Buying stocks is a popular investment choice for both novice and professional investors. Stocks provide the potential to earn higher returns than interest rates paid on government or corporate bonds, but have lower risk than real estate, hedge funds and other alternative investments. Stocks provide you with the highest returns for the investment risk you take (we call this the risk-return trade off).

But how do you choose the best stocks for your investment portfolio? And which broker matches your investment style? Read on to find the answers to these questions.

Best U.S. Platform to Buy Stocks

Best non-U.S. Platform to Buy Stocks

Quick Guide: How to Buy Stocks in 5 Minutes with Stash

- Go to Stash Invest

- Click on “Deposit” to select the payment options

- Select the amount to deposit

- Once the payment has been processed, click on “Search” and type in the stock you’re interested in then press “buy”

- Place an Open Trade on the stock

How to Buy Stocks in the U.S.

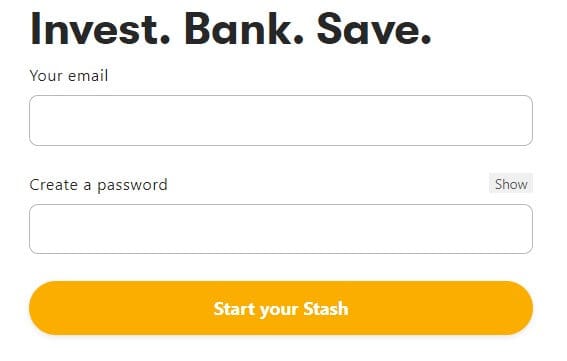

Step 1: Create your Stash Investment Account

To be able to sign up on Stash Invest, all you have to do is fill in the registration form with your email address and password. After that, you can click on 'Start your Stash'. If you are interested, you can also download the Stash app from Google Play and App stores.

Step 2: Fill out your profile

You will now have to go through a fairly brief questionnaire. Based on your answers, the Stash software will finalise your registration and you will be ready to go. We advise to answer the questions honestly.

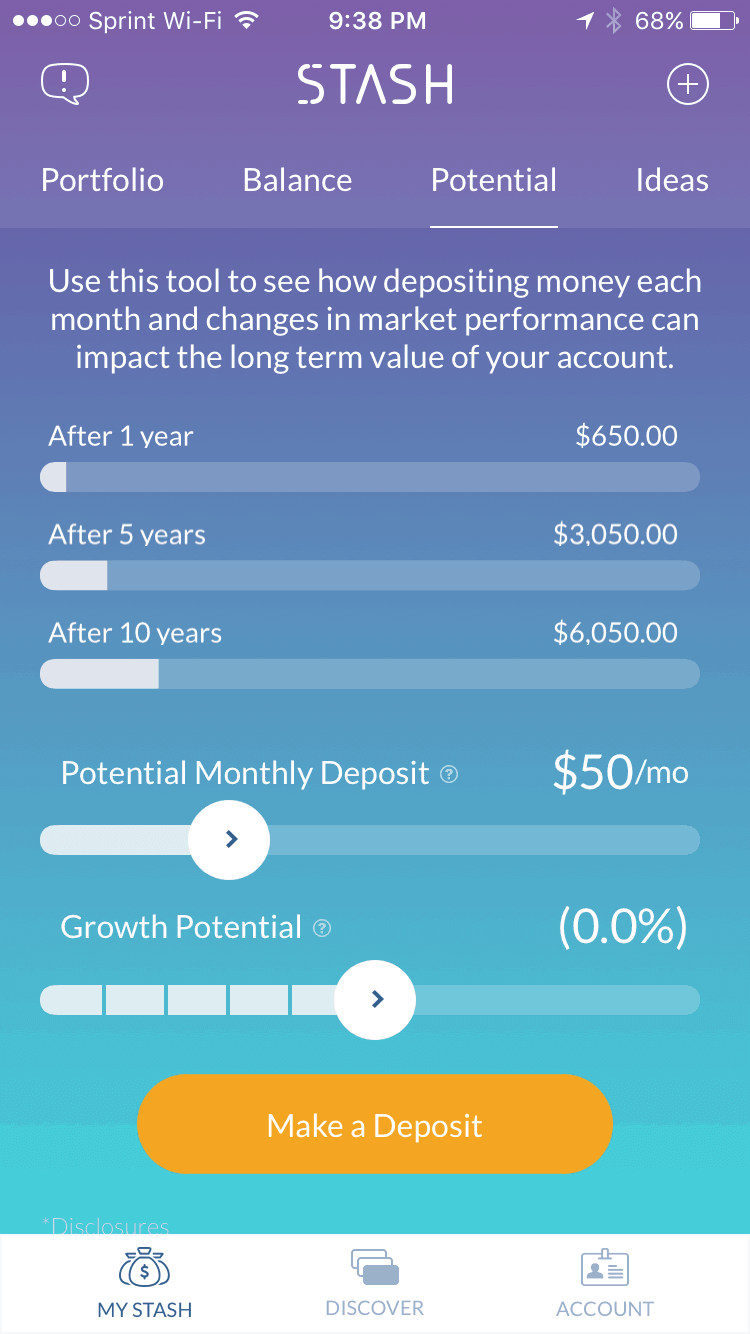

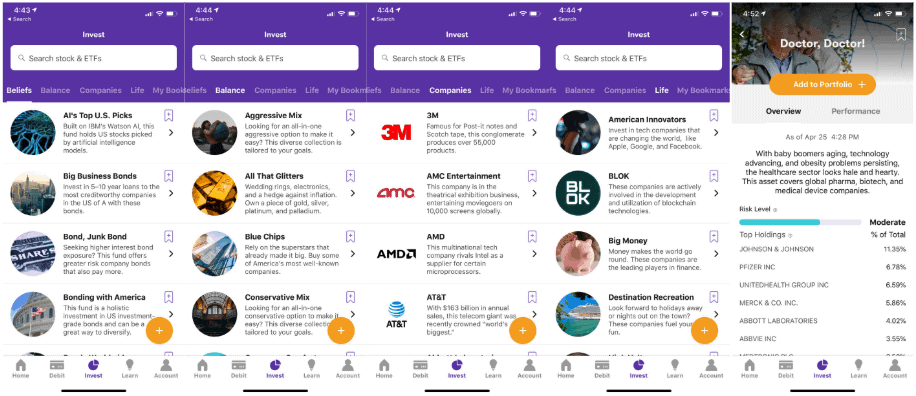

Step 3: Check your investment options

As we said, we recommend answering the questions honestly, because based on the answers you give, the platform will provide a series of investment options that you can choose from and they are all in line with your risk tolerance and all the other information you gave.

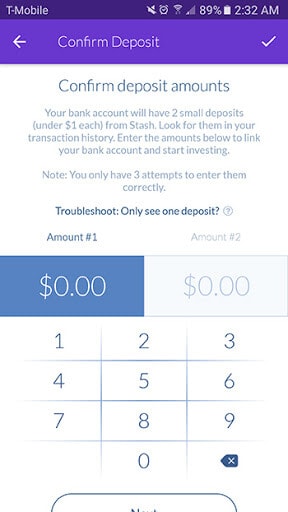

Step 4: Fund your account

You will then be required to connect your bank account with your Stash account to be able to ake investments and most importantly, to make a deposit. The bank account you connect will also be the one you will receive your withdrawals on.

Step 5: KYC & Verification

You will now be asked to provide proof of your identity and to create a PIN number. Make sure you make a note of it so that you don't lose it.

Step 6: Buy Stocks

You can then browse through the stocks available and decide which ones you want to invest on by just clicking on the stock you are interested in.

How to Buy Stocks Outside the U.S.

If you are located outside of the U.S., Plus500 is your best option for buying stocks. It is known to be a remarkable broker for all kinds of users, both beginners and professionals thanks to its simple trading interface, that also contains more complex features and tools for who knows how to use them. For instance, if you qualify as a professional trader, you will be able to raise your leverage levels, which beginner traders are not allowed to do due to an increase in risks. Here is our tutorial on how to start investing in stocks on Plus500.

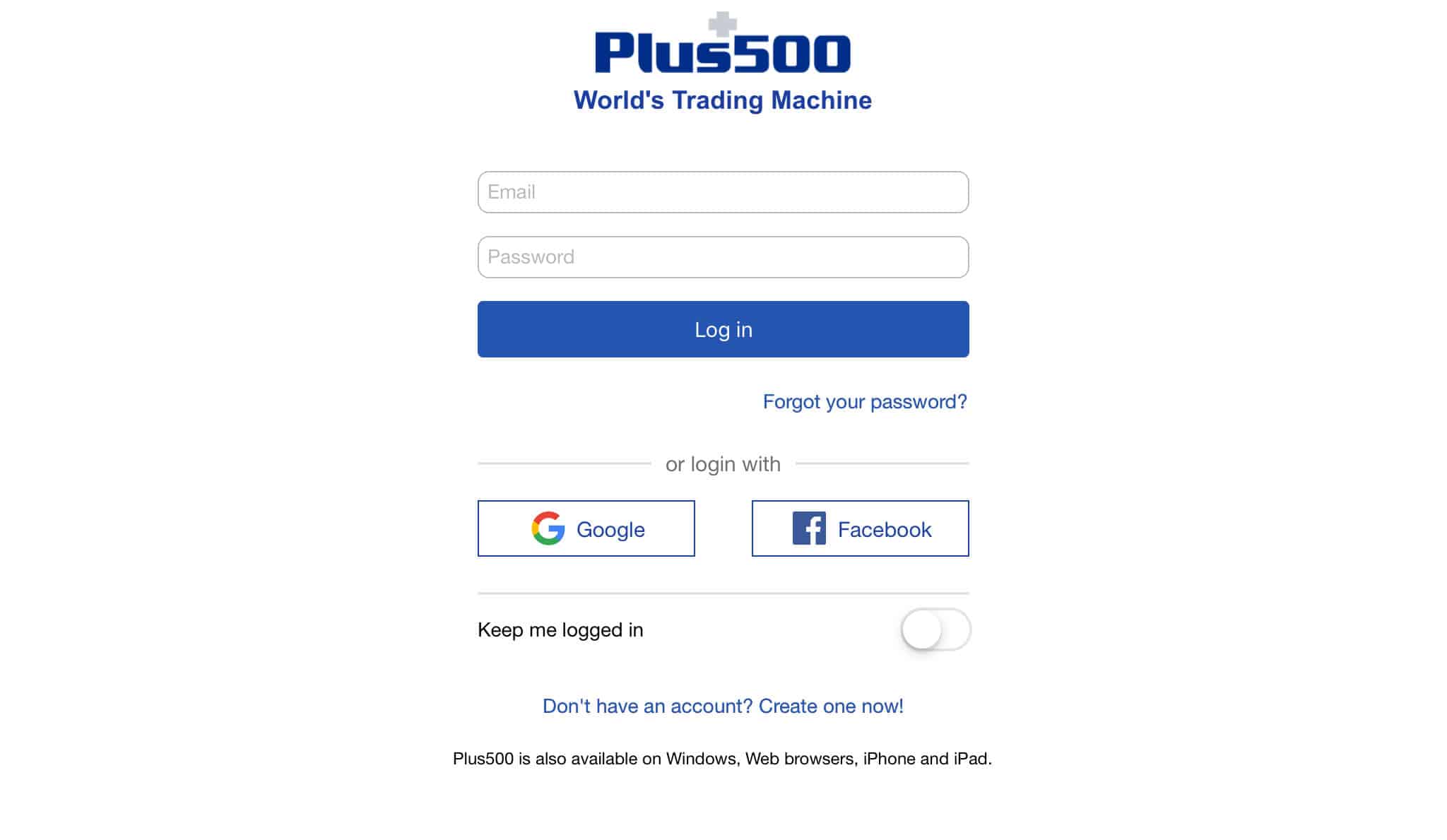

Step 1: Sign up to Plus500

The first thing you have to do to start investing on Plus500 is to register on it. You may also download the mobile app and register on there if you intend to trade on the go as well as on your desktop. You may then decide whether you first want to trade in demo mode or live and as soon as you’ve completed your registration, you will be given access to the trading space. Before you actually can start trading though, you will be required to answer a few questions about your trading experience.

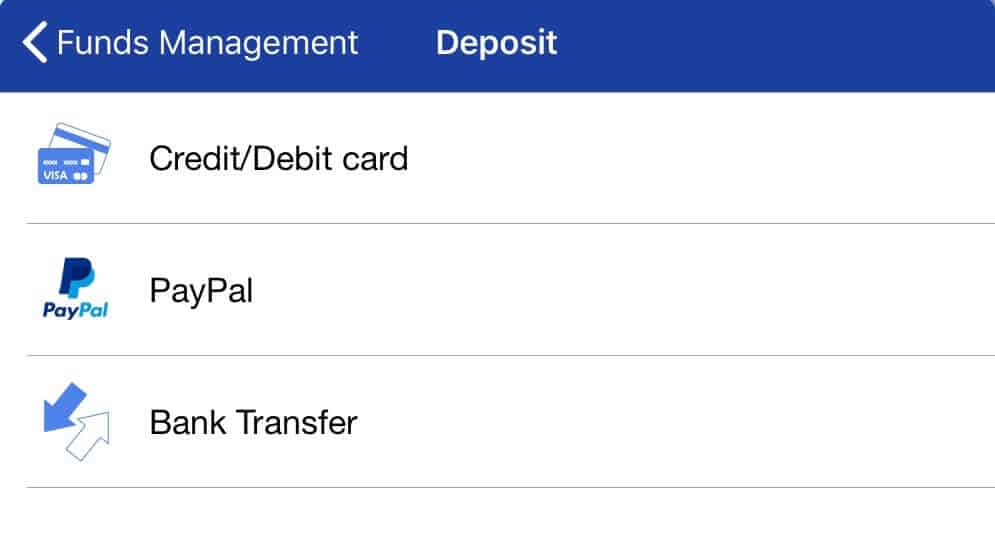

Step 2: Fund your account

When you are ready to start trading on Plus500, you will have to make your deposit. You can pay via credit or debit card, as well as PayPal and bank transfers. Choose whichever one you prefer, insert the amount you want to deposit and complete the payment.

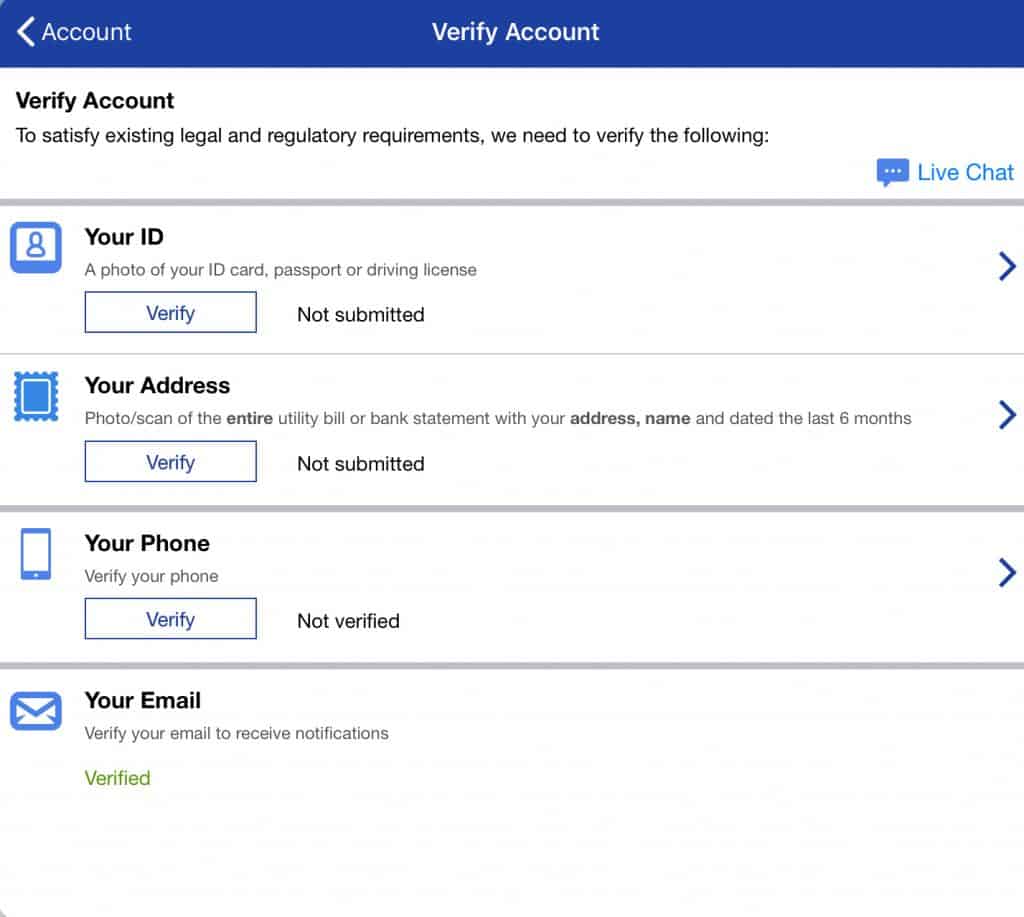

Step 3: Verify your identity

To be able to verify your account, you will have to provide proof of identity as well as a utility bill.

Step 4: Buy Stocks

Buying stocks on Plus500 is just as simple as everything else. All you have to do is go on the trading space and look for the stock you are interested in the asset list. Once you select a stock, you will see all sorts of information on it, including its price fluctuation, its spread, leverage, margin and much more.

You can then decide whether to buy or sell shares just by clicking on the respective buttons once you select the stock you want to invest on.

80.6% of retail CFD accounts lose money

What Are Stocks and What is a Stock Market?

When you buy stocks, you become the owner of shares in a corporation. As an owner, you have voting rights and a share in any dividends paid. In exchange, a company receives capital to run its business. If the company’s revenues and earnings are increasing, you will also make money as the stock price rises. When the stock price rises above the amount paid, you make an investment gain. When the price falls below the price paid, you realize a loss. Dividend paying stocks make regular dividend payments, providing a steady income stream.

The stock market is where buyers and sellers trade stocks of public corporations.

How Is the Value of a Stock Calculated?

In 2018, Apple (APPL) became the first stock to have a value of one trillion dollars. What does that mean? The market value of a stock is calculated by multiplying the current price by the number of shares outstanding.

Market Value = APPL Stock Price x Shares Outstanding

$207.05 x 4,829,926,000 = $1 Trillion+

What type of stocks can I buy?

The wide choice of different types of stocks allows the investor to build a custom portfolio to match investment goals. When choosing stocks to buy, start by determining your risk profile. Most online brokers and robo-advisors provide free risk assessments.

1.Income stocks

On the low end of the risk spectrum is the individual close to retirement. The retiree's portfolio has a higher allocation of cash, bonds and low risk stocks. The lowest risk stocks are known as the blue chip stocks. These large companies have a long history of delivering consistent revenue and earnings growth while paying a steady and increasing dividend. Because they pay steady quarterly income in the form of dividends, they are called income stocks. You will not get rich overnight, but over the long-term income stocks have created more value for investors than high growth stocks.

2. Value stocks

Value stocks are stocks with financial strength – a solid track record of earnings and revenues growth – that are trading at a low price-to-earnings multiple. The low stock valuation is due to a temporary situation typically unrelated to the core financial strength of the business. For example, a decline in the broader stock market, unexpected shortage of semiconductor chips, or failure of a new product line may cause a stock to temporarily decline below its long-term expected value. This situation provides an opportunity for the investor to buy the stock at bargain prices in anticipation of profiting as the stock’s value increases.

3. Growth stocks

On the higher end of the risk spectrum is the millennial. He makes $100k a year, has little or no debt and several decades to save for retirement. He may decide to allocate part of his portfolio to high growth publicly listed companies. The high growth company is growing revenues at a higher rate than average and has a high price-to-earnings ratio. The company reinvests earnings back into the company’s growth instead of paying dividends. Marijuana stocks are examples of high growth stocks. As states deregulate marijuana use, sales of marijuana are growing at more than 30 percent annually.

Penny stocks are considered very high risk high growth stocks. Penny stocks are public companies that trade at a low price (under $5) and do not meet the strict standards to list on a large exchange. Investing in penny stocks is considered speculative investing because they have a high rate of bankruptcy and scams.

Before you invest in any stock, take time to learn about the business. Remember the rule of the most successful value investor Warren Buffett – invest in companies you know and whose products you may use. Not all marijuana stocks are alike. Medical marijuana companies, for example, are licensed to sell products in many US states whereas the recreational marijuana market faces higher regulatory and market risk. No matter which type of stock you choose, you can lower your risk by doing your stock research.

Pricing of a stock

Stockholders are concerned with the stock price. The stock price is determined by the demand by buyers and supply by sellers (where the bid and ask prices meet).

A stock price can be influenced by wider market trends. Sometimes a stock price will be undervalued and other times overvalued by the market. So besides the market value, you will also want to know the true intrinsic value (book value = assets — liabilities) of the company. If the company were to go bankrupt, after paying all the debts and selling the assets, how much would be left over to pay investors?

How to value a stock

How can you assess if a stock will gain in value in the future?

How can you assess if a stock will gain in value in the future?

Many factors affect the revenues and earnings growth of a company and thus the stock price, including internal management, business competition and economic growth.

Therefore, you can never forecast a stock price with 100% certainty.

To estimate a stock’s value, we look at the stock price and related valuation measures. The most commonly used stock performance measures are the price to earnings ratio (P/E ratio) and price to book value ratio (P/B ratio). These measures are used to compare a stock’s current performance to its past performance , as well as the performance of other stocks and stock indexes.

The longer a stock’s history the more accurate a price forecast can be made based on past performance. Johnson & Johnson, for example, has increased its dividend every year since 1963. A consistent dividend payout is an indicator that a company is operating efficiently. This past performance is an indication, but not a guarantee, that the stock will do well in the future.

You also need to consider qualitative factors, such as general business conditions. If a pharmaceutical company gains 60 percent of sales from a drug patent that is about to expire, you will want to know what new drugs are in the pipeline.

Why Should I Invest in the Stock Market?

Stock returns rode a slippery slope downward in the latter half of 2018. Some stock investors withdrew their money from the stock market, while other investors have continued to pour money into stocks. What do these investors know? These are among the many good reasons to invest in the stock market.

1. Compound annual returns

Investors place money in the stock market to grow their wealth. The secret to grow your wealth is the power of compound annual returns. Compound returns are the annualized returns of your investment gains and losses. If you place $1,000 in a savings account, at a 2 percent interest rate, you will have $1,020 in a year. Compounded that $1,020 will equal $1,040.40 in two years.2.

2. The risk-return trade-off

Picking the winning investment sector each year is not an easy task, and it is seldom the same sector two years in a row. But whatever your investment level, one sure bet is stocks. That’s because among all the investment asset classes stocks provide the best risk-return trade-off. The risk-return trade off states that the higher the return the higher the risk. One measure of risk is beta. Beta measures the volatility of a stock relative to the market volatility of 1. Stocks provide a similar return as REITS while assuming a much lower price risk.

Asset Beta 10-year Return

- Stocks* 1.00 10.5%

- Bonds 1.00 2.7%

- REITS 1.33 11%

*This beta score refers to the overall stock market. E-commerce giants Alibaba (BABA) and Amazon (AMZN) have betas over 1.7 whereas Starbucks (SBUK) and Estée Lauder (EL) have betas below 0.50.

3. Diversification

Not all stocks were in the red in 2018. A number of stock funds investing in the NASDAQ-100, technology, internet, and oil drilling equipment had high returns. These are cyclical stocks that grow when the economy is growing. One way to diversify a portfolio is to invest in stocks that are both cyclical and non-cyclical. Cyclical stocks like smartphones and restaurants do well when the economy is growing. Non-cyclical stocks like food and utilities outperform when economic growth is slow because investors divert their money to industries that sell necessities people always need.

4. Passive investments

Passive investors place their money in ETFs, indices and mutual funds for the long term. As the markets continue on their roller coaster ride from year to year, the passive investor can sit back and relax. Eventually, the volatility will smooth out and deliver higher average annual returns than active investment funds. Only 38 percent of active funds beat passive funds in 2018 (WSJ.com). Passive funds are higher yielding and charge much lower fees.

How Much Do I Need to Invest in Stocks?

An investor used to need $500–$1,000 to start investing in the stock market or mutual funds. Today, you can start investing for as little as $5 on your smartphone. Online investing has eliminated the high operating costs of stock trading and fringe benefits like an investment advisor or broker. With low and no fee online brokerages like Markets.com and Ally Invest, you can invest a small amount and still make a profit trading. If you do want to use a broker or consult an investment advisor, many brokers offer these services for an additional fee.

Put another way, how much of your income can you afford to invest? As a rule of thumb, 10 percent of your income is the recommended amount. New investors may want to start out with 5 percent.

How Much Money Can I Expect to Make From Stocks?

The historical returns of stock indexes can provide an indication, but not a guarantee, of future returns. The S&P 500 index is one of the most referenced investment benchmarks. The index is comprised of the 500 largest US public companies by market capitalization. The aggregate market cap, $9.9 trillion, covers 80 percent of total stock market capitalization. The annualized return of the S&P 500 index over the past 10 years was 11.6 or 13.9 percent with dividends invested. Examples of major benchmark indices include:

FTSE 100

FTSE Small Cap Index

Nasdaq 500

Dow Jones Industrial Average

Dow Jones Sustainability Index

S&P 500 Dividend Aristocrats Index

How to Make Money Buying Stocks

New investors may be asking, why invest in stocks? Savings accounts provide a guaranteed annual return. Since stock market prices fluctuate, you assume the risk of selling your stocks for less than you paid for them. Unlike savings accounts or treasury bonds, stocks provide the potential to profit from the underlying stock price appreciation and dividend income.

1. Share price growth

Past performance is not an indication of future investment performance. Generally, though, the return of investment assets over time can provide an indication of future returns. Over the last 10 years, investors have earned a 11.6 percent return on stocks. Savings accounts currently pay a dismal 1–2.5 percent interest rate. Treasury bonds, another safe bet, pay about 2.5 percent. And keep in mind stocks have the same market risk as treasury bonds of 1. Stocks provide an investor with the most attractive returns for the risk taken.

2. Dividends

Dividend-paying stocks provide a steady income stream. As mentioned, the annualized return of the S&P 500 index over 10 years with dividends reinvested increases by 1.7 percent to 13.9 percent. That may seem like a measly increase but not when you consider the power of compound annual returns. The return on a $10,000 investment in 2009 would increase by $6,781.69 to $36,748.30 with dividends reinvested.

3. Buy stock at a discount

Here’s how to buy stock at a discount. A stock that is undervalued relative to its industry group has a greater potential to appreciate in value. The most popular metric for valuing whether a stock is undervalued or overvalued is the price-to-earnings (P/E ratio). The P/E is calculated by dividing a stock’s price by its earnings per share (EPS). EPS is a measure of the amount of the profits earned per share.

Let’s take a look at the value of NVIDIA (NVDA]. The semiconductor maker of powerful chips used in gaming, graphic design and scientific research is facing high demand for its AI-enabled chips. The NVDA price-to-earnings (PE) ratio of 29.6 is well below the semiconductor industry average of 50. As an undervalued stock with high sales growth potential, it could be a good time to buy NVIDIA stock.

Buying Stocks vs Trading Stocks with CFDs

CFD trading is like stock trading but instead of owning the stock outright, the trader buys a contract for differences (CFD) from a broker. The seller and buyer enter into a contract and settle on the difference between the buy and sell price.

Like a stock trade, the trader sets buy and stop limits and places a trade. CFDs are traded on margin and allow the trader to take higher leverage than a margin trade on a stock. An investor can easily take a long or short position in a CFD trade since the CFD allows you to trade assets you do not own.

Short selling involves borrowing shares, selling them at the market price, and then repurchasing them at a lower price and returning the borrowed shares. Like any loan, you will be required to pay back the loan plus interest. If the stock price falls, you will profit. If the stock price rises and you have to buy them back at a higher price, you will lose the difference between what you sold and bought the shares for, plus the interest on the margin loan. When the stock market was declining in 2018, for example, many investors chose to short stocks.

Do I Get Taxed on Profits?

Investors are required to pay capital gains tax on the profits (gains) from selling shares, or any other investment asset that has increased in value (e.g., real estate, art). If you buy Apple stock x10 at $180 and sell them at $200, you would pay tax on the $200 profit.

The capital gains tax varies between 0% and 20% depending on your tax bracket. A high income earner would pay a higher capital gains tax than a low income earner. If you buy Amazon stocks for your sister, you are required to pay capital gains tax when gifting assets.

Capital gains tax is not paid on:

- Gains below your taxable allowance (£12,000 in the UK)

- Gifts to a charity or spouse

- Shares in retirement plans (ISA or PEP in the UK, 401ks or IRAs in the US)

- Dividends, which are tax free

But what about losses? Capital losses (minus the gains) can be deducted from your tax return up to a limit. Beyond the limit, losses can be carried over to the next tax year.

How Many Stocks Should I Invest In?

More important than how many stocks you own is the diversification of your stock portfolio. Start by deciding which type of stocks to buy based on:

1. Your investment goals

Do you want steady-income payers to save for retirement or a bit of oomph to boost your returns? Take another gander at the Income, Value and Growth investing objectives above.

2. Diversification

Never put all your eggs in one basket is a cardinal rule of investing. A portfolio of five stocks diversified across sectors, geography and company size (small, mid and large cap stocks) is more likely to provide a long-term stable return than 10 stocks in high growth technology companies.

3. Risk profile

Those 10 high growth stocks may be in a hot sector that could be obsolete in 10 years. If you are saving for long-term retirement, you would be better off investing in blue chip companies.

Investment advisors recommend between 10–30 stocks. Do not go on a shopping spree and buy 30 stocks tomorrow. Do your stock research and gradually build up a diversified portfolio.

How Do I Sell My Shares?

Timing is everything. When you sell a stock will determine whether you make a profit, take a loss, or breakeven. Understanding the different types of orders can give you more precise control over your trade outcomes. If there is a market sell off, you can be out of the market before the rest of the crowd. Here’s how to invest in stocks while reducing your downside risk.

Market Order

Selling at the market price is the fastest way to execute a trade. When you press sell, you are accepting the current lowest market price. But faster than you can blink, that price can fluctuate. The price can change from the time you click sell to the time the order is filled. The fastest exchanges today buy and sell stocks in under 20 microseconds. If your trade is completed in 100 microseconds, other orders will be executed first. The trade speed is of greatest concern to the day trader and high frequency trader who buy stocks and then sell them immediately for short-term profits.

Place a market order if you are willing to sell at any price.

Limit Order

A Limit Order provides more certainty that your trade will be filled at your requested price. After placing a Limit Order on your online broker screen or directly with a broker, you can go golfing for the day. When the price hits your target price, your Sell Limit Order will be filled at your price or better.

Place a Limit Order if you want to sell at a specific price but are willing to hold onto the stock if your price is not hit.

Stop (Stop-Loss) Order

A Stop-Loss Order is a way of protecting against downside risk. If your risk tolerance is no more than a 10 percent loss, then set the Stop-Loss at 10 percent. If you buy a stock at 100, when the price falls to 90, your trade will be executed. The trade then becomes a market order so it may execute at a different price.

Place a Stop-Loss as insurance your trade will be executed within your risk parameters.

Trailing Stop-Loss

The Trailing Stop-Loss is the trader’s personal line of defence. Let’s say the Trailing Stop is set at 10 percent. When the price rises to 107, the Trailing Stop follows and stops at 97. If the price then declines past 97 to 90, your trade is ‘stopped out’ at 97. Your loss is 3 rather than 10 points. Keep in mind this is a market order so the price could slip to, say, 96 before it is filled. But because the Stop-Loss has your back, you have still limited your losses.

Place a Trailing Stop-Loss if you want to limit your losses if your trade turns against you.

Stop-Limit Order

Together, the Stop-Loss Order and Limit Order allow the trader more assurance of selling at the preferred price. To execute this dashing duo enter both a Stop Price and Limit Price. If the Stop Price is set at 96 and the Limit Price at 94, when the price falls below 96, the order becomes a Limit Order to execute at 94 or better.

Place a Stop-Limit Order if you want more precise control, but not a guarantee, of selling at your preferred price.

When deciding how to buy stocks, keep in mind that when using a Market Order, you are more apt to trade on emotion – the number one reason traders lose money! Stop Loss and Limit Orders instil discipline in your trading and disciplined traders are more successful traders.

Should I Buy Stocks Online or Through a Broker?

Benefits of Buying Shares Through an Online Broker

Most investors buy stocks through a broker. A broker acts as a matchmaker between the buyer and seller. Online stock brokers provide a number of advantages over traditional brokers, including:

✅ Trade anywhere - More and more investors trade on mobile devices. You can trade while waiting for a bus, during the opening act of the Verdi opera, or in the elevator on the way to work.

✅ Low or no fees - Though online brokers do charge fees, they are significantly cheaper than those charged by traditional brokers. Many individual investors can access all the trading tools they need from a discount broker. Brokers offer different levels of account services to meet the needs of different investment styles

✅ Instant trade execution - Trading on market news was impossible in the old days when investors would buy shares in a company by telephone. Today, as soon as the news is released, you can place an order with a click of a mouse.

✅ Many investment securities - Online brokers make it easy to diversify a stock portfolio across asset classes. The inverse correlation of bonds and CDs or higher risk currencies and commodities, hedging with futures and options and diversified ETFs and mutual funds all provide ways to hedge stock price movements.

✅ Stock trading research, price charts and technical indicators - Basic accounts provide access to basic fundamental research, technical analysis tools and order execution.

Benefits of Buying Stocks Through Traditional Brokerage Services

Buying stocks through a traditional brokerage service is a more time-consuming and expensive process. Consider a traditional broker if you seek:

☑️ Regular investment guidance - An active broker may call you up to introduce an interesting new stock or mutual fund. Or he may suggest it is time to rebalance your portfolio.

☑️ Financial advice - A financial advisor provides guidance on portfolio allocation, tax planning, and retirement and insurance products.

☑️ Wealth management advice - A wealth manager will guide you on accounting and taxes, estate planning, and family office planning – and may even provide you with concierge services.

☑️ Face-to-face meetings - After meeting to open your account, brokers typically request quarterly meetings to review your investment performance and introduce you to new products.

☑️ An investment risk assessment - The broker will determine your investment risk profile. For a retiree, for example, a broker may suggest a higher allocation in cash, bonds and value rather than growth stocks. Whereas a millennial may also dabble in real estate, currencies and commodities, and REITs.

☑️ Portfolio rebalancing - Annually or as market conditions change, your broker will rebalance your portfolio.

Brokers work on commission. All of the above services provide an opportunity for the broker to introduce you to new investment products and services. Many online brokers offer premium clients all or some of these services.

Check your monthly statements to ensure all orders were executed in a timely manner and the correct fees charged.

Common broker practices to be on guard for include:

❗️Charging hidden fees

❗️Selling in-house products when other products would have provided a better risk-return tradeoff for the client

❗️Recommending preferred mutual funds, ETFs, and other investment products in exchange for kickbacks (commissions)

How Do I Invest in Stocks Without a Broker?

Direct Stock Purchase

Companies, mostly blue chips, sell stocks directly to investors through direct stock purchase programs (DSPPs). Options include making a one-time purchase or payments deducted over six or more months. A low trading fee may be charged.

Pension Plan

Most employee pension plans offer a self-directed investment option. This allows the employee to choose their own stocks, mutual funds, ETFs and other securities. These portfolios may be restricted to a universe of mutual funds or ETFs.

Which Stocks Should I Buy in 2021?

Beginning stock pickers can find stock-picking among a large number of listed companies challenging. Fortunately, based on past performance, the stock metrics that are an indicator of future performance are well known. They include steady revenues and earnings growth, and dividend payouts. The novice investors should choose stocks based on these and other strong fundamentals. These stocks are more likely to perform well even in a market downturn.

These 10 stocks are good examples of stocks with strong fundamentals that have delivered long-term value to shareholders.

Germany

Daimler

The diversified automotive manufacturer makes cars, vans, trucks and buses. Like many big auto firms, Daimler is making electric cars and trucks and will compete with market leader Tesla. The Germany company is the largest truck maker in the world and thirteenth in the car market. The US-China trade was has impacted international sales. The stock is currently undervalued, you can find out more about how to buy Tesla stocks here.

- Daimler has formed a $1 billion mobility services joint venture with BMW to provide electric car ride-hailing, parking and charging services.

- China’s Geely, which owns 10 percent of Daimler, is partnering with Daimler on an electric smart car for China.

- Its subsidiary Mercedes-Benz, maker of America’s favourite luxury car, is about to register its ninth year of record sales.

Bayer

Because you depend on this trusted aspirin brand when you have a headache or cold for relief and comfort, you should consider placing it in your portfolio. Like Merck and Pfizer, Bayer is a trusted pharmaceutical brand by consumers. Bayer consistently grows revenues and earnings, and thus is considered a safe stock.

- Strong sales from blood clot prevention drug Xarelto and retinal disease drug Eylea

- Half a dozen strong selling brands being launched in new international markets

- Leader in global crop science market, which is experiencing robust international growth

- Consumer health division has rebounded with strong Asian and Latin American growth

- Sales and profit growth forecasted across all business segments in 2021

BASF

This diversified chemicals company may not be a household name but its products are everywhere in our homes and offices. BASF operates in the chemicals, plastics, agricultural, oil and gas, and paper markets. Strong dividend growth in good times and bad has won loyal investors. The stock, hit by the China-led auto market slowdown, is trading at a two-year low. Here’s why it could be a long-term buy:

- Increased sales and efficiencies expected from $9 billion acquisition of Bayer ag science businesses, and buys in 3D printing and nylon markets

- Sale of construction, paper and water assets to focus on more profitable businesses

- Prices and volumes increased in 2018 in midst of global slowdown and China-US trade war

USA

Starbucks (SBUK)

If you do not have a Starbucks in your neighbourhood, you likely will soon. The world’s favourite coffee shop is opening up on hundreds of corners in China and India. Luxury goods companies Estée Lauder and Louis Vuitton are other examples of consumer brands with strong long-term growth prospects in emerging markets. The coffee house that started in Seattle in 1985 now has over 27,000 stores.

- With half of stores in the domestic US market, developing markets are a strong long-term growth engine

- Moving into dining cafes in China to capture rising middle class incomes

- The popular coffee chain has not been impacted by the US-China trade war in China

- Siren specialty group formed to drive growth in Roastery, Siren and bakery stores, including new 4-story Tokyo Roastery

Apple (APPL)

Apple, a widely held blue chip stock by investment funds, is one of the most popular consumer brands globally. Like other fund favorites Microsoft (MSFT) and Johnson & Johnson (JNJ), Apple pays a regular and growing dividend. Regular dividend payers are typically strong operators who consistently increase income.

- A recently launched deal with Alipay to provide interest free financing to Chinese iPhone buyers is expected to boost sales in the region

- The newest models of iPads, iPhones and iWatches will increase sales by the end of the year

- Services division sales grew 24 percent in 2018 as customers buy more music and apps from iTunes

- Healthy Mac sales have moved the PC maker into fourth global market position

Alphabet (GOOG)

Like other FAANG stocks, Facebook, Amazon, Apple, and Netflix (lean more about how to buy Netflix stocks), Google’s parent consistently reports strong revenue growth. These companies hoard their cash rather than pay dividends. This cash cushion has allowed Google to make acquisitions to ensure continued growth. Alphabet’s strong commitment to fostering an R&D culture will pay off in coming years.

- Revenues from the Waymo self-driving car could surpass those of the Internet ad spending business in five years

- Alphabet’s drone delivery service Wing and balloon Internet company Loon are ready for commercialization

- Investment in AI is creating more efficiency in Google’s $26 billion internet ad business

Advanced Micro Devices (AMD)

Advanced Micro Devices is a semiconductor company that makes chips for business and consumer computing devices. In the competitive graphics card business, AMD competes with NVIDIA and Intel. Amazon, Baidu and Microsoft are customers.

- AMD is ramping up production of graphic cards for gaming and cryptocurrency mining, two high growth markets.

- Chip makers of high-performance chips for gaming, cryptocurrency mining and other AMD markets have performed better than the overall sector.

- In the high growth cloud computing and data centre market, AMD is prepared to cruise past NVIDIA with a smaller, more powerful 7nm Radeon data centre GPU accelerator.

Merck (MRK)

Global pharmaceutical company Merck was the darling of the Dow in 2018. Global pharmaceutical company Merck was the darling of the Dow in 2018. A blockbuster lung cancer drug called Keytruda is expected to buoy revenues in coming years. The big pharma company is growing quickly through acquisitions having acquired a dozen companies in five years.

- The drug producing a more than 50 percent survival rate when used with chemo for non-small cell lung cancer (NSCLC) is becoming the standard treatment for NSCLC in the United States.

- The FDA product pipeline is full of late stage drugs awaiting regulatory approval. Over 34 drugs are in Phase II and III stage, 62 percent of which are cancer drugs.

- Merck creates value for shareholders through a regular and increasing dividend and stock buybacks. A $10 billion repurchase program is ongoing.

UK

Experian PLC (EXPN.L)

Experian is one of the big three global credit bureaus, together with Equifax and TransUnion. The company’s main business consumer credit services provides personal and business credit scores and reports. It also provides data analytics and marketing services. In identity theft protection services and insurance, this top three player provides advanced applications in mobile biometrics, voice recognition and facial ID.

- Online, P2P, micro-loans and other new forms of personal and business lending are driving strong demand for credit applications

- After expanding through acquisitions in Europe, North America, Asia, Africa and Latin America, analysts expect efficiencies and synergies across its acquired businesses to drive stronger revenue and earnings growth over the next five years.

- Experian pays a regular and growing dividend.

Tesco (TSCO)

Tesco, Britain’s largest retailer, is celebrating 100 years in business this year. The grocer has expanded into clothing and general merchandise and does $51 billion in annual sales. Tesco has double the UK sales of its closest competitors and also operates in Europe and Asia.

- After improving operating performance and reducing debt during the two-year retail sales lull, the leaner Tesco is well positioned for revenue and income growth.

- In the slower than expected holiday season the company registered stronger sales growth than its competitors.

- Tesco has partnered with the WWF to ensure its product ranges are sustainable and chef Jamie Oliver to help customers make healthier food choices.

- Tesco reinstated its dividend in 2017, after discontinuing it in 2014, a strong indication that the retailer views itself back on the road to long-term profitability.

AutoTrader Group PLC (AUTO)

Since this digital auto market went public in 2016, revenues, income and operating margins have been growing at a steady pace. Auto Trader is a vehicle marketplace where consumers buy cars, trucks, vans, motorcycles and farm machinery from dealers and private sellers. The Dublin-based company has become the number one site to trade cars. Buyers can also find car loans, insurance and related products.

- Revenues from vehicle advertising and display advertising from manufacturers, lenders, and insurers are growing

- The auto marketplace is benefitting from the trend towards buying cars through a monthly subscription. Auto buyers can search by monthly price on the AutoTrader site.

- As new car sales decline, an increase in demand for used cars is raising prices.

Ocado (OCDO)

Ocado operates in one of the fastest-growing segments of online retail – online grocery order and delivery. Six percent of UK households buy their groceries online versus 2 percent in the US. Amazon recently spent $1.4 billion on the acquisition of Whole Foods to enter the grocery business. Ocado is likely to lose its near-monopoly as more competition enters the UK market, but it is all good.

- Ocado is the parent of Ocado Technology, the maker of the robotics that operates Ocado’s efficient food fulfillment centers.

- Ocado is helping retailers move online by providing robotics, cloud, AI, and IoT technology, including Kroger, Morrisons, Claire and Fetch.

- Ocado has recently signed a deal to help put some of Kroger’s $122 billion in retail sales online and build robotic warehouses as part of Kroger’s plan to take on Amazon.

Carnival Corporation (CCL)

Carnival has become the world’s leading leisure travel company by investing heavily in providing a superior passenger experience. Its nine cruise lines hosted 12.4 million passengers in 2018. Twenty five percent of revenues come from non-ticket sales. They include air transportation, excursions, casinos, spas, and other amenities.

- Passenger capacity is expected to grow at a rate of 5.6% from 2018–2022.

- Carnival is building and putting afloat 22 new cruise ships by 2025.

- Its award winning OceanMedallion™ wearable device is one way it is improving operational efficiency. Guests can order services, settle payments, gain keyless access to rooms, and enjoy many other conveniences.

- Its second largest cruise line Princess Cruises – the number one cruise line in China, Taiwan, and Japan and other markets – has launched its first international ad campaign.

- Carnival pays a regular and rising dividend.

China

Alibaba (BABA-US)

Over 500 million people shopped on Alibaba’s Taobao (consumer-to-consumer) and Tmall (business-to-consumer) marketplaces in 2018. Both revenues and profits have been growing at close to 50 percent.

- As the middle class grows in China, Southeast Asia and elsewhere, Alibaba expects to gain one trillion customers by 2036.

- Digitization of its online platform (robots in packaging/delivery, chatbots in customer service) is driving e-commerce growth of 20-30 percent.

- Revenues are being diversified through the high growth Cloud and Entertainment and Media segments. Alibaba Pictures co-produced this year’s Oscars winner GreenBook. More movies are in the pipeline.

China Telecom (CHA-US)

All the users of Alibaba, Baidu (BADU), Sina Weibo (WB) and other Chinese e-commerce and social media players need mobile phones to access these services and China Telecom is supplying them. The state-owned company is number one in fixed-line telephone service and number three in mobiles.

- Mobile subscriber growth doubled in 2017 to 250 million.

- As 4G subscribership surpasses 1 billion, China Telecom is preparing for the roll-out of 5G networks.

- The smart home and cloud businesses are rapidly growing and increasing data usage.

- China Telecom is focused on expanding into other developing markets and is currently developing a network in the Philippines.

India

Infosys (INFY)

Infosys provides technology services and consulting worldwide. Revenues are diversified across industry sectors. The company is currently focused on geographic diversification. Over 80 percent of sales come from the United States and Europe. Infosys is focused on growth in the Asian region.

- Infosys is investing in expanding in high growth Asian and digital businesses.

- The company has formed joint ventures with Hitachi, Panasonic, and Pasona to create a digital procurements platform.

- A JV has been formed with Temasek in Southeast Asia to expand its cloud and AI services.

- After strong growth across industry segments, Infosys has increased its 2021 revenue forecast to 8.5–9%.

TATA Motors (TATA)

Tata Motors sells vehicles in 50 markets worldwide. In addition to low budget cars, the company sells trucks, utility vehicles and defense vehicles. The company recently entered the electric vehicle market. Though overall performance is down due to slower retail sales in China, Tata expects a strong rebound in China sales.

- Tata TIGOR Electric car has gained a first-mover advantage as India transitions to all electrical vehicles by 2030.

- New models have been introduced in best-selling Jaguar i-PACE and Range Rover Evoque lines, and the new Land Rover Defender will be launched in 2021.

- Forecasting future demand in China, Tata is developing sustainable dealer models in China, with a focus on promoting premium models.

Conclusion

Facing historically low-interest rates over the past decade, investors are well-advised to invest in stocks to seek higher returns. Online brokers make it easy to buy and sell stocks from your home. Keep in mind, though, that stocks can decline in value.

Lower your risk of loss by taking advantage of the wide variety of stocks and other securities offered by online brokers to build a diversified investment portfolio. Make good use of investment and trading education offered by online brokers. One of the best ways to develop your investment and trading skills is to follow top-performing traders through social trading and learn about different investment strategies.

Start with safe stocks with strong fundamentals. Make good use of your online broker’s research tools to conduct fundamental analysis. Remember to consider the intrinsic ‘true’ value of a stock, not only its market value.

As you become more comfortable trading and develop a diversified portfolio, you may choose to dedicate a larger allocation to higher risk stocks with the potential for higher returns. You can improve your risk-return profile by choosing a broker that matches your investment style.

FAQs

A take profit order is a limit order stating the price at which you want to close out an order. The shares will be automatically sold at this price. If the price of the stock rises, when it hits the take profit level, the trade is closed at a gain.

A stop-loss order is a limit order stating the price at which you want to close out an order. The shares will be automatically sold at this price. If the price of the stock declines, when it hits the take stop loss level, the trade is closed at a loss.

Many online brokers provide trading and investing in education. You may also choose from a wide of investing seminars. A benefit of signing up with a broker with good training and education resources is you can learn using the trading environment and tools you will be trading with.

Beginning investors sometimes confuse online trading with day trading. The day trader trades securities over a short time period (typically within a day) seeking to profit from small price movements. Both long-term investors and day traders use online brokers to buy and sell securities over the Internet.

A margin account is a loan from a brokerage that allows investors to invest more money than what is in their cash accounts. Instead of paying the full amount for a security from a cash account, the investor pays for part of the total purchase cost and borrows the rest. The investor has more purchasing power and can invest more. The margin loan is secured by the securities. If the securities that secure the margin loan fall in price, the investor will receive a ‘margin call’ to deposit the difference in the change in value.

All types of securities are traded online today. The average investor can invest in cash, bonds, equities, ETFs and mutual funds. An investor with a higher risk profile may choose a broker with access to REITS, currencies, commodities, preferred stock and debt securities. Alternative investments such as initial public offerings, limited partnerships, and hedge funds are sold directly to wealthy investors.

When you invest in any type of security, there is a risk of losing part or all of your investment. Before beginning investing, you should determine your risk profile to ensure you do not invest money you cannot afford to lose. Invest in stocks that match your risk profile. The Sharpe Ratio is a measure of the risk of a security relative to the return earned. Most stock profiles such as Yahoo Finance will provide you with the Sharpe Ratio so you do not have to be concerned with how to calculate it. For example, here is the Sharpe Ratio for three types of stock investments: S&P 500 - 1.0 This measure of risk-adjusted returns tells you how much a stock’s performance varies over time.

Social trading allows investors to copy the trading strategies of their peers.

The price-to-earnings ratio compares the stock price to the actual earnings of the company. The P/E ratio is calculated by dividing the stock price by the earnings per share (EPS).

The price-to-book ratio measures the intrinsic value or book value of a company. The P/B is calculated by dividing the book value (assets minus liabilities) by the number of shares outstanding. How do I use a Take Profit (T/P) limit order?

How do I use a Stop Loss (S/P) limit order?

How can I learn more about stock trading?

What is day trading?

What is a margin account?

What kinds of securities can I buy online?

What are the risks of stock trading?

What is social trading?

What is the Price-to-earnings (P/E) Ratio?

What is the Price-to-book (P/B) Ratio?