On this Page:

Meme coins, the most popular niche in the crypto markets, can produce explosive returns. Recent examples include Moo Deng, Official Trump, Pudgy Penguins, Super Suiyan and Solaxy. Knowing which meme coins to purchase is tricky – most projects fail, leaving investors with worthless tokens.

Read on to discover the best meme coins to buy in 2025, ranked by their upside potential, market capitalization, price performance, community size, token supply, and other important metrics. Learn how meme coin traders pick profitable projects and what risks to consider before proceeding.

Solaxy Shiba Inu BTC Bull Official Trump Mind of Pepe Fartcoin dogwifhat Pudgy Penguins Binance-Peg Dogecoin ai16z Toshi Moo Deng Daku Launch Coin on Believe Animecoin Non-Playable Coin Degen Rekt MIU PONKE Osaka Protocol Ski Mask Dog JOE Apu Apustaja Dogelon Mars Bone ShibaSwap HarryPotterObamaSonic10Inu (ETH) Neiro on ETH Puff The Dragon Coq Inu

#

Coin

Price

24h %

Market Cap

Volume

24h Range

1

current price:

$0.0017

raised:

$39,661,135

Learn more

2

Shiba Inu

SHIB

$0.0(4)15

1.42%

$9,182,251,989

$356,092,825

3

current price:

$0.0025

raised:

$6,222,885

Learn more

4

Official Trump

TRUMP

$13.74

-5.05%

$2,747,355,956

$2,841,541,496

5

current price:

$0.0038

raised:

$10,071,613

Learn more

6

Fartcoin

FARTCOIN

$1.57

8.26%

$1,565,059,099

$262,736,363

7

dogwifhat

WIF

$1.25

7.96%

$1,248,164,565

$1,213,121,294

8

Pudgy Penguins

PENGU

$0.01

-1.68%

$880,731,192

$206,860,104

9

Binance-Peg Dogecoin

DOGE

$0.25

2.21%

$630,805,652

$5,795,282

10

ai16z

AI16Z

$0.35

3.92%

$382,397,091

$141,909,767

11

Toshi

TOSHI

$0.0(3)76

0.59%

$319,731,460

$38,404,947

12

![]() Moo Deng

MOODENG

Moo Deng

MOODENG

$0.29

22.82%

$286,180,402

$1,017,106,319

13

Daku

DAKU

$0.23

6.44%

$227,700,310

$179,284

14

Launch Coin on Believe

LAUNCHCOIN

$0.18

-2.86%

$184,615,562

$106,915,520

15

Animecoin

ANIME

$0.03

0.56%

$154,743,965

$180,874,964

16

Non-Playable Coin

NPC

$0.02

-0.85%

$143,101,735

$3,201,724

17

Degen

DEGEN

$0.0061

-5.50%

$142,261,027

$111,509,560

18

Rekt

REKT

$0.0(6)28

4.95%

$121,286,286

$984,147

19

MIU

MIU

$0.0(6)11

-0.71%

$105,335,801

$2,033,811

20

PONKE

PONKE

$0.19

7.05%

$104,712,417

$19,231,562

21

Osaka Protocol

OSAK

$0.0(6)11

-12.43%

$90,815,799

$317,542

22

Ski Mask Dog

SKI

$0.09

-0.43%

$88,072,472

$999,959

23

JOE

JOE

$0.22

3.04%

$86,842,933

$14,435,895

24

Apu Apustaja

APU

$0.0(3)25

-1.77%

$85,696,264

$2,857,227

25

Dogelon Mars

ELON

$0.0(6)15

0.37%

$82,805,939

$9,474,195

26

Bone ShibaSwap

BONE

$0.32

2.43%

$79,445,170

$11,806,437

27

HarryPotterObamaSonic10Inu (ETH)

BITCOIN

$0.08

-4.03%

$78,676,856

$12,015,946

28

Neiro on ETH

NEIRO

$0.08

3.58%

$78,448,199

$20,660,183

29

Puff The Dragon

PUFF

$0.07

-0.51%

$66,034,942

$283,942

30

Coq Inu

COQ

$0.0(6)94

-3.93%

$65,451,443

$7,975,328

![]()

What Are the Most Popular Meme Coins?

1. Dogecoin ($DOGE)

Dogecoin Price Chart

(DOGE)Dogecoin is the original meme coin. Dedicated to a Shiba Inu dog called Kabosu, it launched in 2013 as a “joke”. Dogecoin had little traction in its early years. It was used as a tipping currency on Reddit but struggled in the price performance department. That all changed during the 2020/21 bull cycle.

One of the world’s most influential people, Elon Musk, took a significant public interest in Dogecoin, labeling it the “People’s Currency”. Musk mentioned Dogecoin in multiple tweets and real-world appearances, causing hype and fear of missing out (FOMO) in the broader markets.

Today, Dogecoin is the de facto meme coin. It has the largest market capitalization and the most unique token holders. While Dogecoin has no utility, this could change with Musk’s front-seat position in the Trump administration. For instance, some experts predict that Dogecoin could be the primary currency backing an X “super app”.

Find out more about Dogecoin:

2. Shiba Inu ($SHIB)

Shiba Inu Price Chart

(SHIB)Shiba Inu is also one of the best meme coins to buy. It’s the second-largest by market capitalization, surpassing a $40 billion valuation at its peak. As the name suggests, this meme coin is based on the Shiba Inu dog breed, just like Dogecoin. It also boasts several million holders, from casual investors to fully-fledged crypto whales.

Like most meme coins, Shiba Inu was initially launched without any use cases. It relied on aggressive marketing and hype, claiming to offer a second chance for those missing Dogecoin’s pricing rally. However, Shiba Inu’s development team has created many benefits for long-term holders.

For example, Shiba Inu’s metaverse allows holders to buy virtual land. Purchased land is backed by Ethereum NFTs, ensuring private and secure ownership on the blockchain. ShibaSwap is another utility-driven feature, allowing holders to trade Shiba Inu via decentralized pools. Not to mention earn competitive yields when providing liquidity.

Find out more about Shiba Inu:

3. Pepe ($PEPE)

Pepe Price Chart

(PEPE)Pepe is based on Pepe the Frog, a popular character from the Boy’s Club comic series. It launched in early 2023 when the wider meme coin markets were bearish. Even so, Pepe was an instant hit with crypto communities.

Pepe has witnessed extreme volatility since its inception. It enjoyed a prolonged upside in late 2024, with retail-centric trading platforms like Robinhood and Coinbase listing Pepe for trading. This resulted in Pepe hitting a market capitalization of over $9 billion.

Today, Pepe trades at a significant discount, like most meme coins. In terms of use cases, Pepe is a conventional meme coin, meaning it was created purely for hype and speculation. Its tokenomics is, however, notable. The entire supply of over 420 trillion tokens is in the public float. The supply is also capped, ensuring new tokens can’t be created.

Find out more about Pepe:

4. OFFICIAL TRUMP ($TRUMP)

Official Trump Price Chart

(TRUMP)OFFICIAL TRUMP is one of the most popular shitcoins and the official meme coin backed by Donald Trump, the 47th President of the United States. Trump’s meme coin was launched just days before his 2025 Inauguration, leading to criticism in some circles. The announcement was made on Truth Social and X, with the markets responding immediately.

Within hours, OFFICIAL TRUMP went from about $7 to over $70, meaning significant gains for those getting in early. However, built on the Solana blockchain, OFFICIAL TRUMP has highly unfavorable tokenomics. 80% of the total supply is controlled by the Trump team, including insiders and developers.

Although those tokens are locked in various vesting schedules, the first batch was released in April 2025. The likelihood is substantial selling pressure, with insiders cashing out their proceeds. This could lead to a much broader sell-off, even if OFFICIAL TRUMP is backed by a sitting President.

Find out more about OFFICIAL TRUMP:

5. Bonk ($BONK)

Bonk Price Chart

(BONK)Bonk could also be considered one of the best meme coins to buy right now. Built on the Solana blockchain, Bonk was initially launched as an airdrop distribution. Those previously engaging with the Solana ecosystem received free tokens, such as developers and creators.

Like many airdrops, the Bonk price initially took a massive hit, with recipients cashing out their “free” money. Even so, the Bonk price then enjoyed a prolonged rally. hitting all-time highs of $0.00005916 in late 2024. Those buying the airdrop dip in December 2022 would have seen gains of almost 13,000%.

Similar to Shiba Inu and FLOKI, Bonk has developed multiple use cases for its community. This includes BONKBETS, an online sportsbook supporting Bonk payments. Bonk Bet is another popular product, with holders having access to a Telegram trading bot. Bonk is listed on the leading exchanges, including Coinbase and Binance.

Find out more about Bonk:

Best Wallet - Diversify Your Crypto Portfolio

What Are Meme Coins?

Meme coins are cryptocurrencies that typically have little to no use cases. They’re often based on popular or trending internet memes, topics, animals, and, more recently, political figures. The original meme coin, Dogecoin, is the largest project in this space. It boasts millions of loyal holders and a multi-billion dollar market capitalization.

Meme coins are highly speculative, with most people buying them just to make money. This makes them extremely volatile. Even so, they are the best-performing niche within the crypto markets, and can explode by significant amounts in a short time frame.

There’s a lot to consider when choosing the best meme coins to buy. For a start, seasoned investors look for strong communities, solid price performance, and sustainable tokenomics. Risk management strategies are also important when investing in meme coins, such as diversification and stop-loss orders.

How Do Meme Coins Work?

Now that we’ve covered the top coins in this space, let’s take a closer look at how meme coins work and how this speculative market functions.

Based on Memes, Animals, or Popular Trends

First, meme coins are based on a specific narrative rather than anything innovative or technical. For instance, some of the best meme coins to buy are based on dogs. Examples include Dogecoin, Shiba Inu, Bonk, dogwifhat, FLOKI, and Ski Mask Dog. Cat-themed coins are also becoming popular, such as Popcat, Mochi, Toshi, and Mog Coin.

Meme coins are frequently dedicated to popular trends and political figures, too. In addition to OFFICIAL TRUMP, political meme coins include Melania Meme, Department of Government Efficiency, and MAGA. Ultimately, there are no limitations when launching meme coins, with millions created this year alone.

Meme Coins Are Launched on Existing Blockchains

Next, it’s important to know that anyone can create a meme coin. User-friendly platforms (like Pump.Fun) make the process fast, cost-effective, and seamless. No coding or programming knowledge is needed – meme coin creators simply need to provide the name, ticker symbol, and total supply. The newly created meme coin is then added to an existing blockchain ecosystem.

The most popular blockchain for meme coins is Solana, considering its low-fee structure. However, Ethereum meme coins are also popular. Up-and-coming meme coin networks include Base, TON, and Arbitrum. Either way, anyone can buy and sell meme coins once they’re launched.

Trading and Meme Coin Price Performance

Meme coins are traded on crypto exchanges, with prices determined by demand and supply. Similar principles can be found in the traditional stock market. Increasing buying pressure means higher demand, allowing the price to appreciate. Conversely, enhanced selling pressure means weakened demand, resulting in declining prices.

Almost all meme coins are initially launched on decentralized exchanges (DEX). No formal application or approval is needed – anyone can add a new coin to a DEX by providing liquidity. The best cryptocurrencies to buy, however, trade on centralized exchanges (CEX) like Binance, Kraken, and Coinbase.

These platforms not only boast millions of active users but also significant liquidity and trading volumes. As such, meme coins securing major CEX listings often perform well. They have access to a much wider audience, including retail clients wishing to invest with credit cards, e-wallets, and other convenient methods.

Making Money From Meme Coins

Unlike Bitcoin, which is best viewed as a long-term investment, meme coins are typically traded in the short term. Even the best meme coins can produce massive returns for days or weeks before losing momentum. Prices can then capitulate quickly, with investment capital shifting into other meme coin projects.

This highlights that meme coin investors should actively monitor and research the markets. It’s often about getting in early and locking in profits before a major reversal. Popcat, for instance, enjoyed a sizable rally in 2024, peaking with a market capitalization of about $1.9 billion. The Popcat price has since declined by almost 90%.

Why Are Meme Coins Popular?

Meme coins are traded 24/7 globally, with millions of market participants looking for the next 1000x gem. But why are they so popular with crypto holders?

Low Barrier to Entry

Meme coins have a very low barrier to entry, meaning they’re highly accessible. Unlike regulated securities, anyone can buy and sell meme coins online. All that’s needed is some cryptocurrency and a self-custody wallet. Traders can then connect to a DEX like Uniswap, PancakeSwap, or Raydium, with no requirement or identifying documents needed to open an account.

Purchased meme coins are deposited straight into the trader’s wallet for safekeeping. Selling is also seamless – the same DEX trading process is used but in reverse. Crucially, the meme coin markets are inclusive, with no restrictions on nationality, investor status, or budget.

Community-Driven

Communities sit at the heart of successful meme coin projects. Some of the best meme coins, such as Dogecoin and Shiba Inu, have millions of loyal holders. Communities help them become mainstream, typically through social media engagement and hype – for instance, by sharing and liking posts on X and Reddit.

Holders often feel part of a bigger movement, defending their coins from so-called FUD (fear, uncertainty, and doubt). Similar concepts can’t be found in the traditional investing scene. Holding a blue-chip stock like Microsoft or IBM provides no emotional connection to these companies.

High Profit Potential

Let’s be clear – the best meme coins to invest in can produce tremendous returns. This is especially true when buying a meme coin early, with new launches often possessing small market capitalizations. Not only does this provide a first-mover advantage, but small-cap coins have plenty of growth potential.

- For example, when Pepe launched in April 2023, it was trading at just $0.000000005514.

- Let’s suppose you invested just $500. This would have converted to about 90 billion Pepe tokens.

- Fast forward to December 2024, and Pepe hit an all-time high of $0.00002825.

- Those 90 billion Pepe tokens would have been worth over $2.5 million at their peak.

- This represents a solid return for a $500 outlay.

Pepe is just one example of many. Investing in meme coins before they explode can be highly profitable, and is the key reason why they are so popular. Everyone wants the next Pepe or Shiba Inu, allowing them to achieve substantial gains without risking a large amount of money.

Affordable for All Budgets

Meme coins are affordable for all budgets. Whether you’re looking to risk a few or thousands of dollars, meme coin trading is financially inclusive. The best crypto exchanges come without minimum trading requirements, so investors can risk amounts they’re comfortable losing.

What’s more, unlike Bitcoin, budget-conscious investors don’t need to buy a small fraction of a meme coin. Most projects have huge supplies, often at least a billion tokens. For instance, consider a $10 purchase in Shiba Inu. Based on current prices, that would yield over 800,000 tokens.

Short-Term Appeal

Another reason meme coins are so popular is their short-term appeal. Investors don’t need to hold for multiple years to witness notable profits. In contrast, traditional investors often hold S&P 500 index funds for several decades, hoping to average annualized returns of 10%.

In meme coin trading, 10% returns can be achieved in hours or even minutes. Similarly, explosive gains of 1,000% or more can be secured in days or weeks. This short-term mindset is why meme coin participation continues to rise, even with the high risk of financial losses.

24/7 Trading

The best meme coins trade on crypto exchanges 24 hours per day, seven days per week. This is unlike the traditional financial markets, which typically operate during standard business hours. As such, stock investors can’t buy or sell until the markets reopen, potentially causing liquidity issues or missed opportunities.

Conversely, meme coin investors simply need to connect to an online exchange to place orders, no matter the time or day. However, do note that meme coin trading volumes decline substantially over the weekend. The result is often enhanced volatility and lower liquidity, so keep this in mind before trading.

How We Selected the Best Meme Coins

Having ranked the best meme coins to invest in, let’s move on to our research methods. Read on to learn how to find meme coin projects before they explode.

Community Engagement

One of the most important metrics when choosing meme coins to watch is the project’s community. Irrespective of use cases, strong and loyal communities can help these coins become mainstream. Just look at Shiba Inu’s journey. It went from a newly launched token to a multi-billion dollar powerhouse in months.

A similar path was seen with FLOKI, Bonk, and Pepe. Several steps can be taken when analyzing a meme coin community. A good starting point is to check its core socials – Telegram and X.

- Telegram: Telegram is typically used for day-to-day communication. Not only between like-minded holders but also in discussions with the team. Assess how many members the Telegram group has, and whether this figure is rising or falling. Importantly, ensure membership numbers aren’t artificially inflated by bots. You’ll know whether this is the case by seeing how active and natural the discussions are. Limited conversations mean the group is likely dominated by bots.

- X: X is the most active place for meme coin engagement. Known as “CT” or “Crypto Twitter”, X attracts millions of investors daily. Similar to Telegram, check how many subscribers the meme coin project has. Evaluate engagement, including how many views and comments each post gets. You should also see if accounts with large followings have engaged with the project, such as sharing or mentioning it.

Another method is to explore how many unique token holders the meme coin has – the more, the better. Look for trends, too. For instance, it’s a good sign if token holders consistently increase.

Market Capitalization

Market capitalization is another important factor when assessing the best meme coins to buy. Projects with a large market capitalization are the most popular, such as Dogecoin, Shiba Inu, and Pepe. These meme coins benefit from significant trading volumes and liquidity, making them easy to trade.

However, large-cap meme cryptocurrency offers a lower upside. Similar to blue-chip stocks like Apple and NVIDIA, higher growth requires substantial capital inflows. This also means lower volatility levels, which will appeal to more risk-averse trading. Conversely, most meme coins have a small market capitalization.

While more volatile and risky, small-cap meme cryptocurrency can produce unprecedented returns.

- For example, suppose you purchase a meme coin that’s valued at $500,000.

- It could easily increase by 10x with modest buying pressure.

- Even so, that project would be worth just $5 million, meaning further upside opportunities.

Although not entirely impossible, large-cap meme coins like Shiba Inu will struggle to achieve 10x gains. Shiba Inu was valued at about $40 billion at its peak. 10x growth would require a mega-cap valuation of $400 billion. This is considerably more difficult to achieve than a $500,000 project hitting $5 million.

Exchange Listings

We mentioned that the best meme coins to buy today generally trade on tier-one CEXs, such as Binance and Coinbase. Conversely, new and small-cap meme coins trade on DEXs, which have limited volumes and liquidity. Therefore, exchange listings should be considered when selecting meme coins to purchase.

For instance, if you’re looking for undervalued gems with 100x potential, DEXs are the way to go. However, if you prefer more stable trading conditions with sufficient liquidity, look for meme coins on CEXs. It’s also wise to keep an eye on new exchange listings from the leading platforms. This can cause an immediate pricing rally, especially if it’s a major CEX.

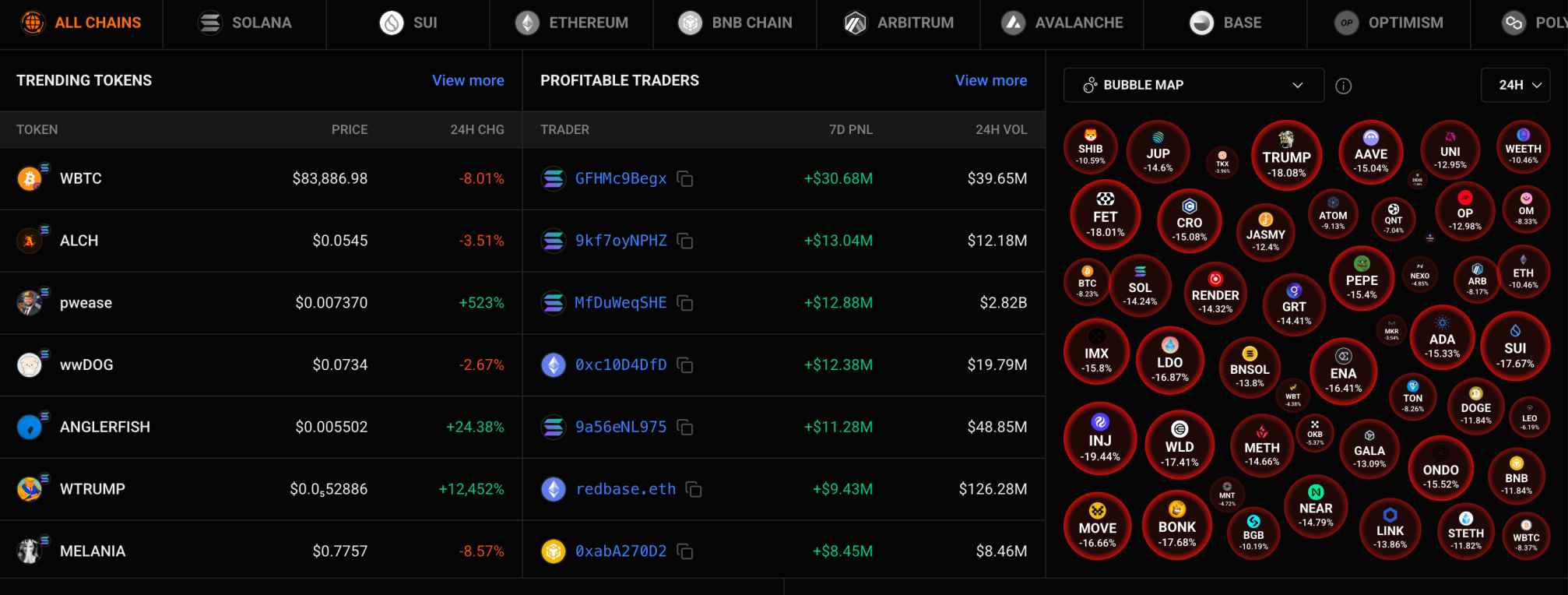

Price Performance

Seasoned investors will analyze pricing data when searching for meme coins that will explode. The best practice is to compare price trends with wider market conditions. For instance, suppose the total value of all meme coins has increased by 15% in the past week. You’ve discovered a meme coin with 90% gains over the same period.

This is a good sign, as that meme coin has vastly outperformed the market. Researching other time frames is also wise. Consider the 1-hour and daily charts for short-term trends. Monthly and quarterly trends are better for longer-term analysis. Either way, it’s best to focus on meme coins that consistently outperform the industry benchmarks.

Ecosystem Trends

Capital flows often move from one blockchain to the next. Being aware of existing and future trends is crucial to maximizing meme coin profits. For example, Solana meme coins enjoyed a prolonged rally in 2024. Popcat, Bonk, and dogwifhat are just some examples. OFFICIAL TRUMP, Melania Meme, and other public figure coins also opted for Solana.

However, it’s also worth exploring Sui meme coins or even XRP meme coins. These blockchains aren’t known for meme coins, but increased trading activity has been witnessed recently. Base, the ecosystem backed by Coinbase, is another narrative to keep an eye on. Base meme coins like Brett, Toshi, and Mochi are increasing their holder numbers rapidly.

Tokenomics

We also analyzed the tokenomics when choosing the best meme coins to buy. First, we only considered projects that have been audited by reputable smart contract firms. The underlying contract should be evaluated for its legitimacy, ensuring no malicious vulnerabilities.

After that, we analyzed the supply dynamics, such as:

- Supply Cap: Meme coins with a limited token supply are preferred. The founders can’t create new tokens, protecting holders from inflationary pressures.

- Circulating Supply: Another important metric, the circulating supply, is the percentage of tokens in the public float. For instance, if 90% is already in circulation, just 10% is held by the team. While not ideal, dumping 10% of the supply wouldn’t be overly catastrophic. However, more than 50% of the supply being held by the team is high risk, considering the consequences of a dump.

- Token Distribution: Experienced meme coin traders will also explore the token distribution. For example, if 80% of the supply is held by just 10 wallets, this is a major red flag. Those 10 wallets could be controlled by insiders. Alternatively, it could be crypto whales, meaning market manipulation is possible.

The best way to research tokenomics, including supply and distribution, is through on-chain data. These platforms extract information from the blockchain, such as wallet balances, transactions, and smart contract deployment. Consider DexTools or DexScreener – both offer free plans.

Latest Trading News

What Are the Risks of Investing in Meme Coins?

We’ve explored the key benefits of meme coins, from their high-growth potential and short-term gains to 24/7 market access. However, meme coins also come with significant risks, including the potential to lose serious amounts of money.

This section explores the risks of meme coin investing in more detail. Read on for the core drawbacks and how to mitigate them.

Extreme Volatility

Even the best meme coins are extremely volatile. This speculative market won’t be suitable if you can’t handle wild pricing swings. Consider that many meme coins have declined by over 80% from their all-time highs in recent months. These are substantial losses, and you can easily lose all the money you invest in a project that goes nowhere.

For instance, suppose you bought dogwifhat in March 2024 when it peaked at $4.85. Today, that investment would be worth 87% less. That said, these volatility levels don’t point to a failed project. On the contrary, many successful meme coins have witnessed similar declines. They’re often just market corrections responding to broader sentiment.

Potential for Serious Losses

According to research, 97% of meme coins end up “dead”. This means investors are left holding worthless tokens, with no means to recoup their investment losses. The most important factor is that meme coin investments are only made with capital you’re prepared to lose.

Put otherwise, meme coins should be viewed similarly to gambling. This means never risking funds required for core expenses, such as rent, taxes, fuel, and food. Unfortunately, many market participants do the exact opposite, leading to reckless and emotion-driven decisions. This is the worst way to approach any kind of investment.

Liquidity Issues

Not all meme coins boast large market capitalizations. Sure, the likes of Dogecoin, Shiba Inu, and Pepe are still valued at several billion dollars, even though they trade at a small fraction of their all-time high. The result is that large-cap meme coins benefit from vast liquidity, making it seamless to enter and exit the market.

However, this is the exception to the rule. The vast majority of meme coins have small market capitalizations and limited trading volumes. Especially those that trade solely on DEXs. The issue is that weak liquidity can make it difficult to cash out. After all, sellers require buyers who are willing to pay their asking price.

Meme Coins Scams

The biggest risk is buying meme coins that are outright crypto scams. This will invariably mean you’re left holding worthless tokens.

Common scams can include:

Honeypots

A honeypot scam is where the meme coin founder creates a malicious smart contract. In simple terms, the underlying code enables the scammer to perform certain functions that will disadvantage investors. For instance, it could prevent anyone but the founder from selling.

This would mean the meme coin’s price constantly increases, considering only buy orders are permitted. The scammer will eventually cash out, leaving victims with serious losses. According to the BBC, one of the most infamous honeypot scams was Squid Game Token, which netted millions of dollars in criminal proceeds.

Rug Pulls

Another common meme coin scam is a rug pull. In this scam, the founders promote the project as the next big thing, often with aggressive marketing tactics and even influencer partnerships. The rug pull happens when the liquidity pool is removed from a DEX, with the scammers disappearing with the funds.

Ultimately, stopping meme coin scams is increasingly becoming challenging. Not only can meme coins be launched and added to exchanges anonymously, but the market is unregulated. Therefore, best practices should be followed when choosing the best meme coins to buy. We discuss risk mitigation strategies later in this guide.

Do Meme Coins Have Any Utility?

When a cryptocurrency has utility, it means that people have a reason to buy and hold the tokens beyond just financial speculation. So that begs the question: Do meme coins have utility and use cases, or are they intrinsically worthless?

Our research shows that the vast majority of meme coins don’t have utility, let alone a functioning website, whitepaper, and roadmap targets. Again, the key issue is that anyone can create a meme coin. Neither blockchain knowledge nor developer skills are needed. “Creators” simply need to choose a meme coin name and narrative, and pay a small fee to launch.

However, we should mention that some meme crypto have built use cases for their communities. A good example is FLOKI. This meme coin has developed a play-to-earn game called Valhalla. It doubles as a metaverse with open-world experiences, earning opportunities, and land ownership via NFTs.

Another example is Shiba Inu, the world’s second-largest meme coin by market capitalization. Shiba Inu’s ecosystem includes a decentralized autonomous organization (DAO), metaverse, and decentralized finance (DeFi) products. While utility offers increased value for long-term holders, just remember that most people still only buy meme coins to make a profit.

How to Trade Meme Coins Effectively

So far, we’ve explained how to find the best meme crypto to buy. Next, we’re going to talk about trading meme coins effectively, including strategies and risk-management principles.

Get Comfortable With DEXs

Unless you’re looking to trade large-cap meme coins, it’s a good idea to get comfortable with DEXs. These aren’t as user-friendly as CEXs. There’s no traditional deposit process, as DEXs can’t accept fiat payments like credit cards or bank wires. Instead, DEX traders connect a self-custody wallet and use its existing balance.

The good news, however, is that DEXs don’t have KYC (know-your-customer) requirements. Traders can buy and sell meme coins anonymously, meaning no personal information or ID documents are required. Another benefit is that DEXs don’t have a single point of failure, vastly limiting the risks of a centralized hack.

What’s more, trades are executed via smart contracts, so DEXs never touch client-owned funds. In terms of specific DEXs, this depends on what blockchain the meme coin operates on. For example, Ethereum meme coins typically trade on Uniswap. Solana meme coins use Raydium or Jupiter.

Here’s a quick overview of how meme coin trading works when using DEXs:

- First, you’ll need a self-custody wallet. One of the best DeFi wallets is Best Wallet, a user-friendly yet highly secure mobile app for iOS and Android.

- Next, cryptocurrencies must be added to the wallet. Again, the specifics depend on the meme coin’s operating blockchain. For instance, you’ll need ETH or SOL when trading Ethereum or Solana-based coins, respectively. You can buy these cryptocurrencies instantly on Best Wallet. Accepted methods include Visa, MasterCard, and Google/Apple Pay.

- The next step is to visit the respective DEX, such as Uniswap. Then, connect the self-custody wallet. Open the wallet to confirm the connection request.

- Then it’s just a case of setting up a trade. You can paste the meme coin’s contract address for added security. This ensures you’re buying the right meme coin. Then, type in the trade amount and confirm. The purchased coins will be added to the connected wallet, often in under a minute.

Actively Research the Markets

The best meme coins to buy are often discovered early by seasoned traders. This is because they actively research the markets. Checking in every now and then isn’t a suitable strategy. First, consider following the main crypto news websites on social media and ensure notifications are switched on. In doing so, you’ll be aware of key market developments straight away.

We’d also suggest following the leading crypto exchanges, such as Binance, Kraken, and Coinbase. Any new listing approvals from these exchanges offer a new trading opportunity. For example, when Coinbase recently approved Toshi, a Base meme coin, its value increased significantly.

Ultimately, well-informed meme coin traders are the most successful. Knowledge is key, so ensure you’re well-versed in trends, narratives, and breaking stories.

Use Stop-Loss Orders

The next best practice is to ensure all meme coin positions have stop-loss orders. This will protect your trading capital from significant losses. In a nutshell, the stop-loss order closes a position when it declines to the stated exit price.

For example:

- Let’s say you purchase one of the new meme coins on Coinbase. The trade is entered at $0.50 per token.

- The maximum you’re prepared to lose on this trade is 10%.

- A 10% decline would mean the meme coin price drops to $0.45. The stop-loss order should be set at this level.

- So, if the meme coin hits $0.45, the stop-loss order is executed, and the trade is closed.

Stop-loss orders are a must, considering meme coin valuations can drop rapidly without notice. Without them, you could wake up to find the meme coin has dropped by over 70% since you last checked.

Have a Profit-Taking Strategy

One of the biggest mistakes made by beginners is failing to lock in profits. This is easier said than done, especially if the purchased meme coin is exploding. At what point should investors cash out? The best practice is to have an exit strategy before placing the initial trade. The strategy can be adjusted if needed, but having one in advance ensures smart risk management.

- For example, let’s say the original investment was $1,000.

- You plan to take out 50% if the position increases by 3x.

- This has come to fruition, meaning that $1,000 is now worth $3,000.

- You’ve taken out $1,500 (50%), leaving the remaining $1,500 in play.

The above example is a solid way of protecting your initial investment while still keeping sufficient funds in the position.

- For instance, suppose the meme coin goes to zero. You’d still have $1,500, meaning a $500 profit on the $1,000 investment.

- Conversely, let’s say the meme coin increases by 2x after you cashed out. You’d have $3,000 open, meaning you could cash out another $1,500, leaving the remaining $1,500 in play.

As mentioned, strategies can and should be updated based on market conditions. For example, bullish news like a tier-one listing or major partnership could justify holding for longer. However, a bearish Bitcoin price will impact the wider market, so cashing out early could be wise.

Either way, take-profit orders can be used when setting exit strategies. They work similarly to stop-losses but in reverse. For instance, suppose the current price is $1. You want to cash out when the meme coin increases by 50%. Simply set the take-profit profit order at $1.50.

Avoid Overexposure

Another common mistake made by meme coin novices is being overexposed. The reality is simple – finding the next meme crypto to explode is no easy feat. According to Coinbase CEO Brian Armstrong, over a million new coins are created every week. Only a small handful will produce returns. The rest will fail, meaning investor losses.

Therefore, the best practice is to ensure you’re diversified across multiple coins. Stick with specific narratives and build positions accordingly. For example, suppose Solana meme coins are making a resurgence. You might consider some large-caps like Bonk and dogwifhat, alongside smaller-cap projects for higher returns.

While diversification is a proven strategy, ensure you don’t have too many positions at any given time. Not only can this make portfolio management challenging, but you’re also limiting the upside potential. Instead, consider focusing on 5-10 coins that you have a strong conviction about.

Always Have Some Stablecoins to Hand

The crypto markets are unpredictable. Nobody can forecast the next big meme coin trends with any certainty. The most important aspect is being ready when a new trading opportunity arises. This means holding some stablecoins at all times. In doing so, you can instantly buy a trending meme coin that you believe will explode.

Otherwise, you’d need to reluctantly sell an existing position. A good example is the OFFICIAL TRUMP meme coin. The markets weren’t aware that Donald Trump was planning to launch a token – OFFICIAL TRUMP was announced via a tweet. Those buying OFFICIAL TRUMP from the get-go could have seen gains of 10x within 24 hours.

Therefore, having some stablecoins on hand would have been crucial. Those stablecoins could have been swapped for OFFICIAL TRUMP almost immediately via a DEX.

How to Avoid Meme Coin Scams

Meme coin scams are now a billion-dollar industry. Many scams can be avoided by knowing what factors to look for. Read on to protect your trading capital from rug pulls, honeypots, and other fraudulent activities.

Verify That the Smart Contract Has Been Audited

The first and most important step is verifying the smart contract. All meme coins have a unique contract that dictates key factors, such as the initial supply and whether tax is charged on transactions. Scammers will often insert malicious terms into the smart contract, allowing them to profit from existing holders.

For example, the smart contract might prevent anyone but the founder from selling. It could also enable the founder to create an unlimited number of tokens. These will be dumped on the markets accordingly. Another strategy is to implement a massive transaction tax, such as 99%. That tax would be transferred to the scammer’s wallet.

Fortunately, blockchain security firms like CertiK Coinsult specialize in smart contract audits. They analyze the respective contract and publish their findings for public viewing. Therefore, if you’re looking at a meme coin that hasn’t been audited, there’s a very good chance it’s a scam.

Verify Whether the Liquidity Pool has Been Locked

The next step is to verify the liquidity pool. As mentioned, new coins typically trade on DEXs until they gain traction. These projects must add liquidity to the DEX, enabling buyers and sellers to trade without needing other market participants. This will be an equal balance of the respective meme coin and a major crypto like ETH or SOL.

Now, if the liquidity pool isn’t locked, the meme coin founder can withdraw it at any time. They’ll often do this once enough traders have purchased the meme coin, meaning the pool contains sufficient ETH, SOL, or whatever major crypto it’s paired with. Once the liquidity is withdrawn, existing holders will be left with worthless tokens that can’t ever be sold.

The good news is that it takes seconds to check whether the liquidity has been locked.

- First, get the meme coin’s unique smart contract address (usually available on the project’s website or social media page).

- Then, go to DexTools and paste the copied contract address in the search bar.

- Click the meme coin that appears and look for the “Liquidity” field from the left-hand sidebar.

If the liquidity has a lock icon, this means it’s locked. Clicking the icon shows how long it’s locked for. No lock icon means the founder can withdraw the liquidity at any point, meaning a rug pull.

Review the Total and Circulating Supplies

Analyzing the meme coin supply will also help you avoid scams. There are two important metrics here.

- First, check the “total” supply. This is the total number of tokens that have been created. Let’s say it’s 1 billion tokens.

- Next, check the “circulating” supply. This is the number of tokens that are in the public float. This means they trade on exchanges or are held in wallets (non-insiders).

The best meme coins have the vast majority of their tokens in the circulating supply. For example, Bonk’s total supply is about 88.8 trillion tokens. Currently, about 77.7 trillion tokens are circulating. This amounts to approximately 87% in public hands.

Now, compare this with Foxy, one of the best meme coins on the Linea network. Its total and circulating supplies are 10 billion and 3 billion, respectively. This means just 33% is in circulation, with the balance held by the founders and early backers (vesting).

Meme Coins FAQ

What makes a cryptocurrency a meme coin?

Why do meme coins often have large token supplies?

How do meme coins go viral on social media?

Do meme coins have any real utility?

Why do meme coins often experience extreme price volatility?

What’s the difference between deflationary and inflationary meme coins?

References

- Exclusive: Trump’s meme coin made nearly $100 million in trading fees, as small traders lost money (Reuters)

- Memecoins are the hottest sector in crypto—but 97% of them are already dead (Fortune)

- Coinbase CEO Brian Armstrong says there are 1 million new cryptocurrencies created every week (Business Insider)

- Inside the shady world of celebrity meme coins (Business Insider)