Crypto wallets are essential tools for anyone navigating the digital assets market. They function as a gateway to the entire crypto ecosystem, allowing anyone with an internet connection to securely store, send, and receive cryptocurrencies without relying on centralized third parties like banks or other financial institutions.

As the crypto market has evolved over the years, wallets have evolved beyond simple asset storage. They are your key to accessing decentralized finance (DeFi) platforms, trading non-fungible tokens (NFTs), interacting with the blossoming ecosystem of Web3 applications, and much more.

In its 2024 Crypto Spring Report, Chainalysis reported that the total number of active crypto wallet addresses passed 400 million in 2024, and that number continues to grow. In this guide, we detail everything you need to know about crypto wallets, how they work, the various types available (and their pros and cons), why they are so important, and how to choose the best one for your specific needs.

What Is a Crypto Wallet?

A crypto wallet is a tool that allows users to store, send, and receive cryptocurrencies. Unlike traditional wallets that hold physical cash, crypto wallets don’t actually store your coins. Instead, it secures your private keys, the unique cryptographic codes that prove ownership over your wallet and grant you access to your cryptocurrencies.

Think of it like a banking app: it shows your balance, lets you make transactions, and even connects you to the greater financial network. But instead of dealing with a centralized traditional bank, you are interacting with the blockchain.

There are two main kinds of crypto wallets: software wallets and hardware wallets. Software wallets are apps built to secure your private keys online, whereas hardware wallets are physical devices that are often kept totally disconnected from the internet to keep your keys secure.

The concept of crypto wallets dates back to the early days of Bitcoin. The very first crypto wallet was created by Bitcoin’s mysterious pseudonymous founder, Satoshi Nakamoto. In fact, the very first Bitcoin transaction happened between Nakamoto himself and Hal Finney, a cryptography pioneer who was vital to the evolution of cryptography and digital assets. Nakamoto sent him 10 BTC to test the Bitcoin wallets.

In the early days of crypto, wallet apps were rudimentary, requiring users to manually enter their long, complex cryptographic keys. Today’s wallets have made the process infinitely simpler with user-friendly interfaces and better storage methods for cryptographic keys like encoded secret phrases instead of 64-character strings of digits. These improvements have made it much easier for beginners and experts alike to store and manage their digital assets.

How Do Crypto Wallets Work?

Cryptocurrency wallets aren’t as complex as they may seem, but many investors simply don’t understand how they work. Unlike a regular wallet, a crypto wallet doesn’t actually store coins or money. They store (and protect) information, specifically your wallet’s private key or keys.

Every wallet is linked to both a private key and a public address (derived from the private key). Your public address is kind of like a mailbox. Anyone can find the address and check its transaction history and holdings using a block explorer like Etherscan but only the private key can unlock the wallet and move stored funds.

What does the wallet do, then? Here’s what they are really doing behind the scenes:

- Retrieves all the information linked to the user’s public address, including balances and transaction history

- Displays the above information in a readable format (like a portfolio page in a brokerage app)

- Allows you to sign and create new crypto transactions of all kinds

- Broadcasts those transactions to the blockchain and ensures they are finalized

Modern crypto wallet apps have made sending and receiving crypto a breeze. All you need to do to send funds is to enter the recipient’s wallet address, specify the amount you wish to transfer, sign the transaction, and confirm the transaction fee. Make sure to double-check that the recipient’s address is correct, as any crypto sent to the wrong address will likely be lost forever.

Receiving crypto is even simpler. All you need to do is share your wallet address with the sender. Once the transaction is confirmed on the blockchain, you’ll get your crypto within seconds or minutes (depending on the blockchain).

Types of Crypto Wallets Explained

Crypto wallets come in various types, each with its own advantages and disadvantages. Broadly, wallets can be classified based on their custody model, connectivity, and form factor. Let’s take a closer look at the different types of crypto wallets.

1. Custodial Wallets vs. Non-Custodial Wallets

One of the primary distinctions among crypto wallets is whether they are custodial or non-custodial.

What Are Custodial Wallets?

Managed by a third party, custodial wallets store private keys on behalf of the user. Examples of custodial wallets include wallets provided by cryptocurrency exchanges like Coinbase, Kraken, and Binance, to mention a few. Custodial wallets always incur at least some degree of counterparty risk, meaning that if the custodian fails or goes bankrupt, you may lose some or even all of your stored cryptocurrencies.

What Are Non-Custodial Wallets?

When you use a non-custodial crypto wallet, you can retain full control of your private keys and your funds. These wallets generally offer greater security and anonymity but require users to manage their keys responsibly. If you lose a private key (or the secret phrase that encodes the key), you lose access to your wallet, and your assets are irrecoverable.

| Type of Wallet | Pros | Risks |

|---|---|---|

| Custodial wallet | – Convenient (third-party handles security) – Recovery options if credentials are lost – Suitable for beginners |

– Less control over funds – Vulnerable to exchange hacks/shutdowns |

| Non-custodial wallet | – Full control over funds and private keys – Enhanced privacy and security |

– If private keys are lost, the assets are unrecoverable – Requires slightly more technical knowledge |

2. Software Wallets vs. Hardware Wallets

Another key differentiator between crypto wallets is how they store private keys. Crypto wallets generally fall under one of two categories: software or hardware wallets.

What Are Software Wallets?

Software wallets are digital applications that store your private keys electronically. They are also sometimes referred to as hot wallets, which just means that they are connected to the internet because nearly all software wallets meet this criteria. Software wallets come in various forms, such as a mobile app, a browser extension, or a web app.

Software wallets are generally considered less safe than hardware wallets because they are connected to the internet, which introduces risks such as hacking and phishing attempts.

While most software wallets use similar technology, there are a myriad of important distinctions between some of the most popular choices. For example, some wallets are only available on a certain platform, whether it be on mobile, desktop, or an internet browser. Naturally, this is an important distinction for most investors.

Mobile app wallets are great tools for users on the go who can’t wait until they get home to make trades or send transactions. Browser-based wallets, on the other hand, make using decentralized finance apps easy.

Most of the leading brands of software wallets, including MetaMask and Coinbase Wallet, offer apps on multiple platforms.

What Are Hardware Wallets?

Hardware wallets are physical devices that securely store private keys and require manual confirmation for transactions. They can function as both hot and cold wallets with a great security advantage – they keep keys offline until needed.

Even though hardware wallets are generally considered the most secure way to store your cryptocurrencies, they have their own share of disadvantages. The most significant is that if you lose both your hardware wallet as well as your recovery phrase (which encodes your private key), your funds are permanently lost. Fortunately, most hardware wallets can generate backup codes for you during the setup process, which can be used to restore your wallet if the device is lost or damaged.

| Type of Wallet | Pros | Risks |

|---|---|---|

| Software wallet | – Free and easy to use – Available on multiple platforms |

– More vulnerable to cyber attacks and phishing (compared to hardware wallets) |

| Hardware wallet | – Top security (private keys are stored offline) – Protection from malware and hackers |

– Expensive compared to software wallets – Can be lost or damaged |

3. Additional Classifications

In addition to the most common types of wallets, crypto wallets are also classified by more niche features like access control mechanisms and blockchain compatibility.

Single vs. Multi-Signature Wallets

Single-signature wallets require only one private key for transactions. Multi-signature (or multi-sig) wallets require multiple private keys for authorization, which increases security for shared accounts. Multi-signature wallets have become mainstays in the crypto world for decentralized autonomous organizations (DAOs) and all kinds of crypto projects that require enhanced security.

| Type of Wallet | Pros | Risks |

|---|---|---|

| Single-signature wallet | – Simple to use with only one key – Faster transactions |

– If the private key is compromised, the funds are at risk |

| Multi-signature wallet | – Enhanced security for shared accounts – Reduced risk of a single point of failure |

– Slower transactions due to multiple approvals – More complex to set up and use |

Single-Chain vs. Multi-Chain Crypto Wallets

Single-chain wallets are designed to store, send, and receive cryptocurrency but typically support only one blockchain network.

In comparison, a multi-chain wallet supports multiple blockchain networks, allowing users to manage different cryptocurrencies in a single place. For example, the multi-chain wallet MetaMask allows users to add any network compatible with the Ethereum Virtual Machine (EVM) to their wallet. This can be a godsend for investors who use multiple chains, allowing them to use the same wallet for all of their transactions.

| Type of Wallet | Pros | Risks |

|---|---|---|

| Simple wallet | – Easy to use and beginner-friendly – Faster transactions and fewer compatibility concerns |

– Limited to one blockchain (e.g., a Bitcoin wallet only stores Bitcoin) – Requires multiple wallets to manage different cryptocurrencies |

| Multi-chain wallet | – Convenient, as you don’t need multiple wallets – Enables cross-chain transactions and DeFi integration |

– More complex interface – Security risks due to broader network exposure |

How to Choose the Best Cryptocurrency Wallet For You

Choosing the right cryptocurrency wallet is important for managing and keeping your digital assets safe. Here is a short guide to help you choose between the many options on the market.

Step One: The Basics

First, you need to consider what kind of crypto wallet you want to use. Research the available options for the networks and cryptocurrencies you are planning on investing in and using. If you plan on using multiple networks, a multi-chain wallet like MetaMask, CoinBase Wallet, or a Ledger device could be a great choice.

You will also need to determine whether you prefer the speed and ease-of-use of software wallets or even a custodial wallet, or if you want to buy a hardware wallet to secure your cryptos. Many investors use both, keeping a software wallet for everyday trading and a hardware wallet for safer, more secure storage, like a digital vault.

Remember that custodial wallets incur significant counterparty risk, which can be devastating in the event of a bankruptcy or bank run. Former users of failed exchanges such as Mt. Gox or FTX learned that lesson the hard way.

Step Two: Evaluate Security Features

Naturally, security should be a top priority for your crypto wallet. Whether you want to buy or sell crypto, or simply store it, it is crucial to choose a wallet that has robust security measures.

One of the most important security measures that many wallet apps offer is multi-factor authentication or MFA. MFA adds an extra layer of protection by requiring multiple verification methods before it grants your access, stopping phishing and other hacking attempts in their tracks.

Some of the other most popular security mechanisms and features to look out for include biometric authentication (like fingerprint or facial recognition), non-custodial key storage (where you retain full control over your private keys), encrypted recovery options (in case of a lost or damaged hardware wallet), open-source code, and more.

Step Three: Integrations and Miscellaneous Features

If you want to use DeFi apps or other crypto platforms regularly, you should consider wallets that work seamlessly with your preferred platforms. Proper integration can make transferring funds quicker and more efficient, while the wrong choice of wallet can lead to challenges, unnecessary expenses, and frustration. Some wallets, such as MetaMask and Coinbase Wallet, are so popular that they are widely supported across the DeFi ecosystem, making them a strong choice for DeFi power users.

As all of these wallet providers compete for control over the market, they are continuously adding new features to their wallets. For example, MetaMask now has a token swap feature that makes it incredibly easy to swap between tokens using a decentralized exchange. Most mobile wallets also have browser apps built inside them to make DeFi seamless.

How to Set Up Your Own Crypto Wallet

Now that you have chosen the best crypto wallet for you, it’s time to get it set up. Below, we detail the full process of setting up a MetaMask wallet on a mobile device. Note that other wallets will be a bit different, though they generally use the same setup process.

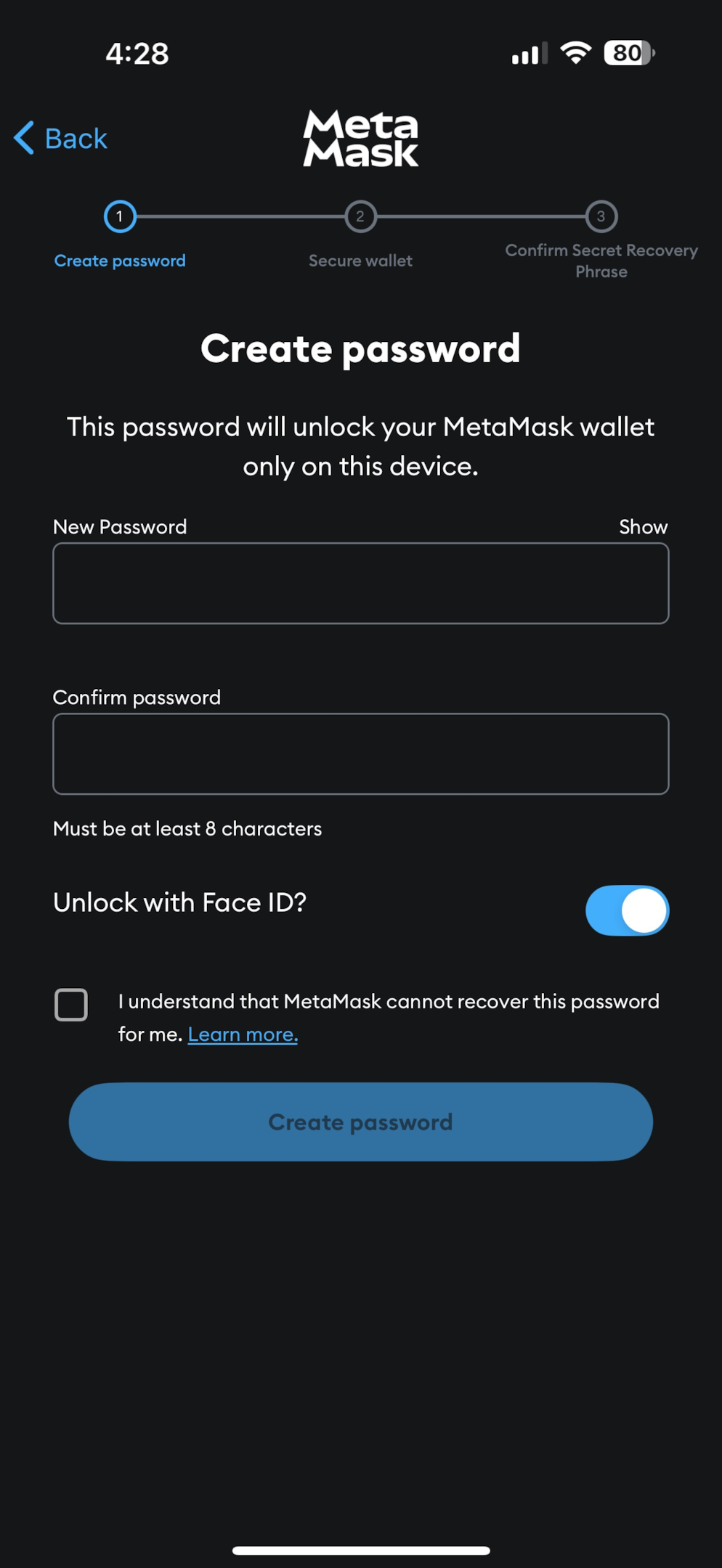

Step One: Create Your Password

Naturally, you need to download the MetaMask app first. It is available on both Android and iOS as well as on Chrome browsers. You can also download a desktop version from the MetaMask website. Once you have the app installed, click “Create a New Wallet” and you will be asked to create a password. Make sure that your password is secure and unique.

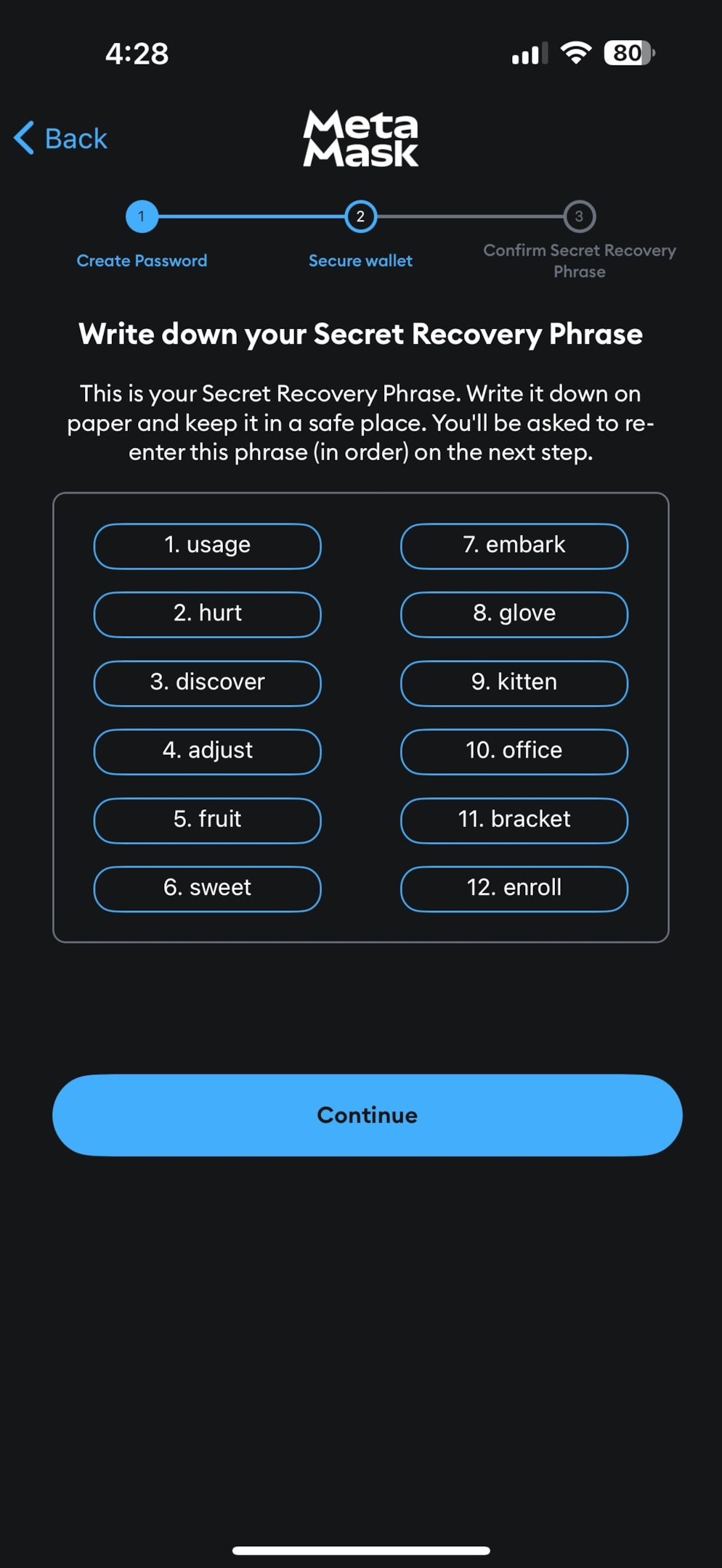

Step Two: Store Your Secret Recovery Phrase

Once you have created your password, the app will generate a Secret Recovery Phrase for you, which encodes your new wallet’s private key. This phrase is used to restore your wallet in case you lose your device, or you forget your password. You will also need to enter the phrase when adding your wallet to a browser or desktop version of MetaMask.

This is the most important step in the entire process because if you lose this phrase and get signed out, you will permanently lose your funds. Make sure to write it down in a secure place like a safe, too, because if a bad actor finds your secret phrase, they could use it to restore your wallet and drain it.

Step Three: Confirm Your Recovery Phrase and Start Trading

Once you confirm that you have written down your recovery phrase, MetaMask will ask you to type it out to make sure that you saved it correctly. Once you finish entering it, you will be ready to start trading.

Keeping Your Crypto Wallet Safe: Smart Habits That Work

In the world of crypto, security is absolutely essential unless you don’t care if you lose all your assets. Keeping your wallet safe doesn’t require cybersecurity expertise, though. Some simple practices can help you avoid common crypto scams. Here are some useful security habits that anyone can follow.

1. Lock It Down with a Solid Password

No more passwords like “123crypto” or “password1*.” Your wallet deserves a unique password that is hard to guess and is filled with numbers, symbols, and mixed letters. It’s like your virtual steel vault door, protecting your digital assets, so don’t make it easy to guess.

It’s also smart to avoid using the same password that you use for other accounts, as data breaches can expose your login details, sometimes leaking them on forums or even the dark web.

2. Turn On 2FA

Two-factor authentication (or multi-factor authentication) is a must when you’re trying to protect your assets. This can be done with SMS-based authentication, where a text message is sent to your phone for confirmation. However, SMS is far from foolproof as it can be vulnerable to SIM-swap attacks. Authenticator apps like Google Authenticator and Authy are often considered much safer and less vulnerable to SIM-swap attacks.

3. Don’t Keep All of Your Coins in One Basket

Many investors like to try to split their funds between wallets, especially if they have large crypto holdings. It’s often a good idea to use a hot wallet for everyday transactions and a cold wallet for your long-term savings.

4. Keep Things Updated

Hackers and cybersecurity experts are locked in a never-ending battle, constantly discovering and patching new bugs and exploits. This is why you should always try to update your wallet apps and firmware to get the latest security patches.

5. Encrypt Your Backups

If you decide to keep a digital copy of your wallet info, encrypt it with a strong password. Better yet, store the encrypted file on an air-gapped offline device or write it down on a slip of paper and keep it in a safe.

6. Triple-Check Addresses

Before you click “send” on any transaction, make sure that the crypto address you are pasting is exactly right. If the address is even one character off, your funds will be lost permanently. Everyone makes mistakes now and again, and new kinds of sneaky malware can swap out addresses in your clipboard (which stores your copied text) to steal your funds.

7. Physical Safety Matters Too

Your backup drives, seed phrases, and hardware wallets should all be secured physically. A locked drawer might work for you, but a hidden fireproof safe or a secure deposit box is even better.

Understanding Cryptocurrency Inheritance

Planning what happens to your crypto assets after you’re gone is more important than many realize. No one wants to think about this but, in reality, this is very important when you hold crypto assets.

Unlike bank accounts and stock portfolios, your family can’t just click “Forgot Password” and recover your wallet in a few steps if you didn’t leave behind access details. In fact, an estimated 17-37% of Bitcoin’s supply is stuck in inaccessible wallets, mostly thanks to lost private keys and address entry mistakes.

This is why you should consider giving trusted family members your recovery information to prepare for the worst case scenario. You could also hide it in a safe and leave the code in your will if you’re particularly anxious about it.

Scams are Everywhere – Stay Sharp

Crypto scams are evolving fast. Before you start using your new crypto wallet, it’s important to know what kinds of scams are out there. Here are some of the most common and threatening kinds of scams you need to know about.

| Threat | Details & Prevention Tips |

|---|---|

| Phishing scams | Fake websites and emails are everywhere. Never click suspicious links. Type URLs manually or use bookmarks to access trusted wallets and exchanges. |

| Fake wallet apps | Only download from official app stores. Verify the developer’s name and check user reviews before installing. |

| Clipboard hacking | Malware can swap crypto addresses when pasted. Always double-check the full address before sending. |

| Social engineering | Scammers pretend to be support agents or influencers. Legit platforms will never ask for your private key or seed phrase. |

| “Too good to be true” offers | Airdrops, giveaways, or fake Elon Musk promotions are almost always scams. If it sounds too good to be true, it is. |

Wrapping Up: The Future of Crypto Wallets

As crypto continues to evolve and grow in popularity, wallets are becoming simpler to use and more versatile. They are now fully integrated into the lives of crypto investors. New wallet features, such as support for multiple blockchains, built-in swapping features, and even in-app integrations with Web3 apps and games, are popping up every other day.

In the near future, your crypto wallet might double as your login for decentralized platforms, your ID for digital events, or even your passport to the metaverse, making it especially important to pick the best crypto wallet for your specific needs.

The key takeaway should be that owning and understanding your cryptocurrency wallet means having real control over your digital assets. Whether you are just starting out or are already a dedicated crypto investor, choosing the right wallet is all about balancing cost, security, and convenience. The tech will only keep evolving, but remember – holding your own keys will always be the key to staying safe in the crypto world.

FAQ

Are crypto wallets free?

Most software wallets are free, but they sometimes offer add-on services in exchange for fees. Hardware wallets are (essentially) never free.

What's the difference between hot and cold wallets?

Hot wallets are connected to the internet, while cold wallets are offline. The first are easier to use while the latter are generally more secure.

Can I store all my crypto in a single wallet?

Yes, if the wallet supports all your coins. Some wallets only work with specific blockchains. Still, experts recommend splitting your holdings between wallets for more security and peace of mind.

Do I need a wallet to buy crypto?

You don't always need your own wallet to buy crypto. Exchanges can also hold it for you. However, if you want more control, you may want to create your own wallet.