GlaxoSmithKline (GSK)—a global powerhouse in vaccine and drug discovery and development, and consumer healthcare—is realigning its businesses to improve performance. After growing into the sixth largest pharma giant through acquisitions of large competitors and innovative biotechs, the three-year plan is to split into two more focused companies: a biopharma and consumer healthcare unit.

If you want to invest in GlaxoSmithKline as it unlocks long-term value for shareholders through a major business reorganization, this guide will explain how to buy GSK stock, evaluate the best GlaxoSmithKline stockbrokers, and assess how its active drug pipeline will contribute to growth going forward.

On this Page:

Best U.S. Platform to Buy GlaxoSmithKline Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in GlaxoSmithKline and found the following broker to offer the best platform, lowest fees and most appealing bonus. Click the link below and get started with just $5 today.

Best Non-U.S. Platform to Buy GlaxoSmithKline Shares

We found the following platform to be best-suited to traders outside the U.S. looking to invest in GlaxoSmithKline, offering competitive spreads and 0% commissions. Click the link below to start trading GlaxoSmithKline with this trusted, regulated broker.

How to buy Glaxo stocks

Although the process of signing up with a broker, depositing funds, and buying Glaxo stocks is super-easy, we’ve outlined a step-by-step guide for those of you that need a bit of help. We’ve opted to show you the process with the broker eToro as an example, but a similar process will apply to most brokers.

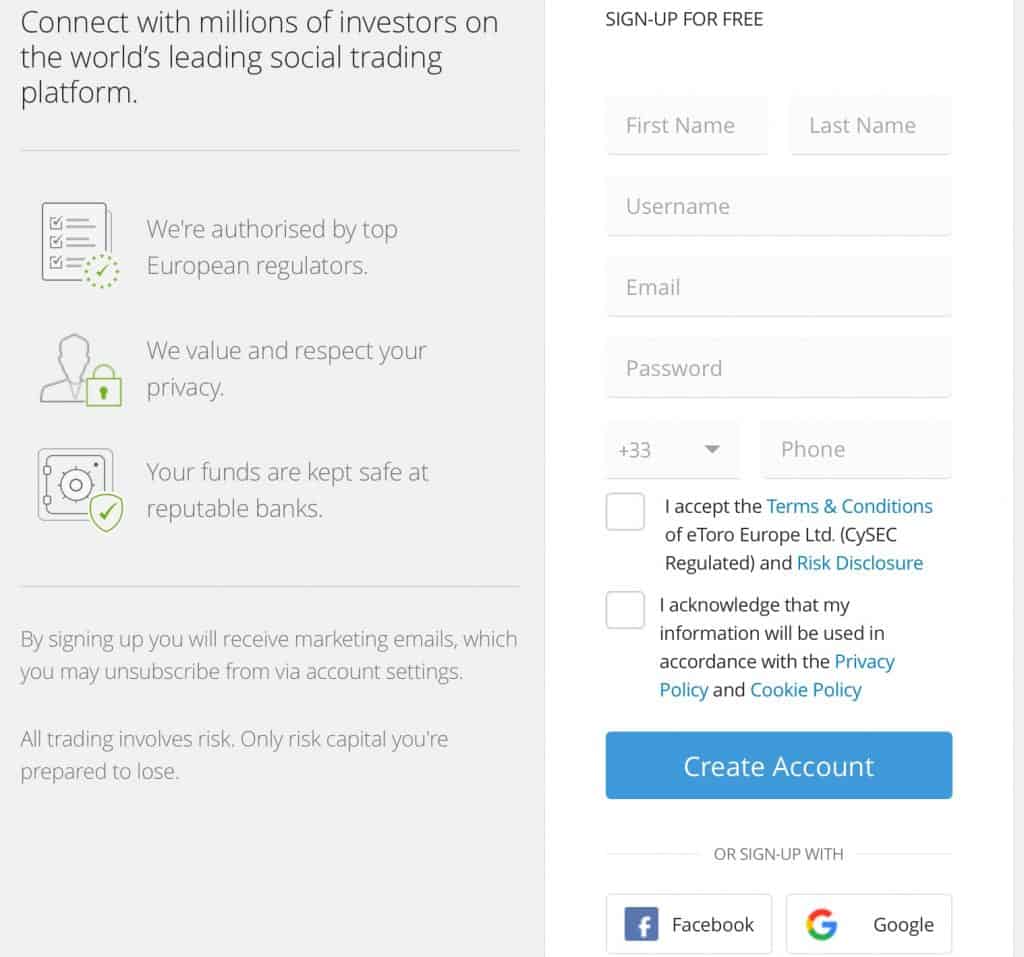

Step 1: Register your account with eToro

The first step to invest in GSK shares is to sign up to our recommended broker eToro. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile.

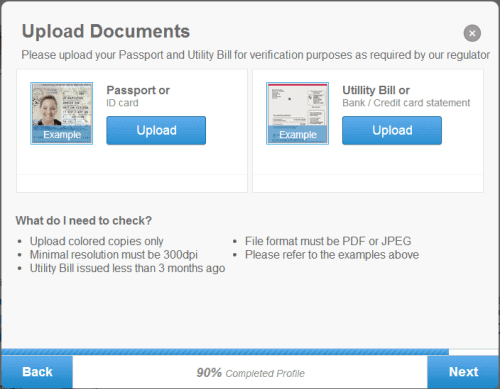

Step 2: Verify your identity

Attach and submit proof of identity for verification.

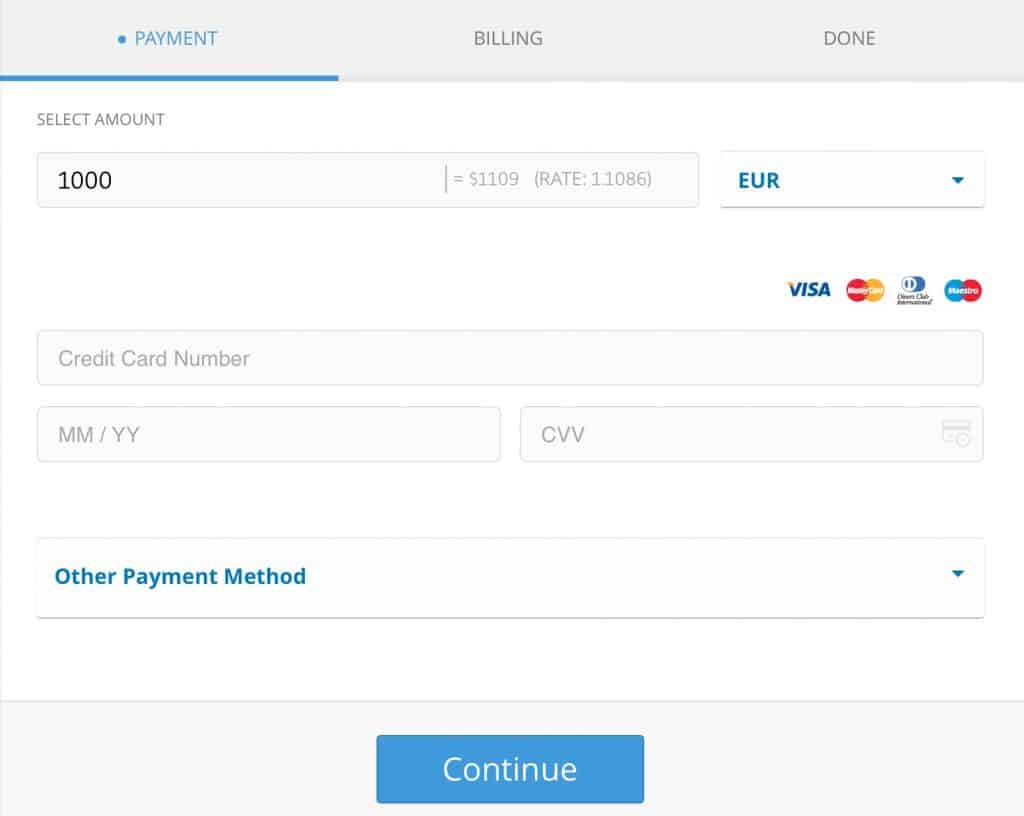

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

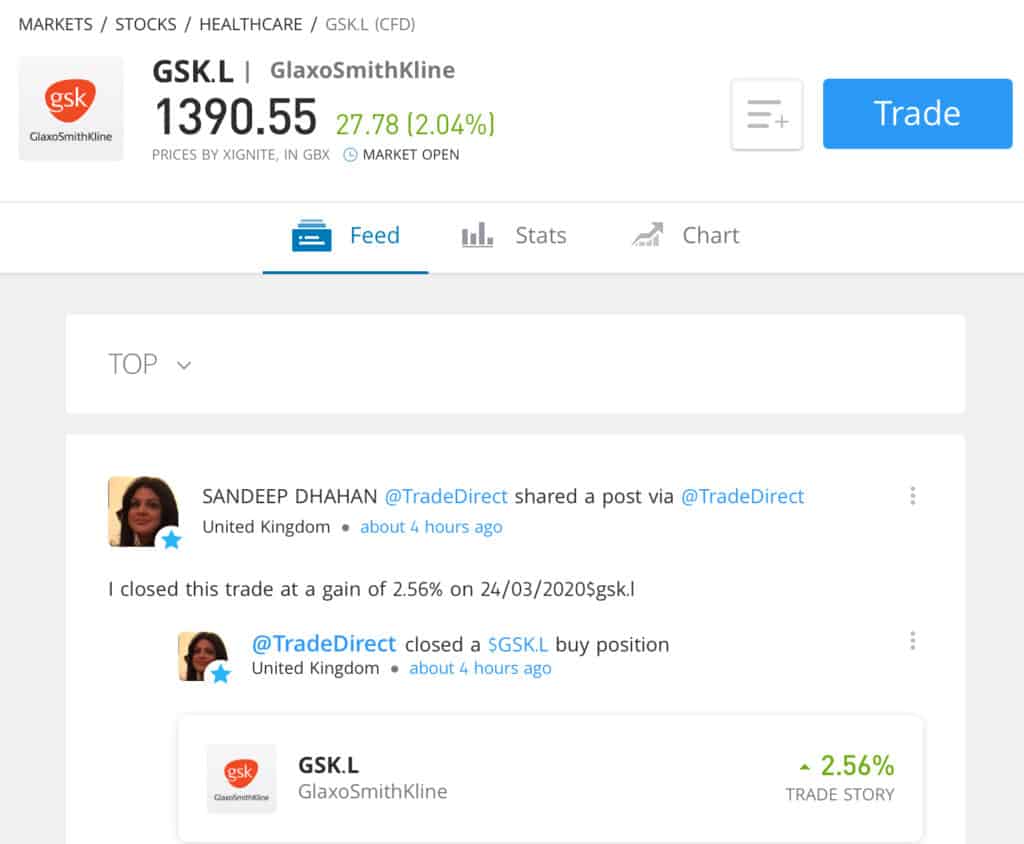

Step 4: Trade Glaxo stock

On eToro, you can invest in Glaxo through direct trading or social investing. Social investors can choose portfolios to copy based on performance and a risk score assigned to every trader portfolio on a scale of 1–6, 6 representing the highest risk. Following is an example of how to buy Glaxo stock.

Step 4A: Place a Glaxo stock trade

To buy shares in GSK, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The GSK stock profile page provides social feeds, stats, charts and research. Social feeds provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

75% of retail CFD accounts lose money.

GlaxoSmithKline Stock: Current Prices and Summary

In the current coronovirus stock rut, Glaxo is proving its potency as a good defensive stock. GSX stock has fallen 15 percent in 2020 versus -30.7 percent for the SPDR S&P Pharmaceuticals ETF (XPH), an industry benchmark. Strong growth in new HIV (Dovato), respiratory (TRELEGY, Nucala) and vaccine (Shingrix) drugs have helped to offset declines in legacy products.

Glaxo has a price-to-earnings (P/E) ratio of 13.41 compared to 17.14 for drug manufacturers (Gurufocus).

Merck 17.4

Sanofi 33.1

Pfizer 9.9

Based on historical earnings, GSX stock appears undervalued.

Glaxo has a price-to-growth (PEG) ratio of 3.6 compared to 1.4 for drug manufacturers (Gurufocus).

Merck 0.0

Sanofi 15.2

Pfizer 1.1

Based on earnings growth potential, GSX stock appears overvalued.

What can we expect for the GlaxoSmithKline stock price going forward? Analysts have a median GSX stock price forecast of $46.62 (high $57.42, low $35.60), a 46.1 percent premium over the current stock price of $31.90.

A Brief Overview of the History of GlaxoSmithKline

GlaxoSmithKline has grown into the world’s sixth largest pharmaceutical company through acquisitions. The company was founded in 1873 as a producer of dried milk baby food products. In 1924, it began to produce its first pharmaceutical product vitamin D (Wikipedia). In 1947, the company went public on the London Stock exchange, where today it is the fourth largest listing in market capitalization. In 1995, Glaxo merged with Burroughs Wellcome & Company, founded in 1880. In 2000, Glaxo Wellcome merged with SmithKlineBeeacham, a biotech and pharma company formed through the merger of SmithKline and Beecham in 1989.

In 2018, Glaxo started to build a consumer healthcare giant when it acquired a 37 1/2 percent stake in its consumer healthcare joint venture with Novartis. In December of that year, it merged its consumer health care unit with that of Pfizer, becoming the global market share leader. Glaxo is now preparing for a demerger by separating into two publicly traded stocks, a biopharma and consumer healthcare business. In vaccines, the market leader produced the first vaccines to treat smallpox (1882) and malaria (2015), after making its malaria data open source in 2010 to accelerate the development of a cure. In pharma, the drug maker is a major player in treatments for HIV/AIDS, respiratory illnesses (asthma, COPD) and cancers.

GlaxoSmithKline Shares Forecast 2020–2024

GlaxoSmithKline’s profit margins have slipped one percent over the last two quarters, ending 2019 at 13.76 percent. The drug maker needs new products to improve profitability. The drug pipeline is piping hot. Twenty new drugs entered Glaxo R&D labs in 2020, for a total of 177—the fifth largest drug pipeline in the pharma league. Three drugs have already been improved in 2020 (Advil Dual Action, Voltaren for arthritis) and one granted priority review (for myeloma). More cancer drugs and treatments for asthma (CAPTAIN) are in the process of being approved.

This innovation has been delivered through an increase in Pharma R&D spend, currently 16 percent of sales. In 2019, profits increased 23 percent, although operating margins in pharma declined 2.1 percent in 2019, but improved in the vaccine and consumer healthcare segments. Glaxo warns of further pressure on profits in 2020 as it ups its R&D spend to accelerate future growth.

Analysts have a median GlaxoSmithKline stock price forecast of $46.62 (high $57.42, low $35.60), a 46.1 percent premium over the current stock price of $31.90.

2020 – Insulated against the global pandemic

2020 will be a year of strategic realignment and, according to management, another year of flat sales. Vaccines, and HIV and respiratory drugs are part of the defensive shield that will help insulate Glaxo sales from the economic effects of the coronovirus pandemic. New drugs in pharma, including HIV and respiratory, are starting to outsell their predecessors. Overall, though, pharma may show a slight sales decline this year. Consumer health is undergoing two years of divestitures and realignment. These divestitures will help cover R&D costs, streamline operations and create more efficiencies. The outlook for GlaxoSmithKline stock is low-to-median.

2021 – Pharma drug pipeline flow

Half a dozen new drugs across cancer, respiratory and HIV are moving towards FDA approvals. They include Glaxo’s cancer super drug for hard-to-treat cancers developed with Merck KGaA Germany. For HIV, sales of new two-drug therapies are now outpacing the decline in three-drug regimens. In recent months, Dovato has been approved in the HIV treatment plans in many countries. Following on strong uptake in the U.S., the Shingrix vaccine—the most effective at preventing shingles—has recently been approved in China, as well as the US, Europe, Canada and Japan. Also in vaccines, Glaxo’s adjuvant coronovirus technology could potentially be used with any vaccines rushed to market in 2020 and 2021 to stop the spread of current and future coronavirus pandemics.

2022 – Consumer health play

The Consumer Health restructuring program is expected to be completed by 2022. Glaxo anticipates profit margins in the mid-to-high 20s, well above the healthcare product industry average of 9.3 percent. We expect the realigned businesses to re-emerge with stronger revenue and profit growth. The outlook for GlaxoSmithKline stock is median-to-high.

2023 – Unlocking shareholder value

This year, Glaxo will have completed its separation into two companies—Biopharma and Consumer Healthcare. Spinoff companies typically perform better in the long term due to a sharpened focus on the core business and improved efficiencies. Likewise, their stock tends to outperform the market. We expect the new Biopharma and Consumer Healthcare stocks to outperform that of the existing pharma conglomerate. The outlook for GlaxoSmithKline stock is median-to-high.

2024 – Global growth

GlaxoSmithKline has close to 25 percent of global vaccine market sales, which it is expected to maintain over the next five years (Statista) as it captures growth as global vaccine sales grow at a forecasted CAGR of 7 percent to $58.4 billion to 2024 (marketsandmarkets). Vaccines will now be part of a streamlined New Biopharma company with a sharper focus on immune system, genetics and new technologies research. Both New BioPharma and New Consumer Healthcare will undergo a major cost reset through the streamlining of operations from the manufacturing and supply chain through to support functions, leading to improved profitability. The outlook for GlaxoSmithKline stock is median-to-high.

Should you Invest in GlaxoSmithKline?

By 2023, GlaxoSmithKline investors will have a choice of investing in the New Biopharma or New Consumer Health stocks, anchored by stronger operating performance and R&D competencies. Meanwhile, investors can ride out the coronavirus economic downturn and cyclical pharma and consumer healthcare businesses with the defensive GSK stock.

Although Glaxo operates in the cyclical pharmaceutical industry, many of its vaccine, HIV, and cancer drugs are insulated from economic and industry downturns. The consumer healthcare business, although more sensitive to the economy, grew grew sales in double digits before the merger. Post-restructuring, the lower cost structure will create a more profitable business.

Pros of investing in GlaxoSmithKline stock

Cons of investing in GlaxoSmithKline

Conclusion

So, should you buy GlaxoSmithKline stock? GlaxoSmithKline is undergoing an expensive reorganization of its businesses to improve efficiencies, and thusly profitability. Beyond the shareholder value creation from the restructuring, investors are sure to benefit when the stock splits into two separate publicly traded companies within three years. GSK stock has promising long-term growth potential and is currently undervalued in the global stock market downturn. All in all, GSK looks like an attractive value play.

GSK pays a regular but fluctuating dividend. The 2019 dividend of $2.37 is expected to remain flat in 2020. The dividend yield is 7.1 percent.

If you want to buy stocks in GlaxoSmithKline, we recommend doing so via a regulated online broker such as the ones below.

FAQs

How do I invest in Glaxo outside of the United Kingdom?

GlaxoSmithKline PLC trades on the London Stock Exchange (LSE) as GSK. The American Depository Receipt (ADR) trades on the New York Stock Exchange (NYSE) as GSK.

Is GSK stock fairly valued?

A 5-year discounted cashflow (DCF) analysis based on a revenue CAGR of 3.3 percent and EBITDA margin of 33.5 percent—in line with management forecasts—produces a median stock price of $51.94, or a 55.8 percent upside, based on a current price of $31.85 (Finbox).

What is GlaxoSmithKline's R&D spend?

Glaxo spent 16 percent of revenues on research and development in 2019, up from 12 percent in 2018. GSK’s R&D expenses are significantly below the pharma industry average. Of the top 20 largest pharma companies, Glaxo spends the least. Merck and Sanofi have an R&D-to-sales ratio of around 20 percent.

Which ETFs and mutual funds have GlaxoSmithKline as a top 10 holding?

Van Eck Pharmaceutical ETF (PPH) 4.27%, SBI Healthcare Opportunities (G) 2.09%, Pacer Global Cash Cows Div (GCOW) 2.2%.

Where and how can you buy GlaxoSmithKline stock?

You can buy GSK shares from online stockbrokers such as eToro. eToro provides an intuitive trading platform that makes it easy to buy and sell stocks. After signing up online, type in the GSK ticker, place your order and you will become an owner of GlaxoSmithKline shares.