As the chipmaker enters the next era of smarter, higher performance computing, this guide looks at how to assess NVIDIA’s future growth opportunities, value NVIDIA stock, and find the best NVIDIA stock brokers.

Should you invest in NVIDIA?

One way to invest in the scientists, technologists, and designers making advances in their fields is to invest in NVIDIA stock. The inventor of the GPU that creates the graphics used to conduct quantum science, animate action in gaming and design products in virtual reality has generated a 57 percent average return to shareholders over the last five years, leaving the semiconductor industry trailing behind at 17 percent.

As NVIDIA diversifies, the chipmaker provides a way to invest in several high growth industries. If you want to invest in the fast growing cloud computing space, you could buy Microsoft stock, or that of Google or Amazon – the top three players. Or you could invest in the NVIDIA chips that power cloud computing platforms. NVIDIA is also a way to invest in the emerging autonomous car industry. And in the $100 billion computer gaming industry, the preferred graphics chips is defending its leading market share with its new Turing architecture.

Pros of buying NVIDIA stock

Smashing Moore’s law

Moore’s law, the 50-year truism that chips will double every two years, has been slowing for years. Chipmakers are betting on design improvements to accelerate chip efficiency. Those design improvements are being made through 3D design powered by the very GPU chips NVIDIA invented. NVIDIA plans to upend Moore’s law by delivering an earth-shattering 1,000 x speed improvement by 2025.

Accelerating scientific discoveries

NVIDIA is expanding into data centres but not any data centres. AI will produce a tremendous volume of data. These chips not only handle high workloads, but importantly, learning workloads. Deep learning and machine learning create huge mounds of data as they self-learn while computing data.

Leading AI chip performance

In the near future, AI will be behind everything we do – from automatically percolating our first cup of coffee in the morning, to picking us at the doorstep in a self-driving car to projecting a 3D product image to global engineering teams through augmented reality. NVIDIA has the highest performing AI chips across new industry AI benchmark standards.

Cons of buying NVIDIA stock

Surviving the crypto bust

The sale of high end GPUs used in PCs declined 40 percent in 2018 over 2017 to $17 billion as the cryptocurrency mining boom went bust. New cryptocurrency mining methods require less computing performance. NVIDIA’s share of this market grew 6.9 percent to 81.2 percent in 2018 at the expense of competitor AMD. NVIDIA is diversifying into new premium and low-to-medium priced chips.

Upping investment in R&D

Research and development costs have been climbing 10 percent a year for the last three years. Sales expenses have risen at 20 percent a year over the same period. These rising expenses have led to a decrease in operating margins in 2019.

Riding a semiconductor down cycle

The cyclical semiconductor industry is in a down cycle, placing pressure on margins as NVIDIA invests in new capacity and products ahead of the rebound. For semiconductor makers with consistent revenues and earnings growth like NVIDIA, the semiconductor dip is an opportunity to buy the stock while it is undervalued. Similarly, it is a good time to buy buy Microsoft stock or other PC hardware and software makers at a discount. These stocks turn up before and lead the semiconductor upturn.

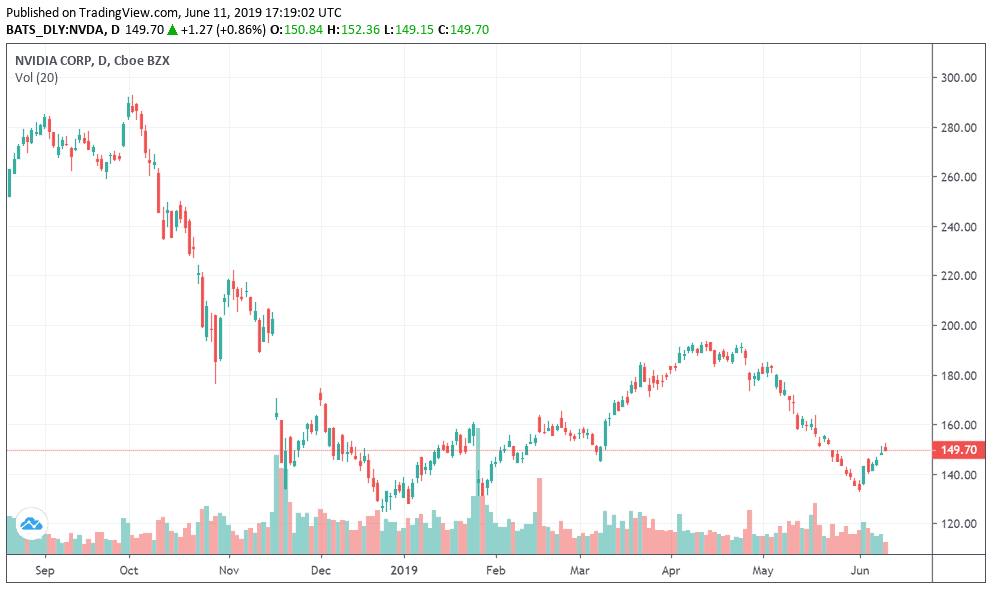

NVIDIA Stock: Current Prices and Summary

As NVIDIA stock absorbs the crypto mining boom and bust in the midst of a semiconductor industry downturn, it appears to be currently undervalued by the market. The NVDA price-to-earnings (PE) ratio of 29.6 is significantly below the semiconductor industry average of 50. Following five-year average earnings growth of 56.6 percent, analysts are forecasting growth in excess of 40 percent over the next two years. The stock decline of 25.8 percent over the last year, a steep drop from the three-year average return of 76.3 percent, looks like a good buy.

NVDA price quote

| Price | $ 170.93 | Daily high | $ 171.44 |

| Volume | 18963658 | Low | $ 169.50 |

| Variation | 12:51 | Opening | $ 169.71 |

| + / -% | 00:30% | Day before | $ 170.42 |

Best NVIDIA Stock Brokers

|

|

|

|

|

|

|

|

|

|

| Pros: |

|

|

|

|

| Cons: |

|

|

|

|

| Spreads | • Spreads from 2 pips • Flat fee on withdrawal | •Fees are built into spread. • Spread cost : 0.35 • Unregulated broker | • Spreads from 2 pips | •Fees are built into spread. • Spread cost : 2 pips |

| Number of stocks available | 4,000 | 2,500 | 1,500 | N/A |

| Financing rate | 8.9% | 7.9% | 13.9% | N/A |

| Visit broker | |

[button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/skilling" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] |

How to Buy NVIDIA Stock – Tutorial

How to buy NVIDIA Stock on Markets.com

The official online broker of the Arsenal Football Club provides all the basic tools and education a retail trader requires. markets.com is owned by Playtech, a public company listed on the London Stock Exchange. Like its PlaytechOne one wallet – the one account solution for playing on casino, poker, sports and other gaming sites – markets.com seeks to provide quick and easy access to a good range of investment products. If you are deciding whether to buy NVIDIA shares on markets.com, review these pros and consumer.

Pros

- Day traders

- Demo account

- Low commissions

- Good quality news flow

- Good set of analytical tools

Cons

- Limited order types

- Not many deposit options

- Customer services not very effective

- Unregulated broker

Start trading NVIDIA stock on markets.com

Step 1: Register your account

You will be prompted to download the markets.com mobile app to register. After filling in basic profile information, a brief questionnaire on investment experience and knowledge, as well as income and assets, will determine your trading level and leverage. 1:30 is the leverage for the average retail investor. So with a $500 deposit, you can trade up to $15,000.

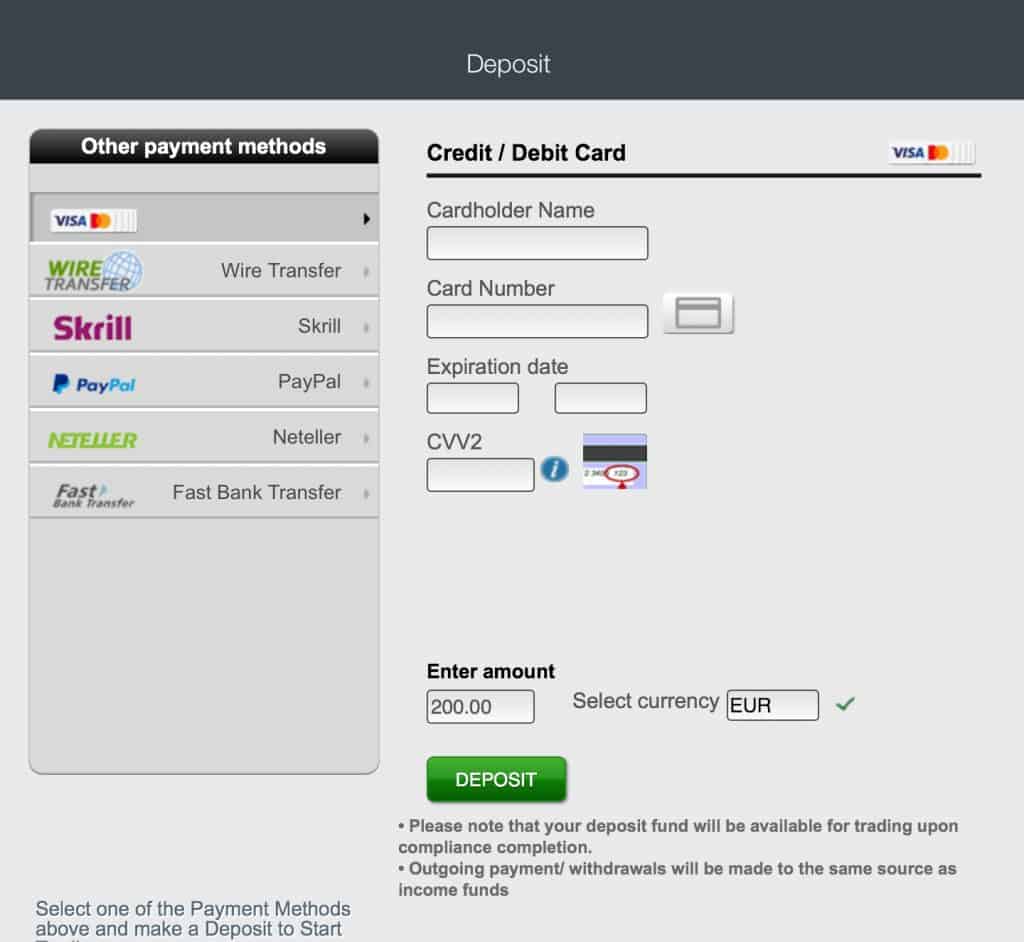

Step 2: Fund your account

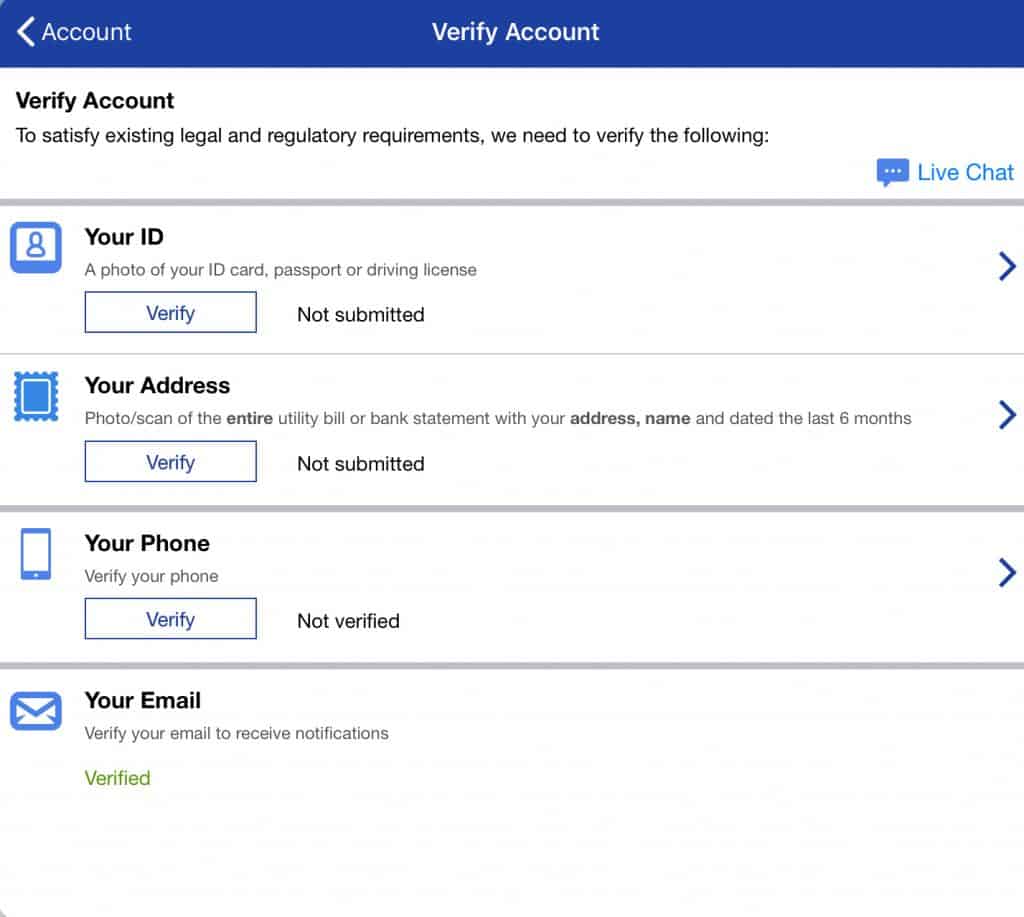

If depositing by credit card, you will need to first have it verified. Click on Verify Credit Card on the My Account Page.

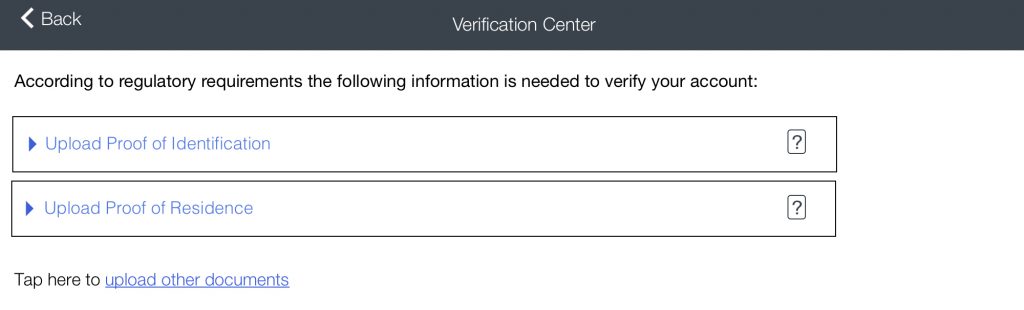

Step 3: Verify your identity

Attach and submit proof of identity and a utility bill for verification. Residents of the USA, Canada, Australia, Hong Kong, Japan and some other countries are restricted.

Step 4: Trade NVIDIA stock

On Markets.com, you can choose to invest in NVIDIA stock, or a wide range of ETFs and indexes with exposure to major technology stocks. Other securities include forex, cryptocurrencies (a handful of majors), bonds, blends, and grey markets in Uber and Lyft ahead of their IPOs. Trending Now displays a list of top moving stocks.

The NVIDIA stock profile provides basic stock price charting information and a market sentiment indicator. Place the trade by choosing the Buy or Sell button.

How to Buy/Sell NVIDIA CFD Stocks on plus500

Novice retail traders may find this platform lacks the trading interface, research tools and education they depend on for general guidance. The experienced trader with their own tools, stock data and news will be at home with the simple, intuitive interface and over 100 technical indicators. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 for stock trades. If you are deciding whether to trade NVIDIA CFD shares on Plus500, review these pros and cons.

Pros

- FCA regulated

- Listed on the LSE

- Easy to use platform

- Great mobile platform

- High order volume

Cons

- Experienced traders only (no fundamental data)

- Only CFD trading

- High financing rates

- No scalping allowed

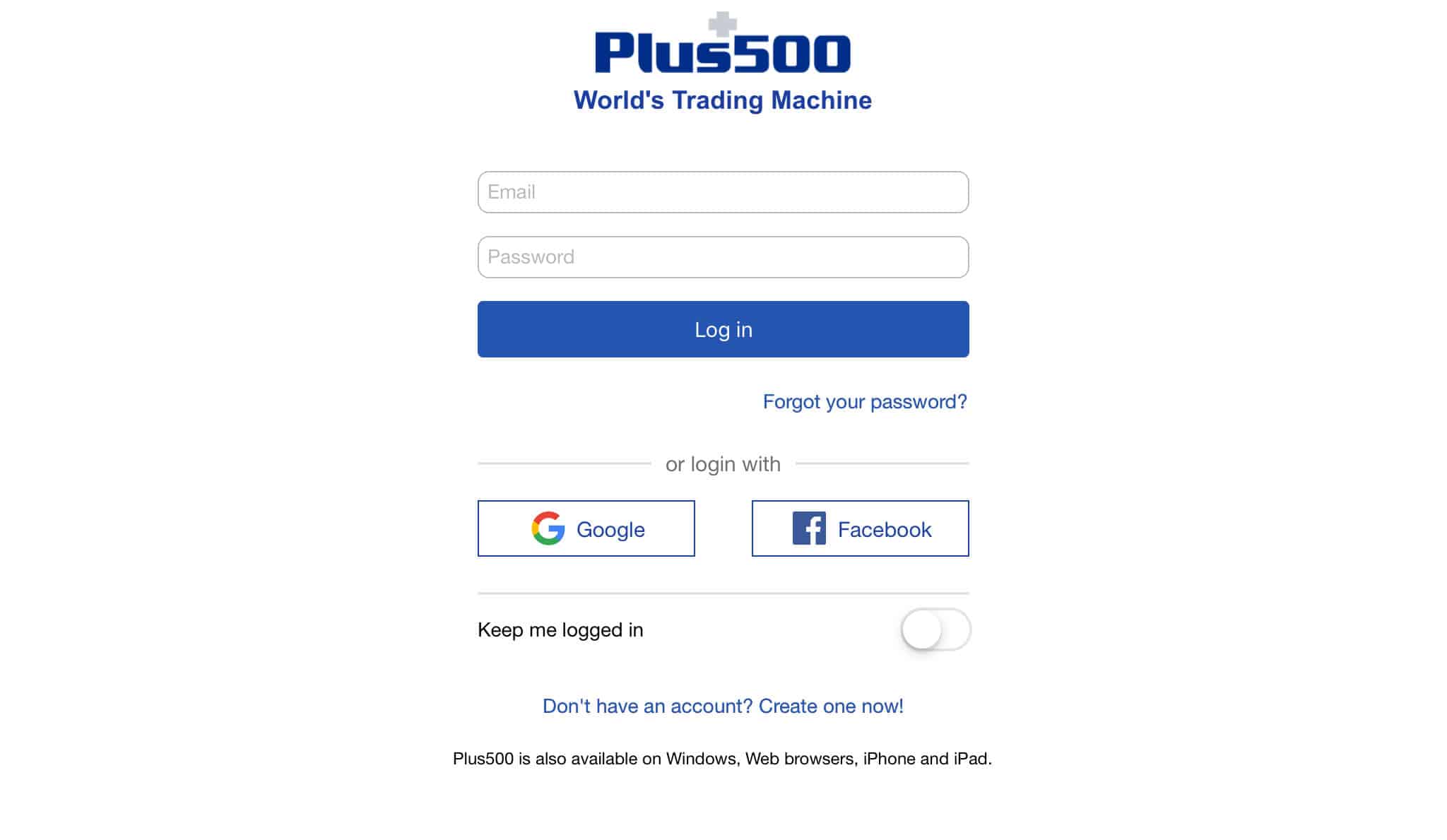

Start trading NVIDIA CFD stocks on Plus500

Step 1: Register your account

Firstly, begin by clicking here and open your account. You will be prompted to download the Plus500.com mobile app to register. Select between a Demo and Real Money account. After filling in basic personal information, you will gain access to the unlimited demo account. Before you can use it, you will be prompted to answer a few questions to establish your investor risk profile.

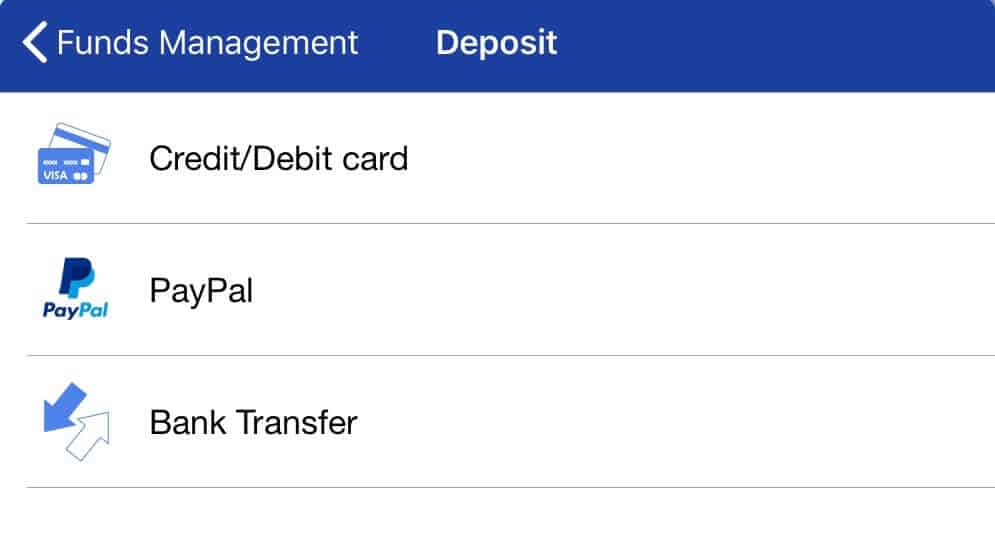

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

Step 3: Verify your identity

Step 4: Trade NVIDIA CFD stocks

Plus500 offers a wide variety of CFDs on investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. On this trading platform for the advanced investor, options are also available. Query NVIDIA and the price quotes for the stock appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money.

A Brief Overview of the History of NVIDIA

Twenty five years ago, three microprocessor engineers working in Silicon Valley started NVIDIA and developed the GPU – the graphics chip that powers much of the world’s most computationally demanding tasks. One of those co-founders was the designer of the first PC graphics processor while at IBM and the GX graphics chip at Sun Microsystems, Curtis Priem (Wikipedia). Co-founder Jen-Hsun Huang is the current CEO and Chris Malachowsky is a senior vice president for engineering and operations. NVIDIA quickly became the premium graphics card in desktop gaming and design graphics applications.

In 1990, NVIDIA’s first GeForce graphics chip was used in Microsoft’s Xbox. The development of parallel processing has put more power behind its chips. In 2011, NVIDIA introduced its mobile system-on-a-chip platform Tegra. The company is growing fast through an aggressive acquisition strategy as it diversifies into new markets. In cloud computing, Baidu and Google are customers. NVIDIA’s most recent acquisition Mellanox strengthens its position in the data centre market. As autonomous cars prepare to take over the automotive market in coming years, Nvidia is making chips for a dozen car makers, including Mercedes Benz, Toyota and Volvo.

NVIDIA Shares: Forecast 2019–2023

NVIDIA enjoyed strong growth in the 2018 calendar year. By the end of the year, financial performance was weak as the semiconductor cycle downturn and slowing Chinese economy began to take their toll on industry profits. The high performance chipmaker is ready for the upturn with major upgrades in AI, deep learning, machine learning, data analytics and graphics across its chip line.

2019 – Let the games continue

The new GeForce 20 series of chips, which create a more photorealistic and immersive gaming experience, had a disappointing market entrance. Once excess inventory is worked off in the first quarter, the chipset is ready to set a new standard in gaming performance. The leading game development platforms Unreal Engine and Unity are incorporating the GeForce chip. Gaming makes up 54 percent of revenues. Low-to-median growth is forecasted for NVIDIA stock.

2020 – Data centres for learning workloads

NVIDIA’s acquisition of Mellanox Technologies in March for $6.9 billion, together with new products for data-intensive industries, provide an edge in cloud computing. NVIDIA’s chips and Mellonox’s interconnects already interoperate in the world’s fastest supercomputers and largest cloud centres. With this technology duo data centre sales, which grew 71 percent from Q1 2018 to Q1 2019, are poised for big gains. Low-to-median growth is forecasted for NVIDIA stock.

2021 – Self-driving cars

Autonomous cars is the sleeper business for NVIDIA. NVIDIA’s chip was used by leading electric vehicle maker Tesla, whose cars are autonomous-mode ready, until Tesla decided to make its own chips in 2018. Whether you invest in Tesla or another carmaker could come down to chip performance. NVIDIA is working with at least two dozen self-driving car makers. Many new self-driving car models will be designed on the newly released NVIDIA DRIVE™ Constellation virtual reality autonomous vehicle simulator. Median-to-high growth is forecasted for NVIDIA stock.

2022 – Higher performance at lower costs

NVIDIA’s new AI-infused chip lines are ready to power forecasted double digit sales growth. The professional visualization segment continues to strengthen its market position with the Quadro RTX, outfitting enterprise workstations with the best in AI and data science. Boeing, Google, Toyota and LinkedIn are new clients. New partnerships with manufacturers and vendors will help lower sales expenses. High R&D costs associated with the significant AI and data science chip upgrades should also ease.

Median-to-high growth is forecasted for NVIDIA stock.

2023 – Beyond gaming

By 2023, NVIDIA will be a more broadly diversified company across gaming, data centres and autonomous vehicles. Median-to-high growth is forecasted for the NVIDIA stock price.

Conclusion

What a semiconductor company does during a cyclical downturn is a good indicator of how it will do during the up turn. As NVIDIA introduces its new AI-enabled chips, the chipmaker is signing on new large corporate clients across all its major business segments. It could be a good time to buy NVIDIA shares while they are undervalued.

When you are ready to buy stocks, we recommend doing so via a regulated online broker such as Plus500 if you’re a UK customer, and Ally Invest for U.S. customers.

FAQs

NVIDIA has paid a consistent and increasing dividend since 2012. NVIDIA currently pays a $0.16 quarterly dividend, which has a 0.38 percent yield.

No, NVIDIA does not have a direct stock purchase plan (DSPP) plan. Many brokers do offer a dividend reinvestment plan (DRIP) for NVIDIA. A DRIP automatically reinvests cash dividends in a stock quarterly. $10,000 invested in NVIDIA five years ago would have grown at a compound rate of 67 percent to $100,900 today versus $97,300 without dividends reinvested.

You can buy NVIDIA stock from online stockbrokers. Markets.com and plus500 are examples of online broker platforms where traders buy and sell NVIDIA stock. After signing up online, type in the NVDA ticker, place your order and you will become an owner of NVIDIA shares. Does NVIDIA pay a dividend?

Can I buy NVIDIA stock directly from NVIDIA?

Where and how can I buy NVIDIA stock?