On this Page:

The second largest cryptocurrency by market cap, Ethereum, is a thriving blockchain ecosystem that pioneered smart contracts and decentralized applications (dApps). The Proof-of-Stake (PoS) network is home to hundreds of meme tokens with some of the most loyal crypto communities.

Read on as we cover the top Ethereum meme coins in 2025 and explain why the most influential blockchain after Bitcoin is a market leader in speculative crypto assets.

What Are Ethereum Meme Coins?

Ethereum meme coins are cryptocurrencies created on the Ethereum blockchain mainly for entertainment. They typically take inspiration from internet meme culture, an influential crypto figure, or viral trends.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$0.0412 | 1.71% | $7,176,696,913 | $111,040,779 |

$0.0411

―

$0.0412

|

| 2 |

|

$0.0572 | 0.78% | $3,035,810,180 | $321,659,981 |

$0.0571

―

$0.0573

|

| 3 |

|

$0.0457 | 1.42% | $553,161,963 | $45,377,039 |

$0.0455

―

$0.0457

|

| 4 |

|

$0.44 | -0.03% | $408,790,783 | $13,053,022 |

$0.42

―

$0.45

|

| 5 |

|

$0.0645 | 0.79% | $176,171,933 | $9,356,490 |

$0.0643

―

$0.0645

|

| 6 |

|

$0.002 | -1.86% | $138,193,777 | $38,777,897 |

$0.002

―

$0.0021

|

| 7 |

|

$0.0002 | -3.08% | $74,255,047 | $20,657,076 |

$0.0002

―

$0.0002

|

| 8 |

|

$0.0612 | 0.75% | $70,363,220 | $2,676,535 |

$0.0612

―

$0.0612

|

| 9 |

|

$0.28 | -5.54% | $68,982,951 | $5,460,922 |

$0.27

―

$0.29

|

| 10 |

|

$0.0777 | 5.48% | $59,022,500 | $60,476 |

$0.0773

―

$0.0779

|

| 11 |

|

$0.0116 | 1.79% | $58,590,437 | $32,354,546 |

$0.0112

―

$0.0119

|

| 12 |

|

$0.0734 | -3.75% | $30,444,042 | $4,557,306 |

$0.0734

―

$0.0735

|

| 13 |

|

$0.0292 | 9.64% | $29,246,378 | $5,988,932 |

$0.026

―

$0.0306

|

| 14 |

|

$0.0427 | -4.20% | $24,398,607 | $2,070,342 |

$0.0426

―

$0.0428

|

| 15 |

|

$0.0006 | 6.38% | $24,046,781 | $886,917 |

$0.0005

―

$0.0006

|

| 16 |

|

$0.0749 | -0.42% | $20,891,685 | $1,954 |

$0.0749

―

$0.0749

|

| 17 |

|

$0.0181 | -5.34% | $18,058,245 | $1,752,628 |

$0.0181

―

$0.0192

|

| 18 |

|

$2.08 | 5.50% | $17,010,096 | $82,149 |

$1.94

―

$2.10

|

| 19 |

|

$0.0021 | 3.16% | $16,906,432 | $858,342 |

$0.002

―

$0.0022

|

| 20 |

|

$0.0738 | 1.58% | $16,260,833 | $1,672,156 |

$0.0736

―

$0.0738

|

Shiba Inu

SHIBPepe

PEPEFLOKI

FLOKISPX6900

SPXMog Coin

MOGTurbo

TURBONeiro

NEIRODogelon Mars

ELONBone ShibaSwap

BONEOsaka Protocol

OSAKConstitutionDAO

PEOPLEMilady Meme Coin

LADYSKekius Maximus

KEKIUSLandWolf

WOLFMilady Cult Coin

CULTPikaboss

PIKANeiro on ETH

NEIRONinja Squad Token

NSTPepe Unchained

PEPUPeiPei

PEIPEIAdditionally, meme coins often lack real-world utility and rely on community hype to boost their value. The section below examines how Ethereum meme tokens differ from coins on other blockchains, how gas fees impact their adoption, and how smart contracts shape their utility.

Can an Ethereum Meme Coin Have Utility?

While many meme coins like Dogecoin (DOGE) lack real-world functionality beyond payments, Ethereum-based tokens can offer utility through smart contracts. Here are some utility benefits employed by several Ethereum meme coins:

- Staking Rewards: The Ethereum PoS network supports crypto staking, allowing holders to earn staking rewards after locking their tokens to help secure the network.

- Token Governance: Some Ethereum-based projects feature a DAO (decentralized autonomous organization), giving token holders voting rights. This allows them to shape the token’s future.

- Burning Mechanisms: Several Ethereum meme coins have token burn mechanisms that permanently remove native tokens from circulation. This helps support the crypto’s price as the meme coin virtually becomes more valuable with a lower supply.

- Play-to-Earn (P2E): Axie Infinity, the most popular P2E game, was initially based on Ethereum. Several meme coins have integrated blockchain gaming utility, with some being built on the Ethereum main chain and L2s.

- Cross-Chain Bridges: Pepeto (PEPETO) is an Ethereum-based meme token building a cross-chain bridge. The blockchain bridge enables interoperability and token transfers across various networks.

By integrating staking, DAOs, token burns, P2E, and blockchain bridges, Ethereum meme coins become more than just speculative crypto assets. These strong use cases could enhance meme tokens’ long-term sustainability and influence in the broader crypto market.

What Are the Most Popular Meme Coins on the Ethereum Network?

Now, on to the reviews of the 2025 top meme coins on Ethereum.

1. Shiba Inu (SHIB)

Shiba Inu (SHIB) is the largest Ethereum-based meme token by valuation and number of token holders. Launched in August 2020 in what started as a joke to compete against meme coin frontrunner Dogecoin, SHIB has expanded into a fully-fledged decentralized ecosystem.

As part of its tokenomics, Shiba Inu sent 50% of its initial total token supply of 1 quadrillion SHIB to Ethereum co-founder Vitalik Buterin in 2021. The Canadian-based engineer subsequently burned 90% of his newly received SHIB tokens and donated the remaining amount to charity.

Shiba Inu Price Chart

(SHIB)Regarding utility, Shiba Inu features a complete DeFi platform, blockchain gaming projects, NFT integration, and a token-burning mechanism. It has one of the biggest communities, called the Shib Army, not only among Ethereum tokens but in the entire meme coin category.

SHIB’s value peaked at around $40 billion in 2021 when the Shiba Inu price experienced an all-time high of $0.00008616. Today, it’s a top-ranking meme coin available for purchase on most centralized and decentralized exchanges.

Find out more about Shiba Inu

2. Pepe (PEPE)

The next popular Ethereum meme coin is Pepe (PEPE). Inspired by the iconic internet meme Pepe the Frog, the token was created in 2023 as a playful competitor to the dog-themed meme token market leaders.

Seeing one of the most rapid price surges in the 2024 meme coin supercycle, Pepe is currently a top-3 meme token and the second largest on the Ethereum blockchain. It has a total supply of 420.69 trillion PEPE tokens and peaked in market valuation at $11 billion at the end of 2024.

Pepe Price Chart

(PEPE)According to Etherscan, Pepe has over 409,000 holders, reflecting its widespread token distribution and overall adoption. In terms of community, the project’s official X account has nearly 800,000 followers, and its popularity has spawned several Pepe-inspired NFTs.

Fully embracing meme coin culture, Pepe has a fair trading mechanism with zero taxes and permanently locked liquidity as all PEPE LP (Liquidity Pool) tokens have been burned. With no developer control, Pepe is completely decentralized and in the hands of its community.

Find out more about Pepe

3. Floki (FLOKI)

Floki (FLOKI) is another top Ethereum meme token based on Tesla billionaire Elon Musk’s Shina Inu dog named Floki. It was launched in 2021 on both the Ethereum and BNB Smart Chain networks, making it a multi-chain cryptocurrency.

Carrying the title “The People’s Cryptocurrency,” Floki initially relied on social hype and marketing for growth. However, the meme coin shifted its focus to building a blockchain ecosystem after experiencing a large market correction following the 2021 crypto bull run.

FLOKI Price Chart

(FLOKI)FLOKI (FLOKI)

Today, the Floki community-powered ecosystem features decentralized offerings across blockchain gaming, NFTs, DeFi, and educational verticals. Valhalla, a P2E online multiplayer game, is the meme coin’s most anticipated title, integrating metaverse NFTs.

Other Floki ecosystem products include the Floki Trading Bot, the University Of Floki blockchain education platform, and the FlokiPlaces NFT and merchandise marketplace. The Ethereum-based crypto achieved its highest valuation in mid-2024, reaching a market cap of over $3 billion.

Find out more about Floki

4. SPX6900 (SPX)

SPX6900 (SPX) parodies the highly established S&P 500 stock market index as a meme token on Ethereum. The crypto project launched with a token supply of 1 billion SPX but burned around 69,000 tokens, effectively making the total circulating supply almost 931 million SPX.

In addition to Ethereum, SPX operates on the Solana and Base networks, increasing the meme coin’s accessibility across blockchain users. It boasts over 37,000 native token holders on the Ethereum blockchain.

SPX6900 Price Chart

(SPX)SPX6900 (SPX)

Launched in 2023, SPX6900 gained traction in the recent supercycle, during which its price surged by over 10,000%. By early 2025, SPX surged to an all-time high price of $1.72 per token with an almost $1.5 billion market cap.

While SPX’s price has retraced since its apex, the meme coin remains a top 200 cryptocurrency and is available on many crypto exchanges. Interested investors can start trading SPX on Bybit, Kraken, MEXC, Raydium, Uniswap, and others.

Find out more about SPX6900

5. Mog Coin (MOG)

Mog Coin (MOG) is a fair launch token initially listed on the Uniswap V2 DEX in 2023. The cat-themed meme coin is branded as “The Internet’s First Culture Coin,” supported by an activity community that shares viral and exciting meme-related content.

Additionally, MOG is a top meme coin pick of popular crypto influencer Murad Mahmudov. Despite the token’s lack of real-world use, Mog Coin emerges as a meme coin with high potential returns due to its cult-like community.

Mog Coin Price Chart

(MOG)Mog Coin (MOG)

The Ethereum-based token has a maximum supply of 420.69 trillion tokens, making its per-coin value extremely low. At its highest, MOG’s price was $0.000004016 per token, and it has since dropped by over 80% as of this writing.

Mog Coin operates on both Ethereum and Base, with over 51,000 and 221,000 holders, respectively. MOG is available for trading on Uniswap V2 for Ethereum and Base, and on Bybit, MEXC, Bitget, and KuCoin, among others.

Find out more about Mog Coin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

How We Selected the Best Ethereum Meme Coins

Let’s break down the factors we considered when choosing the best meme coin on Ethereum.

- Market Adoption: This includes market capitalization and trading volume, which we primarily consider in our selection.

- Historical Performance: Previous price performance reflects a meme coin’s relevance, growth potential, and trendiness.

- Community Engagement: Since meme coins derive most of their value from their community, we look for tokens with high social media activity from their followers.

- Exchange Listings: Being available on multiple crypto platforms shows that a meme coin is significantly popular and has high liquidity.

- Token Distribution: We review the number of token holders a meme coin has relative to its value, with a high number indicating better decentralization and distribution.

While the factors mentioned above help determine the success and popularity of Ethereum meme coins, they do not guarantee profits or long-term viability. Remember that these crypto assets remain highly speculative and strongly driven by hype and market sentiment more than intrinsic value.

What Are the Best Tools to Track New Meme Coins on Ethereum?

Making sound Ethereum meme coin investment decisions requires monitoring the prices and developments of cryptocurrencies. Let’s review some of the best tools for tracking them.

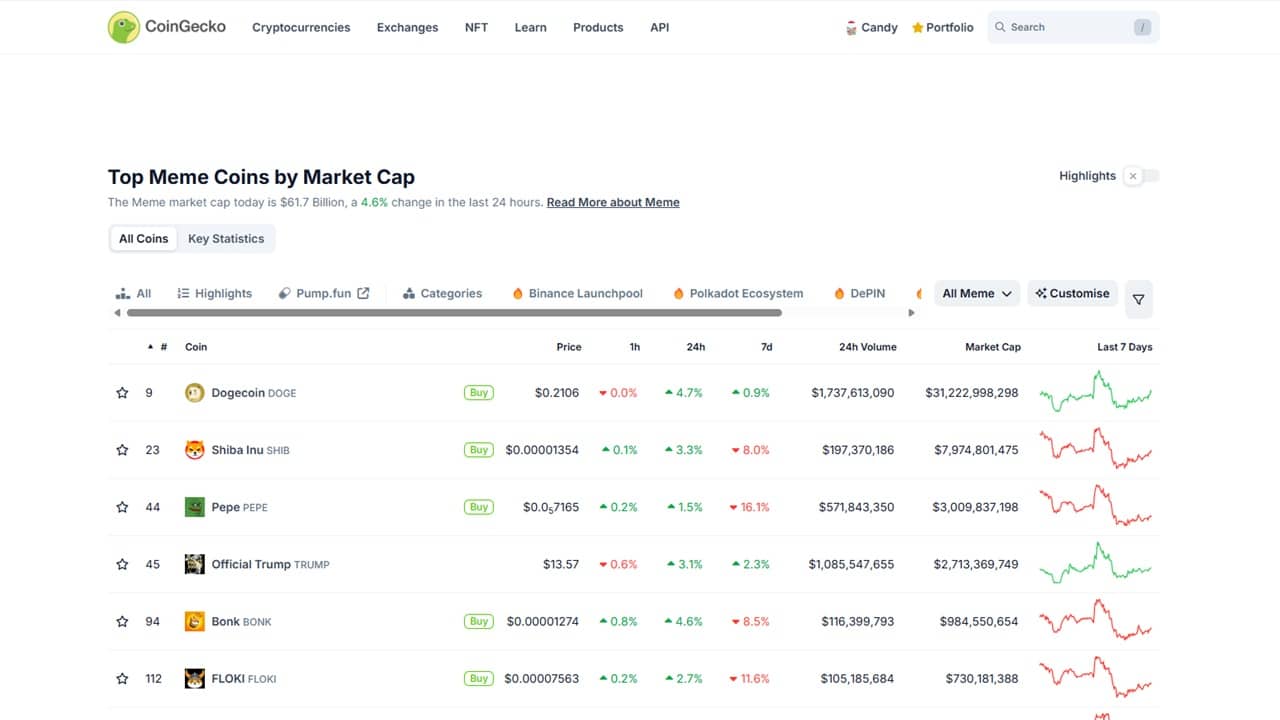

Crypto Data Aggregators

We recommend subscribing to crypto data aggregators that track thousands of tokens to view real-time price data, market capitalization, and trading volume. Two of the most popular crypto analysis platforms are CoinGecko and CoinMarketCap.

CoinGecko was founded in 2014 and monitors tokens, meme coins, NFTs, DeFi, and Web3 projects. It’s an independently owned platform and offers free API access, allowing users and businesses to draw data from the site quickly.

On the other hand, CoinMarketCap was established in 2013 and tracks thousands of tokens and trading pairs. In 2020, the platform was acquired by Binance, the largest centralized exchange. While the acquisition helped CoinMarketCap to grow, some users believe the platform lacks neutrality on crypto matters.

In addition to crypto analysis platforms, many traditional financial apps provide real-time crypto data. Some examples include Yahoo Finance, Fidelity, and TradingView.

Social Media Communities

Knowing the latest news and discussions on the crypto market and specific meme coins can give traders an edge. The top social media platforms for getting token updates include:

- X (formerly Twitter): The go-to channel for real-time crypto news, influencer posts, and whale movements.

- Telegram: Ideal for crypto project team announcements, private groups, and discussions.

- Reddit: Long-form discussions, token analysis, and more extensive community insights.

- YouTube: In-depth project reviews, educational content, and speculation.

- Discord: Best for community discussions, developer updates, and news.

Typically, Ethereum meme coin projects will have at least one official social media channel (usually X) for announcements or engagement. Follow those channels, along with the top Bitcoin investors like Elon Musk, Vitalik Buterin, and Michael Saylor, on their respective accounts.

Official Websites

Meme coin projects on Ethereum should have official websites that provide important details regarding the token. Sometimes, these sites display essential live financial information such as token price, market capitalization, and total circulating supply.

Furthermore, the official pages of the meme tokens often include posts of the latest news and updates regarding the project. At the very least, they should include links to the official social media channels for key announcements.

Early-stage Ethereum meme coin projects sometimes start out as presales, selling the native tokens at below-market prices before they go public. Individuals tracking these types of meme tokens can visit the official presale websites to track the project’s progress, the amount raised, and other essential details.

Ethereum Meme Tokens vs Other Blockchain Crypto

Ethereum, helmed by blockchain engineer Vitalik Buterin, was launched in 2015 and pushed crypto technology beyond peer-to-peer (P2P) transactions. It was the first network to record and execute code through smart contracts, which is one of the key differences between Ethereum meme coins and crypto from other blockchains.

Most Ethereum-based meme coins use the ERC-20 token standard, one of crypto’s most widely used protocols. These tokens can also operate with decentralized exchanges (DEXs), wallets, and dApps on the Ethereum blockchain.

In contrast, cryptocurrencies like Bitcoin (BTC), Litecoin (LTC), and Ripple (XRP) operate on networks with functionality limited to everyday P2P transactions. However, Ethereum currently competes with other Layer-1 blockchains that also support smart contract functionality, including BNB (BNB), Solana (SOL), and Avalanche (AVAX).

High Gas Fees Limit Ethereum Meme Coin Adoption

One of the biggest hurdles to the widespread adoption of Ethereum meme coins is the blockchain’s high network fees and low transaction speeds. The table below compares Ethereum’s gas prices and throughput with those of its top competitors.

| Blockchain | Transactions Per Second (TPS) | Network Fees | Transaction Speed |

| Ethereum | ~15 | High (can vary greatly depending on demand) | 5 to 10 minutes |

| BNB | ~80 | Low | ~3 seconds |

| Solana | ~65,000 | Low | ~2.5 seconds |

| Avalanche | ~4,500 | Low to Moderate | ~2 seconds |

Despite being one of the most widely used blockchains, Ethereum’s gas fees can become extremely expensive, especially during high network congestion. This, combined with its throughput at around 15 TPS, does not provide a conducive environment for meme coin trading compared to other chains.

Meme tokens grow best when they can be traded quickly and in high quantities, allowing new users to invest and increase the cryptos’ value. This is why the Solana meme coin ecosystem quickly rose to prominence, with the network’s 65,000 TPS and $0.00064 median fee per transaction.

Ethereum Smart Contracts With Meme Coins

Smart contracts enable Ethereum meme coins to tap into Web3 applications or dApps on the blockchain. This allows token holders to trade, lend, borrow, and stake their assets on decentralized platforms while maintaining complete control of their crypto holdings.

Furthermore, Ethereum smart contracts have created other digital assets, such as NFTs (non-fungible tokens). Many Ethereum-based meme tokens integrate NFTs into their project roadmaps and tokenomics, aiming to drive value for token holders. For instance, Milady Meme Coin (LADYS) airdropped 1% of its total token supply to PEPE and Milady NFT holders.

How Do Ethereum Layer 2 Solutions Affect the Growth of Meme Coins?

According to CoinDesk, Layer-2 (L2) solutions are fast and cost-effective networks that help facilitate transactions from the Ethereum Layer-1. Many Ethereum community members believe that Ethereum will need to rely on these L2 rollups if the blockchain wishes to remain competitive and scale.

Regarding meme coins, Ethereum L2 solutions could help solidify the L1 chain as a dominant meme token ecosystem. Here’s how Layer-2 solutions help scale Ethereum and benefit tokens on the blockchain:

- Lower Gas Fees: Current rollups are around 5 to 20 times cheaper than Ethereum Layer-1 transaction costs, lowering the barrier to entry for meme coin traders.

- Higher TPS: Ethereum L2 Polygon (formerly MATIC) can achieve 190 TPS, the highest among other scaling solutions for Ethereum. Polygon could support high-volume Ethereum meme coin trading.

- Security: Ethereum is one of the most secure decentralized smart contract platforms. Rollups inherit this level of protection as they send transactions back to the Ethereum L1.

L2 scalability plays a crucial role in meme coin adoption on Ethereum. Lower network costs and higher throughput enhance meme coin liquidity on DEXs, making trading and DeFi processes more efficient. As Ethereum scales, it becomes a more attractive and competitive platform for meme coin projects.

How to Trade Ethereum Meme Coins Effectively

Now that you’ve seen the top meme coins on Ethereum, here are some investing tips to help you manage risk and optimize profits for trading the tokens.

Identify Your Trading Strategy

The first and probably one of the most important parts of trading meme coins on Ethereum effectively is tailoring an investment strategy based on your goals. For this, consider your time horizons, risk tolerance, and market knowledge.

Below are the two main trading strategies for meme coins:

- Short-term Trading: This involves opening and closing crypto positions within a day, often relying on technical analysis and high liquidity for effective trading. It also requires decent market knowledge and skills for success.

- Long-term Investing: Holding meme coins for months or years may also lead to success, especially if the token is widely adopted in the long term. Because less action is required, not much technical skill is required for this strategy.

Individuals can use one or both of these strategies when looking for earning opportunities through Ethereum meme coins. It’s important to understand that both types still incur risks, as meme coins are inherently high-risk tokens. Identify which strategy will work best for you, and do additional research if your goals are not yet clear.

Choose the Right Exchange

A crypto exchange is your gateway to buying Ethereum meme coins, and there are dozens of platforms to choose from. Base your decision on your experience and trading strategy. Here are the two types of exchanges you can find:

- Centralized Exchanges: These platforms are great for beginners and experienced traders, given their user-friendly interfaces with deep liquidity. Their capacity for high-speed trading makes them ideal for short-term strategies and can feature derivatives trading for leveraged positions.

- Decentralized Exchanges: They require knowledge of blockchain applications but provide self-custody of crypto assets and greater privacy. DEXs are great for long-term investing, especially for individuals who wish to stake or lend their tokens for rewards.

It is recommended that beginners start trading with centralized exchanges, as these platforms are easy to use and often feature fiat payment options for frictionless account funding. However, users shouldn’t limit themselves to using just one type of exchange; they can find profit-maximizing strategies that take advantage of both CEXs and DEXs.

Regarding crypto futures and perpetuals trading, increasing potential returns along with more risk, centralized exchanges are more commonly used. Although some DEXs, like dYdX, offer decentralized crypto derivatives trading, CEXs remain the more popular option in this case.

Manage Tokens with a Decentralized Wallet

Whether you use a centralized or decentralized exchange for trading Ethereum meme coins, it’s a best practice to store crypto assets in a non-custodial wallet or decentralized wallet. Compared to just keeping your tokens in a CEX, holding them in a self-custody crypto wallet gives you complete control over your crypto assets.

While centralized exchanges are more secure now than before, they are still prone to malicious attacks and hacks compromising users’ crypto holdings.

Choose from these two types of decentralized wallets:

- Hot Wallet: MetaMask, Best Wallet, and Trust Wallet are all examples of hot wallets. These are desktop or mobile applications connected to the internet, making it easier to buy, sell, and manage tokens on decentralized apps.

- Cold Wallet: These offline hardware devices store users’ private keys, making them resistant to hacks. Many investors use cold wallets to hold cryptocurrencies in the long term.

Active short-term traders benefit significantly from hot wallets, allowing them to easily transfer the Ethereum meme tokens to centralized exchanges for trading. Additionally, these crypto wallets can connect directly to DeFi apps, unlocking passive income possibilities through staking and liquidity farming.

On the other hand, cold wallets provide maximum crypto security. Hardware wallets such as Ledger, Ellipal, and Trezor offer the most cyberattack protection and are ideal for long-term investing strategies.

Set Up Advanced Trading Tools

Strategies requiring higher expertise, such as day trading and crypto perpetuals, integrate advanced trading tools for risk management and optimizing returns. Technical analysis indicators are the most well-used tools and help traders find opportunities based on cryptocurrency price action.

Trading-focused exchanges like MEXC and Binance incorporate technical indicators into their platforms. For instance, MEXC’s partnership with the leading crypto analysis site TradingView allows the exchange to offer important charting indicators. Examples include the Moving Average (MA), Relative Strength Index (RSI), and Bollinger Bands.

Some trading platforms like Pionex specialize in crypto trading bots, automated programs that can open positions 24/7. The bots utilize algorithms set by traders to buy and sell cryptocurrencies based on predetermined parameters. Users can deploy the automated bots to trade Ethereum meme tokens for passive trading.

Latest Ethereum News

How to Avoid Ethereum Meme Coin Scams

Traders who aren’t careful might invest in fraudulent crypto projects, which can be built on any blockchain. Some Ethereum meme coins have been subject to rug pulls and scams, resulting in enormous losses for adopters. Here’s how investors can identify the red flags to avoid becoming victims of meme coin scams on Ethereum.

Check for Smart Contract Audits

One of the best ways to verify an Ethereum meme coin’s legitimacy is to check if it has undergone a third-party review called a smart contract audit. These smart contract evaluations by reputable companies and firms analyze the meme coin’s underlying code.

The smart contract auditors try to find vulnerabilities in the meme coin that could exploit token investors or allow for certain malicious activities, such as honeypots, high centralization, and ownership privileges.

Although some Ethereum-based projects have become successful despite lacking verified smart contract reviews, having these audits makes a meme coin more transparent and trustworthy. We’ve listed various reputable crypto auditing platforms below:

- Hacken

- Hashlock

- Slowmist

- SolidProof

- Coinsult

Taking things one step further, investors can read the smart contract audits from the meme coin project’s official website. The reviews often summarize potential vulnerabilities affecting the security of the token’s code or the smart contract’s overall design. Some risks could result from poor coding or logical errors.

Reviewing Ethereum meme coins’ smart contracts can also help traders better understand the project’s goals and intentions. For example, an audit showing that the meme coin has no tax fees and relinquished control of the smart contract can indicate that the project is designed for fair trading and reduces the risk of developer manipulation.

Review the Tokenomics

A meme coin’s tokenomics—token economics—can show whether the project is positioned for community-driven sustainability or a short-term pump-and-dump scam. The key to analyzing tokenomics is understanding how and why the native token will be distributed.

Here are some important factors when evaluating Ethereum meme coin tokenomics:

- Total Supply: Projects with excessively high token supply, especially following inflationary models, suffer from value and price dilution.

- Liquidity: Tokenomics showing low or no liquidity allocations could indicate a potential rug-pull scam, as retail token owners would have difficulty selling their coins.

- Team Allocation: Avoid tokens where teams have an allocation that is too high without proper reasoning unless they require vesting or locking in the crypto for a long period.

- Utility: Identify how the supply of tokens is allocated for a meme coin’s utility, if any. For example, if the project mentions staking utility, expect an allocation for staking rewards.

These figures can be found in a meme coin’s official whitepaper or crypto analysis platform. Do your due diligence regarding the projects’ tokenomics, as they may vary drastically from meme coin to meme coin.

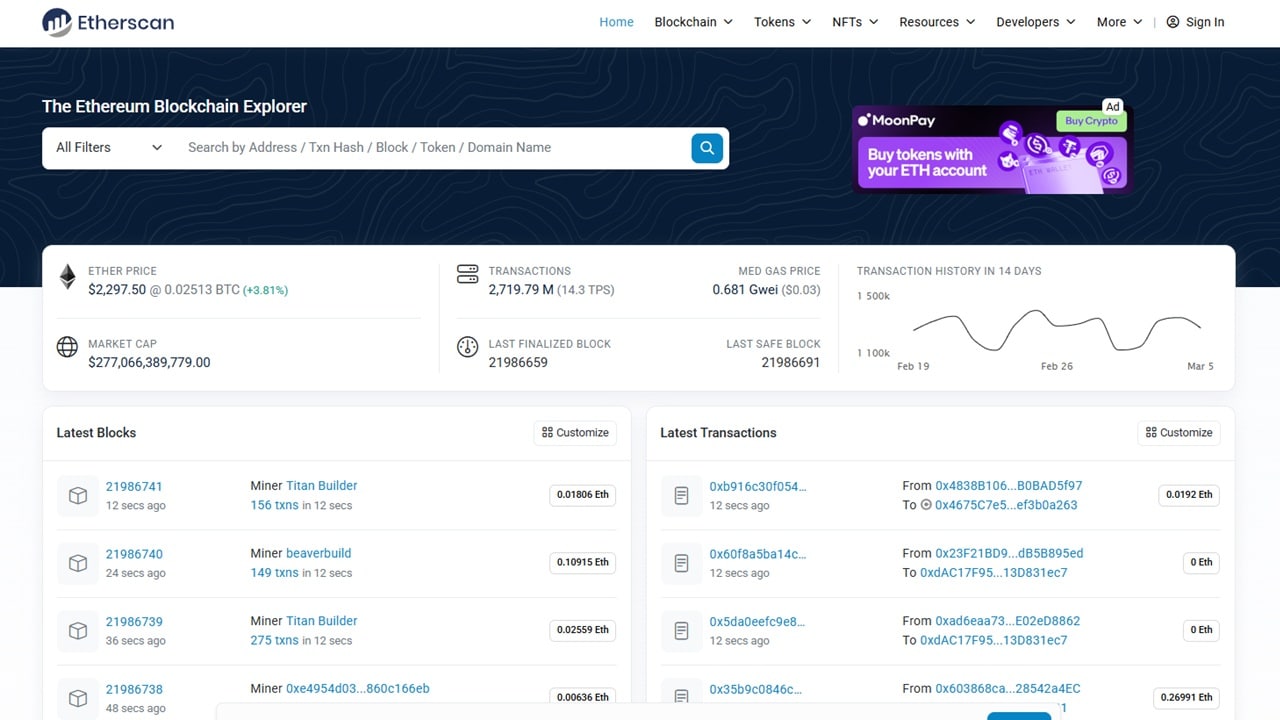

Utilize Ethereum Scanning Tools

Another way to mitigate scam risks on Ethereum meme coins is to access blockchain explorers and scanning tools. These platforms allow users to track all transactions based on the token contract. In fact, they contain a record of all transactions to or from the contract for a fully transparent overview of the project.

Through the blockchain scanners, investors can look for suspicious transactions indicating heavy centralization and the possibility of a crypto scam. Check this list of the top Ethereum scanning tools for monitoring activity on meme coin projects:

- Etherscan: The most established Ethereum blockchain explorer, it’s used to view smart contract interactions, token transactions, and total holders.

- DEXTools: A real-time analysis platform for tracking liquidity based on DEXs. Features pool health and liquidity lock indicators to help traders assess potential token scams.

- Token Sniffer: Provides a safety score based on key meme coin information such as smart contract audits, liquidity status, and trading patterns.

- DEX Screener: Live tracking and advanced analytics for crypto. It features risk analysis, user-friendly design, and DEX-based liquidity monitoring.

Take some time to learn how to use these tools, which enable investors to make data-driven decisions and avoid Ethereum meme token scams.

Ethereum Meme Coins FAQ

What are Ethereum meme coins?

Ethereum meme coins are tokens built on the Ethereum blockchain. They are generally speculative and have limited real-world utility.

How do Ethereum meme coins work?

Most Ethereum meme coins use the ERC-20 fungible token standard. This allows the crypto to operate on Ethereum-based applications like wallets, smart contracts, and exchanges. As ERC-20 tokens, Ethereum meme coins can feature token governance, staking, and other utilities.

Why are meme coins popular on the Ethereum network?

Ethereum has one of the largest crypto communities, making it a popular network for meme coins to gain traction and visibility. Other factors, such as decentralized liquidity, strong developer support, and smart contract utility, have allowed Ethereum to be a thriving meme token ecosystem.

What are the most popular meme coins on Ethereum?

The most popular meme coins on Ethereum in 2025 are Shiba Inu (SHIB), Pepe (PEPE), Floki (FLOKI), SPX6900 (SPX), and Mog Coin (MOG).

Are Ethereum meme coins a good investment?

Ethereum meme coins are high-risk, high-reward crypto assets. While they offer the potential for significant returns, their speculative nature and extreme volatility subject the tokens to huge market swings.

How can I buy meme coins on the Ethereum blockchain?

To purchase meme coins directly from the Ethereum network, users must set up an ETH-compatible decentralized wallet and connect it to a decentralized exchange (DEX) with live meme coin trading.

References

- Gas (Ethereum): How Gas Fees Work on the Ethereum Blockchain (Investopedia)

- Scaling Ethereum (Ethereum)

- Could ‘Based Rollups’ Solve Ethereum’s Layer-2 Problem? (CoinDesk)

- The Fastest Blockchain Processed 91M Transactions in a Day (CoinGecko)

- Miladay Meme Coin (Forbes)

- Next Meme Coin to Pump? Why PEPETO Meme Coin Could Outperform Many Cryptos in 2025 (Bitget)