If you have been following the worlds of tech and finance, you have almost certainly heard the term “DeFi” or decentralized finance. DeFi has long been one of the fastest-growing sectors in the crypto space and finance in general, as it aims to revolutionize how we borrow, lend, trade, and put our money to work.

Unlike the traditional financial system that relies on banks, brokers, or other centralized institutions, DeFi is built on blockchain-based protocols that let anyone with an internet connection access financial tools of all kinds without a middleman.

But what exactly is DeFi, how does it work, and why is it becoming so important?

What Is DeFi?

Decentralized finance (DeFi) is a system of financial tools and services built on top of public blockchains (like Ethereum, for example). Think of it as the digital version of the traditional financial world – only without the middlemen.

Let’s say that you want to take out a loan. In traditional finance, you would have to go through a traditional financial institution like a bank. In DeFi, you can borrow directly from another user, with the entire agreement enforced and mediated by smart contracts, self-executing code that runs on a blockchain.

DeFi protocols also make it easy to earn passive income with your cryptocurrencies. Instead of earning a fraction of a percent in interest with a traditional savings account, you can deposit crypto into a DeFi savings platform and earn potentially much higher returns.

Not only can you earn much higher interest with DeFi applications (dApps), but it’s also a much faster and simpler process. You don’t need to sign up for a bunch of accounts or fill out a bunch of paperwork. All you need is your own crypto wallet and an internet connection.

It’s important to note that DeFi platforms come with significantly more risk, especially because they are not FDIC-insured, unlike traditional banks. They can also be vulnerable to bugs in their code or even hackers, increasing the risks of storing your cryptocurrencies in them.

Nevertheless, for many users, the speed, profit potential, transparency, and high level of control offered by decentralized finance are worth the trade-off.

A Brief History of Decentralized Finance (DeFi)

DeFi might sound futuristic, and in many ways, it is, but it has existed as a concept since the launch of Ethereum in 2015. It finally became a reality in 2017 when the Ethereum blockchain introduced smart contracts – self-executing code that made trustless, peer-to-peer financial transactions possible. From this point onward, DeFi grew like a wildfire.

MakerDAO was one of the very first major DeFi platforms. It allowed users to borrow its new stablecoin called DAI by locking up crypto assets as collateral. This was just the beginning.

In the following years, more innovative DeFi apps began to emerge. The new decentralized exchange Uniswap revolutionized token swaps, making them as easy as a few button clicks, sending the DeFi craze into overdrive.

The real explosion came in the summer of 2020, after Compound Finance, an already popular borrowing and lending platform, launched its native token, COMP, officially kicking off “DeFi Summer.” These tokens were used to incentivize users to lend or borrow with the platform.

These incentives, dubbed liquidity mining or yield farming, caused Compound’s usage to skyrocket, inspiring a wave of other DeFi protocols to follow suit with similar mechanisms. To compete, developers began designing mechanisms that offered users the highest possible yields, attracting a flood of intrepid investors eager to earn massive returns quickly.

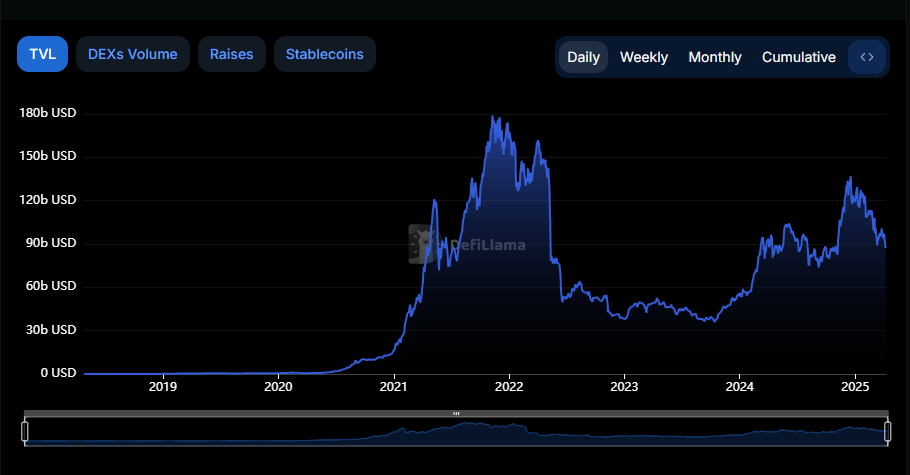

At its peak in late 2021, DeFi platforms held about $178 billion in total value locked or TVL. DeFi was booming at the beginning of 2022, a golden period for crypto in general. At the time, Bitcoin hit its all-time highs, Ethereum surged in value, and investors started putting a lot of confidence in DeFi. By the start of 2022, the total value locked (TVL) in DeFi reached its peak of $180 billion, with everyone from retail traders to crypto funds farming for yield.

Between mid and late 2022, a market-wide downturn wiped out confidence in DeFi as investors sprinted for safe-haven assets like stablecoins and bonds. Like all fast-growing tech, decentralized finance faces a myriad of major challenges. The market crash, along with problems with inflation, bugs, scams, and market volatility, hit the DeFi market hard, with TVL dropping below $40 billion by 2023.

Despite the major dip, DeFi hasn’t disappeared. Quite the opposite – it continues to survive and evolve. In early 2025, TVL bounced back, with $87 billion locked in DeFi platforms around the world, according to DefiLlama.

How DeFi Works

DeFi isn’t just a buzzword or another overly hyped crypto trend. It’s a complete rethinking of how finance can work in a digital world if you remove banks, brokers, and bureaucrats from the equation and replace them with revolutionary blockchain tech.

This unique approach means no paperwork, no middlemen, and no centralized institutions. Instead, you interact directly with software and other users and still do the same things you’d do at a bank or other financial institution – borrow, lend, trade, and save. You can even insure your crypto, all without leaving the DeFi ecosystem.

The foundation of decentralized finance is the blockchain, a decentralized ledger that permanently records every transaction across a network. Instead of a centralized party like a bank keeping track of balances and approvals, blockchains allow users to trade and transact securely and openly without relying on any central authority.

A few years after Bitcoin was released, the visionary cofounders of Ethereum, including Vitalik Buterin and Gavin Wood, developed the tech that would make DeFi possible: smart contracts. Smart contracts are lines of code that automatically execute agreements when both sides meet certain conditions. These contracts, which are used by most blockchains including Ethereum, form the foundation for decentralized applications.

The Goals of Decentralized Finance

At its heart, DeFi is about redefining how we interact with money. The goal is to create a financial system that is open to everyone and gives users more control without sacrificing security and utility. Here are a few of the main goals of decentralized finance:

- True peer-to-peer finance: Sending money, lending, and investing without a bank in sight.

- Global access without barriers: In the DeFi world, your location or background doesn’t matter. As long as you have internet access, you can create a crypto wallet and tap into DeFi platforms.

- Lower costs and flexible terms: With DeFi, you can forget about the terrible savings account interest rates and high service fees that plague centralized banks. Interest rates are often determined by the open market instead of centralized institutions.

- Transparency and privacy: All transactions are permanently recorded on the blockchain, making them easily verifiable and auditable without sacrificing anonymity.

Popular DeFi Use Cases Explained

DeFi is not a theoretical concept. There are now millions of users around the globe actively using it. Here are some of the most popular use cases for DeFi protocols today:

Lending and Borrowing

The lending market is thriving in DeFi these days. Platforms like Compound and Aave let you lend crypto and earn interest or borrow funds by locking up crypto assets as collateral. The process is fully automated and instant – no credit scores and no paperwork. Aave now boasts over $17.5 billion in TVL, just below its all-time high in 2021.

Decentralized Trading

Using decentralized exchanges (DEXes) like Uniswap or Curve Finance allows users to trade cryptocurrencies directly from their crypto wallets. In comparison, centralized finance and exchanges offer less control over your assets and require an account and personal data.

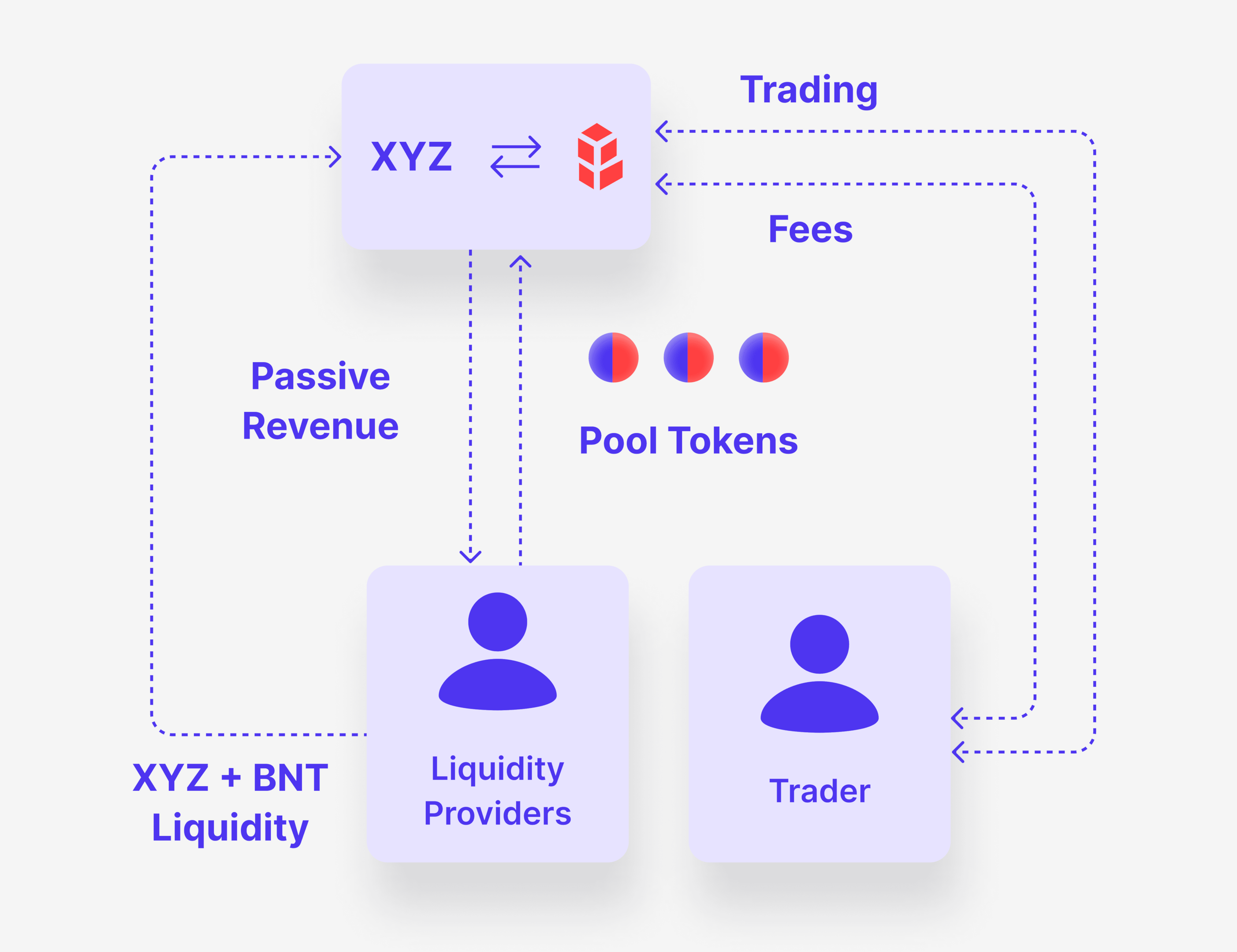

Staking and Yield Farming

DEXes like Uniswap and Curve also enable liquidity mining (also known as yield farming), where users deposit cryptocurrencies into the liquidity pools that power token swaps. In return, they earn a proportional share of the transaction fees charged to swappers and sometimes other additional token rewards. This can be extremely attractive to investors looking for a way to put their cryptos to work, but the risks, such as impermanent loss and smart contract vulnerabilities, shouldn’t be overlooked.

Flash Loans and Arbitrage

One of the most interesting and exciting DeFi innovations is the flash loan. They allow users to borrow and repay cryptos within a single transaction on the blockchain. Because flash loans are complex, risky, and difficult to use, they are mostly only used by experienced developers and arbitrageurs, at least for now. This type of loan was first implemented by Marble Protocol in 2018 and later popularized by Aave.

The YouTube channel Finematics made a great explainer video that goes more in-depth about flash loans if you’re interested in learning more about them.

Flash loans are proof of the incredible potential of DeFi and nothing similar has ever been tried before. However, they aren’t always used with good intentions. Several large exploits have utilized flash loans to steal user funds, making the tech rather controversial in the industry.

One of the most notorious examples of flash loan exploits was in 2020 when a hacker used them to manipulate prices on the bZx protocol (a decentralized margin trading platform). The attacker borrowed a huge sum of Ethereum, used it to manipulate the price of the platform’s native token, secured massive profits, and then paid the loan back, all in one transaction.

Essentially, the hacker executed a short position with inflated leverage, losing the protocol over $8.1 million. This incident caused the BZRX token to fall by over 30%.

DeFi’s Real-World Impact

DeFi has made a splash in markets all around the world, but it has been especially impactful in regions with unstable financial systems or limited access to traditional banking. As of 2021, the World Bank shared that over 1.4 billion adults globally were unbanked and had limited access to reliable payment systems. In these cases, DeFi could be a powerful solution. As long as someone has an internet connection and a crypto wallet, they can more easily participate in the financial economy, even if they don’t have a bank account.

DeFi is also an important source of innovation for the crypto sphere. Most DeFi protocols are open-source, allowing developers to build on top of one another’s work. Over the years, developers have created what experts refer to as a modular or composable DeFi ecosystem to improve the utility and user experience of all DeFi apps.

For example, a stablecoin like USDC can be used across lending platforms, yield farming dApps, and decentralized exchanges. Tools like Chainlink act as oracles, feeding in real-world data into DeFi smart contracts and enhancing the functionality of DeFi apps. On top of that, innovative platforms like Yearn Finance bundle many of these services together and move user funds across various yield strategies, all without human intervention.

DeFi also helped pioneer the concept of community-governed projects through decentralized autonomous organizations or DAOs. Compound Finance, for example, is governed by its token holders in a decentralized and democratic process. Any developer can submit a proposal to change or improve the platform, and token holders vote on whether to implement it. Since DeFi exploded in popularity, so did DAOs, and they now populate the crypto ecosystem.

Getting Started with DeFi

Ready to dive headfirst into DeFi but not sure where to begin? Luckily, getting started is simpler than it sounds, and you don’t need to be a tech genius to do it. All you need is a crypto wallet and at least a little bit of crypto. Here’s how you can start using DeFi protocols.

Step 1: Set Up Your Crypto Wallet

Before you dive into DeFi, you’ll need a crypto wallet. Software wallets like Coinbase Wallet, Trust Wallet, or MetaMask are a few of the most popular choices, though you may want to go for a hardware wallet if you want the most secure option. Note that software wallets are generally faster and more interoperable with DeFi protocols, allowing you to connect to dApps directly from your phone or browser.

When you’re choosing a crypto wallet, make sure to consider ease of use, security features, and compatibility with DeFi platforms.

Step 2: Buy Some Crypto

Once your wallet is ready, you need to fund it before you get started with DeFi. If you already have the crypto you want to use, just send it to your new wallet (and make sure to triple-check the address). If not, you will have to sign up for a crypto exchange. Once you sign up and verify your identity, you can deposit funds, purchase some crypto, and transfer it to your wallet.

Step 3: Choose a DeFi Application

Now that you have cryptos in your wallet, it’s time to decide which DeFi platform you want to use. First, consider your goals. Are you looking to earn passive income, swap tokens, or just explore innovative DeFi tools?

If you want to earn interest on your crypto, check out lending protocols like Aave or Compound Finance, which let you lend your assets to earn passive income.

If you just want to swap tokens, a DEX like Uniswap or Curve Finance is a good bet. Uniswap is the largest DEX, and it boasts a colossal selection of supported tokens. You can also consider providing liquidity to one of these DEXes, though remember that this can be quite risky. Make sure you understand the risks of impermanent loss before pulling the trigger.

If you can’t decide, you can start small and test transactions. Most DeFi platforms have beginner-friendly interfaces, and you can also find tutorials and Discord groups to help you along the way.

Below, you will find a comprehensive table of different DeFi applications, their uses, pros, and cons. Note that using any DeFi protocol incurs at least some level of smart contract risk, though most top platforms have been painstakingly audited by third-party auditors.

| Platform | Primary Use | Pros | Cons |

|---|---|---|---|

| Aave | Lending and borrowing | – Earn interest on deposits – Non-custodial & audited – Flash loans |

– Variable interest rates – Gas fees can add up |

| Compound | Lending and borrowing | – Simple user interface – Auto-adjusting interest – Dev-friendly |

– Limited asset pool – Lower yields than newer platforms |

| Uniswap | Decentralized trading (DEX) | – No account needed – Huge liquidity pools – Permissionless swaps |

– Higher fees during congestion – Risk of impermanent loss |

| Curve | Stablecoin swaps | – Low stablecoin slippage – High APRs for LPs |

– Mostly stablecoins – Not beginner-friendly |

| Yearn Finance | Yield aggregation | – Automates yield farming – Optimized DeFi returns |

– Vault risk if strategy fails – High fees reduce profits |

| Balancer | Asset management, LPs | – Custom pools – Auto portfolio rebalancing |

– Complex pool setup – Risky unbalanced pools |

| SushiSwap | Trading, yield, staking | – Bonus Sushi rewards – Community roadmap |

– Lower volume than Uniswap – Past leadership scandals |

| Lido | ETH staking | – Liquid staking – ETH2 staking without lockup |

– Smart contract & slashing risk – Higher fees |

Advantages and Risks of DeFi

Decentralized finance is changing how we think about money and financial systems. It offers tons of incredibly exciting new opportunities, but it also comes with serious risks. Investing always involves risks, but with complex systems like DeFi apps, it can get especially risky. Before you jump into the DeFi pool, you should know what risks come with it.

Here are some of the most important advantages and risks that you should know before

| Advantages | Risks |

|---|---|

| Open and borderless access | Smart contract vulnerabilities |

| No personal info needed (pseudonymous) | Hacks, rug pulls, and scams |

| Fast transactions and flexible movement of assets | Volatile prices and yields |

| Potential for high returns via staking and yield farming | Lack of insurance and customer support |

| Transparent, powered by on-chain data | Regulatory uncertainty and legal grey areas worldwide |

| Lower costs compared to traditional finance | High gas fees on congested networks |

| Extensive utility: lending, borrowing, stablecoins, NFTs, and more | Some interfaces are complex and require learning |

The Road Ahead for DeFi

Despite its incredibly fast growth, DeFi isn’t set to wipe out traditional intermediaries and finance – at least not overnight. Instead, DeFi is carving out a parallel system for user control, anonymity, and innovation. As regulators catch up with the advances in decentralized finance, we can expect DeFi to coexist with traditional institutions – possibly even tweak how those institutions operate.

DeFi’s evolution to this point hasn’t exactly been smooth. Its rise has been marked by massive hacks, devastating protocol implosions, and regular reminders of the risks tied to cutting-edge technology, especially in finance. The road ahead for DeFi will most likely be shaped by further trials and tribulations, but the efforts of developers and investors will continue and the community will march forward.

What we know for sure is that DeFi is a high-potential but also high-risk frontier. It has challenged traditional finance as we knew it – and will most likely continue to do so in the future.

FAQ

What is DeFi?

DeFi stands for decentralized finance - financial tools and services built on blockchain that let users interact without intermediaries.

Can you make money with DeFi?

Yes. You can make money through DeFi activities like staking, lending, and yield farming - but returns come with risks.

Is decentralized finance safe?

Not entirely. DeFi is still developing, and issues like smart contract bugs or hacks can lead to losses.

Do I need a bank account to use DeFi?

No. All you need is a crypto wallet and internet access.

What are the risks of DeFi?

Common risks include volatility, rug pulls, lack of regulation, and smart contract bugs.

Can a beginner use DeFi?

Yes, there are many beginner-friendly DeFi platforms.