The convergence of artificial intelligence (AI) with blockchain technology is reshaping the industries through innovations in both fields. Recent crypto project developments implement AI to enhance security and improve data management on blockchain platforms. Conversely, new blockchain networks have been created to facilitate decentralized AI models and applications.

As a result, AI-driven cryptocurrencies have taken off over the last two years, reaching a peak market capitalization of nearly $70 billion at the end of 2024. Several AI tokens are at the forefront of technological advancements, with the best AI coins attracting investors with growing interest in the transformative potential of cryptocurrencies coupled with artificial intelligence.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

current price: $0.0038 | raised: $10,071,613 | Learn more | ||

| 2 |

|

current price: $0.06 | raised: $483,110 | Learn more | ||

| 3 |

|

$4.91 | 1.16% | $2,618,761,875 | $73,676,918 |

$4.70

―

$4.93

|

| 4 |

|

$2.04 | 1.75% | $1,335,717,239 | $291,554,943 |

$1.82

―

$2.13

|

| 5 |

|

$4.22 | 7.99% | $1,182,248,074 | $32,077,252 |

$3.73

―

$4.24

|

| 6 |

|

$0.10 | 2.56% | $913,628,234 | $53,305,560 |

$0.09

―

$0.10

|

| 7 |

|

$1.82 | 7.11% | $524,154,508 | $57,944,837 |

$1.66

―

$1.84

|

| 8 |

|

$1.99 | 1.36% | $480,261,732 | $147,164,766 |

$1.82

―

$2.03

|

| 9 |

|

$0.06 | -0.40% | $454,894,892 | $2,821,516 |

$0.06

―

$0.07

|

| 10 |

|

$6.40 | 0.16% | $419,487,324 | $36,168,880 |

$6.04

―

$6.46

|

| 11 |

|

$1.28 | 0.32% | $346,703,973 | $7,194,065 |

$1.21

―

$1.29

|

| 12 |

|

$0.23 | 2.54% | $247,983,588 | $93,072,481 |

$0.20

―

$0.23

|

| 13 |

|

$0.23 | -1.25% | $234,632,254 | $8,346,651 |

$0.23

―

$0.24

|

| 14 |

|

$0.55 | -3.02% | $232,652,295 | $69,651,485 |

$0.52

―

$0.57

|

| 15 |

|

$0.43 | 1.34% | $214,618,079 | $1,731,607 |

$0.42

―

$0.43

|

| 16 |

|

$0.12 | 0.90% | $106,198,121 | $8,399,735 |

$0.11

―

$0.12

|

| 17 |

|

$0.33 | -2.91% | $102,200,753 | $32,522 |

$0.33

―

$0.35

|

| 18 |

|

$0.06 | -5.08% | $100,400,425 | $4,113,639 |

$0.06

―

$0.06

|

| 19 |

|

$0.12 | 2.05% | $95,909,440 | $22,247,987 |

$0.11

―

$0.12

|

| 20 |

|

$0.0044 | 0.00% | $799,118 | $24,676 |

$0.0044

―

$0.0044

|

| 21 |

|

$0.02 | - | - | $47,050 | - |

Mind of Pepe

MIND ⏳Presale Ending Soon 🎯presale stage

SUBBD

SUBBD 🎯presale stageInternet Computer

ICPVirtuals Protocol

VIRTUALStory

IPThe Graph

GRTGrass

GRASSKAITO

KAITOBeldex

BDXArweave

ARAkash Network

AKTai16z

AI16ZGolem

GLMArkham

ARKMOriginTrail

TRACPAAL AI

PAALSingularityNET

AGIXDelysium

AGIChainGPT

CGPTiAgent Protocol

$AGNTPrivateAI

PGPTTop AI Coins to Invest In

As AI continues to reshape industries, several cryptocurrencies are emerging as strong players in this space. Here are the top AI coins of 2025 worth considering for your portfolio.

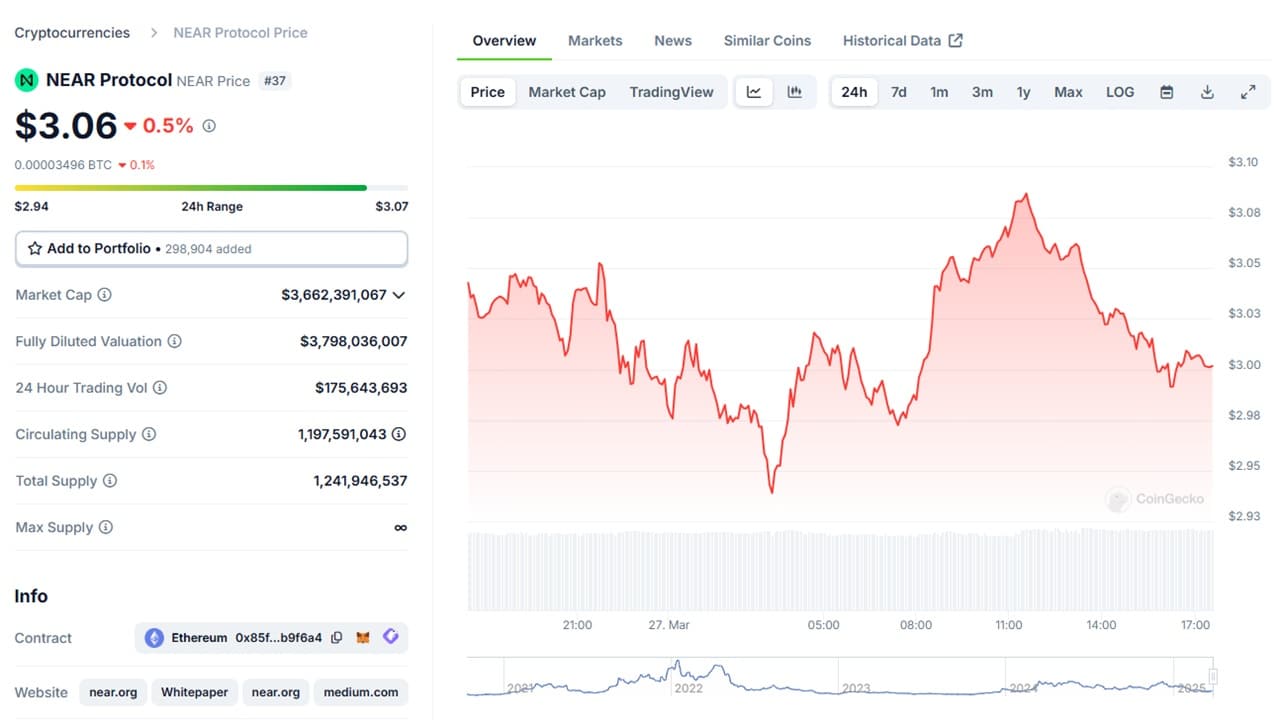

1. NEAR Protocol ($NEAR)

NEAR Protocol Price Chart

(NEAR)NEAR Protocol (NEAR)

NEAR Protocol (NEAR) is a Layer-1 blockchain with a sharded and delegated Proof-of-Stake (PoS) consensus mechanism. Now recognised as the top AI crypto, it was launched in 2020 as a regular, non-Ai project, and immediately positioned itself as a highly scalable and developer-friendly network.

The revolution came in 2024, when NEAR expanded into AI, and the NEAR Foundation announced it would focus on user-owned AI. The blockchain launched NEAR AI, a research toolkit for AI agents and systems with a massive 1.4 trillion-parameter AI model in the same year.

Another key development is NEAR Protocol’s user-agent interface layer, which enables autonomous AI agents to handle Web3 and Web2 services. Over 50 AI teams are building applications within the NEAR ecosystem, which has become the top AI-native blockchain infrastructure in 2025.

What it’s best for: NEAR is one of the few major L1 blockchains that has fully pivoted into AI infrastructure. With nearly half a decade in operation, the cryptocurrency can be considered a long-term bet on the combined value of AI and blockchain technology.

Find out more about Near

2. Internet Computer ($ICP)

Internet Computer Price Chart

(ICP)Internet Computer (ICP)

Internet Computer (ICP) is another L1 AI blockchain that aims to bridge the gap between Web3 and Web2 by completely replacing Web2’s cloud infrastructure with Web3. But how does this relate to artificial intelligence? ICP allows AI applications to be deployed, stored, and executed entirely on the blockchain.

The cryptocurrency utilizes unique smart contracts called “canisters,” which are decentralized web servers that can store large amounts of data, perform complex calculations, and connect to Web2 apps. Canisters are perfect for hosting and executing machine learning models, enabling decentralized and secure AI systems.

Furthermore, canisters can connect to Web2 services and APIs without gas fees. This allows AI models on the Internet Computer blockchain to access real-world data instantaneously. Canisters’ persistent memory is also beneficial for AI agents that require analyzing past data, conversation history, and other long-term information.

What it’s best for: As one of the only networks to host and execute AI programs directly on-chain, Internet Computer offers investors exposure to a Web3-specialized blockchain with a growing AI ecosystem.

Find out more about Internet Computer

3. Bittensor ($TAO)

Bittensor Price Chart

(TAO)Bittensor (TAO)

The next leading project in decentralized AI is Bittensor (TAO). It was developed by the non-profit Opentensor and launched its own chain in 2023 to decentralize access to machine learning models and the training of AI systems.

The Bittensor protocol is a marketplace for machine intelligence, rewarding those who contribute to the network’s overall intelligence through AI. It’s a global AI network that allows anyone to participate and provide machine learning, computing power, or data in exchange for the native TAO token.

For developers, Bittensor’s permissionless participation can help train new AI models with computing power from the entire network. What’s more, the blockchain’s wide-ranging machine learning systems create an optimal environment for AI to develop new and innovative features.

What it’s best for: Unlike other AI cryptocurrencies facilitating artificial intelligence, Bittensor directly contributes to a global, open-source AI network that drives permissionless machine intelligence. It’s an ideal option for investors looking to support the decentralization of AI.

Find out more about Bittensor

4. Render ($RENDER)

Render Price Chart

(RENDER)Render (RENDER)

Render (RENDER) is a peer-to-peer network of GPU (graphics processing unit) power and 3D digital assets. This AI crypto project stands out for the same reason Nvidia has become a $3 trillion company driving the AI revolution – GPUs are great at AI computing.

The Render Network connects people needing powerful graphics processing with those who have spare GPU power. Since AI processes and models require significant amounts of GPU processing power, Render lets anyone on the blockchain connect with a global network of GPUs. In return for their processing power contributions, node operators on the blockchain are rewarded with the native RENDER token.

Crucially, Render supports AI-enhanced creative workflows, catering to the growing number of 3D artists who are integrating AI-generated content in their work. The decentralized cloud of GPU processing has been optimized for AI rendering, creation, and training, while leveraging AI to speed up the overall process.

What it’s best for: Investing in Render gives token holders exposure to the convergence of AI and blockchains, as well as granting access to peer-to-peer graphics processing. Following its migration to the Solana network, RENDER’s price action also relies on the top PoS blockchain’s performance.

Find out more about Render

5. Story ($IP)

Story Price Chart

(STORY)Story (STORY)

The newest project on our AI coin list is Story (IP). It’s an L1 blockchain that aims to revolutionize IP (intellectual property) by onramping it to the network, allowing users to trade their IPs and creators to set the terms for how their IPs on Story are licensed.

In the age of artificial intelligence, one of the most significant issues creators face is a lack of ownership. AI models are often trained on large datasets that include creative output from human users without permission, payment, or attribution.

Story solves this problem by enabling any creator or developer to register their content as an on-chain IP with usage terms and monetization rights. Additionally, Story lets AI agents connect to the blockchain and license their own AI-generated content, which they can autonomously trade in the decentralized IP ecosystem.

What it’s best for: Launched in February 2025, Story is a pioneering AI-powered blockchain concept that offers exposure to an emerging AI and IP economy. Due to its novelty, it’s a particularly high-risk, high-reward investment.

Find out more about Story

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

What Are AI Coins?

AI coins (or AI crypto tokens) are cryptocurrencies associated with blockchain projects that integrate artificial intelligence in some way, either in their core functionality, platform utility, or data infrastructure.

These tokens are typically used to power decentralized applications (dApps) that rely on AI for tasks like data processing, decision-making, automation, or machine learning model hosting.

The Role of AI in Blockchain and Crypto

AI as a whole has gained traction over the last two years, with its global market valuation projected to reach $826 billion by 2030. One of its most significant use cases is blockchain technology, which enhances the operation of decentralized networks. AI enables more optimized transactions, automation, and predictive analytics within crypto platforms.

Artificial intelligence is most frequently utilized in blockchain ecosystems with crypto AI agents. These autonomous programs draw from LLMs (large language models) to interpret and analyze data, which they use to make decisions without human intervention. The top AI agent tokens include Artificial Superintelligence Alliance (FET), Virtuals Protocol (VIRTUAL), and ai16z (AI16Z).

Another influential role that AI has on blockchain technology is interaction with smart contracts, as seen in the Internet Computer network. With AI running through on-chain processes, the data that the program uses remains tamperproof and secure.

How AI Coins Differ from Traditional Cryptos

AI tokens are generally centered around use cases involving AI, such as machine learning, intelligent automation, and analytics. Unlike conventional cryptocurrencies like Bitcoin (BTC), which mainly serve as a store of value, AI coins mostly derive value from the artificial intelligence technology they are based on or which they facilitate.

Here’s a side-by-side comparison table between AI tokens and traditional crypto:

| Aspect | AI Coins | Traditional Cryptos |

| Purpose | Typically, to support AI-powered platforms, model training, data, and/or machine learning apps | As a digital store of value that may be used for decentralized finance (DeFi) |

| Utility | Facilitate the development of AI and/or reward AI-related contributions | Power transactions, staking, and smart contracts |

| Technology | AI models, agents, infrastructure, and/or decentralized platforms | Decentralized ledger and conventional consensus mechanisms |

| Value Proposition | Growing innovations within AI; Could also feature traditional crypto utility | Deflationary mechanisms, mass adoption, and DeFi utility |

| Market Adoption | High-risk sector with strong growth potential | More established with clear historical performance and adoption |

Given this, the key distinction lies in the token’s purpose. AI coins are designed to bring forth or integrate artificial intelligence through blockchain networks. On the other hand, conventional cryptocurrencies like Bitcoin and Ethereum (ETH) focus on being a store of value or as a smart contract ecosystem.

Some traditional cryptocurrencies have managed to pivot and become AI coins thanks to their flexibility. Examples include:

- NEAR Protocol: Started as an L1 project focused on usability and scalability. It’s now the top network for AI-native apps and development.

- Internet Computer: Initially built to bridge Web2 and Web3, it now supports AI integration into its smart contracts for AI hosting and other tools.

- Render: Began as a decentralized peer-to-peer GPU power marketplace, and is now aligned with artificial intelligence due to AI’s reliance on GPU processing.

Key Features to Look for in AI Cryptos

When evaluating AI cryptocurrencies, users must understand each project’s fundamental value, security, sustainability, and market strength. This can be accomplished by identifying the following key features:

- Use Case: Does the AI crypto solve a real-world problem? Understand AI’s role in the project and see how clear the use case is. Tokens with clear functionality and utility transcend the basic speculative nature of some assets.

- Transparency: Be wary of coins that use AI buzzwords without demonstrating their technology. Additionally, look for whitepapers, smart contract audits, and developer information to minimize the risks of potential scams.

- Market Cap: By identifying the AI crypto project’s overall valuation, you can better understand the current market adoption and growth potential.

- Tokenomics: Look for token supplies that are sustainable and well distributed. It should have well-structured incentives for all stakeholders, transparent distribution, and be designed to provide long-term value.

- Community: AI tokens with highly engaged and active community members show social proof that the project is backed and supported by many stakeholders.

Most of the core aspects investors look for in conventional cryptocurrencies are the same when researching AI tokens. One of the key features that you should put more weight on than others is the project’s long-term impact, since many AI projects require constant development and growth.

Why Investors Are Seeking Out AI Coins

The AI crypto market cap has ballooned by up to 1,300% in the last two years, highlighting the transformative technology’s widespread adoption. Let’s explore the primary reasons investors buy into AI decentralized projects.

Decentralized Finance

AI’s adaptive and automatic features enable it to enhance the operation of DeFi platforms. Instead of relying solely on preprogrammed algorithms, AI enables smart contract platforms to adjust lending rates and trading fees based on real-time market trends. For instance, the Aave DeFi protocol uses machine learning to provide optimal lending rates and evaluate borrower credit scores.

For example, NEAR Protocol’s AI-focused infrastructure unlocks new DeFi applications that can make intelligent decisions instantaneously. NEAR users can build an AI agent to dynamically manage a portfolio and communicate through Web2 finance APIs to be an automated broker with innovative protocols.

Data and Analytics

Since AI relies on large datasets for learning, information is its primary fuel source, and AI-focused cryptocurrencies are developing new ways to manage, monetize, and process data. In this regard, Internet Computer is the most advanced platform, providing developers ways to store, execute, and manage AI models on-chain through their unique smart contract “canisters.”

Besides ICP, projects like Bittensor and Story enhance data security with AI. For Bittensor, machine intelligence and data are stored in a peer-to-peer decentralized network, making it nearly impossible to tamper with. Additionally, Bittensor plays a significant role in decentralized AI analytics by enabling anyone on the network to contribute intelligence.

In the Story blockchain, IP data is safeguarded on-chain, and even AI models accessing it must follow the owner’s terms of use. This ensures creators maintain control of their work, even in autonomous and AI agent-driven environments.

NFT Projects and Metaverse Applications

The use of artificial intelligence with NFTs and the metaverse gives rise to new interactive and intelligent digital experiences. The Render blockchain, in particular, is an AI-ready project that allows artists to develop AI-generated content that could be used to create dynamic, 3D NFTs.

Regarding the metaverse, Render can be utilized not only to generate and render assets in real time, but its AI integration could also power intelligent NPCs (non-player characters) and more realistic environments.

Since the metaverse can rely on on-chain connectivity, Internet Computer is another project that could potentially integrate AI with NFTs and metaverse apps. The L1 blockchain already has a robust NFT ecosystem, allowing users to mint and trade NFTs with zero gas fees. Additionally, the network’s smart contract canisters provide the immense bandwidth and scalability that metaverse platforms would benefit from with AI.

Computing Power

While we’ve mostly mentioned how AI can help blockchain technology, decentralized networks can also help advance AI. In particular, the blockchain system enables artificial intelligence to tap into more computing power than centralized systems.

We can easily see computing power improvements for AI in Bittensor and Render. In the case of Bittensor, the blockchain of machine intelligence allows AI models to train with vast amounts of information from a global decentralized network. This accelerates the growth of AI systems trained on Bittensor, providing censor-restricted data for complete usability.

The same idea applies to Render, but instead of AI in a peer-to-peer decentralized platform, it’s all about distributing GPU processing power. The now Solana-based blockchain benefits AI developers as they can leverage Render Network’s ocean of GPU handling capacity. Essentially, AI teams can run more processing-intensive AI logic on Render than centralized setups, enabling them to create more complex and intelligent programs.

How to Buy and Store AI Coins

If you’ve decided to invest in AI cryptocurrencies, the next steps to consider are the best platforms where you can purchase them and apps to help manage them. Let’s go into more detail regarding exchanges for buying AI tokens, storage solutions, and passive income opportunities.

Best Exchanges to Buy AI Cryptocurrencies

Using a crypto exchange is the primary method of buying AI tokens. The best trading platform to use depends on your level of experience and investment goals. Here are the two main types of exchanges where AI tokens are actively traded:

- Centralized Exchange (CEX): This is the most used option of the two and is commonly used by both novice and experienced investors. Centralized exchanges have fast order execution and deep liquidity, making them ideal for active investing and advanced trading (crypto futures and margin trading). However, CEXs store your crypto assets for you, meaning you have less control over them.

- Decentralized Exchange (DEX): While more technical in nature, decentralized exchanges allow users to trade, lend, and swap AI tokens and other crypto assets while maintaining complete control over their private keys. Because they operate on-chain, DEXs usually have slower transaction speeds (based on the network used).

First-time crypto users often start with centralized exchanges because of their simplicity and user-friendliness. Furthermore, the top CEXs support fiat onramping so individuals can easily convert their fiat holdings to crypto for trading.

Many investors use a combination of centralized and decentralized exchanges, taking advantage of the strengths of both. Typically, traders would initially use a CEX to leverage the platform’s easy fiat-to-crypto conversion, fast execution, and low slippage for major cryptocurrencies. Afterwards, they would transfer the purchased crypto to a non-custodial wallet and connect to DEXs for staking, lending, or other DeFi activities.

Safest Ways to Store AI Tokens

No matter where you buy your AI cryptocurrencies, how you store them will decide the security and usability of your assets. This is why storing your AI tokens and other crypto assets in a self-custody or decentralized wallet is strongly recommended.

Using a decentralized wallet gives you complete control of all held tokens and reduces the risk associated with leaving them on exchanges. While the top centralized trading platforms feature robust security measures, they are still vulnerable to hacks that could affect user funds.

As a result, many crypto holders move their tokens into secure, self-custody wallets. Let’s briefly explain the two types of decentralized wallets you can choose from:

- Software Wallet: Also known as a hot wallet, this type of token storage app offers a good balance of security and usability. They’re always connected to the internet so users can quickly connect to Web3 apps for transferring tokens. Examples include Best Wallet, MetaMask, and Trust Wallet.

- Hardware Wallet: Best for long-term holders, a hardware wallet or cold wallet lets you keep your private keys offline, offering greater protection against potential attacks. Examples include Ledger, Trezor, and Ellipal.

When buying cryptocurrencies on exchanges, it’s possible to use software and hardware wallets simultaneously and benefit from the former’s easy Web3 connectivity and the latter’s security. For most users, however, storing AI tokens in one type of decentralized wallet would suffice.

It all boils down to your goals for your AI crypto investments. If you want to actively trade and transfer them between various DeFi apps, using a software wallet is optimal. Those prioritizing maximum asset security and long-term investing are better off storing crypto in hardware wallets.

Staking and Earning Passive Income With AI Coins

Both centralized and decentralized crypto storage solutions offer passive income earning opportunities for AI cryptocurrencies. If your main goal when investing in AI tokens is to maximize their staking utility, we recommend storing them in decentralized wallets so you can connect to DEXs.

DeFi platforms typically offer the highest crypto earnings rates since wallet holders directly interact with the blockchain without any intermediaries. Whether that’s through lending tokens, providing liquidity, or staking cryptocurrencies, decentralized sites offer high security and the best returns.

Some decentralized wallets like Best Wallet include a crypto staking aggregator. The platform features the top APY (annual percentage yield) of various tokens, giving you a clear overview of well-performing assets. While staking aggregators are great for convenient crypto passive income earning, compatibility is the main concern, as users must check if a particular AI token is offered in their crypto staking wallet of choice.

What are the Risks of Investing in AI Crypto

As a new and emerging category, AI cryptocurrencies come with their own set of risks that investors should evaluate with care. The risks aren’t limited to price swings – they also include regulatory uncertainty, unproven technology, and overall speculation.

Market Volatility

AI tokens are especially prone to significant price fluctuations because of how new artificial intelligence has entered the blockchain market. Unlike more established assets like Bitcoin and Ethereum, many AI cryptocurrencies still need to find their footing regarding market adoption, utility, and infrastructure.

Additionally, market volatility is increasingly intense for newer and lesser-known AI tokens because of their limited liquidity and low trading volume. A sudden influx or outflow of capital could cause massive AI cryptocurrency price spikes that could significantly impact short and long-term traders.

The field of artificial intelligence and machine learning is still undergoing rapid experimentation. New breakthroughs (or setbacks) in AI research may indirectly affect the perceived value of any AI crypto project, adding another layer of uncertainty to AI coins’ market performance.

Speculation

Many early AI crypto projects attract investor attention mainly based on promises rather than proof. As a result, AI token valuations are primarily driven by speculation, where the token price doesn’t reflect actual user adoption, technological progress, and real-world utility.

Market trends also play a considerable role in AI crypto speculation. AI has been thrown around as an investment buzzword across different industries and asset classes. The combination of AI and blockchain technology creates media attention and investor enthusiasm in the short term, but can often lead to unsustainable growth with sharp price corrections when the hype fades.

In this regard, AI cryptocurrencies should be navigated with the same caution and risks as meme coins, since both categories are speculative assets. Investors must research beyond headlines and media, understanding each project’s background, developers, real-world functionality, and sustainability.

Compliance Issues

Since AI and blockchain are two new, high-impact technologies, many jurisdictions are still figuring out how to regulate both cryptocurrencies and artificial intelligence.

Crypto regulation has been a legal headache, with some countries showing greater acceptance than others. Bitcoin investors have been debating with government officials on the potential safety concerns, criminal activity, and privacy issues involved with blockchain networks.

In artificial intelligence, institutions have been concerned about AI’s role in cyber threats, deepfakes, autonomous weaponry, and the lack of transparency. Many more officials are concerned with how AI automation can displace jobs, introducing massive wealth inequality that may disrupt traditional employment models.

AI cryptocurrencies are subject to the regulatory uncertainty of both artificial intelligence and blockchain technologies. A change in policy on either of these technologies could result in significant losses for investors.

What’s Next for AI Crypto

Following the 2024 AI crypto bull run, AI-focused tokens will enter a new phase in which real-world functionality matters more than hype. The next generation of decentralized AI projects is geared to transform blockchain operations, making them more intuitive, scalable, and responsive for users.

Smart Contracts and Automation

AI projects are beginning to experiment with AI-powered smart contracts that can evolve and make decisions without human intervention. Conventional smart contracts operate based on predefined rules, but these programs enhanced with AI allow them to be more flexible and dynamic.

Additionally, using AI with smart contracts could reduce developer workloads, especially with repetitive tasks. With the latest machine intelligence, even non-technical users could build smart contracts and other decentralized applications faster and with fewer errors.

Enhancing Security in Crypto

Security remains one of the top concerns in the crypto market, and AI is now being implemented to improve threat detection and response. Machine learning algorithms can analyze real-time transactions, flag suspicious activity, and even block attacks before they cause any damage. Through AI, proactive cryptosecurity is possible and could reduce smart contract vulnerabilities and even rug pulls at the economic level.

Moreover, AI is already being used to analyze token smart contracts, market capitalization, distribution, and other metrics to detect scams. Anti Rug Agent (ANTIRUG) is a top microcap crypto that leverages AI agent technology to look for signs that a token project will likely be a rug-pull scam.

How AI-Driven Projects Could Transform the Blockchain

AI is increasingly finding its place in decentralized autonomous organizations (DAOs), where it can automate decision-making, optimize governance processes, and help communities operate more efficiently. From proposal evaluations to voting mechanisms, AI can streamline complex workflows and reduce human bias, making DAOs more agile and effective.

While crypto once dominated the narrative as the “next big thing,” AI has recently taken center stage in the tech world. Yet, despite the shifting spotlight, crypto has not faded into the background. It has matured, gained institutional attention, and established itself as a key player in global finance and technology.

If AI follows a similar trajectory – moving from hype to real-world integration – the two technologies could converge in powerful ways. The synergy of blockchain’s transparency and decentralization with AI’s learning and automation capabilities could unlock entirely new possibilities in finance, governance, and digital infrastructure.

FAQ

What are AI coins, and how do they work?

AI coins are cryptocurrencies that incorporate artificial intelligence in some way, whether at the protocol level, on the blockchain platform, or beyond. Some AI cryptos like NEAR Protocol and Render help facilitate AI workloads and applications. Other tokens like Internet Computer and Bittensor enable AI models to run directly on-chain.

What is the best AI cryptocurrency to invest in?

There’s no single top AI coin to invest in, but the largest tokens by market cap now are NEAR Protocol (NEAR), Internet Computer (IP), Bittensor (TAO), Render (RENDER), and Story (IP).

Are AI coins a good long-term investment?

As artificial intelligence adoption increases, many consider investing in AI coins as a long-term, high-growth strategy. However, the technology is still new, and the argument can be made that many AI-related assets are overvalued. Investors should weigh both promises and risks associated with AI crypto.

How does AI improve blockchain technology?

AI provides blockchain networks with intelligent automation, smarter data analysis, and quicker decision-making. Because of the technology’s high innovation rate, AI-driven enhancements might be developed in areas of blockchain platforms that have never been done before.

Where can I buy AI cryptocurrencies?

Users can buy AI coins in cryptocurrency exchanges, and some crypto wallets allow investors to buy AI tokens directly on the platform. Major exchanges like Binance, Kraken, and Coinbase usually list the top AI cryptocurrencies.

Are AI-driven crypto projects safe?

Some AI crypto projects are backed by solid developers and have transparent goals, but not all tokens are reliable. Before trusting a project, review its smart contract audits, whitepaper, community feedback, and other clear documentation.

What risks are associated with investing in AI coins?

Risks include market volatility, significant price speculation, unproven or underdeveloped features, and regulatory instability.

Can AI-powered blockchains replace traditional networks?

Given how well-established traditional networks are, AI-driven blockchains are unlikely to replace them. However, AI blockchains could outperform conventional networks in certain areas, allowing them to coexist and serve different purposes.

What is the future of AI in cryptocurrency?

AI is expected to play a growing and innovative role in crypto, with smart contract optimization, self-evolving intelligence, personalized tools, and more. Given how often new advancements occur in AI and blockchain technologies, more efficient and creative developments could quickly gain traction.

How can I earn passive income with AI cryptos?

Individuals can earn passive income by staking AI tokens, providing liquidity pools in decentralized exchanges, or trading them with automated bots.

References

- 2024 NEAR Year In Review (NEAR Protocol)

- How Nvidia grew to a trillion-dollar company fueling the AI revolution (NBC News)

- Render Network Protocol 002: Layer 1 Network Expansion | by Render Network | Render Network (Medium)

- Global AI market size 2030 (Statista)

- Top AI & Big Data Tokens by Market Capitalization (CoinMarketCap)

- Artificial Intelligence and DAOs: The Perfect Match? (Medium)