On this Page:

Following Donald Trump’s victory during the U.S. presidential election on November 5, 2024, the broader crypto market surged to new heights, with Bitcoin leading the charge. Amid the market-wide uptrend, the crypto king zoomed past the golden $100k mark for the first time in history and eventually hit its current all-time high of $108k before a sharp pullback.

As of February 17, 2025, Bitcoin remains the largest and most valuable cryptocurrency, with a market capitalization of approximately $1.91 trillion, accounting for about 57.59% of the total cryptocurrency market capitalization.

This guide will discuss all aspects of Bitcoin and its price alongside other related matters you should know if you wish to start buying BTC. It will also help you understand how the price of Bitcoin is determined, what affects its value, and how to read real-time Bitcoin graphs.

What Is the Price of Bitcoin Right Now?

The Bitcoin price saw a noticeable pullback shortly after hitting an all-time high of $108,239 due to Fed’s recent projection of fewer rate cuts in 2025 and Jerome Powell’s hawkish remark on the possibility of a crypto reserve. At the time of writing, Bitcoin is trading at approximately $96,263, down about 11.5% from its peak.

Bitcoin is a highly volatile asset, and its price fluctuates constantly. Sometimes, these fluctuations can be massive and quite sharp, allowing it to go up or down by hundreds or even thousands of dollars daily.

Bitcoin Price Chart

(BTC)All of this makes it a risky asset, but at the same time, it also offers opportunities for those willing to risk their money in exchange for potential gains.

With that being said, you should always check the price of Bitcoin in real-time on price-tracking websites, such as CoinMarketCap or TradingView, and, of course, on the exchange that you prefer to use for Bitcoin trading.

These platforms let you select a specific time frame, such as 1 day, 7 days, 1 month, 3 months, 6 months, 1 year, and Year-To-Date (YTD), and its price movement throughout the asset’s history, usually marked as ALL.

Furthermore, you can often select what currency you wish the BTC price to be expressed in, with currencies like USD, EUR, and GBP usually supported everywhere.

Meanwhile, complete crypto exchanges have built-in indicators that traders use for technical analysis, and news feeds that publish relevant news and keep track of new developments in the crypto and blockchain world.

This is useful for making a fundamental analysis, as you can determine how certain developments can impact other traders’ behavior. For example, when the FTX exchange collapsed in November 2022, traders took it as a signal to sell, resulting in even further drops in Bitcoin’s price.

Historically, Bitcoin was published as a concept in a document called the white paper on October 31st, 2008, by a person or a group known as Satoshi Nakamoto. A few months later, on January 3rd, 2009, Nakamoto mined Bitcoin’s first Genesis block.

This started the project’s blockchain, and the asset was officially released into circulation. Bitcoin started getting its first price in 2010, trading at only a fraction of a cent. However, in time, it started attracting more users interested in the idea, which increased the demand for it and, as a result, its value.

Eventually, the asset went from $0 to $108k, even though it took over a decade to make that trip.

Why Invest in Bitcoin?

Bitcoin (BTC)

Bitcoin is an asset that has enormous potential. Traders and investors stick to it for many reasons, and new people keep coming into the crypto industry to interact with it. For example, consider the following:

- Bitcoin is the best-established, most valuable, and most significant cryptocurrency by market cap.

- It introduced new technology, making international transactions considerably faster and cheaper than any traditional solution.

- It solved the problem of double-spending.

- Bitcoin is a decentralized digital currency, meaning no government, bank, or company controls it.

- Bitcoin is transparent, which means it can eliminate corruption thanks to its ability to track transactions.

- Bitcoin runs on the Bitcoin blockchain, which is immutable and censorship-resistant.

- Bitcoin’s trading volume is massive, with over 400,000 daily transactions, so it never has liquidity issues.

- Bitcoin’s long-term price performance is marked by massive growth, from $0.0008 to $108k in just over a decade.

- Bitcoin is not backed by any real-world asset of value, which makes its price volatile. While this makes it risky, it also provides an opportunity to earn by buying when the price is low and selling when it goes up.

- Bitcoin adoption is constantly growing among retail users and in the corporate world, where institutional investors actively participate in its trading while companies slowly adopt it.

- Compared to other cryptocurrencies, Bitcoin is far less speculative and more established. It is the most accepted cryptocurrency globally; even US regulators agree it is not a security.

- Many companies, online stores, and other services accept Bitcoin, including PayPal, Amazon, Microsoft, Starbucks, Etsy, and more.

- Bitcoin’s supply is capped at 21 million coins, so inflation is not dangerous.

How is the Price of Bitcoin Determined?

As mentioned, Bitcoin is an asset that is not backed by any real-world asset of value. As such, its price is not fixed and is entirely based on supply and demand. In other words, the supply of a product and the public demand for it are strongly correlated with the price.

When the product is abundant, but no one wants it, the price is, understandably, low. If there is very little product and everyone wants it, it becomes extremely valuable.

For example, Bitcoin has become extremely popular worldwide among retail and institutional investors. As mentioned, many companies have accepted it as a payment method.

This means that it has uses, or use cases, which means that people want it because they can do things with it. This, in turn, increases the demand and price for it.

Bitcoin also has a fixed supply, which is only 21 million. Not only that, but not all of the coins are out in circulation yet, so the circulating supply is even lower than that. With more people continuously entering the industry and seeking Bitcoin, it can only get higher and higher.

New coins enter circulation every 10 minutes, that is true, but with the halving taking place every four years, the amount that enters gets cut in half with every new halving.

Of course, supply and demand play a massive role in determining the price of Bitcoin, but that is not the whole story. The asset differs from traditional currencies because banks and governments manage and control traditional money.

They control the supply to print more money when the demand increases. That way, the currency remains relatively stable, no matter what happens.

Since no such institution can back Bitcoin, no one can control its value with such precision.

Some try to manipulate it by selling or buying massive amounts at once, but other than that, the buyers and sellers hold the biggest influence over its value.

The History of Bitcoin’s Price

Early Days

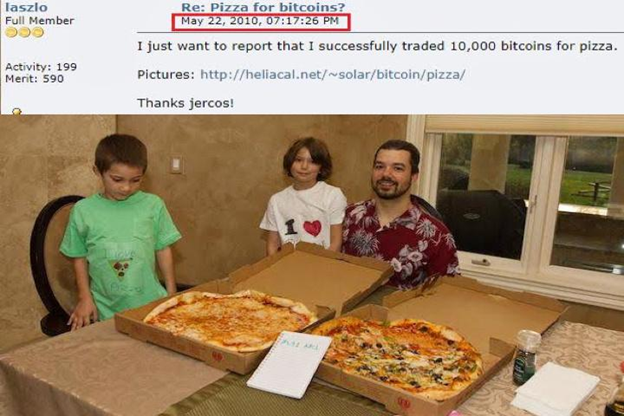

Bitcoin was officially launched in 2009 and received its first transactions and value in 2010. At the time, its first value was $0.0008, and the first famous BTC transaction ever made where someone used it to purchase other goods involved Laszlo Hanyecz, who offered to give 10,000 BTC for two pizzas.

At the time, the coin was $0.004, so he paid around $41 for those two pizzas. Today, 10,000 BTC is over $930 million.

Interestingly, these are considered the two most expensive pizzas in history. Also, since the transaction was conducted on May 22nd, this date is now known internationally as Bitcoin Pizza Day.

Back in those days, Bitcoin did not see many daily transactions. There was no need for Bitcoin exchanges yet, and most people just sent it to one another for hobby purposes.

Soon, however, people started to develop interest, noticing that the asset could be sent worldwide, the transaction would cost mere cents, and it would be completed in only 10 minutes.

In comparison, any international transaction via traditional banks would take more than a week to travel the same distance.

In addition, people realized that no one could freeze their crypto assets since they manage them in their wallets.

This was also the time before blockchain explorers, so that no one could track transactions either, at least not with ease. It also meant that users would have anonymity, and no matter how low the coin’s value was — it still had some value, which meant it could be used for sending money.

Attracting Attention

All of this started attracting investors, tech geeks, but also cybercriminals. Soon enough, Bitcoin was being transacted much more, so the first ever Bitcoin exchange went live in 2010, known as Mt. Gox.

Now that there was a place to buy and sell BTC, interest grew further, and so did Bitcoin’s value. It wasn’t long before it reached $1 in 2011.

Because there is money in cryptocurrency, developers decided to create their own cryptocurrencies, which would be even faster than Bitcoin, or have some other aspects changed. As years went by, more and more people started getting into the crypto industry, which allowed Bitcoin to hit the price of $100. This was in early 2013, and by the end of the year, the coin also managed to hit the price of $1,000 per coin.

However, the following year 2014, the crypto industry was struck by its first big tragedy. Mt. Gox, the exchange where over 70% of all BTC trades occurred then, announced that it was hacked and that the hackers stole 850,000 BTC. This was the first significant theft of Bitcoin, and it caused a lot of panic among BTC users.

Many believed this was the end for the cryptocurrency, and they dumped their coins, causing the price to see its first big crash in April 2014. However, Bitcoin recovered, and by the end of the year, it also started seeing interest from several big companies, including Microsoft, which started accepting it.

In the aftermath of the 2014 Mt. Gox hack, creditors faced a prolonged battle for compensation. Despite the recovery of approximately 142,000 BTC, the repayment process has been fraught with delays. Initially, repayments were slated to begin before October 31, 2023; however, the deadline was extended to October 31, 2024, and subsequently to October 31, 2025. As of February 2025, many creditors have yet to receive their funds, highlighting the complexities and challenges inherent in the restitution process.

Bull Runs and Winters

The price was still strongly affected by the Mt. Gox hack, and while the coin eventually recovered, the exchange did not. However, even Bitcoin needed three years to recover and for investors to overcome their fear of loss, which finally happened in 2017.

Many know it today as the first Bitcoin bull run that took the entire crypto industry to heights never seen before. BTC itself skyrocketed to $20,000 by the end of that year, a massive achievement that no one expected to see.

However, in 2018, the bubble burst, and the prices started to fall. This was when the market learned that Bitcoin and the rest of the crypto industry should expect a lengthy crypto winter after a bull run.

The crypto winter lasted for an entire year, and the price finally started to recover in 2019. Then, in 2020, when the COVID-19 pandemic started becoming a global phenomenon, the crypto industry started crashing again, although only because it correlated with the stock market.

While the stocks continued to fall, Bitcoin and the altcoins quickly bounced back, even outperforming gold, attracting investors on a larger scale.

This led to the second great bull run, and this time, BTC prices skyrocketed to nearly $69,000 per coin. It lost momentum in November 2021, when the obligatory crypto winter started pushing the prices back again.

However, the world was already struggling economically due to the consequences of the pandemic, and then, in early 2022, Russia invaded Ukraine, which had massive geopolitical, financial, and other consequences.

This created a challenging financial situation in a world that has already struggled with inflation, which led many businesses to collapse. The same happened in the crypto industry, leading multiple exchanges, including FTX, one of the largest ones in the world, to file for bankruptcy.

Investigation into the company also revealed mismanagement of users’ funds and other suspicious activities, which only contributed to the collapse of numerous other businesses tied to the platform, and it all prolonged the crypto winter even further.

However, the arrival of 2023 brought a noticeable change right away. As soon as the year had started, investors seemingly found new optimism and interest in digital currencies, which started seeing price recovery.

Bitcoin went from $16.55k on January 1st to $28,967 on March 30th, thus completing the first quarter of 2023 with a YTD high. It rose consistently throughout the remainder of 2023 and eventually ended the year above $42k.

Bigger fortunes smiled on Bitcoin in 2024, fueled by multiple factors, including the approval of crypto ETFs, fourth Bitcoin halving event, consecutive interest rate cuts, and most importantly the emergence of Donald Trump as the 47th president of the United States. While Bitcoin experienced a few setbacks during the year, it kept breaking milestones, starting from a high $70,184 in March to $108k in December 2024.

What Factors Influence Bitcoin’s Price?

Several factors influence Bitcoin price, some already mentioned, while others will be discussed further. For example, there are:

- Supply and demand

- Adoption levels

- Use cases and potential solutions that its technology can offer

- Broader crypto market developments

- Media coverage and news

- Trading volume

- Exchange listings

- Competition

- Mining rewards/costs

Supply and demand were already discussed earlier as the main contributors to price changes, so that we will focus more on other factors, such as adoption.

Essentially, the more businesses and individuals adopt Bitcoin and start using it, the more valuable it becomes. This makes people want to use it, which boosts demand.

And, since Bitcoin is borderless, you can use it anywhere worldwide, as long as you have an internet connection. There are no third parties required where you would have to go to buy it or receive it.

People buy BTC on exchanges or from other individuals directly via P2P platforms. They purchase it from ATMs and receive it as tips, payment for work, gifts, and other reasons.

Another significant factor is competition, primarily from altcoins — alternative cryptocurrencies (to Bitcoin). Altcoin is a term that includes all cryptos except for BTC itself.

Some argue whether Ethereum should be exempt from it, but for the most part, this definition still stands for most people. The crypto industry is flooded with altcoins. As of January 2025, according to Statista, the number of cryptocurrencies worldwide has surpassed 25,000.

While all of them are faster than Bitcoin, and many have specific use cases, Bitcoin is, and will always be the first-ever cryptocurrency. This makes it an extremely powerful brand that might never be surpassed.

Bitcoin Mining Explained

Another big factor for Bitcoin as a whole, and particularly for Bitcoin price, is mining. Or rather, the cost of production of new coins. Satoshi Nakamoto created the concept of blockchain, where user transactions are processed by the algorithm and packed into blocks, which make up the blockchain.

The blockchain is a chronological ledger. However, to process transactions, something needs to power the algorithm.

Since Bitcoin is decentralized, there are no centralized entities to provide the electricity and computing power necessary to process transactions. Instead, Satoshi charged community members with providing them, and each time after processing a group of transactions and creating a block, participants were rewarded with Bitcoin.

These new coins were not previously in circulation, and they come from the 21 million coins that Nakamoto locked up for this purpose.

Each block takes 10 minutes to solve, and to ensure that this time would remain unchanged, he introduced mining difficulty. The algorithm must solve a complex mathematical equation to solve a block.

Depending on the algorithm’s computing power, the difficulty goes up and down for each block to take roughly 10 minutes to solve.

That way, if the amount of power increases, the mathematical problem becomes more complex, and if it decreases, it gets simpler.

Of course, many people want to mine BTC these days, which is why the difficulty is extremely high. Since the process requires a lot of processing and electrical power, the price of Bitcoin increases to make it worth it for the miners to continue doing their work.

Furthermore, the rewards they receive get cut in half after every 210,000 blocks that get solved, approximately once every four years. When Bitcoin first went live, the rewards were 50 BTC per block.

As of February 2025, Bitcoin miners receive a reward of 3.125 BTC for each block mined. This reduction occurred during the most recent halving event on April 20, 2024, when the block reward decreased from 6.25 BTC to 3.125 BTC. This halving process, which reduces the issuance rate of new bitcoins, is programmed to occur approximately every four years, or every 210,000 blocks, until the maximum supply of 21 million bitcoins is reached.

Why is Bitcoin Price Rising and Falling?

As a digital currency that is not backed by anything, it is only possible for it to have any value because people worldwide have a universal agreement that Bitcoin is, in fact, money. With that being the case, some other aspects affect how its value is determined.

For example, its scarcity. Bitcoin is meant to be a global asset, meaning everyone will use it worldwide. Meanwhile, there are only 21 million bitcoins, not all in circulation.

As a result, the greater the number of people that want to use Bitcoin, the more demand there is, compared to this, somewhat limited supply. In other words, with the adoption rising, Bitcoin’s scarcity ensures that the asset’s value will have to increase.

This is the case with any finite resource, including gold. However, since Bitcoin’s price is based on supply and demand — something we already discussed earlier — its price is constantly moving. Little changes in demand will make it move up or down, just like other aspects, such as developments that involve it, directly or indirectly.

For example, when the stock market goes down, chances are that Bitcoin will go up, as it is becoming a safe-haven asset. As such, many believe it will replace gold someday, as its blockchain is not fast enough for the coin to become a currency used for daily payments by everyone worldwide.

Countless things can affect the price of Bitcoin, but in truth, they do not affect the price itself. It all goes back to the investors and their sentiment as they react to market developments, and their reactions influence demand, which makes Bitcoin go up or down.

How Often Does the Price of Bitcoin Change?

Bitcoin trading happens nonstop all over the world. Unlike traditional markets, it doesn’t close for the weekend or at the end of work days. It is constantly open for everyone worldwide, and millions of people are now engaging with it daily. With that being the case, the demand is constantly changing, and so does the price.

We mentioned earlier that price-tracking platforms and exchanges offer Bitcoin charts updated in milliseconds. This is because that is how often the price changes. It moves all the time, which means that, at any moment, there is a chance that something happens to push it up or down.

Who Should Invest in Bitcoin?

Bitcoin is an expensive asset, but fortunately, that doesn’t mean you need to be a millionaire to buy it. While it is true that 1 BTC costs thousands of dollars, the fact is that you can purchase only tiny fractions of it. Just as the dollar has cents, Bitcoin has satoshis. However, while $1 only comprises 100 cents, 1 BTC comprises 100 million satoshis. If you express it in BTC, one satoshi is a decimal with seven zeros and a 1.

The point is to show that buying Bitcoin is still possible, even though 1 total Bitcoin costs thousands of dollars. As a result, anyone can invest in it.

As for who should do it, that is anyone who wishes to profit from long-term investments or short-term trading. Also, anyone who wishes to use Bitcoin for payments, as a safe haven, or any other way that Bitcoin can be used.

With that said, investing the money you can live without is recommended, as you never know what might happen, and the risk of experiencing sudden losses is always present.

Is It Worth Buying Bitcoin in June 2025?

When investing in Bitcoin, choosing the right time is crucial unless you wish to be a long-term investor. Some people prefer to invest their money into BTC, lock up their coins, and forget about them for 5, 10, or even more years.

If this is what you want, feel free to buy Bitcoin (BTC) at any time, as long-term predictions all agree that Bitcoin will skyrocket in the long term, although no one can say precisely what its limitations might be.

Timing is essential for shorter investments or trading, as you need to buy when the price is low and about to head up to make profits. With all that said, is June 2025 a good time to buy Bitcoin?

A lot of experts agree that it is. Bitcoin has just dipped below the $100k level, triggered by the Fed’s stance on interest rate cut in 2025. However, the recent dip may be a good opportunity for those who missed out on the initial pump to acquire Bitcoin.

One major factor that could determine the performance of Bitcoin, particularly in the coming year, would be the outlook of the market. With analysts projecting clearer and more friendly regulations in Trump’s administration, there is a growing belief that the market outlook will be bullish next year. If this is anything to go by, the Bitcoin price could trade above the $120k milestone before the third quarter of 2025.

In January 2025, President Trump initiated several pro-cryptocurrency policies to foster a favorable environment for digital assets. On January 23, 2025, he signed Executive Order 14178, titled “Strengthening American Leadership in Digital Financial Technology,” which emphasizes supporting the growth and use of digital assets and blockchain technologies across all sectors of the economy.

Additionally, the Trump administration has seen a surge in cryptocurrency-related initiatives, including numerous applications for cryptocurrency exchange-traded funds (ETFs). The appointment of Paul Atkins, known for his crypto-friendly stance, as the head of the Securities and Exchange Commission (SEC) has further encouraged this trend.

What Is Bitcoin Used for?

As a digital currency, Bitcoin is considered money by most people, even if most banks and governments do not agree yet. As such, Bitcoin cannot be used to pay your taxes to the government or loans to your bank, but you can use it to purchase goods and pay for services online if you find stores that accept it.

More than that, there are now also crypto cards that allow you to fill their app with your coins and then pay with the card pretty much anywhere.

The companies that issue the cards will convert your cryptocurrency into the merchant’s or service provider’s preferred currency so that you will pay with Bitcoin, and the merchant will receive USD, EUR, GBP, or whatever other currency they wish to receive.

As such, Bitcoin can be considered a payment method, albeit indirectly. On the internet, you can find websites that accept BTC payments, which is a direct use of Bitcoin for this purpose.

However, an even more important use case of Bitcoin is that it provides access to banking and the global financial industry.

Unfortunately, many of the global population live in unbanked or underbanked regions, where the banks simply do not have a presence, and do not offer services. These are typically countries known for poverty.

With no access to banking services, people cannot get loans, start businesses, and help improve their local economies. The banks could change this, but there is no profit for them, so they choose not to. Bitcoin, on the other hand, is borderless and universally available.

Anyone with a smartphone, tablet, laptop, or desktop can access the crypto industry and use Bitcoin or other crypto products.

Decentralized finance (DeFi) is a relatively young sector of the crypto industry. Still, it has already contributed a lot to helping people get crypto loans and offering them passive income in exchange for investing in certain coins and staking them. Bitcoin cannot offer these more complex services, but it can offer access to money, a global financial industry, and speculative investing.

Finally, Bitcoin can also be mined, a popular method of obtaining it. Unfortunately, due to significant competition among miners, it is challenging and expensive to mine BTC as an individual.

However, you can always join one of the many mining pools, which requires purchasing one of their plans and getting a portion of the mined BTC in return.

How to Get Started with Bitcoin Investments

To start trading Bitcoin, you will need a few things. The first thing to do is to identify crypto exchanges available in your country, compare them, and decide which one you will use.

Since Bitcoin is the biggest and most popular cryptocurrency, almost all exchanges have it listed, so you don’t have to worry about whether or not it is supported. However, you should look into aspects like fees, and other assets you might want to buy or sell, etc.

Apart from that, you will also need a crypto wallet that supports Bitcoin.

The best options here include hardware wallets, as they are the safest. Since they are devices that you need to plug into your PC to add and remove crypto, the chances of your funds getting stolen are minimal. However, one thing that you absolutely should not do is leave your BTC in the exchange’s wallet.

If you don’t plan on using them very soon, you should always withdraw your funds from the exchange’s wallet. The reason is that the exchange owns the private keys to the wallet, so it can do whatever it wants. There is a saying in the crypto industry — not your keys or coins.

Other than that, you should make sure to invest in Bitcoin responsibly. That means researching and learning everything about it, using tools like charts, performing technical and fundamental analysis, and more. Note that this will require some time, as you cannot learn everything about anything from only a handful of articles. The more time you dedicate to it, the better your chances of making profits instead of seeing losses.

Taxation on Bitcoin Earnings

Given how much BTC has grown in levels of adoption and price alike, most of the world still lacks regulations for it and the rest of the crypto industry. However, that did not stop most countries from introducing taxes on digital currencies.

To be fair, not all countries have them yet, but many do, and each country has its own rules for taxing crypto. Nothing is universal globally, so you must research local taxation laws to see whether you are obligated to pay taxes and how much.

It is best to do this before you start engaging with Bitcoin and the crypto industry and determine whether your local tax rules are acceptable to you or whether it is worth getting involved.

Short-Term Bitcoin Trading vs. Long-term Bitcoin Investments

One of the most common questions regarding Bitcoin is whether to engage in short-term trading or in long-term investments. Let us say right away that both of these approaches are perfectly legitimate, and neither of them is better or worse than the other.

However, with that said, it is also worth noting that they are two very different approaches, and some people may prefer one, while others may prefer the other.

Essentially, it depends on you, not Bitcoin, which of the two would be a better fit. Long-term investments require you to believe that Bitcoin has a future and will continue to grow bigger in years to come.

It is also popular among people who lack the time or don’t want to continuously monitor the market and wait for new opportunities.

Investing their money into Bitcoin, locking up their coins into a private, secure wallet, and then forgetting about them for years is their preferred approach, and that is what long-term investing essentially is.

On the other hand, trading is an excellent option if you wish to use the constant price surges and drops that happen every day and can sometimes be small and sometimes quite large.

With that said, note that trading requires you to keep an eye on the market, constantly learn how to conduct technical and fundamental analysis, and keep an eye on the news and trends, social networks, discussion boards, and alike to try to deduce when a price change might occur.

Timing is also very important in trading, especially when it comes to day trading, which is when you buy and sell within 24 hours.

This trading method usually brings minimal profits per trade, but they can pile into quite sizable earnings over time. Meanwhile, investing requires you to invest for a long time and make significant earnings at once at some point in the future.

In conclusion, neither is better than the other, but for one, you need to have patience, and for the other, you need discipline, a leveled head, and enough education about the crypto industry to know when it is time to make a move and when you should wait.

Bitcoin Price Prediction

Before we provide any predictions regarding Bitcoin’s future, we would like to point out that this is entirely pure speculation.

An educated guess is still a guess, and while it is based on expert opinions, historical data, current market behavior, and alike, predictions are by no means a guarantee that what is predicted will come to pass.

It is impossible to accurately predict anything in the crypto industry, as it can be turned upside-down in days and sometimes even hours.

With that said, Bitcoin and the rest of the crypto industry have seen a significant price surge in most of the days of 2024, underscoring growing momentum in the market. While it is currently trading in the red due to recent sell-offs, WalletInvestor thinks Bitcoin’s price can reach $131,916 by February 2026, indicating a potential increase of about 37% over the next year.

Changelly’s forecasts suggest that Bitcoin’s average price could reach $150,000 by the end of 2025, with potential peaks up to $200,000. Looking further ahead, Changelly anticipates that Bitcoin’s price may surpass $1 million by 2032.

These projections are based on current market trends and are subject to change due to the inherent volatility of the cryptocurrency market.

Changelly expects the price to continue rising over the next decade and finally cross $1 million around 2032.

Conclusion

Bitcoin is the crypto industry’s biggest and oldest asset with a long history, full of price surges and drops, new milestones, and impossible achievements.

It is also the safest cryptocurrency for investing, as it is the founder of the entire sector. Despite its flaws and the fact that it lacks in terms of speed, scalability, and more, everyone still wants it more than any other crypto.

Some believe that the time to get into Bitcoin is over and that the opportunity was back in 2010. However, the fact is that you can still earn more than decent profits from trading it or investing in it once its price is low in comparison to where it is going.

However, do keep in mind that the risk is not going anywhere either and that any engagement with the crypto industry that you do is done at your own risk.

Understanding that and how the crypto industry works and breathes is key to making good decisions that will bring profits, so do your research, educate yourself on Bitcoin, crypto, and blockchain, and once you feel like you are ready, do give it a go.

Read more:

FAQs

What is the price of Bitcoin?

The current price of Bitcoin is $93,410, but it fluctuates frequently, so use real-time charts to keep track of Bitcoin price.

What is the price of Bitcoin today?

During the day of writing, Bitcoin's lowest price was $93,410, and the highest was $93,790.

What is the price of Bitcoin right now?

The price of Bitcoin right now is $93,410.

What determines the price of Bitcoin?

Bitcoin price is mainly determined by its supply and the demand for it. The secondary factors influencing its value include news, media endorsements, mining costs, real-world uses, etc.

What was the lowest price of Bitcoin?

The lowest price for Bitcoin was $0.0008 when it was traded in 2010.

What was the highest price of Bitcoin?

Bitcoin set its all-time high price on December 13, 2024, when it increased to $108k. Still, we should mention that a new all-time high can be set at any time as Bitcoin is a highly volatile asset.

What price did Bitcoin start at?

Bitcoin was equal to $0.0008 when the first transactions in BTC were conducted.

How often does the price of Bitcoin change?

Bitcoin prices change pretty frequently, even during the hours. There were even cases when Bitcoin lost more than 70% percent of its value in just one day and then recovered by more than 10%.

What influences the price of Bitcoin?

Bitcoin price is determined by the sellers and buyers. If the sellers take over the market, the bear period starts, and the prices drop. In contrast, if buyers take over the market, the bull period begins.

How long does it take to mine 1 Bitcoin?

Even with the most efficient mining systems, it may take up to 5 years to mine just one Bitcoin. But there is an easier way to get it - which is to buy on crypto exchanges.

Why is Bitcoin traded in Dollars?

The US Dollar is considered the most valuable fiat currency in the world and is the world's primary reserve currency. Therefore, the benchmark price for Bitcoin is denominated in US dollar, however, bitcoin is traded on the open market versus any other fiat currency around the world.

How much Bitcoin is left to mine?

The maximum supply of Bitcoin is 21 million, 18.8 million of which is already mined, so there is less than 1.2 million bitcoin left to mine.

What could influence the price of Bitcoin to rise?

Bitcoin price can increase with the massive demand for it. There are certain things that make people start buying Bitcoin, the main of which is the positive events around it.

What is Bitcoin mining?

Bitcoin mining is the process of solving complicated mathematical equations to validate a new block and get rewarded for that. It is done through special computers and devices, and the process consumes enormous amounts of electricity.

Is it still worth investing in Bitcoin?

It actually depends on your budget and investment expectations. In any case, Bitcoin is still highly volatile, and there is a possibility to earn money with Bitcoin investments.

How to predict the price of Bitcoin?

To get an idea of Bitcoin's future price, you can look at the crypto expert predictions, but don't take them for granted and try to combine different analyzes on this issue.