Vegetarians are on the rise across the planet. Whether motivated by healthier eating, animal rights, or lowering greenhouse gases, more people are choosing plant-based foods. Even carnivores are increasing their intake of vegetable-based food. As the proportion of non-meat to meat eaters grows worldwide so too does the value of the stock of Beyond Meat (BYND)– a leading producer of plant-based meat products. Beyond investment and profit maximization goals, the $30 trillion sustainable investment sector likes BYND’s healthy and climate friendly meat.

Vegetarians are on the rise across the planet. Whether motivated by healthier eating, animal rights, or lowering greenhouse gases, more people are choosing plant-based foods. Even carnivores are increasing their intake of vegetable-based food. As the proportion of non-meat to meat eaters grows worldwide so too does the value of the stock of Beyond Meat (BYND)– a leading producer of plant-based meat products. Beyond investment and profit maximization goals, the $30 trillion sustainable investment sector likes BYND’s healthy and climate friendly meat.

If you want to invest in the company that feeds vegan NBA basketball players, Olympic skiers, and world class snowboarders and climbers, this guide will explain how to buy Beyond Meat stock, evaluate the best Beyond Meat stockbrokers, and assess how its first-mover and sustainable investment advantages will affect the stock value as the world shifts eating habits to healthier foods.

Best U.S. Platform to Buy Beyond Meat Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in BYND and found Stash Invest to offer the best platform, lowest fees and most appealing bonus. Click the table below and get started with only $5 today.

Best U.K. Platform to Buy Beyond Meat Shares

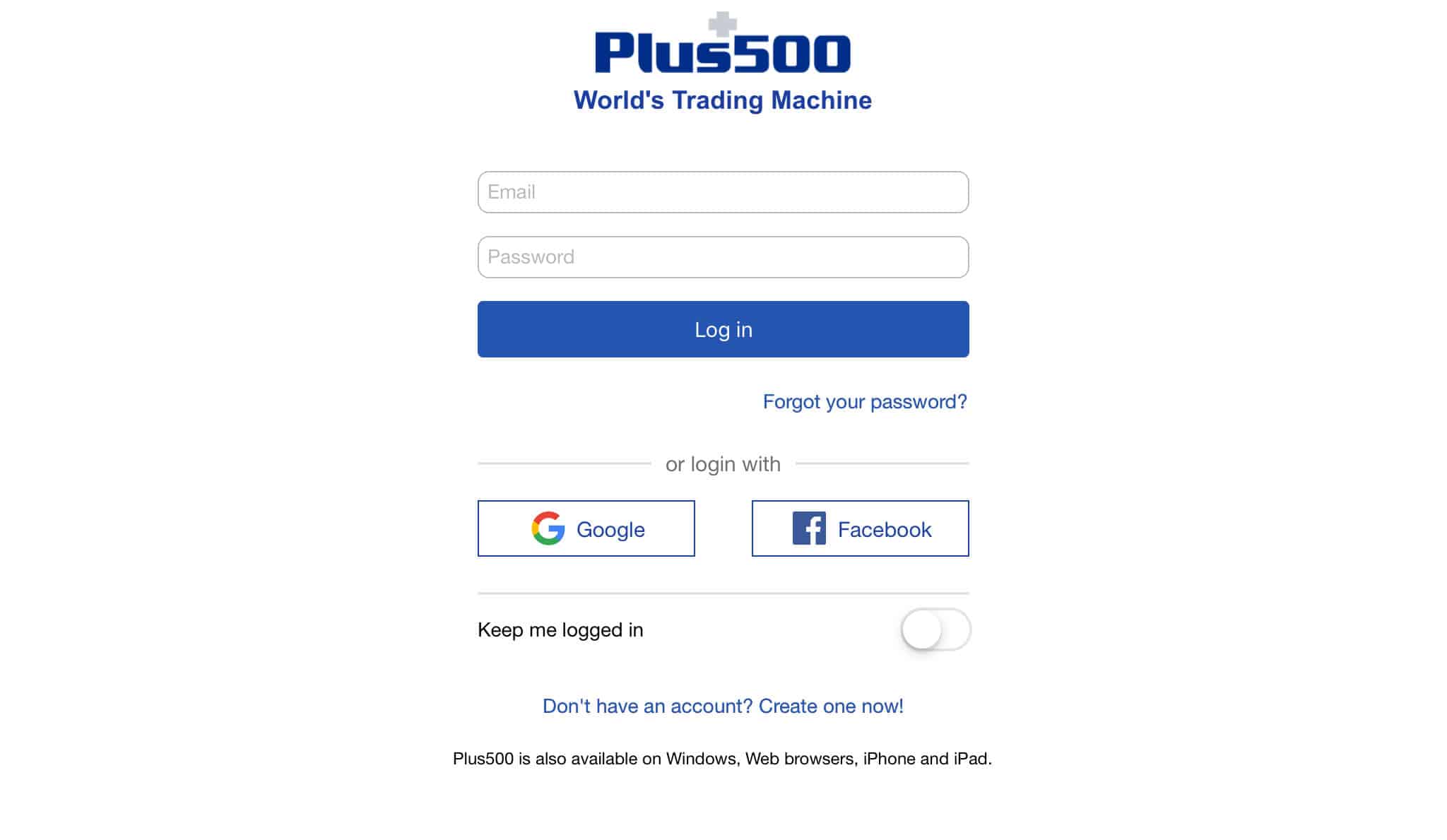

When it comes to U.K. residents, Plus500 is undeniably the best platform for investing in BYND. They are listed on the London Stock Exchange and hold various licenses, offering a secure platform for all investors. They also offer 0% commissions and competitive spreads, with a large variety of shares to pick from.

Should you Invest in Beyond Meat?

Beyond Meat’s move beyond the grocery store offers another momentous opportunity as restaurants and fast food outlets add vegetarian choices. Hardee’s, Del Taco, Dunkin’, and A&W Canada are among the fast food outlets selling Beyond Meat vegetarian choices while products are being tested at KFC, McDonald’s, and Subway. In 3Q 2019, BYND’s restaurant and foodservice revenues increased 312 percent versus 212 percent for retail over the year-ago period, to comprise 45 percent of $92 million in sales, a 250 percent increase.

If you want to invest in the rapidly growing mock meat industry, Beyond Meat is well-positioned to capitalize on healthy eating trends. And uniquely, of the dozen or so leading alternative meat pure plays, Beyond Meat is currently the only public company. Investing in BYND stock offers stock investors an opportunity to gain full exposure to the fast growing alternative meat industry.

But Beyond Meat will face stiff competition for consumer palates ahead. The growth prospects of the maker of the number one selling plant-based burger in the US, the Beyond Burger, will be affected by the following trends.

Pros of investing in Beyond Meat stock

Cons of investing in Beyond Meat

How to buy Beyond Meat stock in the UK

Step 1: Register your account

The first step to invest in BYND in the UK is to sign up to our recommended broker Plus500. Firstly, click on this link and register your account. Select between a Demo and Real Money account. You may sign up for a lifetime Demo account on Plus500. After filling in basic personal information, you will gain access to the unlimited demo account. Before you can use it, you will be prompted to answer a few questions to establish your trader risk profile.

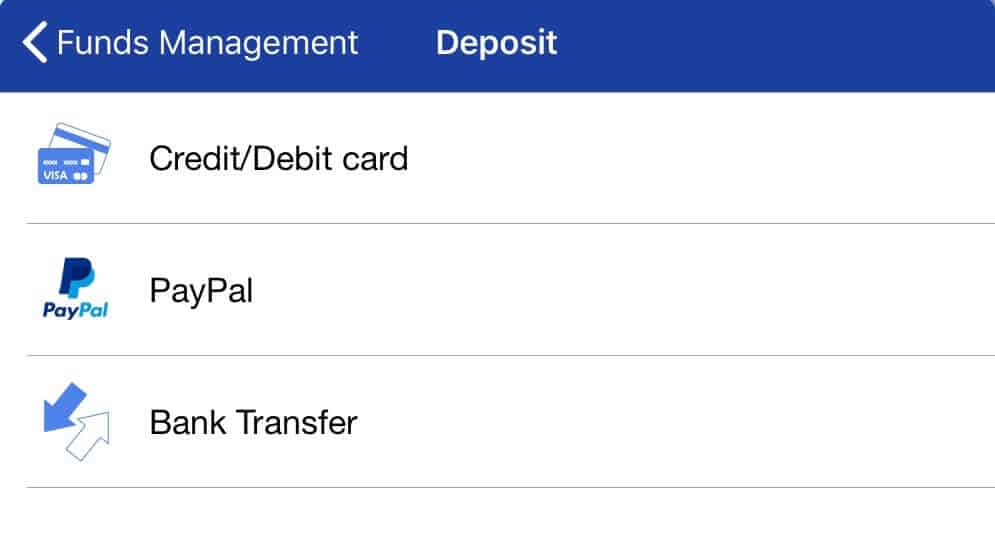

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method. The minimum deposit is $100/£100.

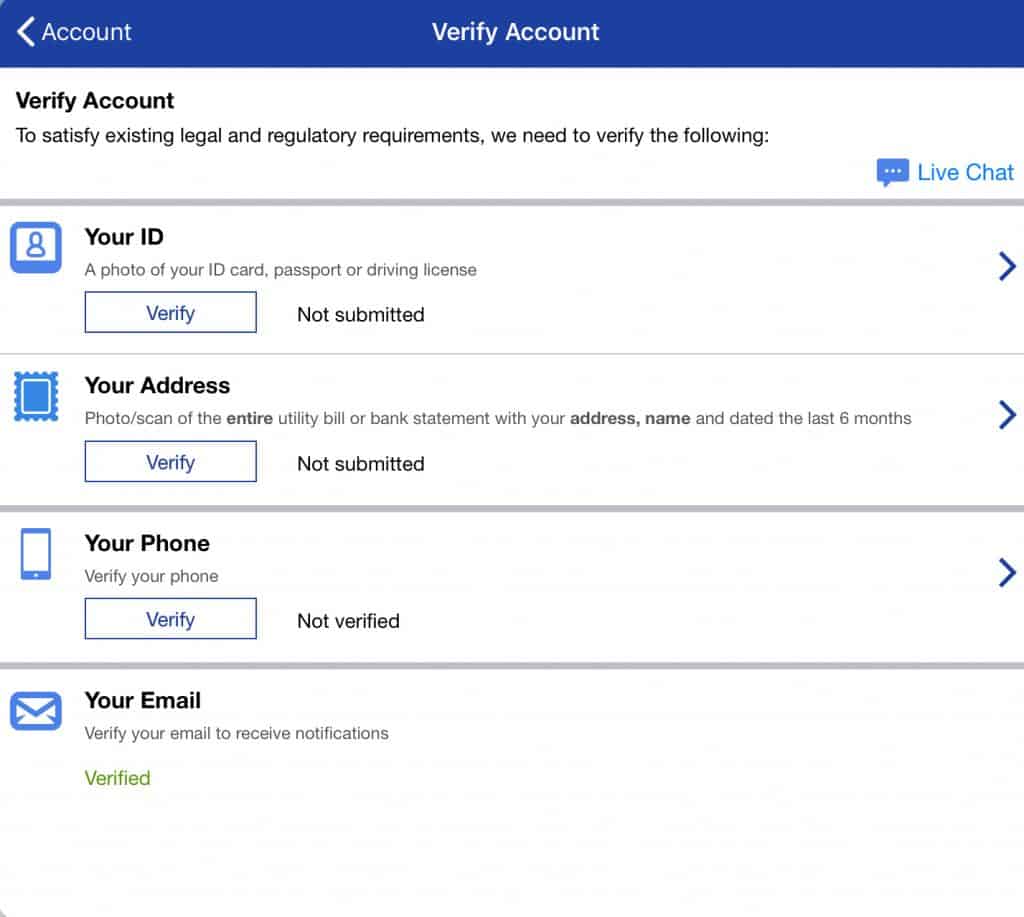

Step 3: Verify your identity

Attach and submit proof of identity and a utility bill for verification.

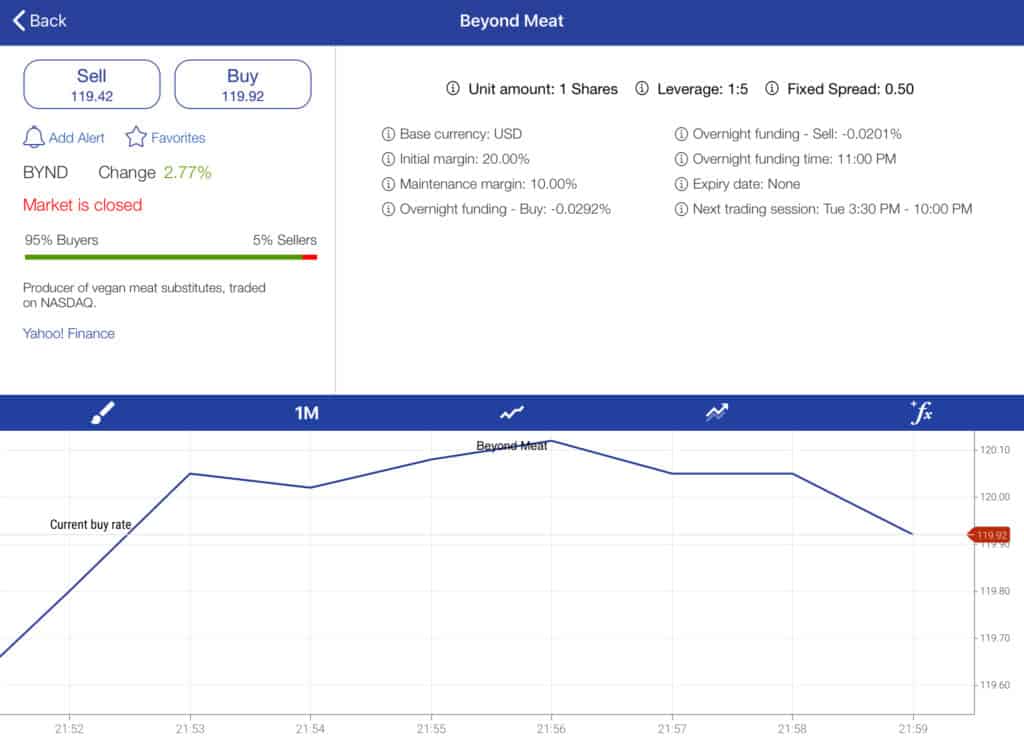

Step 4: Trade Beyond Meat CFD stock

Plus500 offers a wide variety of CFDs on investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. Geared towards the advanced investor, options are also available. Query Beyond Meat and the price quotes for the stock, as well as put and call options, appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators. To trade Beyond Meat shares, click on Buy.

How to buy Beyond Meat stock in the US

Step 1: Register your account

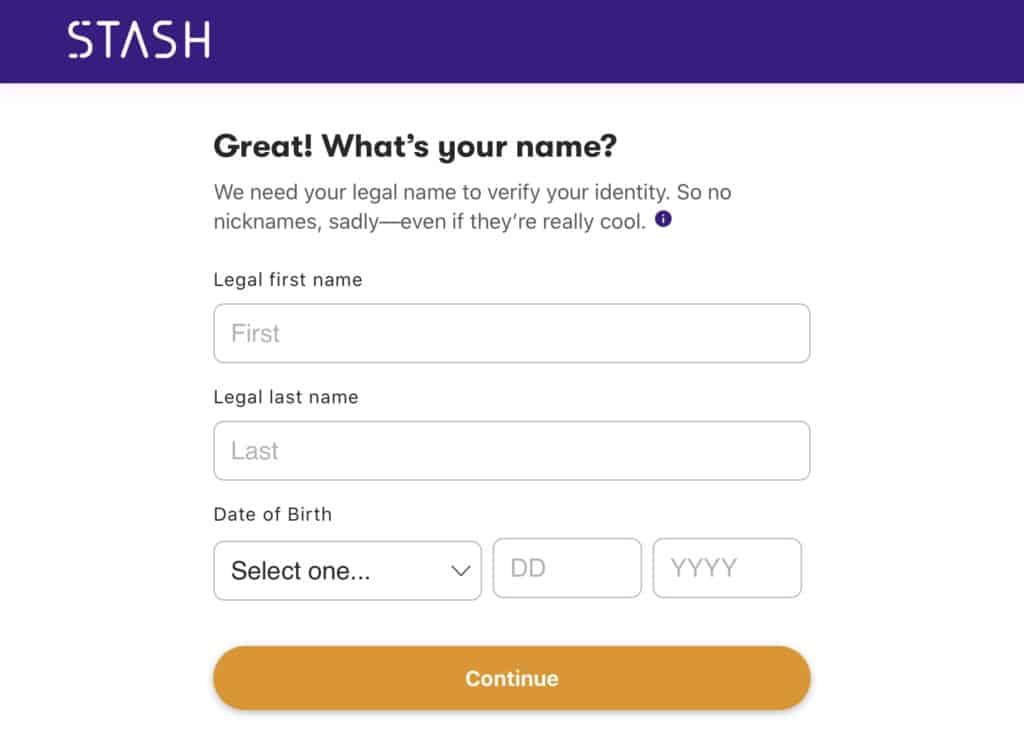

The first step to invest in BYND in the U.S. is to sign up to our recommended broker Stash. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile. For ID verification, you will only be asked for your social security number.

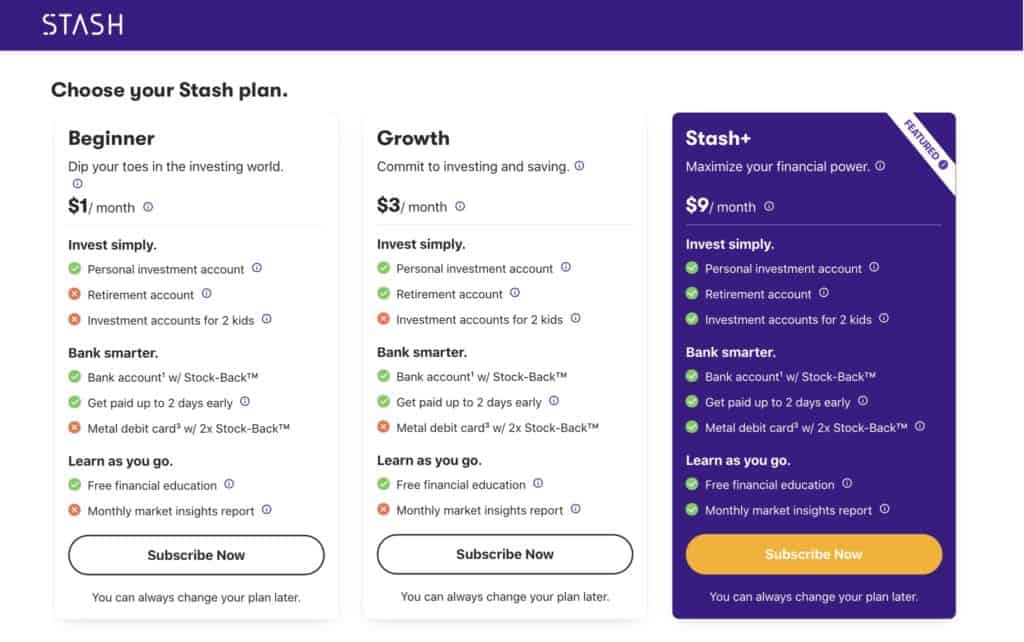

Step 2: Choose a Stash plan

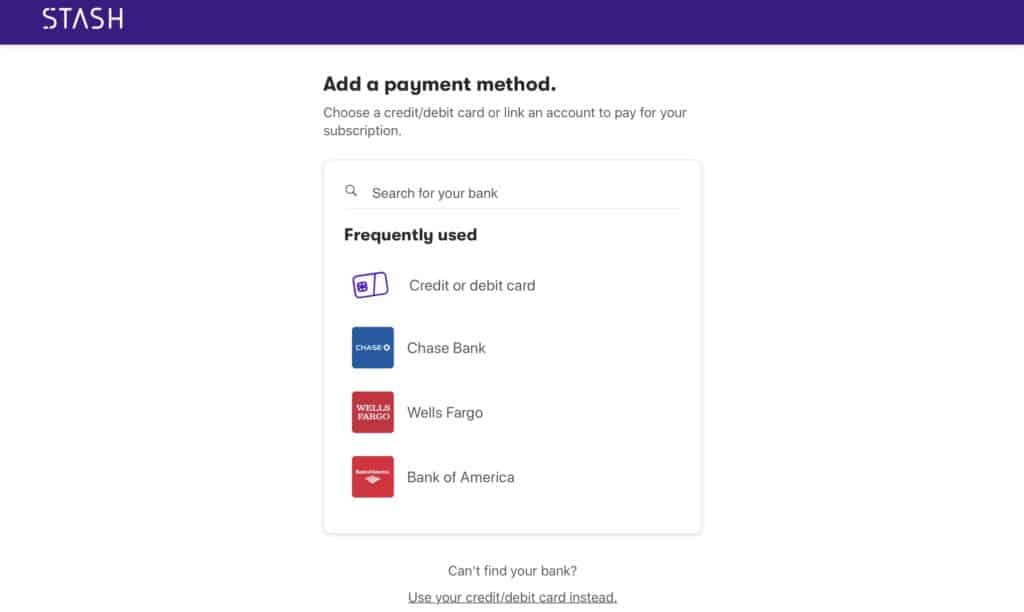

Choose between a Beginner ($1/month), Growth ($3/month), or Stash+ ($9/month) account. All three offer a personal investment account and bank account with Stock-Back™️ rewards and a 2-day early payday. Choose the Growth account to add a Retirement account. Stash+ adds investment accounts for two kids and a debit card with 2x Stock-Back™️. Pay for your monthly subscription via your bank account or debit/credit card.

Step 3: Fund your account

Link your bank account and fund your account by wire transfer. Receive $50 to invest when you deposit $300 within 30 days. Optionally, add the Smart-Save feature, which monitors your income and savings patterns and suggests how much to allocate to savings.

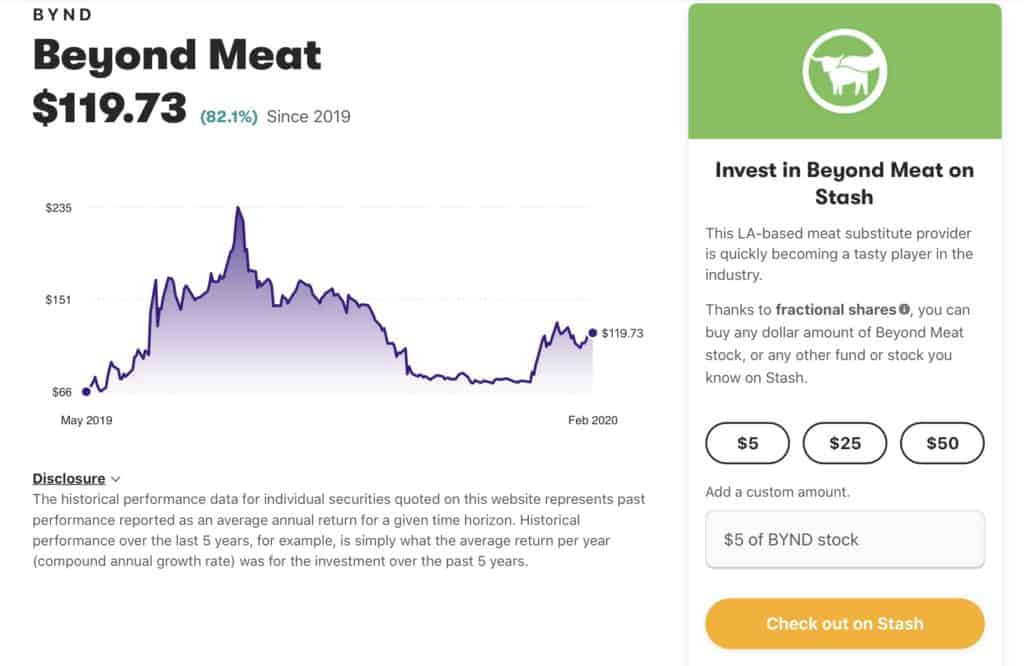

Step 4: Trade Beyond Meat stock

Type the BYND ticker in the Search box. Enter the fractional share amount you want to invest: $5, $25, $50, or a custom amount. Press Check Out on Stash to pay for the stock trade from your Stash account.

80.6% of retail CFD accounts lose money

Beyond Meat Stock: Current Prices and Summary

Investors showed their taste for the maker of juicy (beat juice) plant-based burgers when it went public in May 2019 at an initial share offering price of $25, sending shares spiking to $65.8 on the first day. At $111.9 per share, Beyond Meat stock is trading 67.5 percent above its May 2019 IPO closing price, but less than half of its peak price of $234.90 in July 2019. This performance is more than double that of US Consumer Staple IPOs in 2018 of 30 percent, the highest performing industry sector for public offerings.

If you had invested $10,000 in BYND stock at the closing price on May 2, 2019, your shares would be worth $24,324 today, a 220 percent annualized return. The S&P 500 returned 24 percent over the same period.

As more carnivores switch to plant-based foods, what can we expect for the stock price going forward? Analysts currently have a median price target of $106.9 and high forecast of $185. The median price reflects a decline of xx percent from the current stock price of $117.

A Brief Overview of the History of Beyond Meat

When Ethan Brown founded Beyond Meats in 2009 as a way to solve environmental, animal welfare, and human health problems through meat substitutes, natural and organic grocery retailer Whole Foods was one of the only nationwide retail outlets for alternative meat products. In 2013, Whole Foods opened its 335th store–becoming the eighth largest grocery retailer in the United States–and gave Beyond Meats its big break with a place on its shelves.

Keen venture capitalists quickly saw the opportunity in the natural food sector. From 2009–2013, WF stock appreciated 400 percent to $609.90 while the S&P Retail index increased 200 percent to $182.8 over the same period. In 2011, Beyond Meat secured its first round of venture capital funding from Kleiner Perkins–a backer of more than a dozen of the most successful technology companies including Amazon, Google, and Twitter. Currently, four venture capital firms together hold a 40 percent stake in Beyond Meats. In May 2019, Beyond Meats tapped into the investor appetite for healthy foods with a public stock offering.

Beyond Meats has secured shelf space in many more supermarket chains, including Safeway, Shoprite and Target; and restaurants including TGI Friday’s, Del Taco, and Dunkin’. As BYND’s commercial success grew, Ethan Brown was rewarded for his ESG agenda when he received the 2018 Environment Champion of the Earth Award from the United Nations. That same year, Beyond Meat began its international expansion, securing distribution agreements in Canada, Tesco in the UK and 3,200 Lidl stores in Germany, as well as restaurants in these markets. Including over half a dozen Asian markets, Beyond Meat products are sold in 58,000 retail and foodservice outlets globally.

Beyond Meat Shares Forecast 2020–2024

Beyond Meat is celebrating its 10th year in business on a profitable high note. In the third quarter of 2019, BYND’s net income turned positive. As the company grows globally, it is producing economies of scale and thusly reducing expenses as a percent of sales. Gross margins have moved into the targeted 30 percent range while improving operating margins, currently -1.21, will continue to benefit from declining costs. For 2020, 15 analysts forecast positive earnings per share of $0.17 to $0.88, with an average estimate of $0.42 (Yahoo).

How does BYND’s share price reflect its turn in fortunes? On a forward price-to-earnings basis, BYND stock is trading at 294 times earnings versus 0 times today. While the high P/E naturally raises the question – Is BYND stock overvalued? – following a 47% stock increase in January to $111, Beyond Meat is acting like a growth stock again. Growth stocks typically have high P/Es and price-to-book ratios. On the more tangible P/B ratio, BYND is trading at 18.6 times its net asset value versus 2.9 for the food processing industry.

As the below five-year forecast shows, Beyond Meat is well-positioned to deliver consistent earnings growth going forward. Management has increased its 2019 outlook, boosting its net revenue forecast to $265–275 million, a 200 percent increase over 2018, and upping EBITDA from $0 to $20 million.

2020 – Capitalizing on Investor Appetite for Meat Substitutes

At the grocery store, 43 percent of consumers say they are willing to switch meat-based protein for plant-based protein (Nielsen). Many of these switchers are flexitarians who spend $165 more than meat-only eaters, or $643, per year on meat and meat substitutes. As the second best selling mock meat brand on grocery shelves, and growing sales 20 times faster than its main competitor (in the 12-week period ending October 2019–SPINS), Beyond Meat is expected to continue to enjoy revenues and earnings growth. The outlook for Beyond Meat stock is median-to-high.

2021 – Alternative Meat Pure Plays

Beyond Meat’s expansion into the grocery retail and restaurant channel will accelerate in 2021. However the market will have priced a more predictable growth story into the stock by 2021. ConAgra, Tyson Foods, and other big meat producers will expand their mock meat market share, although the majority of their revenues will still be generated from the meat industry. Sustainable investors will continue to favor meat alternative public pure plays like Beyond Meat. By 2021, though, IPOs of alternative meat companies will start to compete for investor dollars. This competition includes 42 plant-based food companies that raised over half a billion dollars from venture capitalists, a 366 percent increase over five years, in 2018. The outlook for Beyond Meat stock is low-to-median.

2022 – Carving Out Mock Meat Market Share

Beyond Meat’s 10 percent market share in meat substitutes could reach 15–20 percent by 2022. Although this first-mover advantage will be hard to unseat, by 2022, Beyond Meat’s competitors – the big meat producers and fast-growing startups – will be gaining market share. Beyond Meat is likely to expand through acquisitions by gobbling up some of these smaller competitors. Beyond Meat has recently added retail supply chain and marketing executives from Amazon and Coca-Cola to expand its market position in the alternative meat industry. Low-to-median stock growth is forecast. Low-to-median growth is forecast.

2023 – Faux Meat Fast Foodie Trend

In restaurants, Beyond Meat’s restaurant partnerships are expanding into long-term distribution agreements. At the end of January, Beyond Meat’s sausage sandwich went nationwide with Dunkin. Meanwhile, failed partnership talks between main competitor Impossible Foods and McDonald’s increases the chances of a long-term partnership with Beyond Meat. An expansion to nationwide production scale with McDonald’s would produce an upside of 35 percent for the stock, according to analysts AB Bernstein. The outlook for Beyond Meat stock is median-to-high.

2024 – Mock Meat: A Food Staple

Between 2020–2029, the alternative meat industry (plant-based and lab-grown meat) is forecast to grow from $14 billion to a $140 billion industry, a robust compound annual growth rate of 29.2 percent (Barclays). Due to the high costs of producing cellular cultivated meat, it is not likely to represent a significant percent of this market over the next 10 years. During the same period, the global meat market will grow a more modest 3 percent to about $1.8 trillion. By 2029, plant-based meat will comprise about 10 percent of the meat market. Leveraging its early first-mover advantage (see below), we expect Beyond Meat to maintain a leading market share. The outlook for Beyond Meat stock is median-to-high.

Conclusion

Should you buy Beyond Meat stock? Over the next decade, sales of plant-based meat alternatives will grow at a rate 10 times faster than that of the traditional meat market. As the competition mounts from both plant-based startups and big meat producers, can Beyond Meat hold its first-mover advantage?

As the leading producer of alternative meats, Beyond Meat has a stealth opportunity to continue to leverage its first-mover advantage across brand identity, innovation, and economies of scale to maintain and grow its market share.

If you want to buy stocks in Beyond Meat, we recommend doing so via a regulated online broker such as Stash Invest if you’re a U.S customer, or Plus500 for U.K. customers.

FAQs

On a price-to-sales ratio, BYND stock is trading at 25.9 times sales, considerably above the food processing industry P/S ratio of 0.99 (CSIMarket). Noteworthy, Beyond Meat is a growth company competing against large, established meat processors. The overall industry’s shares declined in 2019, contributing to a lower P/S. In comparison, among select competitors, General Mills has a P/S of 1.89, ConAgra 1.22, and Pinnacle Foods 626. Like Beyond Meat, Pinnacle Foods’ stock price growth more directly reflects the high sales growth opportunity in alternative meats, through its Gardein brand. In the most recent quarter, newly acquired Pinnacle was responsible for 20 percent of ConAgra’s sales growth.

Whether or not Beyond Meat is considered overvalued largely depends on the view on future prospects for current products being tested in major restaurant chains. BYND products are currently sold in restaurant chains including TGI Friday’s and Del Taco, and are being tested in KFC, Subway and McDonald’s. If Beyond Meat secures a nationwide market with McDonald’s, Morningstar estimates the deal would generate an additional $400 million in annual revenues.

In Q3 2019, Beyond Meat reported its first quarter of positive earnings. Average analyst consensus is EPS of $0.42 in 2020. Given the growth potential in current restaurant test and grocery markets, a more telling measure is the price of the stock to expected earnings growth. Looking forward, BYND’s 5-year price to earnings growth (PEG) ratio is 2.66, closer in line with the food processing industry’s PEG ratio of 1.98. A comparison can be made to the Tesla stock and electric car growth story – a highly valued stock compared to that of the established automotive industry. Tesla has a forward PEG ratio of 2.5 versus 0.33 for traditional auto makers. Comparatively, BYND shares appear more reasonably valued.

The sustainable investment sector loves this maker of food products for its support of animal welfare, the environment, and natural foods.

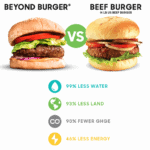

In addition to using non-GMO inputs, a recent lifecycle analysis of Beyond Meat’s 1/4-pound burger versus a meat-based burger found the Beyond Burger generates 90% less greenhouse gas emissions, and requires 46% less energy, >99% less water and 93% less land (Center for Sustainable Systems at University of Michigan).

Currently, the price of plant-based burgers is slightly higher but quickly dropping. The cost of making a Beyond Meat burger has fallen 25 percent over the year, from $4.89 to $3.69, dropping the price 31 cents a pound to $5.74. In comparison, the average price of beef is $3.73 per pound. The decline in the cost of producing and marketing protein-based burgers is allowing Beyond Meat to steadily improve operating leverage and thus generate positive earnings. The EBITDA forecast for 2019 has been raised from $0 to $20 million.

You can buy Beyond Meat shares from online stockbrokers. If you are in the US, you can purchase Beyond Meat shares through eToro. UK-based investors can purchase BYND shares through Plus500. Both online stockbrokers provide intuitive trading platforms that make it easy to buy and sell stocks. After signing up online, type in the BYND ticker, place your order and you will become an owner of Beyond Meat shares. Is Beyond Meat stock overvalued?

Does Beyond Meat have a nationwide distribution agreement with McDonalds?

Is Beyond Meat profitable?

Does Beyond Meat have a sustainable investment advantage?

As a sustainable investment, Beyond Meat is under more pressure by investors to provide stable operating performance. Sustainable investors invest long-term, typically more than five years, with a focus on long-term value creation rather than only considering financial value and risk. With these goals in mind, sustainable investors are outperforming traditional investors.

What are the health benefits of Beyond Meat products?

Is it more expensive to buy a Beyond Meat burger than a beef burger?

Where and how can you buy Beyond Meat stock?

A-Z of Stocks