An altcoin is any cryptocurrency other than Bitcoin. The term combines “alternative” and “coin,” covering the thousands of digital currencies that emerged following Bitcoin’s success in 2009. These cryptocurrencies offer various functionalities, use cases, and technological features that either aim to improve upon Bitcoin’s limitations or have entirely different purposes.

While Bitcoin remains the number one coin on the market, the number of altcoins has grown exponentially – there are over 37 million crypto tokens, and we’re on track to reach 100 million by the end of 2025. Altcoins represent about half of the total cryptocurrency market capitalization, and have a significant role in expanding and utilizing blockchain technology beyond Bitcoin’s original vision of peer-to-peer electronic cash. In this article, we answer the question of what an altcoin is and discuss its characteristics.

Key Takeaways

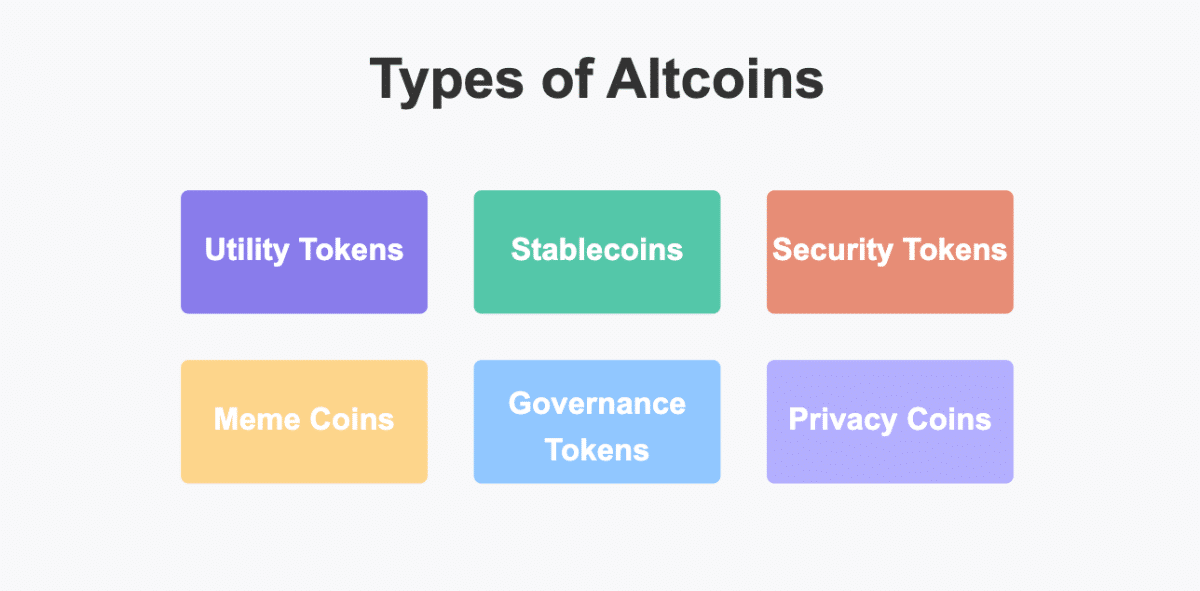

- There are various types of altcoins, including utility tokens, stablecoins, security tokens, meme coins, governance tokens, and privacy coins.

- Altcoins can be a testing ground for blockchain innovations like smart contracts, improved privacy, cross-chain interoperability, and energy-efficient consensus mechanisms.

- Altcoins can offer potentially higher returns than Bitcoin due to their smaller market caps, but they also come with increased volatility, security risks, and higher failure rates.

What’s the Difference Between Bitcoin and Altcoins?

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency and remains the dominant digital asset by market capitalization. Altcoins arrived later, with the first notable examples appearing in 2011, and have since evolved to address limitations in Bitcoin or to serve entirely different purposes.

There are several key differences between Bitcoin and altcoins:

- Age and Establishment: Bitcoin has a 15-year track record since its 2009 launch, while most altcoins are considerably younger. This longevity gives Bitcoin unmatched brand recognition and network effects.

- Market Position: Bitcoin maintains approximately 50% of the total cryptocurrency market cap, providing greater liquidity and stability compared to altcoins.

- Technological Focus: While Bitcoin primarily focuses on being a store of value and medium of exchange, many altcoins offer additional functionality such as smart contracts, privacy features, or specific industry applications.

- Technical Features: Many altcoins have improved upon Bitcoin’s transaction speeds, energy efficiency, and scalability. For instance, Litecoin processes transactions in about 2.5 minutes compared to Bitcoin’s 10+ minutes.

- Volatility: Altcoins typically exhibit higher volatility than Bitcoin due to smaller market caps, less liquidity, and more speculative investment patterns.

Why Altcoins Exist

Altcoins emerged for several compelling reasons. Technological innovation drove many developers to improve upon Bitcoin’s design by addressing limitations in transaction speed, energy consumption, or functionality.

As blockchain technology proved useful beyond simple value transfer, specialized tokens were developed for industries ranging from supply chain management to gaming. The success of Bitcoin demonstrated the potential for digital currencies, attracting entrepreneurs and developers seeking to capture value.

Perhaps most importantly, altcoins are laboratories for testing new consensus mechanisms, governance models, and economic designs that might be too risky to implement on Bitcoin’s established network.

The bottom line is that altcoins exist because they support new technology, offer different use cases, provide varied trading opportunities, and give creators room to experiment.

Evolution of Altcoins

In this section, we discuss the way altcoins have performed since their inception.

2011-2013: Early Alternatives

The first altcoin, Namecoin, launched in April 2011, followed by Litecoin in October of the same year. These early alternatives primarily tried to improve specific aspects of Bitcoin’s technology.

2014-2016: The Rise of Platforms

Ethereum’s launch in 2015 revolutionized the space by introducing programmable smart contracts, enabling the development of decentralized applications (dApps) and eventually giving rise to the DeFi movement.

2017-2019: ICO Boom and Specialization

The Initial Coin Offering (ICO) boom saw thousands of new projects launched, many focused on specific industries or use cases. This period also saw the rise of stablecoins designed to reduce volatility.

2020-Present: Maturation and Integration

Some of the key milestones for altcoins in recent years include increased institutional adoption, the rise of NFTs, and the growing integration of traditional finance and cryptocurrency systems.

At the same time, the barrier to entry for creating new currencies has dropped dramatically. User-friendly development tools, standardized token protocols, and turnkey launch platforms now allow virtually anyone to create and distribute an altcoin with minimal technical knowledge or capital investment.

This has flooded the market with millions of low-quality tokens lacking meaningful utility, security audits, or sustainable tokenomics. This situation has produced additional challenges for investors seeking to identify projects with long-term potential.

Types of Altcoins

There are various types of alternative coins, each with its own purpose and design. Here’s an exploration of the main types:

Utility Tokens

Utility tokens function as digital services or units of access within specific blockchains. They’re designed to serve practical functions rather than simply act as investment vehicles. Functions may include paying for transaction fees or accessing platform-specific features.

| Characteristic | Description |

| Primary Function | Serve as digital services or access units within specific blockchains |

| Purpose | Practical utility rather than investment vehicles |

| Value Derivation | Demand for the underlying service or platform |

| Key Examples | Ethereum (ETH), Chainlink (LINK), Filecoin (FIL) |

| Common Use Cases | Network transaction fees, accessing services, rewarding participants, and facilitating governance |

Utility tokens get their value from the demand for the underlying service or platform. For example, as more developers build applications on Ethereum, demand for ETH increases to pay for transactions, potentially driving up its value. Their value is tied to the utility they provide within their respective ecosystems.

Stablecoins

Stablecoins address one of the biggest challenges in the cryptocurrency market: volatility. They provide a bridge between traditional financial systems and digital assets.

| Characteristic | Description |

| Primary Function | Maintain stable value, reducing volatility |

| Purpose | Bridge between traditional finance and digital assets |

| Stability Mechanisms | Fiat-collateralized, crypto-collateralized, algorithmic, or hybrid approaches |

| Key Examples | Tether (USDT), USD Coin (USDC) |

| Market Role | Enable trading, lending, remittances, and everyday transactions |

Stablecoins maintain a stable value by pegging themselves to external assets like fiat currencies (usually the US dollar), commodities, or through algorithmic mechanisms. Their purpose is to provide stability in the otherwise volatile crypto market, enabling practical use cases like commerce and lending. This is what they are used for:

- Tether (USDT): The largest stablecoin by market cap, pegged to the US dollar

- USD Coin (USDC): A regulated stablecoin backed by fully-reserved assets, primarily cash and short-term U.S. Treasuries

Stablecoins maintain their pegs through various mechanisms:

- Fiat-Collateralized: Backed by reserves of traditional currencies held by a custodian (USDT, USDC)

- Crypto-Collateralized: Backed by reserves of other cryptocurrencies with over-collateralization to account for volatility (DAI)

- Algorithmic: Use smart contracts to automatically expand or contract the token supply to maintain price stability

- Hybrid Models: Combine multiple stabilization mechanisms

Stablecoins have become fundamental infrastructure in this system, enabling trading, lending, remittances, and everyday transactions without exposure to significant price fluctuations.

Security Tokens

Security tokens are a critical bridge between traditional financial markets and blockchain technology. They bring regulatory compliance to tokenized assets.

| Characteristic | Description |

| Primary Function | Represent ownership in external assets or enterprises |

| Regulatory Status | Subject to securities regulations (e.g., SEC oversight) |

| Structure | Similar to traditional securities but blockchain-based |

| Real-World Applications | Tokenized real estate, equity, debt instruments, investment funds |

| Key Benefits | Increased liquidity, reduced settlement times, and fractional ownership |

Unlike utility tokens, which provide access to a product or service, security tokens represent ownership in an external asset or enterprise. They function similarly to traditional securities like stocks or bonds but exist on a blockchain. Security tokens are typically subject to securities regulations, requiring compliance with laws such as those enforced by the SEC in the United States.

Examples and Real-World Use Cases:

- Tokenized real estate: Allowing fractional ownership of property investments

- Tokenized equity: Digital representations of company shares

- Tokenized debt instruments: Bonds or loans represented on a blockchain

- Tokenized investment funds: Providing access to diversified investment strategies

In 2021, Bitcoin wallet firm Exodus successfully completed an SEC-qualified Reg A+ token offering, allowing for $75 million in common stock to be converted to tokens on the Algorand blockchain. This marked the first digital asset security to offer equity in a U.S.-based issuer.

Security tokens offer benefits like increased liquidity for traditionally illiquid assets, reduced settlement times, 24/7 trading, and fractional ownership opportunities that weren’t practical before blockchain technology.

Meme Coins

Meme coins are the more playful side of cryptocurrency, often driven by internet culture and social media momentum rather than fundamental utility.

| Characteristic | Description |

| Primary Function | Community engagement and speculative investment |

| Value Drivers | Virality, social media momentum, and community participation |

| Supply Characteristics | Typically, massive or unlimited token supplies |

| Key Examples | Dogecoin (DOGE), Shiba Inu (SHIB) |

| Risk Profile | High volatility, generally considered speculative investments |

The value of meme coins primarily comes from community engagement, virality, and speculative interest rather than underlying utility or technological developments. They typically gain popularity quickly through social media, often hyped by online influencers and community-driven marketing. The rapid price movements of meme coins often reflect crowd psychology more than traditional investment fundamentals.

Some of the most memorable examples of meme coins include:

- Dogecoin (DOGE): Created in 2013 as a joke referencing the popular Shiba Inu “Doge” meme, it gained significant traction and celebrity endorsements, particularly from meme lord Elon Musk.

- Shiba Inu (SHIB): Launched in 2020 as a “Dogecoin killer,” it developed its own ecosystem with NFTs and a decentralized exchange.

- Pepe (PEPE): Based on the popular internet frog meme, saw explosive growth in 2023.

- Peanut the Squirrel (PNUT): Inspired by a viral New York City squirrel, saw growth in 2024.

Meme coins typically have massive or unlimited token supplies, contributing to their low per-unit prices. While they often lack substantial tech foundations or real-world utility, their strong communities can drive surprising longevity and market capitalization. However, they’re generally considered high-risk investments due to their volatility and lack of fundamental value propositions.

Governance Tokens

Governance tokens allow token holders to shape the future of blockchain protocols.

| Characteristic | Description |

| Primary Function | Grant voting rights within blockchain ecosystems |

| Governance Model | Voting power is typically proportional to holdings |

| Decision Scope | Protocol parameters, fund allocations, and platform upgrades |

| Key Examples | Uniswap (UNI), Maker (MKR), Aave (AAVE) |

| Organizational Structure | Essential Components of Decentralized Autonomous Organizations (DAOs) |

Governance tokens grant holders voting rights within the blockchain, enabling them to propose and vote on changes to protocol parameters, fund allocations, and other important decisions. They distribute decision-making power across a community rather than centralizing it with developers or a foundation.

Token holders’ voting power is typically proportional to their holdings, allowing those with larger stakes to have greater influence over the protocol’s direction. This system promotes long-term thinking, as major holders have a vested interest in making decisions that maintain or enhance the network’s value.

To break the coins down:

- Uniswap (UNI): Enables holders to vote on changes to the Uniswap decentralized exchange protocol, including fee structures and treasury allocations

- Maker (MKR): Allows holders to vote on risk parameters governing the DAI stablecoin system, including collateralization ratios and supported collateral types

- Aave (AAVE): Gives holders voting rights over protocol upgrades, risk parameters, and other aspects of the Aave lending platform

Governance tokens are typically considered utility tokens that serve a specific function within their ecosystem, rather than securities. They’ve become an essential component of decentralized autonomous organizations (DAOs), allowing community-led management of decentralized protocols without central authority.

Privacy Coins

Privacy coins focus on enhancing transaction anonymity and confidentiality, addressing one limitation of Bitcoin’s transparent blockchain.

| Characteristic | Description |

| Primary Function | Enhanced transaction anonymity and confidentiality |

| Privacy Technologies | Ring signatures, stealth addresses, zero-knowledge proofs, transaction mixing |

| Difference from Bitcoin | Bitcoin is pseudonymous, while privacy coins aim for complete anonymity |

| Key Examples | Monero (XMR), Zcash (ZEC), Dash (DASH) |

| Regulatory Challenges | Facing increasing scrutiny in some jurisdictions |

While Bitcoin transactions are pseudonymous (linked to addresses rather than identities), they’re recorded on a public blockchain visible to everyone. Privacy coins use various cryptographic techniques to obscure transaction details, including:

- Ring Signatures: Combine a user’s transaction with others, making it difficult to determine which funds were transferred by whom

- Stealth Addresses: Generate one-time addresses for each transaction to prevent linking payments to a single public address

- Zero-Knowledge Proofs: Allow verification of transactions without revealing specific details about them

- CoinJoin: Mix multiple transactions together to obscure the trail

- Confidential Transactions: Hide transaction amounts while still allowing verification

Privacy coins have legitimate use cases for those seeking financial privacy but have faced concerns about potential illicit use. This has led some exchanges to delist privacy coins in certain jurisdictions to comply with regulatory requirements. You can read our detailed article about privacy coins here.

What Can You Do With Altcoins?

Altcoins have expanded far beyond Bitcoin’s original concept of peer-to-peer electronic cash. Coins like Litecoin and Bitcoin Cash offer faster transaction times and lower fees for everyday purchases. Many investors use altcoins to diversify their holdings across multiple assets to spread risk. Several altcoins implement less energy-intensive consensus mechanisms than Bitcoin’s Proof of Work, such as Ethereum and Cardano’s Proof of Stake or EOS’s Delegated Proof of Stake.

Altcoins introduce capabilities that extend beyond Bitcoin’s functionality. Ethereum, Solana, and others enable programmable smart contracts for decentralized applications. Monero and Zcash enhance privacy with confidential transactions.

XRP and Stellar facilitate fast, low-cost international payments. Many altcoins support DeFi services like lending and trading without intermediaries. Platforms like Ethereum and Solana enable NFT creation and trading.

The altcoin can be a testing ground for blockchain innovation. Projects experiment with scalability solutions to increase transaction throughput. Coins like Polkadot and Cosmos connect different blockchains into interconnected systems.

Various governance models and economic incentive structures align participant behavior with network goals. Industry-specific altcoins demonstrate real-world applications in supply chain, healthcare, and gaming.

How Do Altcoins Work?

At their core, altcoins rely on blockchain technology – a distributed ledger that records all transactions across a network of computers. While they share this foundation with Bitcoin, altcoins often implement blockchains with several variations.

Blockchain provides altcoins with decentralized validation, where transactions are verified by a distributed network rather than a central authority. It creates records that cannot be altered once recorded.

Most blockchains offer transparency, with the ledger visible to all participants (except in privacy-focused coins). Security is maintained through cryptographic techniques that protect the integrity of the network.

Differences in Blockchain Structures

Altcoins differentiate themselves through various blockchain implementations, primarily through their consensus mechanisms. Proof of Work (PoW), used by Bitcoin and some altcoins, requires solving complex mathematical puzzles to validate transactions and create new blocks.

Proof of Stake (PoS), adopted by Ethereum post-Merge, Cardano, and others, selects validators based on the number of coins they hold and are willing to “stake” as collateral. Delegated Proof of Stake (DPoS), used by EOS, allows token holders to vote for a small number of delegates who validate transactions. Proof of Authority (PoA), implemented by VeChain, relies on approved validators with known identities.

Block parameters also vary significantly across altcoins. Some prioritize faster blocks for quicker transactions, while others prefer larger blocks for higher throughput. Many altcoins incorporate features, like the privacy-enhancing technologies in Monero or IOTA’s “Tangle” structure, which replaces a traditional blockchain with a directed acyclic graph.

The blockchain architecture of an altcoin impacts its performance characteristics, including transaction speed, throughput, energy consumption, and security model.

Mining and Staking

The methods used to validate transactions and secure altcoin networks fall primarily into two categories: mining (Proof of Work) and staking (Proof of Stake).

These approaches are different philosophies about how blockchain networks should operate. To help you clearly understand these complex consensus mechanisms, we’ve organized the key differences into comparative tables below.

In these tables, you will see the distinct characteristics of each approach, their resource requirements, and the benefits they bring.

| Feature | Proof of Work (Mining) | Proof of Stake (Staking) |

| Process | Miners compete to solve mathematical puzzles. The winner adds a new block | Validators selected based on coins “staked” as collateral |

| Resource Requirements | Significant computational power and electricity | Minimal computation, requires capital in staked tokens |

| Examples | Bitcoin, Litecoin, Monero, Dogecoin | Ethereum (post-Merge), Cardano, Solana, Avalanche |

| Security Model | Secured by the economic cost of attacking (51% of computing power) | Secured by economic incentives (risk of losing stake) |

| Environmental Impact | Higher energy consumption | Significantly lower energy consumption |

The introduction of staking has created new economic models within the altcoin ecosystem, allowing participants to earn yields on their holdings while contributing to network security and governance. The benefits of staking can be seen in the table below:

| Benefit | Description |

| Energy Efficiency | Consumes far less electricity than mining, addressing environmental concerns |

| Economic Participation | Allows token holders to earn passive income by participating in network security |

| Reduced Sell Pressure | Encourages long-term holding as tokens are locked up during staking |

| Governance Integration | Often combined with voting rights, allowing stakers to participate in protocol decisions |

| Scalability | Generally enables faster transaction processing and higher throughput |

What are the Most Popular Altcoins?

In this section, we discuss some of the most popular alternative coins.

1. Ethereum (ETH)

Ethereum Price Chart

(ETH)Ethereum has a radically different approach to blockchain technology compared to Bitcoin. While BTC was designed primarily as digital money, Ethereum was built as a programmable blockchain platform for decentralized applications.

The development philosophy differs as well, with Ethereum emphasizing functionality expansion, contrasting with Bitcoin’s focus on stability and security. In terms of monetary policy, Ethereum has moved away from a fixed supply model, implementing a burning mechanism that can make it deflationary under high network usage.

Perhaps most significantly, Ethereum transitioned from Proof of Work to Proof of Stake in 2022 (The Merge), dramatically reducing its energy consumption. These differences are Ethereum’s distinct vision for blockchain technology as a foundation for a wide range of applications beyond simple value transfer.

Ethereum pioneered smart contract functionality, which enables:

- DeFi: Lending, borrowing, trading, and other financial services without intermediaries

- NFTs: Digital certificates of ownership for unique assets

- DAOs: Organizations governed by token holders through code rather than central authorities

- Web3 Applications: A new generation of internet applications with user ownership and decentralized governance

Ethereum’s capabilities have spawned applications and services, making it the second-largest cryptocurrency by market cap and the backbone of much of the blockchain advancements we see today.

2. Binance Coin (BNB)

BNB is the native cryptocurrency of the BNB Chain (formerly Binance Smart Chain) and is the backbone of the broader Binance system. It was originally created as a utility token for trading fee discounts on the Binance exchange, but its role has expanded significantly over time.

BNB now powers the BNB Chain network, which hosts thousands of decentralized applications. The token integrates across Binance’s product offerings, including Binance Launchpad, Binance DEX, and Binance Pay.

BNB offers multiple utilities that drive its adoption. Users receive discounts when paying trading fees with BNB on Binance, providing immediate value for traders. The token serves as a payment method accepted for various services within and outside the Binance ecosystem. It functions as gas for smart contract transactions on the BNB Chain, similar to how ETH works on Ethereum.

Participation in token sales on Binance Launchpad typically requires BNB, creating additional demand. The token has even expanded into travel booking through integration with platforms like Travala.com. Within decentralized finance, BNB is used in lending, yield farming, and other DeFi applications on BNB Chain.

BNB’s utility has helped it maintain its position as one of the top cryptocurrencies by market capitalization. This multi-purpose utility model has inspired many other exchange tokens, though few have achieved BNB’s level of adoption and integration.

3. Cardano (ADA)

Cardano Price Chart

(ADA)Cardano distinguishes itself through its academically rigorous development methodology. Development is based on peer-reviewed academic research, assessed by experts before implementation.

The project uses formal verification to mathematically prove code correctness, reducing the risk of vulnerabilities that plague many blockchain projects. Cardano follows a carefully structured development roadmap across five phases (Byron, Shelley, Goguen, Basho, Voltaire), each addressing different aspects of the network’s evolution.

The platform was designed from first principles rather than adapting existing blockchains, allowing fundamental rethinking of blockchain architecture. This methodical approach aims to create a more secure and sustainable platform, though it has resulted in a slower development pace compared to some competitors.

Cardano’s Ouroboros Proof of Stake protocol offers several advantages. It requires minimal energy compared to Proof of Work systems, addressing environmental concerns about blockchain energy consumption.

The protocol allows all ADA holders to participate in consensus through delegation, creating a more democratic system. Stake pools are operated by community members who receive rewards for maintaining network nodes and distributing the responsibilities of network maintenance.

The system provides mathematical security guarantees similar to Bitcoin’s Proof of Work while avoiding its energy requirements. It also enables higher transaction throughput and lower fees, improving scalability.

Cardano’s development philosophy attracts a dedicated community that values technical rigor and methodical progress. This research-first approach contrasts with the “move fast and break things” mentality common in cryptocurrency development, positioning Cardano as a more measured alternative in this niche.

4. Solana (SOL)

Solana Price Chart

(SOL)Solana has positioned itself as one of the fastest blockchain platforms available. It’s theoretically capable of processing over 65,000 transactions per second (TPS), producing a new block approximately every 400 milliseconds. Average transaction costs are fractions of a cent, making micropayments viable. Despite promising high throughput, Solana has experienced several network outages that have raised questions about its stability.

Solana achieves its performance through mechanisms like Proof of History (PoH), a time-keeping system that creates a historical record of events, allowing validators to process transactions without extensive communication.

Its Tower BFT algorithm is optimized to work with PoH, while Turbine breaks data into smaller chunks for easier transmission. Gulf Stream forwards transactions to validators before the current block is finalized, and Sealevel enables parallel processing across multiple GPU cores.

This architecture makes Solana attractive for applications requiring high throughput, including decentralized exchanges, gaming platforms, and NFT marketplaces. However, centralization trade-offs and occasional reliability issues remain points of contention in the blockchain community.

5. Ripple (XRP)

XRP Price Chart

(XRP)XRP was designed specifically to facilitate fast, low-cost international money transfers. Transactions settle in 3-5 seconds, compared to days for traditional banking systems. Transaction fees are minimal (approximately 0.00001 XRP).

XRP can be a bridge currency between different fiat currencies, potentially eliminating pre-funding requirements for financial institutions. Ripple’s On-Demand Liquidity (ODL) service uses XRP to source liquidity for cross-border payments.

Ripple, the company behind XRP, has focused on building relationships with traditional financial institutions through RippleNet, a network of financial institutions using Ripple’s technology for payments.

The company has established strategic collaborations with banks and payment providers globally. Despite facing legal battles with the SEC regarding XRP’s classification as a security in the United States, Ripple continues to expand its international presence, particularly in Asia-Pacific and the Middle East.

What are the Advantages and Disadvantages of Altcoins?

| Pros of Altcoins | Cons of Altcoins |

| ✅Altcoins have given rise to technological advancements in the form of smart contracts, privacy features, scalability solutions. | ❌Altcoins are subject to more dramatic price swings, potential for severe losses. |

| ✅They can be used in various scenarios, including DeFi, NFTs, supply chain, gaming, and identity solutions. | ❌Many altcoins eventually become worthless. |

| ✅They have high potential for growth thanks to smaller market caps with room for appreciation. | ❌Altcoins are susceptible to 51% attacks and smart contract exploits. |

| ✅You can earn passive income with altcoins through network participation and staking rewards. | ❌They have smaller user bases and developer communities. |

| ✅Tailored blockchain applications provide industry-specific solutions through altcoins. | ❌Their potential classification as securities poses compliance challenges. |

| ✅The latest altcoins are interoperable, with cross-chain functionality and the possibility of asset transfers. | ❌Low liquidity makes them harder to buy/sell in large volumes. |

How to Buy Altcoins

The first step is to select the right exchange, because it is crucial for safely buying and trading altcoins. Major centralized exchanges (CEXs) include Coinbase, which is user-friendly with strong security but has limited altcoin selection and higher fees; Binance, which offers extensive altcoin options with competitive fees but can be complex for beginners; Kraken, known for its strong security record and regulatory compliance; and KuCoin, which provides access to many smaller market cap altcoins not available elsewhere.

Decentralized exchanges (DEXs) can be alternatives to CEXs. Uniswap is an Ethereum-based DEX for trading any ERC-20 token. PancakeSwap focuses on BEP-20 tokens on BNB Chain. dYdX specializes in crypto derivatives, while Jupiter is popular for Solana-based trading.

When choosing an exchange, verify that it supports the specific altcoins you want to buy. Consider liquidity, as higher volume exchanges typically offer better prices. Research the security track record and verification requirements. Review withdrawal limits and fees, and confirm the exchange operates in your jurisdiction.

Secure Storage Options (Wallets)

After purchasing altcoins, proper storage is essential for security. Hardware wallets like Ledger Nano X/S, Trezor Model T/One, and KeepKey offer the strongest protection. Software options include MetaMask for Ethereum tokens, Trust Wallet for multiple blockchains, Exodus with its built-in exchange feature, and Phantom for the Solana ecosystem.

Ensure wallet compatibility with your specific altcoins and look for security features like 2FA. Balance security needs with ease of use, understand recovery options, and choose wallets with active development. Store seed phrases offline in secure locations, consider using multiple wallet types, never share private keys, verify transactions carefully, and use hardware wallets for significant holdings.

What Role Will Altcoins Play in the Future?

Altcoins are gradually moving from speculative investments toward practical applications. Industry-specific solutions are emerging in supply chain management, healthcare data sharing, gaming economies, and identity verification. User experience is improving through simplified interfaces, lower fees, faster confirmations, and cross-chain interoperability.

Many enterprises are exploring private blockchains based on altcoin technology, tokenizing loyalty programs, integrating blockchain for product authentication, and implementing decentralized identity solutions. As these technologies mature, altcoins may become practical tools used daily, often without users realizing they’re interacting with blockchain technology.

The boundary between traditional finance and altcoin ecosystems is blurring. Institutional participation is growing through investment funds for specific altcoin sectors, traditional firms offering cryptocurrency services, banks experimenting with blockchain settlements, and corporate treasury diversification.

Regulatory frameworks are developing with clearer token classifications, standardized compliance requirements, integrated blockchain analytics, and potential central bank digital currencies based on altcoin technology. Financial products are evolving beyond Bitcoin ETFs to include tokenized traditional assets, blockchain-based derivatives, and decentralized credit systems.

Conclusion

Altcoins have expanded blockchain technology far beyond Bitcoin’s original vision. From smart contract platforms to privacy-focused coins, altcoins offer functionalities, use cases, and potential investment opportunities. They serve as laboratories for new ideas, testing new consensus mechanisms, governance models, and economic structures that might be too risky to implement on Bitcoin’s established network.

While altcoins can be opportunities for potentially higher returns, they come with several risks. Their higher volatility, security vulnerabilities, regulatory uncertainties, and potential for project failure demand careful research and risk management.

The most successful altcoins will likely be those that find specific niches where blockchain technology offers clear advantages over traditional systems. Before investing in any altcoin, conduct thorough research on the project’s technology, team, community, and use case. Consider consulting with a financial advisor for significant investments, and remember to never invest more than you can afford to lose.

FAQs

What makes an altcoin different from Bitcoin?

Altcoins may have different features, like faster transactions, smart contracts, or privacy enhancements. While Bitcoin focuses primarily on being digital money, altcoins serve varied purposes, from powering decentralized applications to enabling specific industry solutions. Bitcoin remains the largest by market cap and recognition, while altcoins generally have smaller market shares but often more specialized functionality.

Are altcoins a good investment?

Altcoins offer higher potential returns but with greater risks than Bitcoin. They're more volatile, have higher failure rates, and face more regulatory uncertainty. Consider including established altcoins as part of a diversified crypto portfolio, investing only what you can afford to lose, and thoroughly researching each project's technology, team, and real-world adoption.

How do I store altcoins securely?

Use hardware wallets like Ledger or Trezor for long-term storage. For active trading, use reputable software wallets that support your specific altcoins. Always backup your recovery phrase offline, enable two-factor authentication where possible, and never share private keys with anyone.

What are the best altcoins to invest in?

Look for altcoins with real utility, active development, growing user bases, and transparent teams. Established projects like Ethereum, Cardano, and Solana typically offer lower risks. Avoid projects based solely on hype or with anonymous teams. Focus on those solving actual problems with sustainable tokenomics rather than chasing quick gains.

Can altcoins replace Bitcoin in the future?

It is unlikely. Bitcoin's first-mover advantage, network security, brand recognition, and regulatory clarity create significant barriers to full replacement. Instead, expect a situation where Bitcoin can be a digital gold while various altcoins fulfill specialized functions.