Binance Smart Chain, now rebranded as BNB Smart Chain (BSC) is popular thanks to its fast and affordable transactions. Like Ethereum, the network on which BNB chain is based, BSC supports a thriving token ecosystem, ranging from stablecoins to farming tokens. In this guide, we’ll explore the best Binance Smart Chain tokens for specific markets and use cases.

While it doesn’t receive as much press, BSC boasts a Total Value Locked (TVL) on par with Solana and far exceeding Ethereum Layer 2 chains, such as Base and Arbitrum. This stable user base helps foster a thriving ecosystem with some of the most innovative decentralized finance (DeFi) protocols in the crypto space.

Let’s begin with some of the top BSC tokens by market cap, before exploring Binance Smart Chain tokens on a broader level.

Top BSC Tokens by Market Capitalization

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$641.00 | -4.01% | $93,494,998,879 | $1,197,998,076 |

$627.41

―

$670.13

|

| 2 |

|

$13.25 | -4.58% | $8,704,174,799 | $472,579,880 |

$12.77

―

$14.01

|

| 3 |

|

$3.11 | -2.10% | $7,671,651,078 | $270,161,359 |

$3.02

―

$3.25

|

| 4 |

|

$0.0(4)11 | -6.10% | $4,665,216,057 | $1,604,254,073 |

$0.0(4)10

―

$0.0(4)11

|

| 5 |

|

$249.84 | -5.27% | $3,787,097,282 | $474,439,505 |

$241.46

―

$266.32

|

| 6 |

|

$6.00 | -4.89% | $3,603,672,884 | $388,931,541 |

$5.85

―

$6.43

|

| 7 |

|

$0.74 | -6.96% | $1,928,765,500 | $200,033,684 |

$0.72

―

$0.80

|

| 8 |

|

$4.41 | -0.16% | $1,894,208,465 | $55,307,071 |

$4.41

―

$4.43

|

| 9 |

|

$4.17 | -2.88% | $1,888,396,875 | $127,415,522 |

$4.06

―

$4.34

|

| 10 |

|

$102,930.00 | -1.75% | $1,877,294,620 | $30,601,201 |

$99,797.00

―

$105,831.00

|

| 11 |

|

$1.00 | 0.26% | $1,572,850,216 | $7,774,998,924 |

$0.99

―

$1.01

|

| 12 |

|

$2,476.69 | -5.31% | $1,498,826,225 | $84,625,419 |

$2,406.61

―

$2,635.48

|

| 13 |

|

$0.0(4)15 | -4.04% | $1,168,807,848 | $211,035,264 |

$0.0(4)14

―

$0.0(4)15

|

| 14 |

|

$1.00 | -0.01% | $998,824,341 | $1,195,946,585 |

$0.99

―

$1.02

|

| 15 |

|

$640.42 | -4.07% | $844,760,223 | $2,036,037,951 |

$629.01

―

$670.81

|

| 16 |

|

$0.04 | -6.07% | $6,712,596 | $21,963,696 |

$0.02

―

$0.06

|

BNB

BNBChainlink

LINKToncoin

TONPepe

PEPEAave

AAVEUniswap

UNIArtificial Superintelligence Alliance

FETFasttoken

FTNCosmos Hub

ATOMLombard Staked BTC

LBTCFirst Digital USD

FDUSDBinance-Peg WETH

WETHBonk

BONKBinance Bridged USDC (BNB Smart Chain)

USDCWrapped BNB

WBNBAlpaca Finance

ALPACABest BSC Tokens to Buy Now

The Binance Smart Chain ecosystem is home to a diverse range of tokens, including many cross-chain tokens. We’ll focus on tokens best known within the BSC ecosystem, ranging from Binance Coin, the chain’s gas token, to DeFi tokens that help fuel decentralized finance adoption on BNB Smart Chain.

Let’s begin with BNB itself, which serves as the backbone of the chain, enabling users to navigate the network with a single primary token as a starting point.

1. Binance Coin (BNB)

BNB Price Chart

(BNB)BNB (BNB)

Binance Coin launched as a token on the Ethereum chain in July 2017, coinciding with the launch of the Binance crypto exchange. BNB’s initial coin offering priced the token at $0.11, later reaching an all-time high of nearly $800 in December 2024. This impressive price performance rewarded early investors with gains of over 6,000% at the peak.

BNB’s price performance remains strong, with the token currently trading at more than $600.

BNB’s continued price performance can be attributed to several factors, with the most significant reasons centering on a deflationary supply combined with steady demand as the ecosystem grows.

By 2019, the BNB token had migrated to its own blockchain, a network that shares many structural components with Ethereum, but which optimizes consensus for faster and more affordable transactions. Binance Coin (BNB) acts as the fuel token for the BSC network, allowing users to pay for transactions and smart contract interactions with BNB.

The token also ties into the Binance exchange itself, offering discounted trading fees to users who pay with BNB. Similar to Ethereum, BSC uses its fuel token for staking to secure the network. This structure provides a yield for staking BNB and further limits the tokens available for trading.

Today, BNB serves several roles in the BSC ecosystem and beyond, including:

- Fuel token

- Staking

- Collateral asset

- Lending asset

- Peer-to-peer payments (i.e., Binance Pay)

- Purchases

- Liquidity pool pairing

- Binance Launchpad & Launchpool

- Trading fee discounts on Binance Exchange

- Community incentives and grants

While BNB is the center of the BSC world, several key tokens speak to the breadth of the chain’s offerings. Let’s explore those next.

2. PancakeSwap (CAKE)

PancakeSwap Price Chart

(CAKE)PancakeSwap (CAKE)

Decentralized exchanges (DEXs) enable users to swap one token for another without relying on a centralized exchange. Less than a year after Binance Smart Chain launched, PancakeSwap arrived as a fork of the popular Uniswap V2 protocol.

Today, the platform is regarded as the leading DEX protocol on BSC, boasting a total value locked of nearly $6 billion and daily trading volumes ranging from $1 billion to over $8 billion.

Based on Uniswap, PancakeSwap built upon the concept, incentivizing users with the CAKE token. Much like on Uniswap, liquidity providers earn a proportional share of trading fees. However, on PancakeSwap, they also earn CAKE tokens by staking their liquidity positions.

PancakeSwap’s CAKE token is at the center of the protocol. PancakeSwap keeps a percentage of the trading fees. These fees are used, in part, to buy back (and burn) CAKE tokens. Until recently, another portion of the fees paid a yield to users who stake CAKE in Syrup pools. This revenue-sharing made the platform sticky.

Going forward, fees earned by the treasury will continue to “buy back and burn” CAKE tokens. CAKE’s role centers on governance and incentivizing tokens, with the goal of implementing deflationary tokenomics — a shrinking supply.

Although it has fallen short of its all-time highs set in 2021, the recent changes resulting from Tokenomics 3.0 have not significantly affected the market. CAKE follows a similar chart pattern to leading projects like Ethereum, although the deflationary tokenomics could send prices higher over time.

3. Venus (XVS)

Venus Price Chart

(XVS)Venus (XVS)

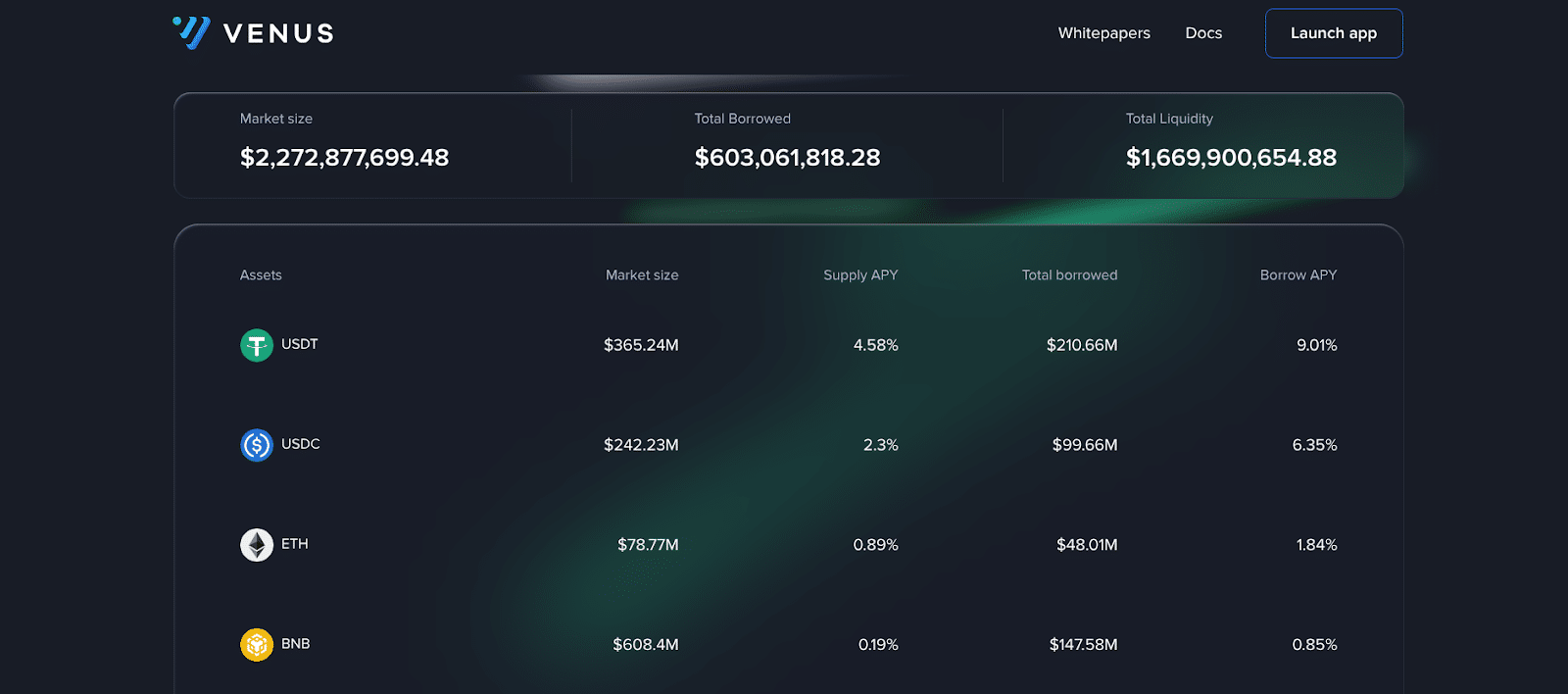

DEXs and lending platforms typically dominate the DeFi space. Venus has become the leading protocol on BSC, surpassing PancakeSwap in total value locked.

The Venus Protocol is a decentralized money market built on the BNB Smart Chain (BSC), facilitating permissionless lending and borrowing of various cryptocurrencies. The protocol represents forks of Compound Finance, a popular lending protocol first developed on Ethereum, and MakerDAO, a decentralized protocol for stablecoins backed by digital assets.

Venus operates as a decentralized digital bank, empowering users to generate interest on their crypto holdings and access loans without intermediaries. Its stablecoin, VAI, closely mimics the role of DAI, the crypto-backed stablecoin from MakerDAO.

The Venus Protocol utilizes XVS for governance, granting holders voting rights on key decisions, including protocol upgrades and parameter adjustments. This decentralized governance model ensures that the protocol remains community-driven and transparent.

The XVS token itself plays a more expansive role in the protocol’s ecosystem, serving as both a rewards token and a governance token. Users can stake XVS to earn more XVS. A portion of the protocol earnings is used to buy XVS on the open market to fund this rewards program. This structure maintains a fixed maximum supply while still allowing for the payment of rewards. Some similar protocols rely on minting new tokens to reward stakers, often leading to negative price trends.

Since its launch in 2020, Venus has become the leading DeFi protocol on BSC. However, the platform now supports a total of seven chains, including Ethereum, Base, and Arbitrum.

Following the crypto bear market bottom in 2022 and 2023, Venus nearly quadrupled its usage, surging to more than $2 billion in TVL.

4. BakerySwap (BAKE)

BakerySwap Price Chart

(BAKE)BakerySwap (BAKE)

Similar to PancakeSwap, BakerySwap is a decentralized exchange (DEX) and automated market maker (AMM) protocol. The protocol enables users to trade various cryptocurrencies without relying on a centralized exchange. However, the platform offers a unique twist in the space by incorporating NFTs. BakerySwap allows users to create, buy, and sell NFTs.

BakerySwap’s native token, BAKE, plays a crucial role in the protocol’s ecosystem, enabling users to participate in governance and earn rewards. The DEX uses full-range liquidity pools with low swap fees of 0.30%. Liquidity providers earn 0.25% on trades.

Where does the 0.05% go? BakerySwap utilizes these funds to purchase BAKE tokens, which are then distributed to users who stake the BAKE token.

In addition, liquidity providers can stake the NFT that represents their liquidity position (BLP token) to earn BAKE. This structure is similar to PancakeSwap, discussed earlier. BAKE is at the center of the protocol, used for both rewards and governance votes.

While in some ways similar to other protocols, such as PancakeSwap, BakerySwap differentiates itself with its NFT integration. In addition to offering a robust NFT marketplace, the platform also lets users stake select NFTs or NFT collections to earn BAKE tokens.

Other elements of the platform attract a diverse audience, including a lottery (buy tickets with BAKE or a chance to win more BAKE) and a new token launchpad, a fundraising platform that grants early access to new tokens on BNB Smart Chain.

5. Lista DAO (LISTA)

Lista DAO Price Chart

(LISTA)Lista DAO (LISTA)

BNB utilizes a proof-of-stake mechanism to secure the network. However, staked tokens remain locked during a 7-day unbonding period. Lista DAO, formerly Helio Protocol, frees up capital by providing a yield-bearing liquid staking token that can be sold at any time or used in DeFi as collateral for loans.

The platform supports liquid staking tokens (LSTs) or liquid restaking tokens (LRTs) as collateral, allowing users to borrow the protocol’s USD-pegged stablecoin, lisUSD.

The protocol launched in August 2022, facing a near-immediate setback as one of its supported yield-bearing assets (Ankr aBNBc) suffered an exploit that allowed additional minting. However, Lista DAO’s TVL has grown steadily since the incident and is now one of the leading protocols on BSC.

Lista DAO’s own token (LISTA) serves as a governance token for the protocol. Users can lock the token in a smart contract to vote on proposals.

Although down from its highs set in early 2024, the token’s volatility provides trading opportunities, and the protocol’s strong growth may make it worth considering as a long-term investment. Many users also pair the token in a liquidity pool to earn trading fees within a specific price range.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

What is Binance Smart Chain?

Binance Smart Chain (BSC) launched in 2020 as a parallel chain to Binance Chain (BC). Both chains have had more than one name over the years.

- Binance Chain, also known as the BNB Beacon Chain, served a governance role while also supporting the BNB token in its BEP-2 form. The chain also hosted the Binance DEX.

- BNB Smart Chain (BSC), also commonly referred to as the Binance Smart Chain, supports EVM (Ethereum Virtual Machine) applications and serves as an execution layer.

In 2024, the two chains merged in a long-anticipated event called the BNB Chain Fusion. Now, all activity occurs on one chain called BNB Chain. The move is expected to improve efficiency for the chain while reducing security concerns.

BNB Chain, still often referred to as BSC or BNB Smart Chain, offers several advantages over similar blockchains, such as Ethereum, including speed, cost-efficiency, and scalability. EVM compatibility makes it easy for developers to port applications from other EVM chains, so many popular decentralized applications (dApps) found elsewhere are also available on BSC.

Fast network speeds, EVM support, and low-cost transactions make BSC well-suited for DeFi, NFT, GameFi, Metaverse, and other Web3 projects. At launch, the chain quickly gained popularity among Binance users and Web3 enthusiasts seeking refuge from higher fees on competing chains.

Many credit BSC’s scalability to its consensus mechanism, which uses proof of stake but with a much smaller validator network compared to Ethereum.

BEP-20 Token Standard

The BEP-20 token enables the creation of tokens that can interact easily with the chain’s smart contracts and decentralized applications. This standard is analogous to Ethereum’s ERC-20 standard, but with distinct differences that cater to the BNB Chain’s architecture.

Most of these differences center on features natively supported by BEP-20, whereas Ethereum’s ERC-20 makes them programmable. For example, BEP-20 aimed for better cross-chain compatibility and integration with Binance’s cross-chain architecture. All the Binance Smart Chain (BSC) tokens discussed earlier in this guide adhere to the BEP-20 standard, ensuring easy transfers and integration with decentralized finance (DeFi) protocols on the BSC.

This standardization enables a wide range of token types, including utility tokens, meme coins, and stablecoins. Let’s look at these in more detail.

Native Tokens

Native tokens refer to those fundamental to the BNB chain ecosystem, serving as the backbone for network operations. The most prominent example is BNB (Binance Coin), which powers transactions, staking, and governance. For instance, BNB is used to pay gas fees and incentivize validators.

Stablecoins

Stablecoins on BSC minimize volatility by pegging their value to stable assets like the US dollar. These tokens provide an asset with relatively stable value, making them popular for lending and payments. Centralized options such as BUSD and USDT coexist with decentralized alternatives like VAI (Venus Protocol) and lisUSD (Lista DAO). These tokens provide relative price stability in an otherwise fluctuating market.

DeFi Tokens

DeFi tokens drive decentralized finance protocols on BSC, enabling governance, rewards, and liquidity mining. Examples include CAKE (PancakeSwap) and XVS (Venus Protocol), which allow users to vote on platform changes, earn staking yields, or share in protocol fees. Other examples include liquid staking tokens, which provide a tradable yield-bearing token that represents staked assets.

Utility and Governance Tokens

Utility tokens grant access to platform-specific features, such as BAKE (BakerySwap), unlocking NFT marketplace functionalities. Governance tokens, such as LISTA (Lista DAO), empower holders to shape protocol decisions through voting. These tokens align incentives between developers and communities, making governance decentralized.

Wrapped Tokens

Wrapped tokens bridge external assets, such as Bitcoin or Ethereum, to BSC, enabling cross-chain functionality. For example, BTCB represents Bitcoin on BSC, allowing users to trade, lend, or stake Bitcoin within BSC’s ecosystem. These tokens enhance liquidity and provide a way to leverage the value of off-chain coins or tokens.

Meme and Community Tokens

Meme tokens like Baby Doge or FLOKI thrive on social hype and community engagement. While often speculative, they leverage viral marketing and charitable initiatives to build loyalty. These tokens highlight BSC’s accessibility for grassroots projects, though they carry higher risk due to volatility.

Non-Fungible Tokens (NFTs)

BSC’s NFT ecosystem utilizes standards such as BEP-721 and BEP-1155 to represent unique digital assets, ranging from art to in-game items. Platforms like BakerySwap and MOBOX host NFT marketplaces and gaming ecosystems, where tokens act as collectibles, membership passes, or tradable virtual goods.

Cross-Chain Tokens

Many tokens in the BNB chain ecosystem arrive via bridging protocols like Wormhole. These function by locking the assets on one chain and issuing an equal number of BEP-20 tokens on BNB Smart Chain. For example, Wormhole SOL (wSOL) is a BEP-20 representation of Solana’s native SOL token. These tokens typically trade at the same price as they do elsewhere due to convertibility. DEX Arbitrage quickly absorbs any meaningful price disconnects.

Risks and Considerations

BSC has experienced enormous growth since its launch and is now the third-largest chain, measured by total value locked. Ethereum still leads the pack; however, with at least part of its dominance attributable to better decentralization and arguably higher security compared to BSC. Let’s explore some risks and considerations to weigh before investing in Binance Smart Chain tokens.

Security Concerns

While BSC’s rapid growth has fueled innovation, the chain has not been immune to security risks. Smart contract vulnerabilities, including coding errors and exploits, have occasionally resulted in losses for users and protocols. For example, Lista DAO’s early 2022 incident — an exploit of its supported asset Ankr aBNBc — highlighted the importance of rigorous audits and potential vulnerabilities due to third-party contracts.

Additionally, BSC’s consensus mechanism is significantly more centralized than that of competing blockchain networks, such as Ethereum. BSC utilizes a combination of proof-of-stake and proof-of-authority to secure the network. Its validator network uses just 21 validators compared to thousands for other popular chains, including Ethereum and Bitcoin, the latter of which uses miners to secure the network.

This higher degree of centralization raises concerns about undue influence by Binance and the increased potential for collusion.

Regulatory Landscape

Although not unique to BSC, regulatory concerns continue to cast a cloud over the industry. Cryptocurrencies with similar characteristics to those we covered earlier have faced lawsuits from the US Securities and Exchange Commission (SEC), and Binance itself pleaded guilty in a case brought by the US Department of Justice.

Smaller projects remain particularly vulnerable to regulatory enforcement. For example, after a prolonged legal battle that drained the coffers, the LBRY project was forced to pay a civil penalty for allegedly selling unregistered securities.

The project held a presale offering, much like countless other projects on BSC and other networks.

Market Volatility

BSC tokens, like all cryptocurrencies, are prone to extreme price swings. The 2022 crypto winter saw many tokens lose over 80% of their value, though recovery in 2023–2025 brought renewed optimism. In the BSC ecosystem, many tokens are paired with BNB in liquidity pools, meaning their price is measured in BNB. Expect volatility as BNB’s price fluctuates.

Latest Market News

What’s Next for BSC Chain Coins?

The future of BSC hinges on technical upgrades, ecosystem growth, and its ability to compete with Ethereum and newer Layer 1 chains, such as SUI and the well-established Solana chain.

All of these still outpace BSC in total value locked, and while TVL may not be the only metric, it is a useful one to understand how useful the protocol is in the real world.

These are some of the areas where BSC will need to compete in:

Upgrades and Scalability

Post-fusion, BNB Chain prioritizes Layer 2 solutions and Layer 1 upgrades (e.g., opBNB) to improve scalability, reduce costs, and alleviate congestion.

Improving interoperability through cross-chain bridges will also help to expand BSC’s reach, enabling asset transfers between networks such as Ethereum and Solana. Wormhole tokens and wrapped tokens are good examples of assets from other chains that can add liquidity to BSC.

Institutional Adoption

As DeFi matures, BSC neds to attract institutional investors seeking yield-generating protocols, following the success of protocols like Venus or Lista DAO.

The chain also supports well-known centralized stablecoins, such as BUSD and USDT, which provide a safe haven while also offering yield opportunities. Institutions using BSC to chase yield would be an obvious win for TVL.

Community and Innovation

User growth also depends on the emergence of new use cases, such as gaming (GameFi), metaverse platforms, and AI-driven decentralized applications (dApps).

The Binance Launchpad and Launchpool platforms continue to onboard projects, which helps improve and grow the ecosystem surrounding BNB.

Challenges

The L2 battle heated up across 2024 and continues to be one of the most active parts of the crypto sphere. Competition from Ethereum’s Layer 2 networks (e.g., Optimism, zkSync) and rival chains, such as Solana or Polygon, remains fierce, and the push for users continues.

As these chains grow in popularity, the performance of Binance Smart Chain tokens will come down to usage, or at least perceived potential for users. For example, Base, an Ethereum Layer 2 backed by Coinbase, has seen the highest net inflows of new users in recent months, and is going to be one of the competitors most watched in comparison to BSC.

FAQs

What is the difference between BEP-20 and ERC-20 tokens?

How can I purchase BSC tokens?

Are BSC tokens safe to invest in?

Can I use Ethereum wallets for BSC tokens?

What are the benefits of using BSC over Ethereum?

References

- BNB Chain Staking (bnbchain.org)

- CAKE Tokenomics Proposal 3.0 (pancakeswap.finance)

- Governance (venus.io)

- Collateral Debt Position – lisUSD (lista.org)

- BNB Chain Fusion (bnbchain.org)

- Binance and CEO Plead Guilty to Federal Charges in $4B Resolution (justice.gov)

- Securities and Exchange Commission v. LBRY, Inc. (sec.gov)