Stablecoins are essential tools for the crypto market, combining the decentralization and utility of blockchain technology with the stability of traditional currencies. Over the years, these powerful tools have established themselves as cornerstones of the crypto ecosystem, helping to stabilize the market, facilitate cross-border transactions, and bridge the gap between traditional finance and cryptocurrencies.

Stablecoins now account for the majority of transactions in the crypto space. In 2024, their total transfer volume surpassed that of Visa and Mastercard transactions combined. So what is a stablecoin, and what makes them so unique?

Unlike Bitcoin or Ethereum, their values are often tied (or pegged) to the prices of more stable assets like the U.S. dollar, other fiat currencies, or even commodities. This guide breaks down everything you need to know about stablecoins, how they work, why they’re so important, and how they’re set to change the world as we know it.

What Is a Stablecoin?

A stablecoin is a kind of digital currency that maintains a fixed value, pegged or tied to another currency, financial instrument, or commodity. The most popular stablecoins in use today are all pegged to the U.S. dollar.

Stablecoins can also be programmable, enabling investors to use them in various decentralized finance (DeFi) protocols to earn interest or even use them as collateral. As such, they are primarily issued on networks like Tron and Ethereum and mix the power of financial stability with the utility of blockchain technology.

A Brief History of Stablecoins

Stablecoins were first developed as an alternative to highly volatile cryptocurrencies, including Bitcoin and Ethereum. Especially in the early years, Bitcoin and Ethereum were simply too volatile for most use cases, so developers created stable, U.S. dollar-pegged stablecoins to provide a more reliable store of value and medium of exchange within the crypto sphere.

When Bitcoin, the first cryptocurrency, was launched in 2009, it began a gradual journey to revolutionize the world’s financial infrastructure. It introduced a decentralized system that eliminated the need for traditional intermediaries, like banks, for instance.

Still, Bitcoin’s limited supply and constantly fluctuating speculative demand resulted in extreme volatility in its price. Ethereum emerged only a few years later, based on the foundation of Bitcoin, but offering expanded capabilities for programmability with smart contracts. Similar to Bitcoin, the second largest cryptocurrency by market capitalization, Ether, also suffers from high price volatility.

Stablecoins came several years later, in 2014. They were created with a simple, yet powerful goal – to offer more efficiency and financial stability. Investors could finally tune their risk levels easily without being forced to go through a centralized third-party by simply swapping their cryptocurrencies for stablecoins.

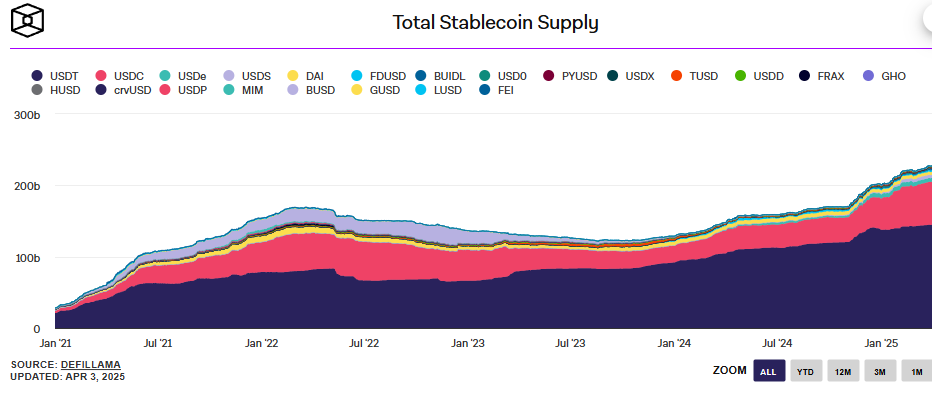

The following chart illustrates the significant growth in the total supply of stablecoins over time.

The Importance of Stablecoins

One of the biggest challenges with cryptocurrencies, especially in everyday transactions, is their unpredictability. Even the largest and most entrenched crypto, Bitcoin, suffers from massive price swings from time to time.

Bitcoin’s volatility can be a massive benefit during bull markets, but it can also be a potentially disastrous vulnerability during troubling times. For example, Bitcoin crashed over 15% in a single day during the crypto bear market that followed the Terra-Luna collapse. On the other hand, during bull markets, Bitcoin’s price can soar 10 or even 20 percent in a single day.

Cryptocurrencies like Bitcoin and Ethereum can be incredibly attractive investments to investors with high risk tolerances. However, when market volatility becomes concerning, stablecoins provide a safe haven for investors to wait out the storm, offering stability while retaining the various benefits of blockchain tech.

Stablecoins are more like currencies than most investments and other cryptos. As a stable medium of exchange, stablecoins are useful for moving funds across the blockchain and are essential tools used to trade against volatile cryptocurrencies with a low risk of price slippage.

The Pros and Cons of Stablecoins Explained

Stablecoins bring numerous advantages to the table. Let’s explore some of the most significant benefits that make them an attractive option:

Fast cross-border transactions

One of the biggest benefits of stablecoins is their transaction speed. Traditional banking systems, particularly international payments, take several days to settle across borders. Stablecoin transactions, on the other hand, can be settled in seconds, regardless of location.

Global accessibility

Unlike traditional currencies or banking systems, bound by regulatory and geographic constraints, stablecoins are more of a global solution. They have a decentralized nature, which means that anyone with internet access can create a free crypto wallet and send and receive stablecoins, regardless of their location.

Cross-platform compatibility

Today, stablecoins are very versatile and as such, they can be used across different platforms. From crypto exchanges to DeFi applications, stablecoins can perfectly integrate into various ecosystems.

A boost in security and privacy

Stablecoins add an extra layer of protection to your financial transactions. Blockchain technology is famous for its high level of security through decentralization and encryption. Additionally, stablecoins offer greater privacy compared to financial institutions, as users aren’t required to disclose as much personal information.

Lower transaction fees

A key advantage of stablecoins is their cost-effectiveness. Traditional financial systems, especially international payments, come with high transaction fees. Stablecoins have significantly lower fees.

Types of Stablecoins

Stablecoins can be classified into four main types based on their collateralization method:

- Fiat-collateralized stablecoins (backed by traditional currencies)

- Crypto-collateralized stablecoins (backed by cryptocurrency)

- Commodity-backed stablecoins (backed by physical assets like gold or oil)

- Algorithmic stablecoins (controlled by smart contracts)

Let’s take a look at each type of stablecoin in more detail.

1. Fiat-Collateralized Stablecoins

Fiat-backed stablecoins are the most common type of stablecoins. They are pegged to government-issued currencies like the U.S. dollar or the euro. These stablecoins maintain their stability by holding reserves of fiat currencies (and sometimes other assets), ensuring that each stablecoin issued is backed by stable assets.

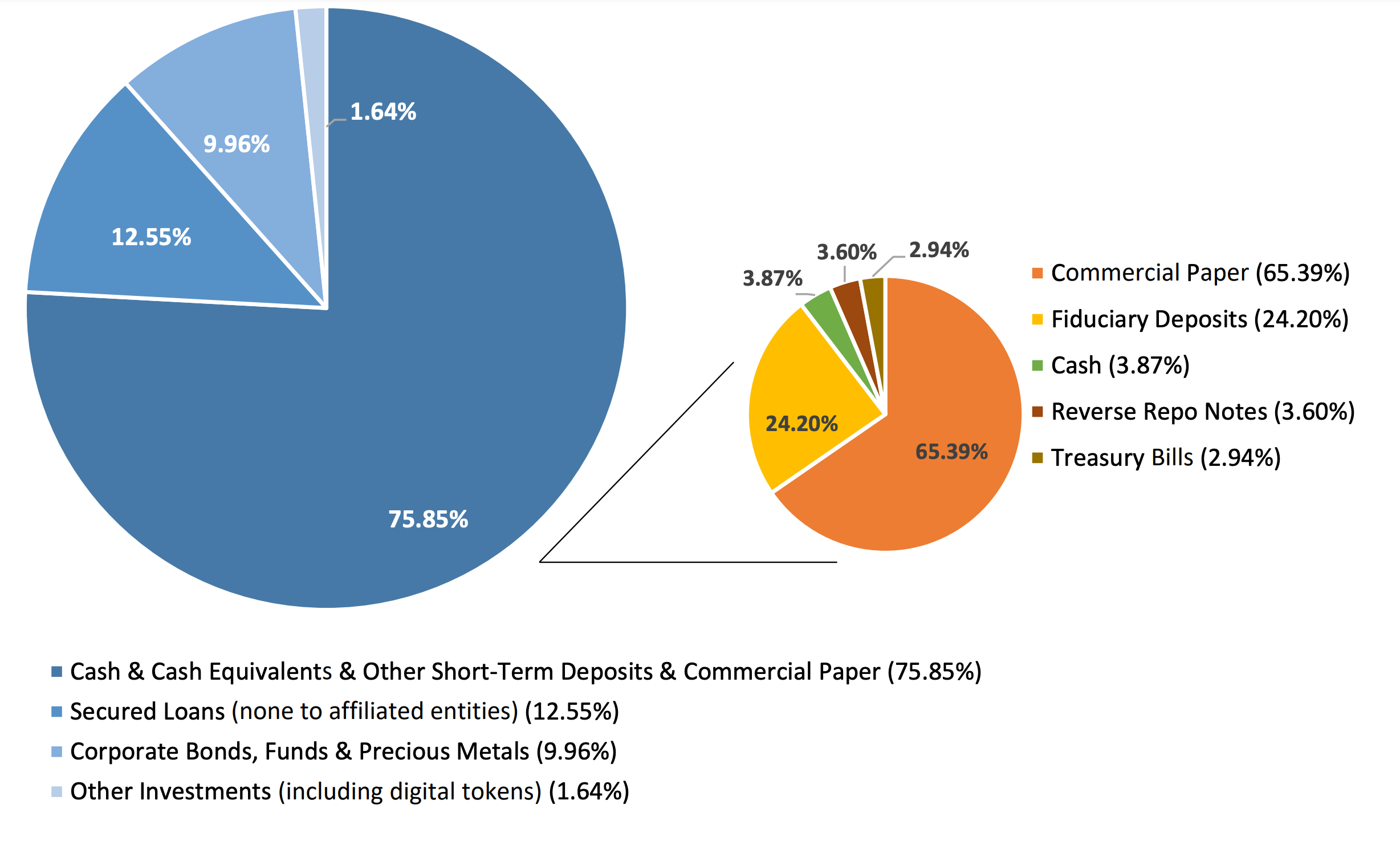

Some fiat-collateralized stablecoins are backed 1:1 with cash and cash equivalents such as USDC while others, including Tether, also hold other assets like corporate bonds, secured loans, and U.S. Treasury Bills in their reserves. This is why analysts generally argue that USDC is significantly more secure than USDT as assets like commercial paper can be much less stable and reliable than fiat currencies.

Examples of Fiat-Backed Stablecoins

- Tether (USDT) – The largest stablecoin in circulation. USDT had a market cap of $83.6 billion in early 2025, which accounted for nearly 70% of the total stablecoin market. Backed by a mixture of assets, including cash and cash equivalents, as well as Bitcoin, precious metals, corporate bonds, secured loans, and other investments.

- USD Coin (USDC) – USDC witnessed a major 79% growth in 2024, reaching a total market cap of $43.9 billion by the end of the year. Backed 1:1 by cash and cash equivalents.

- Binance USD (BUSD) – BUSD was once a major player, but it faced regulatory challenges, which in turn created a decline in its issuance. Backed by cash and cash equivalents, including U.S. Treasury Bills.

Advantages & Disadvantages of Fiat-Backed Stablecoins

| Advantages | Disadvantages |

|---|---|

| Highly stable (fully backed by real-world assets) | Centralized – requires trust in issuing companies |

| Widely accepted across crypto exchanges, DeFi platforms, and payment services | Regulatory scrutiny – governments monitor and impose rules on issuers |

2. Crypto-Collateralized Stablecoins

Otherwise known as crypto-backed stablecoins, crypto-collateralized stablecoins are backed by cryptocurrencies, not fiat currencies. Due to the volatile nature of cryptocurrencies, these stablecoins are often heavily overcollateralized. This means that users must lock up more crypto than the value of the stablecoin as collateral, creating a vital barrier to absorb any major fluctuations in the prices of the collateral.

Crypto-collateralized stablecoins also have to liquidate collateral if their value drops below a critical threshold to ensure the stablecoin’s peg remains stable. If the value of the collateral continues to drop, it can cause a cascade of liquidations, leading to massive losses for investors and potentially even the collapse of the stablecoin’s peg.

Examples of Crypto-Collateralized Stablecoins

- DAI (by MakerDAO) – DAI is a decentralized stablecoin backed by a mix of cryptocurrencies like ETH and USDC. Its overcollateralized mechanism (users must deposit $150 in ETH to generate $100 worth of DAI) ensures price stability (barring a devastating cascade of liquidations).

- sUSD (by Synthetix) – Backed by the Synthetix Network Token (SNX), this stablecoin is minted by users who stake SNX. It’s part of a broader ecosystem, which allows for the creation of synthetic assets such as sETH.

- LUSD (by Liquity) – LUSD is a stablecoin based on Ethereum (ETH). It is unique because of its minimum collateralization ratio of 110%, which makes it more efficient compared to many other overcollateralized stablecoins (like DAI). It operates via smart contracts without governance intervention.

- VAI (by Venus) – VAI is backed by several crypto assets, including BTC, ETH, and BNB. It is part of the Binance Smart Chain ecosystem, mined through the Venus Protocol, and offers low-interest loans.

Advantages & Disadvantages of Crypto Collateralized Stablecoins

| Advantages | Disadvantages |

|---|---|

| Decentralized (no single entity controls its issuance) | Fluctuating value if collateral assets lose value rapidly |

| Resilient to government regulations (due to its operation on smart contracts) | Overcollateralization is required, making it less capital-efficient |

3. Commodity-Backed Stablecoins

Commodity-backed stablecoins are digital assets pegged to the value of physical commodities. These can include gold, silver, oil, or other tangible assets. These stablecoins combine the stability of traditional commodities with the efficiency of blockchain. They are typically redeemable for the underlying asset, therefore providing users with tangible value.

The amount of commodity held in reserve generally corresponds fully to the circulating supply of the stablecoin, which ensures full backing.

Examples of Commodity-Backed Stablecoins

- Paxos Gold (PAXG) – Each PAXG token represents a fine troy ounce of a London Good Delivery Gold bar stored in a secure vault. You can redeem PAXG for physical gold or fiat currency.

- Tether Gold (XAUt) – XAUt is another popular gold-backed stablecoin. Holders can view the serial numbers of their gold bars and redeem tokens for physical gold.

- SilverToken (SLVT) – Each SLVT token is backed by physical silver stored in secure vaults. You can redeem tokens for pure silver bullion or sell them at the current spot price.

Advantages & Disadvantages of Commodity-Backed Stablecoins

| Advantages | Disadvantages |

|---|---|

| Intrinsic, tangible value backed by physical commodities | Storage and security costs, which might affect the efficiency of the stablecoin |

| Holders may have the option to redeem tokens for the physical commodity | Stablecoin issuers must navigate complex regulations |

4. Algorithmic Stablecoins

Also known as seigniorage-style stablecoins, algorithmic stablecoins don’t have direct collateral. Instead, they rely on supply-and-demand mechanisms to maintain their peg. These stablecoins adjust their supply algorithmically (ergo, their name). For instance, if the price of an algorithmic stablecoin rises above $1, new coins are minted to lower the price. If it drops below $1, supply contracts by burning tokens to increase the scarcity.

The most famous example of an algorithmic stablecoin, UST or TerraUST, failed spectacularly in May 2022.

Examples of Algorithmic Stablecoins

- TerraUSD (UST) – UST was initially designed to maintain a 1:1 peg with the U.S. dollar through an algorithm tied to the LUNA token. This stablecoin has since collapsed, but it remains one of the most popular algorithmic stablecoins in history.

- Frax (Frax Finance) – Frax is a partially algorithmic stablecoin that combines collateral backing and algorithmic controls. Frax is very unique because it is partially backed by USDC and uses an algorithm to control its circulating supply to secure its peg further.

- Ampleforth (AMPL) – AMPL is a highly unique stablecoin with a flexible supply mechanism. Instead of relying on collateral, it adjusts its supply daily based on its price.

Advantages & Disadvantages of Algorithmic Stablecoins

| Advantages | Disadvantages |

|---|---|

| Decentralized, no collateral needed | Much higher risk of collapse if market confidence is lost |

| Scalable (algorithmic adjustments allow for automatic mechanisms for price stability) | Most algorithmic stablecoins have failed |

Choosing the Right Type of Stablecoin

If you can’t make up your mind about which type of stablecoin to use, we’ve created this table of perks and risks to help you differentiate between them:

| Type | Best for | Risks |

|---|---|---|

| Fiat-collateralized | Low-risk investors and traders | Centralized, regulatory risks |

| Crypto-backed | DeFi users and decentralization advocates | Overcollateralization needed, risk of liquidation |

| Algorithmic | Innovation-focused projects and high-risk factors | High risk of collapse, dependent on market confidence |

| Commodity-backed | Investors who seek tangible asset-backing | Storage and security costs, regulatory compliance |

Stablecoin Regulation

Stablecoin regulations are changing constantly across the globe as the market continues to grow and evolve. Governments have to continue to create and implement rules to protect consumers, ensure financial stability, and comply with anti-money laundering standards (AML). While these rules are often essential for safeguarding consumers, the constantly shifting regulations can make it difficult for investors and especially businesses to navigate the stablecoin landscape with confidence.

Stablecoin Legislation and Global Regulatory Landscape

The global regulatory landscape for stablecoins is rapidly developing. Here’s what you need to know.

International Regulation

In 2021, the International Organization of Securities Commissions (IOSCO) recommended that stablecoins be regulated as financial market infrastructure. This came in response to increasing concerns over the potential risks created by the larger stablecoins. These worries have only increased following the collapse of UST.

European Union

The EU’s Markets in Crypto-Assets Regulation (MiCa) is a major part of the regulatory framework for stablecoins in Europe. MiCa covers the asset-referenced tokens (ARTs) and the e-money tokens (EMTs), providing specific requirements for stablecoin issuers. EMTs are pegged to official currencies like the euro, and as such, they are subject to more stringent regulations.

🇪🇺 European Union regulators take a significant step towards regulating stablecoins by publishing a set of draft rules under the Markets in Crypto Assets (MiCA) framework.

The proposed regulations aim to establish a clear framework for the issuance and operation of stablecoins… pic.twitter.com/ugrqxHFeJx

— Kyrrex (@Kyrrexcom) March 13, 2024

United States

Stablecoin regulation in the United States is in flux. Stablecoins like USDC and Tether are widely used, but there is still a lot of regulatory uncertainty. In 2024, the U.S. Under Secretary of the Treasury for Domestic Finance urged Congress to address these concerns and implement clear regulations for stablecoins. Some U.S. lawmakers, such as Senator Cynthia Lummis, are at the forefront of stablecoin legislation, pushing for major changes to protect consumers as well as the stablecoin industry.

In March 2024, Senator Lummis and Senator Kirsten Gillibrand introduced the Payment Stablecoin Act. The bill would require issuers to hold full 1:1 reserves for their stablecoins, undergo regular reserve audits, and obtain licensing.

I'm proud to join @SenLummis to introduce the Payment Stablecoin Act.

Passing a regulatory framework for stablecoins is critical to protecting consumers, promoting responsible innovation, and cracking down on money laundering and illicit finance. https://t.co/UP9pk0uQkt pic.twitter.com/lIqA3rwQXN

— Sen. Kirsten Gillibrand (@gillibrandny) April 17, 2024

Japan

Japan is one of the first countries to establish a stablecoin regulatory framework. In Japan, banks and trust companies can issue fiat-backed stablecoins as long as they comply with strict reserve requirements.

Key Highlights from Japan Fintech Week 2025 | Regulated Stablecoins, CBDCs & Web3 Policy in Focus

Japan Fintech Week 2025 brought together regulators, financial institutions, and Web3 innovators to spotlight the rapid developments in stablecoins, digital asset regulation, and… pic.twitter.com/cKRxsycXpn— TOPOS (@topos_network) March 24, 2025

Hong Kong

Hong Kong is long famous for its progressive stance on crypto regulation. The Hong Kong Monetary Authority (HKMA) has developed a framework to provide a sandbox environment for projects to test their business models before they go through regulatory enforcement.

Stablecoin Controversies and Failures Explained

Stablecoins are designed to hold a stable value using various methods, often by maintaining a 1:1 peg to an external asset, such as a fiat currency or a commodity. Unfortunately, it doesn’t always work out that way.

Many tokens on the stablecoin market successfully maintain their peg. However, not all of them have been truly “stable” and a few stablecoins have totally collapsed. Generally only the riskier kinds of stablecoins collapse entirely but even some of the most stable tokens temporarily lose their peg on rare occasions.

The prime example of a failed stablecoin is TerraUSD or UST, which was one of the most popular stablecoins on the market before it imploded. UST was an algorithmic stablecoin designed to maintain its peg through a relationship with its sister token, LUNA. Investors could exchange 1 UST for $1 in LUNA and vice versa, using market forces to help maintain the token’s peg.

In May 2022, the system collapsed completely. UST depegged from $1 after investors started withdrawing and selling their tokens, leading to a downward spiral that left UST nearly worthless in just a few days. The price of LUNA collapsed alongside UST, falling from over $100 to a fraction of a penny. The crash wiped out over $42 billion in market capitalization, making it one of the biggest failures in the history of the crypto industry.

While Tether or USDT has never suffered a major crash like UST, it has been awash with controversies for many years now. It faced significant scrutiny over allegations that it had misled the public about the full extent of its reserves. For years, it claimed that it was backed 1:1 with USD. The New York Attorney General claimed that this hadn’t been true for a long time.

In 2021, Tether settled with the New York Attorney General’s office for $18.5 million after a lengthy investigation, admitting it had falsely claimed that USDT was fully backed 1:1 by U.S. dollars. Tether skeptics were even more shocked when Tether was finally forced to release a breakdown of its real reserves.

The report revealed that almost half of its reserve assets were in the form of commercial paper, a risky kind of short-term, unsecured loan. If USDT had suffered a massive bank run during this period, it’s possible that it could have entirely collapsed, bringing the entire crypto market down along with it.

It’s important for crypto investors to keep these controversies in mind when choosing which stablecoins to invest in. While stablecoins are intended to be secure, reliable stores of value, their stability depends on the mechanisms used to maintain their peg as well as their underlying reserves.

Practical Uses of Stablecoins

Stablecoins have evolved from niche trading tools in cryptocurrency to digital assets with many, many applications. Let’s see some of the most popular use cases for stablecoins.

1. DeFi and Crypto Trading

Stablecoins have been crucial in the decentralized finance (DeFi) space, powering lending, borrowing, and yield farming. Unlike volatile cryptocurrencies, stablecoins generally maintain their value and reduce the risk of impermanent loss. This makes them ideal candidates for liquidity pools, which decentralized exchanges rely on to facilitate token swaps.

2. Peer-to-Peer (P2P) Transactions

One of the best and most popular uses of stablecoins is in peer-to-peer or P2P transactions. They can be sent quickly and with low fees, allowing users to easily send and receive funds without going through centralized financial institutions like banks or other intermediaries.

3. Cross-Border Payments

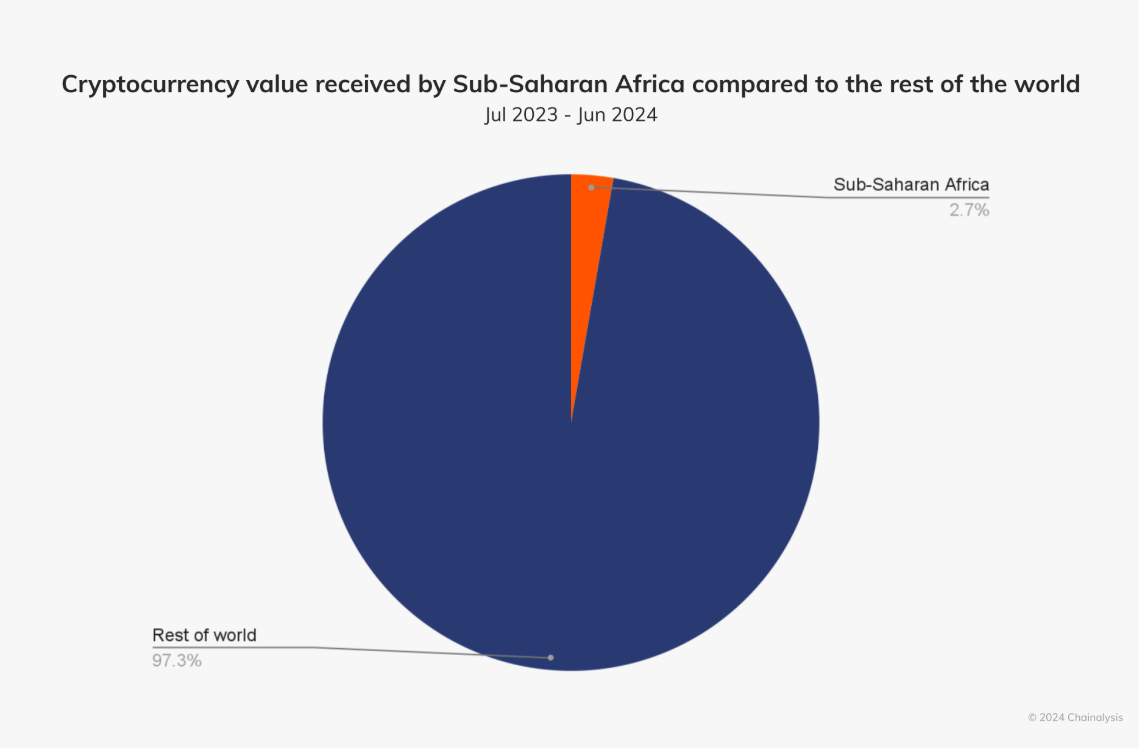

Stablecoins are a game-changer for cross-border transactions since they offer a quicker, cheaper alternative to traditional services. According to a report by Chainalysis, sending $200 from Sub-Saharan Africa via stablecoins can cost up to 60% less than through traditional methods. However, it’s important to make sure that you are in compliance with your local laws and regulations surrounding cryptos, taxes, and cross-border payments.

4. Store of Value in Unstable Economies

In countries that are facing high inflation and economic instability, stablecoins are a much-needed store of value. They can help users preserve purchasing power by swapping from currencies undergoing extreme inflation to more stable assets.

5. Foreign Exchange (FX) and Trade Finance

Stablecoins can simplify foreign exchange and international trade by offering a more transparent and stable digital currency. Businesses can make payments across borders and settle their invoices without worrying about fluctuating exchange rates or high fees.

The Future of Stablecoins

Stablecoins play a crucial role in the crypto market, with new and innovative use cases emerging all the time. As developers continue to innovate and stablecoin adoption keeps skyrocketing, these digital assets will likely only become even more important for traders, investors, and everyday users.

Whether you just want to park some of your funds in a fiat-backed stablecoin to wait out volatility, transfer money globally with low fees, or even earn interest on DeFi platforms, stablecoins offer a stable, secure, and efficient solution. As stablecoins mature and adoption continues to rise, they are set to help reshape modern finance to make it more safe, efficient, borderless, and accessible to all.