Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price tumbled 2% in the last 24 hours to trade at $104,947 as of 7:55 a.m. EST on a 48% surge in trading volume to $51.6 billion.

The BTC price drop comes after the Financial Times reported that Anthony Pompliano is in talks to lead an investment firm that aims to raise $750 million to buy Bitcoin. More details could be revealed next week, it said.

🚨 JUST IN: Anthony Pompliano in talks to lead investment firm looking to raise $750M for $BTC, per FT. pic.twitter.com/zUEKslt0CX

— Cointelegraph (@Cointelegraph) June 13, 2025

While that’s positive news for Bitcoin, surging tensions in the Middle East after Israel launched air attacks on nuclear and ballistic missile sites in Iran, dragged the BTC price down.

Bitcoin Price Risks 12% Crash If This Level Fails

The BTC/USD 3-day chart shows a 50-day Simple Moving Average (SMA) at $94,822, while price action dangles above at $104,947. The price has been grinding upward since late 2024, breaking past the $100K mark recently, with a high of $112,063.

Those green circles on the chart mark key points on the consolidation zone between $92,000 and $101,000, where BTC recently broke out of. Following tensions in the Middle East, the BTC price dipped, testing the upper boundary of the range.

With only 1 day remaining to the close of the 3-day candle, all eyes are on the $101,000 support level, which also doubles as a neckline for a potential double top pattern. If price fails to remain above this support level, it could push the asset toward $94,000 or below.

BTCUSDT Analysis Source: Tradingview

Indicators Signal More Pain Ahead For BTC Price

Digging into the indicators, the Relative Strength Index (RSI) at 57.25 is neutral, but facing downward, which means buying pressure is reducing.

The Moving Average Convergence Divergence (MACD) also shows a potential bearish crossover forming, a signal of impending bearish reversal.

If the market dips, the bulls might hold the line around the $92,000 level, which marks the bottom of the range. A drop below 92,000 could spell trouble and could send the BTC price to $78,000.

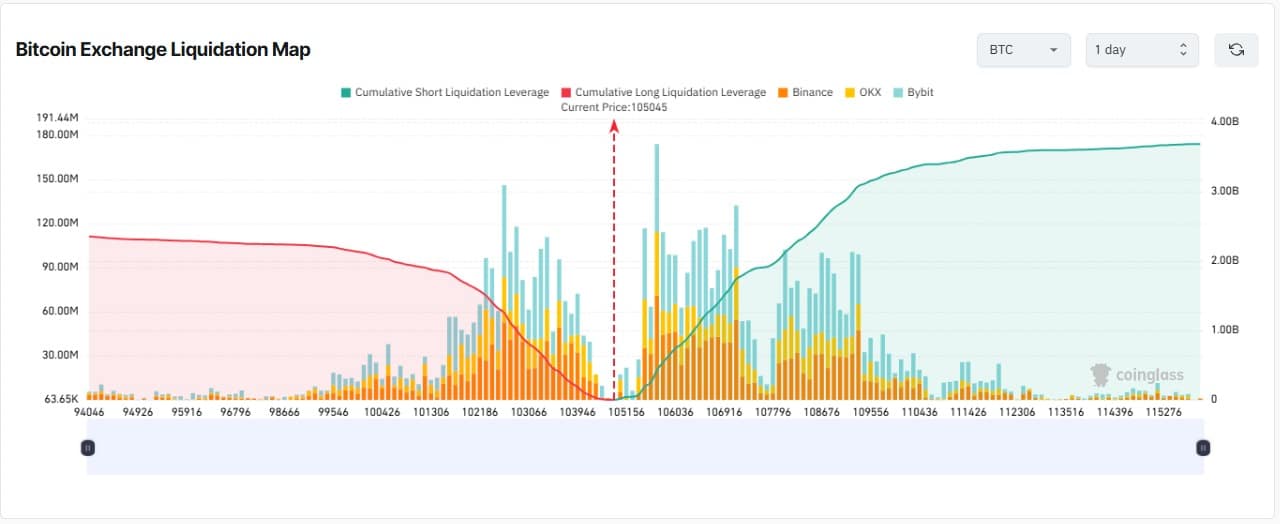

Data from the Coinglass Liquidation Map shows there were more cumulative short liquidation leverage ($3.69 billion) compared to longs ($2.35 billion) in the last 24 hours. This imbalance suggests that bearish sentiment is dominating the current BTC market because traders anticipate the price may drop further in the future.

A deeper analysis of the liquidation map also shows that the $102,000 to $106,000 zone is a key consolidation level for BTC. This signals that, despite a bearish outlook from the chart and technical indicators, Bitcoin price might survive and remain above the $101,000 key support.

Bitcoin Hyper Presale Surges Past $1.1M – Next Crypto To Explode?

As the Bitcoin price battles Middle East tensions, investors are flocking to the new Bitcoin Layer 2 called Bitcoin Hyper (HYPER), which has soared past $1.1 million in funding in presale.

Bitcoin Hyper makes using Bitcoin faster and cheaper. Right now, sending Bitcoin can take up to an hour and cost high fees, even $10 for a $20 payment. Bitcoin Hyper will solve this.

It runs on the Solana Virtual Machine (SVM), which means transactions happen in seconds and fees are tiny. To use it, you just send your Bitcoin to a special address through something called the Canonical Bridge. After that, you can enjoy super quick and low-cost BTC payments.

🚨 Bitcoin Hyper is now live in Best Wallet! 🚨@BTC_Hyper2 is building Bitcoin’s first Layer 2 focused on real scalability — enabling fast, cheap BTC transactions, meme coins, dApps, and more.

It’s secured by Bitcoin L1 and powered by Solana VM tech for high speed and massive… pic.twitter.com/5Ktj12RCR1

— Best Wallet (@BestWalletHQ) June 5, 2025

A smart contract called the Bitcoin Relay Program checks the Bitcoin blockchain to confirm your transaction. Once it’s verified, you get the same amount of Bitcoin on Hyper’s fast Layer 2 network. There, you can send, stake, or trade it instantly.

The system uses zero-knowledge proofs to keep everything safe, and your Bitcoin stays connected to the security of the main Bitcoin network. When you’re done, you can easily move your holdings back to regular Bitcoin.

Buy And Stake HYPER Now – Enjoy 626% APY

The HYPER token is the native asset of the Bitcoin Hyper L2 network and offers staking rewards of up to 626% APY right now. The rate reduces as more investors stake their tokens, so it’s best to get in early. With 30% of tokens set aside for development and 10% for exchange listings, the team is gearing up for growth.

According to 99Bitcoins, a popular crypto channel on YouTube with over 723K subscribers, HYPER might be the best crypto to buy right now.

Bitcoin Hyper tokens are on sale for $0.011875 apiece, and can be bought with crypto or a bank card.

Interested investors should buy before a price hike in a little more than 1 day.

Visit the Bitcoin Hyper presale

Related Articles:

- Cardano Price Prediction for Today, June 12

- Top Cryptocurrencies to Invest in Now, June 12

- BTC Plunges 4%, Investors Flock To This Bitcoin-Gifting ICO

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage