Bitcoin may be digital cash, but it has a lot in common with the paper currency you carry with you. Both BTC and fiat money can be bought, sold, traded, or stored in a wallet. A Bitcoin wallet is a digital wallet.

Using this guide you’ll be able to set up your own secure Bitcoin wallet to safeguard your Bitcoin and other cryptocurrency holdings.

On this Page:

Best Bitcoin Wallets in May 2025

- Best Wallet – Supports Bitcoin and 1000+ Assets

- Exodus – Easy-to-Use Bitcoin Wallet

- Margex Wallet – User-first Approach

- Zengo – No Seed Phrase Vulnerability

- BloFin Wallet – Supports over 500 Assets

- Ledger Stax – Portable Hardware Wallet with an e-ink Screen

- Cypherock – Decentralized Key Storage

- Ellipal – Top Multicurrency Hardware Wallet

- Trezor – Hardware Wallet With Strong Security

- Binance Wallet – 70+ Locked Staking Products

- Bybit Wallet – Popular Bitcoin Wallet Allowing Users to Interact with GameFi and DeFi

- OKX Wallet – Beginner-Friendly Bitcoin Wallet to Interact with Web 3 Projects

- Crypto.com – Uses Safest and Highly Researched Tech

- Coinbase – Supports Staking of ALGO, ATOM, DAI, USDC, XTZ

Best Bitcoin Wallets

Below we take a closer look at the top Bitcoin wallet providers on our list:

1. Best Wallet – Crypto Wallet With AI Integration

Our pick for the best Bitcoin wallet is one that has everything a discerning BTC investor would want. There is the ability to buy and sell multiple crypto assets due to multi-chain support. There are security features that cover everything from multi-factor authorization to biometrics identification. And there is a unique AI integration that would redefine how you interact with the cryptocurrency market.

Known as Best Wallet, this Bitcoin Wallet is yet to be released. But due to its many positive features, the waiting list is long. It allows one to safely buy, sell and store over 1000 crypto assets along with Bitcoin. And with its multi-chain support, you will be able to interact with a wide array of decentralized applications, including staking protocols and yield farming.

But the fundamental feature that sets this crypto wallet apart from the rest is the AI chatbot. This advanced tool helps with interacting with the crypto wallet in a whole new way. It also offers insights into the current state of the cryptocurrency market.

Another additional feature is the inclusion of the token – $BWAT. Staking this asset allows users to gain access to several perks, including zero gas fees.

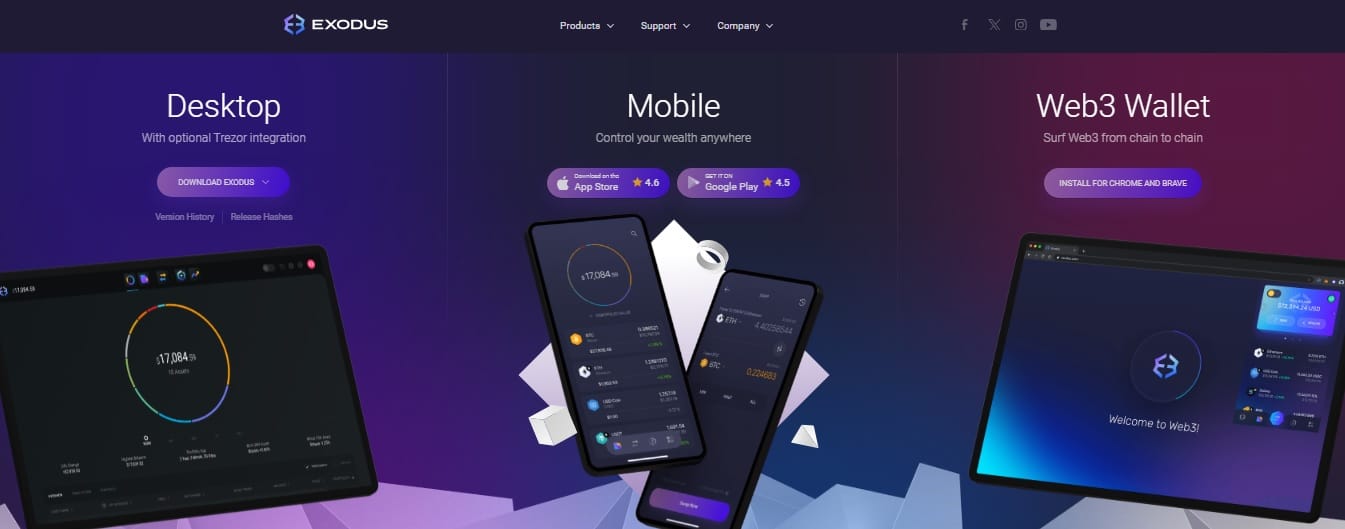

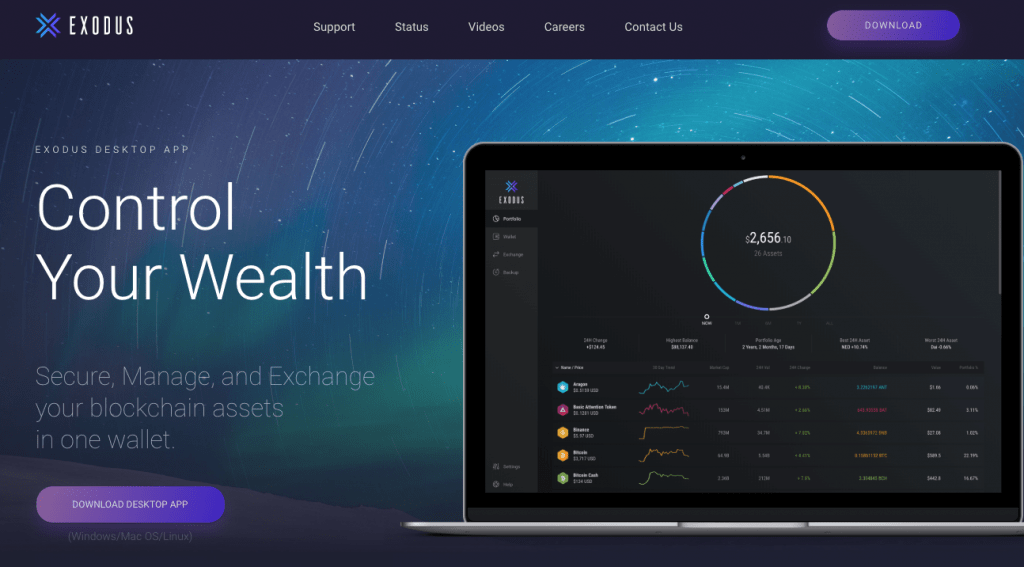

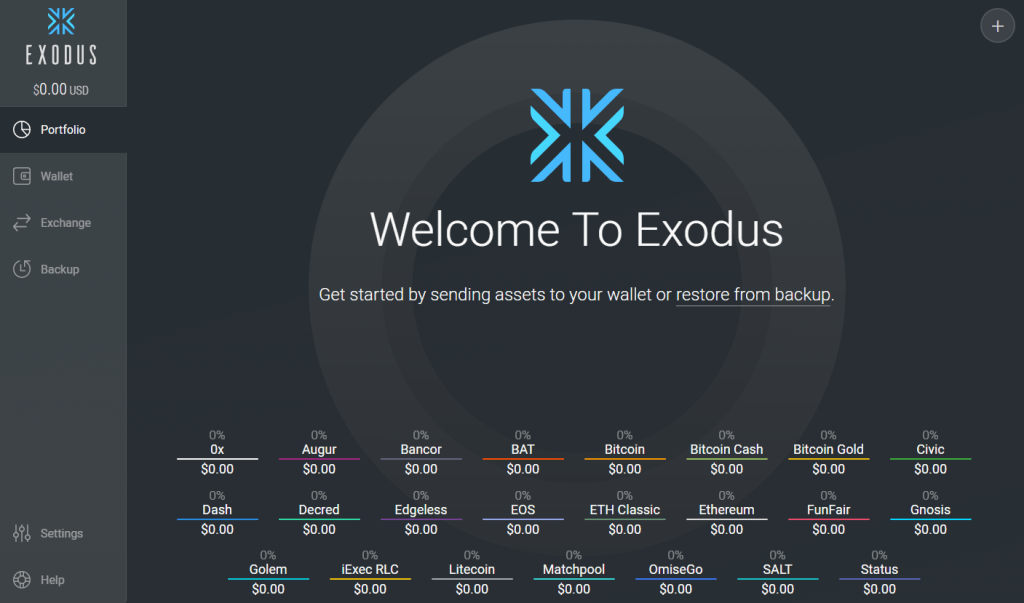

2. Exodus – Easy-to-Use Bitcoin Wallet

Exodus has distinguished itself as one of the most reliable Bitcoin wallets that investors should try out this year. With its easy-to-use interface, mobile accessibility, anonymity, staking options, and ultimate security features, Exodus caters to the various preferences of beginners and professional investors alike. Besides Bitcoin, Exodus supports more than 250 cryptocurrencies.

As such, it is considered an ideal choice for those seeking to diversify their crypto portfolios. When it comes to accessibility, Exodus has a desktop version that’s currently available for Windows, Linux, and Mac OSX operating systems. Those who like to manage and grow their crypto portfolios even while on the move will also find Exodus’ mobile version attractive. Exodus’s mobile app is compatible with both iOS and Android devices, delivering the same experience as its web version.

While using Exodus, investors can rest assured that their financial and personal details are private. No personal data is required by the wallet for users to download, install, and use the wallet.

Also, users can exchange their favorite cryptocurrencies without leaving the app or undergoing any KYC process, thanks to its support for non-custodial third-party API exchange providers.

Another standout attribute of Exodus wallet is its support for staking. It allows users to stake multiple assets so that they can compound their gains with passive rewards. Nonetheless, the APY reward for each asset varies. Additionally, Exodus comes with an NFT marketplace where users can receive, store, and share their digital collections.

3. Margex Wallet – User-First Approach

Margex Wallet stands out as a solid wallet option for beginners looking for the best place to keep their Bitcoin. Built within an exchange app, this wallet solution ensures that users can store Bitcoin and major altcoins like ETH, TRX, MATIC, SOL, XRP, ADA, LTC, AVAX, DOGE, and BCH amongst others.

Beyond effective crypto storage, Margex also provides a secure avenue for all users, including newbies to buy, sell, and trade any of the aforementioned crypto assets. While catering to professional traders with its advanced trading tools like leverage trading, Margex also incorporates copy trading so that beginners can net huge gains without necessarily having a deep knowledge of the market.

With its copy trading feature, beginners will be able to imitate the trading strategies of successful traders and benefit from the potential opportunities in the market. Users are not mandated to pay a certain fee before maximizing this feature.

Complementing Margex’s appeal as an ideal wallet option for beginners is its easy-to-use interface, ensuring that they can navigate all the embedded features without seeking the support of third parties. The platform’s layout is not only simple to navigate but also easy on the eyes, thereby enhancing accessibility.

Security is the most important aspect of a wallet that ensures safe transactions and attracts trust among users. To guarantee the maximum safety of users and their funds, Margex uses an advanced encryption protocol so that all data exchanged between the platform and traders will be intercepted by hackers. In addition to this, Margex supports a 2FA wallet protection technique to prevent any unauthorized access.

Margex is a no-KYC Bitcoin wallet, which implies that new users won’t have to embark on any rigorous registration process before getting started with the app.

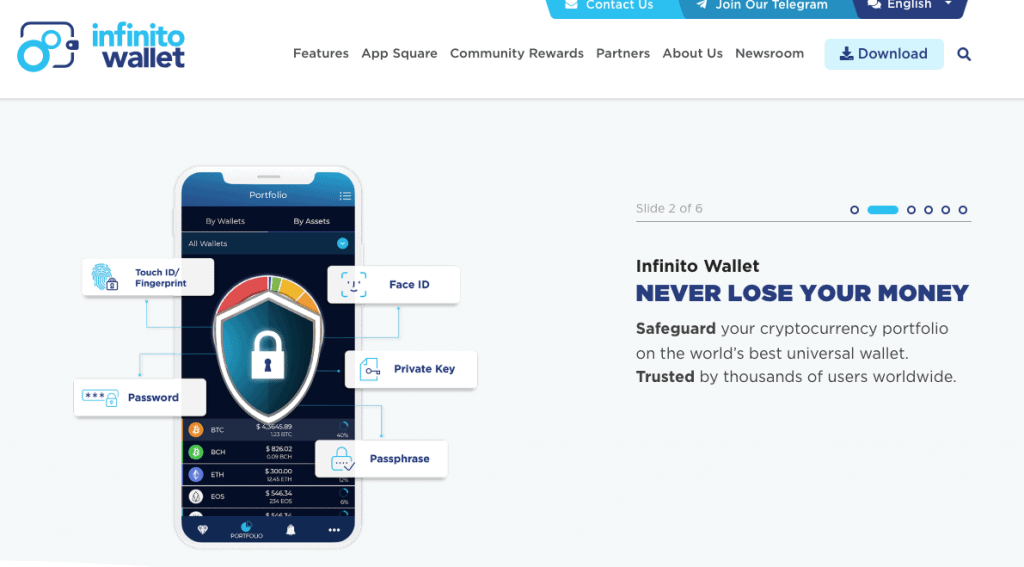

4. Zengo – No Seed Phrase Vulnerability

Zengo stands out as another popular wallet where users can manage their cryptocurrencies and NFTs with ease. At the heart of Zengo lies the principles of simplicity, security, and innovation. Users can trade Bitcoin and well-known altcoins like Ethereum, Dogecoin, Polygon, Tether, Shiba Inu, and hundreds of others on Zengo.

To improve the overall experience of its users, Zengo supports WalletConnect. Therefore, users can seamlessly connect to dApps and NFT marketplaces like OpenSea. That being said, one major selling point of Zengo that differentiates it from others is its advanced cryptography which ensures that the wallet has no seed phrase vulnerability.

Those using the wallet don’t have to worry about private crypto keys to keep their assets safe. This aspect of Zengo enhances its market appeal, positioning it as one of the safest and most simple wallets to use this year.

Additionally, Zengo has embraced securely encrypted biometrics and password-free security measures to ensure that users stay in full control of their assets. Those who need help while exploring any of its features can take advantage of its ever-active customer support service.

Finally, Zengo has a mobile app that can be downloaded on Google Play and App Store. On Google Play alone, the app boasts more than 500k downloads, underscoring its popularity among wallet users.

5. BloFin Wallet – Supports More Than 500 Crypto Assets

BloFin Wallet leaves no stone unturned to provide a seamless service to beginners seeking the right spot to store their Bitcoin holdings. Like Margex, the BloFin Wallet also operates within its exchange app, drawing users with an array of industry-standard features such as spot trading, copy trading, futures trading, Earn program, and many more.

Contributing to the positive user experience on BloFin is its sleek interface. BloFin is built with users’ convenience in mind. Its user-focused layout design makes navigating through all the aforementioned trading features and tools a breeze for beginners.

Beginners and intermediate traders who are occupied with other commitments can take advantage of BloFin’s copy trading feature to replicate top traders’ strategies at no cost. The platform’s futures trading supports over 320 USDT-M perpetual contracts, including Bitcoin.

In terms of deposits and withdrawals, BloFin also supports more than 80 fiat currencies and offers reasonable trading fees. Users can also stake their Bitcoin alongside ETH and USDT to earn passively. Staking on BloFin comes with two options – flexible and fixed products.

The former allows users to redeem their assets at any time while the latter requires stakers to deposit the assets for a specified period of time. All in all, both options provide an ample opportunity for Bitcoin investors to amplify their returns.

Meanwhile, to ensure that activities on its platform are in line with regulatory stipulations, BloFin incorporated a Know-Your-Transaction system. Developed by AnChain.AI, this AI-powered blockchain innovation facilitates real-time monitoring of transactions, empowering the team to discover illicit movement of funds.

Lastly, CER.live, a renowned firm that analyzes the security level of crypto exchanges, scores BloFin 88/100 when it comes to safety, ranking it among the most secure digital assets trading platforms around. Hence, it is considered a good place for users to maximize their Bitcoin assets.

6. Ledger Stax – Portable Hardware Wallet with an e-ink Screen

Ledger Stax is a new hardware wallet designed by Ledger, a well-known crypto and blockchain security solutions provider. Described as the upgraded versions of Nano X and Nano S Plus, Ledger Stax is popular for its high standards of security and usability.

One major attribute of this cold storage wallet that distinguishes it from its predecessors is its e-ink screen which offers efficient readability, regardless of the lighting conditions. In addition to this, the innovative e-ink display enhances the outlook of the hardware device, giving it a unique curved look while also ensuring low power consumption.

Another key attraction for Ledger Stax is its portability, meaning it can easily fit it into users pockets, allowing them to move around with it at any period of time. Unlike other hardware wallets, users can power their Ledger Stax devices either through USB-C or wireless charging. This standout attribute adds an extra layer of flexibility to powering the device and ensures that users can choose from any of the options that’s most convenient to them.

Meanwhile, Ledger Stax is built on the same efficient security model as all Ledger devices. This next-generation wallet is developed in a way that makes it resistant to remote and physical attacks. It combines ST33K1M5 Secure Element Chip, pin protection, and two-factor authentication (2FA) to ensure that users’ private keys stay encrypted.

Furthermore, Ledger Stax has a protective mode that instantly locks the gadget once it detects a malicious attempt to access the assets in the wallet. Highlighting its credibility, Ledger Stax has earned a Common Criteria (CC) EAL 5+ certification which attests to how the hardware wallet is up to the International information technology security evaluation standards.

Finally, for those scouting for a reliable device to manage your large crypto portfolios, look no further than Ledger Stax. It supports more than 5,000 cryptocurrencies and NFTs through its mobile-friendly Ledger Live app.

7. Cypherock – Decentralized Key Storage

Cypherock is flying high on our list of the best Bitcoin wallets for beginners due to its strong emphasis on protecting users’ assets through decentralized key storage. The hardware wallet eliminates seed phrase vulnerabilities through its Shamir Secret Sharing mechanism which cryptographically divides users’ private keys into shards and stores them on five tamper-proof devices – one X1 vault and four X1 cards.

The vault device has a dual-chip architecture, accompanied by an OLED display and a joystick for effective offline transactions. X1 cards, on the other hand, come with EAL 6+ Secure Elements to deliver almost the same level of security as credit cards. Meanwhile, whenever users want to execute a transaction, all they need is the X1 vault and one of the X1 cards.

Through this strategic approach, Cypherock prevents every risk associated with conventional seed phrase backups. However, while Cypherock doubles as a hardware wallet and private keys storage, those who still want to access their seed phrase and back it up elsewhere for additional security are free to do that.

On this note, one such backup option that we recommend is Cryptotag Zeus. Designed with titanium, Cryptotag seed recovery plates are indestructible by fire below 1667°C, bullets, erosion, and corrosion.

That being said, Cypherock is known for its extensive crypto support, covering over 9000 assets. More so, setting itself apart from its peers, Cypherock allows up to four wallet accounts per device, making it a perfect pick for crypto whales.

Meanwhile, the wallet is accompanied by a desktop app – CySync – to ensure easy management of users’ assets. Those using the wallet will also be able to explore a host of applications in the world of DeFi.

Most importantly, Cypherock has been fully audited by WalletScrutinity and Keylabs, reinforcing its position as one of the safest hardware wallets for beginners. The device is quite affordable and intending buyers stand the chance to receive a 17% discount if they use our promo code “coldwallet.”

8. Ellipal – Top Multicurrency Hardware Wallet

Ellipal is an innovative touchscreen Bitcoin wallet that leverages a QR code scanning camera to sign transactions, thereby eliminating the risks associated with USB or wireless connections. For those looking for a secure place to store, manage, and grow crypto assets, Ellipal is one of the best options to consider.

Ranked as one of the top three hardware wallets by Forbes, Ellipal supports up to 10,000 cryptocurrencies including Bitcoin and some of the best cryptocurrencies around. The crypto wallet is also compatible with more than 40 blockchains and features a dual-layer defense with CC EAL 5+ Secure Element chip so that users can feel safe while maximizing their assets.

Meanwhile, the Ellipal wallet comes in two models – Titan 2.0 Cold and Titan Mini Cold. The duo are non-custodial hardware wallets with similar features but different prices. The Titan Mini version of the Ellipal wallet appeals to mobile users as it weighs 100 grams and can be easily kept in any pocket.

Considering their anti-tampering and fully air-gapped features, investors can rest assured that their wallets are protected from exploitation.

Adding a feather to Ellipal’s cap is its companion app which has been designed with users’ convenience in mind. With this app, users can buy Bitcoin and other cryptos via third-party providers like Banxa.

9. Trezor – Hardware Wallet With Strong Security

For those who prefer to use a hardware wallet and have a larger amount of bitcoin to store, Trezor is an ideal option. we have selected two of the best-known cold storage wallets. It is a small-sized device that can hold different types of cryptos, such as Bitcoin, Ethereum, Ripple, Cardano, Zcash, etc. Launched in 2014, it was the first hardware wallet that offers secure storage for your BTC and other crypto assets.

You can get Trezor for under $100, and the package also includes a USB that connects the small device to your computer. You will also get a list where you should create a 24-word security code for your Trezor that later you can use to recover your wallet in case you lose your Trezor.

The device stands out with excellent privacy, and even the company producing it cannot track how you use it as long as there is no serial number written on it.

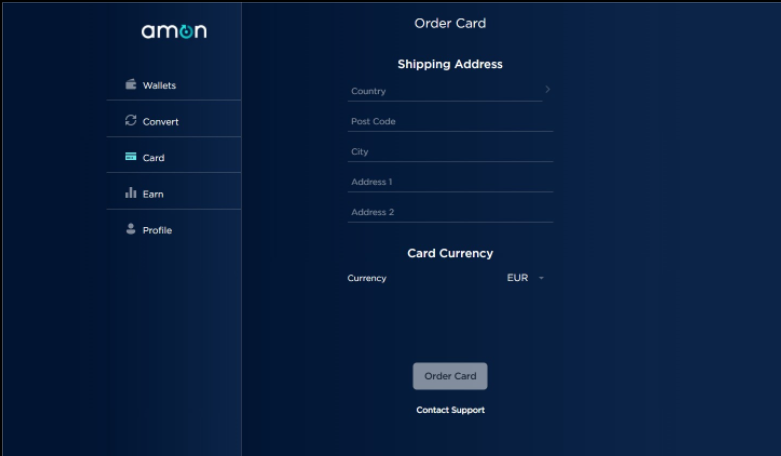

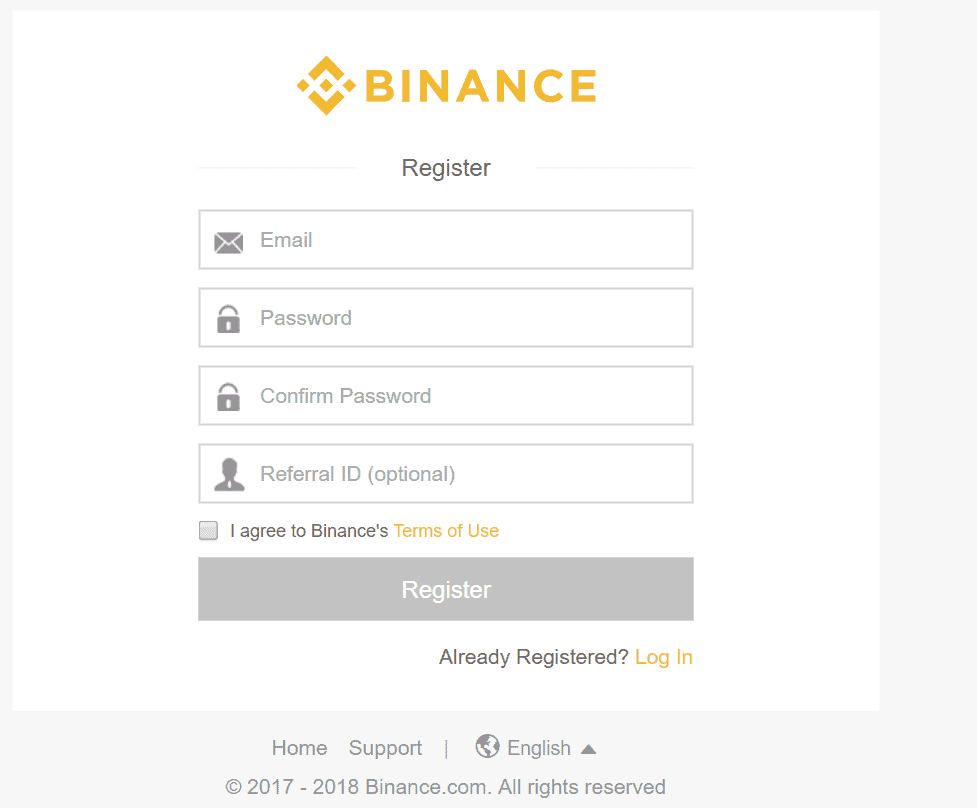

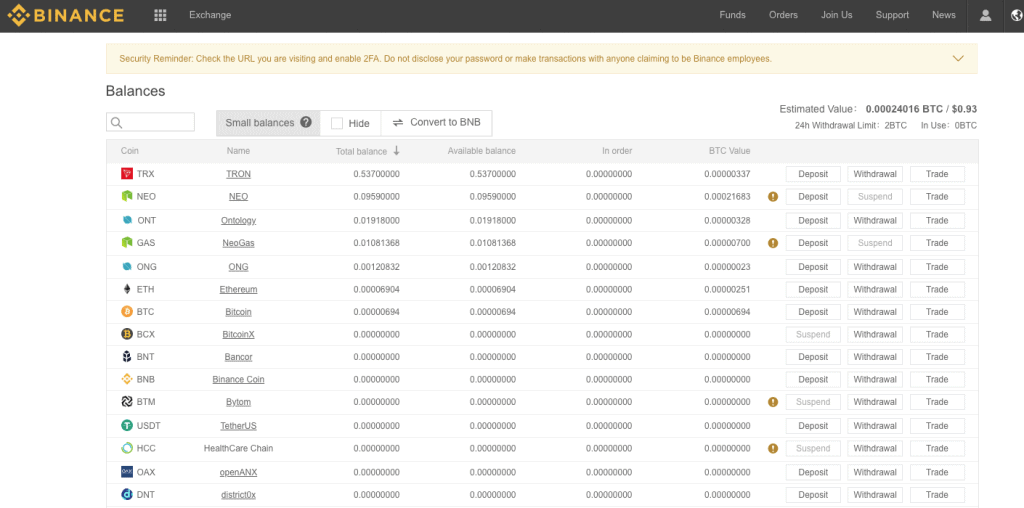

10. Binance Wallet – 70+ Locked Staking Products

Binance is a cryptocurrency exchange and a peer-to-peer marketplace that offers users a vast selection of digital assets.

To store these cryptocurrencies, Binance also offers one of the best Bitcoin wallets used by already 10 million people around the world. It interacts with several blockchain wallets and crypto tokens and it has a mobile app that you can install on your device and use to store, receive, exchange, and send hundreds of cryptocurrencies.

Additionally, Binance Wallet not only allows you to store your cryptos but also gives you the opportunity to earn rewards by staking your coins. At the time of writing, Binance supports locked staking of 76 different cryptos.

For Americans, there’s Binance US which has the same features as Binance.

11. Bybit Wallet – Good Bitcoin Wallet Allowing Users to Interact with GameFi and DeFi

Bybit is a cryptocurrency exchange that emerged in 2018 and soon earned renown thanks to multiple inclusive facilities to make it open to buying cryptocurrencies. Bybit’s bitcoin wallet, the Bybit wallet, allows mobile users to easily interact with Bybit’s ecosystem.

Users can see the list of top DeFi and GameFi projects through the wallet. And they can also access the top NFT collections. The Bybit wallet also comes back with a learning tool that allows users to learn about DeFi and other nuanced blockchain concepts in a simple language. The wallet also comes with a Dapp aggregator, giving investors access to the best-decentralized applications available in the market.

The wallet also gives users access to IDO cryptos and swap facilities. Staking pools that let investors generate income from on-chain liquidity mining are also accessible through the Bybit wallet. Bybit has also introduced a “Rewards” section recently that gives users access to airdrops and other rewards in return for completing the Web 3 tasks.

New users will also be benefited, as those who go to the official platform and sign up can get a bonus of up to 5030 USDT.

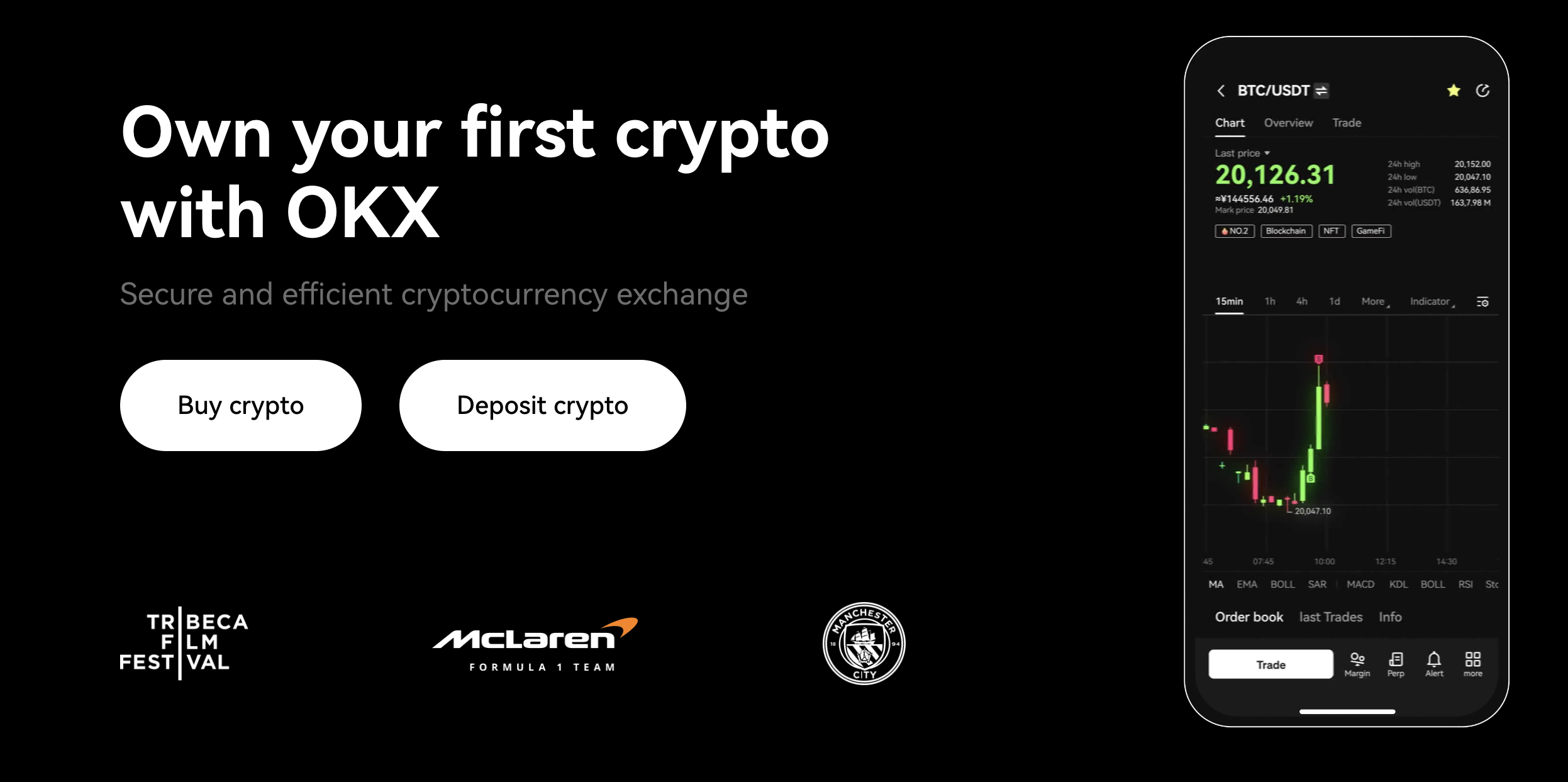

12. OKX Wallet – Beginner-Friendly Wallet to Interact with Different Web 3 Project

OKX is the world’s third-biggest cryptocurrency exchange by market capitalization. It supports over 350 cryptocurrencies that users can buy and sell either using crypto or over 112 different fiat methods. OKX supports basic trading, derivatives, and margin trading. The platform also has a trading bot, providing a hands-free trading facility. Block trading features are also available on OKX.

One of the best add-ons of OKX is the copy trading utility. It allows users to find trading influencers, track their trading signals and copy them. That utility is suitable for traders who want to make gains without having to dive into multiple research sources for each crypto asset. Users can also become lead traders – whose trading strategies get copied – and earn passive income based on the number of users copying their strategies.

OKX also has a Grow Program, which includes OKX Earn, that offers staking rewards and APR (Annual Percentage Returns), and loans. Users can also use the “Jumpstart” program to find high-quality projects to invest in.

All these features can be interacted with using the Bitcoin wallet that OKX sponsors. It is a soft wallet that offers flexibility as well as security. In terms of licenses, OKX has acquired registration to operate in Dubai. The exchange has also applied for a license in China recently.

Overall, OKX is a beginner-friendly exchange with a Bitcoin wallet that people can easily interact with. Its easy-to-use interface positions it as one of the top crypto wallets for beginners. The wallet allows users to access over 50 decentralized networks. The wallet also features a Web 3 dashboard that lets investors access Dapps, NFTs, and other crypto-related features.

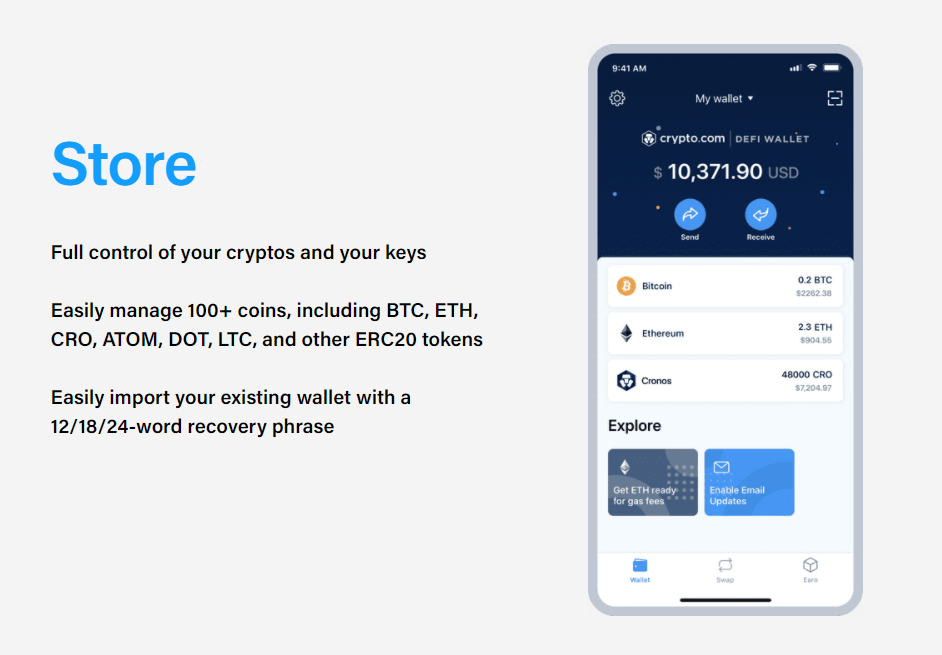

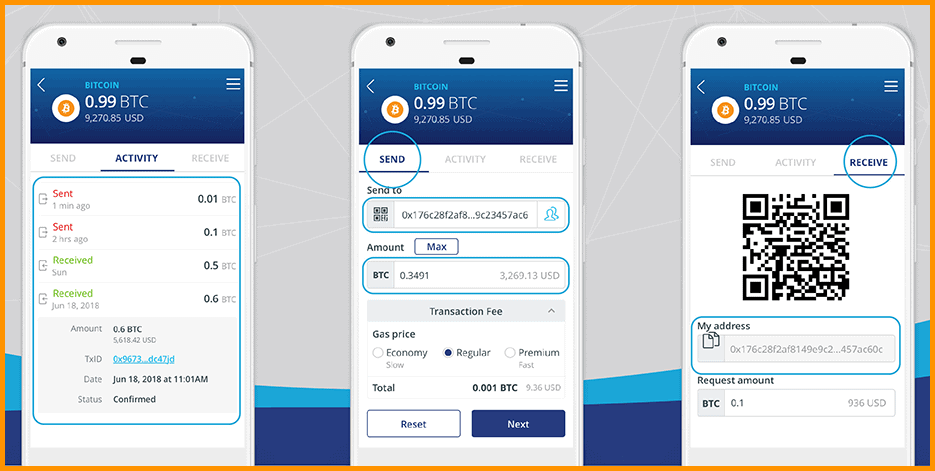

13. Crypto.com Wallet – Uses Safest and Highly Researched Tech

Crypto.com DeFi Wallet is the best Bitcoin wallet for storing, earning, and growing your cryptocurrencies. It is a non-custodial wallet that provides access to a comprehensive set of DeFi services in one location. In this wallet, your private keys to Bitcoin are encoded locally on your device using Secure Enclave and are safeguarded by biometric and two-factor authentication. Here, you have complete control over your private keys here.

You can send cryptocurrency to anyone at your chosen confirmation pace and the network fee. Users can send and receive more than 500 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), DeFi coins such as Uniswap (UNI), Compound (COMP), Yearn finance (YFI), stablecoins, and other ERC20 tokens. ERC721 and ERC1155 Ethereum-based NFTs are also supported on this wallet.

The Crypto.com DeFi Wallet helps to discover DeFi projects in a simple and secure manner. With DeFi Earn, you can deposit and obtain the highest returns on your DeFi tokens. Aave Lending V2, Yearn Earn V2, Compound, Cosmos Staking, and native CRO Staking are all consolidated with DeFi Earn.

This wallet also has a multi-wallets function through which you multiple wallets under the Defi Wallet App by making new wallets or importing existing wallets. You can connect your Crypto.com DeFi Wallet to the Crypto.com App with your preferred wallet for gaining access to Crypto.com’s various crypto financial products.

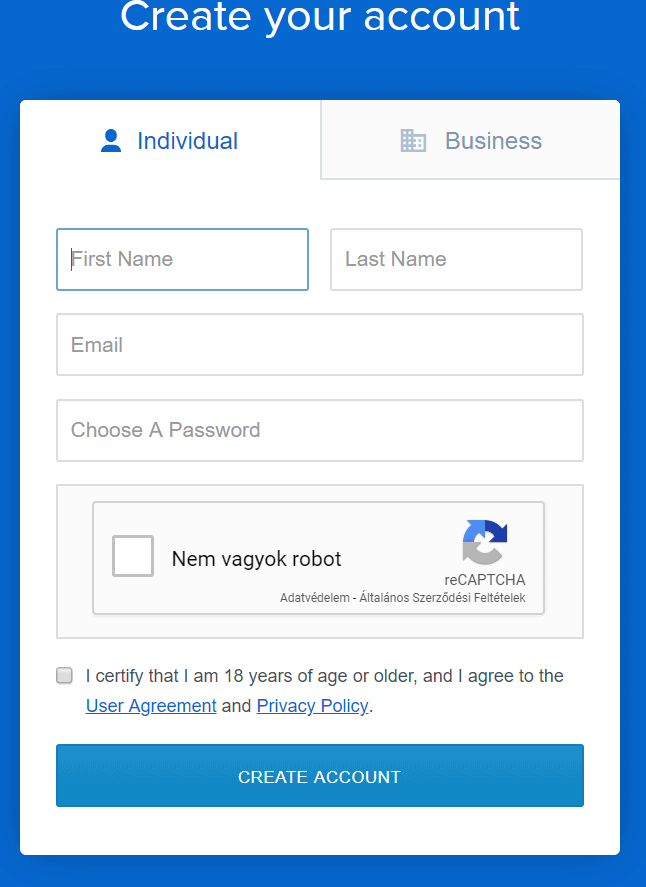

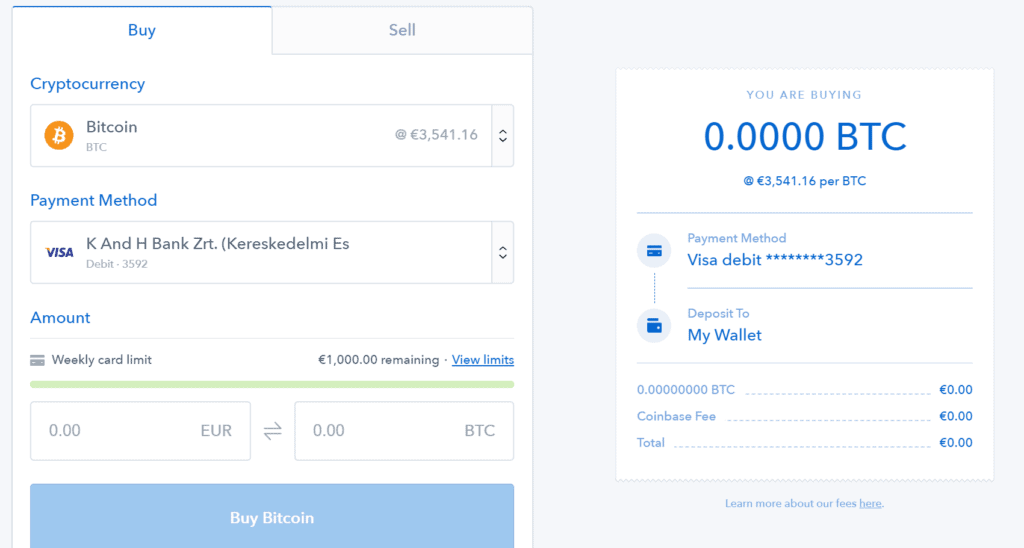

14. Coinbase Exchange Wallet – Supports Staking of ALGO, ATOM, DAI, USDC, XTZ

Coinbase is another worldwide known cryptocurrency exchange that also offers a separate crypto wallet known as Coinbase wallet. The latter exist standalone, and you don’t have to open a Coinbase account to have a Coinbase Wallet. Still, you can link your wallet to your Coinbase account and quickly transfer your funds between them.

With your Coinbase Wallet, you can store your crypto coins in one place and get access to more than 500 cryptocurrencies and several NFTs, take part in ICOs, shop at the stores where they accept cryptocurrencies, send crypto to any part of the world, and not only. Among the essential features of the platform offers is its easy and simple-to-use interface. Another crucial thing is your security – Coinbase Wallet protects your private keys with high-standard security systems, including Secure Enclave, biometric authentication, and optional cloud backups.

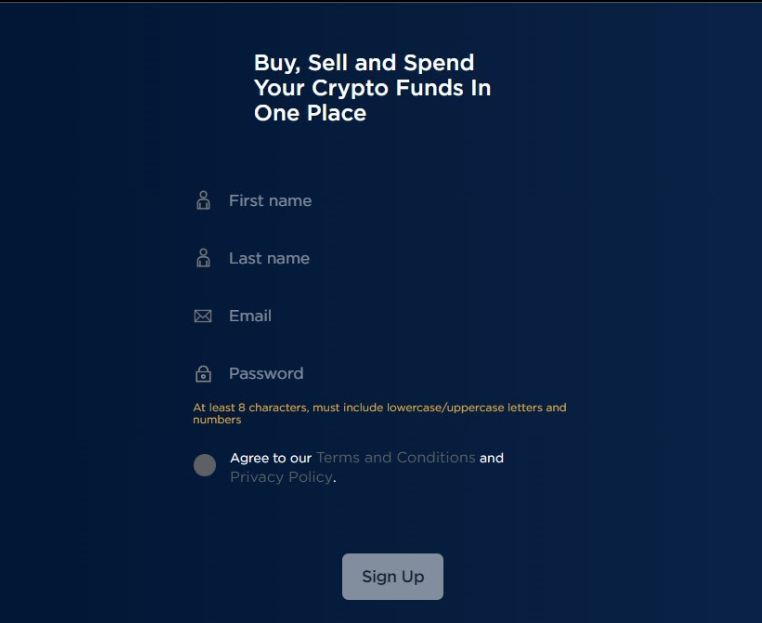

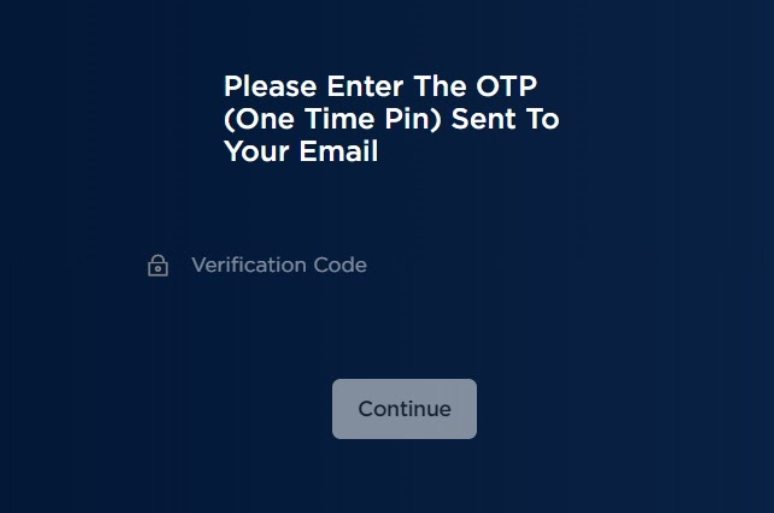

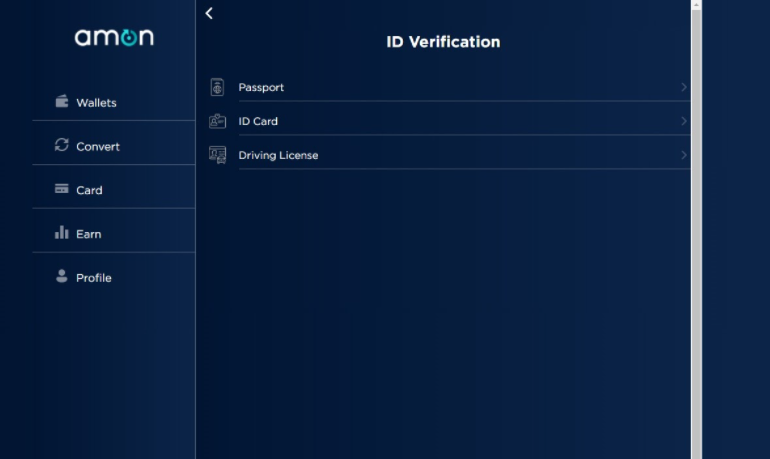

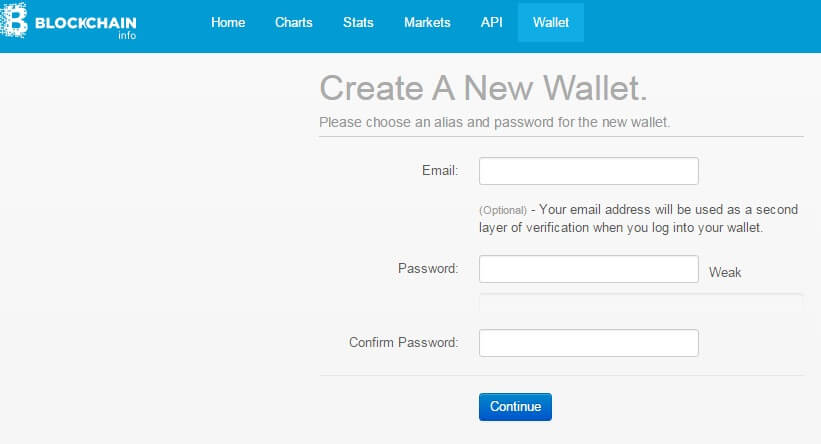

How to Create a Bitcoin Wallet

What is a Bitcoin Wallet?

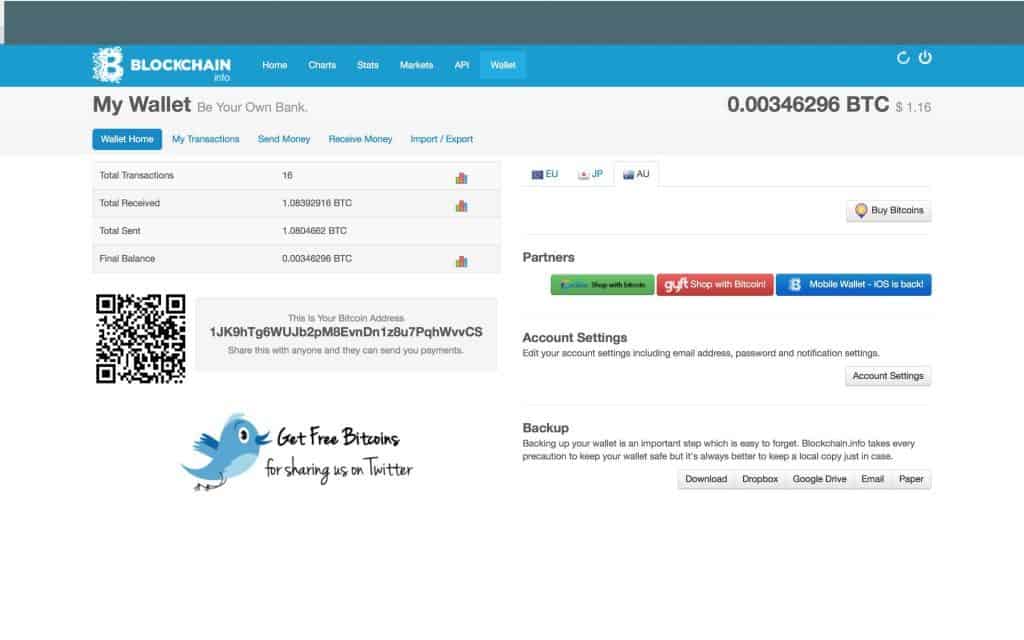

In essence, when you buy Bitcoin, you get cryptographic information through which your Bitcoin address is linked to you. This information represents a combination of long and complex codes which are rather difficult to remember (or to hack). That’s why you need a bitcoin wallet where you store these codes or otherwise called private keys. Your Bitcoin wallet interacts with the blockchain network and allows you to send your Bitcoin or receive a new BTC.

Never trust your Bitcoin wallet to someone else in the same way as you don’t trust your physical wallet where you keep your money. If someone gets your private keys, they can easily have access to your Bitcoins and steal it. Hence, you create a personal password for your crypto wallet, which you must not lose or forget.

With a Bitcoin wallet you can:

- Receive cryptocurrencies

- Send cryptos

- Trade crypto

- Withdraw cryptos at a Bitcoin ATM

Never:

- Forget your wallet password

- Trust your password to anyone else

- Lose a hardware Bitcoin wallet

Nowadays, you have multiple Bitcoin wallet options to select – you can download it on your mobile phone, computer or buy it in the form of a physical device. On the whole, bitcoin wallets can be of three basic types – software, hardware, and exchange wallets.

A software wallet, also known as a hot storage wallet, is a program or an app that you download and install on a device. In their turn, software wallets can be mobile, web, and desktop wallets.

Alongide securing your investments, the possible uses of a Bitcoin wallet are endless, from BTC wallets for gambling to crypto savings accounts in which you earn interest on the Bitcoin, other cryptos or stablecoins in your wallet balance.

Exchange Wallets

In the early days of the crypto craze, there was a widespread opinion among crypto fans – “don’t keep your crypto on a cryptocurrency exchange”. It is because the first cryptocurrency exchanges like Mt Gox and others were less trustworthy and involved lots of scams.

Today this saying seems quite outdated, as brokers are trying to build more trust, and you can find basically several good brokers that are regulated and fully licensed platforms where you can safely trade and keep your crypto.

From all the available options, hardware wallets are indeed well-known as the most effective and secure way to store bitcoin, but they have their shortcomings too. The biggest threat is that you can lose it or forget your keys, and there is still the possibility of being hacked (remember the Metamask wallet case).

Crypto exchanges can also be hacked, but unlike hardware wallets, top regulated brokers like Coinbase will compensate for your loss while crypto wallets won’t.

Hardware Wallets

A hardware wallet, also known as a cold storage wallet, exists in the physical form. You can buy a hardware wallet from the store and use it to keep your Bitcoin offline. And the third type is an exchange wallet which operates utterly different from the previous two, as long as it is a centralized way of storing your BTC while the other two are decentralized.

The exchange wallet is provided by your broker/exchange and is also known as your brokerage account. When you buy Bitcoin on an exchange platform, your coins are automatically saved on your exchange wallet.

We should note that the exchange wallets provided by top brokers that are regulated by serious financial institutions are usually as reliable as decentralized bitcoin wallets. So, in all cases, when you select a Bitcoin wallet, the important thing is not the type of wallet you choose but its reliability and effectiveness.

How To Keep Your Wallet Seed Phrase Safe

With the high rate of hacking in the crypto realm, there’s no better time to keep your seed phrase safe than now. While some users have resorted to writing down their seed phrases on a piece of paper, keeping the document safe from water or fire damage can be so challenging.

Likewise, storing it on your laptop or smartphone can be risky as both gadgets are vulnerable to malware and spyware.

As such, it is no surprise that savvy crypto holders are now turning to innovative physical storage brands like Cryptotag. Renowned for its flagship products – Thor and Zeus, Cryptotag makes it possible for crypto investors to safely store their seed phrases and protect their funds.

Both Zeus and Thor are designed with users’ convenience in mind and can withstand extreme conditions. Unlike other physical seed phrase storage solutions, these products are resistant to fire and water.

At its core, Cryptotag caters to both beginners and seasoned crypto enthusiasts, thanks to its user-friendly posture. Users do not need any technical expertise to maximize all the features embedded in Zeus and Thor. More So, these products are quite affordable, meaning users won’t have to break the bank to store their seed phrases in a safe spot.

Conclusion

To conclude, Bitcoin is digital money that needs to be stored somewhere, much like any other digital asset. Hence, several crypto wallets emerged offering different services to store your cryptocurrencies. On the whole, they are of three kinds – exchange wallets, hardware, and software wallets.

Notably, while exchange wallets were once known as a not-so-secure method to store your bitcoin today, things have significantly changed. There are several brokerage platforms and crypto exchanges with a good reputation that also offer a safe place to store your bitcoin. Apart from the exchange wallets, you can also buy hardware wallets, which is physical device that helps you to keep your bitcoin offline.

A software wallet is another type of bitcoin wallet that exists in the form of apps that you install on your device and use it. There are multiple crypto wallets, so you may be somehow confused while selecting the most suitable one. Therefore, from our research, we have collected a list of the five best bitcoin wallets, including Best Wallet, Exodus, Zengo, Ellipal, and Ledger.

FAQs

Can I store all my cryptocurrencies in the same wallet?

Yes. There are multiple wallets available that allow you to store multiple cryptocurrencies of multiple chains. The latest one to come is the Best Wallet.

Can I send Bitcoin to a Ripple or Ethereum wallet address?

Absolutely not! This will result in the loss of your funds, so make sure never to send one coin to the address of another coin type. Bitcoin to Bitcoin addresses. Ethereum to Ethereum addresses. Ripple to Ripple addresses. Some ERC20 tokens (tokens created using Ethereum) can be sent to Ethereum addresses, but this is an exception that you'll learn when you get deeper into this discipline. For now, keep it simple and send specific coin types to specific wallet type addresses.

What is the best Way to keep my Cryptocurrencies safely stored?

The best way to store your cryptocurrency safely is to use a hardware wallet or other 'cold' (offline) solution. Even a paper wallet is safer than a software wallet that's running on an internet-connected computer, as the latter could theoretically be hacked. A device with no internet connection can't be hacked through the internet.

Can I convert Bitcoin to FIAT currency on my wallet?

On certain wallets, like the Coinbase wallet, you can trade fiat currency for Bitcoin, and vice versa. These are specially licensed and regulated wallets, and typically are associated with a specific exchange. This is not the norm.

Can I link my credit card to my bitcoin wallet?

On specifically licensed and regulated wallets, like those belonging to Coinbase, you can pay for Bitcoin with credit card. This is not normally available through software and hardware wallets.

ZenGo

ZenGo

Comments are closed.