Proof of Work (PoW) remains a cornerstone of the crypto space due to its unparalleled security. The PoW consensus mechanism secures a blockchain network by requiring miners to validate transactions and solve complex mathematical puzzles to create new blocks in the chain. This process is energy-intensive but provides higher security combined with decentralization. In this guide, we’ll explore the best proof-of-work coins to understand what sets them apart.

More than a decade after its launch, Bitcoin remains the most trusted blockchain network, thanks to its time-tested proof of work. This is why investors still choose Bitcoin over other crypto assets. However, several other PoW coins offer similar security protocols, making them worth a closer look.

Top PoW Cryptocurrencies by Market Cap

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$105,371.00 | 0.16% | $2,093,679,084,492 | $28,123,653,123 |

$103,977.00

―

$106,443.00

|

| 2 |

|

$0.20 | 2.11% | $29,337,074,572 | $1,106,013,958 |

$0.19

―

$0.20

|

| 3 |

|

$404.63 | -0.02% | $8,042,926,522 | $128,304,874 |

$398.42

―

$406.45

|

| 4 |

|

$89.69 | 1.69% | $6,807,273,033 | $320,913,566 |

$87.90

―

$90.53

|

| 5 |

|

$364.65 | 5.42% | $6,719,203,857 | $112,590,816 |

$343.22

―

$367.40

|

| 6 |

|

$17.61 | 3.70% | $2,678,990,921 | $46,956,734 |

$16.82

―

$17.72

|

| 7 |

|

$0.09 | 3.53% | $2,369,612,858 | $64,891,583 |

$0.08

―

$0.09

|

| 8 |

|

$54.16 | 3.41% | $868,326,336 | $81,987,242 |

$52.37

―

$55.26

|

| 9 |

|

$34.24 | 2.48% | $680,553,618 | $18,292,420 |

$32.98

―

$34.37

|

| 10 |

|

$0.06 | -2.37% | $448,208,430 | $2,423,929 |

$0.06

―

$0.06

|

| 11 |

|

$0.08 | 2.68% | $401,942,568 | $23,258,475 |

$0.07

―

$0.08

|

| 12 |

|

$36.54 | 2.16% | $401,295,811 | $227,420 |

$35.77

―

$36.67

|

| 13 |

|

$22.43 | 2.41% | $275,523,129 | $30,584,183 |

$21.72

―

$22.58

|

| 14 |

|

$15.67 | 0.86% | $263,649,318 | $3,735,631 |

$15.53

―

$16.05

|

| 15 |

|

$0.0043 | -1.60% | $201,241,860 | $29,867,111 |

$0.0041

―

$0.0045

|

Bitcoin

BTCDogecoin

DOGEBitcoin Cash

BCHLitecoin

LTCMonero

XMREthereum Classic

ETCKaspa

KASZcash

ZECBitcoin SV

BSVBeldex

BDXConflux

CFXMimbleWimbleCoin

MWCDash

DASHDecred

DCRNervos Network

CKBBest Proof of Work Cryptocurrencies

1. Bitcoin ($BTC)

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, pioneered the proof-of-work cryptocurrency space, borrowing the PoW concept from Hashcash, a protocol to reduce email spam. As the first decentralized digital currency, Bitcoin benefits from both name recognition and the largest decentralized mining network. This network effect that aids adoption is reflected in Bitcoin’s market capitalization, which rivals the GDP of large countries like Mexico.

The PoW consensus mechanism used by Bitcoin relies on the SHA-256 hashing algorithm, which requires significant computational power to solve. This energy-intensive process makes it extremely difficult for an attacker to control more than half of the network’s mining power, a scenario known as a 51% attack. In a 51% attack, an attacker would need to control a majority of the network’s mining power to manipulate transactions and compromise the integrity of the blockchain. However, the sheer amount of computing power required to launch such an attack makes it highly unlikely.

Bitcoin Price Chart

(BTC)From another perspective, this mining power has an enormous cost. Any attempt to rewrite Bitcoin’s ledger would be cost-prohibitive. However, that same mining power directed at securing the network would likely be profitable, creating a strong incentive to secure the network rather than attack it.

Although launched as a peer-to-peer electronic cash system, as described in the Bitcoin whitepaper, Bitcoin’s role has evolved. Many now see Bitcoin as a store of value, a type of digital gold, juxtaposed against a world of inflationary fiat currencies.

Bitcoin’s fixed maximum supply of 21 million bitcoins, combined with a decentralized network of miners, makes it a haven for those looking to preserve value using a permissionless network.

Find out more about Bitcoin

2. Dogecoin ($DOGE)

Launched in 2013 by Jackson Palmer and Billy Markus, Dogecoin was created as a tongue-in-cheek alternative to Bitcoin. The now-famous dog-themed coin poked a bit of fun at the crypto market and became a huge hit. Dogecoin still enjoys an energized worldwide community.

Dogecoin is a fork of Luckycoin, which was itself a fork of Litecoin—another proof-of-work coin that we’ll cover in more detail in the next section. Dogecoin’s distinctions from Bitcoin are notable, with a total supply of 148 billion dogecoins versus Bitcoin’s fixed maximum supply of 21 million bitcoins.

Dogecoin Price Chart

(DOGE)Additionally, Dogecoin’s block times are faster, with a new block being mined every 1 minute, compared to Bitcoin’s 10 minutes. The faster block times, combined with ultra-low transaction fees, made Dogecoin a popular crypto for tipping and microtransactions.

However, Dogecoin departs from Bitcoin’s store-of-value role due to Dogecoin’s inflationary design. The protocol adds new coins to the supply with each mined block, with no maximum cap on supply. This issuance of new coins is fixed at 10,000 DOGE per block, which means that the inflation rate decreases over time as the total supply grows.

Dogecoin also uses a mining algorithm known as Scrypt, which is similar to Litecoin’s algorithm. This makes it more resistant to specialized mining hardware and allows for greater decentralization by making Dogecoin mining more accessible.

Find out more about Dogecoin

3. Litecoin ($LTC)

Launched in 2011 by Charlie Lee, a former Google engineer, Litecoin was designed to be a faster and more lightweight alternative to Bitcoin. Lee created Litecoin as a response to the growing centralization of Bitcoin mining, with the goal of making it more accessible to individual miners.

Litecoin’s distinctions from Bitcoin are notable, although several of the key distinctions center on the number four. Litecoin’s total supply of 84 million coins is four times Bitcoin’s 21 million. Similarly, block times are four times faster, with the Litecoin network mining a new block every 2.5 minutes compared to Bitcoin’s 10-minute average block time.

Litecoin Price Chart

(LTC)Litecoin (LTC)

Another key difference between Litecoin and Bitcoin centers on their halving schedules. A halving is an event where the reward for mining a block is cut in half for future blocks, which helps to control the supply of new coins and reduce the rate of inflation.

Litecoin’s halving schedule is similar to Bitcoin’s, occurring every 4 years but every 840,000 blocks. By contrast, Bitcoin’s halvings occur every 210,000 blocks. We’ll discuss the details of halving events and their impact on cryptocurrency markets later in this guide.

Often referred to as “silver to Bitcoin’s gold,” Litecoin has established itself as a reliable and widely accepted cryptocurrency in its own right. Faster transaction processing times, lower transaction fees, and a proven history make Litecoin one of the leading proof-of-work coins.

Find out more about Litecoin

4. Monero ($MNR)

Monero launched in 2014 as a proof-of-work coin focused on privacy and anonymity. Its blockchain makes it difficult to trace the origin and destination of transactions. This is achieved through Monero’s CryptoNote architecture, including ring signatures, which provide a way of verifying transactions without revealing the sender’s identity.

Think of it like a group of people signing a document together – it’s impossible to tell who actually signed it. This makes it extremely difficult for anyone to track Monero transactions or identify the people involved.

Monero uses the RandomX mining algorithm, which is designed to be resistant to Application-Specific Integrated Circuits (ASICs) mining. This CPU-optimized mining algorithm allows for greater decentralization by making mining accessible to anyone with a modern CPU and enough RAM. By contrast, mining for other proof-of-work coins like Bitcoin is dominated by costly specialized mining equipment.

Monero Price Chart

(XMR)Monero (XMR)

Unlike Dogecoin, which has a fixed issuance of 10,000 DOGE per block, Monero’s block reward decreases over time, with the reward being halved every 4 years. However, the reward never actually reaches zero, and instead bottoms out at a minimum of 0.6 XMR per block. This ongoing emission of new XMR ensures that miners will always have some incentive to secure the network and helps to maintain a consistent and predictable level of inflation over time.

Although competing proof-of-work coins used pseudonymous wallet addresses as identities on the network, associating a real-world identity with a wallet address is often still possible. Monero obscures the sender, receiver, and the transaction amount, making it a popular choice amongst privacy advocates.

Find out more about Monero

5. Kaspa ($KAS)

Kaspa launched in 2021, following Bitcoin’s fair-launch principles. However, Kaspa’s architecture makes it more scalable and energy-efficient than traditional proof-of-work coins.

Kaspa’s blockchain uses a BlockDAG (Directed Acyclic Graph) architecture, which allows for multiple blocks to be created in parallel, enabling faster block times and increased transaction throughput. Rather than using a sequential blockchain, like Bitcoin and most other proof-of-work coins, Kaspa stores its transactions on a network of linked blocks. Kaspa’s PHANTOM GHOSTDAG consensus mechanism allows the network to process blocks in parallel, boosting throughput.

Kaspa Price Chart

(KAS)Kaspa (KAS)

Although Kaspa’s mining algorithm, kHeavyHash, was initially designed to be ASIC-resistant, the industry has since developed specialized ASIC hardware tailored to the kHeavyHash algorithm. As a result, Kaspa mining is now heavily dominated by ASICs, which have a significant performance advantage over general-purpose hardware like GPUs or CPUs.

In addition to its significant architectural differences from other proof-of-work coins, the Kaspa network also differs in its long-term roadmap. Most PoW projects focus on simpler peer-to-peer payment mechanics. Kaspa includes smart contract support in its roadmap, with support for tokens and decentralized finance (DeFi) applications. Historically, smart contracts have been limited to proof-of-stake networks. Kaspa promises to bring greater functionality bolstered by PoW’s higher security.

Although younger than more established proof-of-work coins, Kaspa has garnered considerable interest in the crypto space, reaching as high as $5 billion in market cap. One-second block times and low transaction fees make Kaspa well-suited for peer-to-peer payments, while upcoming smart contract functionality opens the door to a much larger use case.

Find out more about Kaspa

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

What Is Proof of Work and Why Does It Matter?

Proof of work (PoW) is a consensus mechanism used by many cryptocurrencies to secure their networks and verify transactions. In PoW chains, miners compete to solve complex mathematical puzzles to validate transactions and create new blocks. Each block holds transactions, and the mining process validates these transactions.

Under the hood, PoW chains used hashes (encrypted values) to represent transactions.

- Input: Alice sent Bob 1 bitcoin.

- SHA-256 Output: 96f9ee71f141565b9e015db74759cd1a59b486c2df91e213b71dd911b5d70d0f

Each transaction becomes part of a larger puzzle as miners hash these individual transactions in pairs until there is one hash for the entire block.

But why do miners need to solve puzzles? These puzzles are designed to be so computationally intensive that they require significant energy and resources to solve. This makes it extremely difficult – and prohibitively expensive – for a single entity to manipulate the blockchain. To do so, they would need to control a majority of the network’s mining power.

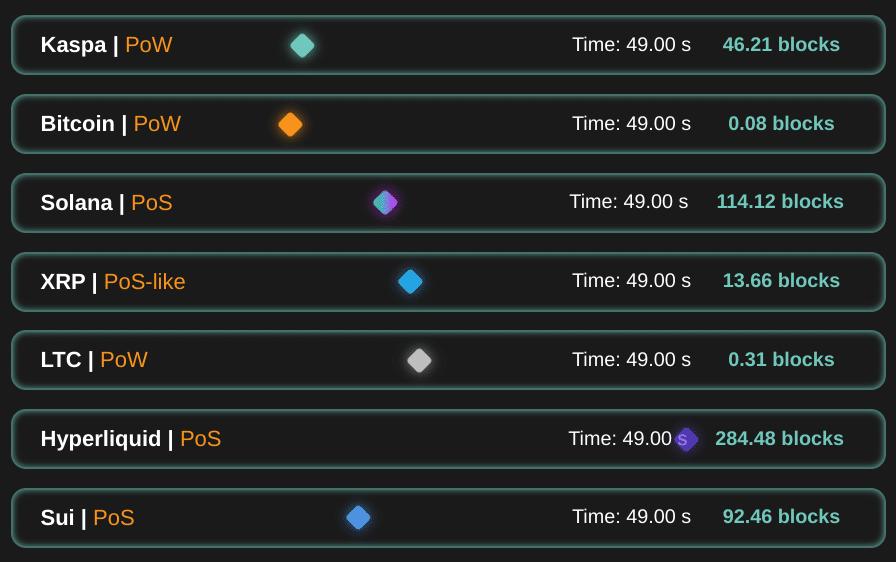

Proof of Work vs Proof of Stake

In contrast to Proof of Stake (PoS), where validators are chosen to create new blocks based on the amount of cryptocurrency they hold, PoW relies on computing power. The energy cost of mining creates a disincentive to fraud.

Other consensus mechanisms, such as Delegated Proof of Stake (DPoS) and Proof of Authority (PoA), also differ significantly from PoW. While PoS and its variants offer advantages in terms of energy efficiency and scalability, PoW security keeps Bitcoin and similar projects in high demand.

Bitcoin shines in the headlines, but several other proof-of-work coins offer similar characteristics, some of which borrowed from Bitcoin’s tech. Collectively, these crypto projects represent the best proof-of-work coins, yet each serves a distinct market within the crypto world.

Proof of Work Basics

The “work” in PoW is the massive computational power required to mine a block. PoW ensures that the network is secure, decentralized, and resistant to attacks.

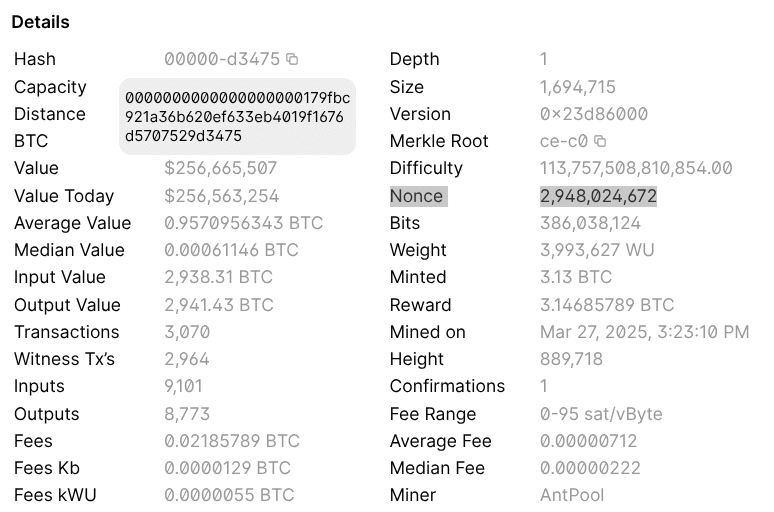

However, the “proof” in proof of work centers on a nonce (a number used only once). Miners hash the block header, which involves three components.

- Metadata about the block, including a hash of the previous block

- A summary of transactions in the block

- The nonce

Transactions may differ, depending on which ones a miner includes. However, the real variable is the nonce. Miners increment the nonce, creating millions of hashes, until a miner on the network successfully mines a block.

The Bitcoin block shown below highlights the block’s hash as well as the nonce.

Above the nonce, you’ll see the difficulty level assigned to the block. PoW protocols like Bitcoin adjust the difficulty to maintain a targeted average block time. Next, we’ll discuss how this process works and how mining rewards are adjusted over time.

Mining Difficulty and Rewards

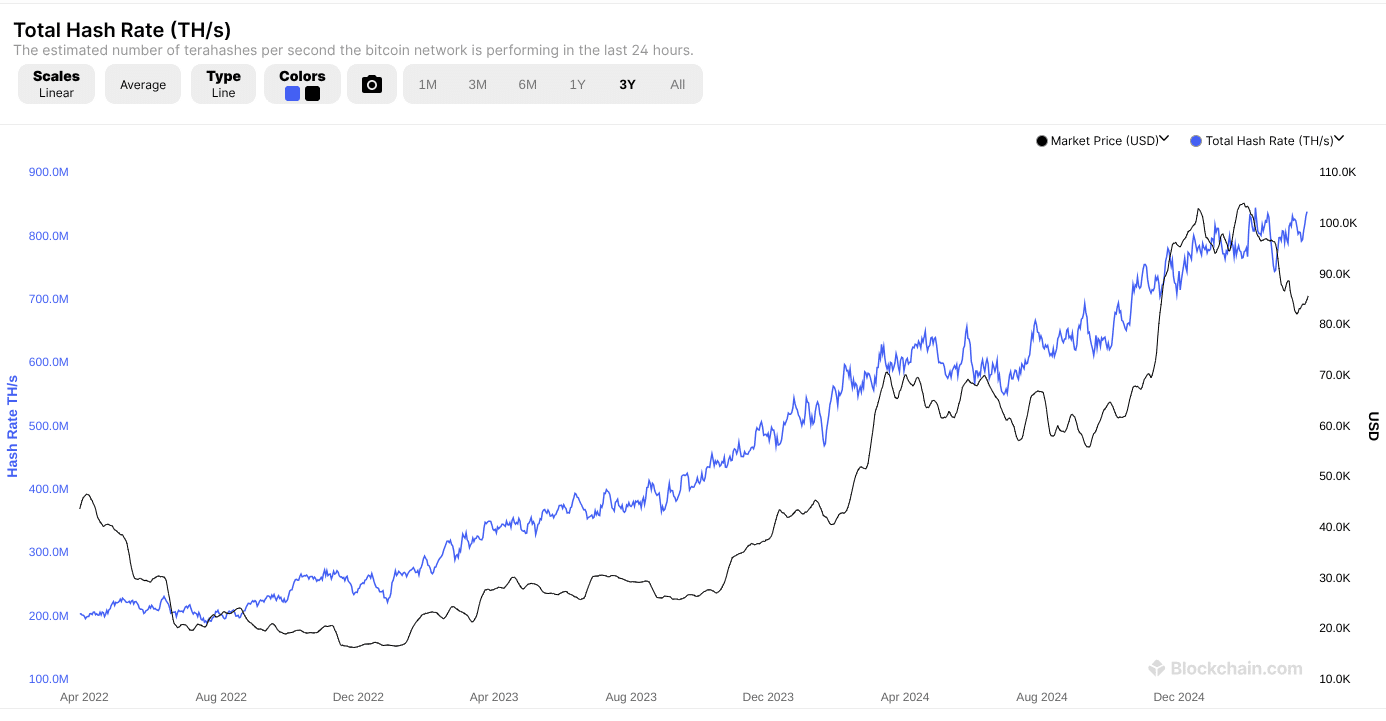

Some describe Bitcoin as a timekeeper, and many other PoW chains follow similar strategies to produce a new block at a targeted frequency. For Bitcoin, this block time is 10 minutes (on average). The Bitcoin network adjusts the difficulty every 2,016 blocks (about 2 weeks) based on the amount of hash power (computational power) on the network. A decline in hash power results in a lower difficulty, and vice versa.

In addition to adjusting the mining difficulty, the reward for mining a block is also adjusted over time. For example, the Bitcoin block subsidy (new bitcoins created) is currently set at 3.125 BTC per block, but it is halved every 210,000 blocks, or approximately every four years. This shrinking block subsidy also slows down the rate at which new coins are created, controlling inflation.

In addition to the block subsidy, miners earn transaction fees from the transactions in the blocks they mine, creating an ongoing incentive to secure the network.

Bitcoin and other proof-of-work coins are designed to adapt to changes in network hash power due to mining power costs, equipment, or the market value of mining rewards.

In recent years, Bitcoin hash rates follow a similar trendline to Bitcoin’s market price, as seen below.

Advantages of Proof-of-Work Coins

Proof-of-work coins offer some key advantages over competing consensus mechanisms, such as proof of stake or proof of authority. Although alternatives are cheaper, faster, or less energy-intensive, the top cryptocurrency is still a PoW coin (Bitcoin).

The primary benefits of PoW coins center on their security and decentralization. The PoW consensus mechanism provides a higher level of security, with an attacker needing to control 51% of the network’s computational power to manipulate the ledger. By comparison, some proof-of-stake networks can be compromised if a single entity or group controls more than 33.3% of staked value.

The decentralization of PoW coins also brings a major advantage. A global network of miners, rather than a central authority, makes PoW more resistant to censorship and control. By contrast, XRP, another early crypto project, uses “trusted validators,” with Ripple Labs largely controlling the selection of these validators. Similarly, BNB Smart Chain combines proof of stake with proof of authority, leaving consensus for the chain with just 21 validators.

Bitcoin, Dogecoin, and similar PoW chains allow anyone to participate in the mining process. This makes PoW coins an attractive option for those who value their freedom and autonomy.

Several of the best proof-of-work coins boast well over a decade of history. This track record of reliability and consistency has helped establish trust and confidence in the PoW consensus mechanism and paved the way for the development of the next generation of PoW coins.

Latest Bitcoin News

How to Buy and Mine Proof-of-Work Coins

To invest in proof-of-work coins, you have two main choices: buying or mining. We’ll discuss mining shortly. First, explore the two primary ways to buy, starting with the most beginner-friendly option.

- Centralized exchanges like Binance, Coinbase, and Kraken allow you to buy cryptocurrencies using a debit card or by linking a bank account. Most crypto exchanges provide a simple interface to buy in a few clicks or an advanced platform with lower trading fees.

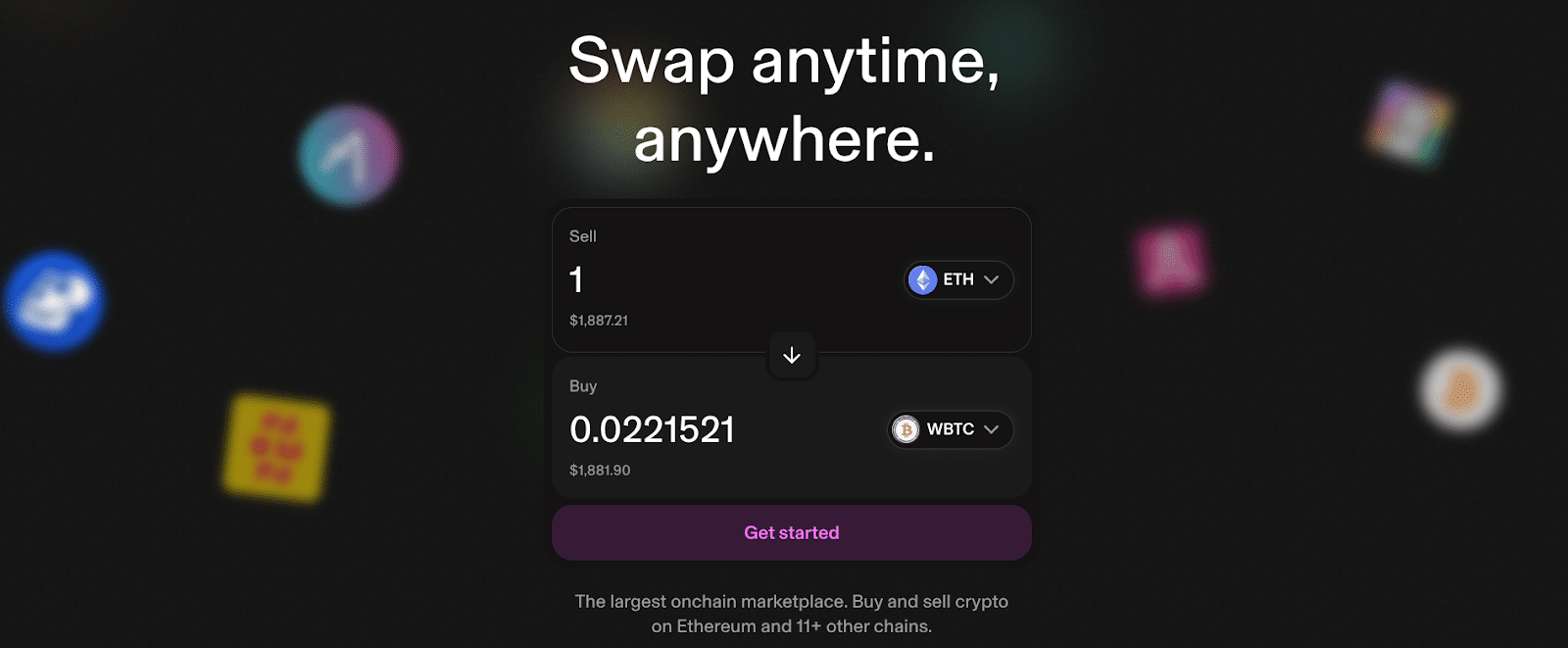

- Decentralized exchanges offer another method of buying. However, you’ll need to purchase some crypto to swap for other assets. When using a decentralized exchange, such as Uniswap, you’re swapping a token like USDC or ETH for a wrapped version of a PoW coin, such as WBTC (Wrapped Bitcoin).

These wrapped tokens typically trade at the same price as the underlying asset. However, when using a decentralized exchange, research the token before making a swap to confirm sufficient liquidity. Also, verify the correct contract address for the token.

How to Start Mining PoW Coins

PoW coins also offer a unique opportunity to mine coins rather than buy them. However, the type of hardware you have available or are willing to buy determines which type of crypto you can mine.

For example, if you have a computer with a modern CPU and 8GB of RAM, you can mine Monero using a mining pool. In this example, you’ll earn a share of the mining rewards proportional to your hash rate.

However, you’ll likely need specialized hardware to mine Bitcoin, Litecoin, Dogecoin, or Kaspa. All of these coins are now dominated by ASIC mining. Another group of proof-of-work coins, including Ethereum Classic and Ravencoin, can be mined with a modern GPU.

Specialized hardware can add hundreds or even thousands to the cost of a mining rig, but there are other considerations as well. Electricity becomes an ongoing cost. Additionally, mining creates a lot of heat (and noise). Often, it’s more practical to start with CPU mineable coins. If you think mining is a fit for you, then you can do the research and invest in specialized mining hardware.

Mining pools are almost always the most practical choice over solo mining, the latter of which may never provide any mining income at all. Many pools provide stats for given hardware configurations to help you determine profitability. However, due to crypto’s volatility, you may have to hold the coins you mine until prices rise to realize a profit.

What Will PoW Mining Look Like in the Future?

The future of PoW mining is uncertain, but several factors will likely impact the industry. Halving events will continue to reduce the block reward for many PoW coins. As adoption grows and as prices rise, difficulty levels may also increase. Energy costs are likely to increase as well.

However, the mining industry has already begun adapting to a changing landscape. By some estimates, more than half of all Bitcoin mining now uses sustainable energy sources. The industry has also found ways to use stranded energy that is impractical to transfer, putting it to use in crypto mining. While headlines often compare global Bitcoin energy usage to that of entire nations, a measured analysis finds that Bitcoin is more environmentally friendly than headlines suggest.

Expect to see more innovation, both in sourcing sustainable energy and in improved mining efficiency through hardware or algorithm improvements. However, by definition, PoW will always require much more energy than competing consensus mechanisms like proof of stake.

Risks of Investing in PoW Coins

Proof-of-work coins offer a unique set of benefits, including security and decentralization. However, investing in PoW coins also comes with several risks specific to this sector of the market. Environmental impacts lead the list despite the steps the mining industry has already taken to prioritize sustainable energy sources.

Regulatory Concerns About PoW

Regulatory uncertainty still clouds markets. Governments around the world have scrutinized the cryptocurrency industry, with some implementing bans or restrictions on PoW mining. For example, China has banned crypto mining, citing concerns over energy consumption and environmental impact. However, despite the ban, China still generates as much as half of Bitcoin’s total hash rate.

Although regulatory uncertainty weighs on the entire crypto industry, PoW coins, and Bitcoin specifically, often become the center of attention when the topic turns to energy usage and environmental concerns. In the US, individual states, including New York, have placed moratoriums on crypto mining powered by fossil fuels. Notably, some blockchain projects have already moved to more energy-efficient consensus mechanisms.

Security and Network Risks

In addition to regulatory risks, PoW coins also pose security and network risks. One of the most significant risks is a 51% attack, which occurs when a group of miners controls more than half of the network’s mining power. This can allow attackers to manipulate the blockchain, with the most common result being double-spending.

Although Bitcoin’s current hash rate makes it prohibitively expensive to attack the network, smaller crypto projects have suffered 51% attacks, including Ethereum Classic, which was attacked multiple times in 2020. Security and decentralization remain PoW’s main selling points. However, for smaller projects, both of these are uncertain.

When a small group of miners controls a large portion of the network’s mining power, it can lead to centralization and reduce the network’s security. This can make it easier for attackers to launch a 51% attack or manipulate the blockchain in other ways.

Former PoW Coins That Switched to PoS

The proof-of-work consensus mechanism became a cornerstone of the cryptocurrency industry with launch of Bitcoin. Litecoin, Dogecoin, and even Ethereum followed the PoW path forged by Bitcoin. However, in recent years, some projects have begun to transition away from PoW in favor of alternative consensus mechanisms, such as proof of stake, or even hybrid strategies designed to reduce energy usage or improve scalability.

One of the most notable examples of a project transitioning away from PoW is Ethereum. In 2022, Ethereum, the second-largest cryptocurrency by market cap, completed a transition from PoW to PoS, which has improved the network’s energy efficiency dramatically, although the chain still struggles with scalability. By Ethereum’s estimates, the transition reduces Ethereum’s energy consumption by up to 99%. Notably, the Ethereum Classic chain, which forked from Ethereum in 2016, still uses PoW.

Zcash, a privacy-focused cryptocurrency, has also considered a future PoS migration. Zcash currently uses a hybrid PoW/PoS consensus mechanism, but ongoing discussions suggest a move to PoS is likely.

Similarly, Dash, on the other hand, also uses a hybrid approach to consensus. The Dash network uses a combination of PoW and PoS, which allows it to leverage the benefits of both mechanisms. The PoW component of the network is responsible for securing the blockchain and verifying transactions. However, miners are also subject to minimum holding requirements to ensure honest operation. This structure reduces the reliance on PoW and Dash’s energy requirements.

Should Investors Buy PoW Coins?

Which consensus method offers the best long-term solution and opportunity? For crypto investors, the answer depends on several factors, including risk tolerance, investment goals, and market analysis.

Both PoW and PoS models have their advantages and disadvantages. PoW coins, such as Bitcoin and Litecoin, have a proven track record of security and decentralization. However, they are often criticized for their energy inefficiency and scalability limitations.

On the other hand, PoS coins, such as Ethereum (post-Merge), offer improved energy efficiency but may compromise on security and decentralization. While Ethereum still struggles with scalability, the project is working toward solutions, and other PoS networks have proven that proof of stake can provide robust performance.

Comparing returns, PoW coins have historically performed well in bull markets, with Bitcoin being a prime example. Bitcoin has also proven more resilient in many cases, with Ethereum and other top proof-of-stake coins seeing deeper sell-offs during market turbulence.

Each approach offers its own value proposition. PoW promises higher security and more decentralization, although adoption remains critical to security. On the other hand, PoS dramatically reduces energy demands while delivering added functionality, such as smart contracts. The cost, however, becomes lower security. Many PoS networks can be manipulated if a single entity or group controls more than a third of the staked assets.

For many investors, the question of which type of crypto consensus to place bets on might be the wrong question to ask. Instead, the question might be how to allocate your portfolio between competing consensus strategies that ultimately provide different benefits. Knowing the risks and potential rewards of each is essential, but in the foreseeable future, both PoW and PoS will play a big role in crypto markets. A diversified approach removes the need to choose a winner. Perhaps both PoW and PoS will prevail.

Proof of Work FAQs

What are the best Proof-of-Work coins to invest in?

The best proof-of-work coins to invest in include established coins like Bitcoin, Litecoin, Dogecoin, and Monero. These coins have a strong track record of security, decentralization, and market demand. Newer options, such as Kaspa, deserve consideration as well.

Why is Bitcoin still Proof-of-Work?

Bitcoin still uses proof of work because it has a proven track record of security and decentralization. Additionally, a change to the Bitcoin protocol requires adoption by the mining node operators. Any attempt to switch to PoS would likely result in a fork in the chain, with the two chains diverging after the split.

How does mining work for PoW coins?

Mining for PoW coins involves solving complex mathematical puzzles to validate transactions and create new blocks. Miners compete to solve these puzzles, and the first miner to solve one adds a new block to the blockchain and receives a reward in the form of newly minted coins and/or network fees.

What is the most energy-efficient PoW cryptocurrency?

Kaspa is considered one of the most energy-efficient PoW cryptocurrencies due to its use of a novel consensus algorithm called GHOSTDAG. This algorithm allows for faster block times and increased transaction throughput while reducing energy consumption.

Can PoW coins be staked like PoS coins?

Generally, no. PoW coins cannot be staked like PoS coins. In PoS systems, validators 'stake' their own coins to participate in the validation process, whereas in PoW systems, miners compete to solve mathematical puzzles to validate transactions. However, some chains use a hybrid PoW/PoS consensus mechanism.

What are the risks of investing in PoW cryptocurrencies?

The risks of investing in PoW cryptocurrencies include market volatility, regulatory uncertainty, and potential 51% attacks. Additionally, the energy consumption required for mining can lead to environmental concerns and increased costs.

Are PoW coins more secure than PoS coins?

PoW coins are generally more secure than PoS coins due to their ability to resist 51% attacks and maintain decentralization. However, this increased security comes at the cost of increased energy consumption.

How do mining rewards change over time for PoW coins?

Mining rewards for PoW coins typically decrease over time as the block reward halves at regular intervals (e.g., every 4 years for Bitcoin). This reduction in reward helps to control inflation.

What are the best mining pools for PoW cryptocurrencies?

The best mining pools for PoW cryptocurrencies depend on various factors such as fees, payout structures, and pool size. Some popular mining pools include Braiins Pool, Antpool, and F2Pool.

Will Proof of Work become obsolete in the future?

It's unlikely that proof of work will become obsolete in the future. While alternative consensus mechanisms like proof of stake are gaining traction, PoW remains a widely used and trusted mechanism for securing cryptocurrency networks. Additionally, many experts believe that both PoW and PoS will coexist and play important roles in the cryptocurrency ecosystem.

References:

- Bitcoin homepage (Bitcoin.org)

- Dogecoin homepage (Dogecoin)

- Litecoin homepage (Litecon)

- Monero homepage (Monero)

- Kaspa TPS (Kaspa Speed)

- Kaspa homepage (Kaspa)

- Phantom Ghostdag, Kaspa whitepaper (Kaspa)

- Bitcoin hash rate (Blockchain.com)

- Survey confirms year on year in sustainable power mix (Bitcoin Mining Council)

- ABLs, Bitcoin Miners, and Monetizing Stranded Energy (Secure Finance Network)

- New York governor signs first-of-its-kind law cracking down on bitcoin mining (CNBC)

- Ethereum Classic Suffers Second 51% Attack in a Week (Nasdaq)