On this Page:

Microcap cryptocurrencies are digital assets with relatively low market capitalizations, typically under $50 million. Some investment analysts consider crypto below $100 million in market cap as microcap tokens.

While microcap cryptos are highly volatile and risky investments, they can have higher growth potentials than large-cap tokens like Bitcoin and Ethereum. With much more room to grow, microcap cryptocurrencies provide high-risk, high-reward opportunities for opportunistic crypto investors. Here are 5 best microcap cryptos to buy in 2025.

| # | Coin | Price | 24h % | Market Cap | Volume | 24h Range |

|---|---|---|---|---|---|---|

| 1 |

|

$0.0098 | -1.80% | $173,797,579 | $2,171,383 |

$0.0098

―

$0.01

|

| 2 |

|

$0.0(5)23 | -1.44% | $114,251,614 | $426,232 |

$0.0(5)23

―

$0.0(5)24

|

| 3 |

|

$0.15 | 0.45% | $112,832,455 | $24,288,244 |

$0.15

―

$0.15

|

| 4 |

|

$0.09 | 5.07% | $89,016,840 | $11,824,537 |

$0.09

―

$0.09

|

| 5 |

|

$0.0(3)16 | -2.19% | $56,358,333 | $32,330 |

$0.0(3)15

―

$0.0(3)16

|

| 6 |

|

$0.0(4)44 | -4.78% | $39,085,197 | $1,219,843 |

$0.0(4)44

―

$0.0(4)46

|

| 7 |

|

$0.01 | -2.87% | $33,873,844 | $5,072,338 |

$0.01

―

$0.01

|

| 8 |

|

$0.0(3)47 | -7.22% | $33,336,439 | $1,694,647 |

$0.0(3)47

―

$0.0(3)51

|

| 9 |

|

$0.0(4)46 | - | $29,692,907 | $54,169 | - |

| 10 |

|

$0.02 | -7.72% | $23,804,047 | $12,261,867 |

$0.02

―

$0.03

|

| 11 |

|

$0.06 | 4.05% | $23,184,176 | $177,468 |

$0.06

―

$0.06

|

| 12 |

|

$0.0(6)63 | -3.49% | $21,054,976 | $56,925 |

$0.0(6)57

―

$0.0(6)66

|

| 13 |

|

$0.0047 | -8.14% | $18,621,900 | $233,155 |

$0.0047

―

$0.0052

|

| 14 |

|

$0.0014 | -5.42% | $14,353,323 | $269,005 |

$0.0014

―

$0.0016

|

| 15 |

|

$0.02 | 14.45% | $9,416,953 | $140,917 |

$0.02

―

$0.02

|

| 16 |

|

$0.03 | 1.64% | $5,745,702 | - |

$0.03

―

$0.03

|

| 17 |

|

$1.00 | 0.10% | $5,658,685 | $45,856 |

$1.00

―

$1.00

|

| 18 |

|

$1.00 | 0.00% | $4,712,398 | $2,119,951 |

$1.00

―

$1.00

|

| 19 |

|

$1.00 | 0.05% | $4,559,781 | $7,322 |

$1.00

―

$1.01

|

| 20 |

|

$1.09 | 0.00% | $3,493,531 | - |

$1.09

―

$1.09

|

| 21 |

|

$19.88 | 51.22% | $2,229,638 | $8,360 |

$13.13

―

$20.82

|

| 22 |

|

$0.0020 | -11.34% | $2,041,537 | $964,097 |

$0.0020

―

$0.0023

|

| 23 |

|

$0.0(8)37 | -6.62% | $1,575,738 | $55,191 |

$0.0(8)35

―

$0.0(8)46

|

| 24 |

|

$0.03 | -0.92% | $1,266,956 | - |

$0.03

―

$0.03

|

| 25 |

|

$1.09 | -2.13% | $1,084,946 | $1,109 |

$1.07

―

$1.12

|

| 26 |

|

$0.02 | -0.76% | $1,071,208 | - |

$0.02

―

$0.02

|

| 27 |

|

$0.0(3)93 | 0.12% | $934,063 | $100,029 |

$0.0(3)84

―

$0.0011

|

| 28 |

|

$0.0025 | -1.98% | $840,877 | - |

$0.0025

―

$0.0026

|

| 29 |

|

$0.0053 | - | $458,363 | $56,633 | - |

| 30 |

|

$0.0097 | -0.69% | $363,589 | - |

$0.0097

―

$0.0099

|

| 31 |

|

$0.0047 | 2.15% | $321,027 | - |

$0.0045

―

$0.0050

|

| 32 |

|

$0.0037 | -5.73% | $227,527 | $27,817 |

$0.0036

―

$0.0040

|

| 33 |

|

$0.0086 | 3.67% | $50,328 | - |

$0.0083

―

$0.01

|

DigiByte

DGBVVS Finance

VVSSiren

SIRENMoonbeam

GLMRCorgiAI

CORGIAIMESSIER

M87Orbiter Finance

OBTWojak

WOJAKMoonRabbits

MRBpippin

PIPPINDragonchain

DRGNIlluminatiCoin

NATISTRIKE

STRIKEDione

DIONELion Cat

LCATHUSD

HUSDHermetica USDh

USDHNectar

NECTVai

VAIHigh Yield USD (Base)

HYUSDHacash Diamond

HACDLarge Language Model

LLMToad (SOL)

$TOADJarvis

JARVISSoul Scanner

SOULLA

LAAnti Rug Agent

ANTIRUGGiveth

GIVMetaverse ETP

ETPBismuth

BISGarlicoin

GRLCVega Protocol

VEGAMonkex

MONKEXTop Microcap Cryptos to Watch in 2025

Let’s head straight into the reviews for some of the best microcap crypto to watch out for in 2025.

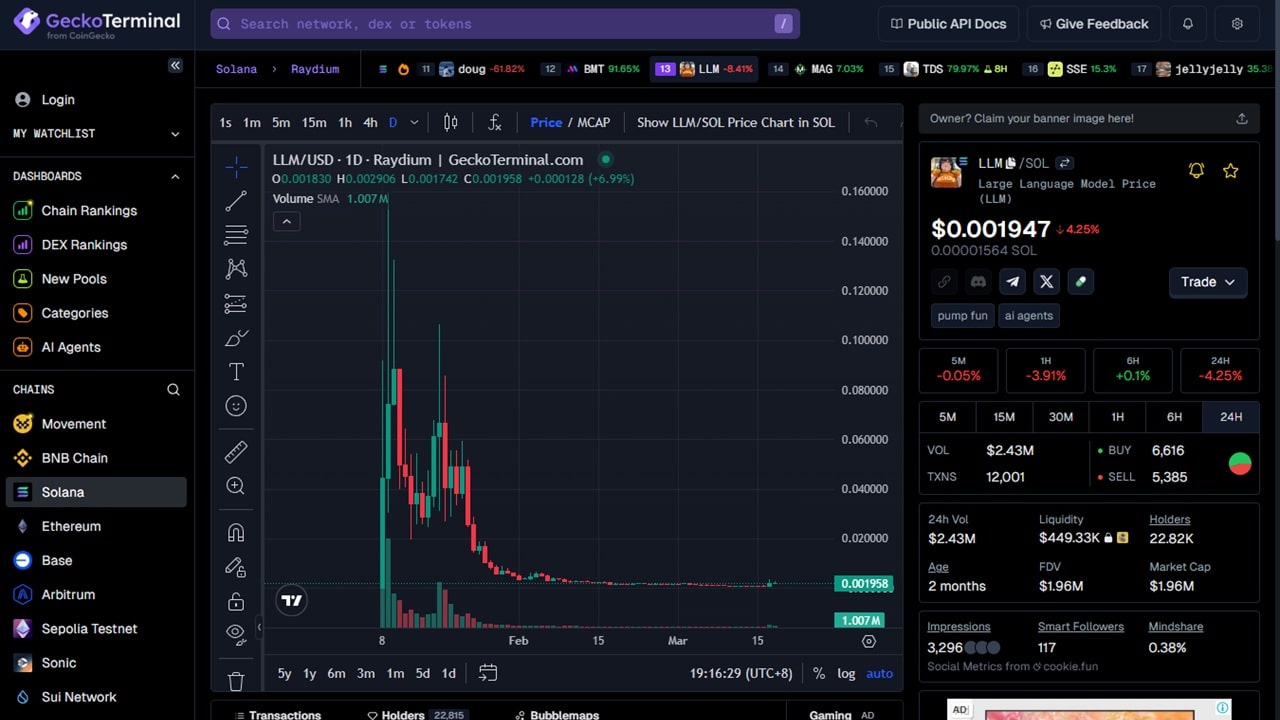

1. Large Language Model (LLM)

Large Language Model (LLM) is an AI meme coin built on the Solana network. Launched in January 2025 on the Pump.fun app, LLM was released as a parody of ai16z (AI16Z), the first DAO (decentralized autonomous organization) venture capitalist platform run by AI agents and one of the top artificial intelligence meme tokens.

Before it became a microcap crypto, Large Language Model peaked in valuation shortly after its release. In fact, LLM peaked at a $125 million market capitalization when it achieved its all-time high price of $0.1437 per token on January 9, 2025.

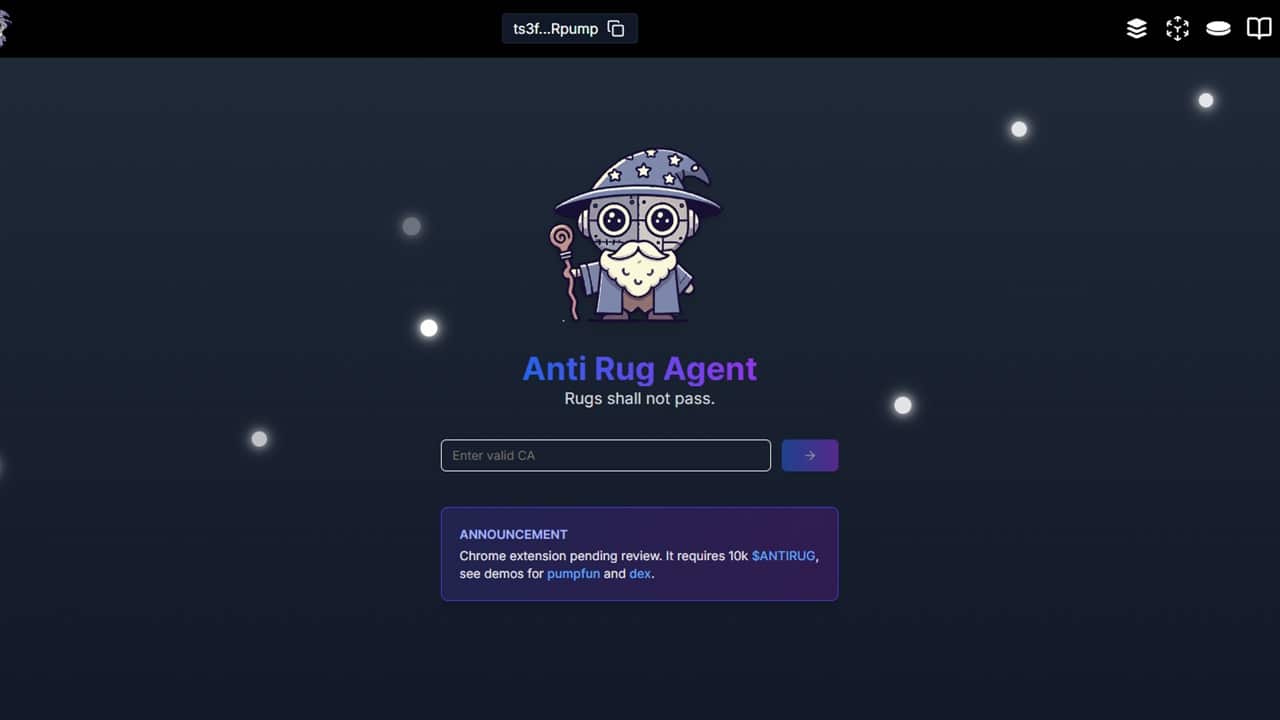

Large Language Model Price Chart

(LLM)Large Language Model (LLM)

LLM has a total supply of 1 billion tokens, zero transfer taxes, and a fully revoked contract, leaving trading and growth completely to the Large Language Model community. With no utility or roadmap, LLM is purely a meme token and derives value from crypto investor speculation.

Those interested in buying LLM tokens can find the AI crypto live on various exchanges, including LBank, Raydium, MEXC, and Ourbit. The official Large Language Model X account has over 11,100 followers, and at the time of writing, nearly 22,500 wallets hold LLM.

Find out more about Large Language Model (LLM)

2. Giveth (GIV)

Giveth is a crypto donation platform aimed at helping non-profit projects raise funds through Web3 technology. Through its peer-to-peer system, token donations are directly transferred to projects, and donors are rewarded for their contributions and

This microcap token has been gaining traction following the development of several new features, such as a staking mechanism and Quadratic Funding (QF). With the staking utility, GIV token holders are more incentivized to hold their crypto and support its price. On the other hand, QF helps Giveth projects secure more funding fairly with many donors.

Giveth Price Chart

(GIV)Giveth (GIV)

Based on the Giveth roadmap, the Ethereum-based crypto aims to add two other features in the future. One upcoming addition is a smart contract mechanism that would help generate yield on idle donations. At the same time, another development aims to incorporate bonding curves that would help innovate the funding of public goods.

Since Giveth’s launch in 2021, the microcap token experienced a significant market correction that could pose a potential opportunity for investors to snag GIV at a discounted rate. The project has a total supply of 1 billion tokens, with 90% of the total supply distributed over 5 years from launch.

Find out more about Giveth

3. Toad (TOAD)

Toad (TOAD) is a Solana-based microcap meme coin inspired by the Frog and Toad characters in the famous American Literature children’s book. The cryptocurrency surged in price at around the time of the latest meme coin supercycle, rising by over 5,000%.

The native token, TOAD, emphasizes community-building, which it claims will be critical in the meme coin’s success. As it stands, Toad (TOAD) has no tax fees, and all LP (liquidity pool) tokens have been burned, ensuring that liquidity remains for the crypto.

Toad (SOL) Price Chart

($TOAD)Toad (SOL) ($TOAD)

According to the Toad (TOAD) whitepaper, the meme coin will establish strategic partnerships with influential players in the crypto ecosystem to fuel collaborative growth. Additionally, the project will look to make strategic listings on top cryptocurrency exchanges for broader market access.

So far, Toad (TOAD) has over 10,500 followers on X and nearly 46,000 token holders. It has a total supply of about 420 trillion TOAD tokens and can be traded live on BitMart and Raydium.

Find out more about Toad (TOAD)

4. Anti Rug Agent (ANTIRUG)

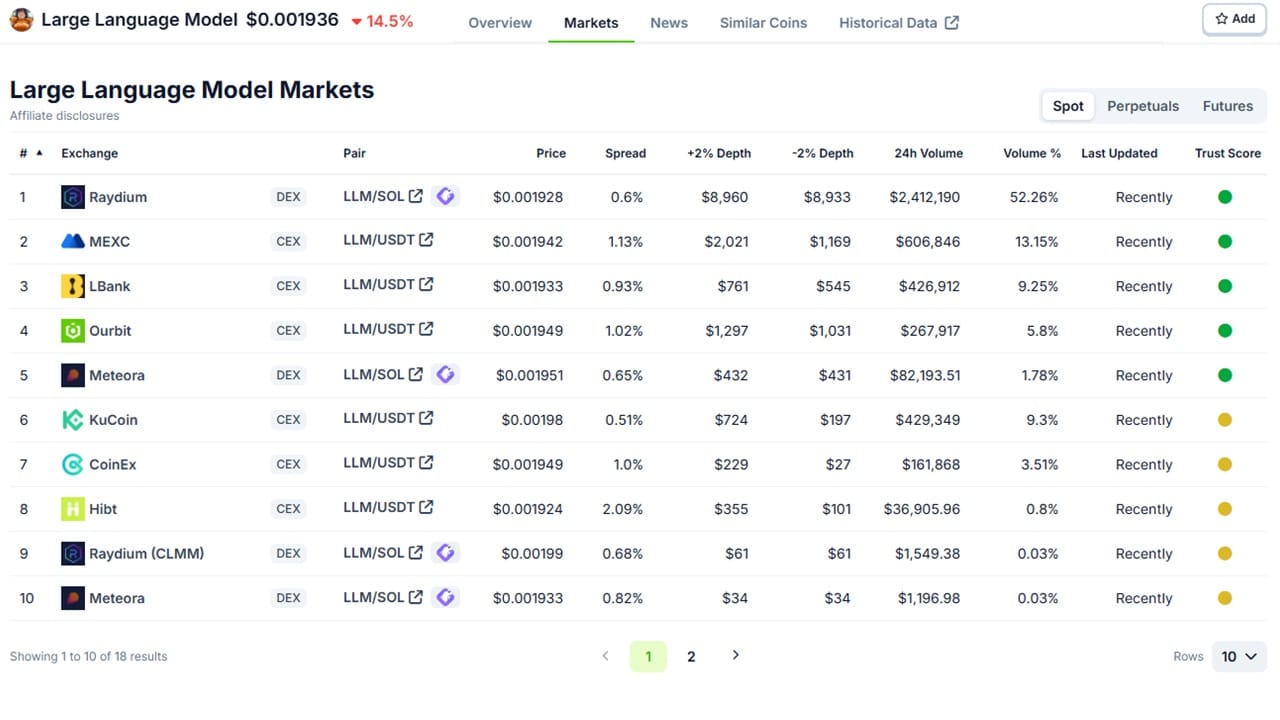

Anti Rug Agent is another AI-powered Pump.fun cryptocurrency. Launched in January 2025, the crypto project helps individuals scan tokens and utilizes AI agents to look for potential rug-pull indicators.

Users can copy and paste token contract addresses to the Anti Rug Agent website, where the AI agent reviews the crypto and generates an analysis of the project’s safety. In particular, Anti Rug Agent provides an AI safety score, token breakdown, and overall smart contract evaluation.

Anti Rug Agent Price Chart

(ANTIRUG)Anti Rug Agent (ANTIRUG)

One of the project’s newest features is a Chrome web extension that allows users to inspect cryptocurrencies more quickly and seamlessly check for rug-pull scams. Plans are also in place to enable individuals to build AI agents with tailored tools for evaluating tokens.

Furthermore, Anti Rug Agent aims to expand across various chains in the future, including Base, Ethereum, and Polygon. Given Anti Rug Agent’s usability, the microcap token has gained a following of nearly 24,000 accounts on X and over 4,000 token holders.

Find out more about Anti Rug Agent

5. Soul Scanner (SOUL)

Soul Scanner is a Telegram bot ecosystem that offers real-time smart contract evaluations. The program analyzes any smart contract that an individual sends it and reviews important details like transaction history and deployment details to find potential vulnerabilities.

Other Soul Scanner features include rug pull alerts, price monitoring, and comprehensive reports in a user-friendly setup. SOUL is the project’s native token and provides holders exclusive access to premium and upcoming features for a better experience.

Soul Scanner Price Chart

(SOUL)Soul Scanner (SOUL)

Another feature of the Soul Scanner ecosystem is Soul Sniper, a trading and sniping Telegram bot offering fast trades on the Solana network. Swaps take less than 4 seconds (on average) to complete, and snipes land on average within the first five blocks.

Soul Scanner and Soul Sniper have over 41,500 and 25,600 monthly Telegram users, respectively. For 2025, the project aims to improve its user interface and add more bot features to increase its utility. SOUL tokens can currently be purchased on the Raydium DEX.

Find out more about Soul Scanner

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

How We Chose the Best Microcap Crypto

Market capitalization is a measure of a token’s market size, calculated by multiplying the token price by the cryptocurrency’s total supply. It’s one of the most important metrics to consider when investing in a digital asset, as it shows the crypto asset’s market presence and project size.

With over 10,000 microcap cryptocurrencies in the market, finding the top tokens within the category requires considering several key characteristics. In particular, we examined and analyzed market trends, use cases, trading volume, liquidity, exchange listings, developer teams, and community engagement.

Given the high-risk nature of microcap crypto assets, our evaluation prioritizes transparency, sustainability, and long-term potential. However, we still recommend investors do their own research regarding each microcap crypto mentioned.

Market Trends

Most microcap cryptocurrencies are either driven by speculation or niche blockchain applications. Because of this, understanding current market trends is essential when analyzing microcap tokens.

Crypto projects that ride on emerging trends like AI agent coins, real-world assets, and blockchain tools usually have more significant upside potential than tokens that don’t align with these sectors. Reviewing how microcap crypto capitalizes on industry trends would give investors a clearer picture of the token’s future relevance and market adoption.

Additionally, popular Bitcoin investors like Mark Cuban or Elon Musk could influence market trends. Their influence through social media interactions and announcements could profoundly impact investor confidence, especially during bullish market conditions.

Use Case Viability

Another factor indicating strong investment potential is a microcap token’s real-world application. A strong utility adds to a crypto’s value and could make it more resistant to market volatility. We examine how the microcap cryptocurrency solves specific problems and if there is a growing demand for its solution.

Some popular crypto use cases include the following:

- Real-world asset tokenization

- Decentralized AI tools and platforms

- Climate-friendly solutions

- Cross-chain interoperability

- Supply chain transparency and efficiency

Notably, having real-world functionality is not a requirement for microcap tokens to surge in price. Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) rely purely on speculation and community activity for growth.

Trading Volume, Liquidity, and Exchange Listings

Liquidity is one of the most fundamental aspects of any cryptocurrency, and microcap tokens are no exception. Highly liquid cryptocurrencies indicate a large and active market of traders, making it easier to trade.

High trending trading volume and liquidity are exceptionally positive indicators for microcap cryptocurrencies because of their low market capitalizations. We reviewed the daily trading volume of these cryptocurrencies to gauge current market activity and investor interest.

Furthermore, we consider a microcap token’s current and potential exchange listings. Cryptocurrencies listed on top-tier centralized exchanges (CEXs) like Binance, Coinbase, and Kraken tend to show strong potential. Meanwhile, token listings on DEXs like Uniswap and Pancakeswap reflect the crypto’s on-chain accessibility.

Developer Activity

Microcap cryptocurrencies must prove their reputability since they’re less trusted than tokens with higher market caps. One way that cryptos can showcase trustworthiness is through the activity and transparency of their developers.

For this, we examined microcap cryptos’ project roadmaps, smart contracts, and social media channels to see if the team has made any official announcements of ongoing improvements and enhancements. Strong technical leadership and experienced developers show credibility and expertise, boosting the crypto’s reputation.

An active development can signify a crypto’s long-term success, showing that its team is heavily invested in continuously building the cryptocurrency. Conversely, abandoned social media accounts and a lack of developments raise red flags regarding the microcap token’s future viability.

Community Engagement

A thriving community is a significant indicator of a microcap token’s longevity, regardless of its functionality and real-world use cases. In fact, community engagement alone is responsible for the high growth experienced by some meme coins, showing that hype and user activity can sometimes trump actual token utility.

For this reason, we evaluated the social media presence of microcap tokens across various platforms, including X (formerly Twitter), Telegram, Discord, and Reddit. Projects with more organic and decentralized engagements with regular announcements from their developers showcase greater credibility.

Conversely, inactive communities with artificially inflated follower numbers could be signs of potential manipulation or a genuine lack of interest from members. Some cryptocurrencies utilize DAO-based systems to incentivize community engagement, which we also consider in our analysis.

Why Invest in Microcap Crypto?

There are various benefits to investing in microcap cryptocurrencies that are limited or absent when buying tokens with more significant valuations. Let’s break down these advantages below:

- Growth Potential: Microcap tokens generally have higher growth potential than large-cap cryptocurrencies like Bitcoin and Ethereum. They also have a higher chance of gaining traction within a short time.

- Low Entry: Microcap cryptos are often more affordable because of their low market adoption. This allows investors to buy a significant volume of tokens with little capital. Additionally, users can easily diversify their portfolios with microcap tokens while their prices are low.

- Innovative Technologies: Some microcap cryptocurrencies feature pioneering technologies that could be currently underutilized or not yet widespread. Users have the chance to invest in these innovative projects before they gain traction with the public.

- Trading Opportunities: Short-term traders can sometimes find success in microcap tokens, especially when they recently pick up trading volume and liquidity.

- Early-Stage Support: Many microcap tokens are still in their early stages, allowing investors to support and contribute to the project’s development.

Investors should understand the upsides of buying microcap tokens so that they can tweak their strategies to maximize these benefits. Consequently, everyone should consider the other side—the risks associated with investing in low-market-cap cryptos, which we’ll discuss in the next section.

Risks of Investing in Microcap Cryptos

Microcap token investment strategies are mostly double-edged due to the high-risk, high-reward nature of the crypto assets. The following are the most significant risk factors associated with microcap cryptos:

- High Volatility: Investors will encounter volatility risks when trading microcap tokens, especially if they are unprepared for sudden price spikes and corrections.

- Low Liquidity: Limited token liquidity poses several disadvantages, including a higher risk of price manipulation and difficulty entering or exiting the market.

- Safety Risks: Compared to more established cryptocurrencies, microcap tokens are more vulnerable to fraud, rug pulls, and other safety hazards that add to the overall investment risk.

- Unproven Applications: Many early-stage projects are microcap cryptos and might lack fully developed technology and security features.

- Lack of Accessibility: Most microcap cryptos aren’t available on the top exchanges, making them difficult for traders to find and access. Some tokens can even be delisted from exchanges, reducing market adoption chances.

Remember that most microcap cryptos do not gain traction, making considering the risks all the more necessary. When investing in tokens with small market valuations, follow best practices, such as conducting thorough research, exercising caution, and diversifying your portfolio.

Latest Market News

Where to Buy and Trade Microcap Cryptos

Investors can find microcap cryptocurrencies on various trading platforms. However, due to their limited market adoption and liquidity, not all exchanges list these types of tokens.

Centralized Exchanges vs. Decentralized Exchanges

Microcap tokens should be listed on at least one exchange, either a centralized or decentralized exchange. Being listed on multiple trading platforms could indicate better market potential, but this is not necessarily the case.

Either way, users can only trade microcap crypto in exchanges where the token is live. Crypto data aggregators like CoinGecko and CoinMarketCap provide real-time data on almost all cryptocurrencies, including microcap tokens. Use them to see which exchanges feature the token you wish to trade.

Many microcap cryptocurrencies can be traded on both centralized and decentralized exchanges. Here’s a breakdown of the two types of exchanges to consider when buying or selling the token:

- Centralized Exchanges: Of the two, CEXs are faster and easier to use. They typically offer more fiat funding options, advanced charting tools, and customer support that provide a user-friendly trading experience. However, they often need to comply with strict financial regulations, requiring KYC (know your customer) verification, and don’t give users complete control over their crypto holdings.

- Decentralized Exchanges: DEXs are more secure since all transactions are processed on the blockchain. As a trade-off, transaction speeds are often limited by the scalability of the network on which they’re based. Also, users need a decentralized wallet to access the DEX but retain complete anonymity and control over their tokens.

When investors choose whether to use a centralized or decentralized platform for trading microcap tokens, they should consider their experience level, security preferences, and trading strategies. CEXs are more beginner-friendly platforms that support high-speed trading but may not always list microcap tokens because of their low liquidity and high risk.

In contrast, DEXs are usually the first platforms to list microcaps since anyone can list new crypto by providing the proper liquidity. While decentralized exchanges have no regulatory oversight, traders can use them anonymously while keeping decentralized control over their tokens.

How to Find Early Microcap Listings

Investing in microcap tokens before gaining mass market adoption can be profitable if traders can find the right projects. Here are three ways to find early-stage microcap projects:

- Crypto Launchpads: These blockchain platforms showcase new cryptocurrency projects in their presale stage, raising funds before they are publicly traded. Presale tokens are offered at discounted rates, providing early investment opportunities. Examples include the Best Wallet Upcoming Tokens launchpad, Polkastarter, and BSCPad.

- Data Aggregators: Besides showing which exchanges microcap tokens are traded in, crypto data aggregators are incredibly useful for finding new cryptocurrencies to invest in. Users can use built-in filtering tools to find microcaps on different blockchains and categories while reviewing important token details like market capitalization and trading volume.

- Social Media: Online communities like X, Telegram, and Discord can serve as key information channels for new microcap listings. Following key crypto influencers like Vitalik Buterin, Elon Musk, and Michael Saylor could help you stay updated with the latest trends and platforms with microcap opportunities.

Other places to help traders discover new microcap cryptocurrencies include DEX aggregators like DEXTools, blockchain explorers, and mid-range crypto exchanges like MEXC, Bitget, and LBank.

Liquidity Pools & Market Depth Considerations

When trading microcaps on decentralized exchanges, investors should consider the platforms’ liquidity pools (LPs) size. The pools are smart contracts that act as automated market makers, each with one pair of cryptocurrencies enabling DEX traders to swap tokens.

The larger the microcap token’s liquidity pool, the easier it will be to execute trades without significantly affecting the crypto’s price. In contrast, smaller LPs make tokens more sensitive to huge price swings when swapped, making the price more volatile.

On centralized exchanges, market depth refers to the number of buy and sell orders available for cryptocurrencies at different price points. Greater market depth means that the exchange has more trading activity for the token, allowing for smoother transactions.

Observing liquidity pools and market depth is critical when trading microcap cryptos, as this will help mitigate liquidity risks that could result in exchange losses.

How to Research and Pick Winning Microcap Cryptos

Thorough research and evaluation increase the chances of finding highly rewarding microcap cryptocurrencies. It often requires fundamental analysis, reviewing technical indicators, and monitoring user sentiment across social media platforms.

Fundamental Analysis of Microcaps

Through fundamental analysis, individuals can more clearly understand a cryptocurrency’s underlying value. By comparing the intrinsic value to the token’s current price, investors can decide whether the microcap token is undervalued or overpriced.

Additionally, individuals tend to value a token’s fundamentals more when considering a cryptocurrency as a long-term investment. Since many microcaps are early-stage projects, having an insightful fundamental analysis is crucial. Here are the top fundamentals that investors should look out for in microcap tokens:

- Project Utility: As mentioned earlier, a microcap token that solves a real-world problem with an emerging trend presents a viable use case that adds to its overall value. A project’s whitepaper showcases the crypto’s functionality in this regard.

- Tokenomics: A microcap’s token distribution strategy can also significantly affect long-term value. Green flags include low circulating supply, deflationary mechanisms, and decentralized allocations.

- Developer Team: If possible, research the microcap crypto’s development team. Past success is one of the best predictors of future success, so transparent developers with plenty of blockchain experience add credibility and project value.

- Roadmap: Assess the project’s roadmap to see its potential long-term sustainability. Platforms with strong future goals and milestones show a team’s commitment and ongoing development.

- Exchange Listings: Microcap tokens that are live on multiple exchanges can indicate growing market adoption and better liquidity, setting the stage for future growth.

Using RSI, MACD & Moving Averages for Small-Cap Coins

Next, we move on to technical indicators, which help traders determine price action and trends for cryptocurrencies of all sizes. Here are three of the most widely used technical indicators and what they can inform us regarding the asset:

- Relative Strength Index (RSI): This indicator measures a crypto’s price momentum by determining if it is overbought or oversold within a specific time frame. On a scale of 0-100, an RSI above 70 signals that the crypto may be overbought, while an RSI below 30 suggests that the token is oversold.

- Moving Average Convergence/Divergence (MACD): Another momentum indicator, MACD helps traders find trend reversals and signs of when to go long or short. The MACD can be used with volume indicators for more accurate signal confirmations for trading microcaps.

- Moving Average (MA): Using a Moving Average can help users identify price trends. The MA can be set to track shorter or longer trends, such as 7-day, 50-day, and 100-day Moving Averages.

Traders usually value technical indicators over fundamental analysis for short-term cryptocurrency trading strategies. Also, individuals often utilize multiple indicators simultaneously, depending on the trading opportunities that they are optimizing for.

Identifying Breakouts & Accumulation Zones

A popular trading strategy for microcaps and high-growth potential cryptocurrencies is spotting breakouts and accumulation zones. With highly volatile and low-market-cap tokens, breakouts can lead to explosive price movements.

One way to confirm breakouts is by identifying key price levels while monitoring trading volume. Locating the support and resistance levels when trading tokens over a specific period of time can help predict future price movements.

For example, bullish price action can occur when a token surges past a critical resistance level accompanied by high trading volume that increases buying pressure. Investors can win trades by buying tokens on key support levels before the breakout or even as the crypto is about to run up after breaking past a resistance level.

See our Cryptocurrency Prices page for a more detailed explanation of crypto fundamental and technical indicators.

Tracking Mentions on X, Discord, and Reddit

Another major driver for high-potential microcap cryptos is social media sentiment. By tracking activity on the top social networks, investors can determine whether a microcap is gaining or losing traction within its community.

- X (Formerly Twitter): Crypto communities, influencers, and developers often discuss upcoming small-cap tokens on X. As the largest social media site for cryptocurrencies, X is one of the best platforms to track increasing token mentions, growing follower accounts, and high engagement rates.

- Discord: Many microcap tokens and projects use official Discord servers so that the development team can interact with holders and community members. Track a microcap Discord group’s activity to see how loyal and dedicated the community and developers are.

- Reddit: Monitoring subreddits under specific crypto exchanges, blockchain networks, and other communities helps find organic discussions on microcaps. Analyzing Reddit threads on microcap tokens can help identify whether the crypto receives genuine user interest or fake hype.

How to Spot a Microcap Pump-and-Dump

Crypto pump-and-dump schemes are particularly prevalent in small-cap cryptocurrencies, so identifying potential risk factors can help microcap investors avoid significant losses. Follow the steps below to identify potential microcap pump-and-dumps:

- Review fundamentals: Check for any red flags regarding a microcap’s fundamentals, including the tokenomics, whitepaper, and team transparency. Shady developers on projects without actual development activity and centralized token control are potential pump-and-dump risk factors.

- Check the token via DEXTools: Review the microcap’s DEXTscore, a token reliability score based on the number of token holders, transactions, audits, and liquidity pools. A higher score means a lower chance of being a pump-and-dump token.

- Look for smart contract audits: See if the microcap’s smart contract is independently audited. Review the audits to ensure ownership is renounced, liquidity is locked, and minting is limited or unavailable. Some smart contract audits explicitly review for rug-pull potential.

- Asses the token’s liquidity: Microcap cryptocurrencies with low trading volumes are easier to manipulate. Pump-and-dump schemes are more likely when there isn’t enough liquidity for actual trading.

- Monitor price movement: Abrupt and unexpected price spikes within a short period and without explanation can indicate artificial price manipulation.

As a general rule, conduct thorough due diligence when considering any microcap token and practice cautious investing to minimize exposure to scams.

FAQ – Best Microcap Crypto to Buy in 2025

What is considered a microcap crypto?

Cryptocurrencies with less than $50 million market capitalization are considered microcaps. However, investment analysts sometimes consider tokens less than $100 million in market cap under the microcap category.

Are microcap cryptos a good investment?

Microcap cryptocurrencies can be highly profitable, but they come with significant risks. Traders should only invest money they can afford to lose when investing in these highly speculative crypto assets.

Is trading microcap cryptos risky?

Because of their low liquidity and trading volume, microcap cryptocurrencies are prone to huge price swings, making them volatile digital assets. They’re also inherently highly risky because of various factors such as low market adoption and high potential to be rug pulls or scams.

How can I find microcap cryptos before they pump?

Investors can use several channels to find high-growth potential microcap tokens. One way is to monitor crypto communities on X, Discord, and Reddit. Another is to scan crypto launchpads, which are platforms showing early-stage blockchain projects that are currently fundraising.

How do I know if a microcap crypto is a scam?

Some red flags to look out for when researching a microcap cryptocurrency are a lack of smart contract audits, shady developers, low token distribution, unsustainable tokenomics, and suspicious trading activity.

What’s the difference between low-cap and microcap cryptos?

The main difference between low-cap (or small-cap) and microcap cryptocurrencies is their valuation. Low-cap tokens usually have a market cap of $100 million to $1 billion, while microcap crypto is worth less than $50 million (sometimes less than $100 million).

References

- From Memes To $500 Million In Revenue: The Pump.Fun Phenomenon (Forbes)

- What Is the Memecoin Supercycle? The Explosive Growth of Memecoins (CoinGecko)

- Cointelegraph Bitcoin & Ethereum Blockchain News (Cointelegraph)

- All Cryptocurrencies (CoinGecko)

- Decentralized Autonomous Organization (DAO): Definition, Purpose, and Example (Investopedia)

- Delisting Definition (CoinMarketCap)