Tokenomics are the economic principles and models that govern cryptocurrencies. They involve token supply mechanisms, distribution strategies, utility features, and incentive structures that collectively determine a digital asset’s fundamental value beyond market speculation.

In this article, we examine the critical components of tokenomics that separate sustainable projects from fleeting trends. We provide you with essential knowledge to evaluate crypto investments based on economic fundamentals rather than hype or short-term price movements.

Key Takeaways

Why Do Tokenomics Matter?

Tokenomics, a blend of “token” and “economics,” is the set of economic principles and models that govern the creation, distribution, and management of cryptocurrencies. It involves the factors influencing a token’s utility, scarcity, distribution, and ultimately, its value.

Just as traditional economics examines the production, distribution, and consumption of goods and services, tokenomics analyzes how digital tokens function within their own ecosystems. Understanding tokenomics is crucial for evaluating a crypto project’s potential for success and sustainability.

The tokenomics of a crypto project impact your investment decisions and the overall health of crypto projects. Even though it may seem purely academic at first, there are several critical reasons why tokenomics matter:

- Investor Attraction: Strong tokenomics can attract investors because they ensure fair distribution, utility, and potential for value appreciation. Investors who see well-thought-out economic models are more likely to commit capital.

- Ecosystem Health: Well-designed tokenomics motivate user participation and long-term commitment, creating a healthy ecosystem. The right balance of rewards and utility keeps users engaged.

- Value Impact: Bitcoin’s fixed supply model and Ethereum’s transition to a deflationary model post-EIP-1559 show us the significant impact of tokenomics on a cryptocurrency’s value and adoption rate.

- Risk Mitigation: Identifying poor tokenomic structures helps you avoid potential scams or failed projects before investing.

Key Components of Tokenomics

In this section, we break down the details and elements that create tokenomics:

Token Supply

The supply mechanism is one of the most fundamental aspects of tokenomics.

- Maximum Supply: The total number of tokens that will ever exist. For instance, Bitcoin has a capped supply of 21 million coins, creating digital scarcity.

- Circulating Supply: The number of tokens currently available in the market, which can be significantly lower than the maximum supply due to vesting schedules or token lockups.

- Fixed vs. Inflationary Supply: Some tokens have a capped supply, as mentioned (Bitcoin), while others continuously create new tokens (like Dogecoin). Inflationary tokens increase in supply over time, while deflationary tokens decrease in supply through mechanisms like token burns (e.g., Binance Coin).

Supply dynamics greatly impact token value. Generally, tokens with a fixed or diminishing supply tend to appreciate in value if demand grows. In contrast, inflationary tokens may face downward price pressure unless sufficient utility drives demand.

For example, Bitcoin’s halving events, which reduce the rate of new Bitcoin creation approximately every four years, are often associated with Bitcoin price increases due to the reduction in new supply.

Token Distribution

How tokens are initially allocated and subsequently distributed plays a critical role in a project’s decentralization and fairness:

- Fair Launch: Tokens are distributed without pre-mining or early access (e.g., Bitcoin). This approach is often viewed as more equitable since everyone has the same opportunity to acquire tokens.

- Pre-Mining: A portion of tokens is allocated to specific parties before public release (e.g., Ethereum). While this approach can fund development, it may create concentration risks.

A percentage of tokens is also distributed to different stakeholders, including the team and founders, early investors and venture capital, advisors, community and public sale, and treasury or ecosystem fund.

Timelines that lock tokens for team members and investors to prevent immediate selling avoid dumps of market and align incentives with the project’s long-term success.

A healthy token distribution typically avoids excessive concentration among team members or early investors and includes reasonable vesting periods to ensure all participants work toward the same goals.

Token Utility

A token’s utility refers to its specific use cases. Strong utility drives demand, which can positively impact value.

Governance utility grants voting rights on protocol changes and upgrades, allowing token holders to influence a project’s future.

Staking involves locking tokens to earn rewards or secure the network, creating scarcity while providing passive income. Transaction fees represent another common utility, where tokens are needed to pay for operations.

Access rights utility enables token holders to gain entry to specific platform features or services, creating exclusivity. As a medium of exchange, tokens allow user transactions, serving as the currency. Collateral utility allows tokens to back loans or other financial instruments, expanding their financial applications.

Strong token utility creates natural demand by giving users concrete reasons to acquire and hold tokens beyond speculation.

Incentive Mechanisms

Incentive mechanisms encourage behaviors that benefit the network and token holders:

- Staking Rewards: Users lock their tokens to support network operations and earn rewards. This helps secure the network while reducing the circulating supply.

- Liquidity Mining: Providing liquidity to decentralized exchanges in exchange for token rewards, which helps create liquid markets.

- Yield Farming: Strategically moving assets across platforms to maximize returns, which can drive ecosystem growth.

- Governance Rewards: Benefits for participating in protocol governance, encouraging active community involvement.

Well-designed incentives align all stakeholders’ interests with the ecosystem’s long-term health.

Token Burns

Token burns permanently remove tokens from circulation, reducing the total supply. Burns primarily aim to increase scarcity and potentially enhance value, creating deflationary pressure that can benefit long-term holders. Projects use burns through various methods to manage their token economies effectively.

Scheduled burns occur at predetermined times, such as BNB’s quarterly burns, providing predictability for investors. Like Ethereum’s post-EIP-1559 mechanism, transaction fee burns automatically destroy a portion of the fees paid for network operations. Buyback and burn programs use project revenue to repurchase tokens from the market before permanently removing them from circulation.

Binance is a good example of effective token burning through its commitment to quarterly BNB burns until 50% of the total supply is destroyed. Similarly, Ethereum’s EIP-1559 update introduced an automatic burn mechanism that destroys a portion of transaction fees, potentially making ETH deflationary during periods of high network activity.

Governance Structures

Governance structures represent a crucial aspect of tokenomics, determining how decisions are made about a project’s future development and direction. Many crypto projects implement Decentralized Autonomous Organizations (DAOs), which enable governance through community participation rather than centralized control. In these systems, token holders can vote on proposals affecting the project’s direction, code upgrades, treasury management, and strategic initiatives.

Voting power is typically proportional to the number of tokens held, giving larger stakeholders more influence over decisions on protocol upgrades, fund allocation, and other critical matters. This approach aligns influence with investment but can sometimes raise concerns about power concentration. Some projects have implemented alternative voting mechanisms, such as quadratic voting or time-locked voting, to balance representation.

Good governance structures strike a careful balance between operational efficiency and decentralization principles. They allow projects to evolve and adapt to changing conditions while maintaining community trust and buy-in. Projects with transparent, inclusive governance mechanisms often demonstrate greater resilience and community support during challenging market periods, as stakeholders feel genuine ownership over the project’s development and success.

Tokens vs. Coins: Understanding the Difference

Coins

Tokens

Have their own blockchains (e.g., Bitcoin, Ethereum)

Built on existing blockchains (e.g., USDC on Ethereum)

Primarily function as currency

Can represent various assets or utilities

Used for transactions, store of value

Used for specific functions within ecosystems

Monetary Policy and Inflation Control

Monetary policy and inflation control approaches mirror traditional central banking strategies but operate through code rather than human decision-making, managing their token economies with predictable rules and transparency. Algorithmic adjustments automatically modify token supply, helping maintain price stability or achieve specific economic targets without manual intervention. These mechanisms might increase token issuance during low-demand periods or reduce supply when demand rises.

Stablecoin models are another advanced application of tokenomics principles, using various mechanisms to maintain price stability. Collateralized stablecoins back their value with reserves of other assets (like USD or crypto), while algorithmic stablecoins use dynamic supply adjustments to maintain their peg. Hybrid models combine both approaches for enhanced stability and efficiency.

These monetary policy tools help projects achieve specific economic objectives and give users greater certainty about how the token supply will change over time and under different market scenarios.

Tokenomics in Practice: Case Studies

Examining successful cryptocurrencies may give us some insights into how tokenomics principles work in real-world applications.

Bitcoin (BTC)

Bitcoin Price Chart

(BTC)

Bitcoin established the gold standard for tokenomics with its elegantly simple yet powerful economic model. Its fixed supply cap of 21 million coins guarantees scarcity, a stark contrast to inflationary fiat currencies. Bitcoin distributes new coins through a mining process that rewards network validators, with rewards cutting in half approximately every four years through “halving” events. This predictable reduction in new supply has historically coincided with price appreciation cycles.

This structure rewards miners with both newly minted BTC and transaction fees, ensuring network security even as block rewards diminish over time. Bitcoin’s decentralized consensus mechanism means no single entity controls its monetary policy or governance, making it resistant to capture by special interests. This has helped Bitcoin maintain its position as the leading crypto by market capitalization.

Ethereum (ETH)

Ethereum Price Chart

(ETH)

Ethereum has evolved its tokenomics significantly since its 2015 launch. Initially using a proof-of-work model similar to Bitcoin, Ethereum transitioned to proof-of-stake with its “Merge” upgrade, dramatically reducing new ETH issuance and energy consumption. This shift allowed token holders to participate in network security through staking rather than energy-intensive mining.

The EIP-1559 marked another evolution. It introduced a burn mechanism that destroys a portion of transaction fees, potentially making ETH deflationary during periods of high network activity.

ETH has multiple crucial functions within its ecosystem: paying for computation (gas fees), securing the network through staking, participating in governance, and serving as the base layer for thousands of tokens and dApps. These diverse utilities create consistent demand pressure that complements its more controlled supply mechanics.

Binance Coin (BNB)

BNB Price Chart

(BNB)

BNB has shown how a utility token can evolve beyond its initial purpose to become a multi-functional ecosystem asset. Originally created as an exchange token offering trading fee discounts on Binance, BNB has expanded its utility considerably. The token now powers the BNB Chain ecosystem, serving as the native currency for transaction fees, participating in token sales on Binance Launchpad, and paying for various services.

Binance implements a regular quarterly burn mechanism that destroys BNB tokens using a portion of the exchange’s profits, with plans to continue until 50% of the total supply (100 million BNB) is permanently removed from circulation. The token is also used in decentralized finance applications built on BNB Chain, which reminds us how strong tokenomics can help a token expand beyond its original purpose.

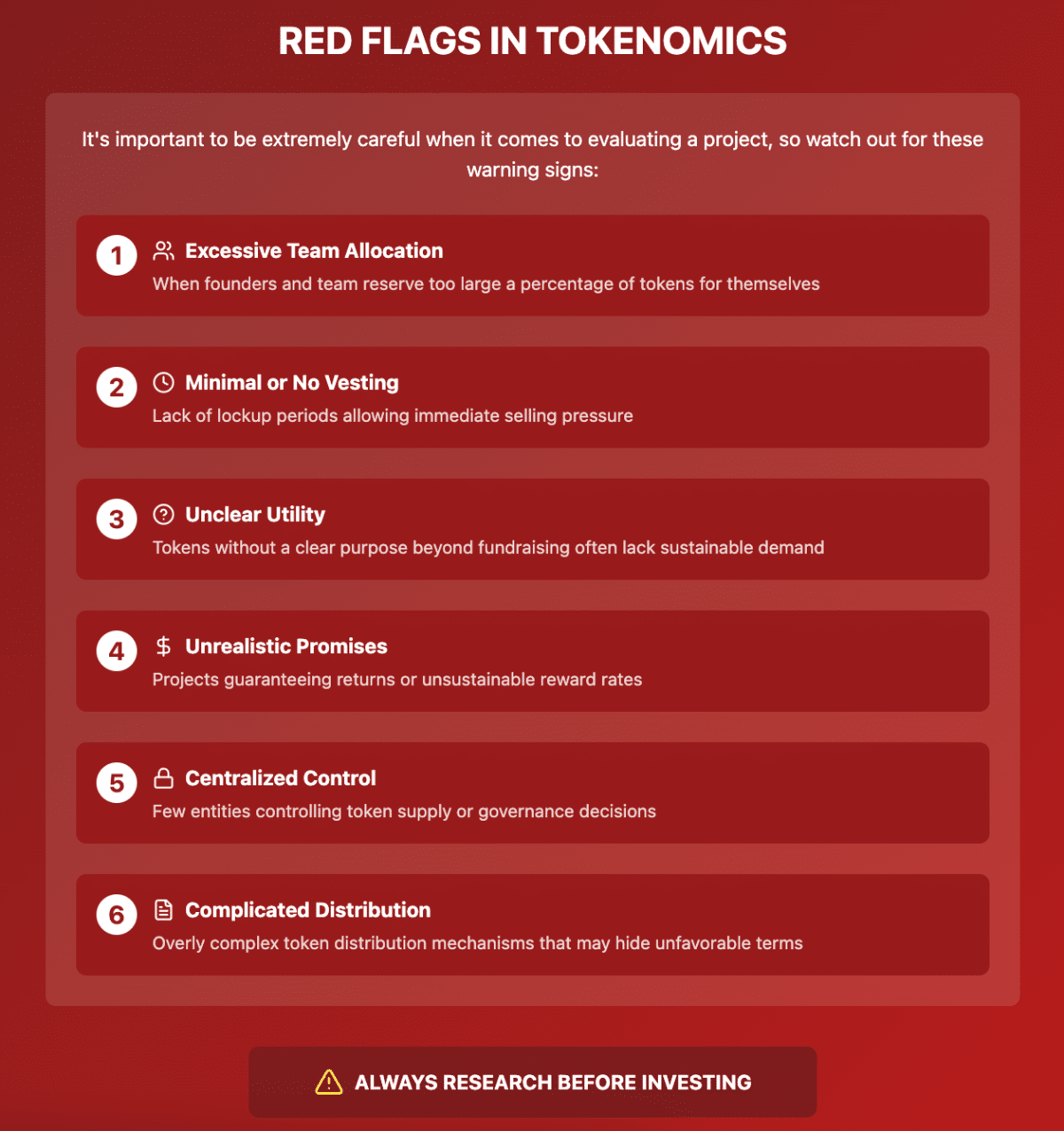

Red Flags in Tokenomics

It’s important to be extremely careful when it comes to evaluating a project, so watch out for these warning signs:

- Excessive Team Allocation: When founders and team members control a disproportionately large percentage of tokens (typically more than 20-30%).

- Minimal or No Vesting: Lack of lockup periods for early investors and team members, allowing immediate selling pressure.

- Unclear Utility: Tokens without a clear purpose beyond fundraising often lack sustainable demand.

- Unrealistic Promises: Projects guaranteeing returns or unsustainable reward rates often have flawed economic models.

- Centralized Control: Few entities controlling the token supply or governance decisions create manipulation risk.

- Complicated Distribution: Overly complex token distribution mechanisms may hide unfavorable terms.

What Do Good Tokenomics Look Like?

Based on successful crypto projects, we can identify several characteristics of effective tokenomics:

Balanced Supply and Demand

Good tokenomics carefully manages supply relative to expected demand. Bitcoin’s fixed cap creates natural scarcity that prevents inflation, while Ethereum’s post-EIP-1559 burning mechanism dynamically adjusts supply based on network activity.

Practical projects create mechanisms that respond to usage patterns. Some use algorithmic adjustments that expand or contract supply based on predefined market conditions, preventing both excessive inflation and deflationary spirals that might impede adoption.

Fair and Transparent Distribution

Projects with healthy tokenomics distribute tokens in a way that prevents excessive concentration and clearly communicate allocation across stakeholders. Fair launches like Bitcoin’s mining-only approach contrast with pre-mined tokens that allocate portions to teams and investors.

Neither approach is inherently superior, but transparency is essential. The industry standard for team and advisor allocations typically falls within 10-20%, with longer vesting periods (2-4 years) signaling long-term commitment. Projects that hide large investor allocations or have minimal lockup periods often face dramatic price volatility once these tokens unlock.

Clear and Valuable Utility

Successful tokens have genuine utility that creates natural demand beyond speculation, solving real problems users face. BNB’s fee discounts provide measurable savings, while governance tokens like MKR enable meaningful participation in protocol decisions.

Forced token utility (where a project creates unnecessary token requirements for functions that don’t need them) usually fails to generate sustainable demand. The best tokens feel like a natural extension rather than an arbitrary requirement.

Sustainable Incentive Structures

Reward mechanisms should be economically sustainable in the long term, not relying on unsustainable high yields or inflationary practices. Many DeFi projects initially offered triple-digit APYs that quickly collapsed, destroying user trust.

Sustainable projects balance short-term incentives with long-term alignment, often with declining emission schedules that bootstrap initial adoption while preventing excessive dilution. They create virtuous cycles where token value appreciation benefits both early and late adopters, avoiding scenarios where early participants profit solely at newcomers’ expense.

Robust Governance Framework

Good tokenomics includes governance mechanisms that allow the project to adapt while maintaining decentralization principles. MakerDAO is an example of this with its refined governance process that balances technical expertise with community input. Effective governance includes discussion forums, proposal frameworks, and implementation processes.

Projects must strike a balance between responsiveness and stability, avoiding both dictatorial control and paralyzing democracy. The best systems usually involve graduated governance, where minor changes have lower thresholds than fundamental protocol adjustments.

Transparency and Community Trust

Documentation and communication around tokenomics should be clear, accessible, and comprehensive. Projects that regularly update the community about tokenomic changes build significantly more trust than those operating behind closed doors. This includes transparent reporting about treasury management, regular updates about token burns or minting, and clear explanations when protocol changes impact tokenomics.

Projects that undergo voluntary security audits and share results publicly demonstrate a commitment to both security and transparency, which further strengthens community confidence in the long-term vision.

Why Tokenomics Aren’t Foolproof

Despite best efforts, tokenomics can fail for several reasons. Excessive control by founders or early investors often leads to market manipulation that undermines decentralization principles. When a small group controls a large percentage of tokens, they can artificially influence prices through coordinated buying and selling, leaving average investors vulnerable to sudden market movements.

Tokens without clear use cases typically struggle to maintain value beyond initial speculation. Many projects launch with vague promises about future utility that never materialize, leaving tokens with no reason to hold value once speculative interest wanes. This pattern frequently emerges with “solution-looking-for-a-problem” projects that create tokens without addressing genuine market needs.

Unsustainable reward systems create long-term problems for many projects. High initial yields attract users but frequently lead to inflation and devaluation once these incentives inevitably decrease. Projects that distribute excessive tokens as rewards without corresponding growth in utility or adoption weaken the value of existing holders. This creates selling pressure that depresses the token value.

The absence of clear documentation erodes investor trust and leads to community fragmentation. When developers change tokenomic parameters without transparent communication, investors feel blindsided and community members often split into opposing factions. Additionally, market conditions beyond project control (like regulatory changes, macroeconomic factors, or broader crypto market sentiment) can overwhelm even the most thoughtfully designed tokenomics.

Conclusion

Tokenomics is a foundational aspect of any cryptocurrency project, influencing its adoption, value, and longevity. By understanding the principles behind crypto tokenomics, you’ll be better equipped to evaluate crypto projects based on their fundamental economic design rather than merely following price action or hype.

Before investing in any cryptocurrency, take the time to analyze its tokenomics thoroughly. Ask yourself: Does this token have genuine utility? Is the supply mechanism sustainable? Is the distribution fair? Does the incentive structure align with long-term growth?

By making tokenomics a central part of your investment research process, you’ll be able to identify promising projects with solid foundations and avoid those built on unsustainable economic models, regardless of how attractive their short-term gains might appear.