Coinbase is the largest crypto exchange in the US and is widely considered to be one of the safest places to buy and sell crypto in the world. That makes it a popular platform for crypto traders and investors right now, as the market appears to be on the verge of another bull run.

Coinbase offers hundreds of tokens, so deciding which ones to buy can be the toughest part of using the exchange. We’ll highlight the best crypto to buy on Coinbase today and explain how to choose which tokens to add to your wallet.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$104,879.00 | -1.23% | $2,083,088,112,872 | $40,307,653,044 |

$104,053.00

―

$106,377.00

|

| 2 |

|

$2,573.70 | -2.99% | $310,585,140,657 | $22,423,083,726 |

$2,547.68

―

$2,662.29

|

| 3 |

|

$2.20 | -3.56% | $128,887,173,170 | $3,233,150,500 |

$2.16

―

$2.28

|

| 4 |

|

$665.76 | -1.86% | $97,064,751,675 | $1,015,318,858 |

$658.64

―

$679.66

|

| 5 |

|

$160.48 | -4.57% | $83,740,001,581 | $4,833,844,185 |

$157.99

―

$168.24

|

| 6 |

|

$1.00 | 0.01% | $61,036,474,535 | $11,963,108,956 |

$1.00

―

$1.00

|

| 7 |

|

$0.20 | -9.05% | $29,773,031,634 | $2,306,964,866 |

$0.20

―

$0.22

|

| 8 |

|

$0.27 | -2.23% | $25,618,979,834 | $744,526,007 |

$0.27

―

$0.28

|

| 9 |

|

$0.71 | -3.75% | $25,447,256,784 | $865,445,322 |

$0.69

―

$0.73

|

| 10 |

|

$104,667.00 | -1.46% | $13,467,171,591 | $296,284,258 |

$103,932.00

―

$106,501.00

|

| 11 |

|

$3.32 | -6.79% | $11,089,936,693 | $1,392,941,781 |

$3.28

―

$3.59

|

| 12 |

|

$14.26 | -6.71% | $9,362,868,959 | $599,922,580 |

$13.97

―

$15.29

|

| 13 |

|

$21.32 | -6.02% | $8,978,612,272 | $623,975,962 |

$21.00

―

$22.72

|

| 14 |

|

$0.27 | -3.37% | $8,474,284,364 | $267,510,023 |

$0.27

―

$0.28

|

| 15 |

|

$3.32 | -2.37% | $8,192,644,721 | $399,538,714 |

$3.24

―

$3.43

|

| 16 |

|

$405.08 | -0.97% | $8,049,254,886 | $202,043,154 |

$398.20

―

$412.89

|

| 17 |

|

$0.0(4)13 | -7.15% | $7,726,773,194 | $329,721,197 |

$0.0(4)12

―

$0.0(4)14

|

| 18 |

|

$88.55 | -6.50% | $6,717,917,988 | $609,687,889 |

$87.35

―

$94.70

|

| 19 |

|

$4.17 | -6.63% | $6,353,058,689 | $320,364,693 |

$4.10

―

$4.47

|

| 20 |

|

$2.53 | -9.73% | $3,091,510,598 | $307,353,656 |

$2.49

―

$2.82

|

| 21 |

|

$0.36 | -12.70% | $1,733,968,955 | $363,003,370 |

$0.35

―

$0.41

|

| 22 |

|

$0.0029 | -8.07% | $407,561 | - |

$0.0029

―

$0.0032

|

Bitcoin

BTCEthereum

ETHXRP

XRPBNB

BNBSolana

SOLUSDC

USDCDogecoin

DOGETRON

TRXCardano

ADAWrapped Bitcoin

WBTCSui

SUIChainlink

LINKAvalanche

AVAXStellar

XLMToncoin

TONBitcoin Cash

BCHShiba Inu

SHIBLitecoin

LTCPolkadot

DOTNEAR Protocol

NEARArbitrum

ARBWorldCoin

WDCTop Crypto to Buy on Coinbase

Let’s take a closer look at the five best crypto to buy on Coinbase for 2025.

1. Bitcoin

Bitcoin Price Chart

(BTC)HarryPotterObamaSonic10Inu (ETH) (BITCOIN)

Bitcoin ($BTC) is the crypto market leader by a wide margin, and analysts expect it could dominate the next bull run. That’s because Bitcoin, more than any other crypto asset, has become mainstream. It’s now available to everyday investors through Bitcoin ETFs. Even some financial advisors are starting to recommend that investors hold a portion of their portfolio in $BTC.

On top of that, countries are now looking at buying Bitcoin. The Trump administration signed an order to establish a Strategic Bitcoin Reserve, which could eventually buy new $BTC and send demand soaring. Other countries would likely follow suit, kicking off a global wave of Bitcoin buying.

Analysts like ARK Invest CEO Cathie Wood have predicted that Bitcoin’s price could rise to $1.5 million by 2030 — making the token’s recent moves seem tiny in comparison. In fact, that price represents a more than 12x gain from Bitcoin’s all-time high. Bitcoin might already be the biggest crypto, but it still has much room for explosive growth.

Find out more about Bitcoin

2. Solana

Solana Price Chart

(SOL)Solana (SOL)

Solana ($SOL) is a major up-and-coming crypto that’s seen massive growth in the last few years. It rose from the ashes of the FTX bankruptcy in 2022 — Solana was closely tied to FTX — to become the third-largest smart contract blockchain platform after Ethereum and BNB Smart Chain. Now, Solana is a hub for new Web3 development and could be poised for even more gains.

A big part of what’s driven Solana’s momentum and made it one of the best altcoins is that it has become the go-to blockchain for meme coin development. Meme coin traders have put a lot of transaction volume on the network, bringing it more attention and revenue from $SOL gas fees. Meme coins have also introduced some exciting new utility features that are currently only available on Solana, making this blockchain somewhat unique.

It’s worth noting that Solana competes with Coinbase’s own Layer-2 blockchain technology for Ethereum, Base. However, both networks have performed very well, and there’s no reason investors can’t bet on both. Investors can also look forward to a potential $SOL ETF, which just launched in Canada and could be coming to the US market soon.

Find out more about Solana

3. Chainlink

Chainlink Price Chart

(LINK)Chainlink (LINK)

Chainlink ($LINK) describes itself as the “backbone of blockchain,” and that’s not far off. This project plays a critical role as a blockchain oracle, compiling data from various real-world sources and bringing it on-chain. Chainlink is essential to letting blockchains know what’s happening in the stock market, tracking interest and exchange rates around the world, and more.

That makes Chainlink a crucial piece of infrastructure for decentralized finance (DeFi) — it’s one of the best DeFi cryptos to buy now. It’s also critical for any smart contracts and projects that require real-world data. Even crypto betting platforms like Polymarket rely on data from Chainlink.

The $LINK token is required to pay for all of this data, so its price is closely linked to growth in Chainlink’s data streams and revenue. No serious competitor to Chainlink has yet emerged, so the project looks positioned to continue dominating the blockchain oracle market throughout the next bull run. That’s good news for $LINK, which could see significant growth.

Find out more about Chainlink

4. Cardano

Cardano Price Chart

(ADA)Cardano (ADA)

Cardano ($ADA) is another smart contract blockchain that competes directly with Solana and Ethereum. It’s had a difficult time finding its footing in the market, but that could be about to change as scalability becomes more important than first-mover advantages. Cardano is one of the most scalable blockchains in existence and offers static transaction fees to keep users happy even as the network becomes busier.

Cardano is also one of the most robust blockchains thanks to its Ouroboros protocol, which looks for the longest consensus chain instead of requiring all network validators to come to agreement. This makes Cardano more resistant to censorship and enables the blockchain to work around the clock, regardless of changes in $ADA staking pools.

The $ADA token is used to pay gas fees on Cardano, so any growth in the network is good for the coin’s value. Analyst Lark Davis recently predicted that $ADA could jump to $10 this cycle, a more than 10x gain. Even though that’s an unusually bullish forecast, it gives an idea of just how much room this ADA has to run — it could be one of the best cryptos under $1 right now.

Find out more about Cardano

5. Ethereum

Ethereum Price Chart

(ETH)Ethereum (ETH)

Ethereum ($ETH) is the largest smart contract blockchain and the leader that Solana, Cardano, and many other projects are chasing. It remains well in the lead, however, especially after the recent innovation of Layer-2 networks that have helped Ethereum become more scalable. Ethereum’s seemingly major weakness was its lack of scalability, and the situation is rapidly improving.

As a result, the door is wide open for Ethereum to become the decentralized computing platform for the entire world. It’s already the de facto blockchain of choice for Web3 and is home to major projects like Uniswap, Aave, Bonk, and more. Ethereum has the most developers and the most users, which gives it a flywheel advantage, especially as generative AI technology makes its way onto the blockchain.

The $ETH token also has some financial catalysts behind it. Ethereum ETFs launched in 2024 and give institutional investors an easier way to buy $ETH, pushing up the token’s price. Plus, there are persistent rumors that Ethereum could be added to the US’s Strategic Bitcoin Reserve, creating massive new demand for $ETH.

Find out more about Ethereum

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Why Buy Crypto on Coinbase?

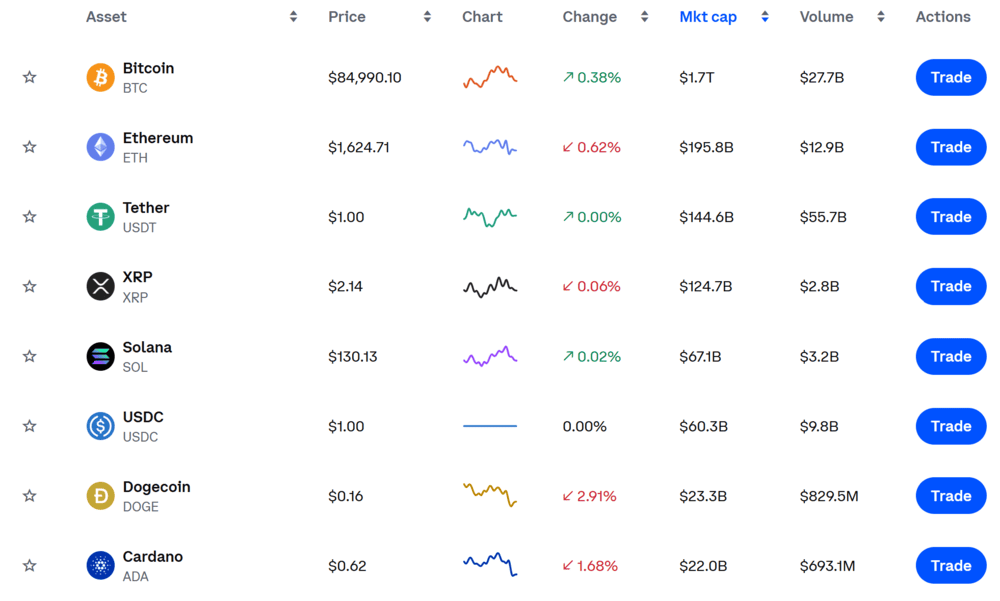

Coinbase is one of the most popular crypto exchanges because it combines a great selection of tokens with user-friendly features and strong security. Let’s dive into some of the top reasons to use Coinbase as your crypto exchange.

Major and Trending Cryptocurrencies

Coinbase offers trading on around 300 cryptocurrencies, ensuring investors have plenty of different tokens to choose from when building a portfolio. You’ll find well-established crypto majors like Bitcoin and Ethereum as well as newer and trending tokens like Swell, Ribbon Finance, DEXTools, and more.

One of the great things about Coinbase is that it thoroughly vets all of the tokens it lists for trading. That’s not a guarantee that coins on the exchange will go up, but it does vouch for them being legitimate projects with strong decentralization.

Simple Fiat On-ramps

Another reason to choose Coinbase over competing exchanges is that Coinbase makes it easy to turn your dollars into crypto. You can fund your exchange account with a credit or debit card, Apple or Google Pay, PayPal, or a bank transfer. There are several different ways to buy crypto, including making an instant purchase with a card or funding your account and using Coinbase’s spot trading platform.

On top of that, Coinbase offers a crypto debit card with cashback rewards. So, you can spend crypto from your Coinbase account on real-world purchases instead of having to convert back to fiat currencies.

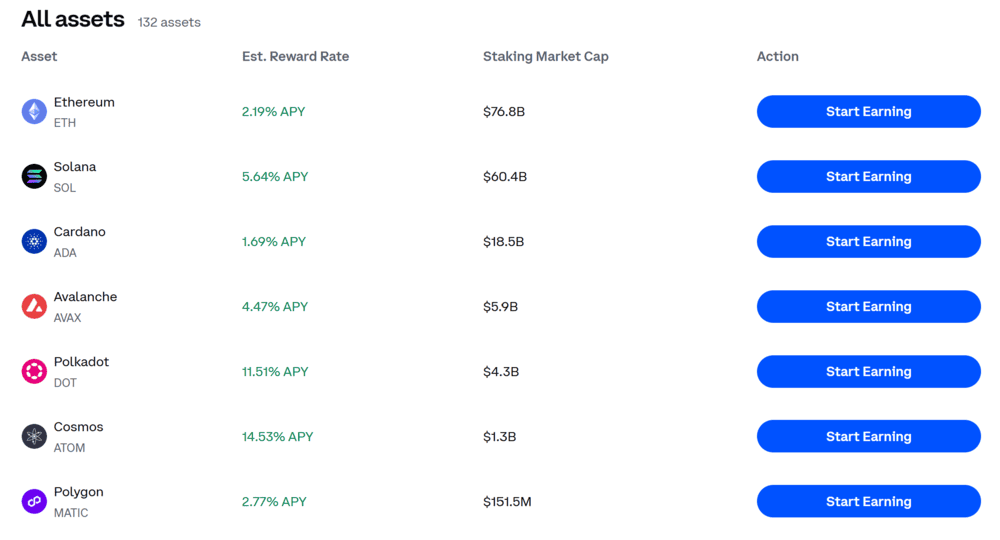

Staking Options for Supported Assets

At Coinbase, you can stake more than 130 different cryptocurrencies to earn an APY up to 14%. All staking at Coinbase is flexible, so your tokens are never locked up, and there are no penalties if you withdraw your tokens. In addition, your crypto never leaves your account, so it’s completely safe — Coinbase customers have never lost tokens while staking with the exchange.

Strong Security Measures

Coinbase emphasizes crypto security and ensures that customers’ tokens at the exchange are safe from hacks and scams. It offers a variety of security measures including two-factor authentication (2FA), multi-approval withdrawals, and password protection. Coinbase also has an in-depth online security center and offers 24/7 security if you have questions about your account.

Regulated and Publicly Traded

Coinbase is a publicly traded company on the NASDAQ stock exchange, which comes with significant reporting requirements and regulation by the Securities and Exchange Commission (SEC). The company is fully transparent about its financial health and potential risks. It also backs customer funds 1:1, ensuring that financial difficulties at the exchange will never impact the safety of your crypto.

How to Choose the Right Crypto to Invest in on Coinbase

With hundreds of cryptocurrencies to choose from on Coinbase, how should you decide which tokens are the best to invest in? We’ll explain a few key factors to consider that will help you choose the right crypto to buy.

Investment Goals

The best place to start when choosing which crypto to buy is to think about your investing goals. First, are you looking to buy and hold cryptocurrencies long-term or actively trade them to make a short-term profit?

Which of these goals you choose has a big impact on your buying decisions. Long-term investors will look at how a token might perform over the next 5-10 years and not worry about price fluctuations over shorter timescales. Short-term traders will focus mainly on those price fluctuations and their opportunities, without worrying much about a token’s fundamental value in the long run.

Another thing to consider is your appetite for financial risk. Newer tokens or those with a smaller market capitalization are generally considered riskier than larger, more established tokens like Bitcoin and Ethereum. They could see bigger price swings and are more vulnerable to bullish or bearish catalysts. Low-risk investors will likely want to stick with major cryptos, whereas more risk-tolerant investors may be okay pursuing bigger gains in new or trending tokens.

Finally, be sure to think about diversifying your portfolio. Instead of investing in just one cryptocurrency, spreading your money across several different tokens — ideally in different sectors of the crypto market — can reduce your risk. If one token suffers bad news, it will only affect a portion of your portfolio rather than sink the whole portfolio.

Market Timing

It’s also important to consider market timing — that is, when to buy and when to sell — when investing in cryptocurrencies.

Low-risk investors or those who don’t want to spend a ton of time monitoring the market can benefit from a strategy known as dollar-cost averaging. This involves investing small amounts into cryptocurrencies on a regular basis. You might buy at some high prices and some low prices, but over time your investments will average out and you’ll be able to benefit from long-term price appreciation in the tokens you choose.

More risk-tolerant investors and crypto traders will want to take a more active role in deciding when to buy and sell. This involves monitoring cryptocurrency markets, market trends and market caps to find opportunities when prices are unusually low or could be poised to rise.

Timing the market this way involves deep research. You must carefully watch crypto news for potential catalysts and track crypto sentiment on social media. You can also use technical price charts and indicators to identify potential price movements before they happen.

Coinbase Tools & Features

Coinbase itself offers a variety of tools to help you invest in top cryptocurrencies and trade the market.

For investors, some of the best features on Coinbase include recurring buys and watchlists. Recurring buys let you automatically invest in a specific token on a regular schedule — making dollar-cost averaging incredibly easy. Watchlists enable you to monitor specific tokens you’re interested in, so you can see when their price pulls back and there’s a potential entry point for an investment.

For active investors and traders, Coinbase offers a powerful technical analysis platform. It’s packed with more than 100 technical indicators and offers access to the exchange’s order book so you can view trading volume and activity around a token in real-time. Coinbase also supports limit orders, stop loss orders, and other more complex order types to help you manage your trading risk.

Both traders and investors can take advantage of Coinbase’s flexible crypto staking to earn interest on their coins, no matter how long they plan to hold them for. In addition, security is baked into Coinbase’s platform, so you don’t have to worry about the safety of your crypto while you’re trading or investing.

What are the Risks of Buying Crypto on Coinbase?

While Coinbase is a widely used, regulated, and trusted platform, there are some risks to buying cryptocurrencies that investors should be aware of.

Volatility and Market Sentiment

No matter what exchange you use to buy cryptocurrency, a major risk you’ll need to contend with is volatility. Crypto prices can rise and fall suddenly with little warning, so investors need to be prepared to stomach potential changes in their portfolio value. It’s also important to have strong risk management practices to limit the amount you lose in a market downturn.

Anything can cause a move in token prices, from a general souring of investor sentiment to major news around crypto regulation. Make sure you’re staying on top of crypto news cycles so you can respond to any changes in the market appropriately.

Scams and Security

Even though Coinbase vets all of the tokens it lists for trading, there is no guarantee that tokens listed on the exchange are safe. It’s up to you to research any token before you buy it to ensure that it’s legitimate.

We recommend looking at a cryptocurrency’s whitepaper, roadmap, and social media channels to determine if a token is real or a scam. It is also a good idea to use on-chain analysis tools to identify the number of unique token holders who own a coin and spot any potential links between wallets that hold a large number of a token.

It’s also critical to keep your Coinbase account secure. Choose a secure password and use Coinbase’s features like 2FA to further protect your account. Never share your password with anyone — Coinbase will never ask for it, so it could be a phishing scam if the exchange contacts you and requests your password.

Conclusion

The best crypto to buy on Coinbase today are Bitcoin, Solana, Chainlink, Cardano, and Ethereum. These coins offer strong growth potential in the coming bull market and have strong backing from crypto analysts. That said, be sure to do your own research and stay up to date on the latest trends in the crypto market when investing.

While these tokens offer a start to your portfolio, you can also diversify further by checking out 300+ other tokens on Coinbase, and be sure to check out our guide to potential upcoming Coinbase listings. Start exploring all the tokens on Coinbase today.

Best Crypto to Buy on Coinbase FAQs

What is the safest cryptocurrency to invest in on Coinbase?

Bitcoin is the safest cryptocurrency to invest in on Coinbase. It’s the world’s largest cryptocurrency and is widely available, including through Bitcoin ETFs and from traditional brokerage firms. That said, no cryptocurrency investment is fully safe since prices can go down at any time, so make sure that investing in Bitcoin aligns with your risk tolerance.

Which crypto has the most growth potential in 2025?

Some of the cryptos with the most growth potential in 2025 include Bitcoin, Solana, and Chainlink. These tokens could see gains of 10x or more, although a lot depends on macroeconomic conditions and changes to crypto regulations in the US.

Can I stake crypto directly on Coinbase?

Yes, you can stake a limited number of crypto tokens directly on Coinbase. The exchange offers flexible staking periods and competitive APYs on supported assets.

How often should I review my crypto portfolio?

For long-term investors, it’s a good idea to review your crypto portfolio every three to six months. This ensures that you can rebalance your holdings as prices change and adjust to changes in the crypto market, such as new regulations or trends.

Is Coinbase a good platform for beginners?

Yes, Coinbase is designed to be beginner-friendly. It offers a friendly user interface, multiple ways to buy crypto with your favorite payment method, and learning resources to help you navigate the market. Coinbase also offers a separate crypto trading interface for more advanced users.