The two biggest cryptocurrency exchanges used to trade cryptocurrency from anywhere around the planet right now are Binance and Coinbase.

Brian Armstrong and Fred Ehrsam founded Coinbase in the year 2012, making it one of the initial exchanges on the market. regulated in the United States, it provides users access to several of the most popular cryptocurrencies being traded around today. A simple interface and the option to purchase cryptocurrency using a credit card or a bank account have made Coinbase one of the world’s most popular exchanges.

Changpeng Zhao, the brains of Binance, launched the company around five years later in 2017. As of this writing, it is the world’s largest cryptocurrency exchange in terms of trading volume. However, Binance had to create a new company called Binance US, exclusively for American customers since the service is offered across over 180 jurisdictions.

Both sites provide a wide variety of cryptocurrencies to choose from. Currently Coinbase supports around 120 different cryptocurrencies, while over 600 coins may now be traded on Binance’s platform and more coins are listed each month.

In order to help you pick which platform is best for you, we’ve taken a look at each platform’s currency support as well as its security and costs.

We also recommend eToro as it’s more regulated, and also fully open to the United States, whereas Binance has less coins available in the US. eToro also has copytrading unlike either Binance or Coinbase. Investors often open accounts on several different crypto platforms to take advantage of the varying features.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

Binance vs Coinbase Compared – Quick Overview

| Coinbase | Binance | |

| Fees |

|

|

| Key Platform Features |

|

|

| Security Features |

|

Advanced access control capabilities include;

all of which may be enabled or disabled by the user. |

| Cryptocurrencies Supported | Total of approx. 10,000 crypto assets – 167 of which are currently tradable – ranging from relatively low market caps to the highest. | Binance offers 600 different cryptocurrencies worldwide, however is limited to around 60 in America. |

| Types of Transactions | Standard Coinbase – buying, selling, receiving and exchanging.

Coinbase pro – withdrawing, trading, stop order, time in force order, and limit order. |

The accepted trade orders include;

|

| Deposit Methods | Bank Account (ACH), Debit Card, Wire Transfer, PayPal, Apple Pay, & Google Pay. | Bank Transfer (SEPA / SWIFT),

Bank Card (Visa / Mastercard), P2P Express, Advcash Account Balance. Also allows direct crypto deposits through third party e-wallets. |

| Special Features |

|

|

Binance – Key Pros and Cons

- Wide range of cryptocurrencies available

- Buys (both non-instant and instant) have low fees

- Cheap trading fees

- Other fees are also competitive

- Big forums with active community

- Wide variety of resources available for education

- USA has limited accessibility

- Common problems amongst account verification

- Not so much transparency

- Withdrawing money also has fees

- Number of different platforms could cause confusion

- Chatbot is useless and email channel does not work

- Not insured by the SIPC or FDIC

Your capital is at risk.

Coinbase – Key Pros and Cons

- Very user friendly UI

- All major debit / credit cards accepted

- Bank transfer costs relatively cheap

- Wide variety of options when it comes to security features

- Users & employees can communicate through live chat

- Smaller amount of options than Binance

- Short term trading or scalping is not allowed

- High fees with the use of credit cards

- KYC compliance requires verification of I.D. and selfie

- Cannot use prepaid cards without associating a billing address

- Apple & Google pay options are not yet available everywhere in the world.

Your capital is at risk.

Binance vs Coinbase – Mobile App and Platform Overview

Binance is a one-stop shop for all things crypto, offering consumers a one-stop shop for all their crypto needs. The sophisticated charting, trades, and custom API keys available on Binance allow expert users to go even further into the platform’s technical aspects.

You can create a free Binance account by entering your login information. You may use two-factor authentication and link your bank or payment card after you’ve verified your email address. Once you’ve done that, you’re ready to begin purchasing cryptocurrency.

Buying, selling, and trading cryptocurrencies is made easy with Coinbase. On the move, you may utilise their mobile app for iOS and Android.

Coinbase has a straightforward sign-up process and verification procedure that makes it easy for anyone to kickstart their trading journey. For the first step, you’ll need a government-issued picture ID to create an account for free. You may either take a photo of your ID using the Coinbase app or manually submit it on the Coinbase website.

Once your identity has been validated, you may use a credit or debit card to make your first cryptocurrency purchase.

Some nations may not have access to Binance or Coinbase (as of March 2021).

In order to comply with severe KYC (Know Your Customer) and anti-money laundering regulations in the United States, Binance established a separate platform for U.S.-based customers.

As contrast to Binance.com, Binance.US has a smaller range of cryptocurrencies and fewer trading possibilities. With no margin trading, restricted crypto-to-crypto trading, increased deposit and purchasing fees, and no credit card transactions, Binance US is presently not the best alternative for US citizens.

Coinbase’s complete platform is presently accessible to citizens of the United States and is currently available in 100 countries.

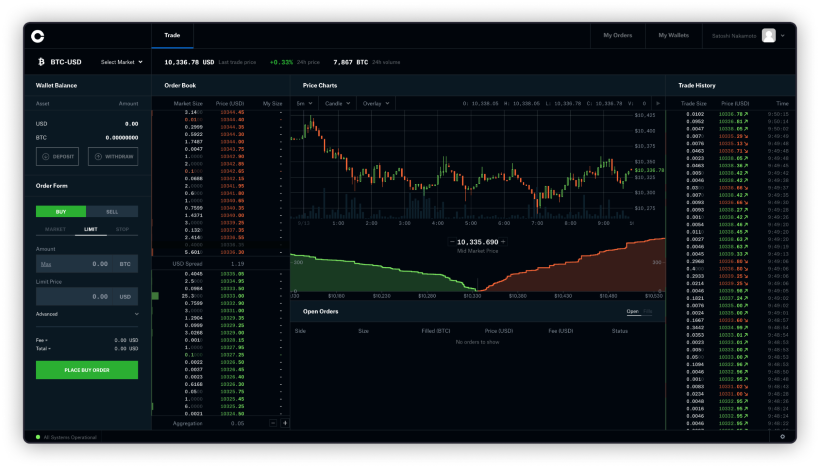

For a more direct comparison, one could compare the two platforms below, with the Binance platform on top and the Coinbase Pro platform at the bottom.

Binance vs Coinbase – Fees

Between Binance and Coinbase, there is a huge difference when it comes to fees. Trading cryptocurrency and funding your Binance account both cost less when using Binance.

When making a purchase via Coinbase, you’ll pay a fixed cost of around 0.50 percent. Additional fees are imposed by Coinbase dependent on the kind of account used to make the transaction.

There are a few things to keep in mind while using Coinbase to buy bitcoin. It costs up to 9% of the total price to buy and sell a coin using a credit or debit card on the same day.

Crypto investors who plan on buying & holding a coin for the long run should use Coinbase.

Binance provides cheaper transaction costs and a pricing structure that rewards high-volume traders. Maker and taker fees are the same, even though they employ a maker-taker fee structure

Users are paid a “taker fee” if their market-priced order is quickly completed by another user. Orders that aren’t instantly matched are put in the order book and the user is designated a “maker” and is paid a maker fee when the transaction is completed.

A 0.1 percent cost each transaction is imposed, with reductions for utilising the Binance native token (BNB token) to pay for these fees. Binance is the only place where these tokens may be acquired.

As the number of Bitcoins traded increases, the charge decreases to a maximum of 0.02 percent.

With an average transaction charge of around 0.1 percent, Binance may considerably reduce your expenditures (or less). Binance’s fee transactions are among the lowest in the market if you are a frequent trader.

One can find the differences between each exchange’s fees in more detail using the table below;

| TRANSACTION | BINANCE FEE | COINBASE FEE |

| Buy/Sell with Bank Account | 0.10% | 1.49% |

| Buy/Sell with Wallet | 0.10% | 1.49% |

| Buy/Sell with Credit/Debit Card | 1%–3% | 2% |

| Instant Card Withdrawal | N/A | Up to 1.5% |

| Wire Transfer (USD) | Free | $10 ($25 outgoing) |

| Exchange Crypto | 0.10% | 0.50% |

| ACH (USD) | Free | Free |

Binance vs Coinbase – Deposit and Withdrawal

The coinbase deposit & withdrawal fees are as follows;

Deposit fees are variable depending on the payment method used;

UK bank wire transfers, SWIFT payments and US ACH bank transfers are free, while US wire transfers have a flat rate of $10, a rate of €0.15 for SEPA transactions and a rate of 3.99% per debit card deposit. On the other hand, withdrawal fees are £1 for SWIFT and UK bank withdrawals, €0.15 for SEPA and the rest are free.

The Binance deposit & withdrawal fees are as follows;

Deposits through bank accounts are free outside the US and $15 is charged per wire transfer from America. Debit and credit card transactions carry a rate of 3.5% with a minimum of $10. When it comes to withdrawing money from Binance, there is a flat fee which is paid by users to take care of the transaction costs. The rates depend on the blockchain network and can vary according to usage volumes and congestion. To learn more about the deposit & withdrawal fees on Binance’s alternative US site, you can visit our Binance review.

Binance vs Coinbase – Security

Coinbase has its own built-in digital wallet that you may use to store your cryptocurrencies. A password and biometric access restrictions are used to keep it secure. Additionally, a 12-word recovery phrase encrypts your data to keep it safe (similar to other digital wallets).

Coinbase provides two-factor authentication through SMS or the Google Authenticator app. This helps protect your account by requiring a six-digit passcode that expires at the end of the day.

There are just a few exchanges that maintain your funds in “cold storage,” such as Coinbase (e.g. not connected to the internet). Over 98% of all cryptocurrency holdings are kept in cold storage, making them impenetrable to cyber criminals.

A bitcoin vault is also available on Coinbase, ensuring the safety of your digital assets even further. As a precaution, these vaults may be configured to demand numerous user approvals before a withdrawal can be made. They are also time-locked, which means that a withdrawal is invalidated if all approvals for the transaction have not been received within 24 hours.

The only other exchange that provides FDIC protection on USD (US Dollar) deposits is Coinbase (up to $250K). With this insurance, you may have up to $250,000 worth of deposited USD cash insured. As with other investments, FDIC coverage does not extend to any investments in your account, but solely to the cash in the account. This means that if anything goes wrong, you won’t be able to claim compensation for any losses in crypto money.

Binance vs Coinbase – Supported Cryptocurrencies to Trade

Coinbase’s list of top 100 tradable cryptocurrencies;

| # | Name | Symbol |

| 1 | 0x | ZRX |

| 2 | 1inch | 1INCH |

| 3 | Aave | AAVE |

| 4 | Aergo | AERGO |

| 5 | Aioz Network | AIOZ |

| 6 | Alchemix | ALCX |

| 7 | Alchemy Pay | ACH |

| 8 | Adventure Gold | AGLD |

| 9 | Algorand | ALGO |

| 10 | Amp | AMP |

| 11 | Ampleforth Governance Token | FORTH |

| 12 | Ankr | ANKR |

| 13 | API3 | API3 |

| 14 | ARPA Chain | ARPA |

| 15 | Assemble Protocol | ASM |

| 16 | Augur | REP |

| 17 | Avalanche | AVAX |

| 18 | Aventus | AVT |

| 19 | Axie Infinity | AXS |

| 20 | Badger DAO | BADGER |

| 21 | Balancer | BAL |

| 22 | Bancor Network Token | BNT |

| 23 | Band Protocol | BAND |

| 24 | BarnBridge | BOND |

| 25 | Basic Attention Token | BAT |

| 26 | Biconomy | BICO |

| 27 | Bitcoin | BTC |

| 28 | Bitcoin Cash | BCH |

| 29 | Bluzelle | BLZ |

| 30 | Bonfida | FIDA |

| 31 | Bounce Token | AUCTION |

| 32 | Braintrust | BTRST |

| 33 | Cardano | ADA |

| 34 | Cartesi | CTSI |

| 35 | Celo | CGLD |

| 36 | Chainlink | LINK |

| 37 | Chiliz | CHZ |

| 38 | Civic | CVC |

| 39 | Clover Finance | CLV |

| 40 | Compound | COMP |

| 41 | Cosmos | ATOM |

| 42 | COTI | COTI |

| 43 | COVAL | COVAL |

| 44 | Cryptex Finance | CTX |

| 45 | Crypto.com Chain | CRO |

| 46 | Curve DAO Token | CRV |

| 47 | Dai | DAI |

| 48 | Dash | DASH |

| 49 | Decentraland | MANA |

| 50 | Decentralized Social | DESO |

| 51 | DerivaDAO | DDX |

| 52 | DFI.Money | YFII |

| 53 | Dia | DIA |

| 54 | District0x | DNT |

| 55 | Dogecoin | DOGE |

| 56 | Enjin Coin | ENJ |

| 57 | Enzyme | MLN |

| 58 | EOS | EOS |

| 59 | Ethereum | ETH |

| 60 | Ethereum Classic | ETC |

| 61 | Ethereum Name Service | ENS |

| 62 | Ethernity Chain | ERN |

| 63 | Fetch.ai | FET |

| 64 | Filecoin | FIL |

| 65 | Function X | FX |

| 66 | Gala | GALA |

| 67 | Gitcoin | GTC |

| 68 | Gods Unchained | GODS |

| 69 | Goldfinch | GFI |

| 70 | Golem | GLM |

| 71 | GYEN | GYEN |

| 72 | Harvest Finance | FARM |

| 73 | Highstreet | HIGH |

| 74 | Horizen | ZEN |

| 75 | IDEX | IDEX |

| 76 | iExec RLC | RLC |

| 77 | Immutable X | IMX |

| 78 | Internet Computer | ICP |

| 79 | Inverse Finance | INV |

| 80 | IoTeX | IOTX |

| 81 | Jasmy | JASMY |

| 82 | Keep Network | KEEP |

| 83 | Kryll | KRL |

| 84 | Kyber Network | KNC |

| 85 | LCX | LCX |

| 86 | Liquidity | LQTY |

| 87 | Litecoin | LTC |

| 88 | Livepeer | LPT |

| 89 | Loom Network | LOOM |

| 90 | Loopring | LRC |

| 91 | Maker | MKR |

| 92 | Maple | MPL |

| 93 | Mask Network | MASK |

| 94 | Measurable Data Token | MDT |

| 95 | Mirror Protocol | MIR |

| 96 | Moss Carbon Credit | MCO2 |

| 97 | mStableUSD | MUSD |

| 98 | My Neighbor Alice | ALICE |

| 99 | NKN | NKN |

| 100 | NuCypher | NU |

Binance’s list of top 100 tradable cryptocurrencies;

| # | Name | Symbol |

| 1 | JasmyCoin | JASMY |

| 2 | Bitcoin | BTC |

| 3 | Binance USD | BUSD |

| 4 | ApeCoin | APE |

| 5 | Ethereum | ETH |

| 6 | Ethereum Classic | ETC |

| 7 | Ethereum | ETH |

| 8 | Terra | LUNA |

| 9 | Avalanche | AVAX |

| 10 | Bitcoin | BTC |

| 11 | Shiba Inu | SHIB |

| 12 | STEPN | GMT |

| 13 | SuperRare | RARE |

| 14 | Gala | GALA |

| 15 | XRP | XRP |

| 16 | USD Coin | USDC |

| 17 | BNB | BNB |

| 18 | THORChain | RUNE |

| 19 | Solana | SOL |

| 20 | Bounce Finance Governance Token | AUCTION |

| 21 | Waves | WAVES |

| 22 | Contentos | COS |

| 23 | Ethereum | ETH |

| 24 | Origin Protocol | OGN |

| 25 | TerraUSD | UST |

| 26 | TRON | TRX |

| 27 | Cardano | ADA |

| 28 | Loopring | LRC |

| 29 | ApeCoin | APE |

| 30 | Fantom | FTM |

| 31 | MovieBloc | MBL |

| 32 | Highstreet | HIGH |

| 33 | Polkadot | DOT |

| 34 | Harvest Finance | FARM |

| 35 | JasmyCoin | JASMY |

| 36 | Terra | LUNA |

| 37 | The Sandbox | SAND |

| 38 | Immutable X | IMX |

| 39 | USD Coin | USDC |

| 40 | Litecoin | LTC |

| 41 | Tether | USDT |

| 42 | Dogecoin | DOGE |

| 43 | Frontier | FRONT |

| 44 | Shiba Inu | SHIB |

| 45 | NEAR Protocol | NEAR |

| 46 | Dash | DASH |

| 47 | ConstitutionDAO | PEOPLE |

| 48 | Alpine F1 Team Fan Token | ALPINE |

| 49 | Serum | SRM |

| 50 | BNB | BNB |

| 51 | Terra | LUNA |

| 52 | Tranchess | CHESS |

| 53 | Audius | AUDIO |

| 54 | Chainlink | LINK |

| 55 | Polygon | MATIC |

| 56 | Elrond | EGLD |

| 57 | SuperRare | RARE |

| 58 | Avalanche | AVAX |

| 59 | Decentraland | MANA |

| 60 | Alpine F1 Team Fan Token | ALPINE |

| 61 | Ethereum | ETH |

| 62 | Cosmos | ATOM |

| 63 | Beta Finance | BETA |

| 64 | Moonbeam | GLMR |

| 65 | STEPN | GMT |

| 66 | ApeCoin | APE |

| 67 | SXP | SXP |

| 68 | Qtum | QTUM |

| 69 | Sun (New) | SUN |

| 70 | Solana | SOL |

| 71 | Bitcoin | BTC |

| 72 | Santos FC Fan Token | SANTOS |

| 73 | Bitcoin | BTC |

| 74 | Alpaca Finance | ALPACA |

| 75 | Ethereum Classic | ETC |

| 76 | VeChain | VET |

| 77 | League of Kingdoms Arena | LOKA |

| 78 | Shiba Inu | SHIB |

| 79 | BinaryX | BNX |

| 80 | Zcash | ZEC |

| 81 | Cocos-BCX | COCOS |

| 82 | OMG Network | OMG |

| 83 | EOS | EOS |

| 84 | The Graph | GRT |

| 85 | Filecoin | FIL |

| 86 | Terra | LUNA |

| 87 | Smooth Love Potion | SLP |

| 88 | Ethereum Classic | ETC |

| 89 | Moonriver | MOVR |

| 90 | Trust Wallet Token | TWT |

| 91 | Internet Computer | ICP |

| 92 | Oasis Network | ROSE |

| 93 | Keep3rV1 | KP3R |

| 94 | Contentos | COS |

| 95 | QuickSwap | QUICK |

| 96 | Gala | GALA |

| 97 | Aave | AAVE |

| 98 | Frontier | FRONT |

| 99 | dYdX | DYDX |

| 100 | Measurable Data Token | MDT |

Both Binance and Coinbase have a wide variety of cryptocurrencies to choose from when it comes to picking what to invest in. In this case, Binance has the upper hand with the wider variety, giving players the privilege of being able to trade over 600 cryptocurrencies, around five times more than that available on coinbase.

Binance vs Coinbase – Supported Cryptocurrencies to Stake

The benefits of staking with Binance

Binance’s staking mechanism provides a broad variety of options. It’s possible for users to examine all of the alternatives offered on the site, as well as the amount of danger they pose. The higher the APY, the greater the risk, whereas the lower the APY, the less risky the investment. As opposed to flexible saving alternatives, which give incentives on a daily basis, but only at a very modest rate of return, consumers benefit from frozen funds once the term has expired.

An IEO, or Initial Exchange Offering, is a way for cryptocurrency entrepreneurs to raise money via an exchange. Binance Launchpad pioneered this method. Users of the Binance Launchpad may sometimes win prizes by staking their currencies in various projects on the platform. The projects that may be staked are updated on a regular basis.

Stakable cryptocurrencies on Binance

| Digital Assets | Duration | Max. Locked Staking Limit Per User | Standard Annualized Interest Rate | Min. Locked Staking Limit |

| AXS | 90 days | 3 AXS | 104.62% | 0.0001 AXS |

| SHIB | 10 days | 7,000,000 SHIB | 10.12% | 200 SHIB |

| VET | 90 days | 3,000 VET | 7.32% | 1 VET |

| SOL | 90 days | 3 SOL | 12.12% | 0.0001 SOL |

| AVAX | 90 days | 5 AVAX | 20.19% | 0.0001 AVAX |

| NEAR | 90 days | 25 NEAR | 20.27% | 0.001 NEAR |

| LUNA | 90 days | 5 LUNA | 16.67% | 0.0001 LUNA |

| ADA | 90 days | 200 ADA | 10.43% | 0.001 ADA |

| MATIC | 90 days | 150 MATIC | 20.09% | 0.001 MATIC |

| CAKE | 90 days | 10 CAKE | 70.56% | 0.001 CAKE |

The benefits of staking with Coinbase

“Proof of Stake” settlement mechanisms are currently used by several cryptocurrencies to guarantee that all transactions are confirmed and protected without the need for a bank or payment processor in the midst of the transaction. For more information, read our Coinbase review.

Staking a portion of your assets for a certain period of time earns you benefits for helping to keep the network safe with these types of cryptocurrencies. Rewards will be given in return for your cooperation. If you’re going to keep your cryptocurrency for a longer amount of time, this is a great way to put it to work for you instead of just sitting there.

Eligible users may stake Tezos, Cosmos, or ETH and earn up to 5% interest (depending on the kind of asset invested) by June 2021 through the main Coinbase app or website. For more information, one can visit coinbase.com/staking.

Stakable cryptocurrencies on Coinbase

| Cryptoasset | Yearly investment interest |

| Ethereum (ETH) | 4.50% APR |

| Algorand (ALGO) | 0.45% APY |

| Cosmos (ATOM) | 5.00% APY |

| Tezos (XTZ) | 4.63% APY |

| Dai (DAI) | 0.15% APY |

| USD Coin (USDC) | 0.15% APY |

Binance vs Coinbase – Unique Features

It’s possible to purchase and sell bitcoin with ease using both Binance and Coinbase, but they approach it in quite different ways. Each platform has a few distinct features:

Binance’s Special Features

Rewards for participation: Binance routinely hosts contests and challenges to encourage user engagement. The Binance rewards center is where users may collect their winnings. Airdrops for newly listed cryptocurrencies are also offered by Binance.

Binance Academy: The Binance Academy is the company’s own free educational platform. Binance Academy is a one-stop shop for all things crypto, from introductory crypto training to expert lectures on trading.

Binance has one of the broadest selections of trading possibilities of any exchange. The following is a short rundown of some of the potential trading options:

- Guess the price battles

- P2P trading

- Liquidity pools

- Margin

- Limit TP/SL order

- Time in force limit orders

- OCO orders

- Post only

- Trailing stop

- Stop Market

- Stop Limit

- Market

- Limit

Binance has made its API keys available to the general public, enabling third-party applications to interface with the platform.

Coinbase Special Features

Coinbase provides brief instructional films that guide customers through various bitcoin projects at the price of nothing. A little amount of bitcoin will be given to people who watch these films on the platform and mobile app.

For those who want to stay on top of the latest in the crypto world, Coinbase has an integrated newsfeed. The feed collects news stories from across the web to bring you the latest information on the state of the crypto market.

Coinbase customers may set up price notifications for the cryptocurrencies they are interested in following. It’s possible to keep an eye on a list of currencies and get alerts on your phone, or you may check the app for changes.

Binance vs Coinbase – Final Verdict

Even though Binance might seem like the clear winner with cheaper fees, larger volumes, and more vast options, Coinbase does have its own set of strongpoints such as ease of use, accessibility, and security. So a Binance vs Coinbase comparison might come down to your specific needs. If you’re a beginner you likely won’t need to margin trade on leverage, which Binance offers but Coinbase doesn’t.

Another good example of a user-friendly crypto platform amongst Binance alternatives to keep in mind is eToro.

On eToro.com you can not only invest in and trade cryptocurrencies, but also other commodities such as stocks, fiat currencies, real life commodities like gold, and many more, with educational resources available to learn to trade.

You can also copytrade professional traders rather than attempting to time the 24/7 crypto markets yourself.

For more information on eToro, read our eToro review. In terms of regulation and ease of use, it’s our recommendation for the best crypto platform of 2024.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

How to transfer Bitcoin from Coinbase to Binance?

Coinbase has a “Receive” button, which is where you’ll locate the bitcoin you wish to send. Make a note of the wallet address that Coinbase has created for you. Take a look at Binance’s “Funds” section and choose “Withdraw Bitcoins.” Copy the Coinbase wallet address and paste it into the “To” box.

How to transfer from Binance to Coinbase?

Before you can move from Binance to Coinbase, you’ll need to open both your Coinbase and Binance accounts. Access Coinbase dashboard, then click on “Send/Receive.” Using this tab, choose the asset you want to send to Coinbase.

How is Binance different from Coinbase?

It’s straightforward to use, but the sheer quantity of options might be intimidating to a newbie. Consumers who are already acquainted with cryptocurrency jargon and investment possibilities should use Binance, while Coinbase is designed for people who just want to trade quickly and easily. Both exchanges provide mobile applications with a wide range of features and functions.

Which is better, Coinbase or Binance?

When it comes to the most fundamental aspects of an exchange — cost & investment opportunities — Binance takes the cake. Bankrate deemed Binance the best cryptocurrency exchange for beginners because of its low trading fees. Coinbase, on the other hand, has a little edge when it comes to the finer points, such as the security, transparency, and customer service.

Is Binance cheaper than Coinbase?

Yes, Binance is way cheaper than coinbase, with the exception of Binance US. Despite the fact that Binance.US charges a little higher fee for U.S.-based customers, it is still far less expensive than Coinbase. Depending on your payment method, you may end up paying as much as 4 percent in transaction fees in addition to the standard 0.50 percent Coinbase fee.