This content is not intended for US users. eToro USA LLC does not offer CFDs; only real Crypto assets are available.

eToro is an FCA regulated trading platform and can be used to buy Bitcoin with an e-wallet, Paypal, credit card, bank transfer, and several other deposit methods, alongside 100+ other cryptos.

The Economic Times rated it the best crypto exchange to invest in its eToro review.

Though founded in 2007, eToro opened to US investors in 2018. Investors from many other countries have already used the platform to trade crypto, forex, stocks, commodities, ETFs, and more, including the UK, Australia, and Europe.

Opening an account on eToro.com takes only a few minutes. EToro’s interface is simple and user-friendly compared to many other popular crypto exchanges. It has convenient tools for beginners and is suitable for traders with substantial experience.

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Some features, such as the copy trading tool, have given it a unique edge in the industry, allowing traders to replicate the buys and sells of an experienced professional trader.

Other features, such as eToro’s Copy Portfolios – now also known as Smart Portfolios – enable an investor to mimic the portfolio allocation of a verified trader. The social trading platform is also helpful for sharing views concerning the market and following influential investors to get their insights and trading strategies.

Along with cryptocurrencies, eToro offers trading of 680+ ETFs and 5500+ stocks. Free trading courses are also available on this platform, covering lessons for beginners and advanced traders.

or newbies, the virtual portfolio tool of eToro comes to the rescue. It provides a pre-loaded virtual amount of $100,000 to practice their trading skills and get accustomed to the features before trading with real money.

eToro has a transparent fee structure. Unlike many of its competitors, it offers competitive spreads, appealing to many investors across the globe. It has a small withdrawal fee and charges an inactivity fee only after 12 months of an inactive trading account. To learn more about eToro, read our complete eToro review below.

eToro Pros & Cons

- It has many popular coins compared to some other major exchanges

- Zero commission on stocks

- Competitive spreads depend on the types of cryptocurrencies

- Investors can copy other traders using the copy trading tool

- Virtual Portfolio, an educational tool for beginners

- Social trading platform to connect users

- It can be accessed on desktop and mobile devices

- Upwards of 680 ETFs, 5500 Stocks and 100 Cryptocurrencies are Supported

- Not available in a few US states

- Limited investment options

- It may not be suitable for traders looking for advanced technical analysis

- Withdrawal fees

- Inactivity fees

eToro Review – Platform features

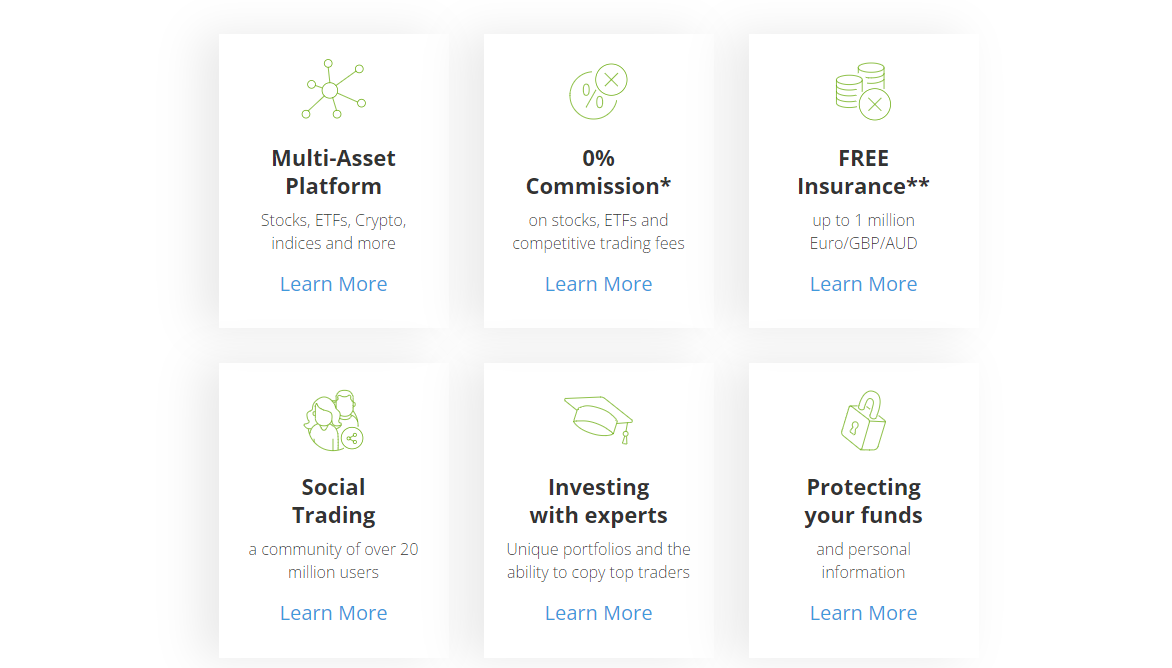

eToro stands out of the sea of online investment platforms due to its unique approach in terms of interactions, customer support, and trading concepts. Here is an overview of the platform’s highlights that set eToro apart.

- CySEC, FCA, and ASIC regulated

- Crypto, Forex, Commodities, Stocks, Forex, and ETF trading allowed

- Free demo account

- Extended trading hours

- Supports more than 680+ ETFs, 5500+ stocks, 100+ cryptocurrencies.

- Has recently added support for EUR

- Small spread mark-up

- Unconventional fee structure

- Deposits via debit or credit card, bank wire, PayPal, Skrill, Neteller, and more

- Copy trades of winning traders

- Compatible with IOS and Android mobile applications

- Comprehensive educational resources

- Paper trading for testing out strategies

Fees:

- Trading Fees: 0% for Stocks, 0.75% to 4.9% for cryptos

- Conversion fees: crypto-to-crypto conversion 0.1%

- Crypto transfer fee: 0.5%

- Over 40 coins and tokens are available to trade in the US, and many more worldwide

- Minimum withdrawal $30, withdrawal fee $5

- 7 days hold on deposits allowed

- Taxable account types

What is eToro?

eToro is presently one of the world’s most frequently used social trading and multi-asset brokerage platform, with over 363 million trades opened on it so far. With registered offices in Cyprus, the UK, and Israel, eToro has a presence in over 140 countries; its popularity rooting in its user-friendly interface and focus on social and copy trading.

eToro was among the first online brokerage platforms to offer digital currency trading, as it started offering support for Bitcoin (BTC) on its CFD trading platform in 2014. Soon, it also added support for Ethereum (ETH) and Ripple (XRP), as other brokerages followed. Today, the platform supports over 40 100+ cryptocurrencies, 680+ ETFs, and 5500+ stocks.

The social trading platform based out of Tel-Aviv allows users to get involved in real-time in Forex, Cryptocurrency, Stocks, Indices, Commodities, and ETFS. From day trades to long-term investments, eToro has emerged as a one-stop destination for all kinds of trading needs for users. The platform also features extended trading hours, allowing users to trade for longer.

What particularly stands out, however, is its excellent and robust support for social trading. eToro is somewhat both the pioneer and the market leader in this segment. The platform has also implemented AI recently, offering information about top investors, daily movers, and other information pertaining to the market.

In this in-depth eToro review, we will detail every aspect of this popular online trading platform and deconstruct its innovative concepts, trading experience, and features, pros, and cons for retail and institutional clients worldwide.

About the Platform

eToro is the “World’s Leading Social Trading Platform” for good measure, offering investment opportunities in global financial markets, including stocks, crypto, commodities, currencies, indices, and ETFs. At its core, eToro is driven to empower a global community of investors and revolutionize how people invest through sound financial resources and education.

The multi-asset investment platform that eToro has created today is built on social collaboration and investor education pillars. EToro strives to create and foster a community for users to connect, share, and learn the best investment practices. This is the genesis of its social trading concept as well. The platform boasts a growing suite of top-notch services, some notable ones being:

- Investing in leading stocks from the world’s top exchanges with 0% commission and without any limits on trading volumes

- Trading in a wide variety of leading crypto assets and crypto crosses by leveraging innovative platform tools backed by eToro’s very own trading platform, wallet, and exchange in one.

- Without limiting yourself to units, one-click trading, flexible leverage, and deep liquidity for trading commodity CFDs from the world’s top resource markets.

- User-friendly trading enabled the most active financial market in the world – the foreign currency exchange (FX) – with up to 1:30 leverage to gain greater exposure with lesser capital.

- Benefiting from market trends of major stock exchanges worldwide whenever they go up or down, with the flexibility to manage your exposure as you deem fit.

- A flexible yet comprehensive way of investing in the financial markets with Exchange-traded funds (ETFs) at a low-cost entry point and without management fees, thus ideal for portfolio diversification.

When eToro’s three promising founders first came together in 2007, they wanted to disrupt the trading world by improving its accessibility. The idea behind eToro is to make trading accessible to anyone, anywhere, besides reducing dependency on traditional financial institutions known to accrue benefits for themselves first and customers later.

Origin and History

The Tel Aviv-based online trading platform goes back to 2007 when Ronen Assia, David Ring, and Yoni Assia co-founded it. The social and copy trading pioneer began operations under RetailFX as an online forex broker.

This first iteration of eToro was an online trading platform that made trading accessible to retail investors with the help of graphical representations for various financial instruments. It soon changed its name to eToro, expanding its services gradually to include commodities, indices, and stocks.

In 2009, eToro launched its cutting-edge, intuitive trading platform, enabling users to trade online financial assets. There were plenty of professional tools for both beginner and advanced traders.

A year later, the world’s first social trading platform, OpenBook, was launched, allowing users to copy other successful traders and join the fintech revolution. No wonder the platform soon attracted global attention, besides winning the Finnovate Europe Best of Show award for 2011.

2007 – The year eToro was launched

By 2010, eToro had already launched the innovative social trading feature it is known worldwide for, enabling users to automatically copy trades of successful traders of choice on the platform. Thus, eToro emerged as the world’s first and leading social trading network in no time.

After the launch of its mobile application, eToro introduced a wide selection of stocks, enabling traders to diversify their portfolios even better. The platform continued working on its intuitive and innovative interface and introducing unique features.

One example is the CopyPortfolios, which groups assets or investors together based on a theme or strategy, deploying advanced algorithms, machine learning, and AI to curate assets based on market conditions.

In 2014, the online broker achieved another milestone when it added Bitcoin support to its ever-expanding platform. Users could now use eToro to buy and sell CFDs on the world’s most talked-about digital currency. Four years later, the support was extended to Ethereum and Ripple, while more and more digital assets were added in the following years.

In 2018, eToro established itself as one of the crypto industry’s strongest and most popular pillars, launching its platform’s eToroX and crypto wallet features. Despite the highly competitive and still expanding crypto exchange market, eToro has managed to cement its position through quality and unique crypto trading services for a wide geographical base.

As recently as 2019, eToro began servicing the US market as well. Last year, it launched the eToro Money feature, a new financial service offering a holistic approach to investing through instant withdrawals and no FX conversion fees. Earlier this year, eToro also officially launched stock investments in the US.

The platform’s recent announcement to go public via a SPAC merger with FinTech Acquisition Corp. V has taken the industry by storm. The platform has been valued at around $10.4 billion and shows tremendous potential for growth and expansion in the years to come.

Current Market

eToro is currently viewed as one of the most user-friendly and innovative crypto trading platforms. The online broker utilizes the best-in-class infrastructure to ensure the safest, fastest, fairest, and most transparent trading experience ever.

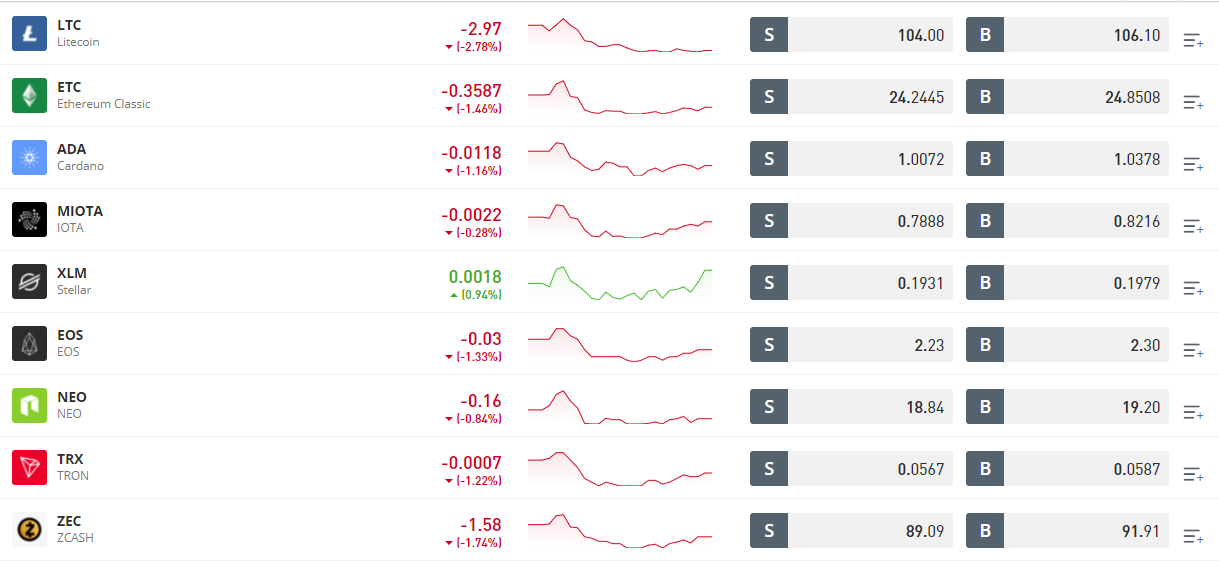

These features are the biggest reasons behind its massive influx, with more than 17.5 million registered users in 2020. According to eToro, they made $264 million in 2021’s second quarter in crypto commissions alone, which drove 73% of their total commissions. The highest trading volumes recorded were in Bitcoin, Ether, Cardano’s Ada, and Dogecoin.

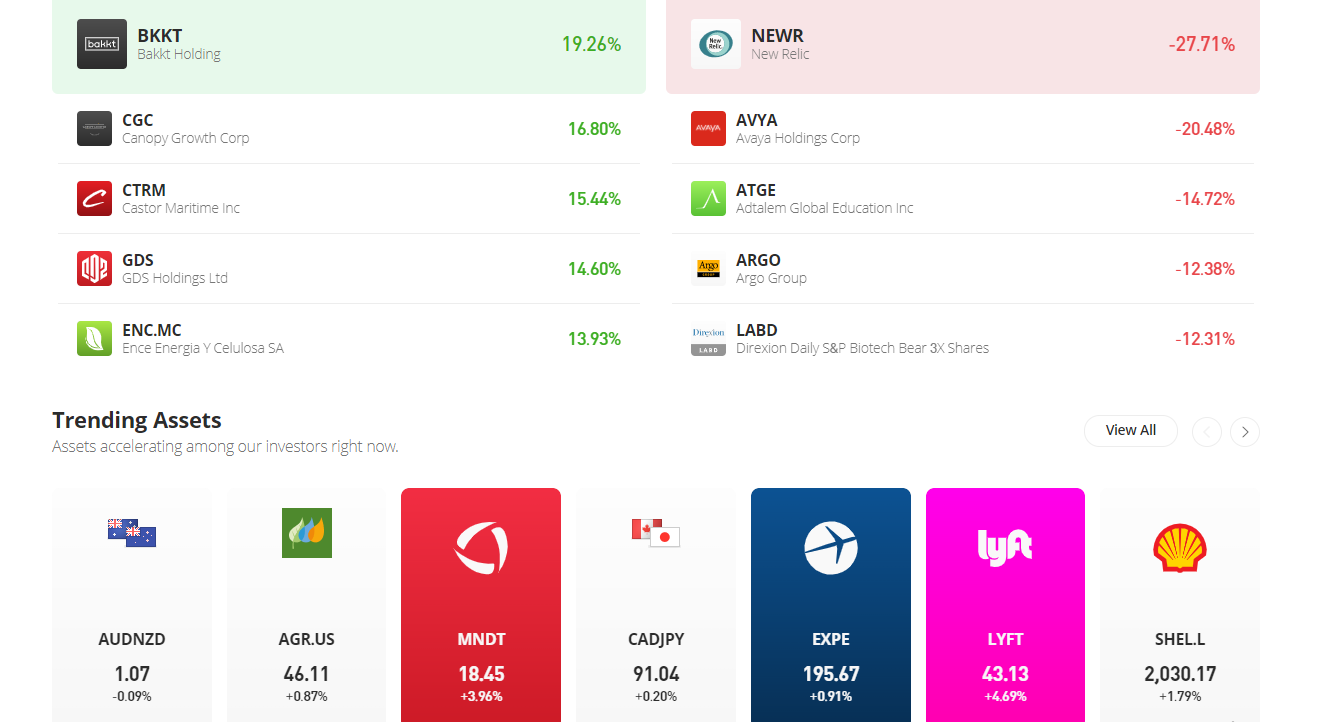

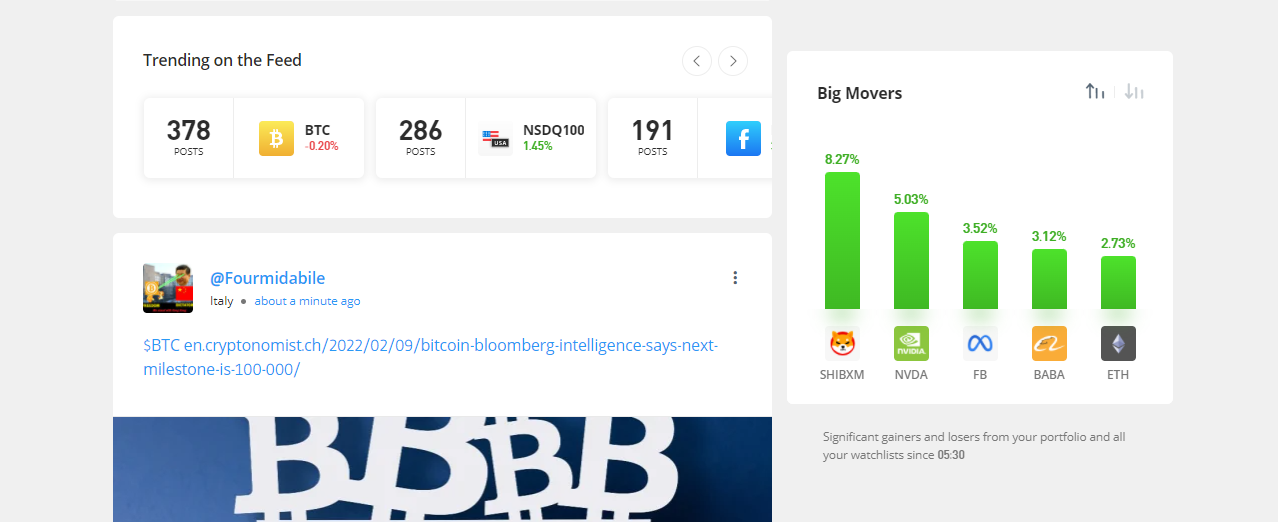

Trending assets feed on eToro

The powerful lift in customer engagement and transactions has certainly emerged as positive momentum for the trading platform. The combined trading commissions for all assets, including stocks, commodities, and currencies besides crypto, stood at $362 million in a single quarter last year.

The platform also added 2.6 million new registered users in that quarter, compared with 1.2 million a year ago. The overall trading volume also saw a massive leap, with eToro executing 127 million trades in Q2 of 2021, up 72% a year ago. These numbers speak tons about eToro’s growing popularity and user base, which will only increase. As of 2024, the platform has upwards of 35.5 million registered users.

The growth and proliferation of eToro’s market are attributed by co-founder Assia to both the revival of crypto and the unprecedented pandemic-driven market volatility, among other factors over the last year. Increased trading activity on eToro has also seen patterns and trends, such as the rise in self-directed investing, long-term secular trends in investor behavior, etc.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Top Features

Demo Trading

Users on eToro Have the option to available the demo account feature, allowing them to experience the platform as an investor without using real money. All the trading processes happening in real-time are mimicked in a demo account, allowing users to understand the requirements of such a process and how it works.

Once you have carefully studied and familiarized yourself with the trading processes on eToro, you can trade with real money and earn real profits. The best part is that users can use real-time and demo trading accounts simultaneously. This makes it possible to switch between accounts whenever you want to test a feature before investing your money.

Vibrant Online Community

eToro’s global online community is a vibrant, ever-growing forum of active users interacting with one another, just like popular social media platforms. Community members can like, and reply to comments, besides sending messages to other users. You might even remain anonymous, without uploading any images and still, be a part of the highly engaging online community that eToro offers.

Different Trading Options

Depending on the kind of service you want to use, there are multiple trading and order options to choose from. It is in the hands of the user to control how their account works during live transactions, which you can then use to lower your investment risks and make maximum profits available.

Specify Market Values

eToro lets users specify the price to sell their stocks or assets beforehand. The system will then run multiple times to detect matching offers and request your permission to authorize the sale if it finds a good fit. This ensures that customers can benefit from escalating or falling values at any given time, even if they are not manually using the platform at that very instant.

Close-Trade Order

Users on eToro are given control over limiting their trading sessions depending on realizing their target profits. This is a smart way of trading even when you cannot monitor the trading personally, as explained earlier.

Stop-Loss Order

eToro traders can even peg their transactions at a specific value to avoid losses using automatic features such as social trading or copy trading. Especially when you are not monitoring a live trading session manually, this feature allows you to set a cap on your transactions to stop trading when there is a potential for more losses.

Insights and Analytics

eToro has some of the best analytics tools to offer to its users who can make better investment decisions even if they are not experts or have not hired additional expert help from outside.

This in-built feature lets you make the most of eToro’s guidance and intuitive insights without spending tons on financial advisors. Analytics are shared with users through trend lines, pricing charts, and other technical indicators.

Important filters have also been added to insights and analytics, allowing users to filter assets by UCITS, asset class, dividend yield, stock exchange, sectors, price changes, etc.

Online Investment Education Portal

The online trading platform offers many educational resources on investment processes, especially for new users trying to learn more about the options and nuances of eToro. A range of free readable content is available, which helps users to avoid making common mistakes while investing.

Expert webinars also cover essential investment topics that new and old investors can use to improve their skills and decisions. These are in addition to free trading courses available on the platform.

Mobile Application

The eToro mobile app is available for Android and iOS users, allowing them to manage their investments on the go. The app is user-friendly and free from common bugs that eToro’s competitors face.

No major glitches are hampering the mobile experience, and users can easily buy and sell their assets or stocks at any time of the day because the app works in real time, just like the web platform.

Access to Updates

eToro also lets customer Customers stay updated with the economic calendar, dividend calendar, upcoming IPO calendar, quarterly report calendar, etc.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

How does eToro Work?

eToro has become one of the most preferred options because of its beginner-friendly interface. It is straightforward to use and offers unique features that make trading a seamless experience as far as platform technicalities are concerned. As it is strictly regulated, trading on eToro is highly secure.

It is regulated in Europe by the Cyprus Securities & Exchange Commission (CySEC), in the UK by Financial Conduct Authority (FCA). eToro complies with and operates under the Markets in Financial Instruments Directive (MiFID) in the UK and Europe.

In the United States, it is registered with FinCEN and is a member of SIPC. In Australia, it is regulated by the Australian Securities & Investments Commission (ASIC) and has an Australian Financial Services Licence (AFSL).

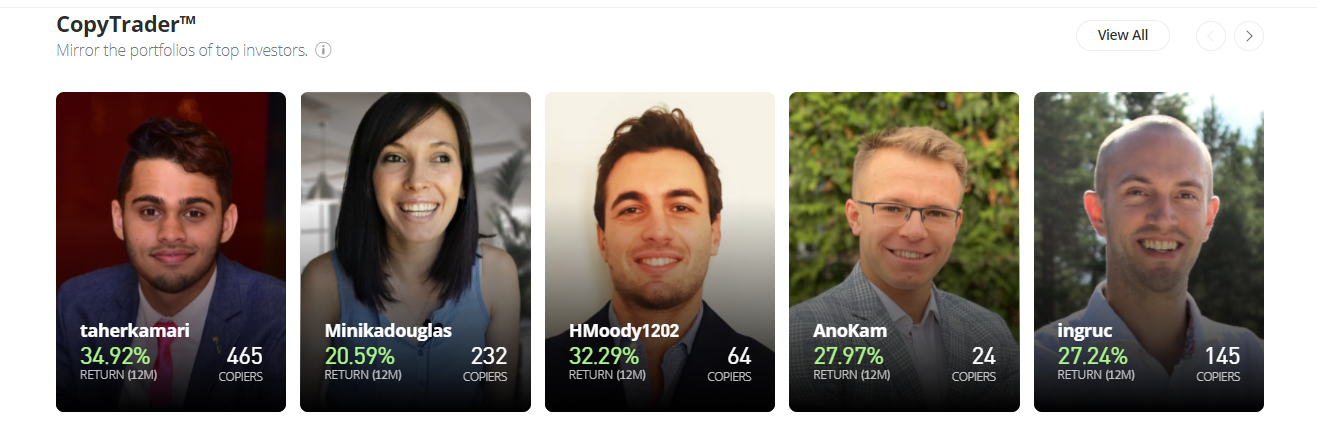

Copy Trading and Copy Portfolio

The features that make eToro unique and famous for investors are copy trading and copy portfolio tools. The exchange curates “Popular Investors” and allows other users to follow their portfolios and copy their trades.

eToro considers certain factors like the investment amount of investors, their duration on the platform, and the number of users who have copied these famous investors to determine their status and pay them accordingly.

Introduced in 2010, eToro’s Copy Trading feature enables users to follow and copy other successful traders easily. The platform reduced the minimum investment required to use this feature with time, allowing many new investors to make the best use of the feature.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Even if you lack the time or experience of trading, you can trade conveniently with this feature. Once a user copies another investor, the investor’s trades are automatically replicated in the user’s portfolio in real time.

With eToro’s copy portfolio feature, you can buy/sell specific cryptocurrencies and occasionally choose one of the four portfolios strategically rebalanced by eToro. These portfolios include a variety of cryptocurrencies and altcoins. Traders can now invest in coins other than the most popular ones, i.e., Bitcoin and Ethereum, within a single portfolio.

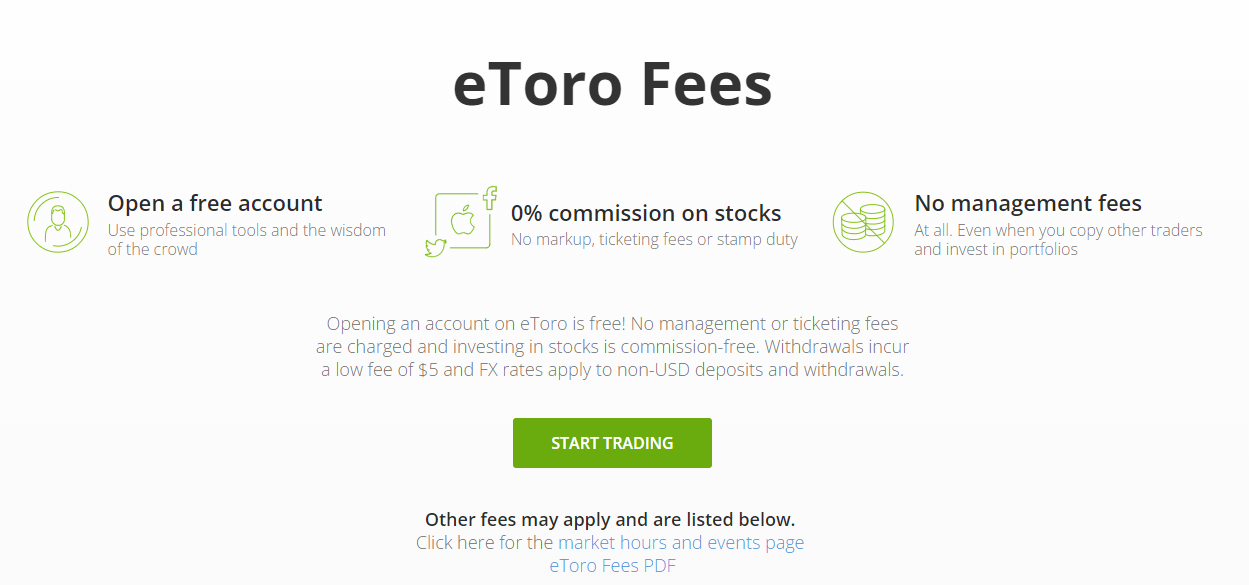

Competitive Fees

Many popular exchanges have a complex fee structure, but this is not the case with eToro. It has a transparent pricing structure and offers competitive prices for trading.

First, it is a 0% commission trading platform. While many cryptocurrency exchanges have spreads and transaction fees (which vary as per the trade size), eToro’s fee structure consists entirely of spreads.

A spread is simply the difference in price between buying and selling cryptocurrencies on a platform. Although spreads are subject to change (which makes them variable), eToro’s spreads are transparent, and the platform is known to offer fair deals regarding these charges.

Read more about trading fees on eToro

Users can start investing in cryptos on the platform without prior sector knowledge. They use the market research available online and the practical trading tools and educative section offered by eToro. This way, users can gain the requisite knowledge to proceed with their trading journey.

Investing manually using the eToro platform is simpler compared to other exchanges. The broker allows users to invest in stocks and cryptos with a 0% commission. Traders can also open leveraged or short positions using CFDs, conduct technical analysis using ProCharts, and get substantial market insights using the Research Tab.

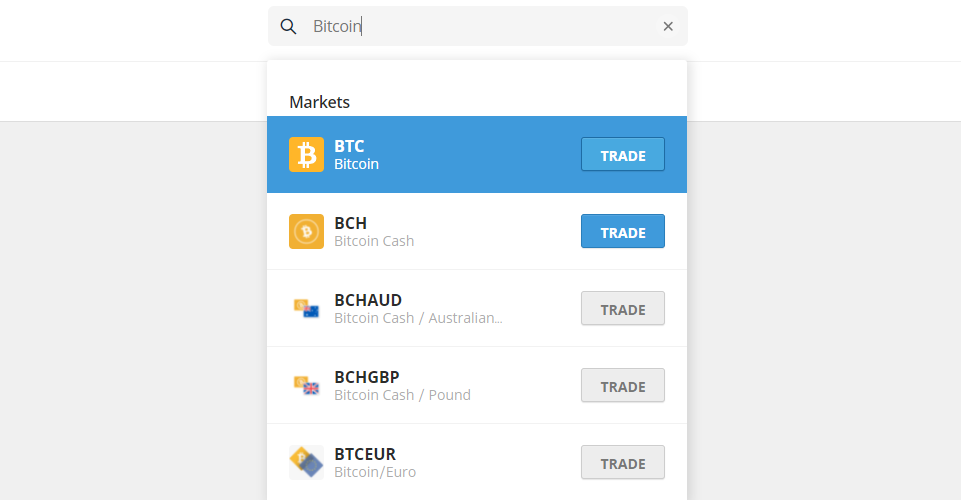

Variety of Cryptocurrencies

Although other platforms offer more cryptocurrencies than the platform, eToro has over a dozen cryptocurrencies. It is still a renowned platform compared to others, as it lists the most popular cryptocurrencies on the platform for trading. As of this year, the platform supports over 100 cryptocurrencies.

Virtual Portfolio and Other Features

eToro’s virtual portfolio feature allows users to rehearse their trading skills and get familiar with the tools it offers before they buy trades with real money. The demo account offers $100,000 of virtual money that can be used to buy cryptos and understand market trends. Although there are no real gains or losses, this helps put trading skills to the test.

This is an excellent way to understand market volatility and have a fair idea of the performance of cryptocurrencies. Before using actual money on assets, one can use the virtual portfolio also to test the features that eToro offers, including copy trading and copy portfolio. eToro offers $100,000 virtual money to enable traders to experiment and explore.

Virtual Portfolio feature

The virtual account enables users to open positions, try out different strategies, familiarize themselves with the leverage feature, check out eToro Portfolios for investment, put the Stop Loss / Take Profit features to use, see how copy trading works, connect to other users using the eToro social platform, etc. On eToro one can create a personalized watchlist to get real-time market volatility alerts.

SL / TP orders can automatically close a position upon reaching a desired profit/ loss point. With a Trailing Stop Loss, the stop loss point will rise proportionately as the market moves in the desired direction. One-Click Trading can pre-decide investment amount, take profit/ stop loss, leverage, and later apply these values to trades.

Portfolios by eToro

eToro portfolios can be used by users for long-term investment. It is an innovative investment tool offering a plethora of choices to traders. Each eToro Portfolio has different assets per a thematic investment strategy. The eToro’s investment team makes optimal use of a machine-learning algorithm to create and manage the eToro Portfolios.

Ease of Use and Interface

eToro’s interface is one of the most user-friendly worldwide compared to other trading platforms. The web platform and mobile app provide nearly the same features, with a very high ease-of-use factor.

eToro provides two mobile applications – the eToro app and eToro Money. Both apps are available on Google Play for Android and Apple App Store for iOS devices. The applications maintain the same look and feel of the web version and offer modern functions such as dark and light mode themes, synced watchlists, and interactive dashboards to ensure a unified platform experience across devices.

Search by name or ticker to buy cryptos

The charts have also been designed to be responsive, like the web platform experience. However, there are just 5 indicators compared to 67 on the web. Including drawing tools would be a welcome enhancement. Besides this, the entire user experience is cleanly designed with a well-integrated mobile application.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Security

eToro is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) throughout the European Union. All activities on the platform comply with the requirements of MiFID (Markets in Financial Instruments Directive) and ASIC (Australian Securities and Investments Commission).

Regulatory compliance aside, eToro is generally an established and highly-trusted online trading platform. Investors can rest assured of its security across asset trading, with the platform’s strong track record of storing investor funds for over a decade.

Interestingly, a significant part of user funds is held in cold storage on eToroX. This reduces the chances of losing funds due to a cyber-attack or operational error. A cold storage Custody as a Service (CaaS) solution has been deployed on the exchange in partnership with leading cybersecurity company GK8.

High-level of security offered by eToro

Apart from all these features, eToro still encourages users to conduct appropriate and detailed research before beginning trading activities on the platform, letting them know how risky an affair can be for the uninitiated. eToro recommends that users acquire advice from an independent financial advisor, along with placing due focus on their risk appetite, trading experience, and knowledge of financial markets in the first place.

Most importantly, it encourages users to set up two-factor authentication (2FA) as an added layer of protection. This is not mandatory but highly recommended by the platform.

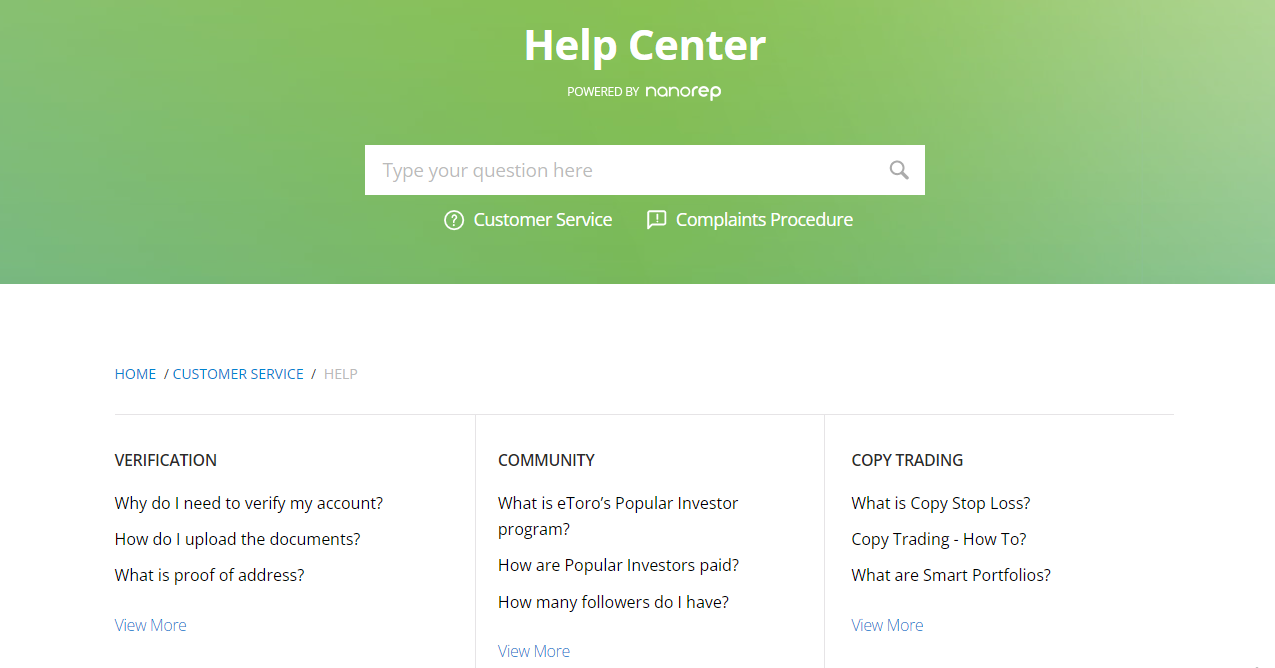

Customer Support

Choosing a good crypto exchange depends on a variety of factors. When traders opt for an exchange, they expect instant customer support to trade cryptocurrency with the proper knowledge and benefit from the right tools. Besides risks, trading on an online platform comes with various challenges.

If customers face any issues regarding deposits, withdrawals, trades, transfers, etc., the customer support team of the exchange should be available to address their concerns at the earliest. While many online exchange platforms offer 24/7 customer support, only a few can meet customers’ expectations.

eToro has active customer service support. Users can raise tickets, track the progress of open tickets, see the details of resolved issues, etc. Browsing through the customer support section and putting across questions in the knowledge base is uncomplicated for users.

Pre-written articles for solving common issues

eToro enables users to send feedback directly to the eToro team. The support team attends to all queries on time. The customer service center of eToro also has a Live Chat section, which provides instant help regarding deposits, withdrawal, account opening, verification, trading & investing, and various tools that eToro offers, like social trading, etc.

Before raising any ticket in the customer service section, it is advised to check the Help Center page of eToro and search for the desired queries in the frequently asked questions (FAQs) section. After opening a customer service request, the team takes a stipulated time to address the request. It is advised not to open multiple tickets for one issue. Users can quickly check their customer service ticket status after they log in.

eToro customer team can be approached both through the web and mobile devices.

Its dedicated crypto wallet app has multi-signature authorization, making it secure for users. For offering the right guidance and quick assistance to customers, it has emerged as the top crypto exchange option for both new and seasoned investors.

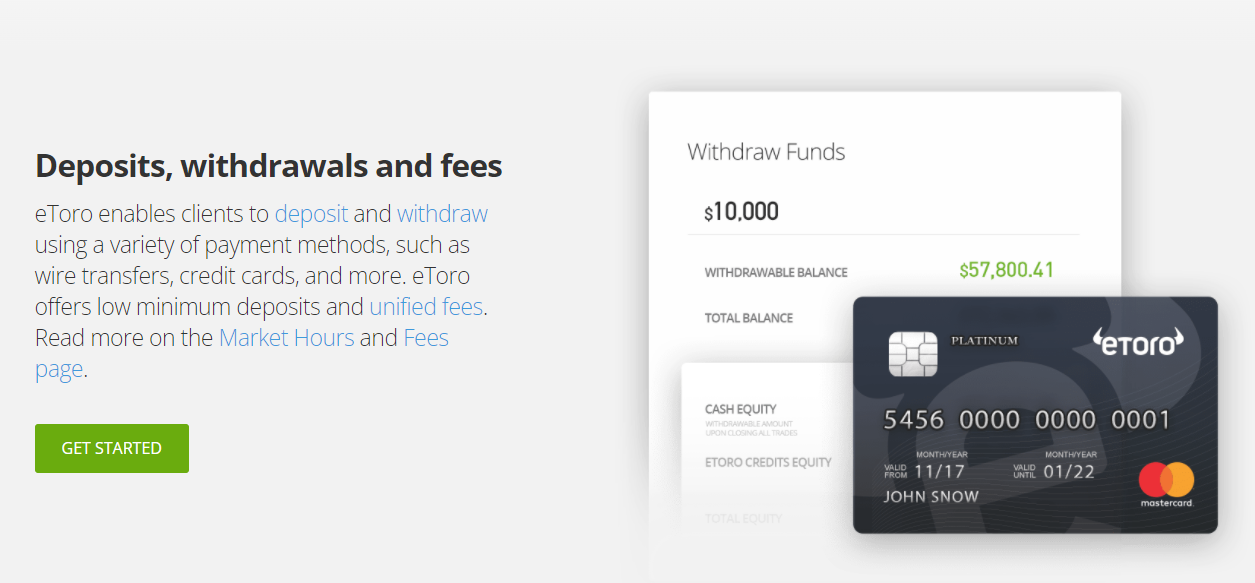

Deposits and Withdrawals

eToro’s fees are based on a spread system. It is the difference between the crypto buying and selling price. The spreads differ for different coins and fluctuate according to market conditions. Users have to pay the spread on many platforms while buying and selling. eToro charges only a round-off spread, a one-time payment per trade.

Deposit Fees

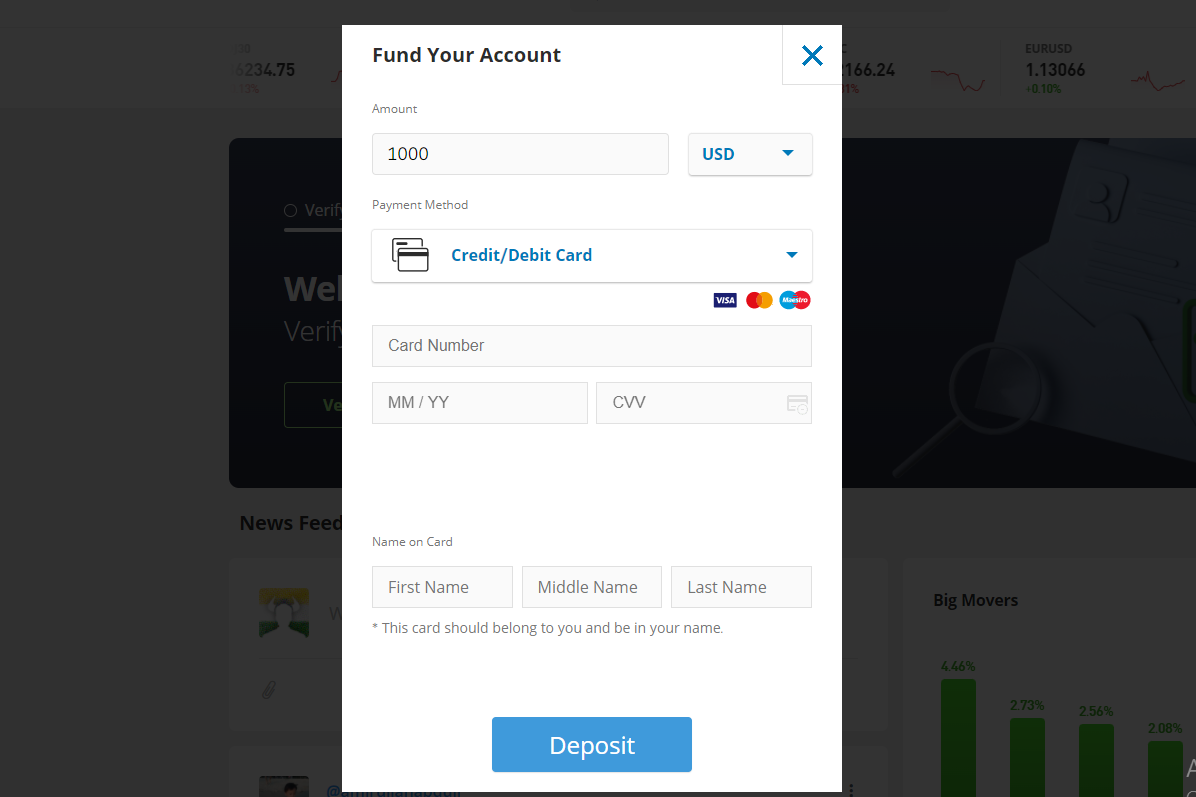

Users can use many deposit options, including bank transfers, various wallets like PayPal, etc. eToro does not charge any deposit fees for U.S. users and others across the globe. It does not charge any fee from users while depositing money in their eToro account in U.S. dollars. However, depositing another currency attracts a small currency conversion fee.

The minimum deposit on eToro is $10 for the United States. And the minimum deposit for United Kingdom-based users is $50. For users of many other countries, the minimum deposit is $50. If funds are deposited through bank transfer, they are instantly credited to the account. The platform also supports EUR now.

Withdrawal Fees

Like other exchanges, You can keep your crypto holdings in your eToro account. The process is hassle-free if you want to withdraw your cryptos to store them on the eToro or any other crypto wallet.

The platform has a flat charge of $5 for all withdrawals. The minimum amount for withdrawals is $30. When you use the eToro Wallet, you will have to pay some fees. It has a 0.5% charge when you send money from your eToro account to the eToro wallet. The minimum charge is $1, and the maximum is $50.

Fees and Charges

One of the downsides of eToro is its complex fee structure, especially in crypto CFD and cryptocurrency trading. Although the trading fees are relatively low compared to most of eToro’s competitors, additional fees are levied on currency conversion and withdrawal.

Users must also be wary of the difference in fees and charges depending on their location. Here is a comprehensive look at the different kinds of fees that users can be charged on eToro:

Trading Fee

eToro charges trading fees through spreads likely to rise and fall with market conditions. Unlike most competitors, eToro charges round-turn, meaning there is a single spread for buying and selling crypto assets. These spreads range from 0.75% for Bitcoin trades to 5% for trading Tezos. Generally, most cryptocurrency spreads fall between 1.9% and 2.9% on average.

One of the most significant advantages that eToro is known to offer is no requirement for any extra charges on stocks or ETF trading using the platform. Most competitors charge little to hefty fees for such services, making eToro stand out.

Withdrawal Fee

There are no withdrawal fees for US customers currently, but there is a minimum threshold of $30 for withdrawals. Outside the US, eToro charges a withdrawal fee of $5.

Currency Conversion Fee

Customers outside the US must pay a currency conversion fee starting at 50 basis points (bps) for deposits and withdrawals made in currencies other than the USD.

Transfer Fees

Some fees are levied on users for transferring cryptos out of eToro or even into their eToro Money crypto wallet. The actual fee charged will depend on the cryptocurrency being transferred.

Inactivity Fees

Over and above the rest, eToro also charges a $10 inactivity fee per month for accounts that have shown no activity for more than a year.

Stamp Duty

Unlike other platforms that charge 0.5% of traders’ stock investments as stamp duty, eToro has no such fees.

The stamp duty levy is on all UK stocks listed on notable exchanges, including the London Stock Exchange, probably because eToro wants to encourage users to focus on the UK market, where they can make maximum gains without paying any stamp duty. Besides these fees and charges, there are also some other programs and features investors should know about when dealing with eToro:

VIP Account Club: eToro offers exclusive VIP access to a specific section of users who are part of the eToro Club. The club has five membership tiers, ranging from Silver to Diamond, open to those traders who maintain balances between $5,000 and $250,000.

Each membership tier brings its own features and benefits, ranging from exclusive access to Trading Central, discounts on withdrawal and deposit fees, and the provision of a dedicated account manager to take care of your activities.

Popular Investor Program: eToro also boasts a unique Popular Investor Program exclusively for traders who allow others on the platform to copy their strategy using eToro’s unique social trading feature. The program has four levels beginning with Cadet and ending in Elite.

The first, or Cadet tier, is open to those with over $1,000 in account equity, have attracted over $500 in customer assets copying their strategy, and have continually maintained a risk score below 7 for at least two months. The Popular Investor Program also offers traders a range of benefits, such as spread rebates, monthly payments, management fees for Elite investors, and so on.

Zero-Commission Stock Trading: Besides CFD shares, eToro maintains its zero-dollar commission for stock trading, which is not available to US investors alone. Fractional shares are also supported.

Cryptocurrencies on eToro

One of the most remarkable highlights of the eToro platform is that it enables users to diversify their investment portfolio with significant cryptocurrency investments. Most of the biggest cryptocurrencies in the world are available to trade, including Bitcoin, Ethereum, Bitcoin Cash, Ripple, Cardano, Dash, Dogecoin, Polkadot, Solana, Stellar Lumens, and Litecoin. The number of cryptos supported on this platform exceed 100.

Different cryptocurrencies available to trade

eToro’s users can choose between trading cryptocurrency on the dedicated CFD trading platform on the market’s leading social network and investment platform or eToroX, the professional-grade crypto exchange.

Trading on CFD

The platform uses “Contracts for Difference” (CFDs) instead of direct market trading to facilitate more significant exposure to various markets for users. With a CFD, users can open positions with brokers to replicate the market conditions of the underlying traded market. If the position closes in profit, the broker must pay the trader. However, the broker can charge the trader for the difference if it closes at a loss.

All assets have an exclusive “feed” highlighting information, pricing, statistics, and trends. Users can add all the markets they are interested into the watchlist, thus being able to monitor performances across all of them in a single glance.

Trading on eToroX

eToroX combines institutional-grade exchange features, such as US dollar deposits, margin trading, trading APIs, and faster execution. In case you are a professional or institutional trader, this is the most suitable trading platform for cryptocurrency that you can use.

Interestingly, eToro facilitates direct crypto-to-crypto trading for all 100+ cryptocurrencies to users outside of the US. In the US, a crypto-to-crypto conversion option, like that on Coinbase, is available to users for Bitcoin, Litecoin, Bitcoin Cash, Ethereum, and Stellar.

eToro also offers a free digital wallet to store cryptocurrency, which we have discussed in more detail in this article. Users can transfer cryptocurrency from the eToro platform to their individual digital wallets. However, they must note that all such transfers are one-way. Any currency transferred to the wallet cannot be transferred to the eToro trading platform.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro Copy Trading

Copy Trading is a unique eToro feature not offered on other leading platforms. You can use the feature to follow the portfolios of “Popular Investors” and simply copy their trades.

There are factors like investment, duration spent on the platform, and the number of users copying these investors, which are taken into consideration by the platform to curate the list. eToro pays these investors accordingly by considering their individual status.

The feature was introduced in 2010 and has increased its reputation ever since. Users can make use of this tool to copy other traders effectively. For many new investors, who do not have adequate experience, this tool is useful.

You can use this feature to start trading and get familiar with the crypto market. When you copy another investor, it automatically replicates the trades of that particular investor in real-time in your portfolio.

You can use filters to look for popular investors. These include gains, risk scores, asset classes, etc. When you sign up for this tool, the statistics of investors you wish to copy are easily visible to you so that you can make an informed decision.

If you are looking for suggestions to copy a trader, you must go through the Editor’s Choice to successfully locate popular investors. If you are an experienced trader with the required trading skills and a good trading history, you can join the Popular Investor program to receive cash payments and added perks.

The flagship – CopyTrader feature on eToro

Many traders use the copy trading feature to mimic the moves of high-performance traders with just a few clicks. After you decide the amount you want to use in your portfolio, the platform mirrors the trades of your favorite investor by making an automatic proportionate allocation of the set funds.

You do not have to pay any management or other fees using this tool. This trading tool allows you to copy up to 100 investors at a given time.

Although it is an exciting option, it involves many risks as you already deal with a highly speculative market. The users who are a part of the community engage in active trading, and it thus becomes a riskier affair than long-term investments.

Most copy traders have different altcoins apart from BTC and ETH. Many experts suggest a long-term investment is much better than investing in short-term assets. Before using the copy-trading tool, you must be prepared to handle the added risks. After you opt for the same, you can stop copying a trader whenever you wish to.

eToro assigns a risk score to all users, and the score is publicly visible. If the score exceeds a certain point, eToro does not allow users to copy them. Using the copy trading feature requires you to invest a minimum of $200.

eToro Copy Portfolio

Another unique feature of eToro is its portfolio offerings. You can now buy specific cryptocurrencies and invest in one of its four cryptocurrency portfolios. All of these are carefully created and rebalanced quite often by the platform. All these portfolios have different cryptocurrencies that also include altcoins.

Investing in a portfolio means being prepared for the added risks of trading cryptos. Many investors are considering coins other than Bitcoin and Ethereum for investment, and these portfolios offer the suitable variety to traders.

Theme based investing and diversification options on eToro

If you wish to opt for a portfolio, you must go for a higher minimum investment of at least $500 (which varies as per your chosen portfolio). As per experienced traders and expert analysts, you are recommended to invest 5% of your overall portfolio in cryptos. Many beginners may want to gather some experience before using this tool.

The Portfolios offered by eToro are as follows:

- Market Portfolios that have a specific segment of the market as its focus. It includes the likes of tech, finance, gaming, etc. eToro takes critical assets from each segment and brings them all into one Portfolio.

- Top Trader Portfolios that have various traders as their focus. It brings the top traders on the platform into one bracket and allows users to invest in their collective experience.

- Partner Portfolios, which eToro’s partners create. These are among the leading financial institutions across the globe. This segment operates like Market Portfolios.

eToro Social Trading

Social trading is one of the highlights of the eToro platform. It refers to combining social media and online trading to foster a peer-to-peer approach to community-powered financial trading. Social trading of online assets has proven beneficial for new and experienced investors.

The concept is to give investors a certain level of transparency on the performance metrics of each trader on the platform, thus enabling them to follow the traders of choice, exchange knowledge within the community, understand why certain trading decisions have been made, and emulate successful trades for beneficial outcomes.

The eToro CopyTrader features allow users to do exactly that, copy and trade successful moves on the platform automatically. Users can choose which investor they want to copy and mirror their positions automatically with a button click. At the same time, they have complete control over potential losses with the stop-loss feature, which they can use to limit trades and activities.

The minimum amount for copying a user is $200, while the maximum amount that can be automatically copy-traded is $500,000. There is an upper limit of copying 100 traders simultaneously as well.

Even without using the CopyTrader function exclusively, users can view millions of trading portfolios, key insights, relevant statistics, besides risk scores on eToro. Worldwide users other than US users enjoy complete access to all public profiles worldwide, while clients in the US have limited access to other US users alone.

Knowing and understanding the strategy of other traders

The social trading feature on eToro works like a social media platform, offering interactive and informative feeds of user thoughts and comments all throughout. As soon as you log in to eToro, you will see a general feed covering opinions on crypto, markets, and investing by fellow users.

You may then navigate to one coin or managed portfolio at a time, just like social media platform profiles. Here, you can view unique feeds with only user posts related to that offering.

New, as well as experienced investors, can use these comments and insights to breed trading ideas or simply understand the nuances of online trading. However, you have to keep in mind that these are individual endorsements, and not assured facts with quality checks placed on them.

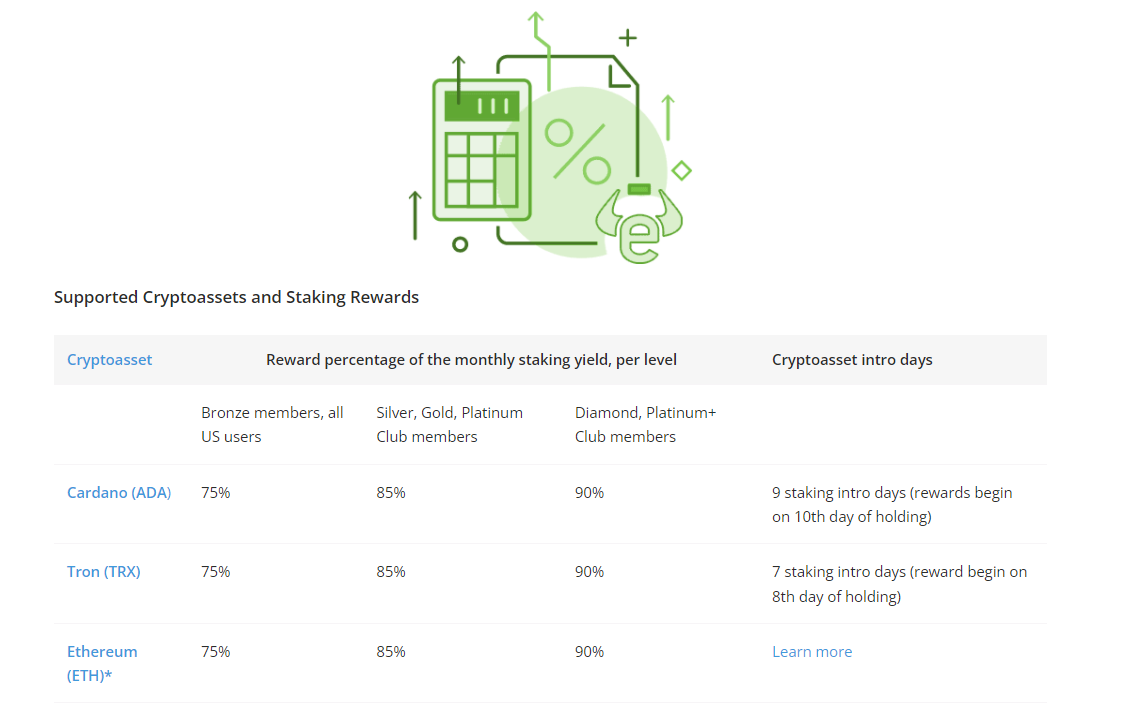

Staking with eToro

Users, who own and hold supported crypto assets on eToro, can earn rewards through staking. EToro executes the process on the users’ behalf. Just like an investor earns interest by holding money, users on eToro can stake their crypto assets and earn rewards (which are more crypto assets) for holding them.

As it is a regulated platform, the process is convenient and secure. eToro pays staking rewards to users every month for the supported crypto assets. Users do not have to carry out any tasks. The platform pays them without any action on their part.

Staking yield on eToro

The staked crypto assets belong to eToro users, and eToro effectively executes the staking procedure. The platform takes cautionary measures to ensure safety against added risks while staking. eToro allows users to be free from the complications of staking cryptos independently. While staking, the platform charges a small fee by keeping a minute percentage of the rewards. It uses these funds to pay operational, technical, and legal costs.

eToro now also offers 4.8% interest on unused capital.

eToro’s Staking Service is not applicable for holdings using CFDs, copy portfolios, copy trading, or short positions.

How are staking rewards calculated?

- eToro takes snapshots of a user’s holdings daily at 00:00 GMT, showing the user’s eligible staking units for open positions.

- By month-end, all month snapshots are divided as per the number of days of that month to calculate the average daily amount.

- An individual user’s monthly reward is calculated on the average daily amount. After calculating the monthly reward percentage per crypto asset, eToro adds the applicable club member percentage.

Who are eligible for staking rewards?

eToro users holding any supported crypto assets are eligible, with certain exceptions. The ones not eligible are-

- For Cardano (ADA) and Tron (TRX): All eToro US users; UK residents registering on the platform on or after 8 February 2022.

- For ETH 2.0: All eToro US users; UK residents registering on the platform on or after 1 February 2022.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro Wallet

The eToro wallet is the only avenue for transferring coins off the eToro platform so that users can be assured maximum security for crypto holdings. This eToro wallet is known as eToro Money. It is offered as a separate mobile application that investors can use to deposit and withdraw money in actual cryptocurrencies.

The wallet’s private keys are guarded by the eToroX, which acts as a custodian of your crypto assets. The eToro Money wallet has been designed to resemble the look and feel of the eToro mobile application itself, and also comes with support features for social trading.

Your capital is at risk

Payment Methods on eToro

The best part about investing in eToro is the wide variety of approved payment options, which makes it simple to deposit funds into your account and start trading. Several globally accepted payment methods have also been included, making it convenient for many users to trade on the platform irrespective of location.

Deposits can be made into your eToro account via bank credit and debit cards, virtual credit cards from reputable brands, PayPal, Neteller, or even Skrill. For investors living in the UK, a direct bank transfer is also enabled.

All the payment methods allowed on eToro are fast, seamless, and reliable. Money transferred is reflected in your account within a few minutes, thus enabling faster trading for all.

An important point to note, however, is that a minimum deposit limit must be followed. Investors must pay at least $200 to begin trading on the platform. EToro has associated the pegging of this amount as the minimum value that can yield a significant profit for the platform, besides helping depositors make the most of their trades.

How to Open an Account on eToro?

To Open an Account on eToro, follow the steps below-

Sign Up

- On the www.eToro.com page, click the “Create an account” or “Trade Now” button.

- On the following web page, look for an electronic form to enter all the personal data and open a new trading account.

- Fill in the relevant information on the form. You can also log in via Facebook or Gmail.

- Carefully review your information before submitting it. Spend time to familiarize yourself with the Terms & Conditions and privacy policy of eToro.

- After you review all the terms, indicate your agreement by checking the appropriate box.

- Click on the “Sign-Up” button to submit your information.

- eToro and all associated brands fully comply with Directive 2005/60/EC of the European Parliament and the Council, on preventing the Use of the Financial System for Money Laundering and Terrorist Financing.

- As a mandate, according to the EU, as mentioned earlier, laws and regulations, all investors must undergo the KYC process.

- As far as the KYC process is concerned, newly registered investors must provide a Confirmation of Residence. You can use a bank statement or utility bill with the last 3 months’ statement.

- You can submit Proof of Identity by using a copy of your valid passport, or any other officially issued photo ID.

- New investors are also requested to complete a questionnaire that helps eToro to offer customized packages to investors. The questionnaire might have queries related to the professional status of new investors, their knowledge of the trading market, financial liquidity, investment targets, risk appetite, etc.

Fund your account

Once your account is verified, you can proceed to fund your account. You can take advantage of various payment methods to make deposits. These include debit cards, credit cards, and wallets like PayPal. For UK and US-based users, the minimum deposit is $10.

Buying Crypto

You can click ‘Trade Markets’ on the sidebar, choose ‘Crypto’ from the top of the search filter and go for the desired cryptocurrency. Click ‘Buy’ to set an investment amount and confirm.

Your capital is at risk

Why eToro stand out of the crowd?

eToro is one of the most prominent and renowned online trading platforms globally for good reason. The user-friendly online broker has slowly become a vibrant hub for investors, offering unmatched investment experience on the open market.

The reasons behind its popularity are many. From enabling all transactions on the platform in real-time to offering a dedicated and comprehensive mobile application for any location, eToro places due to focus on investors’ interests and convenience.

Here are some of the best attributes of eToro that help it stand out of the crowd and establish its league in the field of online assets trading:

Customer Support

eToro’s intuitive and interactive interface is paired with its supportive real-time service. Users can engage quickly and in real-time with team members via live chat. Fast and efficient contact channels are supported on the platform for users to send in queries or ask for help through emails, phone calls, or chat services.

This is ideal, considering that trading activities happen 24×7, and customers can need support at any hour or minute of the day.

In addition to traditional customer support, eToro has also embedded artificial intelligence, allowing users to get information about investors, popular stocks, daily movers, and more.

Beginner-Friendly

eToro is a great trading choice for brokers in the world of investing, with its array of valuable tools and features that make both its web platform and mobile application extremely user-friendly in the first place.

Unlike other platforms that do not provide sufficient analysis for beginners to make the best investment decisions, eToro offers features like extensive educational resources, social trading, and copy trading to ensure that new investors can place their best foot forward.

They can conveniently assess their risk score, weekly and monthly trading volumes, average profits, losses, and holding times for every investor they are interested in emulating. These key insights are instrumental in building their skills, understanding, and portfolio as successful investors.

Trading tools

eToro offers comprehensive in-house trading support for its users through an array of tools and a team of experts who can easily manage your investment portfolio. The convenient alternatives available for investors on the platform reduce the time wasted on handling lengthy processes independently. There are plenty of options for users based on their investment goals.

For instance, customers can choose the Building Corporate Investment Portfolio option to gain access to experienced professionals who can then guide them toward building a portfolio matching the standards of leading banks. This includes the Bank of America, JP Morgan Chase, etc.

You may even decide to build a portfolio featuring stocks from companies yielding regular dividends, in which an in-house expert will help you access stocks of leading brands.

Is eToro legitimate?

eToro is the ideal platform for those new to investing, considering its exhaustive combination of online trading and social media emulation. A wealth of educational content is available on the platform to improve and brush up your trading skills, besides plenty of opportunities for big profits with the Copy Trading feature.

Novices can also use the free demo account feature to test the waters before investing money. Even for investment veterans, the eToro platform has numerous incentives, insights, and opportunities to thrive. Experienced investors can share their knowledge with fellow users to improve their performance while earning a healthy income.

High-level security offered by eToro

Overall, we can conveniently call eToro a legitimate and friendly trading platform for all sections of investors. The intuitive platform interface provides educational courses on learning to trade for beginners.

In a nutshell, eToro is suitable for you if you are interested in investments in stocks, commodities, liquid currencies, indices, exchange-traded funds, and cryptocurrencies on a regulated, secure platform. It is the perfect destination for buying and selling an impressive array of cryptocurrencies with a straightforward fee schedule and the benefit of social trading.

Comparing eToro with Top Exchanges

eToro vs Bybit

- Regulation

eToro is a highly regulated and popular cryptocurrency platform in the United States. Bybit is a popular cryptocurrency derivatives exchange, but it is not available in the U.S.

While eToro is beginner-friendly and is sometimes not preferred by traders looking for advanced technical analysis, Bybit has a wide range of advanced trading tools.

Unlike eToro, Bybit is not regulated. Despite no regulation, it offers top-notch security and commits to zero downtime. It claims to handle 100,000 transactions per second, making it faster than other platforms in the industry. This aspect makes Bybit attract many investors as traders want to avoid the hassle of server downtime at all costs.

- Unique features

eToro has features like copy trading, social trading, copy portfolio, etc., The platform has also integrated AI, as well as provided important filters on the platform. Bybit does not offer these features.

- Leverage, deposits, withdrawals, fee

Bybit offers crypto derivatives exchange up to 100x leverage. In contrast, eToro offers 30:1 for significant currency pairs, 20:1 for non-major currency pair, major indices, and gold, 10:1 for commodities except gold and non-major equity indices, 5:1 for individual equities, and 2:1 for cryptos.

Bybit has a Dual Price Mechanism, so traders do not suffer from trade/ price manipulation. You can set stop-loss and derive profit simultaneously while placing a limit order on Bybit.

Bybit has an in-built Tradingview, including comprehensive indicators. On Bybit, the withdrawal charges vary according to assets (for instance, 0.0005% for BTC); on eToro, it is flat $5.

eToro enables instant deposits through Paypal, Neteller, Skrill, etc., while Bybit does not handle fiat deposits directly.

- KYC

There is no KYC process on Bybit unless you want to withdraw 2 BTC per day, but the KYC process is mandatory on eToro. Both eToro and Bybit have a user-friendly interface.

- Compatibility

Both platforms are available on a desktop and can be accessed on apps available for Android/ IOS devices.

- Customer Support

These two exchanges have dedicated customer support. The customer support service of Bybit operates 24/ 7 whereas, on eToro, the customer services are offered 24/ 5. eToro is preferred by beginners and seasoned investors, whereas Bybit is more suitable for investors with substantial trading experience.

Comparison between top Crypto Platforms

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

eToro vs Binance

Binance is a cryptocurrency exchange for advanced traders accessing various currencies and futures. It has low fees, advanced trading tools, and many cryptocurrencies on its list. Like eToro, Binance offers various ways of depositing money into a user’s account. On Binance, you can opt for either crypto-to-crypto or fiat-to-crypto trading.

While eToro is available in most US states, Binance is not available for users in the U.S. eToro is a commission-free trading platform, whereas Binance charges fees while trading. Its fee structure is lower than many other exchanges in the sector. The highest spot trading fee on Binance is 0.1%.

- Features

While eToro offers features like copy trading, copy portfolio, and social trading, Binance offers attractive passive income methods (although these involve various risks). Traders can earn up to 30% APR on specific cryptos by participating in the staking program on Binance. You can also put assets into a flexible savings account for consistent rates.

Investors who have adequate experience in the trading market can add liquidity to token pairs to earn income. Make sure that you thoroughly understand the risks while participating in these programs.

Binance includes decentralized finance (DeFi) tokens, Bitcoin (BTC), altcoins, etc. On eToro, users may not be able to do advanced technical analysis, but Binance has an advanced trading interface with charting tools.

- Leverage

Binance offered leveraged tokens for traders to multiply their positions accordingly. Using leverage while trading involves risks, and you must only invest the money you can afford to lose. eToro does not offer leverage.

- Regulations

While eToro’s regulation and licenses include that of the Cyprus Securities & Exchange Commission (CySEC), Financial Conduct Authority (FCA), Financial Instruments Directive (MiFID), FinCEN, FINRA, SIPC, ASIC, and AFSL, Binance has received regulators’ attention in the U.K., Japan, Canada, Singapore, and Thailand.

- User-friendly

While eToro is a simple-to-use platform, Binance is a more complex one. It is designed specifically for experienced traders. With a significant market selection and in-depth dashboards, users might find it difficult to move swiftly through the platform while investing in cryptos and other assets. Although it does have a ‘Classic’ mode which is less advanced.

eToro vs Coinbase

- Regulation

eToro has regulations and licenses from Cyprus Securities & Exchange Commission (CySEC), Financial Conduct Authority (FCA), Financial Instruments Directive (MiFID), FinCEN, FINRA, SIPC, ASIC, and AFSL.

Coinbase complies with the applicable laws and regulations in its operating jurisdictions. United States Coinbase, Inc. has the license to operate in most U.S. jurisdictions. Coinbase’s money transmission licenses cover US dollar wallets and transfers in most states and digital currency wallets and transfers in some states.

Coinbase is registered as a Money Services Business with FinCEN. Coinbase complies with financial services and consumer protection laws, including The Bank Secrecy Act, The USA Patriot Act, most states’ money transmission laws, and corresponding regulations.

- Unique features

eToro has features like copy trading, social trading, copy portfolio, etc., and offers various cryptocurrencies.

Coinbase does not have the features mentioned earlier but offers a wide selection of cryptocurrencies. Coinbase Pro, attached to Coinbase, is an advanced option that facilitates viewing real-time order books, and charting tools and charges lower fees.

- Leverage, deposits, withdrawals, fee

eToro’s leverage includes 30:1 for major currency pairs, 20:1 for non-major currency pair, major indices, and gold, 10:1 for commodities except gold and non-major equity indices, 5:1 for individual equities, and 2:1 for cryptos. Coinbase does not offer margin trading.

eToro has a flat $5 charge for withdrawals, whereas withdrawal charges on Coinbase vary as per the type of cryptocurrency. If you spend USDC with your Coinbase Card, it does not charge any fee. But it has a flat 2.49% transaction fee on all purchases made with other cryptocurrencies, including ATM withdrawals.

eToro enables instant deposits through Paypal, Neteller, Skrill, etc. US customers can fund their Coinbase accounts with USD via bank-wire/ ACH transfers, debit cards, PayPal, Apple Pay, and Google Pay.

- KYC

The KYC process is required on both eToro and Coinbase platforms. This process ensures the safety of users and their funds. It also prevents the creation of fraudulent accounts on the platforms.

- Compatibility

Both platforms are available on a desktop and have apps for Android/ IOS devices. Coinbase Pro is a platform attached to Coinbase.

- Customer Support

Both these exchanges have good customer support. Coinbase customer support service operates 24/ 7, and eToro customer support service operates 24/ 5. Coinbase has live phone support and live message support, and various other channels. eToro offers active LIVE chat support, among other options.

eToro vs Kraken

- Regulations

eToro has regulations and licenses from Cyprus Securities & Exchange Commission (CySEC), Financial Conduct Authority (FCA), Financial Instruments Directive (MiFID), FinCEN, FINRA, SIPC, ASIC, and AFSL.

Kraken complies with the legal and regulatory requirements in its operating jurisdictions. FinCEN regulates it, and the Wyoming Division of Banking regulates Kraken Bank. It is registered as a Money Services Business (MSB) with FinCEN (USA) and FINTRAC (Canada). It is regulated by the FCA (UK) and the AUSTRAC (Australia). It is also registered with the FSA (Japan).

- Unique features

While eToro has features like copy trading, social trading, copy portfolio, etc., Kraken has a comprehensive security approach, crypto pricing benchmarks, over-the-counter personalized services, account management services, etc.

- Leverage, deposits, withdrawals, fee

Kraken offers margin trading up to 5x leverage. In contrast, eToro’s leverage includes 30:1 for significant currency pairs, 20:1 for non-major currency pair, major indices, and gold, 10:1 for commodities except gold and non-major equity indices, 5:1 for individual equities, 2:1 for cryptos.

eToro has a flat $5 withdrawal charge, whereas, on Kraken, it varies as per the type of cryptocurrency.

eToro enables instant deposits through Paypal, Neteller, Skrill, etc. Customers can fund their Kraken accounts with various bank transfer options that are country-specific.

- KYC

The KYC process is mandatory for eToro as well as Kraken. Kraken offers different levels of verification as per the account type, which includes Starter, Express, Intermediate, and Pro.

- Compatibility

Both these platforms can be accessed on the web using a desktop and on apps available for Android/ IOS devices.

- Customer Support

eToro and Kraken offer active customer support services. These services are available to users 24/5 on both platforms.

eToro Review – the Verdict

35.5 million registered users trust the eToro platform and use it to buy and trade crypto and other financial assets online. The platform is constantly introducing new innovations and tools to improve the trading experience of investors, e.g. tools like ProCharts and One-Click Trading.

eToro is a multi-asset platform that comes with a variety of financial instruments. It has many categories and thus meets the needs of diversified traders and investors. eToro is a highly regulated platform which makes it a secure trading space. If you are new to the crypto market, eToro is a good platform. It is also suitable for traders with industry experience looking for short or long cryptocurrencies.

Beginners can use the platform to trade crypto and connect to members of the eToro community worldwide, in the US, the UK, and every country where eToro is available. Sign up on eToro.com to get started investing in cryptocurrency.

Related

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Is eToro regulated?

It is regulated in Europe by the Cyprus Securities & Exchange Commission (CySEC), in the UK by Financial Conduct Authority (FCA). eToro complies with and operates under the Markets in Financial Instruments Directive (MiFID) in the UK and Europe. In the United States, it is registered with FinCEN and is a member of FINRA and SIPC. In Australia, it is regulated by the Australian Securities & Investments Commission (ASIC) and has an Australian Financial Services Licence (AFSL).

Is eToro safe for cryptocurrency trading?

As it is highly regulated, it becomes a safe choice for trading cryptocurrencies. However, being a safe exchange does not protect you from market volatility. Investing in any asset, including cryptocurrency, involves risks and you must be prepared to face these before you trade cryptos.

Is eToro available for US-based investors?

eToro is available for crypto trading to investors residing in most states in the United States.

Is eToro the best UK broker for Bitcoin?

eToro is one of the safest and most preferred UK brokers for Bitcoin trading. Its stringent regulation has made it a reliable option for UK investors. Opening an account on eToro is simple and you can do so in just a few minutes.

What are eToro special features?

eToro has unique features like copy trading, copy portfolio, and social trading. With copy trading, you can mimic the trades of verified investors on the platform based on their past records and the nature of their investments. Once you go for copy trading, it will automatically copy the trades of your chosen investors and replicate them in your portfolio. You can use the copy portfolio feature to choose a portfolio created and rebalanced by the eToro team. These portfolios bring a variety of assets together and you can opt for one of these portfolios to diversify your investment. With social trading, you can connect to the eToro community. It has a media feed like other social networking platforms and allows you to share views on the market, get insights from top investors, and keep yourself updated with the industry happenings. These features make eToro stand ahead of many other leading exchanges.

Is KYC mandatory on eToro?

Since eToro is highly regulated, verifying your identity and going through the KYC is mandatory. It ensures safety to your details and funds. Once you complete the KYC process on the platform, depositing funds, trading, selling your holdings, and withdrawing funds is simple.

How much money do I need to invest in cryptos on eToro?

eToro has a minimum deposit of $10 for the US and the UK-based traders. For many other countries, it is $50. You can start investing in cryptos with just $10 on the platform.

Can I use eToro on my mobile?

eToro has a seamless interface for mobile phones. The app is available for both Android and iOS devices.

How can I know more about trading skills?

eToro offers educative resources and features that you can use to hone your trading skills. Its virtual portfolio/ demo account comes with $100k of virtual funds so that you can practice your trading strategies before you put real money on cryptos.

How to open an account on eToro?

Visit the eToro 'Create an account' page.

Select a username, provide your email address, and choose a password. Carefully review and agree to eToro's Terms and Conditions, Privacy Policy, and Cookie Policy by checking the respective boxes. Finally, click the 'Create Account' button to complete the process.

Bitcoin

Bitcoin