Cisco’s heyday may have been the 90s, when it thrived as a major supplier of network systems just as the market began to boom (in 1992 Fortune rated Cisco as the second fastest growing company in the US). However, there has been signs of a comeback in recent times. Are we about to see this tech titan return to the powerhouse status it enjoyed before the dot-com bubble burst?

Over the last decade, Cisco Systems (CSCO) has developed into a mature stock, drifting a long way from the world record market cap ($546 billion) it achieved in 2000. Growth has been slow but steady since it joined the Dow 30 in 2009, but recent ventures into other tech areas, including security and applications, have been fairly successful and could kick some life into stalling growth rates. It’s also worth noting Cisco’s increasingly healthy dividend offering.

This guide covers everything you need to know about Cisco stock, including how to buy it, the best Cisco stockbrokers, and how to assess the future performance of the company.

On this Page:

1. eToro – Market leading broker built on social trading innovation

You probably know eToro as the broker that pioneered social trading. Since its early days as a market disruptor and leader of the Fintech revolution, this innovative trading platform has developed into one of the biggest names in the industry and continues its march in 2020 with a venture into the American market.

eToro grants access to a huge range of financial assets across several categories, giving you a wide choice of ways to invest in Cisco stock. Alongside Cisco, you’ll find more than 800 stocks to invest in or trade.

Pricing is extremely completive, with zero-commission on stock and ETF trading for European clients and no stamp duty for UK customers on stocks.

Though currently limited to crypto, eToro’s US userbase won’t have to wait long before they can invest in stock on the platform.

You can either buy Cisco stock by opening a BUY (long) position and investing in an underlying asset (meaning you actually own the stock you’ve purchased) or trade Cisco by employing CFDs (Contracts for Difference). With CFDs you can speculate on a stock’s price movements without actually buying it. This opens up a range of different possibilities including the use of leverage and the option to open a SELL (short) position.

The CopyTrader function, which allows you to copy the positions of more experienced traders and, hopefully, profit from their expertise, has been a big success. It goes without saying that this is no guarantee of profits, but tapping into a community of expert traders is a great way to develop your own skills and knowledge.

Similar features are available elsewhere, but you’ll be hard pressed to find a broker that does a better job of simplifying the process.

You can open an account with as little as $200, so dipping your toe in and sampling the eToro experience is relatively affordable. In fact, you can get to grips with the platform for free courtesy of a demo option that gives you $100,000 in practice funds to play with.

eToro is regulated in multiple jurisdictions, with licenses from ASIC, CySEC, and the FCA. If you need assistance with any of the below steps, eToro has a customer support team available 24/7.

- Simple and intuitive web and mobile platform

- An unlimited demo account

- Social trading

- High fees

- $5,000 account minimum for CopyPortfolios

Should I Buy Cisco Stock? Points to Consider

Interested in buying or selling Cisco stock? It’s a good idea to take a closer look at the company fundamentals and consider historic price movements and forecasts before you take the plunge.

Cisco business model and share price history

Cisco was one of the biggest successes of the 90s dot-com boom, providing the networking products and infrastructure that drove the ascent of the internet protocol. At the height of its powers Cisco achieved a staggering market cap of $546 billion, trumping even Microsoft to become the world’s most valuable company. Then the dot-com bubble burst and Cisco’s stratospheric growth went with it.

After that crashing descent, the company recovered and settled into a period of steady growth, trading above $33 and achieving a market cap of $202 billion in late 2007. However, the company took another bruising hit when the 2008 global economic crisis struck, and Cisco’s share price plummeted as low as $14.

The next decade saw an unspectacular recovery and steady growth. Cisco remains a market leader in networking hardware, but it’s become increasingly clear that diversification might be necessary to rouse this sluggish tech giant. There are signs that new, non-core segments, like security and applications, could outperform more established areas of the business. However, it’s worth noting that Cisco’s video conferencing app, Webex, has been massively outperformed by Zoom during the Coronavirus lockdown.

Cisco stock dividend information

Cisco introduced dividends in 2011, having previously deemed them a waste of spare cash that might be put to use more productively. It’s a measure of how different the company is these days that reliable dividend payouts are now among the best reasons to invest in Cisco.

Cisco pays an annual dividend of $1.44 per share, with a dividend yield of 3.5%. At the time of writing the last dividend payment, of $0.35, was made to shareholders on January 22, 2020.

Cisco’s earnings per share (EPS) for the quarter ending January 31, 2020 was $0.68, a 7.94% increase year-over-year.

As of April 21, 2020, Citigroup’s daily P/E Ratio is 12.593. This compares to a networking industry average of 13.97. This could be interpreted as an indication that market participants expect Cisco to underperform. It also puts Cisco roughly in line with the US market average P/E Ratio.

Cisco stock forecast and prediction

According to CNN, 20 analysts offering 12-month price forecasts for Cisco Systems have a median target of 46.00, with a high estimate of 60.00 and a low estimate of 40.00. This represents a 10.36% increase on the current price of 41.68 as of 23rd April 2020. Consequently, Cisco is currently given a hold rating by CNN-polled analysts.

How to Buy Cisco Stocks from eToro

The first step will be to sign up to eToro, ded and funded your accoutn,follow these simple steps to buy Cisco stocks.

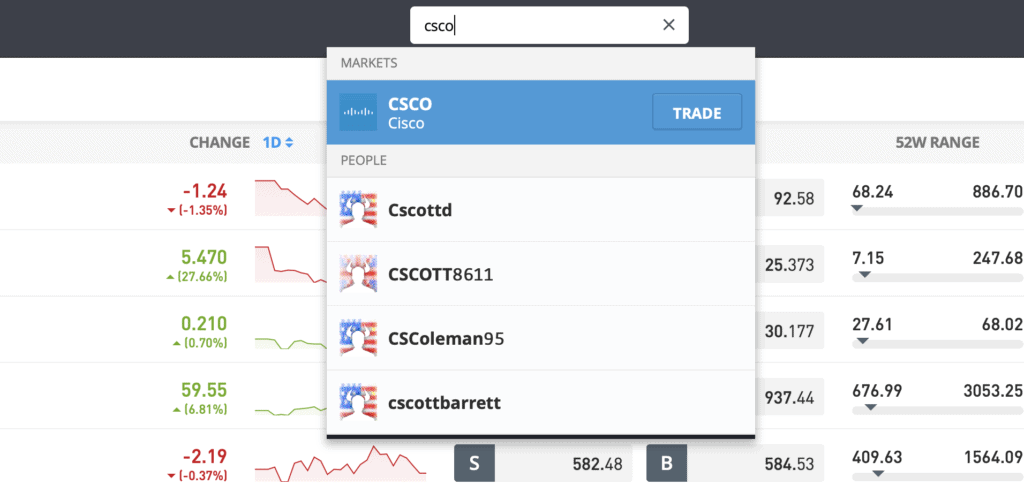

Step 1: Search for Cisco (CSCO) Stock

The first step will be to search for the stock in the trading dashboard.

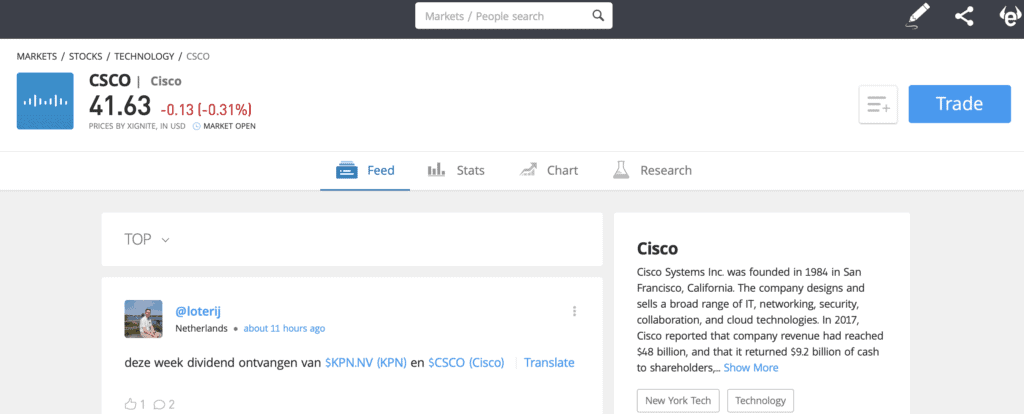

Step 2: Click on trade

Secondly, click on trade.

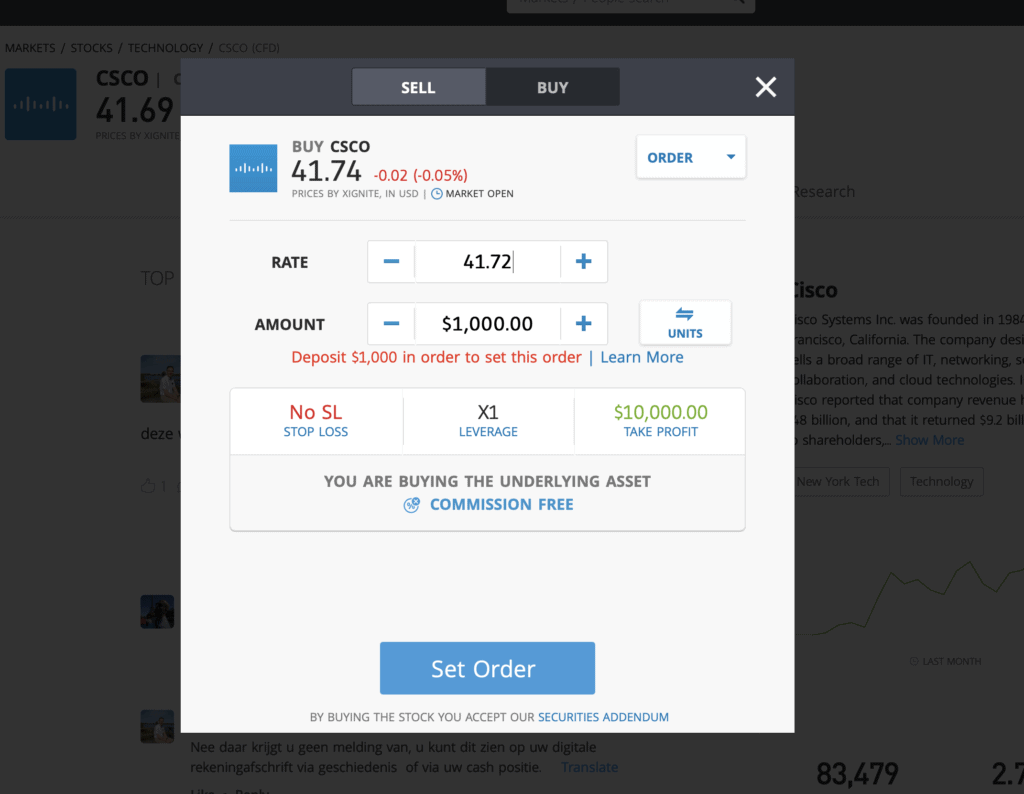

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase the real stock without leverage and proceed to set your order, or if you wish to trade stock CFDs and invest in Cisco with leverage, set your leverage amount, Stop loss and Take profit order limits. Finally, click on Set Order.

Investing in Cisco Shares – Final Thoughts

It’s unlikely that Cisco is about to experience a significant surge and there is plenty to worry investors in the wake of COVID-19. Companies are likely to delay expenses relating to infrastructure upgrading while the economy is experiencing such uncertainty, so we can expect Cisco to follow the market as it enters a likely recession.

Looking beyond the COVID-19 downturn, some optimism can be gleaned from Cisco’s recovery after the 2008 crash. We expect a solid recovery to around $46 when the market begins to recover.

FAQs

Should I buy Cisco stock or wait?

There seems to be a consensus among analysts that Cisco is more of a hold than a buy stock right now. A solid recovery is expected after a Coronavirus downturn, but this is contingent on factors that, at the time of writing, remain uncertain. We don’t yet know what the recovery time frame looks like. Overall, Cisco looks like a reasonable long-term investment. Looking beyond stock valuation, income investors have good reason to be tempted by Cisco’s very decent dividend returns.

What are the fees when buying Cisco stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy Cisco stock.

Is there a Cisco stock price prediction?

12-month price forecasts for Cisco Systems - gathered from 20 leading analysts - have a median target of 46.00 with a high estimate of 60.00 and a low estimate of 40.00.

What does the Cisco stock dividend pay?

Cisco pays an annual dividend of $1.44 per share, with a dividend yield of 3.5%. At the time of writing, the last quarterly dividend payment was $0.35.