On this Page:

McCaleb is the definition of a serial entrepreneur and has founded numerous influential projects beyond Ripple including Mt. Gox, MetaMachine, and Stellar, to mention a few. His career hasn’t been without controversies, though, especially regarding his involvement in the once-dominant Bitcoin exchange Mt. Gox, which collapsed in 2014.

Despite much legal scrutiny, McCaleb has remained a key player in the crypto industry, earning the nickname “the Teflon Don of Crypto” due to his ability to avoid regulatory fallout.

Below, we will explore McCaleb’s illustrious (and infamous) career, controversies, milestones, and net worth over the years.

Breaking Down Jed McCaleb’s Net Worth in 2025

| Asset | Contribution to Net Worth |

|---|---|

| MetaMachine earnings | Undisclosed |

| Sale of Mt. Gox | Undisclosed (-$50,000 after collapse) |

| Sale of 12% minority stake of Mt. Gox | 1 bitcoin |

| XRP holdings sold | $3.14 billion (around $1.98 billion post-taxation) |

| Ripple equity and salary | Undisclosed |

| XLM holdings and sold tokens | Undisclosed |

| Other crypto/NFT investments | Undisclosed |

| Total net worth | $2.9 billion |

Jed McCaleb’s Net Worth: Early Life and Education

Jed McCaleb was born on June 8, 1975, in Fayetteville, Arkansas, and spent most of his childhood in Little Rock. He briefly attended the University of California, Berkeley, before leaving to pursue a programming career in New York City.

McCaleb married MiSoon Burzlaff, with whom he has a daughter and a son, but they have since divorced. The family relocated from Williamsburg to upstate Patterson in 2010.

McCaleb is a private person, and not much is known about his personal life.

Becoming a Mastermind in Tech and Crypto

Jed McCaleb dedicated his life to technology at a young age and has been successful ever since. From revolutionizing file sharing with eDonkey2000 to launching one of the first big Bitcoin exchanges, Mt. Gox, and co-founding Ripple, he has become a powerful force in the digital world. Let’s explore how he built his impressive fortune.

Strong Beginnings with MetaMachine

In 2000, Jed McCaleb founded MetaMachine Inc., a company that developed eDonkey 2000, a pioneering peer-to-peer file-sharing application. A year later, Sam Yagan joined him as the company’s CEO, while McCaleb remained as CTO.

eDonkey2000 quickly became a major success. The program allowed users to share large files (including tons of pirated music) directly with each other and was easy to use. At its peak, the network had over four million active users.

Despite its success, this project was short-lived. In September 2006, MetaMachine agreed to a $30 million settlement with the Recording Industry Association of America (RIAA) to avoid potential copyright infringement lawsuits. As part of this settlement, MetaMachine had to cease distributing eDonkey2000 and related software.

McCaleb never revealed how much he made from the company or how much was wiped out by the massive settlement, but he was still wealthy enough to move on to a new large project: the crypto exchange Mt. Gox.

Founding Mt. Gox

McCaleb’s first major tech adventure ended up in ruins thanks to its legal tussle with the RIAA. However, this didn’t make him back down. In 2007, a few months after the agreement with RIAA, McCaleb purchased the domain mtgox.com, intending to create a trading site for Magic: The Gathering Cards.

After working on the site for three years, McCaleb decided to repurpose Mtgox.com as a Bitcoin exchange, inspired by the crypto trend that roamed the world.

The Bitcoin exchange quickly gained popularity, handling a massive portion of global Bitcoin transactions. At one point, Mt. Gox accounted for over 70% of all Bitcoin transactions.

In March 2011, Mark Karpeles reached out to McCaleb and offered to buy the platform. McCaleb sold it to him, but remained a minority owner until the platform’s collapse in 2014. He retained a 12% equity stake in the business, but in 2014, he decided to sell his remaining stake to a group of U.S. investors, including Brock Pierce, for a nominal amount of one bitcoin.

The details of the original contract where Jed McCaleb sold Mt. Gox to Mark Karpeles remain largely undisclosed. However, we did find that, in March 2011, McCaleb stated the following: “To make mtgox what it has the potential to be would require more time than I have right now.” He later mentioned that he lost around $50,000 following the exchange’s collapse in 2014, which suggests that the price was relatively modest.

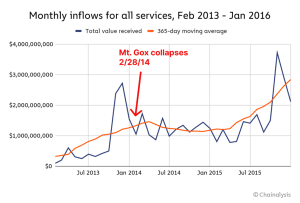

The Tragic Downfall of Mt. Gox

Mt. Gox’s prominence in the crypto market made it a common target for hackers, so the platform faced many security problems in the years it operated. The first time Mt. Gox was hacked was in 2011 when hackers stole the equivalent of $8.75 million from users. In June of that year, hackers compromised an auditor’s computer and manipulated the exchange’s Bitcoin price, temporarily driving it down to $0.01 per Bitcoin (the market value was $30 at the time). The hackers then purchased around 2,000 bitcoins at an artificially low price, making out like bandits.

This breach didn’t destroy the platform, though it was on its last legs. Finally, it was hacked again in February 2014, leading the exchange to suspend withdrawals. The company found that it had lost between 650,000 and 850,000 bitcoin, worth at least $400 million, in the attack.

Luckily, the exchange was able to locate about 200,000 of the stolen Bitcoin. However, the missing cryptocurrency destabilized the market tremendously, which pushed the business into insolvency. In April 2014, the company filed for bankruptcy in the Tokyo District Court and was ordered to liquidate.

As of April 2024, repayments to Mt. Gox’s creditors are still ongoing, meaning the saga isn’t over just yet. However, there’s a silver lining – some Mt. Gox customers may ultimately benefit from losing their Bitcoin in the scandal. Even though a limited amount of bitcoin was recovered, and they’ll get roughly 15% of the bitcoin they originally held, the tremendous increase in Bitcoin’s value since the hack makes the fraction of their previous Bitcoin worth many times more than their original balance.

#MtGox is the main failure in crypto history

☑️ Today marks exactly 11 years since Mt.Gox, the largest cryptocurrency platform at the time, went dark.

☑️ The exchange declared bankruptcy in 2014 after revealing the loss of approximately 850,000 $BTC due to hacking and… pic.twitter.com/jeFpb6geCG

— Web3_Vibes (@W3Vibes) February 7, 2025

When Mt. Gox’s Bitcoin was stolen, the coins were worth around $400 million total. By the time repayments are completed, around $9 billion worth of bitcoin will be returned. This goes to show how much Bitcoin and the cryptocurrency market has grown in just 10 years.

Legal Trouble for Mt. Gox

Following the bankruptcy proceedings, it was revealed that Mt. Gox was technically insolvent for at least two years before the major hack. Investigations found that approximately 80,000 BTC were missing even before Karpeles acquired the exchange in 2011.

This discovery led to various allegations against Jed McCaleb, with analysts arguing that the exchange was already struggling before its sale (and that he hid that fact from them). As a result, investors filed lawsuits against both Mark Karpeles and Jed McCaleb, even though McCaleb had no links to the company at the time of the hack.

In June 2019, former Mt. Gox traders Joseph Jones and Peter Steinmetz filed a lawsuit against McCaleb in California, accusing him of fraudulent and negligent misrepresentation, claiming that he was aware of the significant security issues as early as 2011 but failed to disclose them to users.

As of today, there’s no publicly available information indicating a settlement or a resolution. The case appears to be dismissed, settled out of court, or ongoing without any public disclosure.

As for Mark Karpeles, he faced legal proceedings in Japan, and in March 2019, the Tokyo District Court found him guilty of falsifying data to inflate Mt. Gox’s holdings by $33.5 million. He was sentenced to 30 months in prison, suspended for four years.

Moving On to Ripple (XRP)

In 2011, after selling Mt. Gox, Jed McCaleb was ready for a new challenge. He started working on a virtual currency system that relied on consensus validation among network participants. This was a rather unique approach, different from the mining-based approach used by Bitcoin. This project later became known as the Ripple protocol.

When the project was in its early stages, McCaleb brought in David Schwartz and secured funding from investor and crypto expert Jesse Powell. He also hired Arthur Britto as the chief strategist and Chris Larsen, who took on the role of CEO. Soon enough, the company was rebranded as Opencoin. McCaleb remained as chief technology officer at the time.

In 2012, the XRP Ledger (XRPL) was officially introduced, featuring its native cryptocurrency, XRP. The founders allocated 80 billion XRP to Ripple Labs, the company established to develop use cases for the digital asset.

Jed McCaleb, as one of the co-founders, received around 9 billion of this allocation, which contributes a lot to his current net worth. The remaining XRP was placed into an escrow account to ensure a predictable supply.

For about two years, McCaleb remained actively involved in developing the Ripple protocol and its native currency. However, in July 2013, he stepped away to take on a less active role in the company.

After leaving Ripple in 2013, McCaleb began selling his XRP holdings. However, to prevent market disruption, an agreement was established that limited the amount he could sell annually. So, he had to gradually sell his XRP, and by July 2022, he reportedly sold all of his remaining tokens.

Over eight years, Jed McCaleb sold around 5.7 billion of these tokens, earning around $3.14 billion. Given that he originally received 9 billion XRP, he would have earned approximately $4.96 billion from XRP sales if he sold it all. Post-taxation, his $3.14 billion would leave him with around $1.98 billion (based on the standard U.S. tax rate of 37% for high-net-worth individuals).

The math doesn’t add up here, though. If McCaleb had 9 billion XRP and donated 2 billion, there’s still 1.7 billion XRP that’s unaccounted for. The remaining could be part of his holdings post-settlement or part of an agreement not to sell, but this hasn’t been discussed publicly.

In fact, more recent sources mention that Jed McCaleb is still selling XRP these days. In 2024, he reportedly sold over 54 million in XRP, which would indicate that he has more to sell – possibly the amount that was missing from our calculation.

The situation became even more confusing in June 2024, when Ripple reportedly transferred 100 million XRP from their wallet directly to Jed McCaleb, spurring a major controversy.

Legal Trouble with Ripple

After leaving Ripple, Jed McCaleb was once again put into the spotlight through a legal dispute with the company over the sale of his XRP holdings. Ripple’s management accused him of breaching the agreement that restricted how much XRP he could sell at a time.

The agreement came with strict selling limits and capped McCaleb’s sales at 0.5% of the average daily XRP trading volume during the first year, 0.75% in the second and third years, and 1% by the fourth year. Ripple alleged that McCaleb attempted to bypass the contract’s restrictions by coordinating the sales with his family members.

According to the complaint, McCaleb sold 96,342,361 XRP through an account they alleged was his. He was entitled to sell only $10,000 in XRP per week during the first year, a small fraction of the proceeds he made from the sale (if it was indeed him).

McCaleb, in turn, alleged that the XRP was gifted to his family members before the agreement with Ripple Labs was finalized, so this was not subject to the agreement.

“I am 100% sure I am not in breach of any agreement with Ripple Labs, and all evidence will support that,” he said.

The dispute was settled in 2016 with a new arrangement. McCaleb agreed to donate 2 billion XRP to a charitable fund with the same restrictions as his personal holdings. The parties also agreed to set up a custody account managed by Ripple for the rest of his 5.3 billion XRP to ensure that he wouldn’t break the structured sales agreement.

~60 days left until Jed McCaleb is out of #XRP.

I can't wait to stop talking about this, and finally put this FUD to bed.🛌

Jed Balance Link: https://t.co/w6jvVKHw3y#Ripple #Crypto #Cryptocurrency #Stellar #XLM pic.twitter.com/IB8vhRfMga

— Martin Valk (@martincpvalk) June 4, 2021

This wasn’t the end of McCaleb’s legal trouble with Ripple. In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging that XRP was an unregistered security. To everyone’s surprise, McCaleb was not named in this lawsuit. This led to a lot of controversy and discussion about the consistency of the SEC’s actions, especially given McCaleb’s role in selling the allegedly unregistered security.

Starting Anew With Stellar

Jed McCaleb isn’t one to give up when he’s down. In 2014, he was already a multi-millionaire – and maybe even a billionaire but it wasn’t enough. After leaving Ripple, he co-founded Stellar Lumens alongside his former lawyer, Joyce Kim. Before he launched this new venture, he referred to it as the “Secret Bitcoin Project” while seeking alpha testers.

To start the project, the duo partnered with Stripe CEO Patrick Collison to establish a non-profit organization called the Stellar Development Foundation. In July 2014, they officially launched the project and got $3 million in seed funding from Stripe.

The project was officially a decentralized payment network and protocol that came alongside its native token, Stellar (XLM). At the launch, the network had 100 billion tokens. Twenty-five percent of the tokens were allocated to other non-profits working toward financial inclusion, while Stripe earned 2 billion tokens for its investment.

Later on, the token was renamed from Stellar to Lumens (XLM) to help differentiate it from the Stellar network.

By January 2015, Stellar had widespread adoption and 3 million users. Its market cap was an impressive (for the time) $15 million. Later that same year, the Stellar Development Foundation released an upgraded protocol with a new consensus algorithm called the Stellar Consensus Protocol (SCP), developed by Stanford professor David Mazieres. This same year, Stellar was integrated into Vumi, the open-source messaging platform, as well as with Ordian, who adopted the protocol to support microfinance institutions in Nigeria.

In 2016, Deloitte integrated Stellar into their cross-border payment application, Deloitte Digital Bank, which marked a big leap for the platform. The same year, Stellar boosted its payment network and incorporated different payment systems, including Tempo Money Transfer (France), ICICI Bank (India), and Coins.ph (Philippines).

When Stellar started collaborating with IBM and KlickEx in 2017, this boosted XLM’s market capitalization, getting it to rank 13th in market capitalization at the time.

While McCaleb played a major role in Stellar’s inception, his direct involvement with this project began to fade after the launch – similar to most of his projects. By 2016, he had stepped down from his leadership role but he continued to work in the cryptocurrency space.

Stellar has continued to solidify its position in the cross-border payments sector. XLM’s market performance has had its ups and downs, but it continues to be one of the top 30 cryptocurrencies by market capitalization.

I guess most people here don't know this, but Stellar was created by Jed McCaleb who was also one of the creators of XRPL & co-founder of Ripple. Jed played dirty and tried to crash XRP. This is one of the many reasons I will never support Stellar or hold XLM, other than also… https://t.co/X58OXC29Go pic.twitter.com/KNk3DbtX0R

— Panos 🔼{X}🇬🇷 (@panosmek) February 9, 2025

Unlike Ripple, we still don’t know McCaleb’s stake in Stellar or how many Lumens he owns. However, he surely owns – or owned – a large portion of the tokens, given that was the driving force behind its inception.

Pivoting to Aerospace

In 2021, McCaleb decided to expand his reach into the aerospace industry. He founded the company Vast with a mission to develop artificial gravity space stations, an advanced theoretical technology that you have probably seen in your favorite SciFi media. As of 2023, he is the company’s CEO, chairman, and sole founder.

Together with my MBRSC colleagues and astronauts, I visited @vast, a company specialising in building space stations, in Los Angeles. Glad to meet @JedMcCaleb, Founder and Board Chair, and @Maxhaot, CEO, and learn about their projects for the future of space exploration. Our… pic.twitter.com/Uo1J7mZv8i

— Salem AlMarri سالم حميد المري (@Salem_HAlMarri) January 24, 2025

In February 2023, Vast Space acquired the Hawthorne-based space startup Launcher, with its founder, Max Haot, becoming Vast’s president. As of October 2024, Vast employs over 600 people, indicating that McCaleb’s latest venture is a resounding success.

Specific financial details about Vast Space’s valuation are not publicly available right now.

Crypto and NFT Holdings of Jed McCaleb

Jed McCaleb’s crypto investments most likely extend far beyond his XRP tokens, which he sold by 2022, and his XLM tokens (which remain undisclosed). His primary focus has been Ripple (XRP) and Stellar (XLM), but he likely owns other cryptocurrencies.

How Jed McCaleb Mastered Crypto

Jed McCaleb’s legacy in the cryptocurrency industry is undeniable. He has continuously shaped the landscape of digital finance. His story is rife with controversies and legal challenges, but he has been, without a doubt, one of the most influential pioneers in the crypto world since its inception. His projects have driven blockchain tech forward and contributed to the broader acceptance of cryptocurrencies.

Jed McCaleb’s story teaches us a powerful lesson in the value of perseverance and resilience. Despite his billionaire status, a track record of grand achievements, and many legal problems along the way, his willingness to keep pursuing new ventures after experiencing failures is a testament to his determination.

Whether it was the downfall of Mt. Gox, the legal battles with Ripple, or the many challenges with building Stellar, McCaleb has faced many obstacles. But, he has never let setbacks define him. Instead, he used each experience to fuel his next project.

Essentially, McCaleb’s journey reminds us that the pursuit of success doesn’t stop, even when things don’t go according to plan.

FAQs

What is Jed McCaleb’s estimated net worth in 2025?

In 2025, Jed McCaleb's net worth is estimated to be around $2.9 billion.

What are some of Jed McCaleb’s most significant achievements?

McCaleb is best known for co-founding Ripple and Stellar, as well as playing a key role in the early development of Mt. Gox.

How did Jed McCaleb accumulate his wealth?

His fortune primarily comes from his contributions to Ripple and Stellar, along with his early investments in cryptocurrency and blockchain technology.

Is Jed McCaleb still involved in new projects?

Yes, despite his wealth, McCaleb continues to pursue new ventures, with a current focus on the aerospace industry.