Join Our Telegram channel to stay up to date on breaking news coverage

The Senate’s advancement of the GENIUS Act represents groundbreaking regulatory progress for cryptocurrency markets. This pivotal stablecoin legislation could trigger multi-year bull market conditions affecting new crypto listings. Establishing a federal regulatory framework promises unprecedented clarity for digital asset innovation and development.

Bitwise identifies massive growth potential with stablecoin market expansion from $245 billion to $2.5 trillion. Ethereum, Solana, and DeFi assets like Uniswap and Aave could benefit significantly from legislation. Institutional confidence strengthens as regulatory uncertainty diminishes, encouraging strategic cryptocurrency investment decisions nationwide.

New Cryptocurrency Releases, Listings, & Presales Today

Best Wallet Token’s presale raised over $12.5 million, showcasing strong demand for its wallet ecosystem. With integration across 50 chains and cashback incentives, it targets mainstream adoption through usability and rewards. Syntor AI’s partnership with AstraAI strengthens its edge-computing infrastructure for scalable Web3 AI applications. Centrifuge collaborates with BlockTower Capital to scale tokenized real-world assets with institutional-grade infrastructure.

1. Best Wallet Token ($BEST)

Best Wallet Token powers a non-custodial wallet supporting thousands of cryptocurrencies across over 50 major blockchains like Bitcoin and Ethereum. With 50% month-on-month user growth, it targets 40% of the $11 billion non-custodial wallet market by 2026. Consequently, its intuitive app enables seamless buying, swapping, holding, and selling of digital assets. Additionally, Best Card allows real-world spending with crypto at Mastercard-accepting merchants. Furthermore, staking $BEST unlocks higher rewards and reduced fees. Thus, it offers a versatile solution for crypto users. As a result, $BEST drives accessibility in decentralized finance.

$BEST provides exclusive early access to trusted presales, enabling users to invest in promising projects before public launches. Its Best Card offers cashback on purchases and lower transaction fees for $BEST holders and stakers. Moreover, Best DEX aggregates over 50 decentralized exchanges for optimal swap rates and liquidity. Additionally, higher APY staking opportunities significantly enhance returns for token holders. Furthermore, cross-chain swaps across 50 chains ensure flexibility for users. Consequently, $BEST enhances trading and spending efficiency. Thus, it caters to both novice and experienced crypto enthusiasts.

The presale for $BEST has raised $12,576,175.39, with tokens priced at $0.025065, reflecting strong investor interest. This funding supports further development of its decentralized exchange and wallet features. Furthermore, the presale strengthens its market position significantly. It enables the expansion of cross-chain capabilities and user incentives. Thus, $BEST’s presale underscores its growth potential. Consequently, it positions $BEST as a competitive player in the wallet space.

Best Wallet has been featured in prominent outlets like Techopedia, Cointelegraph, and Cryptonews, boosting its credibility. These partnerships highlight its growing influence in the crypto industry. Moreover, such visibility consistently attracts new users and investors. Furthermore, media coverage validates its innovative approach to non-custodial wallets. Additionally, these collaborations enhance its reputation among crypto enthusiasts. Thus, Best Wallet strengthens its market presence significantly. Consequently, it builds trust and expands its user base effectively.

Visit Best Wallet Token Presale

2. Syntor AI ($TOR)

Syntor AI provides decentralized compute, storage, and AI services to enhance Web3 application development with scalability and interoperability. Its infrastructure addresses computational complexity, enabling efficient decentralized app performance. Consequently, it seamlessly supports AI model training and synthetic data monetization. Additionally, decentralized storage and edge computing reduce latency for real-time applications. Furthermore, staking and yield optimization offer passive income opportunities. Thus, Syntor empowers developers with robust Web3 tools. As a result, it accelerates decentralized application innovation significantly.

Web3 development faces challenges like complex computations, inefficient data management, and difficult AI integration, hindering scalability. Syntor’s distributed computing network supports AI training and inference cost-effectively. Moreover, its decentralized data marketplace ensures privacy-preserving AI development efficiently. Additionally, current solutions lack scalability for data-intensive applications, slowing innovation. Furthermore, Syntor’s edge computing enhances real-time AI performance significantly. Consequently, it overcomes barriers to Web3 application growth. Thus, it fosters innovation across decentralized industries.

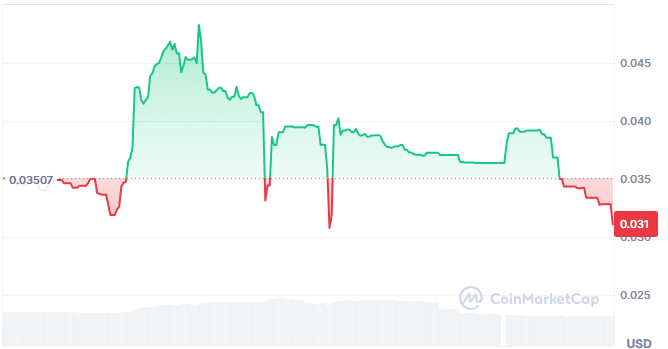

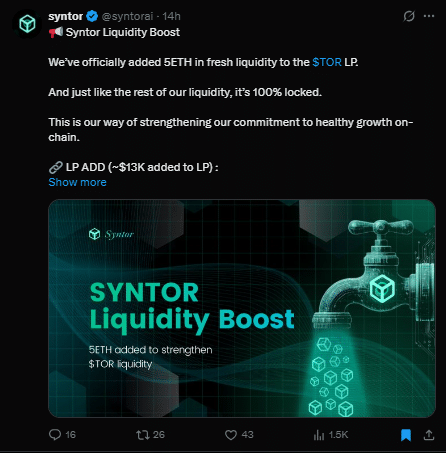

Syntor’s partnership with AstraAI strengthens its position in Web3 AI ecosystems significantly. This collaboration effectively enhances Syntor’s compute and AI development capabilities. Moreover, it supports the creation of advanced, interoperable Web3 solutions. Furthermore, AstraAI’s expertise bolsters Syntor’s infrastructure for developers. Recently, Syntor added 5ETH to its fully locked $TOR liquidity pool. This significantly strengthens on-chain growth and market stability, effectively reinforcing investor confidence.

Syntor enables AI-powered decentralized apps with seamless integration of custom models for enhanced functionality. Its decentralized AI training leverages distributed computing for cost efficiency. Additionally, Farming-as-a-Service and AI-driven yield optimization maximize DeFi returns effectively. Furthermore, decentralized storage supports secure data handling for AI and apps. Moreover, edge computing ensures low-latency inference for real-time applications. Thus, Syntor enables diverse, innovative Web3 use cases. Consequently, it drives scalability and adoption in decentralized ecosystems.

3. Centrifuge ($CFG)

Centrifuge pioneers real-world asset tokenization, offering investors transparency and diversified portfolio access through its robust infrastructure. Its smart contracts enable asset managers to tokenize funds efficiently, reducing operational costs. Consequently, it integrates tokenized assets with DeFi protocols like lending markets. Additionally, Centrifuge Chain supports on-chain governance and asset securitization seamlessly. Furthermore, the Centrifuge App streamlines investment and fund management processes, enhancing liquidity and financial access. As a result, Centrifuge transforms asset management significantly.

Centrifuge’s institutional-grade RWA Launchpad provides flexible smart contracts for rapid tokenized product deployment. Its deRWA service creates transferable tokens for DeFi integration, enhancing liquidity. Moreover, the fund management system captures on-chain and off-chain portfolio data securely. Additionally, the RWA Market enables lending and borrowing against tokenized assets. Furthermore, Liquidity Pools allow cross-chain investments without leaving native chains. Consequently, Centrifuge effectively bridges traditional and decentralized finance. Thus, it unlocks new capital sources for asset managers.

Centrifuge Chain, a layer-1 blockchain, supports real-world asset tokenization as NFTs linked to off-chain data. It houses pools, tranches, governance, and the CFG token for protocol management. Additionally, E disregardVM compatibility enables transactions via wallets like MetaMask for user convenience. Furthermore, Liquidity Pools seamlessly facilitate investments from Ethereum and Layer-2 ecosystems. Moreover, Centrifuge Prime simplifies RWA onboarding for DAOs and protocols. Thus, it streamlines technical and legal processes effectively. Consequently, it enhances accessibility for on-chain organizations.

The CFG token migration is LIVE! 🚀

Migrate your CFG and WCFG to the new token now.

Everything you need to know: https://t.co/eE2sdFOnYB

Questions? Join us on Discord: https://t.co/ky4QCxwv3c pic.twitter.com/UD6IE2M7vO

— Centrifuge (@centrifuge) May 20, 2025

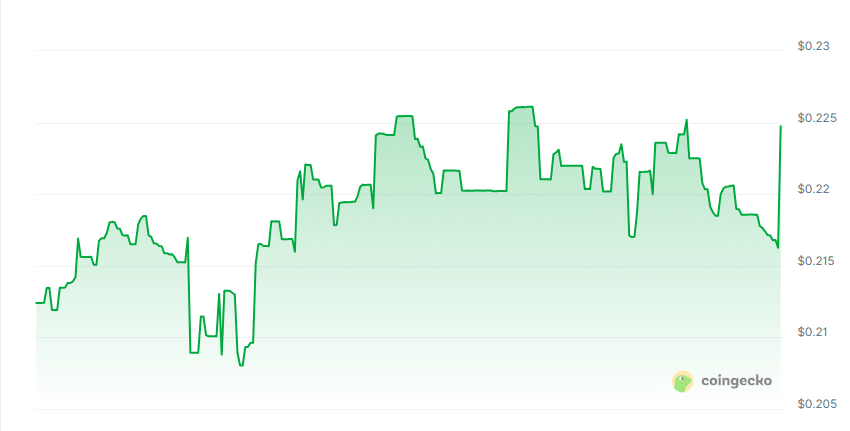

In recent news, the CFG token migration is live, allowing users to transition seamlessly to the upgraded token system. CFG and WCFG holders can now migrate their tokens intuitively on Centrifuge’s infrastructure. This migration enhances protocol efficiency by optimizing transaction speeds and significantly reducing operational costs.

Centrifuge’s partnership with BlockTower Capital strengthens its real-world asset tokenization efforts significantly. This collaboration leverages BlockTower’s expertise in capital stewardship and risk management. Moreover, it effectively enhances Centrifuge’s credibility among institutional investors. Furthermore, the partnership supports scalable RWA portfolio development for on-chain entities. Additionally, it drives the adoption of tokenized assets in DeFi markets. Thus, it positions Centrifuge as a leader in asset tokenization. Consequently, it attracts diverse investors and asset managers.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage