing. Inexperienced investors will buy that token, believe Coinbase approval is imminent and thus, further price increases. The scammers will eventually dump their tokens once enough buying pressure is achieved.

Anyone left holding those tokens will be left with substantial losses, with no sight of any Coinbase listings. Importantly, we should again mention that nobody but Coinbase can initially announce listing confirmations. Ishan Wahi, a former manager at Coinbase, was convicted of insider trading in 2023.

Sentenced to two years in prison, Wahi was indirectly buying cryptocurrencies that Coinbase had approved before the announcement was made public. This provided an unfair advantage, making it the first insider trading case in the crypto markets.

Potential for delayed or canceled listings

Another risk is that approved Coinbase new listings can be delayed or cancelled. Delays could be due to broader market conditions or issues with liquidity provision. The worse case scenario is a cancelled listing, perhaps due to certain terms or requirements being broken. In the meantime, we have explored the best crypto to buy on Coinbase today.

This would include the approved project inside trading their own tokens or tipping of the community. Just remember, Coinbase listings aren’t confirmed until the spot trading market opens. Even then, Coinbase frequently delists cryptocurrencies from its exchange. This is often because of limited demand, weak trading volumes, and legitimacy issues.

Short-lived pricing rally

We mentioned that historically, most upcoming Coinbase listings achieve a short-term pricing rally. This can last for hours, days, or even weeks during bullish cycles. However, the key risk is that you buy a newly listed token at the rally’s peak.

- For example, suppose the token was priced at $1 when the listing approval was announced.

- You catch the listing announcement a few hours later, paying $1.70.

- Not only did you miss 70% gains, but $1.70 was the peak.

- An immediate reversal begins, with the token eventually losing all of its gains.

Never assume investing in newly listed cryptocurrencies guarantees returns.

How to stay updated on potential listings

Staying updated on new Coinbase listings is crucial. Getting in at the earliest stage possible can yield the biggest pre-listing gains. It can also ensure you avoid scams, such as fraudulent listing claims.

- Monitoring Coinbase’s official listing page on X: The most important step is to follow Coinbase’s X page for new listing announcements. This is the first place listings are released, ensuring everyone receives the information at the same time. Switching notifications on is a must. This will ensure a Coinbase new listings alert is received in real time.

- Following crypto influencers and news outlets: In case you missed the Coinbase announcement, following respected crypto influencers and news outlets is also a good idea. However, it’s crucial to verify the listing news directly with Coinbase’s X page. Otherwise, there’s no guarantee it’s legitimate.

- Using tools like CoinGecko and CoinMarketCap for tracking: CoinGecko and CoinMarketCap are good choices for keeping tabs on pricing data, including volume and liquidity. Look for trends that could suggest potential upcoming Coinbase listings. You might also consider DEX Screener and DEXTools for analyzing on-chain data from DEXs.

Coinbase potential listings FAQs

How does Coinbase decide which coins to list next?

Coinbase considers a wide range of metrics when making listing decisions. This can include strong demand, high trading volumes, growing communities, and unique use cases.

How can I tell that a coin might be listed on Coinbase soon?

The only way to know if a coin will be listed on Coinbase is when the X announcement is made. Anything else is pure speculation.

Where can I find rumors or announcements about potential Coinbase listings?

Upcoming Coinbase listing rumors are typically made on X and within Telegram groups. Rumors shouldn’t be acted upon – nobody but Coinbase can make the initial decision.

Do trading volumes on other exchanges influence Coinbase’s listing decisions?

Yes, Coinbase primarily makes revenue from trading commissions. Therefore, it could list a project if it’s generating high volumes on other exchanges.

What happens if a rumored Coinbase listing doesn’t happen?

Existing holders might dump their tokens if a Coinbase listing doesn’t materialize. This is why cryptocurrencies should never be purchased purely because of a listing rumor.

How quickly does a coin get listed after an official announcement from Coinbase?

Coinbase typically gets listed within 24 hours of the official announcement. The specific listing date and time are mentioned in the respective X post.

Why do some coins take longer than others to get listed on Coinbase?

There is no secret formula to a Coinbase listing. Some projects are established, have substantial communities, and have multi-billion dollar valuations but still haven’t been approved.

Is there a way to request or vote for a coin to be listed on Coinbase?

Projects can directly apply for a Coinbase listing, but the process is long and extensive. Asking Coinbase to list a specific coin has little impact until demand is significant.

References

- What is Market Depth? (Corporate Finance Institute)

- Coinbase CEO Brian Armstrong Says There are 1 Million New Cryptocurrencies Created Every Week (Business Insider)

- Former Coinbase Insider Sentenced In First Ever Cryptocurrency Insider Trading Case (US Department of Justice)

- Coinbase ex-manager sentenced to 2 years in prison in US insider trading case (Reuters)

- Coinbase New Coin Listings (Coinbase X Page)