Nintendo (NTDOY) is a leading maker of video game consoles and video games. In a console market where the fight for market share is fiercer than the battles in a Super Smash Bros. game, Nintendo’s Switch has been overtaking the competition in sales growth. The game maker is now ramping up new game releases to play on Switch devices and finding new ways to monetize its Mario, Pokemon and other games enthralling gamers for decades. With a sharpened focus on its digital assets, Nintendo expects to widen margins and drive earnings growth.

If you want to invest in Nintendo as it leverages its valuable video game IP in new games, remakes, theme parks and movies, this guide will explain how to buy Nintendo stock, evaluate the best Nintendo stockbrokers, and assess how new console competition will affect the stock value.

On this Page:

Best U.S. Platform to Buy Nintendo Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in Nintendo and found the following broker to offer the best platform, lowest fees and most appealing bonus. Click the link below and get started with just $5 today.

Best Non-U.S. Platform to Buy Nintendo Shares

We found the following platform to be best-suited to traders outside the U.S. looking to invest in Nintendo, offering competitive spreads and 0% commissions. Click the link below to start trading Nintendo with this trusted, regulated broker.

How to buy Nintendo stocks

Although the process of signing up with a broker, depositing funds, and buying Nintendo stocks is super-easy, we’ve outlined a step-by-step guide for those of you that need a bit of help. We’ve opted to show you the process with the broker eToro as an example, but a similar process will apply to most brokers.

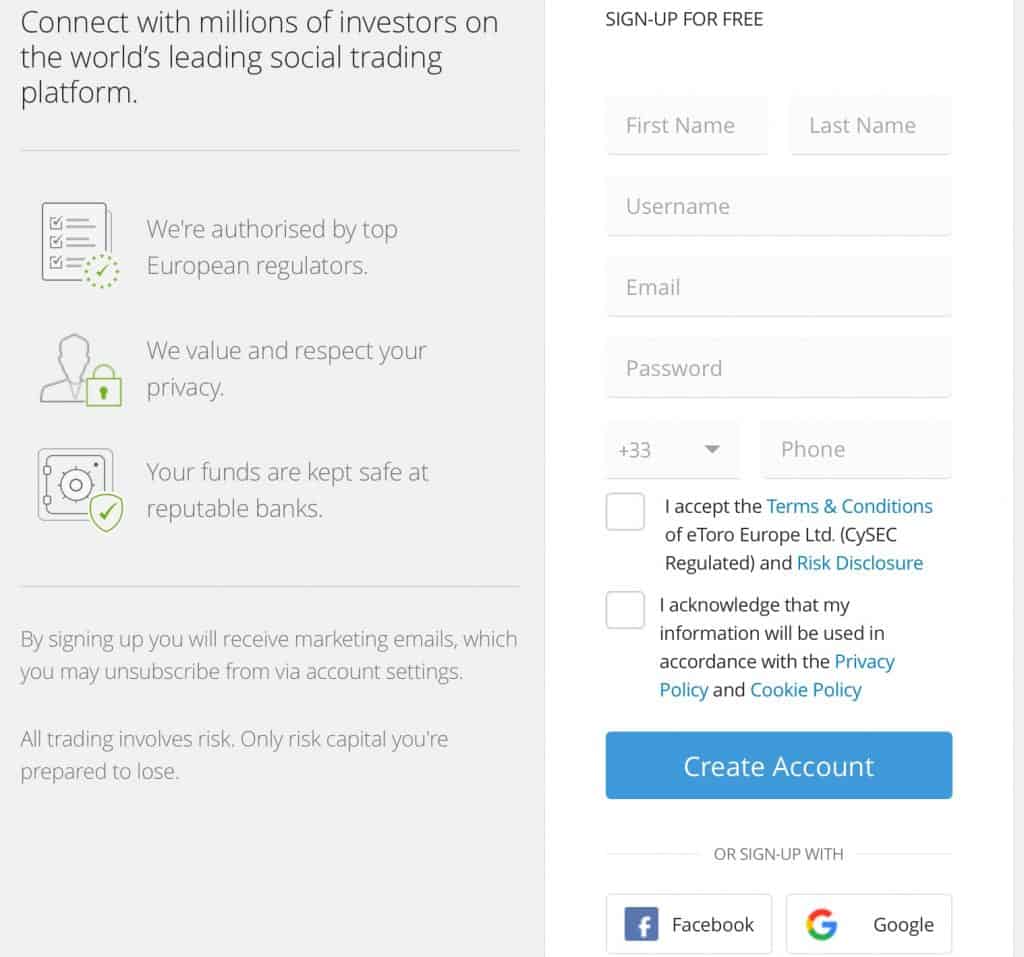

Step 1: Register your account with eToro

The first step to invest in NTDOY shares is to sign up to our recommended broker eToro. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile.

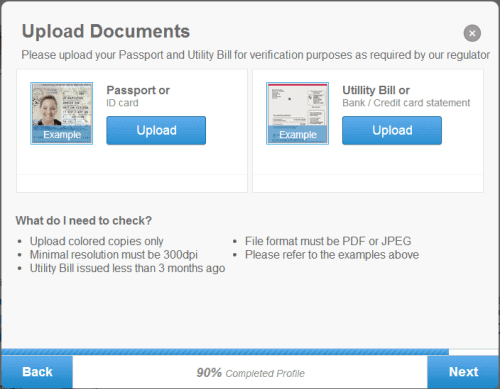

Step 2: Verify your identity

Attach and submit proof of identity for verification.

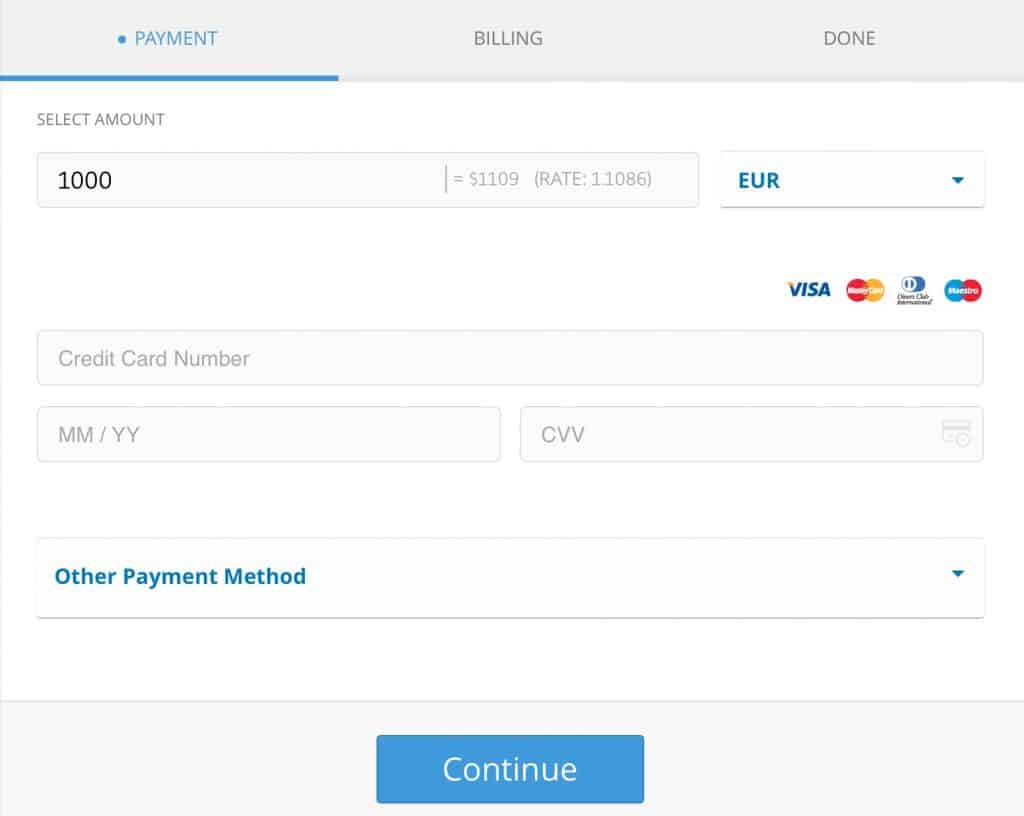

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

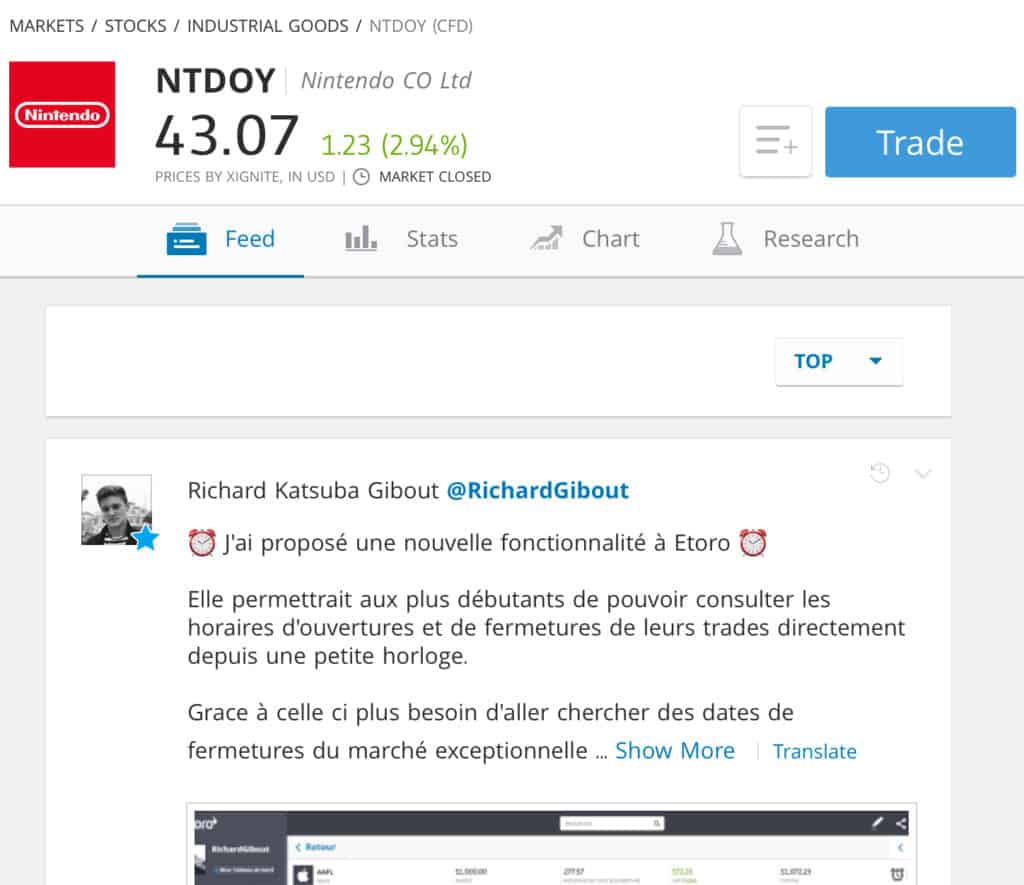

Step 4: Trade Nintendo stock

On eToro, you can invest in Nintendo through direct trading or social investing. Social investors can choose portfolios to copy based on performance and a risk score assigned to every trader portfolio on a scale of 1–6, 6 representing the highest risk. Following is an example of how to buy Nintendo stock.

Step 4A: Place a Nintendo stock trade

To buy NTDOY shares, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The NTDOY stock profile page provides social feeds, stats, charts and research. Social feeds provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

75% of retail CFD accounts lose money.

Nintendo Stock: Current Prices and Summary

NTDOY shares have a 5-year trailing return of 27.37, a tad brisker than that of the electronic gaming and multimedia sector at 20.55 percent. Returns are down this year -15.9 percent while the gaming sector has eked out a 0.17 percent gain for shareholders. The leading video game player maker reported earnings growth of 6 percent to $1.55 billion in the October-December quarter of 2019, slightly below expectations. From the end of January, the stock has fallen 17 percent to $42.20. The earnings shortfall, though, could be explained by an expected decline in 3DS platform sales – 3–4 percent of console sales – while Shift sales forecasts have been revised upward.

NTDOY has a price-to-earnings ratio of 27.19. In gaming consoles, the high diversification of Sony and Microsoft makes a comparison difficult. If you are seeking cheap stocks in the video gaming sector, some of Nintendo’s competitors have lower valuations, such as Electronic Arts (EA) at 11.2 and Chinese online game provider NetEase (NTES) at 14.6. But overall, Nintendo shares look slightly undervalued compared to those of the dynamic gaming industry. Actvision Blizzard (ATVI), Take-Two Interactive (TTWO) and the maker of Angry Birds Rovio (HEL: ROVIO) have a PE of 29.8, 37.2 and 21.3, respectively.

Looking forward, Nintendo analysts forecast growth of 5.9 percent in 2020 and 25 percent in 2021 (based on a March fiscal year end). When considering PE relative to earnings growth, Nintendo’s PEG ratio is 0.95 versus 2.3 and 2 for Activision Blizzard and Take-Two Interactive, respectively. With a PEG of less than 1, the stock is considered undervalued.

What can we expect for the stock price going forward? Analysts have a median Nintendo stock price forecast of $56.5 (high $64.9, low $38.8), a 34.6 percent premium over the current stock price of $41.98.

A Brief Overview of the History of Nintendo

Nintendo was founded as a playing card company by Fusajiro Yamauchi in Kyoto, Japan in 1889. In the 1970s, the company moved into electronics and the toy business before dedicating its efforts to the development of video games in the 1980s. In 1983, the Nintendo Entertainment System and Game Boy were introduced. Two-and-a-half decades later in console evolution the Nintendo DS (with touchscreen) and Wii (with Wifi) were developed. The Nintendo 3DS (3D display) and Wii U are still in the all-time highest sales league for video consoles. The game changer was the launch in 2016 of the hybrid Switch – a hybrid home-handheld device, which has been the fastest selling game console since its launch.

Alongside the hardware, in 1975, Nintendo began developing games for the arcade game industry. Super Mario Bros. began its ascent to currently being the best-selling game on home video consoles in the 1980s. By 1995, Nintendo had sold over one billion game cartridges. It then moved into 3G graphics by buying a stake in Rare. In the mid-2000s, Nintendo began producing its popular titles for mobile devices. Today, 30 percent of the most popular video games are produced by Nintendo.

Nintendo Stock: Current Prices and Summary

Nintendo’s decision to not release a Switch in 2020 is risky. Hardware comprises 96 percent of revenues, of which Switch represents 86 percent; and games 3.8 percent. However, our analysis of sales momentum and new console demand this year shows the Switch still has good shelf life. Management’s 2020 forecast is for revenues to grow 5 percent, operating income 8 percent, and earnings per share 7 percent to $2.25.

2020 – Mobile gaming

The slowdown in global gaming device sales in 2019 while the market awaits next generation game consoles from Sony and Microsoft could persist well into 2020. An exception is Nintendo Switch sales. Nintendo Switch is still beating its own sales records and its entry into China in December was a smash. The Switch, launched with Tencent, flew off the shelf over the holidays with 100,000 units sold and is on track to take the leading market position from PlayStation4 in 2022 (Niko Partners). As with other industries, the coronovirus has struck video gaming. Switch hardware and accessory sales in Japan, North America and Europe are expected to suffer from a components shortage from China. The outlook for Nintendo stock is low-to-median.

2021 – No new Switch

Nintendo disappointed gamers by announcing it would not introduce a new Switch in 2020. Instead, it has introduced the handheld Switch Lite. Since major competitors Sony and Microsoft do not plan to introduce their next gen models until the 2020 holiday season, the competition will intensify in 2021. With these new consoles running on higher performance chips, Nintendo may need a new model, itself, this year to keep gamers happy. Though below we speculate on why the new graphics chips, already released, may not be a large threat to Switch. The outlook for Nintendo stock is median-to-high.

2022 – Let the games begin

The $200 Switch Lite has created increased demand for video games, including the new Pokémon Sword and Shield, Mario Kart Deluxe, Super Smash Bros and other Mario titles. After being criticized for the slow release of new titles, Nintendo plans to ramp up the release of enhanced, new and third party games. China will be a major market for new titles. The expanded game library will help diversify revenues, expand margins, and increase profits. The outlook for Nintendo stock is median-to-high.

2023 – eSports monetization

As the value proposition in the eSports market increases, Nintendo is also committing more resources to marketing and sponsorship eSports games. Nintendo has only one title in the top 10 in eSports games – Smashing Brothers, previously eschewing the idea of giving competitors prize money to play. But the market has become too big for Nintendo to ignore. The top five games have paid out half a billion in prize money ($505.2B), with Dota 2 paying out the highest in awards, $221.6 million (Esports Earnings). Super Smash Bros. Melee is number 29 for game prizes at $3.1 million. The number of eSports gamers will grow at a 14 percent CAGR over five years to over 300 million – the size of the NFL audience. By 2022, advertising, sponsorship and related revenues will surpass $3 billion (Goldman Sachs). The esports-ready Switch’s successful entry into China with over 400 million gamers and one third of the future eSports market is a big opportunity. In North America, Nintendo is partnering with Battlefy to run Super Smash Bros Ultimate tournaments in 2020. The outlook for Nintendo stock is median-to-high.

2024 – Games on the fly – Mobile and cloud

Games played on mobile and the cloud will drive growth during this forecast period. Mobile games now comprise almost 50 percent of the games market. Console platforms and games will lose some market share to these virtual options. We expect Nintendo’s current 19 percent console market share to expand, particularly at the expense of Sony and Microsoft. Nintendo Switch’s ability to traverse both mobile and home markets while giving mobile gamers console-level hardware features will spur growth. The outlook for Nintendo stock is median-to-high.

Should you Invest in Nintendo?

The gaming market is anxiously awaiting next generation gaming consoles and the new gaming experience delivered by higher performing chips. As expected, hardware and software sales are declining as gamers become bored with their current toys. The Nintendo Switch is the exception. Gamers are enamoured with the hybrid gaming device. How will the Switch compete against these next generation devices? Since the 1970s, Nintendo has proven that it can not only compete but lead the market in gaming devices and software.

Pros of investing in Nintendo stock

Mobile is 45 percent of the gaming console market, followed by console (32%] and PC (23%).

Cons of investing in Nintendo

Conclusion

Should you buy Nintendo stock? Nintendo is busy adding new video games to keep Switch users amused. At current growth rates, by the end of the year when half a dozen competitors release new consoles, Switch could have many happy gamers glued to its popular video games.

If you want to buy stocks in Nintendo, we recommend doing so via a regulated online broker such as the ones below.

FAQs

If you are seeking to invest in gaming stocks with high earnings growth, in 2019, Nintendo’s earnings per share grew 779.7 percent to $0.65. Electronic Arts EPS also enjoyed snippety growth of 107.2 percent to $9.51. In comparison, the EPS of Take-Two Interactive ($2.96) and Activision Blizzard ($1.95) declined 7.79 and 17 percent, respectively.

Game revenues are currently less than 5 percent of Nintendo revenues. Video game makers enjoy wider profit margins. Nintendo’s current profit margin is 16 percent. In comparison, companies focusing mainly on video games, not consoles, have higher profit margins. TenCent (TCEHY), CapCom (TYP), Activision Blizzard, Netease (NTES) and Electronic Arts have profit margins in the 20+ percent range.

Short interest in NTDOY stock is low at 0.5. The short ratio has fallen from 1.8 in mid-2019 when the market reception of Switch Lite and Switch in China were unknown. Both launches generated higher than forecast sales volume.

Global X Video Games & Esports ETF (HERO), VanEck Vectors Video Gaming and eSports ETF (ESPO)

You can buy NTDOY shares from online stockbrokers such as eToro. eToro provides an intuitive trading platform that makes it easy to buy and sell stocks. After signing up online, type in the NTDOY ticker, place your order and you will become an owner of Nintendo shares. Which video gaming stocks are growing fast?

How will Nintendo’s expansion of its video game titles affect profitability?

Are short sellers shorting Nintendo?

Which ETFs have Nintendo as a top 10 holding?

Where and how can you buy Nintendo stock?