Few businesses will emerge unscathed from the COVID-19 pandemic, but the travel industry has suffered particularly badly. Like most travel companies, Royal Caribbean Cruises has been shuttered since March and its cruise ships won’t be setting sail any time soon. Inevitable, the impact on revenue has been severe and its stock price has taken a hammering. So, is now a good time to buy Royal Caribbean Stock?

It’s hard to look beyond the such an unprecedented setback, but some investors will be assessing Royal Caribbean’s revival prospects and wondering if now is a smart time to invest in its diminished stock.

Thinking of investing Royal Caribbean? This guide will explain how to buy Royal Caribbean stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Royal Caribbean Stock

If you want to buy Royal Caribbean stock, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is the best platform on which to buy RCL stock. If you’re inside the US or Canada, our top pick is Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

Widely known as one of the pioneers of social trading, eToro has developed into one of the world’s leading brokers in the last decade. This is largely in part due to its CopyTrader tool, which allows you to copy the portfolios the future traders of high performing traders.

The selection of markets is comprehensive, including stocks, indices, commodities currencies and crypto. When it comes to stock investing, you’ll find more than 800 tradeable stocks to invest in.

If you’re contemplating an investment in Royal Caribbean, it’s easy to open a long position and buy the underlying asset. Alternatively, you can trade RCL CFDs with up to 1:5 leverage.

eToro’s pricing is super competitive – there are no commission or stamp duty on stock purchases and the minimum deposit ($200) is relatively affordable. If you’re new to trading, or just new to eToro, you can get to grips with the$100,000 demo account before trading with real money.

With its smartly designed, easy to navigate UX and an interface that resembles popular social media platforms, eToro succeeds in creating a fluid, accessible trading experience that should suit both beginners and seasoned traders.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Royal Caribbean Stock? Points to Consider

It’s always best to do your research before you buy NCLH stock or other cruise assets like Norwegian Cruise Line stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Royal Caribbean Cruises business model and share price history

Unsurprisingly, Royal Caribbean announced bruising first quarter losses in May. The company reported a net loss of $1.44 billion, or $6.91 a share, which compares to a net income of $249.7 million, or $1.19 a share, in the same period last year. Revenue fell 17% to $2.03 billion, missing analyst targets.

Given the circumstances, such bracing figures are to be expected, like all cruise lines, Royal Caribbean has been forced to suspend its cruise operations since March. The question of when its ships can set sail again remains fraught with uncertainty.

Royal Caribbean, along with Carnival and Norwegian Cruise Line, is reported to be targeting a return to business in early August, although some consider this optimistic.

It’s likely that bookings will remain low throughout the rest of 2020, but investors have been encouraged by the company’s claim that 2021 bookings are ‘within historical ranges’.

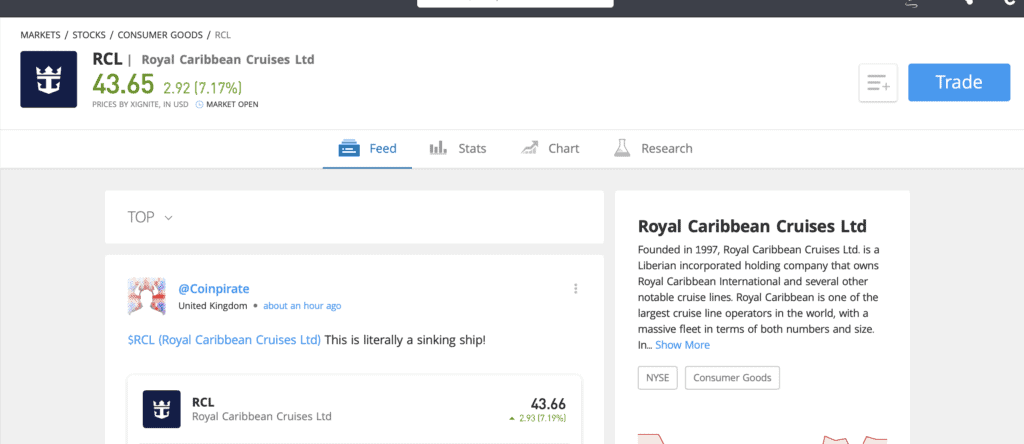

In fact, despite such poor quarterly results, RCL stock responded positively to the Q1 earnings report, rising 7.4% to $43.66 the next day. Analysts were also encouraged, hiking price-targets as high as $67.

Royal Caribbean Cruises stock dividend information

Royal Caribbean pays out 32.70% of its earnings out as a dividend, which amounts to an annual dividend of $3.12 per share with a dividend yield of 7.12%. The most recent quarterly payment was made to shareholders on April 6.

Royal Caribbean Cruises stock forecast and prediction

Royal Caribbean’s median 12-month target price according to CNN – based on 19 analyst forecasts – is $49.00, with a low target of $20.00 and a high target of $67.00. The median target represents an 11.64% increase on the current price of $43.89.

MarketBeat’s analyst ratings are more optimistic, reporting a median target of $86.59. However, the consensus rating in Hold.

How to Buy Royal Caribbean Stock on eToro

It’s quick and easy to invest in Royal Caribbean stock at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy Royal Caribbean Cruises stock.

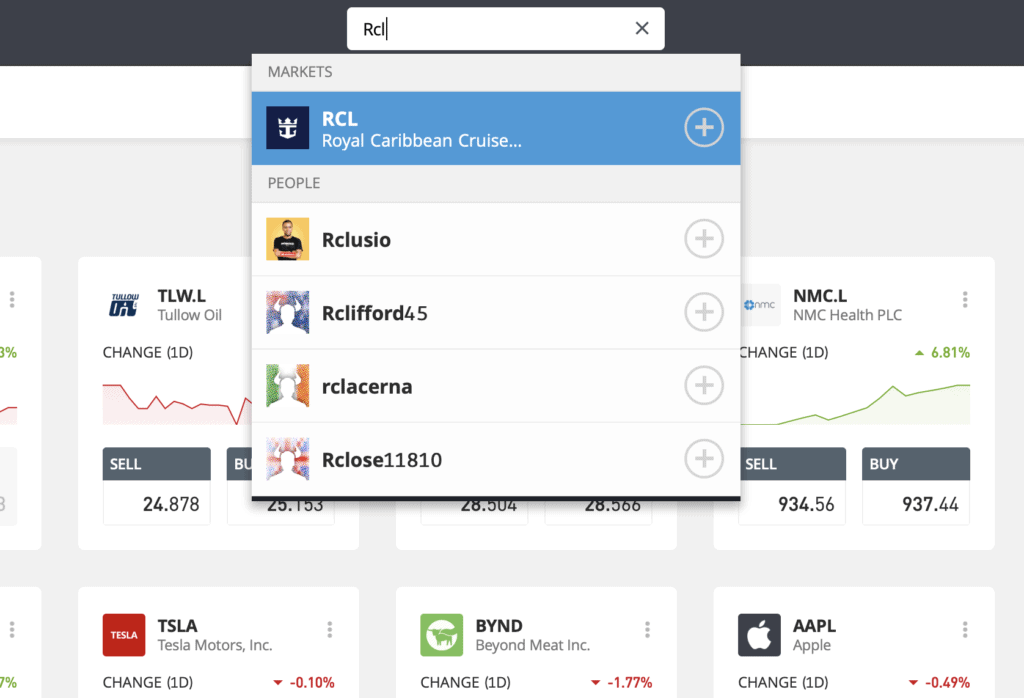

Step 1: Search for Royal Caribbean (RCL) Stock

Look up Royal Caribbean by typing the ticker symbol RCL into the search box.

Step 2: Click on trade

Click Trade in the top right corner of the Royal Caribbean Cruises page.

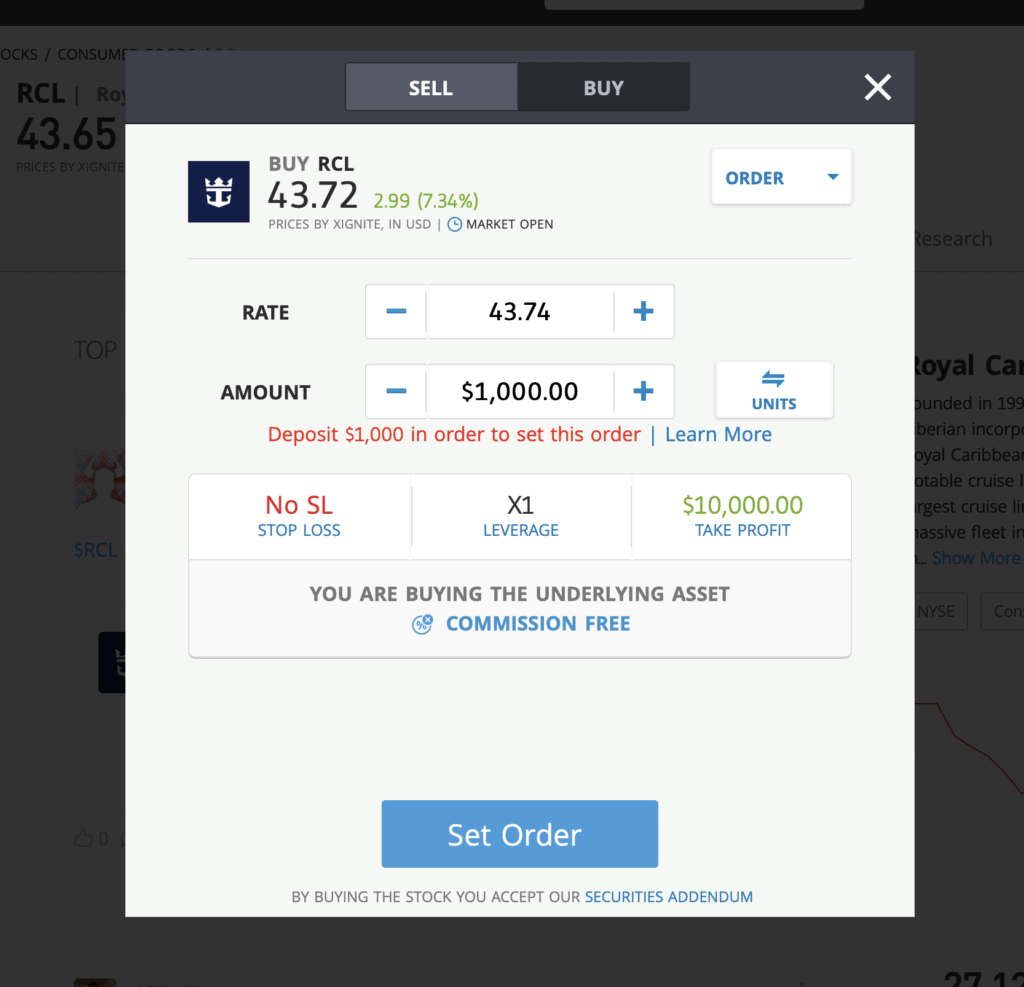

Step 3: Specify ‘Buy’

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade RCL CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Buying Royal Caribbean Stock – Final Thoughts

It certainly isn’t the safest time to invest in cruise line stock, but many regard Royal Caribbean as better equipped than its peers to manage pandemic losses and get back to business as usual. At present, the company is burning through $250 to $275 million per month but has somewhere in the region of $3.3 billion in liquidity to call on.

Having plummeted to a 67.2% year-to-date deficit, RCL stock has potential to rise in the short term, thanks largely to upgraded targets, but a full recovery will rely on solid evidence that business can resume sooner rather than later.

If you want to buy Royal Caribbean stock, we recommend registering with one of our recommended stockbrokers. eToro is our number one broker if you’re outside the US, while we suggest US traders go with Stash Invest.

FAQs

Should I buy Royal Caribbean stock or wait?

Some analysts rate RCL as a Buy but we’re inclined to advise caution while the cruise industry continues to face such an uncertain future.

What are the fees when buying Royal Caribbean stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy RCL stock.

Is there an RCL stock price prediction?

Analysts estimate a median 12-month forecast of $49.00, which represents a 11.64% increase on RCL’s current price of $43.89.

What does the Royal Caribbean stock dividend pay?

Royal Caribbean pay an annual dividend of $3.12 per share with a dividend yield of 7.12%.