Ethereum is a decentralized, open-source blockchain platform that enables smart contracts and decentralized applications (dApps) to run without downtime, fraud, control, or interference from third parties. As the second-largest cryptocurrency by market cap after Bitcoin, with $305,820,492,542, Ethereum goes far beyond simple currency transactions.

As a platform, Ethereum allows developers to build and deploy code that executes exactly as programmed. This revolutionary approach has established Ethereum as the foundation for what many consider to be the future of the internet – Web3.

Key Takeaways

- Ethereum functions as a programmable blockchain platform, enabling thousands of decentralized applications through smart contracts.

- ETH is Ethereum’s native cryptocurrency, used to pay for transactions and computational services on the network via gas fees.

- Ethereum transitioned from Proof of Work to Proof of Stake (via “The Merge” in 2022), reducing energy use by 99.95% and allowing users to stake ETH to help secure the network and earn rewards.

How Was Ethereum Created?

Ethereum was created in 2013 by a young programmer named Vitalik Buterin. Buterin appreciated the innovation behind Bitcoin but saw limitations in its inability to support complex applications beyond simple monetary transactions.

In his own words, Buterin thought those in the Bitcoin community weren’t approaching the problem in the right way. He said: “I thought they were going after individual applications; they were trying to kind of explicitly support each [use case] in a sort of Swiss Army knife protocol.”

In late 2013, Buterin published a white paper describing a more versatile platform that could support any type of application through a general-purpose blockchain. This vision would eventually become Ethereum.

Buterin didn’t work alone. Several co-founders played crucial roles in Ethereum’s development:

- Gavin Wood: Authored the Ethereum Yellow Paper (technical specification) and created Solidity, Ethereum’s primary programming language.

- Charles Hoskinson: Helped establish the Swiss-based Ethereum Foundation and its legal framework before leaving to create Cardano.

- Joseph Lubin: Founded ConsenSys, a blockchain software company that has incubated many Ethereum-based projects.

- Anthony Di Iorio: Provided initial funding and business direction.

- Mihai Alisie: Co-founded Bitcoin Magazine with Buterin and helped establish the Ethereum Foundation.

Launch and Development

In July 2014, the Ethereum team launched a crowdfunding campaign to finance the project’s development. The campaign was remarkably successful, raising over $18 million by selling Ether (ETH) tokens to early supporters. This was one of the most successful crowdfunding efforts at that time.

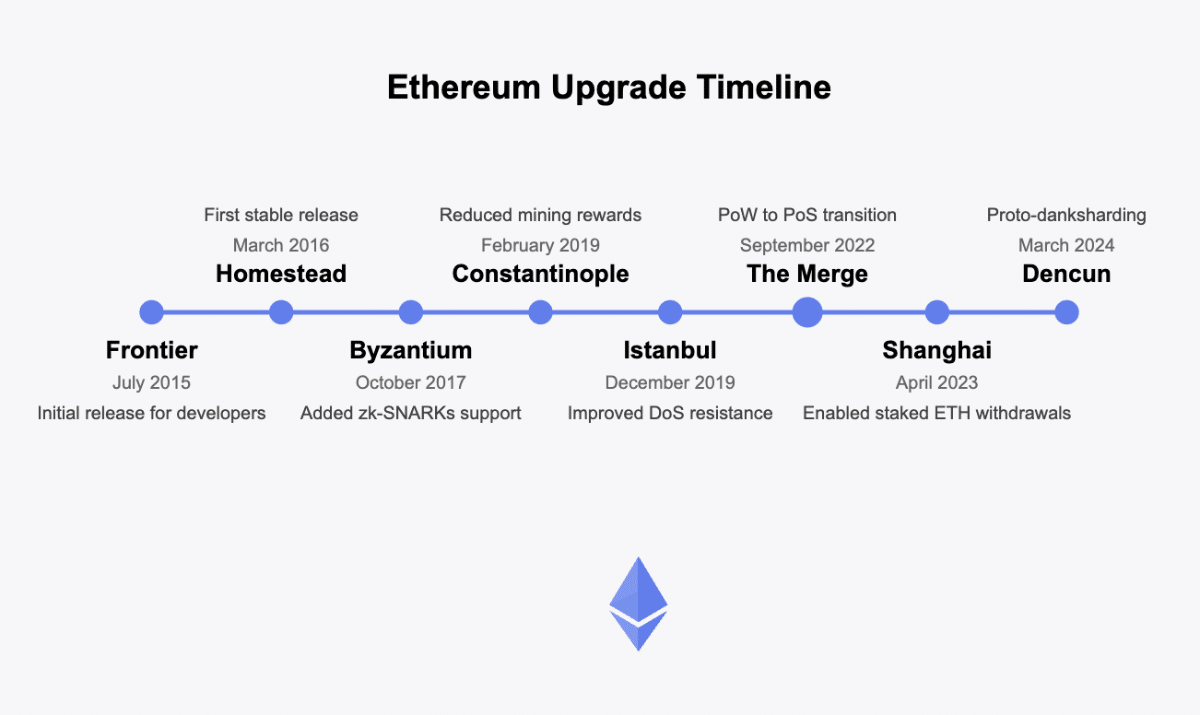

The first live release of Ethereum, known as “Frontier,” launched on July 30, 2015. This initial version targeted developers to start building on the platform. The network has since seen several upgrades:

- Homestead (March 2016): The first stable release.

- Metropolis: Byzantium (October 2017): Added zk-SNARKs support and other improvements.

- Metropolis: Constantinople (February 2019): Reduced mining rewards and optimized certain operations.

- Istanbul (December 2019): Improved denial-of-service attack resistance and adjusted gas costs.

- The Merge (September 2022): Transitioned from proof-of-work to proof-of-stake.

- Shanghai (April 2023): Enabled staked ETH withdrawals.

- Dencun (March 2024): Introduced proto-danksharding for improved scalability.

Understanding Ethereum’s Architecture

At the heart of Ethereum is the Ethereum Virtual Machine (EVM), a Turing-complete software environment that runs on thousands of connected computers worldwide. The EVM is considered a global, decentralized computer where anyone can execute code, given sufficient gas (transaction fees).

Here are the key characteristics of the EVM:

- Deterministic execution: The EVM will always produce identical outputs given the same input and state.

- Isolation: Smart contracts execute in a sandboxed environment, meaning they can’t access the host computer’s processes, filesystem, or network.

- Universal compatibility: The EVM operates consistently across all Ethereum nodes, ensuring uniformity in execution.

The EVM executes bytecode, which is compiled from higher-level programming languages like Solidity. This arrangement allows developers to write readable, maintainable code that transforms into instructions the EVM can process.

Smart Contracts

Smart contracts are self-executing agreements with the terms directly written into code. Once deployed on the Ethereum blockchain, these contracts automatically enforce and execute their conditions without requiring trust between parties or intermediaries like lawyers or notaries.

For example, a simple smart contract might say: “When Party A deposits 1 ETH into this contract, transfer Digital Asset X to Party A’s address.” This transaction happens automatically when the condition is met, with no possibility of fraud or manipulation.

Smart contracts have allowed a wide range of applications:

- Decentralized exchanges where users trade digital assets directly without centralized intermediaries

- Lending protocols where users can lend and borrow crypto assets based on collateral

- Insurance products that automatically pay out when verifiable conditions are met

- Digital identity systems that give users control over their personal information

- Supply chain tracking for increased transparency and authenticity verification

The power of smart contracts comes from their immutability and trustworthiness. Once deployed, they execute precisely as programmed, regardless of external factors.

Ether (ETH)

Ether (ETH) is Ethereum’s native cryptocurrency and has multiple purposes within the ecosystem:

| Gas fees | ETH is used to pay transaction fees (gas) for operations performed on the network. |

| Staking | After the transition to proof-of-stake, ETH holders can stake their tokens to help secure the network and earn rewards. |

| Store of value | Many investors hold ETH as a long-term investment, similar to Bitcoin. |

| Medium of exchange | ETH can be used to purchase goods, services, and other digital assets. |

Unlike Bitcoin’s fixed supply cap of 21 million coins, Ethereum doesn’t have a hard maximum on the total supply of ETH. However, the issuance rate has significantly decreased following the transition to proof-of-stake, with some ETH even being burned (removed from circulation) during high network activity.

As of April 2025, approximately 120 million ETH are in circulation, with the annual issuance rate at around 0.5-1% and decreasing significantly lower than most national currencies.

Ethereum’s Evolution: From Proof-of-Work to Proof-of-Stake

In this section, let’s discuss the steps Ethereum went through:

The Merge

On September 15, 2022, Ethereum completed its most significant upgrade to date: “The Merge.” This historic event transitioned Ethereum from an energy-intensive proof-of-work (PoW) consensus mechanism to a more sustainable proof-of-stake (PoS) system.

Under the previous PoW system, miners competed to solve complex mathematical puzzles, consuming vast amounts of electricity in the process, comparable to the energy usage of medium-sized countries. The shift to PoS fundamentally changed how the network validates transactions and creates new blocks:

- Validators replace miners: Instead of requiring powerful mining hardware, validators stake at least 32 ETH as collateral to participate in block validation.

- Energy efficiency: The transition reduced Ethereum’s energy consumption by an estimated 99.95%.

- Improved security: The economic cost of attacking the network increased substantially, as attackers would need to stake and potentially lose large amounts of ETH.

- Reduced issuance: The shift decreased the rate of new ETH creation by approximately 90%, contributing to a more sustainable economic model.

The Merge was the culmination of years of research and development and represented one of the most complex upgrades in blockchain history. At the same time, the network continued to operate without interruption.

Post-Merge Upgrades

Following The Merge, Ethereum’s development has continued with several major upgrades:

Shanghai Upgrade (April 2023)

The Shanghai upgrade (also known as Shapella) implemented the crucial functionality and allowed validators to withdraw their staked ETH, completing the final piece of the transition to proof-of-stake. This upgrade included:

- Staking withdrawals: Validators could finally access their staked ETH and rewards.

- Gas optimization: Several Ethereum Improvement Proposals (EIPs) that reduced the gas costs of certain operations.

Dencun Upgrade (March 2024)

The Dencun upgrade introduced proto-danksharding through EIP-4844, which improved Ethereum’s scalability, particularly for Layer 2 solutions. Key components included:

- Blob transactions: A new transaction type that stores data “blobs” (Binary Large Objects) separately from the execution layer.

- Reduced costs for rollups: Layer 2 solutions like Optimism and Arbitrum saw substantial reductions in their operating costs, which translated to lower user fees.

- Data availability improvements: Enhanced the network’s capacity to handle transaction data without congesting the main execution layer.

Pectra Upgrade

The Pectra upgrade aims to enhance validator operations and further improve network efficiency through:

- Improved proposer-builder separation: Streamlining block production mechanisms.

- Enhanced verification systems: Making the network more resistant to certain types of attacks.

- Optimizations for single-slot finality: Reducing confirmation times for transactions.

Ethereum’s Ecosystem

Decentralized Finance (DeFi) is one of Ethereum’s most transformative applications. DeFi refers to a set of financial services and products built on blockchain technology that aim to recreate and improve upon traditional financial systems without relying on centralized intermediaries like banks or brokerages.

As of 2025, the Ethereum DeFi ecosystem locks up over billions of dollars in value across various protocols, including:

Lending and Borrowing Platforms

Platforms like Aave, Compound, and MakerDAO allow users to:

- Lend their crypto assets to earn interest (often at rates significantly higher than traditional banks)

- Borrow against their crypto holdings by posting collateral

- Create decentralized stablecoins backed by crypto assets (like DAI)

For example, on Aave, you might deposit ETH as collateral and borrow USDC (a stablecoin) at a variable interest rate determined by supply and demand within the protocol. All of this happens without a bank or credit check—the smart contract enforces the terms automatically.

Decentralized Exchanges (DEXs)

DEXs like Uniswap, SushiSwap, and Curve enable tokens to be traded peer-to-peer without centralized intermediaries. These platforms use various mechanisms:

- Automated Market Makers (AMMs): Use liquidity pools instead of traditional order books

- Order book DEXs: Maintain a decentralized order book similar to traditional exchanges but without custodial control

- Aggregators: Search across multiple DEXs to find the best price for a given trade

Derivatives and Synthetic Assets

Protocols like Synthetix, dYdX, and GMX allow users to:

- Trade derivatives (futures, options, etc.)

- Create and trade synthetic assets that track the price of real-world assets (stocks, commodities, etc.)

- Access leveraged trading positions

These platforms expand access to financial instruments traditionally restricted to institutional investors or those in specific geographic regions.

The growth of DeFi has democratized access to financial services, though it comes with risks including smart contract vulnerabilities, impermanent loss for liquidity providers, and significant price volatility.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets on the blockchain. Unlike cryptocurrencies such as ETH, where each unit is identical to every other unit, NFTs have distinct characteristics that make each one unique and non-interchangeable.

The ERC-721 standard, introduced in 2018, established the foundation for NFTs on Ethereum. This was later supplemented by the ERC-1155 standard, which allows for more efficient creation of both fungible and non-fungible tokens in a single contract.

NFTs have created several groundbreaking use cases:

Digital Art and Collectibles

The most publicized application of NFTs has been in digital art and collectibles. CryptoPunks pioneered this space with 10,000 uniquely generated characters, becoming one of Ethereum’s first NFT collections. Bored Ape Yacht Club followed with character designs that double as membership to an exclusive community, while Art Blocks introduced generative art created by algorithms and stored on-chain.

These projects have seen individual pieces sell for millions of dollars, creating unprecedented economic opportunities for digital artists.

Gaming and Virtual Worlds

NFTs have revolutionized ownership in gaming by enabling true player ownership of in-game items, weapons, and skins that can be traded outside the game environment. Virtual land parcels in metaverse projects like Decentraland and The Sandbox now represent genuine digital real estate, while unique game characters with varying attributes function as valuable digital assets.

The play-to-earn model has created new economic opportunities for gamers, particularly in developing economies where players can earn meaningful income through gameplay.

Practical Applications

NFTs go beyond art and gaming with practical applications in everyday scenarios. They’re transforming event ticketing by reducing fraud and enabling programmable royalties on secondary sales. Services like Ethereum Name Service (ENS) use NFTs to provide human-readable blockchain addresses, simplifying transactions.

Perhaps most significantly, NFTs are beginning to represent ownership of physical items through real-world asset tokenization, from luxury goods to real estate, bridging the gap between digital and physical ownership.

The NFT market has experienced significant volatility, with trading volumes swinging from over $40 billion in 2021 to lower levels in subsequent years before stabilizing around $15-20 billion annually by 2025.

Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) are a new model for collective organization and governance, enabled by smart contracts on Ethereum. DAOs operate according to transparent rules encoded on the blockchain, with decisions made through community voting rather than centralized leadership.

By 2025, over 4,500 DAOs manage collective treasuries exceeding $20 billion, and they have various purposes:

Protocol Governance

Many DeFi protocols have transitioned governance to DAOs, where token holders vote on parameter adjustments, treasury management, and protocol upgrades. This approach ensures users have a direct say in the evolution of platforms they use.

Uniswap exemplifies this approach, allowing UNI token holders to propose and vote on changes to the protocol, including how trading fees are distributed.

Investment Collectives

Investment DAOs pool capital to invest in early-stage crypto projects, purchase high-value NFTs, and fund public goods and infrastructure. These collectives enable individuals to gain exposure to opportunities typically reserved for venture capital firms, while spreading risk across the collective and leveraging community expertise for investment decisions.

Notable examples include Flamingo DAO, which focuses on NFT investments, and MetaCartel Ventures, which invests in Ethereum projects.

Social and Creative Organizations

DAOs have emerged around social and creative endeavors, funding music and art projects, supporting content creators, and coordinating community-owned media. These organizations create new economic models for cultural production and allow creators to engage directly with their communities while giving supporters genuine ownership stakes in cultural projects they value.

Friends With Benefits (FWB) exemplifies this model, operating as a social DAO with its own token that grants access to exclusive events, Discord channels, and governance rights.

ERC Protocols

Ethereum Request for Comments (ERCs) are technical standards that define rules and interfaces for tokens, smart contracts, and applications built on Ethereum.

Some of the most influential ERC standards include:

ERC-20: Fungible Tokens

The ERC-20 standard established a common interface for fungible tokens, which creates thousands of cryptocurrencies on Ethereum. Key functions defined in the standard include:

- Transferring tokens between addresses

- Checking account balances

- Approving third parties to spend tokens on your behalf

ERC-20 tokens power most DeFi, including stablecoins like USDC and Tether, governance tokens like UNI and AAVE, and utility tokens for various platforms.

ERC-721: Non-Fungible Tokens

As mentioned earlier, ERC-721 defined the standard for non-fungible tokens (NFTs), enabling unique digital assets with provable scarcity. This standard revolutionized digital ownership by making it possible to verify the authenticity and uniqueness of digital items.

ERC-1155: Multi-Token Standard

ERC-1155 combines the functionality of ERC-20 and ERC-721, allowing a single contract to contain fungible and non-fungible tokens. This standard has been beneficial for gaming applications, where both currency-like resources and unique items are needed.

ERC-4626: Tokenized Vault Standard

A newer standard, ERC-4626, standardizes yield-bearing vaults, making it easier for protocols to interact with each other’s yield-generating strategies. This has improved capital efficiency and user experience across DeFi platforms.

Ethereum vs. Bitcoin

While Bitcoin and Ethereum are often compared as cryptocurrencies, they have fundamentally different purposes. We created a table to highlight their features and characteristics:

| Feature | Bitcoin | Ethereum |

| Primary Purpose | Digital money and a store of value | Programmable blockchain platform |

| Focus | Financial transactions | Smart contracts and decentralized applications |

| Analogy | Digital gold | Digital world computer |

| Flexibility | Limited scripting capability | Turing-complete programming |

| Applications | Payments, wealth storage | DeFi, NFTs, DAOs, games, identity systems |

| Maximum Supply | 21 million BTC | No fixed cap for ETH |

| Annual Issuance Rate (2025) | ~0.8% | ~0.5-1% (can be deflationary) |

Bitcoin excels at being a secure, censorship-resistant form of digital money with a predictable supply schedule. Meanwhile, Ethereum prioritizes flexibility and programmability, enabling a vast system of applications.

Technical Differences

The technical architecture of Bitcoin and Ethereum shows us their different objectives:

| Technical Aspect | Bitcoin | Ethereum |

| Consensus Mechanism | Proof-of-Work | Proof-of-Stake (since Sept 2022) |

| Block Time | ~10 minutes | ~12-15 seconds |

| Transaction Throughput | ~7 transactions per second | ~15-30 transactions per second (base layer) |

| Programming Language | Script (limited) | Solidity, Vyper (Turing-complete) |

| Supply Model | Fixed cap of 21 million BTC | No fixed cap, issuance ~0.5-1% annually |

| Transaction Model | UTXO (Unspent Transaction Output) | Account-based model |

| Fee Structure | Transaction fees to miners | Gas fees (partially burned) |

These technical differences translate into practical distinctions in how the networks operate and what they can accomplish. Ethereum’s faster block times provide quicker confirmation of transactions, while its account-based model simplifies complex interactions between smart contracts.

Ethereum vs. Alternative Smart Contract Platforms

While Ethereum pioneered smart contract functionality, several competitors have emerged with different approaches, as we can see in the table below:

| Feature | Ethereum | Solana | Cardano | Avalanche |

| Consensus Mechanism | Proof-of-Stake | Proof-of-History + Proof-of-Stake | Ouroboros (PoS) | Avalanche Consensus |

| Transactions Per Second (Base Layer) | ~15-30 | ~2,000-3,000 | ~250-1,000 | ~4,500 |

| Smart Contract Language | Solidity, Vyper | Rust, C, C++ | Plutus (Haskell-based) | Solidity, multiple others |

| Launch Date | 2015 | 2020 | 2017 | 2020 |

| Developer Ecosystem Size (2025) | Largest (~550K active devs) | Large (~110K active devs) | Medium (~80K active devs) | Medium (~75K active devs) |

| DeFi Total Value Locked (2025) | $410B+ | $53B+ | $22B+ | $38B+ |

Ethereum maintains several key competitive advantages:

- First-mover advantage: The most established smart contract platform with the largest ecosystem

- Developer mindshare: More developers are building on Ethereum than all other smart contract platforms combined

- Composability: Applications that can interact without problems, create powerful network effects

- Security through maturity: Battle-tested through years of holding billions in value

- Decentralization: A more distributed validator set than most competitors

However, challenges remain, particularly around scalability. Alternative platforms often advertise higher throughput at the base layer, though this typically comes with trade-offs in terms of decentralization or security. Ethereum’s scaling strategy focuses on Layer 2 solutions to preserve the decentralization and security of the base layer.

Challenges and Criticisms of Ethereum

Despite its ambitions, Ethereum faces some scalability challenges. The base layer can only process approximately 15-30 transactions per second, far below what’s needed for global adoption. During periods of high demand, this limitation manifests as:

- High gas fees: During peak usage, transaction costs can spike to tens or even hundreds of dollars

- Transaction delays: Confirmation times increase as users bid up gas prices to have their transactions processed faster

- Failed transactions: Users who set gas prices too low may see their transactions fail after waiting in the mempool

These issues have created barriers to adoption, particularly for users with smaller amounts of capital who find the costs prohibitive relative to their transaction size.

Ethereum’s scalability roadmap includes several approaches:

- Layer 2 solutions: Rollups like Optimism, Arbitrum, and zkSync process transactions off-chain and submit cryptographic proofs to the main Ethereum chain

- Sharding: Future upgrades plan to split the network into multiple parallel chains to increase throughput

- Proto-danksharding: The Dencun upgrade introduced “blob” transactions to improve data availability for rollups

While these solutions show promise, fully addressing Ethereum’s scalability challenges remains a work in progress.

Security Considerations

Ethereum’s security model has proven to be strong at the protocol level, but vulnerabilities often appear in applications built on top of it.

Smart Contract Risks and Solutions

Smart contracts are immutable once deployed, meaning bugs can have permanent consequences. The 2016 DAO hack resulted in approximately $50 million worth of ETH being drained when an attacker exploited a recursive call vulnerability, while in 2017, a coding error in the Parity wallet led to $300 million worth of ETH being permanently locked.

DeFi platforms have suffered numerous exploits involving flash loans, oracle manipulations, and other sophisticated attacks, resulting in billions of dollars in losses over time. Some common smart contract vulnerabilities and ways that they have been tackled include:

Reentrancy attacks, which happen when a contract calls itself before updating its state. Developers now use coding patterns like Check-Effects-Interactions and tools like ReentrancyGuard to stop this.

Integer overflows and underflows—when numbers go beyond allowed limits—have caused issues too, such as in Beauty Chain. These are now mostly prevented using SafeMath and newer Solidity versions.

Front-running lets validators reorder transactions for profit, especially on decentralized exchanges (DEXs), often through MEV. Solutions include commit-reveal systems and batch auctions.

Oracle attacks, where price feeds are manipulated (e.g., Harvest Finance, bZx), are now tackled using time-weighted averages and multiple data sources.

Poor access controls led to problems like the Parity Multi-Sig wallet hack. These are now addressed with role-based access and better testing.

Logic bugs from flawed contract design, like with Yam Finance, highlight the need for formal verification and thorough audits.

To improve security, projects now rely on multiple audits, mathematical checks, and bug bounties. Many also use phased launches, value limits, timelocks, multisig permissions, and upgradeable contracts to handle issues more safely.

Centralization Risks

Despite Ethereum’s decentralization goals, certain aspects show concerning centralization tendencies. A majority of nodes run the Geth client, creating potential single points of failure.

Large staking services control significant portions of the validator set, while many dApps depend on centralized infrastructure services like Infura for blockchain data. These centralization vectors could potentially undermine Ethereum’s censorship resistance and trustlessness if left unaddressed.

Regulatory Uncertainty

The regulations for crypto and blockchain technology remain unsettled, creating uncertainty for Ethereum and projects built on it:

- Securities classification: Questions about whether certain tokens qualify as securities under various jurisdictions

- DeFi regulation: Evolving regulatory approaches to decentralized exchanges, lending platforms, and other financial applications

- Compliance challenges: Tension between principles like privacy and permissionlessness versus anti-money laundering requirements

Obviously, this regulatory uncertainty creates operational and legal risks for developers, users, and investors.

The Future of Ethereum

After discussing all the elements, characteristics and features of Ethereum, it’s time to find out what lies ahead.

Layer 2 Scaling Solutions

Layer 2 (L2) scaling solutions have become the primary near-term answer to Ethereum’s scalability challenges. These systems process transactions off the main Ethereum chain while inheriting its security guarantees, dramatically increasing throughput and reducing costs for users.

Optimistic Rollups

Platforms like Optimism and Arbitrum implement optimistic rollups that assume transactions are valid by default, only verifying them when challenged. This approach allows a challenge period where fraudulent transactions can be proven invalid through fraud proofs.

Optimistic rollups maintain high compatibility with existing Ethereum tools and smart contracts, making migration straightforward for developers. Users benefit from fee reductions of 90-95% compared to the Ethereum base layer, making previously uneconomical use cases viable again.

Zero-Knowledge Rollups

Solutions like zkSync and StarkNet utilize zero-knowledge proofs to validate transactions by generating cryptographic proofs that transactions are valid without revealing their details. This approach provides faster finality than optimistic rollups since there’s no challenge period required. Zero-knowledge rollups also offer potential privacy benefits by hiding transaction details while still ensuring validity. Though they’ve historically had more limited EVM compatibility, this gap is rapidly closing with ongoing development.

By 2025, Layer 2 networks collectively process over 80% of all Ethereum transactions, with costs typically remaining under $0.50 per transaction regardless of network congestion. The introduction of proto-danksharding in the Dencun upgrade has further reduced L2 costs by improving data availability on the Ethereum base layer, making it cheaper for rollups to post transaction data and pass those savings to users.

Ethereum 2.0 and Beyond

Ethereum’s development roadmap addresses three key pillars: scalability, security, and sustainability. The Merge in September 2022 was an important moment, transitioning Ethereum from energy-intensive proof-of-work to eco-friendly proof-of-stake, reducing energy consumption by 99.95% and setting the stage for future scaling solutions.

The upcoming “Surge” focuses on scaling Ethereum through full danksharding—an evolution of the proto-danksharding introduced in the Dencun upgrade. This will increase data availability for Layer 2 solutions, potentially supporting over 100,000 transactions per second when combined with various rollup technologies. For users, this means consistently low fees even during periods of high demand.

Security enhancements are being addressed through the “Scourge” phase, which includes proposer-builder separation to mitigate MEV extraction, distributed validator technology for increased validator security, and secret leader election to protect block proposers from targeted attacks. These improvements will make Ethereum more resistant to centralization pressures and sophisticated attack vectors.

Technical optimizations in the “Verge” phase include Verkle trees implementation to reduce node storage requirements and state expiry to decrease the burden on full nodes. These changes will make running an Ethereum node more accessible, enhancing the network’s decentralization. Single-slot finality will reduce confirmation times from minutes to seconds, improving both user experience and security guarantees.

The “Purge” phase will streamline Ethereum’s technical foundation by simplifying the EVM and cleaning up historical design decisions. This will create a more elegant and maintainable system without compromising functionality.

While these improvements might sound like they’re merely technical, they’ll enable entirely new applications that weren’t previously possible due to cost or performance constraints. Decentralized social media, complex games, identity systems, and global financial services will become viable on Ethereum, potentially transforming how we interact online and manage digital assets.

The ultimate vision for Ethereum is to become the foundation for a more open, accessible internet where users control their own data, identity, and digital assets. With these upgrades, Ethereum is positioning itself to fulfill this vision and support the next generation of decentralized applications.