On this Page:

Investors are now generating substantially higher yields than regular staking can provide. Here’s your essential guide to restaking, including how it works, its advantages, risks, and everything in between.

Key Takeaways

- Restaking enables investors to earn significantly higher yields than regular staking by securing multiple networks. However, it also introduces major risks, including slashing, smart contract vulnerabilities, and the potential for cascading failures in interconnected DeFi protocols.

- Unlike native restaking, which requires running a validator node, liquid restaking allows users to restake assets via third-party DeFi apps. These platforms issue liquid restaking tokens (LRTs), which can be traded or further staked for additional returns.

- Restaking lowers the cost and complexity of launching new DeFi protocols. This enhances trust and accelerates innovation, making restaking a foundational component of the evolving DeFi landscape.

What Is Restaking?

There are two basic kinds of restaking: native restaking and liquid restaking. Native restaking, where a validator reuses their staked assets to secure multiple networks on top of securing the base blockchain, is only relevant if you are already running a validator node (or plan to).

Liquid restaking, on the other hand, allows regular users to restake their assets using a third-party app or protocol without running their own validator node. In return, they receive placeholder tokens known as liquid restaking tokens or LRTs, representing their staked position.

These tokens can be freely traded or even staked on other DeFi platforms to earn even more interest (with increased risk).

The Pros and Cons of Restaking

The main benefit of restaking is the additional interest you earn from the restaking protocol. It increases capital efficiency by putting your dormant crypto to good use. Instead of sitting in a validator or staking pool, your crypto can earn almost double the interest by restaking (and sometimes more).

Increasing your passive income and capital efficiency is always nice but it doesn’t come without increased risk. There are a number of major risks that you take when you restake tokens including: smart contract risk, slashing, decreased liquidity, risk of cascading failure, and more.

Naturally, the more platforms that you trust with your money, the more risk you incur. But that doesn’t paint the full picture. When you restake, your funds aren’t just locked up in a vault; they are actively securing multiple Proof-of-Stake protocols.

One of the greatest risks of using a restaking protocol is slashing, the mechanism used by PoS networks use to enforce validator integrity by penalizing misbehavior like attacking the network or even excessive downtime. When you restake on a given platform, you have to trust that it will follow the rules to the letter or risk losing part or all of your investment.

Another major risk that comes with restaking is smart contract risk. All decentralized apps (dApps) are made with self-executing smart contracts, lines of code that automate transactions of all kinds without the need for intermediaries. Like all code, smart contracts can contain bugs, security flaws, and loopholes that can be exploited by hackers, leading to lost funds or even catastrophic protocol failure.

The increased use of restaking protocols also creates a major risk for the entire system and not just the individual investor. Many of these restaking platforms are heavily interconnected and if a load-bearing platform fails, they might all crash and burn alongside it, losing (or at least devaluing) everyone’s assets.

How To Start Restaking With Eigenlayer: Step by Step

Restaking may seem daunting, and it certainly can be, but modern DeFi platforms and crypto exchanges make it remarkably easy. But before you can start, you need to choose which restaking protocol you want to use.

Eigenlayer is generally the most popular option but there are plenty of alternatives including Pendle Finance and Ether.fi. Eigenlayer makes it incredibly easy to start restaking.

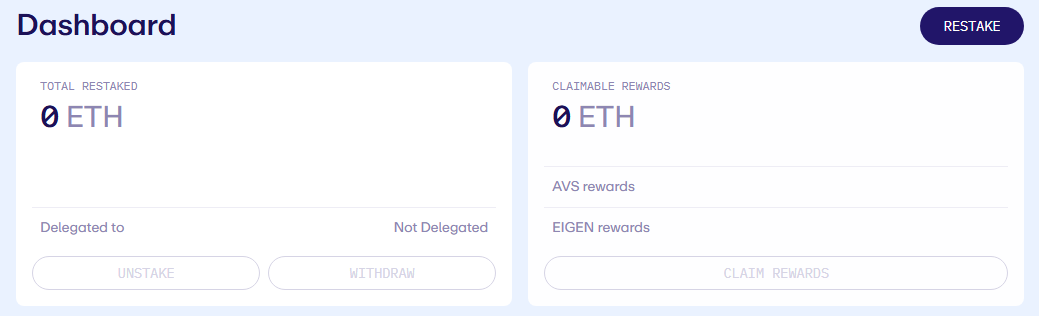

First, navigate to the Eigenlayer App (app.eigenlayer.xyz) and connect your crypto wallet. Eigenlayer supports the vast majority of the most popular wallet apps including MetaMask and WalletConnect. Next, click “RESTAKE” at the top right.

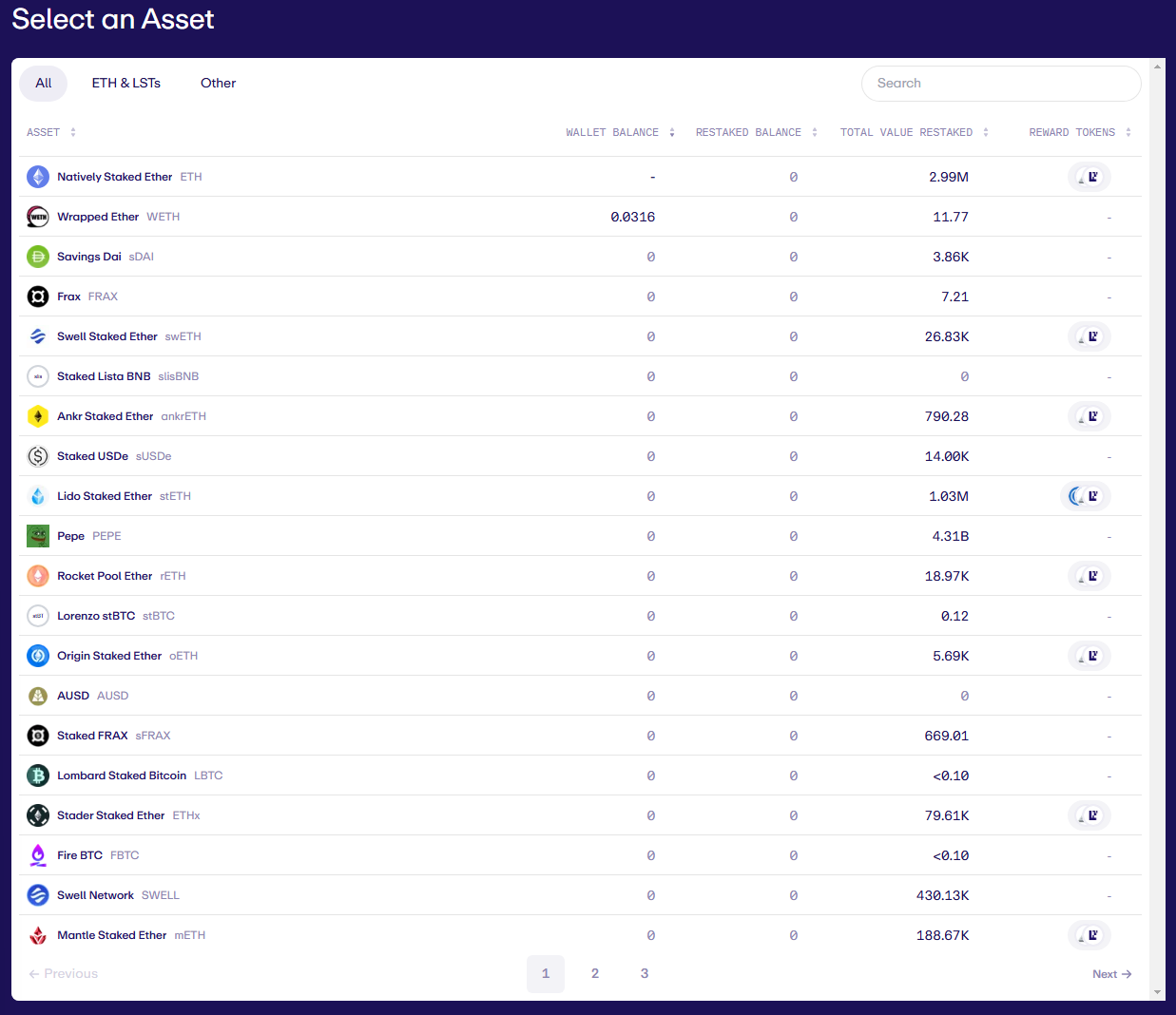

Next, you will have to choose which asset you want to stake. Note that “Natively Staked Ether” is for validators only, and it is not used inliquid restaking. If you already have wrapped Ethereum (WETH) or one of the listed liquid restaking tokens, you can select it in the menu and continue the process.

If you want to stake Ethereum (or another token not listed below), you will need to swap it for WETH or a different supported crypto. You can use MetaMask’s swap functionality for the swap or navigate to a DEX like Uniswap, and the fees for wrapping Ethereum are minimal.

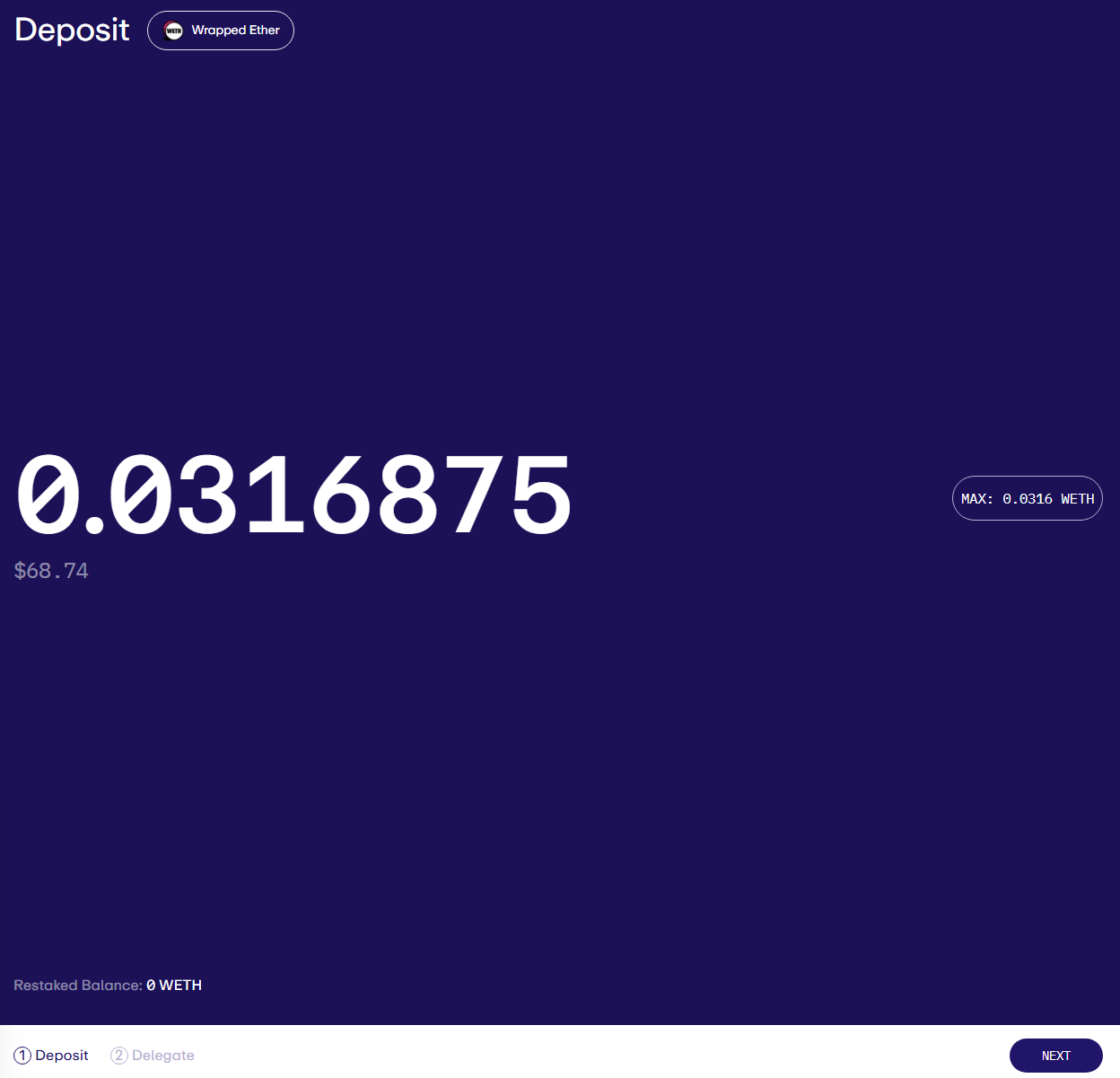

Once you have selected your token of choice, enter the amount you want to restake and click “NEXT” at the bottom right of the page.

Now, you need to choose which operator you want to delegate your tokens to and hit “SUBMIT” at the bottom right. This will open a series of transactions in your web3 wallet for approval, including:

-

- a spending cap request (so that you can deposit tokens)

-

- a deposit transaction

-

- a delegate transaction to assign your stake to the chosen operator

Once these transactions complete, you’re all done! You can check up on your restaked tokens and eventually claim your rewards in Eigenlayer’s dashboard.

If you don’t want to get lost in all of the technicalities and steps required to restake through a DeFi platform like Eigenlayer, you can just use an exchange like Kraken or Coinbase to restake in a few clicks.

How Restaking Is Already Reshaping the DeFi Landscape

Restaking is a powerful tool for crypto investors, but it’s even more valuable for entrepreneurial developers who want to build innovative protocols from the ground up. It allows these new apps to harness the immense network security provided by Ethereum’s PoS consensus mechanism.

This makes it both much cheaper and faster to launch new protocols, ratcheting up innovation in the DeFi scene to an entirely new level. Perhaps even more importantly, it gives them a base layer of security that new users can trust.

Most hardy crypto investors don’t exactly trust every new DeFi platform on the block, no matter how innovative or useful it is. However, with the additional layer of security provided by restaking through Ethereum, they are more likely to explore these new platforms and drive the industry further and faster.

Is Restaking The Future of Crypto?

Most DeFi aficionados will tell you that restaking will almost certainly be a core pillar of the future of crypto and especially DeFi. It drives innovation by making development cheaper, easier, more secure, and faster and provides a vital base layer of security to the entire ecosystem.

Restaking might not be for everyone, but it is quickly becoming one of the most popular ways to increase capital efficiency and extract more interest out of your hard-earned cryptos. The blossoming ecosystem of DeFi apps and crypto exchanges, including Eigenlayer, Pendle, and Kraken, has made restaking easier than ever before, allowing users to complete the process in just a few minutes (or less).

However, it’s also essential to remember that restaking comes with significant risks, and the slight boost in interest earnings may not be worth it for investors with lower risk tolerance. Even if you choose the most popular and secure restaking protocol, there is always a chance of losing your entire principal.

FAQs

What is the purpose of restaking?

The purpose of restaking is to earn extra interest and capital efficiency by using the same principal crypto to secure multiple networks or protocols.

What is native restaking?

Native restaking is the process used by existing network validators who use their staked assets to secure one or more other networks.

What is liquid restaking?

Liquid restaking allows regular investors to restake their assets using a DeFi app or crypto exchange to secure additional networks and earn extra interest.

What are the risks of restaking?

Restaking incurs a myriad of risks including slashing risk, smart contract risk, and risk of catastrophic protocol failure.