On this Page:

Fiat on-ramps and off-ramps are financial services that enable the conversion between traditional government-issued currencies (fiat) and cryptocurrencies. On-ramps allow users to purchase crypto with fiat money, while off-ramps enable crypto holders to convert their tokens back into fiat currencies like USD, EUR, or GBP.

These conversion mechanisms handle billions of dollars in monthly transaction volume globally and are essential infrastructure for cryptocurrency adoption. With approximately 560 million crypto users worldwide as of 2025, these gateways are a critical bridge connecting traditional banking systems with blockchain-based digital assets.

Key Takeaways

- Fiat on-ramps and off-ramps are the bridge between traditional currencies and cryptocurrencies. They handle billions in monthly transaction volume and enable millions of crypto users to move between financial systems.

- On-ramp options vary widely in fees and processing times. Off-ramp methods include exchanges, crypto cards, and P2P platforms, each with different tradeoffs.

- Most fiat on-ramps and off-ramps require identity verification, so be prepared to submit documents like a passport or driver’s license.

What are Fiat On-Ramps and Off-Ramps in Crypto?

Fiat on-ramps and off-ramps make it easy to convert traditional government-issued currencies (fiat) to cryptocurrencies, and vice-versa. They are a bridge connecting the established financial system (TradFi) with the emerging decentralized finance (DeFi).

These conversion mechanisms are crucial for several reasons:

- They make cryptocurrencies accessible to everyday users who usually deal with traditional currencies.

- On-ramps and off-ramps enhance liquidity in the crypto market by enabling more capital to flow in and out.

- They ensure cryptocurrencies aren’t confined to digital ecosystems but have practical utility in real-world scenarios.

- The ability to convert crypto back to fiat builds trust, reassuring users their investments aren’t locked in an inaccessible format.

Without reliable fiat ramps, the interaction between traditional finance and cryptocurrencies would remain fragmented, significantly limiting the growth and utility of digital currencies.

What Is a Crypto On-Ramp?

A crypto on-ramp (also called a fiat on-ramp) is a service that allows individuals to convert traditional currencies like dollars, euros, or pounds into cryptocurrencies. It is the entry point for users who want to participate in the crypto economy but don’t yet hold digital assets.

On-ramps typically involve payments made via credit/debit cards, bank transfers, or digital wallets. They’re created to simplify the complex process of acquiring cryptocurrencies, which might otherwise involve dealing with some technical aspects like wallets, keys, and exchanges. All these might intimidate you if you were a newcomer.

By offering user-friendly interfaces that guide customers through the purchase process, on-ramps make cryptocurrencies accessible to a broader audience. As a result, they help expand the user base and drive adoption of blockchain technologies.

What are the Most Common On-Ramp Methods?

There are several methods available for converting fiat currency to cryptocurrency:

- Bank Transfers: Direct transfers from your bank account to a cryptocurrency exchange or platform. These typically have lower fees but may take several business days to process.

- Credit/Debit Card Purchases: Offers nearly instant transactions but usually comes with higher fees (typically 3-5% of the transaction).

- Third-party Payment Providers: Services like MoonPay and Ramp Network that specialize in fiat-to-crypto conversions and can be integrated into various platforms and wallets.

- Crypto ATMs: Physical machines that allow users to purchase cryptocurrencies with cash or cards. While convenient, they typically charge premium fees (often 5-12%).

- Electronic Payment Services: Some regions support services like PayPal, Apple Pay, or Google Pay for cryptocurrency purchases.

- Gift Cards: In some markets, users can purchase cryptocurrency using retail gift cards, providing an alternative to traditional payment methods.

Each method has different advantages regarding speed, fees, accessibility, and privacy. Your choice often depends on your location, the urgency of your transaction, and your personal preferences regarding costs and verification requirements.

Popular On-Ramp Platforms

Several established platforms offer reliable on-ramp services, and here is the table to check them out:

| Platform Type | Platform Name | Key Features | Best For |

| Centralized Exchange | Coinbase | User-friendly interface, multiple payment methods, higher fees | Beginners, users prioritizing ease of use |

| Centralized Exchange | Binance | Competitive fees, a wide range of cryptocurrencies | Active traders, those seeking variety |

| Centralized Exchange | Kraken | Strong security, regulatory compliance | Security-conscious users |

| Wallet with Integrated Buy Functions | MetaMask | Direct purchases within the wallet interface | Web3 users, DeFi participants |

| Wallet with Integrated Buy Functions | Best Wallet | Mobile wallet with built-in purchase options | Mobile-first users, multi-coin support |

| Wallet with Integrated Buy Functions | Coinbase Wallet | Connected to Coinbase’s exchange infrastructure | Existing Coinbase users |

| Neobank Offering Crypto | Revolut | Digital banking app with crypto buying/selling | Banking app users, Europeans |

| Neobank Offering Crypto | Cash App | Popular payment app with Bitcoin support | P2P payment users, Bitcoin beginners |

| Neobank Offering Crypto | Robinhood | Investment platform with crypto trading | Stock traders, commission-free seekers |

| Specialized On-Ramp Services | MoonPay | Dedicated fiat-to-crypto infrastructure | Integration partners, seamless UX |

| Specialized On-Ramp Services | Ramp Network | Seamless on-ramping with lower fees | Cost-conscious users |

| Specialized On-Ramp Services | Simplex | Payment processing specializing in crypto purchases | Card payment preference, partner networks |

Remember that the best platform depends on your location, preferred cryptocurrencies, desired payment methods, and fee tolerance.

What Is a Crypto Off-Ramp?

A crypto off-ramp is a service that allows users to convert their cryptocurrencies back into fiat currencies. This functionality is crucial for those who need to liquidate their crypto assets to cover expenses, realize profits, or simply manage their portfolios.

Thanks to off-ramps, cryptocurrencies can have practical utility in the real world. Without reliable off-ramps, users might hesitate to invest in cryptocurrencies due to concerns about converting them back into a form they can use for everyday expenses.

The ability to easily cash out crypto holdings reassures users that their investments are not locked in an inaccessible format, which builds trust in the cryptocurrency ecosystem and is essential for building long-term participation in the market.

What are the Most Common Off-Ramp Methods?

Several methods are available for converting cryptocurrency back to fiat currency:

- Selling on Exchanges and Bank Withdrawals: The most common method is selling cryptocurrency on an exchange and withdrawing the proceeds to a bank account. This typically requires identity verification and may take 1-5 business days, depending on the platform and your location.

- Crypto Debit Cards: Cards like Crypto.com Card, BitPay, and Coinbase Card allow users to spend their cryptocurrency directly, with the platform automatically converting crypto to fiat at the point of sale. May involve various fees.

- Peer-to-Peer (P2P) Trading Platforms: Services like LocalBitcoins and Paxful connect buyers and sellers directly, allowing for various payment methods when selling crypto, including bank transfers, PayPal, or even cash exchanges.

- Gift Card Platforms: Services like Bitrefill allow users to purchase gift cards with cryptocurrency that can be used at major retailers, effectively converting crypto to spendable value without going through the banking system.

- Crypto ATMs: Some ATMs support two-way transactions, allowing users to sell cryptocurrency and receive cash immediately, though typically with high fees.

- Direct Merchant Acceptance: As more merchants begin accepting cryptocurrency payments, users can effectively off-ramp by purchasing directly with their crypto.

Each method offers different advantages in terms of speed, convenience, privacy, and cost. Your choice will depend on your specific needs, location, and how quickly you need access to funds.

Popular Off-Ramp Services

Several established services provide reliable crypto-to-fiat conversion:

| Platform Type | Platform Name | Key Features | Best For |

| Centralized Exchange | Coinbase | Direct bank transfers in many countries | Users needing reliable bank withdrawals |

| Centralized Exchange | Kraken | Reliable withdrawals and strong security | Security-focused users |

| Centralized Exchange | Binance | Multiple withdrawal options across various countries | International users, flexibility seekers |

| Payment Gateway | BitPay | Merchant-focused with consumer services | Business owners, regular spenders |

| Payment Gateway | Wirex | Card linked to both crypto and fiat accounts | Travel spenders, everyday purchases |

| Payment Gateway | Crypto.com | Popular Visa debit card tied to crypto balances | Regular retail shoppers, rewards seekers |

| Fiat-Compatible Wallet | Cash App | Bitcoin selling and bank account withdrawals | US-based users, simple withdrawals |

| Fiat-Compatible Wallet | Revolut | Digital banking with crypto selling capabilities | European users, banking integration |

| Fiat-Compatible Wallet | Trust Wallet | Mobile wallet with integrated selling options | Mobile-first users, convenience seekers |

| P2P Platform | Paxful | Numerous payment options for selling crypto | Users with limited banking access |

| P2P Platform | Hodl Hodl | Non-custodial P2P trading platform | Security-conscious users, no-KYC preference |

Again, the ideal service for you depends on factors like your geographic location, preferred withdrawal methods, speed requirements, and fee considerations.

Do On-Ramps and Off-Ramps Charge Fees?

Yes, virtually all on-ramp and off-ramp services charge fees, though the structure and amounts vary significantly between providers and methods.

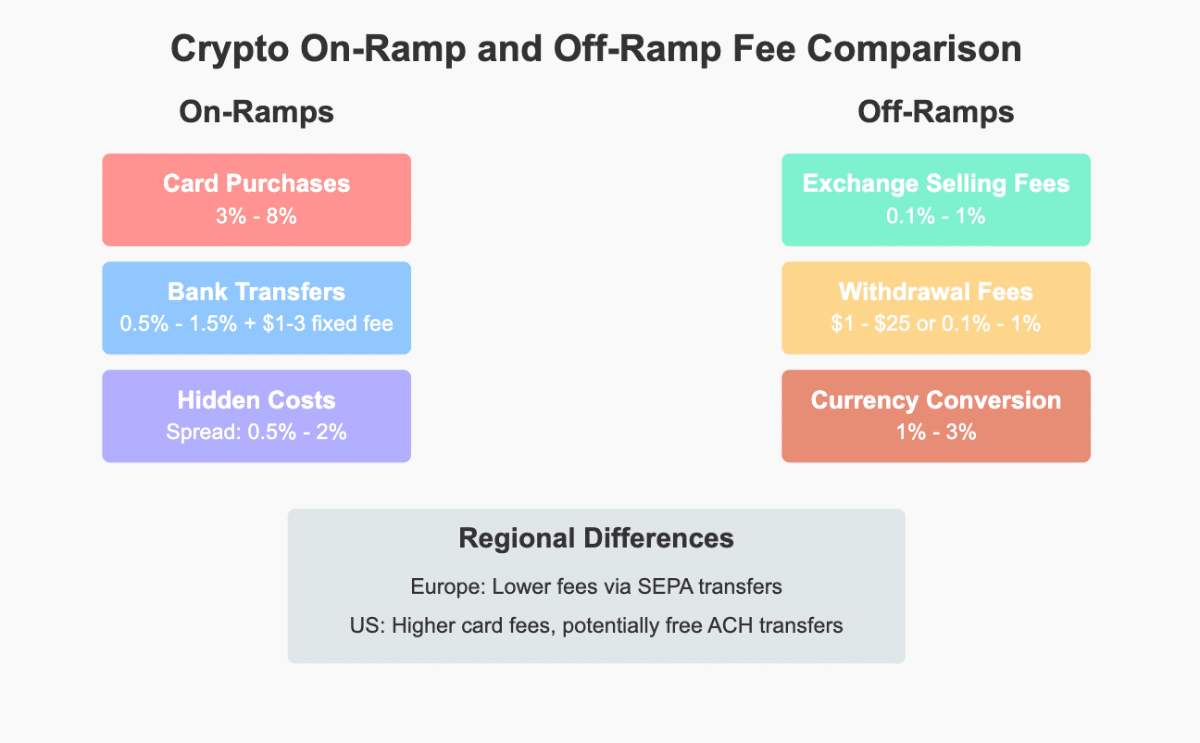

Card purchases for on-ramps are typically the most expensive option, with fees ranging from 3% to 5% on major exchanges, while some specialized services charge up to 7-8%. These often include both the platform’s fee and payment processor fees. Bank transfers offer generally lower fees for on-ramps, ranging from 0.5% to 1.5% on major exchanges, with some platforms offering free ACH transfers in certain regions plus small fixed fees of $1-3.

For off-ramps, exchange selling fees typically range from 0.1% to 1%, depending on the platform, with some exchanges offering tiered structures based on trading volume. Withdrawal fees for bank transfers range from $1-25, depending on the method (ACH, wire, SEPA), with some exchanges charging a percentage (0.1-1%) instead of a flat fee. International withdrawals generally cost more.

Watch for hidden costs like the spread (0.5-2%), currency conversion fees (1-3% when moving between different fiat currencies), and network fees for blockchain transactions. Geographic location significantly impacts fees, with Europeans often enjoying lower fees through SEPA transfers, while US customers typically have higher card fees but potentially free ACH transfers. Larger exchanges generally offer lower fees due to volume, while specialized services may charge premium rates for convenience.

Many providers offer promotional fee-free transactions for new customers or reduced fees for specific cryptocurrencies like USDC on Coinbase. For best results, compare the total cost (including spread) across multiple platforms before making large transactions.

How Long Do On-Ramp and Off-Ramp Transactions Take?

Transaction times can be different depending on several factors, ranging from instant to several business days.

Credit/debit card purchases and crypto debit card transactions typically process within minutes, while some domestic bank transfers in countries with real-time payment systems complete within hours. Standard methods like regular bank transfers, ACH, and SEPA transfers generally take 1-5 business days. Slower methods, including international transfers in specific corridors and first-time withdrawals requiring additional verification, can take 5+ business days.

Several factors influence processing speed. Your KYC/verification status affects timing—first-time users often experience longer waits, while higher verification tiers enable faster withdrawals. Payment method significantly impacts speed, with cards providing faster deposits than bank transfers. Platform policies also matter, as some exchanges implement mandatory holding periods for security reasons.

Network congestion during high traffic periods can slow both traditional banking and blockchain networks. Geographic location plays a role, too, as different countries have varying banking infrastructures, with some regions benefiting from faster payment systems. Transaction size can trigger additional security measures for larger amounts, extending processing times.

For time-sensitive transactions, use platforms that clearly communicate expected processing times and consider faster options, even if they come with higher fees.

Do On-Ramp and Off-Ramp Services Have Any Limits?

Yes, on-ramp and off-ramp services typically impose various transaction limits, which can affect users’ interactions with these platforms.

Most platforms implement tiered limit structures based on verification levels. With basic verification (email/phone only), you’ll typically face daily limits of $500-2,000 and monthly limits of $5,000-15,000 with restricted payment methods. Standard verification (ID verification) increases these to daily limits of $2,000-10,000 and monthly limits of $20,000-50,000 with access to most payment methods.

Enhanced verification (ID + proof of address + source of funds) offers much higher capacity with daily limits of $10,000-100,000+ and monthly limits of $50,000-1,000,000+, plus access to all payment methods and potentially lower fees. Institutional/VIP tiers provide custom limits based on requirements, though they may require formal agreements and enhanced due diligence.

Geographic location also impacts available services and limits. Some countries have limited or no access to major platforms, while certain regions face stricter limits due to perceived risk factors. Regulatory compliance varies widely—EU/EEA regions typically require strong AML/KYC but offer consistent access, while US users face state-by-state variations in available services.

Banking relationship restrictions and payment method limitations create additional constraints. Not all banks accept transfers from crypto platforms, and card purchases often have lower limits than bank transfers. Users should plan ahead for larger transactions, possibly spreading them across multiple days or using OTC services for high-volume needs.

On-Ramps and Off-Ramps AML Requirements

Anti-money laundering (AML) requirements are crucial to these services, and platforms implement various compliance measures to prevent financial crimes.

Know Your Customer (KYC)

KYC procedures are fundamental to AML compliance, and here are the reasons why they are important:

- Regulatory Compliance: Financial authorities worldwide require KYC to prevent money laundering, terrorism financing, and other financial crimes.

- Risk Management: KYC helps platforms assess and mitigate risks associated with their users.

- Enhanced Security: Identity verification adds a layer of protection against fraud and unauthorized account access.

- Banking Relationships: Financial institutions require crypto platforms to implement robust KYC to maintain banking partnerships.

What Information Users Typically Need to Provide

The verification process usually involves submitting photos or scans of documents through the platform’s secure portal. Many services now incorporate liveness checks or video verification to ensure the person applying is genuinely the document holder, adding an important layer of security against identity fraud.

KYC requirements typically increase with transaction volumes. Basic verification requires email address and phone number verification, along with basic personal information like your name, date of birth, and address. This level grants minimal functionality and lower transaction limits.

Standard verification requires more substantial documentation, including a government-issued ID (passport, driver’s license, or national ID), a selfie or video verification for ID matching, and proof of address through a utility bill or bank statement. This middle tier unlocks most platform functionality and moderate transaction limits.

Enhanced verification requires deeper financial scrutiny, including documentation of the source of funds, proof of income or wealth, tax identification information, and responses to enhanced due diligence questions. This highest tier provides access to maximum transaction limits and all platform features.

Compliance With Local Laws

Keep in mind that regulations are different across jurisdictions. In strict environments like the European Union, the United States, and Singapore, platforms must adhere to comprehensive frameworks requiring thorough customer verification and reporting. Moderate frameworks exist in the UK, Canada, and Australia, while many developing markets have emerging or limited regulations.

These differences obviously impact user experience. Some platforms restrict services in certain jurisdictions due to regulatory uncertainty or compliance costs. Higher-regulation regions typically require more thorough verification but may offer higher transaction limits once completed. Documentation requirements vary by location, with some jurisdictions demanding some additional documents. Due to compliance checks, processing times often run longer in heavily regulated markets.

Risks of Non-Compliant Platforms

Using on-ramp or off-ramp services that don’t properly implement AML/KYC measures poses several significant risks:

The first risk is frozen funds:

- Platforms may freeze accounts and funds if suspicious activity is detected later or if compliance issues arise.

- Authorities may take action against non-compliant platforms, potentially freezing all user assets during investigations.

- Traditional financial institutions may block transfers to/from platforms with inadequate compliance, trapping funds in transition.

The second risk involves security and legal implications:

- Users of non-compliant platforms may inadvertently become involved in money laundering investigations, even if their own activities are legitimate.

- Insufficient documentation can create problems during tax audits or reporting.

- Platforms avoiding compliance obligations are statistically more likely to be fraudulent operations.

- Some non-compliant platforms may collect personal information without adequate security, increasing identity theft risks.

Using properly regulated and compliant services provides better protection and legal clarity, even if it requires more time-consuming verification procedures. The additional security and reliability typically outweigh the convenience of faster onboarding with less scrutiny.

What are Decentralized On- and Off-Ramps?

Decentralized on-ramps and off-ramps exchange between fiat and cryptocurrencies without relying on centralized intermediaries, offering different benefits and challenges than their centralized counterparts.

P2P marketplaces connect buyers and sellers directly, allowing them to negotiate terms and use various payment methods. Popular examples are LocalBitcoins, Paxful with its 300+ payment options, truly decentralized Bisq requiring no KYC, and non-custodial HodlHodl using multi-signature escrow.

These platforms offer better privacy with minimal or no KYC for certain transaction sizes, diverse payment methods unavailable on centralized exchanges, global accessibility in regions where major exchanges don’t operate, and direct rate negotiations. Some provide non-custodial trading to reduce counterparty risk.

However, users should be aware of risks, including counterparty fraud despite escrow systems, variable transaction speeds dependent on both parties, typically higher prices than centralized exchanges, a steeper learning curve, inconsistent liquidity based on active users in your region, and limited dispute resolution options.

Most P2P marketplaces implement escrow systems where the platform holds cryptocurrency while fiat payment processes, providing some protection while still requiring vigilance regarding platform reputation and counterparty reviews.

Stablecoins and Cross-Border Use

Stablecoins are a vital component in decentralized on/off-ramp strategies. Many users employ a two-step process: first, they convert fiat to stablecoins like USDT or USDC, then trade those for other cryptocurrencies. This approach reduces volatility risk during the conversion process while benefiting from stablecoins’ broad acceptance across exchanges and faster cross-border settlement compared to traditional banking.

In emerging markets, stablecoins serve multiple crucial functions. They provide currency protection in countries with unstable currencies, offer cheaper remittance alternatives, deliver banking alternatives in underbanked regions, and work around payment limitations where traditional rails fall short. In some jurisdictions, stablecoin transactions also face fewer restrictions than direct crypto purchases.

This approach has become popular in regions with currency controls, banking limitations, or high inflation. However, users should note that stablecoin regulations are increasing in many jurisdictions.

Choosing the Right On-/Off-Ramp

Choosing the appropriate fiat on-ramp and off-ramp services is crucial for many reasons. When evaluating platforms, consider geographic availability first—not all services operate in all countries, and banking integration varies by region. Check supported currencies, examining both fiat options and the range of cryptocurrencies offered, including stablecoin availability.

Fee structures and processing speeds significantly impact your experience. Compare deposit fees (typically 0.5%-5%) and withdrawal fees (fixed or percentage-based), and be alert to hidden costs like spreads or conversion markups. A platform’s reputation and security measures are equally important—research its operating history, insurance coverage, security features, and regulatory status.

Consider these additional factors when making your choice:

- User interface simplicity and intuitiveness

- Customer support quality and availability

- Verification requirements and associated limits

- Integration with wallets or services you already use

- Mobile access for on-the-go transactions

Protecting yourself from crypto scams is essential. Always verify URLs carefully, using bookmarks for legitimate sites and being wary of search results. Research platforms thoroughly before use, check established review sites, and verify company registration. Enable 2FA, use strong passwords, verify addresses carefully, and start with small test transactions when using a new service.

Future Trends in On-/Off-Ramps

Several key trends are emerging in crypto. Web3 wallet integration is advancing user experience by embedding purchase functions directly into applications. This creates an experience where users can buy crypto without leaving their dApp.

Stablecoins are becoming central to the on/off-ramps, offering volatility protection during conversion and easier movement between cryptocurrencies. Platforms increasingly support direct onboarding into USDC or USDT with lower fees, providing clearer regulatory status and natural entry points to DeFi ecosystems. This approach combines blockchain benefits with the stability needed for mainstream adoption.

Regulatory developments continue to change and develop, with global trends toward tighter compliance through Travel Rule implementation and enhanced KYC processes. This creates challenges around compliance costs and innovation, but also spurs adaptive responses like RegTech solutions and decentralized identity systems. These evolving regulations will significantly impact how users access and exit the cryptocurrency ecosystem in the coming years.

Conclusion

Fiat on-ramps and off-ramps serve as essential bridges between traditional financial systems and the cryptocurrency ecosystem. They enable the movement of value between these two worlds, making digital assets accessible to everyday users while providing the flexibility to convert back to fiat currencies when needed.

As we’ve explored, these services come in various forms—from centralized exchanges and specialized payment providers to P2P marketplaces and integrated wallet solutions. Each option presents different tradeoffs in terms of fees, speed, accessibility, privacy, and security.

The importance of these bridges cannot be overstated. Without reliable, user-friendly on-ramps and off-ramps, cryptocurrencies would remain confined to a relatively small community of technical enthusiasts rather than achieving the widespread adoption we’re beginning to see today.

When selecting the right on-ramp or off-ramp for your needs, carefully consider factors like geographic availability, supported currencies, fees, speed, security measures, and the platform’s reputation. Taking time to research these elements can help ensure a smooth experience and protect you from potential risks.

FAQs

What's the easiest way to buy crypto with fiat?

The easiest way is to use a credit/debit card to buy on a user-friendly centralized exchange like Coinbase or Binance. While card purchases typically charge higher fees (3-5%), they offer beginners the simplest and fastest experience.

Can I use a crypto ATM as an on-ramp?

Yes, crypto ATMs function as on-ramps, allowing you to insert cash and receive cryptocurrency into your digital wallet. They're convenient for cash purchases but typically charge premium fees ranging from 7-15% and may have lower transaction limits than online exchanges.

What's the safest way to cash out my crypto?

The safest way to cash out crypto is through a regulated, well-established exchange with proper security measures. Platforms like Kraken or Coinbase that implement strong security protocols, offer insurance coverage, and comply with relevant regulations offer the most secure off-ramping experience.

Do I have to pay taxes when using an off-ramp?

Yes, in most countries, converting crypto to fiat through an off-ramp creates a taxable event. You're usually required to report and pay capital gains taxes on any profit realized between your purchase price and the value when selling. Regulated exchanges often report large transactions to tax authorities.

Are there truly anonymous on-ramps or off-ramps?

No truly anonymous on/off-ramps exist in the traditional sense. While some P2P platforms and DEXs offer increased privacy with limited KYC for smaller amounts, they still leave blockchain transaction records. Truly anonymous conversion between fiat and crypto has become increasingly difficult as regulations tighten globally.

What if my country doesn't support crypto on-ramps?

If your country lacks direct crypto on-ramps, consider P2P trading platforms, using VPN-compatible exchanges (though this may violate terms of service), or stablecoin purchases through third-party services. Some users in restricted regions use gift card conversion methods or rely on trusted contacts in supported countries.

Are stablecoins easier to off-ramp than Bitcoin or Ethereum?

Stablecoins are often easier to off-ramp than Bitcoin or Ethereum because their stable value eliminates price volatility concerns during the withdrawal process. Many exchanges offer direct stablecoin-to-fiat pairs with lower fees, and some payment services now support stablecoin transfers directly to bank accounts or payment cards.

What should I do if my withdrawal gets delayed or frozen?

If your withdrawal is delayed or frozen, first check the transaction status on the blockchain explorer if applicable. Contact the platform's customer support with your transaction ID and details, providing any verification documents they request. Remain patient during compliance checks, but if unresolved after 1-2 weeks, consider escalating through formal complaint channels or regulatory authorities.