Pi Network (PI) is a layer-1 blockchain centered around mobile-based mining that offers low fees and support for decentralized applications (dApps). While mining is a large part of Pi Network, the PI crypto itself has drawn a lot of attention since its inception. We’ve prepared this guide to explain how to buy Pi Network without joining the mining program.

Read on to gain exposure to Pi Network in 2025, learn how its Stellar Consensus Protocol works, and where the Pi Network price is headed in the short and long term.

How to Buy Pi Network in 4 Easy Steps

Follow these steps when exploring how to buy Pi Network coin:

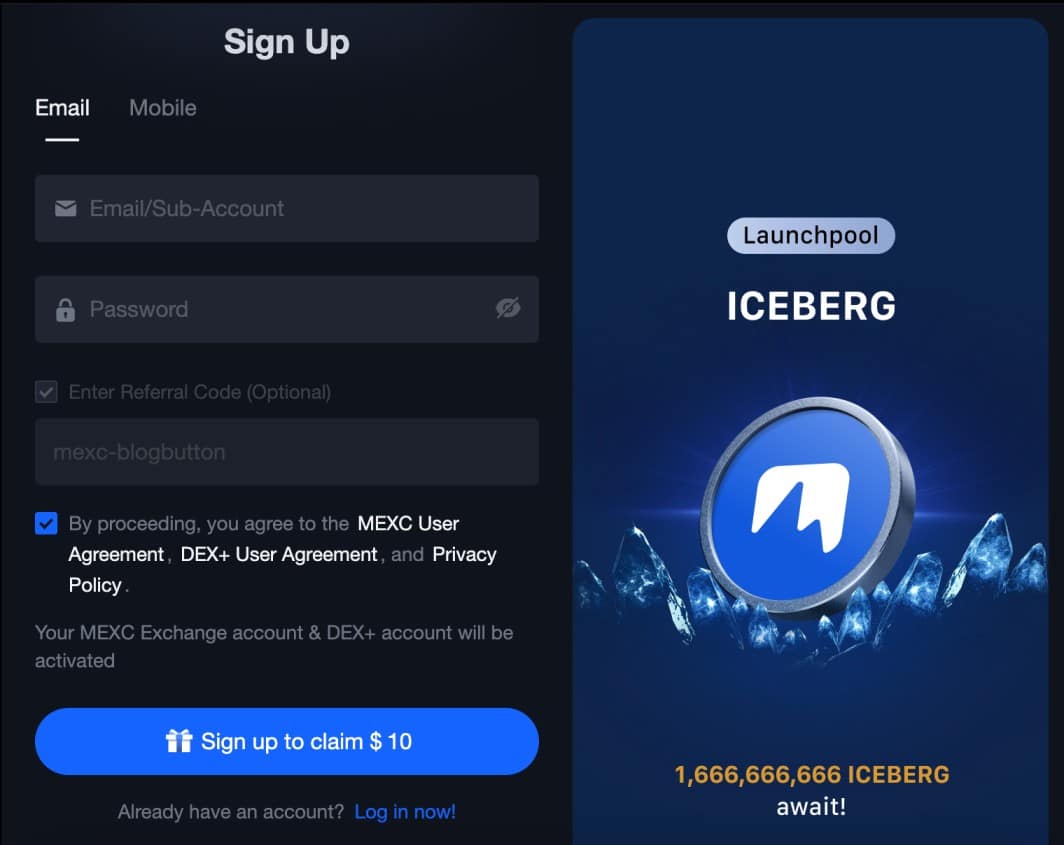

- Step 1: Choose an Exchange: Choose an exchange that lists PI tokens, offers low fees, and supports your preferred payment method. MEXC is a good choice – commissions start from 0%, and deposit types include debit/credit cards and e-wallets.

- Step 2: Open an Account: Visit the MEXC website to open an account. New customers register with an email address or mobile number only – no personal information or government-issued ID is needed. Ensure you activate account security measures like wallet whitelisting and email confirmations.

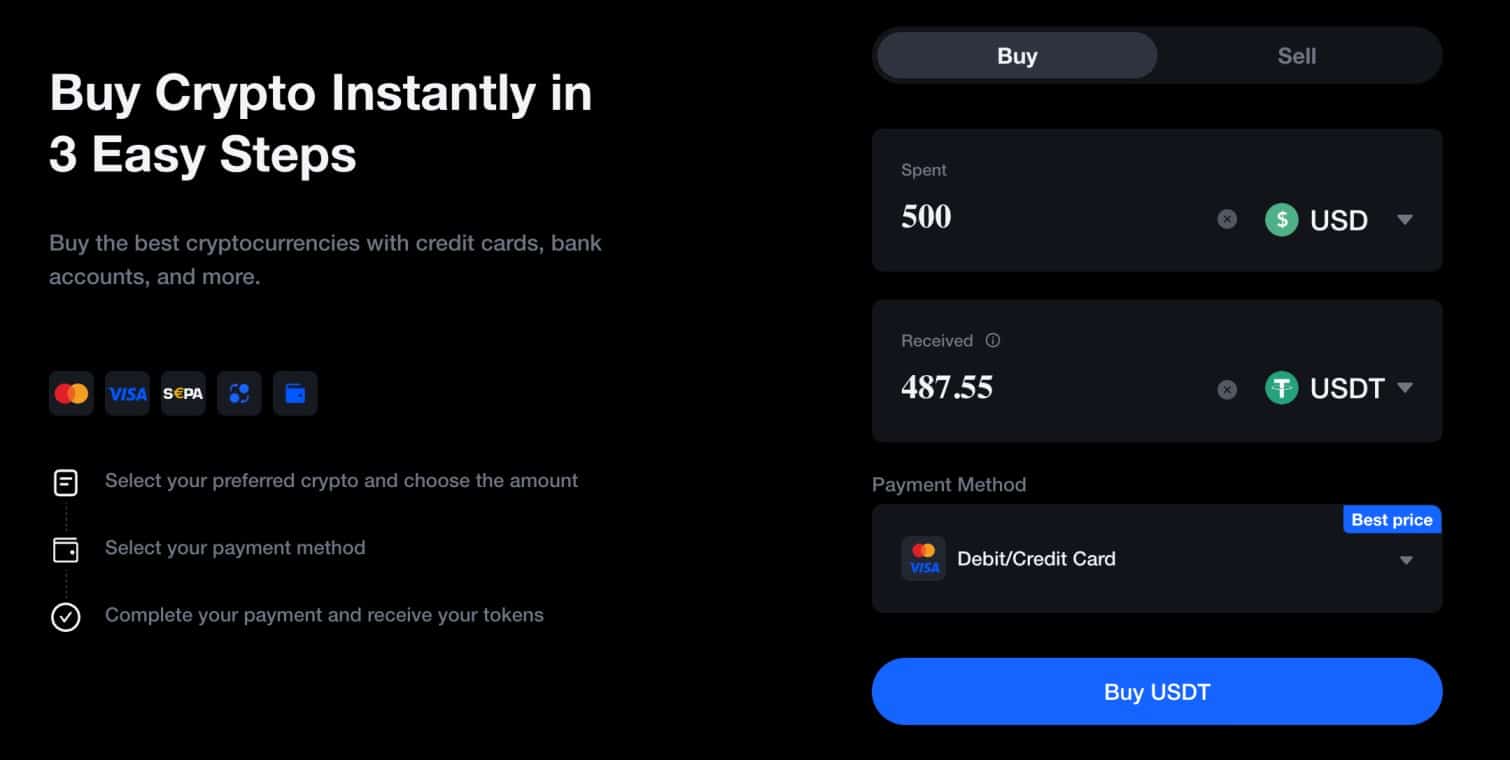

- Step 3: Deposit Funds: MEXC accepts fiat money, but the instant buy feature doesn’t support Pi Network. You can buy Tether (USDT) instantly and then swap the tokens for PI in the next step. The minimum deposit is $10.

- Step 4: Buy Pi Network: Click “Markets”, search for “PI”, and click the “PI/USDT” pair. Create a market or limit order, enter the purchase amount, and confirm. The exchange swaps USDT for PI and adds the tokens to your account balance.

Key Takeaways on Pi Network

Pi Network’s fundamentals are summarized below:

| Launched | March 14, 2019 |

| Ticker Symbol | PI |

| Blockchain | Pi Network (layer-1) |

| Maximum Supply | 100 billion |

| Circulating Supply | 7.2 billion |

| Staking? | No |

| Use Case | Layer-1 blockchain that offers low-cost and fast transactions, and support for dApps. Users can mine PI tokens via the Pi Network app for iOS and Android. |

| Consensus Mechanism | Stellar Consensus Protocol |

| All-Time High | $2.98 |

| X page | https://x.com/PiCoreTeam |

| Website | https://minepi.com/ |

How to Buy PI Network – Step-by-Step Instructions

Here’s a more extensive walkthrough on how to buy PI in 2025. Follow these steps to invest in the Pi Network ecosystem in under five minutes.

Step 1: Create an Exchange Account

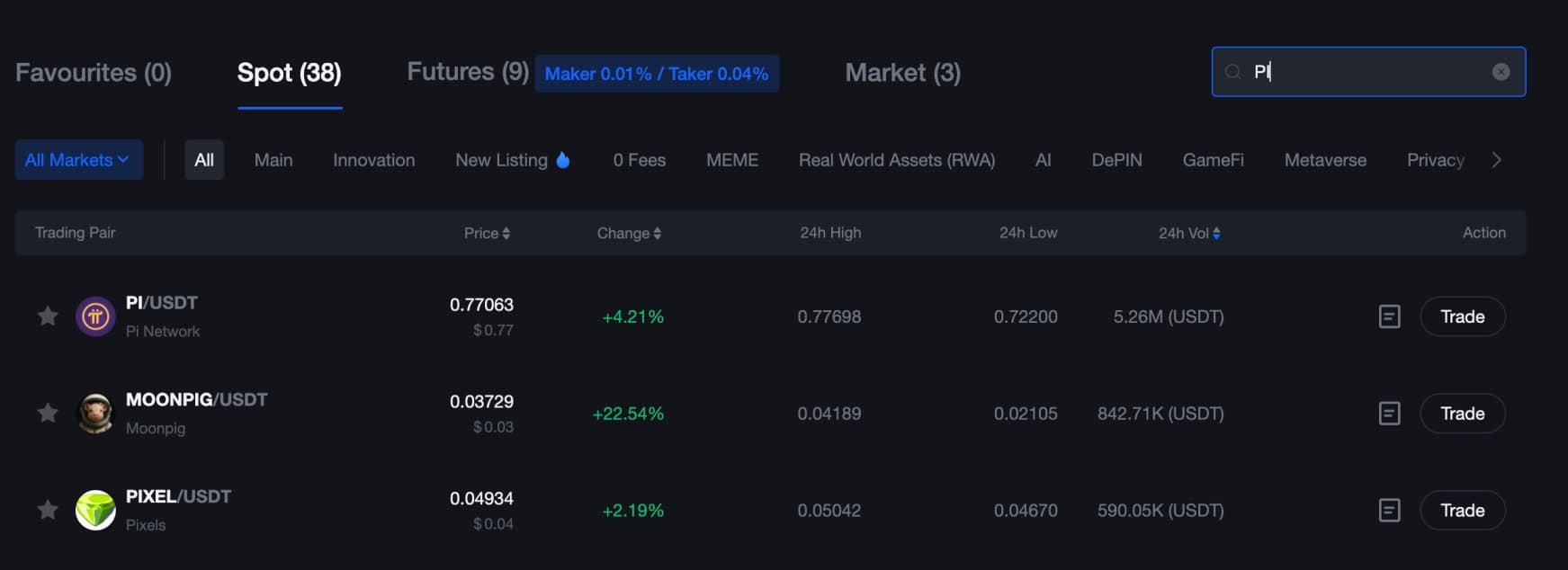

Pi Network is listed on the best crypto exchanges, including MEXC, OKX, Gate.io, and Bitget, where users can buy and trade PI. These exchanges offer a convenient and secure trading experience, although MEXC is the standout platform.

MEXC offers anonymous trading accounts, commissions from 0%, and support for traditional payment methods. Its PI/USDT market attracts deep liquidity, too, so you can trade without facing unfavorable slippage levels.

Visit the MEXC website to open an account. Choose between an email address or a mobile number as the identifier and enter a strong password. MEXC offers multiple features for account security, including two-factor authentication (2FA), email confirmations, and device whitelisting. Activate these safety measures within your MEXC account.

Step 2: Purchase USDT With Fiat Money

MEXC offers the PI/USDT market like most crypto exchanges – this means you need USDT tokens to invest in the Pi Network. You can deposit USDT into the MEXC account by making a wallet transfer. The exchange credits crypto payments near-instantly.

Those without USDT can use MEXC’s fiat gateway service. The platform supports multiple payment methods, from Visa and MasterCard to Google Pay and Neteller.

Click “Buy Crypto” and complete the purchase form, including the currency, amount, and preferred deposit type. Ensure USDT is selected as the receiving currency and enter the payment details when prompted.

The exchange adds USDT to the account balance a few seconds after processing the payment.

Note: Transaction fees are built into the quoted exchange rate, which varies based on the currency and payment method.

Step 3: Search for PI and Choose an Order Type

Once you’ve got some USDT tokens in your MEXC account, the next step is to swap them for PI. Click “Markets” and search for “PI” market, then select the “PI/USDT” market.

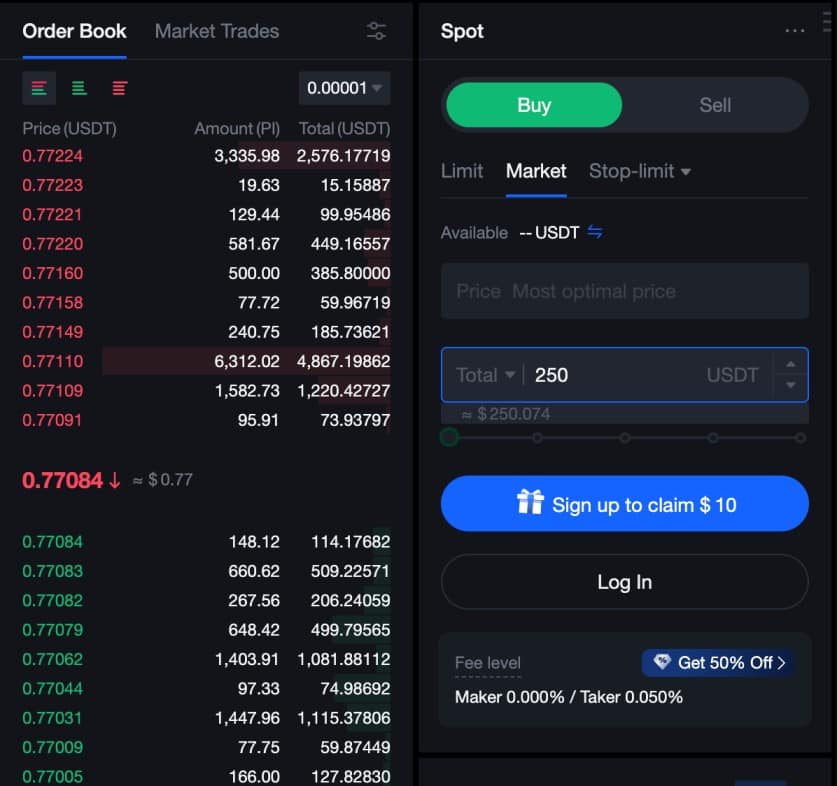

The order form to buy PI is situated to the right of the pricing chart. MEXC supports market and limit orders – here’s how they work:

- Market Orders: This order type executes almost immediately at the next best available price. Market orders are suitable when trading large market-cap cryptocurrencies like Pi Network, as sufficient liquidity ensures traders avoid slippage.

- Limit Orders: Those with large investing budgets or implementing short-term trading strategies may prefer limit orders, as they let users specify the entry price. The order executes only when the stated Pi Network price triggers, which means another market participant has accepted it.

MEXC charges 0.050% on market orders while limit orders are commission-free.

Step 4: Buy Pi Network

Select one of the order types and enter the number of USDT tokens to swap for PI. If you bought USDT specifically to invest in the Pi Network, move the exchange slider to 100% – this means you’re using the entire USDT balance to buy PI.

Place the order and wait for the exchange to execute it. While market orders confirm near-instantly, limit orders remain pending until the price matches.

Note: PI tokens appear in the MEXC account when the trade is complete. It’s advisable to withdraw them to a non-custodial wallet to eliminate counterparty risks. We discuss Pi Network wallets later in this guide.

What Is Pi Network (PI)?

Founded in 2019, Pi Network is a layer-1 blockchain that supports decentralized and immutable digital money.

It implements the Stellar Consensus Protocol mechanism to validate PI movements. This consensus mechanism enables transaction speeds of just five seconds on average, regardless of where the transacting parties are located. Fees typically cost under a cent, and the network can handle up to 70,000 transactions per second. Pi Network also supports dApps, so developers can build and launch Web 3.0 applications like games, lending protocols, and decentralized swaps.

Pi Network’s unique feature is its mobile-first mining program. Users mine PI tokens effortlessly on an iOS or Android app, simply by logging in once per day. The mining process is designed not to drain the device’s battery, unlike some other solutions on the crypto market.

History

While Pi Network went live in March 2019 and allowed users to mine and earn PI right away, it wasn’t until February 2025 that PI launched on exchanges. Before the token generation event (TGE), the team distributed PI via an airdrop campaign – early adopters could have earned over six years’ worth of mining rewards had they logged into the mining app daily, producing a significant market cap when entering the crypto market.

30 billion PI, reflecting 30% of the maximum supply, was allocated to the pre-mining airdrop. However, participants have claimed less than 8 billion PI so far, possibly because the app requires users to complete know-your-customer (KYC) verification before it releases the tokens. Not everyone is comfortable sharing their government-issued ID, with people in many areas not having access to one in the first place, which perhaps explains the shortfall.

As expected, a majority of airdrop participants sold their PI tokens at the TGE. This is a common outcome with free airdrop distributions, as users cash in their gains rather than hold the tokens long-term. The result is that PI declined by over 65% on the first day, although the original listing Pi Network price was recovered in under a week, before slowly correcting to the current price level.

Tokenomics

Pi Network has a capped supply of 100 billion PI. At 65%, a significant portion of tokens are used for mining rewards, with 30% of that amount allocated specifically for pre-mainnet participants (those who mined PI before the February 2025 launch).

10% of the supply is used for community and ecosystem growth, and 5% for exchange liquidity. The remaining 20% goes to the core team, although the tokens unlock over several years.

Use Cases

PI covers network fees when users send funds to another wallet location.

The blockchain supports dApps, including games and decentralized finance (DeFi) services. All dApps are accessible on the Pi Network app for iOS and Android. dApp transactions require smart contract movements, so users need additional PI for gas fees.

The app also lets users mine PI tokens without needing expensive hardware devices, unlike Bitcoin and other proof-of-work (PoW) blockchains. The mining process does not strain the phone’s battery either – a common issue found with competitor projects. Users log into the app daily to accumulate mining rewards, and the tokens can be sold on exchanges right away.

Community

Pi Network has built a substantial community since it launched in 2019. The app boasts over 60 million “Pioneers”, users who have mined PI at least once.

The ecosystem also contains “Contributors”, which form security circles with at least three other users. This status earns participants mining bonuses of up to 100%. There are also “Ambassadors”, who earn additional rewards when they refer new users to the network. “Nodes” are the fourth tier – they validate blocks on Pi Network’s native desktop software.

Pi Network also has an impressive social media community, including over 4.3 million followers on X and 3.3 million on Telegram.

Why Buy PI: Is it a Good Investment

Consider these factors when exploring how to buy Pi Network.

Innovative Technology

As one of the best altcoins to buy, Pi Network has strong technological fundamentals. The project offers a native layer-1 blockchain with superior performance metrics – it’s highly scalable, transactions take just five seconds to validate, and network fees cost under a cent. These factors make Pi Network ideal for cross-border payments, including micro transactions.

Pi Network also offers a unique mining mechanism that revolutionizes the concept of legacy blockchains like Bitcoin and Bitcoin Cash. These PoW platforms require miners to purchase application-specific integrated circuits (ASICs) to be competitive, and this hardware costs a fortune and is very expensive to run.

Pi Network, on the other hand, allows its community to earn mining rewards with a basic smartphone. The mining app is free to use and doesn’t put a strain on the device. This makes Pi Network an inclusive blockchain project that’s accessible globally.

Mobile-Based dApps

Decentralized applications (dApps) are commonplace in crypto, popular on chains like Ethereum, Solana, Avalanche, and other top ecosystems. The Pi Network project does, however, stand out for its mobile-first ethos, as dApps operate within the Pi Network app. This strategy means that Pi Network has access to over 4.8 billion smartphone users globally, a significant market compared to the desktop space.

Mobile dApps are simpler to use, too, as they allow access from anywhere at the tap of a button, assuming a stable internet connection. dApps rely on smart contract execution, which requires PI tokens for network fees. This system creates a rising demand for PI, as more people need tokens as the dApp ecosystem grows.

Post-Airdrop Dip

The Pi Network price has experienced extreme price volatility since the airdrop distribution and TGE. While PI initially recovered after the airdrop dump, the token trades almost 60% below its original listing price and 75% below the all-time high of $2.98.

According to some analysts, these market dynamics offer a favorable entry point for new investors – those buying PI at current prices can secure a significant discount, and wait as the project’s strong fundamentals could result in another Pi Network price rally.

Holding Pi Network Coin in a Wallet

Pi Network has its own token standard, so wallet support isn’t as wide as that of Ethereum, Solana, and other established blockchains.

Most users store their tokens in the Pi Network app, which doubles as the official ecosystem wallet. The app also enables users to send and receive PI without dependence on centralized intermediaries. However, the Pi Network app has a major drawback – it doesn’t support other cryptocurrencies. This means you’d need to manage multiple wallets to manage diversified funds, rather than store all of your investments in one place.

Another option is using a third-party wallet provider that supports Pi Network and other network standards. Trust Wallet is a top choice for mobile-centric users, as it’s available on iOS and Android and supports over 100 blockchains. Alternatively, Atomic Wallet is a popular option for managing cryptocurrencies on a desktop device. It offers native software for Windows and Mac, plus a browser extension for Chrome.

Although Trust Wallet and Atomic Wallet offer several security features, blockchain experts explain that hardware wallets are a better option when storing sizable amounts of PI. Hardware wallets, which typically start from $50, depending on the model, store cryptocurrencies offline. The device does not connect to live servers, so users are protected from internet threats like remote hacks and viruses.

Pi Network Price Prediction 2025–2030

Read on to discover Pi Network’s price prediction and potential in the short and long term.

PI Price Prediction 2025

The PI price saw extreme volatility upon entering the market, when a large number of tokens was sold at the TGE. Exchange data on the price action shows that the token price dropped from $1.85 to as low as $0.64 on the first day of trading, yet it recovered six days later.

PI reached an all-time high of $2.98 on February 26th, 2025, after which the token entered a downward trend throughout the next month, hitting an all-time low of $0.40 on April 5th. PI has since recovered to $0.84, a small fraction of its peak valuation, but current Pi Network sentiment is positive and may indicate further gains.

Pi Network Price Chart

(PI)Pi Network (PI)

According to analysts, PI could return to its $2.98 high in Q2 2025, especially if Bitcoin holds above the $100,000 level. The token may experience further growth in the second half of 2025, as some commentators predict that Bitcoin will hit $250,000 by the year’s end. This outcome would value Bitcoin at almost $5 trillion and potentially trigger an extended altcoin season, benefitting coins like PI.

As a utility-driven project with solid fundamentals, the PI token price could close 2025 at $4.57. This bullish Pi Network price prediction reflects a $33 billion Pi Network market cap.

PI Price Prediction 2026

Some analysts believe that the crypto ecosystem will cool off in 2026, citing previous market peaks from late 2021 and 2017. This investment thesis relies on Bitcoin’s four-year cycle, which starts with the halving event and ends at the altcoin season’s peak.

The opposite viewpoint is that historical cycles are no longer valid. It’s not just retail clients that buy and sell cryptocurrencies anymore – the world’s largest institutions are investing substantial sums into digital assets. The U.S. administration has hinted at a strategic crypto reserve, so there’s buying pressure at a government level, too.

These market trends indicate that Bitcoin and altcoin valuations may reach new heights in 2026, with our Pi Network price prediction indicating the price of $9.59 in Q4 2026.

PI Price Prediction 2030

Long-term forecast for PI sees the price increase drastically, with PI experiencing more price action and capturing a large market capitalization. Investors may experience the full growth cycle by holding PI until the end of the decade. Five years have passed since the mainnet launch, giving the core team ample time to grow its ecosystem, including its suite of dApps. The key metric is real-world adoption, as Pi Network requires growing daily active users and total value locked (TVL).

In the broader sector, the Web 3.0 era could be in full force, with crypto ownership the new norm and a significant transition to DeFi services like loans, peer-to-peer yields, liquid staking, and asset tokenization. Pi Network supports these high-growth markets, paving its way to becoming a major player in the wider dApp market.

Bitcoin could also reach the $1 million level by 2030, making it one of the most valuable stores of value globally. This forecast would provide altcoin markets with unprecedented liquidity and drive more crypto-centric ETFs for Wall Street. These metrics may enable the PI price to hit $32.60 in 2030, a Pi Network price prediction that results in a nearly 40-fold increase compared to the current price.

Potential Highs & Lows of PI

The table below summarizes our PI price predictions from 2025 to 2030:

| Year | Potential Low | Potential High |

| 2025 | $0.40 | $4.57 |

| 2026 | $3.78 | $9.59 |

| 2030 | $21.84 | $32.60 |

What Influences the Price of Pi Network?

Like all cryptocurrencies, PI faces volatility and uncertain market dynamics. Nevertheless, there are a number of key forces that drive the Pi Network price and can inform your investment decisions:

- Token Unlocks: The core team holds 20% of the total PI supply – these tokens unlock gradually over the next few years. Each unlock dilutes existing token holders and may impact the PI price temporarily.

- Ecosystem Adoption: Pi Network will succeed or fail depending on its ecosystem activity and growth. The blockchain has over 65 million app users in 2025, although most participate in the mining program exclusively. The project also requires a growing dApp suite and rising transaction activity.

- Tier-One Exchange Listings: The team has secured notable exchange listings, including MEXC, OKX, and Gate.io. Listings with tier-one platforms like Binance, Kraken, and Coinbase will help PI reach its true potential, since these exchanges have deep liquidity and institutional-grade trading volumes.

- Market Cycles: Pi Network, like most altcoins, relies on a strong Bitcoin price to produce extended gains. While Bitcoin rose by just 1.25% in the past 24 hours, PI increased by 12% over the same period. This data shows that PI vastly outperforms the market leader when sentiment is high.

- Ad Revenue: The project’s advertising program enables enterprises to market their products and services on Pi Network’s app. The program could generate considerable revenues when you factor in the app’s 65 million users. That revenue can be reinjected back into the PI ecosystem, helping the team onboard users, developers, and strategic partners.

Conclusion: Should You Buy PI?

Pi Network’s long-awaited airdrop went live in February 2025, over five years after the project launched. After early volatility, PI tokens have since stabilized, thanks to Pi Network’s strong fundamentals, including access to an innovative blockchain ecosystem that supports mobile mining, Web 3.0 dApps, and transaction speeds of sub-five seconds.

Investors who want to capitalize on the market dip can safely buy PI on MEXC. The exchange offers anonymous accounts and commissions that start at 0%. MEXC users can deposit funds with traditional money, and the platform has verified proof-of-reserves. Before making an investment decision, always do your own research and don’t trust any investment advice or price prediction at face value.

FAQs

Where to buy Pi Network coin?

How much is 1000 PI in dollars?

How to convert PI into money?

Will Pi Network be listed on Coinbase?

Does PI have a future?

Will Pi Network reach $10?

References

- Pi Network whitepaper (Pi Network)

- Five types of attacks on hardware crypto wallets (Kaspersky)

- Bitcoin retakes $100,000 amid an easing of global trade tensions (Bloomberg)

- Bitcoin to hit $250,000 this year and Magnificent 7 to adopt stablecoins, Cardano founder predicts (CNBC)

- How ETFs and institutions are driving the surge in Bitcoin prices (Reuters)

- Will Bitcoin reach $1 million? BTC miner CEO shares ambitious 2030 prediction (Finance Magnates)