Tether Price Chart

(USDT)Tether (USDT)

Unlike other cryptocurrencies which are known for their volatile nature in the market, Tether is known for its stability (the first of many stablecoins) and it is tied to the U.S. dollar. Hence the ticker name, USDT.

Tether has a current circulating supply of 152,399,462,952 USDT. This article will go into more detail on the Tether price and how to make use of this crypto.

Tether Price Now – Live Price Chart

At the time of writing, Tether is of course still trading at around $1.00. Its price has been reduced by 0.03% in the last 7 days. The last 24 hours have seen a decline of 0.01% in its value. These small fluctuations are the result of more investors buying Bitcoin or other cryptos using USDT, than selling crypto into USDT.

View the price of Tether now on the live Tether price chart below.

[ccpw id=”432762″]The all-time high value of Tether was $1.21, the result of a large market sell off into Tether.

Where can I buy Tether (USDT)?

The stability of Tether allows its investor to swap any cryptocurrency with it, and this interchanging of crypto tokens has its advantages as the conversion of cryptocurrency to any fiat currency or cash takes more time along with some cost transaction fees.

People are increasingly using Tether to make cross-border payments and for doing purchases and daily transactions. If you also want to take those benefits of Tether, then it is worthwhile to consider investing in this cryptocurrency.

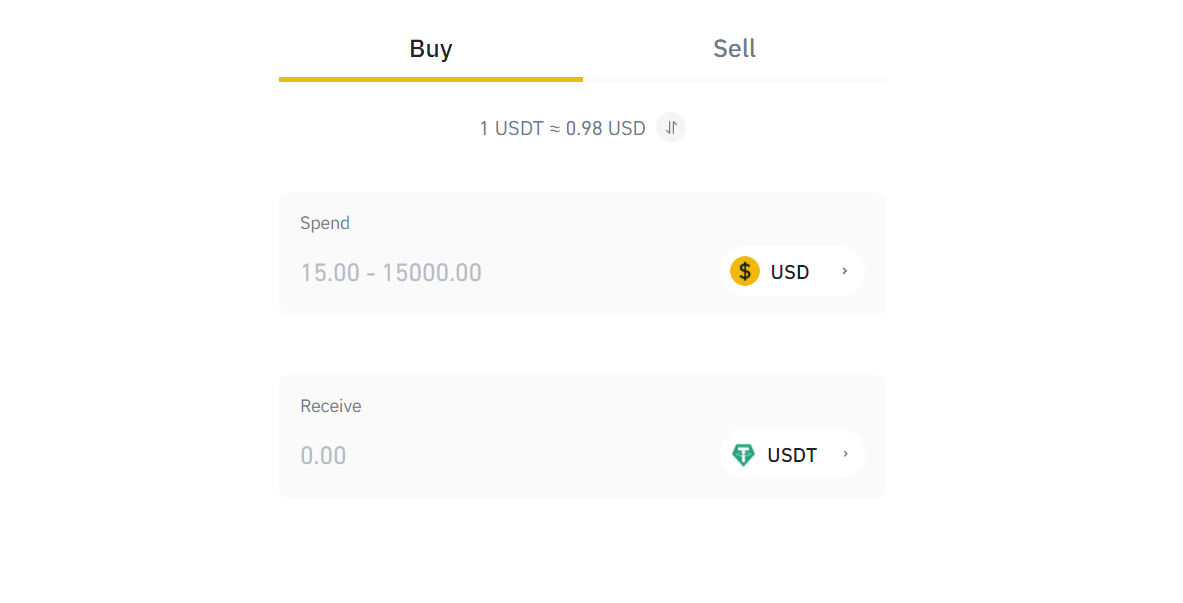

Easy UI on Binance for buying Tether

You can buy Tether from our top recommended trading platform, Binance, which has one of the lowest trading fee among any crypto brokers. It also provides numerous features such as Two factor authentication verification, Federal Deposit Insurance Corporation (FDIC), device management, address whitelisting, cold storage.

For a beginner, Binance serves as the perfect start owing to its easy UI & large range of features such as live cryptocurrency prices, price analysis, trading news, etc.

Tether Price History

Tether, founded in 2014, is one of the first cryptocurrencies in the market which got its value connected with any fiat currency. The price of Tether has been associated with the price developed of a real-world asset, i.e. U.S. Dollar.

This means whenever any new USDT tokens are issued by Tether, the company allocates the same amount of U.S. Dollars in its reserves. This ensures that these tokens are completely backed by cash and cash equivalents. Experts think that this connection is the reason behind the stability of this cryptocurrency.

A single Tether is usually near to the value of a single U.S. Dollar. The year 2021 saw this crypto getting the title of one of the biggest cryptocurrencies in the world. Tether price usually fluctuates between the range of $0.99 and $1.0012, and it rarely witnesses any movement beyond this range. Given below is the analysis of Tether’s price history over the years:

Tether price history, via Binance and Trading View

Fluctuations in the early years

The primary purpose of Tether is to maintain the value of $1 at all times. However, the initial years of this currency saw several fluctuations in its prices. It experienced its lowest value ($0.57) in March 2015, while it saw its all-time high price of $1.32 in July 2018.

These fluctuations occur because of the change in the demand for the currency. The demand for stable cryptocurrencies like Tether is less whenever the crypto market is facing a price surge on its chart, therefore its price fluctuations could be attributed to this change in demand for this token.

Similarly, this demand becomes more whenever any cryptocurrency crashes in the market. For instance, price fluctuation in Tether was observed during the Black Thursday sell-off in March 2020, when Bitcoin dipped to $4000. During that same time, Tether experienced a spike in its prices, and it went to the value of $1.05.

Further, other external factors have also played an important role in bringing slight volatility to Tether at times. Tether has faced many lawsuits in its history which have played an important role in bringing down its price. Its price was reduced by a whopping figure of 3% when the New York Attorney General’s office (NYAG) instituted legal proceedings against its project.

Stability in recent times

Tether has been on a stable run in recent times. It has generally remained near to the value of $1, thereby maintaining its stability in the eyes of investors. Though there are minor deviations of $0.01 observed in its prices, however, they do not live for a longer period.

For instance, Tether witnessed a surge in its prices when Bitcoin got crashed to a figure below $54,000 during April 2021. Traders exchanged their Bitcoins with Tether during that price volatility, which resulted in Tether’s price rise to the level of $1.004.

Nonetheless, it has remained stable near to the mark of $1 in recent months. This stability is a good sign for its investors as it would allow them to trade this token at the time of market volatility.

Update – as of 2022, the total market value of the eight stablecoins has exceeded $150 billion. The top ranked stablecoins by marketcap are USDT (Tether), USDC and BUSD. Source – THE BLOCK, who calculate coin metrics.

Other stablecoins used in crypto are DAI, USDP, TUSD, HUSD, and GUSD.

Best Tether Exchanges in May 2025

On eToro you can trade against USD, and on ByBit, Binance, KuCoin, Coinbase and Bitfinex you can buy and trade against USDT.

How is the price of Tether (USDT) determined?

Any beginning investor should understand the factors determining the prices of cryptocurrencies. Knowledge of these factors helps in assessing the right time to invest.

Since Tether is a stable coin, its value usually remains close to the figure of $1. However, some events significantly affect the investment in this cryptocurrency, thereby bringing some minor deviation in this stable crypto. Given below are the factors determining the price of Tether:

Shifting of Funds by the Investors

Tether is a special form of cryptocurrency which pegs its value to the U.S. Dollar. Though its monetary value is not primarily dependent upon forces of the crypto market, volatility in the crypto market affects the investment in this currency.

Whenever any volatility is faced in the crypto market, or investors expect a sudden fall in the price of any cryptocurrency, traders buy Tether from their current cryptocurrencies for countering the market’s volatility. Tether’s stability serves as a safe haven for investors or traders during that time of crisis.

Though a significant increase in the price of Tether is rarely observed due to the stable nature of this currency, its investment gets significantly enhanced during the volatile run of cryptocurrencies in the market.

Similarly, traders withdraw their investment from Tether whenever any bullish trend is witnessed in the crypto market as investors are having better prospects of raising money during that time.

Implications of Proceedings

Recently, Tether was brought under the scrutiny of authorities over an accusation that the company does not hold enough reserves to back its currency, though the company denied that claim and stated that Tether is 100 percent backed by fiat currency.

In light of these accusations, rumors were floated that Tether would get delisted from various exchanges. One of the cryptocurrency exchanges associated with Tether even suspended the deposits in U.S. dollars, sterling, Japanese yen, etc. US regulator CFTC (Commodity Future Trading Commission) had also fined Tether a humongous amount of $41 million for allegedly giving misleading statements about its reserves relating to the period 2016-2019.

Despite being a stable cryptocurrency, Tether’s price was affected by these developments as it suffered a dip in its value due to the lack of confidence among the investors after these incidents.

Tether Mining

Generally, the prices of cryptocurrencies are also affected by their mining process. However, mining does not play any role in the present case as Tether cannot be mined. One has to purchase it from Tether Limited or cryptocurrency exchanges that support Tether.

Your capital is at risk.

How often does the price of Tether (USDT) change?

Unlike other cryptocurrencies which are in a state of constant flux, stable cryptocurrencies are designed to stay constant or at least near to their current value. Their values generally do get affected substantially by any significant market event. This is why they are always on the wish list of every investor whenever the market faces any turbulence.

Such is also the case of Tether, where its value has remained near to the figure of $1 in recent times. Even if the company faces any unfortunate externality or the market faces any boom in the prices of other cryptocurrencies, it is expected that only minor deviations would be observed in Tether’s price. Therefore, investors should expect that its price would remain constant at around 1 dollar in the upcoming times.

Since market volatility or news related to Tether company would at least have an impact on Tether’s price, the investors need to remain equipped with all such developments.

One can visit Binance, where several articles provides all beginners and investors with various insights on questions like how much should be invested in Tether when they have to buy, hold, or sell it strategically.

Investing in Tether

The importance of Tether is felt during the times whenever the crypto market faces any sudden crash or observes bearish trends. At that time, investors or traders could swap their cryptocurrencies with Tether, and minimize their losses.

Is it worth buying Tether (USDT) in May 2025?

The volatile nature of the crypto market is not unknown among investors. Investors could face the bearish run of cryptocurrencies at any time. This enhances the importance of Tether in the eyes of traders.

The threat of the third wave of the coronavirus is not unreal at this time due to the finding of the new variant of coronavirus. All financial markets could face bearish trends if this deadly virus has its dangerous run in various countries. In light of these developments, the option of having an investment in a stable currency like Tether becomes prominent.

Therefore, one could buy it in December 2021, and sell Tether at a higher price, thereby making some profit on its investment.

Who should invest in Tether (USDT)?

Tether is an attractive investment avenue for both: beginners and established investors as it serves the purpose of a safe haven by providing the much-needed cushion in an uncertain sphere of the digital financial market.

Therefore, all beginners, short-term investors, long-term investors could consider investing in Tether. In case you are a beginner and are not acquainted much with cryptocurrency, then you could take your call after learning some basics through cryptocurrency beginners’ guide and analysis options available on Binance.

How to get started with Tether (USDT) investments?

Several features available on Binance

You can make investments in Tether by following these simple steps on Binance:

Step 1: Make your account on Binance by clicking here.

Step 2: Visit KYC (Know-Your-Customer) protocol, and get your identity verified with the required documents.

Step 3: Deposit some money into your account so that you can buy Tether. You can do it through various payment methods.

Step 4: Search for Tether in the search box, and click on the trade button to start dealing in this emerging cryptocurrency.

Your capital is at risk.

Investing in Tether (USDT) responsibly

Make sure you go through price analysis, price predictions, trade news, and other relevant data available on Binance before making any investment in Tether. Though Tether is stable in terms of its price, however, that does not exempt the need of being responsible while trading with this crypto.

If you are a beginner, you need to make your fundamentals strong regarding cryptocurrency, and understand what factors determine Tether price, and learn other trading techniques so that it could help you in making profits in the long term.

Tether Taxation

As per the Internal Revenue Service (IRS), all cryptocurrencies have to be treated in the form of capital assets, and investors are liable to pay taxes to the government of the USA in case they sell any cryptocurrency at a profit. This is very similar to traditional transactions involving the selling of stocks or funds on gain.

The quantum of tax is dependent upon the period of your investment. Generally, your profits would be taxed at short-term capital gains rates if you have held up a cryptocurrency for less than a year. Similarly, if you have held up crypto for over a year, then your profits would be taxed at a long-term capital gains rate.

You will be levied with a penalty if you did not report your taxable income from the selling Tether. Usually, taxable events include transactions like selling Tether, paying for goods or services through Tether, converting any crypto into Tether, being paid in Tether, receiving rewards in Tether, etc.

Taxes would not be charged from investors in case of any non-taxable event. For instance, transactions like donating Tether to a qualified tax-exempt charity or non-profit organization, buying Tether with cash and holding it, etc. are not subjected to any tax in the absence of any non-taxable event.

Tether vs other cryptos

Tether has been on a steady run for a long time. It is supposed to be a calm island amidst the uncertain waters of cryptocurrencies. Unlike Tether, Other cryptocurrencies like Bitcoin and Ethereum generally witness an adventurous run in the crypto market. Given below is the comparison of Tether with some biggies of the crypto industry, i.e. Bitcoin and Ethereum.

Tether vs Ethereum

Ethereum is a decentralized, open-source blockchain network. It comes after Bitcoin in terms of market capitalization in the entire crypto-ecosystem. Its public ledger is utilized for recording and validating transactions.

The native cryptocurrency of this platform is Ether. It has multiple applications running on its platform and is used by its users for making global payments.

Tether vs Bitcoin

Bitcoin is the first cryptocurrency that was introduced in the market. The soaring price of this crypto has enhanced the popularity of cryptocurrencies among the common people, thereby making it the flag bearer of blockchain technology in the world.

This cryptocurrency stands first in terms of market capitalization in the entire cryptocurrency ecosystem. Further, Bitcoin is managed by a decentralized authority and its transactions are organized on the proof-of-work protocol.

Day-Trading Tether (USDT) vs Long-Term Tether (USDT) Investments

Should you go for long-term investment or day trading of Tether? Well, the answer generally depends upon two factors: the price of Tether and investors’ objectives.

Tether’s price chart is expected to show its regular flat line of $1 in the upcoming times with some minor increase in its price. This stability would attract both long-term and short-term investors to invest in this crypto to ensure that their investment remains profitable even in the event of any market crash.

Since the decision regarding the duration of investment is dependent upon many factors including investor’s expectations, budget, market-driven events, etc, it is advisable to do due diligence before making your investment. One has to do extensive research to make an informed decision regarding the duration of the investment.

Investors could seek the assistance of some professional research platforms like InsideBitcoins. This platform makes investors’ research process and helps them in making the right decisions at the right time with its amazing trading instructions and techniques.

InsideBitcoins constantly oversees the crypto market and provides all important updates regarding this market to its users. Further, it also has crypto bot traders which save time and efforts of the investors by automating the process of researching and investing at the optimal time.

Your capital is at risk.

Conclusion

Potentially, Tether is a useful coin to hold. Investors should consider investing in this crypto not to make money – as the Tether price doesn’t change – but to ensure that their investment in the crypto market industry gets stabilized during the period of volatility.

Apart from being a safe haven for investors, Tether has its additional benefits too. It is easy to swap any crypto with Tether which saves your time and transaction fees. Tether is also responsible for creating liquidity on exchange platforms and bringing stability to investors’ portfolios. USDT helps in creating no-cost exit techniques for crypto enthusiasts and allows traders to make cross-border payments quickly with fewer transaction fees.

Though Tether can’t be used to make much money by trading it, there are crypto exchanges and lending platforms that are ready to pay you high-interest rates to keep and stake USDT on their platforms. For that reason it can be worthwhile to invest in Tether in a sense – learn more about staking crypto here.

You can buy Tether on the most popular and largest cryptocurrency exchange by trading volume, Binance.

FAQ

Is Tether a good investment?

Tether is a good investment not to make money, but to ensure that your investment in the crypto market industry gets stabilized during the period of volatility. Further, Tether allows you to earn high-interest rates when you keep USDT on crypto exchanges and lending platforms.

How much is the price of Tether?

At the time of writing, Tether has been trading at $1.00 with its current circulating supply of 73,121,243,701.641 USDT.

How to buy Tether?

You can buy Tether from online broker known as Binance, where the Binance Academy provides additional benefits in the forms of price analysis, expert opinion, etc. to all the users alongside trading.

How to get free Tether?

You can earn free cryptocurrencies through the offers of the company, rewards earned in any ceremony, free crypto signup bonuses, etc.