Bitcoin mining is the backbone of the Bitcoin network—a process that simultaneously validates transactions, secures the blockchain and introduces new bitcoins into circulation. Since Bitcoin’s creation in 2009, mining has evolved from a hobby anyone could do on a personal computer to an industry requiring specialized hardware and a sum of electricity consumption that not everyone can get their hands on.

In December 2024, Bitcoin broke all the records and exceeded the $100,000 price level for the first time. After all the breakthroughs, mining still remains a critical component of the cryptocurrency ecosystem. Whether you’re considering becoming a miner yourself or simply want to understand how Bitcoin works under the hood, our guide will walk you through everything you need to know about cryptocurrency mining.

Key Takeaways

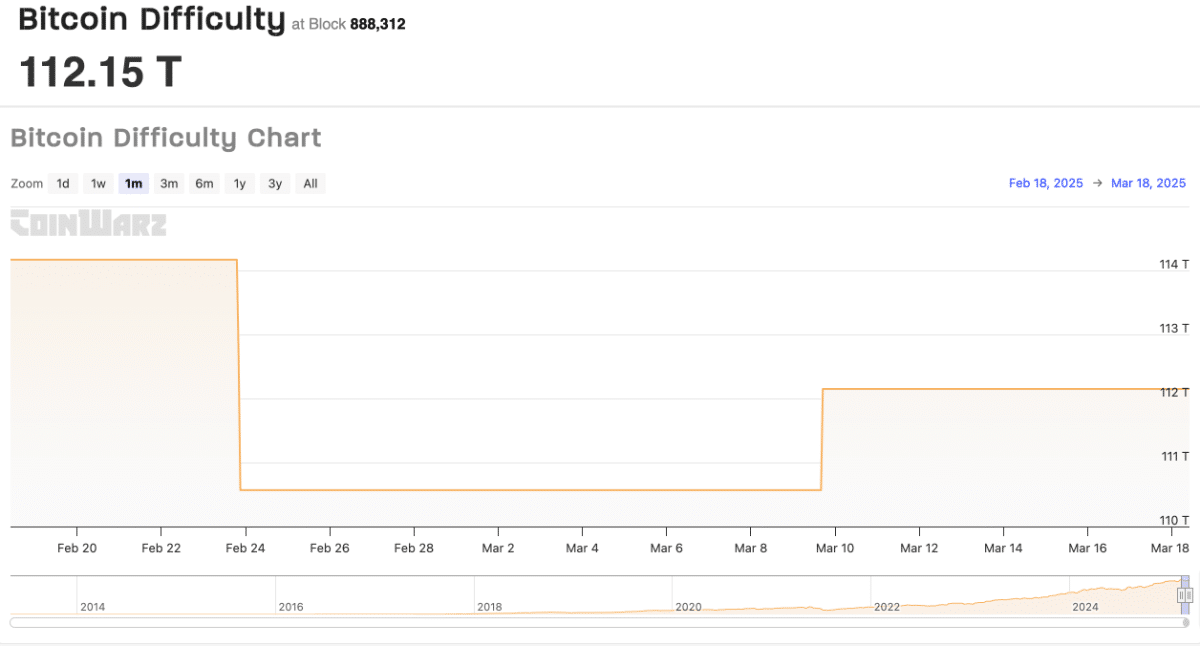

- Bitcoin mining was once a hobby anyone could do on a personal computer. Now, it is an industry that requires specialized ASIC hardware and substantial electricity, and the mining difficulty is currently at 112.15 trillion.

- Joining mining pools is essential for individual miners, as solo mining is no longer viable for most; the three largest pools (FoundryUSA, AntPool, and ViaBTC) control over 65% of global mining power.

- Profitability depends on multiple factors, including hardware efficiency, electricity costs, Bitcoin’s price, and difficulty level. Depending on these variables, typical ROI timelines range from 6 to 36 months.

What is Bitcoin Mining?

Bitcoin mining is a network-wide competition to generate a cryptographic solution that matches specific criteria. When a correct solution is reached, the miner or the miners who reached the solution first are rewarded with Bitcoin, plus the fees for their work.

However, mining also has multiple crucial purposes beyond just creating new coins. Let’s break them down:

- Transaction Validation: Miners verify and confirm pending transactions on the Bitcoin network, ensuring that coins aren’t spent twice (solving the “double-spending problem“).

- Network Security: The computational work performed by miners secures the blockchain against attacks, making it extremely expensive to alter past transactions.

- New Bitcoin Issuance: As a result of the mining, new Bitcoins are created and distributed according to a predetermined schedule.

According to the Bitcoin protocol, there will only ever be 21 million Bitcoins in existence. All Bitcoins in existence are expected to be mined by around 2140. After that point, mining will continue, but miners will be rewarded solely through transaction fees.

How Does Bitcoin Mining Work?

It’s time to discuss the Bitcoin mining process and its core components:

The Proof-of-Work Consensus Mechanism

Bitcoin uses a consensus mechanism called Proof-of-Work (PoW). This system requires miners to show they’ve used significant computational resources to solve complex mathematical puzzles. It’s like a network-wide competition where miners compete to be the first to find a solution to a particular cryptographic problem.

This may sound a bit complex, so here’s a simplified example:

Imagine you ask friends to guess a number between 1 and 100. Your friends don’t have to guess the exact number; they just have to be the first to guess a number less than or equal to your number. If you think of the number 19 and a friend comes up with 21, another 55, and yet another 83, they lose because they all guessed more than 19.

But they get to guess again, and the next guesses are 16, 41, and 67. The one who guessed 16 wins because that person was first to guess a number less than or equal to 19.

In Bitcoin mining, this guessing game happens on a much larger scale, with trillions of attempts per second across the network.

The Hash Function

At the heart of Bitcoin mining is the hash function, specifically SHA-256 (Secure Hash Algorithm 256-bit). A hash function takes any input data and produces a fixed-length string of characters, which appears random but is deterministic (the same input always produces the same output).

For example, if you input “Hello World!” into a SHA-256 hash function, you’ll get:

Change just one character to “Hello World!0” and you get a completely different hash:

This function acts like a digital fingerprint maker. The fact that this fingerprint changes completely if you change one tiny detail forces miners to try billions of random combinations until they find one that produces a fingerprint smaller than the target value. It’s how Bitcoin ensures security while issuing new coins.

The Mining Process

Here are the steps of the actual mining process:

- Block Creation: Miners collect pending transactions from the network’s memory pool and assemble them into a block.

- Header Generation: They create a block header that includes several pieces of information, including a reference to the previous block (creating the “chain” in blockchain).

- Puzzle Solving: Miners then attempt to find a solution to a mathematical puzzle. They do this by adding a number called a “nonce” to the block header and running it through the SHA-256 hash function.

- Target Hash: The network sets a “target hash,” and miners must find a hash value that is less than or equal to this target. The lower the target, the more difficult the puzzle.

- Block Discovery: When a miner finds a hash that meets the target requirement, they broadcast the solution to the network for verification.

- Verification and Reward: Other nodes verify the solution, and if valid, the miner receives the block reward (currently 3.125 bitcoins as of the April 2024 halving) plus any transaction fees.

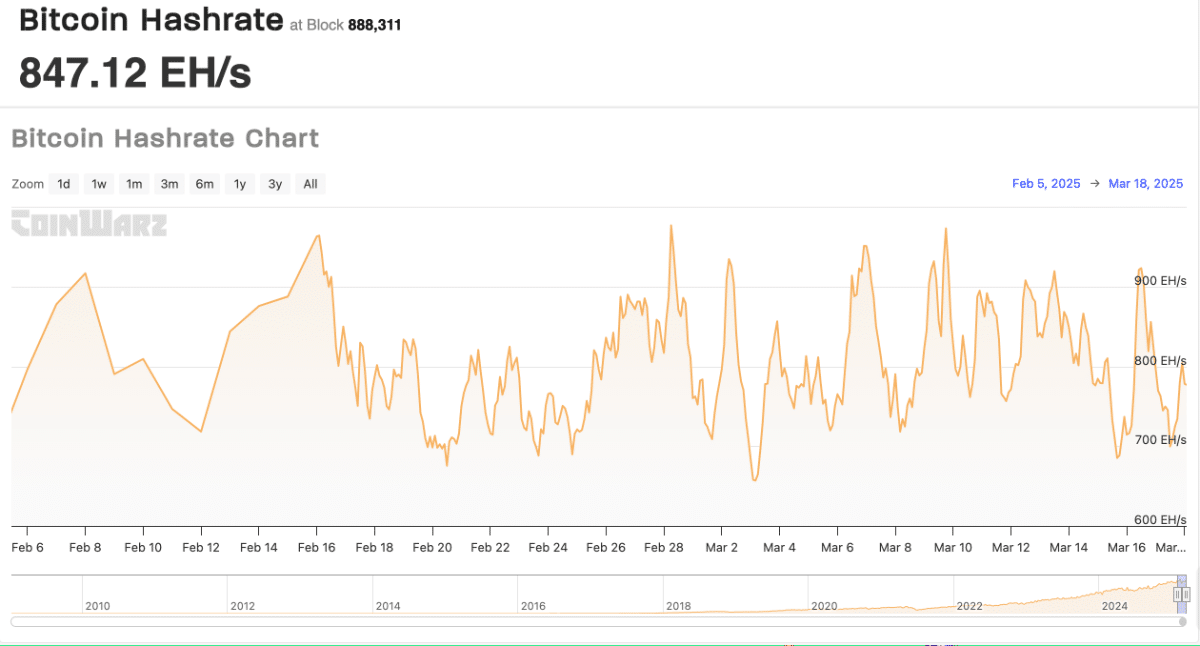

As of May 2025, the Bitcoin network hash rate has reached 847.12 EH/s at block height 888,311. Despite this enormous computing power (equivalent to billions of modern computers working simultaneously), the network maintains its target of finding one block approximately every 10 minutes by automatically adjusting the mining difficulty, which currently stands at over 112 trillion.

The Difficulty Adjustment

Bitcoin’s network automatically adjusts the mining difficulty every 2,016 blocks (approximately every two weeks) to maintain an average block time of 10 minutes. If blocks are being mined too quickly, the difficulty increases; if too slowly, it decreases.

As of March 2025, the difficulty level has increased to 112.15 trillion (112,149,504,190,350 to be exact), meaning the chances of producing a hash below the target on a single try is approximately 1 in 112.15 trillion.

To put that in perspective, you have better chances of winning the lottery than generating a valid hash on a single attempt.

Bitcoin Mining Hardware

Since Bitcoin was launched in 2009, lots of things have changed. Hardware used for mining was no exception.

The Evolution of Mining Hardware

CPU Mining (2009-2010) Bitcoin mining began with central processing units (CPUs) in standard computers. In the early days, anyone could mine Bitcoin using their personal computer, and the rewards were substantial (50 BTC per block). However, as more miners joined and difficulty increased, CPU mining quickly became inefficient.

GPU Mining (2010-2013) Miners soon discovered that graphics processing units (GPUs) were much more efficient at the specific calculations required for mining. GPUs could process many more calculations in parallel, increasing hash rates substantially. This era saw the first mining rigs with multiple GPUs connected to a single system.

FPGA Mining (2011-2013) Field-Programmable Gate Array (FPGA) devices represented the next step in mining evolution. These programmable circuits could be configured for Bitcoin mining algorithms, offering better performance and energy efficiency than GPUs.

ASIC Mining (2013-Present) Application-Specific Integrated Circuits (ASICs) was revolutionary in Bitcoin mining. These chips are designed specifically for mining cryptocurrency and offer exponential performance and energy efficiency improvements. Modern ASIC miners are many orders of magnitude more powerful than the earliest mining hardware.

Recently, ASICs have become so dominant that they account for approximately 75% of all Bitcoin mining hardware in use.

Comparing Mining Hardware

Here’s how different types of mining hardware compare:

| Hardware Type | Hash Rate Range | Power Efficiency | Initial Cost | Pros | Cons |

| CPU | 2-50 MH/s | Very low | $200-$1,000 | Already owned, multipurpose | Extremely inefficient, not profitable |

| GPU | 10-100 MH/s | Low | $500-$2,000 | Multipurpose, can mine other crypto | High power consumption, not competitive for Bitcoin |

| FPGA | 500-1,000 MH/s | Medium | $2,000 – $7,000 | Programmable for different algorithms | Expensive, complex setup |

| ASIC | 30-335 TH/s | High | $500 – $15,000 | Highest performance, best efficiency | Single purpose, becomes obsolete quickly |

Popular ASIC Models

Below, you will find some of the leading ASIC miners for Bitcoin:

- AntMiner S19 XP Series: Offers up to 160 TH/s with an efficiency of around 21 J/TH.

- AntMiner S9: An older model that provides about 13.5 TH/s at 0.098 W/Gh efficiency.

- AvalonMiner 1246: Delivers approximately 90 TH/s at an efficiency of 38 J/TH.

- WhatsMiner M30S++: Provides about 112 TH/s with 31 J/TH efficiency.

- SEALMINER A2: One of the newer models optimized for Bitcoin mining with competitive hash rates.

If you decide to buy mining hardware, you should consider the following:

- Hash rate (the speed at which the device can compute)

- Energy efficiency (how much electricity it uses relative to its hash rate)

- Purchase cost and expected lifespan

- Heat generation and cooling requirements

- Noise level (most ASIC miners operate at about 90 decibels, similar to a lawn mower)

Bitcoin Mining Software

While hardware performs the actual computations for mining, software connects that hardware to the Bitcoin network and manages the mining process. The right software can greatly impact mining efficiency and profitability.

Here are some of the most popular software:

- CGMiner: An open-source mining software developed in 2011 that has become the go-to choice for experienced Bitcoin miners. It supports a wide range of hardware, including ASICs, and runs on Windows, Mac, and Linux.

- Awesome Miner: A powerful management solution that allows users to control multiple mining rigs and pools from a single dashboard. It supports various mining engines and is compatible with Windows and Linux.

- EasyMiner: A user-friendly option designed for beginners with a graphical interface that simplifies the mining process. It runs on Windows and supports CPU and GPU mining.

- BFGMiner: An advanced tool for miners with support for monitoring, remote interface capabilities, and the ability to mine multiple cryptocurrencies simultaneously.

- Cudo Miner: A solution with intelligent coin-switching capabilities that automatically mines the most profitable cryptocurrency at any given time.

- NiceHash: A unique platform that combines mining software with a marketplace for buying and selling hashing power.

- ECOS: A recent addition that helps miners track profitability in real-time, allowing for instant decisions on performance optimization.

Key Features to Consider

When choosing Bitcoin mining software, consider the essential features:

- Ensure the software supports your specific mining hardware.

- Beginner miners should prioritize software with intuitive interfaces, while experienced miners might prefer more advanced options with extensive customization.

- Look for software that can automatically adjust settings to maximize hash rate and minimize power consumption.

- Real-time tracking of hash rate, temperature, fan speed, and other metrics is crucial for maintaining optimal performance.

- The ability to easily connect to various mining pools expands your options for collaborative mining.

- Strong encryption, two-factor authentication, and DDoS protection have become increasingly important as cyberattacks on mining operations rose by 30% in 2024.

- Some software is free but may charge a percentage of mining rewards, while others have upfront costs but no ongoing fees.

These are the mining software features that ultimately create the best possible opportunities for miners.

Mining Pools

As Bitcoin mining difficulty has increased, individual miners with limited resources find it challenging to mine blocks independently. This reality has led to the rise of mining pools.

What Are Mining Pools?

Mining pools are groups of miners who combine their computational resources (hash power) to increase their chances of finding blocks and receiving rewards. When a pool successfully mines a block, the reward is distributed among members based on their contributed hash power.

The largest mining pools include:

Together, these three pools hold more than 65% of the world’s Bitcoin mining power.

Pool Reward Methods

Mining pools distribute rewards using various methods:

- Proportional (Pay-per-Share or PPS): Miners receive payment based on the number of shares they contribute, regardless of whether the pool finds a block.

- Pay Per Last N Shares (PPLNS): Rewards are distributed based on the number of shares submitted in a specific time window before finding a block.

- Full Pay Per Share (FPPS): Similar to PPS but also includes transaction fees in the calculation.

- Score-Based Method: Rewards older shares more heavily, encouraging miners to stay with the pool longer.

Solo Mining vs. Pooled Mining

| Aspect | Solo Mining | Pool Mining |

| Reward frequency | Highly irregular (could be months or years between rewards) | Regular, smaller payments |

| Reward amount | Full block reward when successful (3.125 BTC + fees) | Proportional share of rewards |

| Control | Complete control over which transactions to include | Pool operator decides |

| Setup complexity | More complex setup | Easier for beginners |

| Hardware requirements | Significant hardware investment needed | Can start with smaller setups |

| Luck factor | Extremely high | Shared risk across the pool |

Right now, it only makes sense if a beginner miner joins a pool, otherwise it would require a massive hash power.

Mining Rewards and Halving Events

Bitcoin’s economic model includes a built-in mechanism to control inflation and ensure scarcity: the block reward halving.

Bitcoin Block Rewards

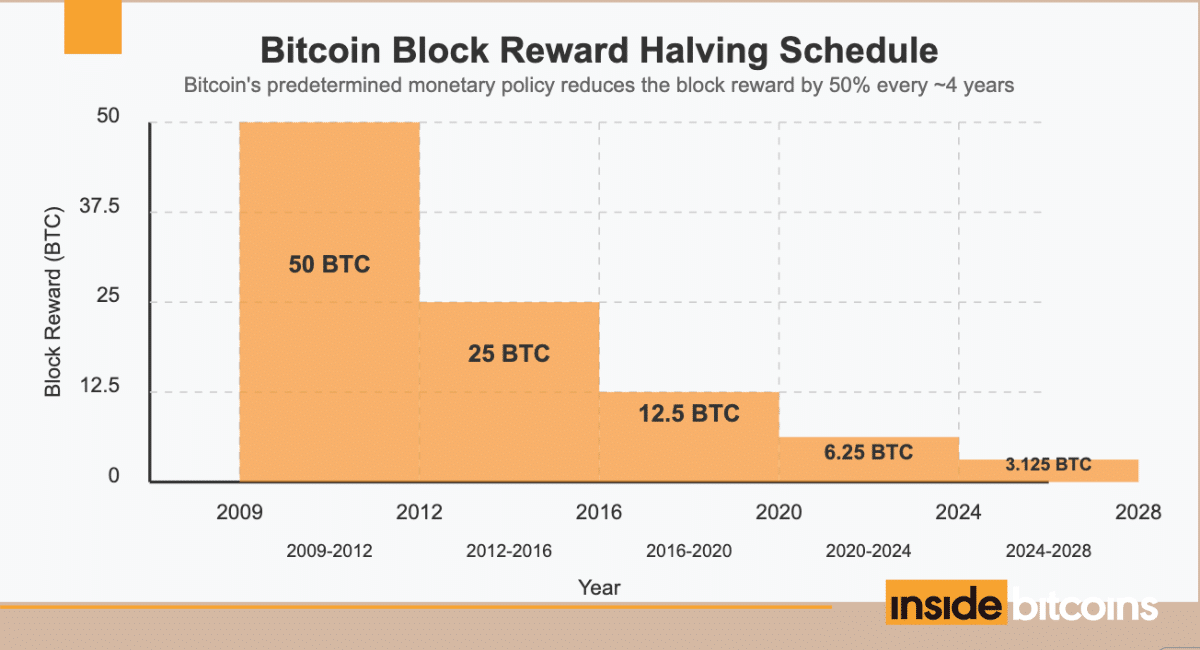

When Bitcoin launched in 2009, miners received 50 BTC for each block they mined. This reward is programmed to be cut in half every 210,000 blocks (approximately every four years), an event known as “the halving.”

You can take a look at the halving schedule in the illustration below:

At current rates, the next halving will occur in 2028, when the reward will drop to 1.5625 BTC per block.

Transaction Fees

As block rewards decrease over time, transaction fees become increasingly important for miners. Users pay these fees to prioritize their transactions in new blocks.

With Bitcoin’s price exceeding $100,000 in December 2024, transaction fees have become a significant component of mining revenue, accounting for approximately 10-15% of total mining income.

After all 21 million bitcoins are mined, transaction fees will be the only motivation for miners to continue securing the network.

Impact of Halvings on Mining Profitability

Now, let’s break down the elements of the halving effect on mining profitability:

- Immediately after a halving, miners’ revenue is cut in half, which can make mining unprofitable for those with less efficient equipment.

- Less efficient miners may shut down after a halving, temporarily reducing the network’s total hash rate until difficulty adjusts.

- Historically, halvings have preceded significant bull runs in Bitcoin’s price, though the relationship is complex and not guaranteed to continue.

- Halvings tend to favor larger, more efficient operations, potentially increasing centralization.

After the April 2024 halving, several smaller mining operations were forced to shut down due to decreased profitability, though the price rally to over $100,000 has brought many back online with upgraded equipment.

Energy Consumption and Environmental Impact

Bitcoin mining energy consumption has become one of the most debated aspects of the cryptocurrency.

It may sound crazy, but Bitcoin mining consumes approximately as much electricity as some small countries. The exact amount fluctuates based on the network’s hash rate, the efficiency of mining equipment, and other factors.

This high energy consumption is a direct result of Bitcoin’s proof-of-work consensus mechanism, which intentionally makes mining computationally intensive to secure the network.

Environmental Concerns

Bitcoin’s energy usage has raised legitimate environmental concerns:

- Carbon footprint: In regions where electricity is generated primarily through fossil fuels, Bitcoin mining can contribute significantly to carbon emissions.

- Electronic waste: As mining hardware quickly becomes obsolete, it creates substantial e-waste. Digiconmist estimates that Bitcoin mining generates approximately 30.7 kilotons of e-waste annually.

- Local grid impacts: Mining operations can strain local power grids in some areas, potentially affecting electricity costs and availability for other users.

Sustainable Mining Practices

All these problems have made people rethink their methods. The industry is increasingly moving toward more sustainable approaches:

- Many large mining operations are relocating to areas with abundant renewable energy, such as hydroelectric power in regions of the United States, Norway, and Iceland.

- Newer ASIC models significantly improve efficiency, reducing the energy required per hash.

- Some innovative mining operations capture and reuse the heat generated by mining equipment for heating buildings or other purposes.

- Some mining companies buy carbon credits to offset their emissions.

According to research from the University of Cambridge, the majority of Bitcoin mining operations are now centered in the United States. Of the nearly 38% of global Bitcoin mining activity conducted in the U.S., more than 62% is concentrated in four states: Georgia (30.76%), Texas (11.22%), Kentucky (10.93%), and New York (9.77%).

You can take a look at Cambridge’s Bitcoin mining map here.

Regulatory and Legal Considerations

The legal status of Bitcoin mining varies widely around the world, with some countries embracing the industry and others imposing restrictions or outright bans.

Here’s how different jurisdictions approach Bitcoin mining:

Favorable Jurisdictions:

- United States: Generally permitted, though Bitcoin mining regulations vary by state. Some states like Texas and Wyoming have enacted friendly legislation to attract miners.

- Canada: Largely supportive, with abundant hydroelectric power attracting miners.

- Iceland: Embraces mining due to abundant geothermal and hydroelectric power and cold climate.

- Georgia (country): Has become a mining hub due to low electricity costs and favorable regulations.

Restricted or Regulated Jurisdictions:

- Paraguay: Introduced a temporary mining ban in April 2024.

- Sweden: Introduced a 6,000% tax increase on energy used for cryptocurrency mining purposes.

- Norway: Introduced a proposal in 2024 to require data centers to apply for their intended activities, allowing the government to disprove requests for mining.

- Kazakhstan: Increased taxes on energy used for cryptocurrency mining in 2022 and in 2023, decided to only allow it when there is a surplus of energy.

Prohibitive Jurisdictions:

- China: Enacted a general ban on mining in 2021, forcing many operations to relocate.

- Algeria, Egypt, Morocco, and Bolivia: Have explicitly banned crypto mining.

Compliance Considerations

You need to consider the following If you’re considering mining Bitcoin:

- Mining rewards are typically considered taxable income in most jurisdictions.

- Larger mining operations often need to register as businesses and comply with relevant regulations.

- Some areas have special tariffs or restrictions on energy-intensive operations.

- Miners may need to adhere to noise, electronic waste disposal, and emissions regulations.

- Some mining pools require identity verification to comply with anti-money laundering regulations.

Economic Factors Influencing Mining

Several economic factors affect the profitability and viability of Bitcoin mining operations.

Bitcoin Price Volatility

The price of Bitcoin has a direct impact on mining profitability. When prices rise, mining becomes more profitable, attracting more miners to the network. Conversely, price drops can make mining unprofitable for those with higher operational costs.

For example, when Bitcoin broke the $100,000 barrier in December 2024, a single block reward of 3.125 BTC was worth approximately $315,625, not including transaction fees.

Mining Difficulty

As more miners join the network, the difficulty of mining increases to maintain the target block time of 10 minutes. This dynamic adjustment means that profitability can decrease even if Bitcoin’s price remains stable.

Operational Costs

The primary operational costs for miners include the following:

- Electricity: Typically the largest ongoing expense, with costs varying dramatically by location. In some regions, electricity can account for 60-80% of operational costs

- Hardware acquisition: Initial investment in ASICs and supporting infrastructure.

- Maintenance: Cooling systems, replacement parts, and technical support.

- Facility costs: Rent, security, and infrastructure for mining operations.

- Network infrastructure: Reliable internet connectivity with low latency.

A profitable mining operation must ensure that the combination of block rewards and transaction fees exceeds these operational costs over the long term.

Setting Up a Bitcoin Mining Operation

If you’re considering setting up your own operation, here’s a step-by-step mining operation guide:

Research and Planning

Starting your own Bitcoin mining operation requires careful planning and execution. Begin with research into current mining profitability, comparing various hardware options and their efficiency ratings. Don’t forget to calculate your local electricity costs precisely, and don’t overlook local regulations and tax requirements that might affect your operation.

Hardware Selection and Acquisition

Hardware selection comes next. As we mentioned before, ASIC miners are practically essential. Buy these specialized machines from established manufacturers or trusted resellers to avoid scams. Pay close attention to key specifications like hash rate, energy consumption, and warranty terms when making your selection.

Location Setup

Your mining location needs proper preparation. Most residential electrical systems can’t handle multiple ASIC miners, so electrical upgrades may be necessary. Install cooling systems to prevent overheating and implement noise reduction measures since ASICs produce sound levels comparable to lawnmowers. We also advise you to secure your expensive equipment with appropriate security measures and ensure you have a reliable internet connection.

Software Configuration

Software configuration is equally important. Install mining software that’s compatible with your specific hardware. If you’re joining a mining pool rather than mining solo, create the necessary accounts. Set up a secure Bitcoin wallet to receive your mining rewards. Start small to test your setup before scaling up to your full capacity.

Ongoing Management

Successful mining requires ongoing management. Monitor key performance metrics like hash rate and temperature regularly. Keep all software and firmware updated to maintain efficiency and security. Plan ahead for hardware upgrades as technology advances. Track your profitability against operational costs continuously, and maintain proper records for tax compliance.

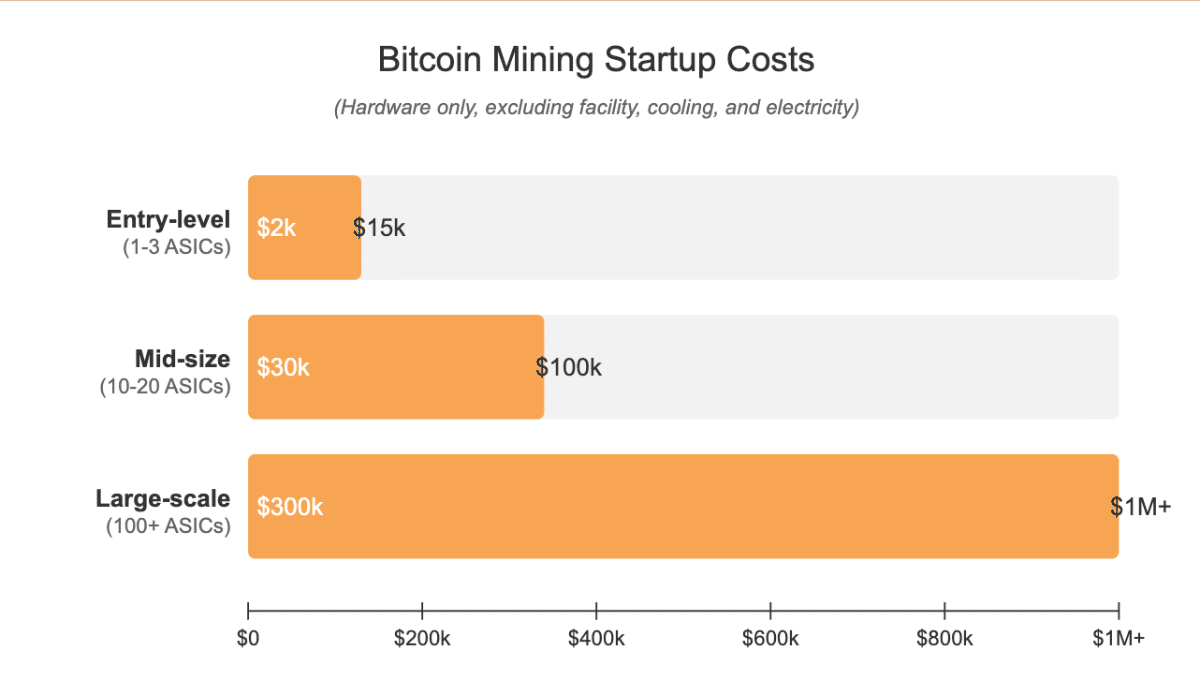

Estimated Startup Costs

Check out an estimate for what you might spend for all the mentioned setups:

- Entry-level setup (1-3 ASIC miners): $2,000-$15,000

- Mid-size operation (10-20 ASIC miners): $30,000-$100,000

- Large-scale farm (100+ ASIC miners): $300,000+

Keep in mind that these costs do not include facility preparations, cooling systems, or ongoing electricity expenses.

Cloud Mining

Cloud mining offers an alternative approach if you are interested in BTC mining but are unwilling or unable to set up physical hardware.

Cloud mining allows individuals to rent mining power from companies that maintain large mining facilities. You essentially pay for a share of the mining operation’s hash power, receiving proportional rewards minus fees.

Here are several companies that offer cloud mining services:

- ECOS: Established in 2017, ECOS offers cloud mining services with a minimum investment of $99. It operates a Bitcoin mining facility in the Armenian Free Economic Zone.

- Binance: The popular cryptocurrency exchange offers cloud mining services with a user-friendly interface and no hidden charges (not available to U.S. users).

- NiceHash: Offers both mining software and a marketplace for buying and selling hash power.

Cloud Mining Benefits

- The provider handles all hardware setup and maintenance.

- You don’t have to deal with the physical aspects of mining.

- You can start with a small amount and increase your investment over time.

- The provider typically upgrades hardware as needed.

Cloud Mining Risks and Drawbacks

- After fees, cloud mining is typically less profitable than successful self-mining.

- If the cloud mining company goes bankrupt or is fraudulent, you could lose your investment.

- You have no say in how the operation is run or what coins are mined.

- Many services have minimum contract lengths or termination fees.

Be aware that cloud mining scams are unfortunately common. Before investing, thoroughly research any provider, check reviews from multiple sources, and start with small amounts to test the service.

Profitability and ROI

Determining whether Bitcoin mining will be profitable requires careful analysis of multiple factors. When calculating mining profitability, you need to account for all revenue components: the current block reward (3.125 BTC), average transaction fees per block, current Bitcoin price, and your share of the network’s total hash rate.

On the cost side, consider your initial hardware investment, ongoing electricity expenses (your power consumption multiplied by your electricity rate), cooling costs, regular maintenance, and pool fees if you’re mining with others. Don’t forget to factor in expected difficulty increases, hardware depreciation, Bitcoin’s price volatility, and the impact of future halving events.

Several online tools can help crunch these numbers for a quick estimate. NiceHash, for instance, offers a mining calculator on their website that incorporates these variables to project your potential returns. Remember that mining profitability can change dramatically as market conditions evolve.

Return on Investment (ROI) Timeline

In the mining environment, ROI timelines vary widely:

- The best-case scenario is 6-12 months (with very low electricity costs and favorable Bitcoin price action)

- The average scenario is 12-24 months

- The worst scenario is 24-36 months

However, these estimates are highly variable and depend on many factors outside a miner’s control, particularly Bitcoin’s price and network difficulty.

Strategies to Improve Bitcoin Mining ROI

- Relocate to areas with low electricity costs and cool climates.

- Implement advanced cooling solutions to reduce energy consumption.

- Use software to optimize performance and power usage.

- Repurpose generated heat for other uses to offset costs.

- Develop a strategy for when to hold mined Bitcoin and when to sell.

- Work with tax professionals to optimize your mining operation’s tax situation.

Common Challenges and Solutions

Even experienced miners face ongoing challenges. Here are some of the most common Bitcoin mining challenges, potential solutions and best practices:

Rising Electricity Costs

One of the biggest challenges for cryptocurrency mining operations is the volatility of electricity prices, which can significantly impact profitability. To mitigate this risk, miners can consider relocating their operations to regions where energy costs are lower and more stable.

Optimizing power usage effectiveness (PUE) is another crucial step, ensuring that energy is used efficiently and reducing waste. Renewable energy sources such as solar or wind power can also provide long-term cost savings and sustainability benefits. Negotiating fixed-rate contracts with utility providers helps stabilize electricity expenses, shielding operations from sudden price surges.

Additionally, using smart mining software that dynamically adjusts operations based on real-time electricity prices can enhance efficiency and cost-effectiveness.

Hardware Obsolescence

Mining hardware quickly becomes outdated as newer, more efficient models enter the market, making it increasingly difficult for older equipment to remain competitive. To address this, businesses should incorporate regular hardware upgrades into their long-term strategy, ensuring they stay ahead of technological advancements.

Selling older equipment while it still retains value can help recoup costs and fund new purchases. Alternatively, repurposing older ASICs for mining altcoins, where they may still be effective, can extend their usefulness.

A hybrid approach that combines owned hardware with cloud mining solutions can also provide flexibility and cost savings, relieving miners from the financial burden of frequent hardware replacements.

Cooling and Noise Management

The intense computational power of ASIC mining rigs generates significant heat and noise, creating operational challenges that require careful management. Advanced cooling systems, such as immersion cooling, can dramatically improve heat dissipation, extending hardware lifespan and improving efficiency.

Soundproofing measures, including acoustic panels and enclosures, can help reduce noise pollution, particularly for mining operations in urban or shared spaces. Distributing mining equipment across multiple smaller locations can further alleviate heat concentration and noise issues.

Additionally, setting up facilities in naturally cooler climates can lower the cooling costs needed to maintain optimal operating conditions.

Network Difficulty Increases

As more miners join the network, the difficulty of mining Bitcoin rises, reducing profitability over time. To counteract this, mining operations must prioritize efficiency, optimizing hardware performance and energy consumption to maintain profitability despite increasing difficulty. Participating in mining pools can provide more stable returns, as rewards are distributed based on collective computational power.

Expanding into related services, such as hosting mining equipment for other users or offering consulting services, can diversify revenue streams and reduce dependence on mining rewards alone.

Security Risks

Both physical and cybersecurity threats pose significant risks to mining operations. Protecting mining facilities with robust physical security measures, such as surveillance cameras, restricted access, and alarm systems, is essential to prevent theft and unauthorized entry.

Online security is equally critical, requiring secure, non-public internet connections to reduce exposure to cyber threats. Implementing two-factor authentication (2FA) for all accounts adds an additional layer of security against unauthorized access.

Keeping mining software and firmware updated ensures vulnerabilities are patched, reducing the risk of cyberattacks. Distributing operations across multiple locations further mitigates risk, so that a security breach or equipment failure in one facility does not compromise the entire operation.

Market Volatility

Bitcoin’s price fluctuations can create uncertainty in mining profitability, making financial planning challenging. Maintaining cash reserves can provide a financial buffer during market downturns, ensuring operations remain sustainable even during periods of low Bitcoin prices.

Developing a strategic approach to selling mined Bitcoin—whether through periodic sales, holding strategies, or automated selling triggers—can help maximize returns. Hedging strategies, such as futures contracts, can further protect against price volatility.

The Future of Bitcoin Mining

Bitcoin mining is rapidly changing, with technological advancements leading the way. Manufacturers are pushing the boundaries with next-generation ASICs, incorporating 3nm technology that promises greater efficiency than ever before, with competition such as mobile mining solutions driving further development.

Meanwhile, immersion cooling techniques are gaining traction, submerging mining equipment in specialized fluids to boost performance while cutting cooling costs.

Smart miners are turning to AI for an edge. Machine learning algorithms now optimize operations in real time, adjusting to fluctuating electricity prices and market conditions automatically. The industry also welcomes renewable energy, with customized solutions that directly integrate solar, wind, and hydropower into mining operations.

Industry consolidation continues as bigger players with deeper pockets gain market share. At the same time, savvy miners are spreading their operations across multiple countries to minimize political and regulatory risks. We’re also seeing more mining companies buying their own power plants to control electricity costs—their biggest operational expense.

Traditional financial institutions are finally warming up to BTC mining trends. Banks and investment firms are spending money on mining operations as Bitcoin steadily moves into the mainstream financial world.

Looking further ahead, Bitcoin’s approach toward its 21 million coin supply cap will transform mining economics. Transaction fees will gradually replace block rewards as miners’ primary income. All of this raises questions about network security—will fee income be enough to incentivize miners to keep securing the blockchain?

Regulators are paying closer attention to mining operations, particularly regarding energy consumption and financial oversight. Additionally, as more transactions move to Layer 2 solutions like Lightning Network, miners will increasingly process larger settlement transactions rather than individual payments.

Conclusion

Bitcoin mining has transformed from a hobbyist activity into an industry that plays a crucial role in securing the world’s largest cryptocurrency network. With Bitcoin’s price reaching unprecedented heights in December 2024, mining continues to attract interest despite increasing competition and complexity.

Whether you’re considering mining as a business venture or simply want to understand how Bitcoin works, it’s clear that this industry will continue to evolve as technology advances and regulations develop.

The most successful miners will be those who can adapt to changing conditions—optimizing for energy efficiency, navigating regulatory requirements, embracing technological innovations, and making sound economic decisions in the face of market volatility.

While the barriers to entry for profitable mining have never been higher, the industry remains a fascinating intersection of cryptography, economics, computer science, and energy management that will continue to shape the future of Bitcoin for decades to come.

Frequently Asked Questions (FAQs)

What is Bitcoin mining?

Bitcoin mining is the process of validating transactions on the Bitcoin network and securing the blockchain. Miners use specialized computers to solve complex mathematical puzzles, and when successful, they're rewarded with newly created Bitcoins and transaction fees.

How does Bitcoin mining work?

Miners compete to solve cryptographic puzzles by generating random numbers (nonces) until they find one that produces a hash value below the target set by the network. This process requires significant computational power. The first miner to find a valid solution earns the right to add a new block of transactions to the blockchain and receives a reward.

Is Bitcoin mining profitable?

It depends on several factors: your hardware's efficiency, electricity costs, Bitcoin's price, and the network's difficulty level.

What equipment is needed for Bitcoin mining?

You'll need ASIC miners, which are specialized machines designed specifically for mining. You'll also need reliable internet, proper cooling systems, and enough electrical capacity.

What are mining pools?

Mining pools are groups of miners who combine their computing power to increase their chances of solving blocks and earning rewards. When a pool successfully mines a block, the reward is distributed among participants based on their contributed hash power.

What is a Bitcoin halving event?

A halving event reduces the reward miners receive for validating transactions by 50%. It occurs approximately every four years (or every 210,000 blocks). The last event occurred In April 2024, when the reward dropped from 6.25 to 3.125 bitcoins per block.

How does Bitcoin mining impact the environment?

Mining consumes too much electricity, raising environmental concerns. However, the industry is increasingly shifting toward renewable energy sources like hydroelectric, solar, and wind power. Many mining operations now seek locations with abundant clean energy, and newer mining hardware continues to improve energy efficiency.