Bitcoin halving decreases the rate at which new Bitcoins enter circulation. It occurs approximately every four years and reduces the block reward miners receive by 50%.

Halving is a fundamental part of Bitcoin’s economic model, helping it maintain its scarcity and controlling inflation.

Only 21 million Bitcoins will ever exist, and approximately 19.7 million were already in circulation as of April 2025. Halvings are crucial in stretching the remaining supply over the next 115 years until the final Bitcoin is mined around 2140.

Key Takeaways

- Bitcoin halving reduces mining rewards by 50% every 210,000 blocks (approximately every four years).

- The most recent April 2024 halving cut rewards from 6.25 to 3.125 BTC per block.

- Halving creates scarcity by slowing the rate at which new Bitcoins enter circulation. This helps maintain the maximum supply cap of 21 million coins until around 2140.

What Happens During the Bitcoin Halving?

Bitcoin halving refers to a pre-programmed event that happens approximately every four years when the reward for mining new blocks is cut in half. This mechanism was created by Bitcoin’s pseudonymous creator, Satoshi Nakamoto, to control the cryptocurrency’s inflation rate and ensure a finite supply of Bitcoins.

The Technical Process

The Bitcoin blockchain operates through a consensus mechanism called Proof of Work (PoW), where participants known as miners compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain. When miners successfully solve these cryptographic puzzles, they receive a block reward from newly minted Bitcoins.

During a halving event, this block reward is reduced by 50%. For instance, when Bitcoin launched in 2009, miners received 50 BTC for each block they added to the blockchain. After the first halving in 2012, this reward dropped to 25 BTC, and it has continued to decrease with each subsequent halving.

The halving occurs every 210,000 blocks, which takes approximately four years based on Bitcoin’s design of producing a new block roughly every 10 minutes. This systematic reduction in mining rewards has several purposes:

- It controls inflation: By reducing the rate of new Bitcoins entering circulation, Bitcoin halving helps control inflation and maintains the cryptocurrency’s scarcity.

- It ensures that the supply is finite: Unlike traditional fiat currencies that can be printed indefinitely, Bitcoin has a capped supply of 21 million coins. The halving mechanism ensures that this maximum will not be reached until around 2140.

- It creates scarcity: The decreasing rate of new Bitcoins entering the market can potentially drive up value if demand remains constant or increases.

The halving mechanism ensures that Bitcoin remains resistant to manipulation and provides predictability that many investors find attractive.

Historical Halving Events

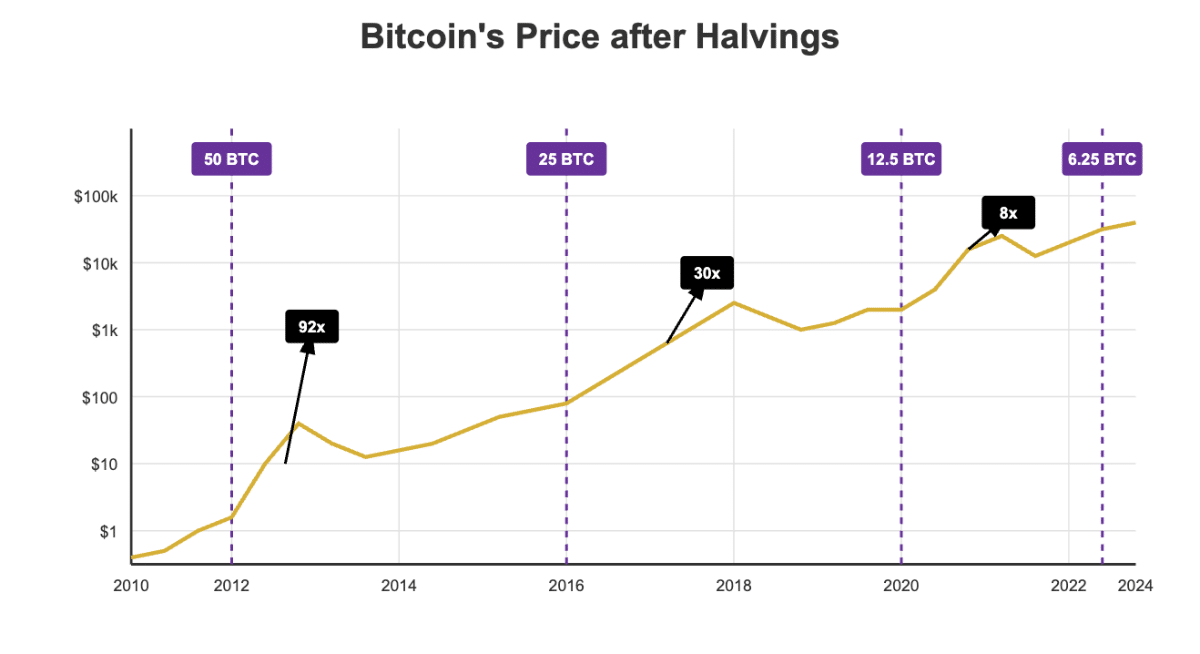

Bitcoin has experienced four halving events since its creation, each with its own market dynamics and consequences.

First Halving – November 28, 2012

The first halving took place on November 28, 2012, at block height 210,000. This milestone event reduced the block reward from 50 BTC to 25 BTC, halving the rate of new Bitcoin creation.

Market Impact:

- Bitcoin price on halving day: $12.35

- Price 150 days later: $127.00 (approximately 928% increase)

- One year post-halving: Bitcoin price rose by an astonishing 8,069%

The first halving happened when Bitcoin was still relatively unknown to mainstream investors. However, it set a precedent for future halvings because it showed a significant price appreciation in the following months. This event also coincided with increasing media attention and growing interest from early adopters.

Second Halving – July 9, 2016

The second Bitcoin halving occurred on July 9, 2016, at block 420,000, reducing the mining reward from 25 BTC to 12.5 BTC.

Market Impact:

- Bitcoin price on halving day: $650.63

- Price 150 days later: $758.81 (approximately 16.6% increase)

- One year post-halving: Bitcoin reached a price of approximately $2,500

While the immediate price reaction was less dramatic than after the first halving, Bitcoin still experienced growth in the following year. This period also saw increasing institutional interest and the development of a more mature cryptocurrency ecosystem, with more exchanges, wallets, and services becoming available.

Third Halving – May 11, 2020

The third Bitcoin halving took place on May 11, 2020, at block 630,000, reducing the block reward from 12.5 BTC to 6.25 BTC.

Market Impact:

- Bitcoin price on halving day: $8,821.42

- Price 150 days later: $10,943.00 (approximately 24% increase)

- By April 2021: Bitcoin reached an all-time high of approximately $64,000

The third halving occurred during unique global circumstances—the early stages of the COVID-19 pandemic. Despite initial economic uncertainty, Bitcoin experienced remarkable growth in the following year, partly driven by increased institutional adoption, including significant investments from companies like Tesla and MicroStrategy, as well as the growing recognition of Bitcoin as a potential hedge against inflation.

Fourth Halving – April 19, 2024

The most recent Bitcoin halving occurred on April 19, 2024, at block 840,000, cutting the mining reward from 6.25 BTC to 3.125 BTC.

Market Impact:

- Bitcoin price on halving day: $64,968.87

- Post-halving performance: Slight positive price movement followed by market fluctuations

Unlike previous halvings, the fourth one occurred in a more mature market environment, with significant institutional involvement through Bitcoin ETFs approved by the SEC just months before the event. This halving also took place after Bitcoin had already reached new all-time highs earlier in 2024, although it surpassed its own record later on in the year, breaking past the $100K barrier for the first time ever.

Implications of Bitcoin Halving

The halving affects various aspects of the Bitcoin ecosystem, from mining economics to market dynamics.

Impact on Miners

Bitcoin mining is a competitive and resource-intensive process that requires significant investment in specialized hardware (ASIC miners) and electricity. The halving directly affects the profitability of mining operations in several ways:

- When block rewards are cut in half, miners immediately earn 50% less in new Bitcoins for the same amount of computational work, potentially squeezing profit margins.

- Miners must evaluate whether their operational costs (electricity, maintenance, equipment) remain economically viable against the reduced rewards.

- Each halving tends to drive innovation in mining technology as operators seek more energy-efficient solutions to maintain profitability.

- Smaller miners with higher operational costs may find it difficult to remain profitable after a halving, potentially leading to industry consolidation where larger, better-capitalized mining operations gain market share.

For example, following the 2024 halving, some miners with older, less efficient equipment may have been forced to shut down operations if they couldn’t offset the reduced block rewards with either Bitcoin price appreciation or significantly reduced operational costs.

The economics of mining after a halving often depend on various factors, including:

- The miner’s electricity costs

- The efficiency of their mining equipment

- Their scale of operations

- The post-halving market price of Bitcoin

Large mining operations, such as Marathon Digital Holdings (which increased its Bitcoin holdings to 16,930 and its fleet of miners to 231,000 before the 2024 halving), often prepare for halvings by scaling up their operations to maintain their competitive edge despite the reduced rewards.

Market Dynamics

The connection between halving and market dynamics is complex and has different sides:

- By reducing the rate at which new Bitcoins enter circulation, halvings create a supply shock. If demand remains constant or increases while supply growth decreases, economic theory suggests this should exert upward pressure on price.

- While past performance doesn’t guarantee future results, significant price increases within 12-18 months have followed all previous halvings. This historical pattern has created certain expectations among investors.

- The predictable nature of halving events means they are anticipated well in advance, which can lead to market participants positioning themselves before the actual event.

- Halvings may contribute to Bitcoin’s cyclical market behavior, potentially triggering new market interest and investment phases.

The 2024 halving was particularly unique because it occurred after the approval of Spot Bitcoin ETFs in the United States, which provided traditional investors with easier access to Bitcoin exposure.

Network Security

The security of the Bitcoin network relies on a mining ecosystem with a wide distribution of mining power. Halving events can potentially impact network security in several ways:

- If halving makes mining unprofitable for a significant number of participants, it could decrease the network’s hash rate (the total computational power dedicated to mining Bitcoin), at least temporarily.

- In theory, a substantial reduction in mining participation could make the network more vulnerable to a 51% attack, where a single entity controls the majority of mining power. However, Bitcoin’s scale makes this scenario increasingly unlikely.

- As block rewards diminish over time, the economic incentive for miners is expected to shift from block rewards to transaction fees gradually. This transition is crucial for maintaining network security in the long term.

After the 2020 halving, despite concerns about potential security implications, the Bitcoin network’s hash rate recovered quickly and went on to reach new all-time highs.

Environmental Considerations

Bitcoin mining’s energy consumption has been a topic of significant debate. The halving may have indirect implications for Bitcoin’s environmental footprint:

- Reduced rewards increase pressure on miners to find more energy-efficient methods, potentially accelerating the adoption of renewable energy sources.

- Each halving tends to render older, less efficient mining equipment obsolete, pushing the industry toward more energy-efficient hardware.

- Miners often relocate to regions with lower energy costs after halvings, which can include areas with abundant renewable energy resources.

The environmental impact of Bitcoin mining continues to evolve, with initiatives promoting sustainable mining practices gaining traction in response to public and investor concerns.

Upcoming Halving Events

Based on Bitcoin’s protocol, halvings will continue to occur every 210,000 blocks until the maximum supply of 21 million bitcoins is reached. Here’s a projection of future halving events:

| Estimated Year | Block | Block Reward After Halving |

| 2028 | 1,050,000 | 1.5625 BTC |

| 2032 | 1,260,000 | 0.78125 BTC |

| 2036 | 1,470,000 | 0.390625 BTC |

| 2040 | 1,680,000 | 0.1953125 BTC |

| 2044 | 1,890,000 | 0.09765625 BTC |

| 2048 | 2,100,000 | 0.04882812 BTC |

These dates are estimates, as the actual timing depends on the consistency of block production, which can vary depending on mining difficulty adjustments and network hash rate.

As we mentioned, the final Bitcoin is projected to be mined around the year 2140, after which no new Bitcoins will enter circulation. At that point, the total supply will have reached its maximum.

Transition to Fee-Based Incentives

As block rewards continue to diminish with each halving, a critical transition in Bitcoin’s economic model is taking place:

Currently, miners receive income from two sources:

- Block rewards (newly created Bitcoins)

- Transaction fees paid by users

As block rewards approach zero over the coming decades, Bitcoin’s security model will increasingly rely on transaction fees to incentivize miners. This transition raises important questions about the long-term sustainability of the network:

- Fee Market Development: Will transaction fees naturally rise to levels that adequately compensate miners for securing the network?

- Network Usage: The viability of a fee-based incentive system depends on robust network usage generating sufficient transaction volume and fees.

- Layer 2 Solutions: How will scaling solutions like the Lightning Network, which reduce on-chain transactions, affect the fee market?

- Security Budget: The concept of Bitcoin’s “security budget”—the total rewards available to miners—is crucial for maintaining the network’s resistance to attacks.

Bitcoin developers, economists, and the broader community continue to discuss and research how this transition will unfold and what measures might be needed to ensure the network’s long-term security and sustainability.

Is Bitcoin Halving Good or Bad?

Bitcoin halving has both advantages and potential challenges.

Advantages

- Bitcoin’s halving schedule creates a predictable and diminishing inflation rate, contrasting with the often unpredictable inflation of fiat currencies.

- The systematic reduction in new supply enhances Bitcoin’s value proposition as “digital gold” or a store of value.

- By stretching the distribution of new Bitcoins over more than a century, the halving mechanism promotes sustained interest and participation in the network.

- Unlike traditional monetary policy, which can change with political circumstances, Bitcoin’s economic policy is transparent and immutable.

Challenges

- Each halving puts pressure on mining economics, potentially leading to reduced network security if not offset by price appreciation or efficiency gains.

- Halvings can contribute to market speculation and price volatility as participants attempt to position themselves for expected price movements.

- The long-term shift from block rewards to transaction fees presents uncertainties about future network economics.

- The expectation of price increases due to increasing scarcity encourages hoarding rather than using Bitcoin as a medium of exchange, potentially limiting its utility.

Whether the halving mechanism is considered positive or negative largely depends on one’s perspective on Bitcoin’s primary purpose. Those who view Bitcoin primarily as a store of value or inflation hedge tend to view the halving positively, while those focused on Bitcoin’s use as a payment system may be more concerned about the sustainability of network security as block rewards diminish.

Should You Invest in Bitcoin During a Halving?

There are several factors to take into account if you are considering investing in Bitcoin around halving events.

While past halvings have been followed by significant price appreciation, it’s essential to remember that correlation doesn’t imply causation, and many other factors influence Bitcoin’s price.

Markets are forward-looking, and halving events are known well in advance. This means that expected effects may already be “priced in” to some extent.

Historical data suggests that significant price movements often occur months after a halving rather than immediately. This indicates that a longer-term investment horizon may be more appropriate for halving-related investment strategies.

Bitcoin remains volatile, and investing based on halving expectations carries significant risk. Investors should only allocate capital they can afford to lose.

Rather than buying Bitcoin around a halving event, some investors prefer dollar-cost averaging (regularly purchasing smaller amounts) to reduce timing risk.

The 2024 halving presented unique circumstances compared to previous halvings, with Bitcoin spot ETFs recently approved and significant institutional participation in the market. These factors may have altered the traditional market patterns around halving events.

Conclusion

Bitcoin halving is one of the most fundamental aspects of Bitcoin’s economic design. It has a crucial role in controlling its supply, influencing market dynamics, and shaping the long-term trajectory of the world’s first cryptocurrency.

The halving mechanism reflects Bitcoin’s core principles of predictability, transparency, and resistance to inflation, which distinguish it from traditional monetary systems. The community will face new challenges and opportunities as Bitcoin transitions from a primarily block reward-based economy to one increasingly reliant on transaction fees. This evolution will test the resilience and adaptability of Bitcoin’s economic model as it moves toward its ultimate supply cap of 21 million coins.