Countries around the world are beginning to relax stringent lockdown measures introduced to stop the spread of COVID-19, but there remains a widespread acceptance that the world can’t return to its pre-pandemic self until a successful vaccine is developed. Unsurprisingly, there’s a great deal of interest in the various vaccine candidates, including Sanofi’s collaboration with GlaxoSmithKline. So, is now a good time to buy Sanofi stock?

The French pharmaceutical giant is well-established as one of world’s leading vaccine developers and seems set to play a key role in the battle to beat COVID-19. Investors are sure to be monitoring Sanofi stock with interest.

Thinking of investing in Sanofi stock? This guide will explain how to buy Sanofi stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Sanofi Stock

If you want to invest in Sanofi, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is our number one platform. If you’re inside the US or Canada, Stash Invest is the best place to buy Sanofi stock.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro launched in 2007 with a fresh, innovative ‘social trading’ platform. It succeeded in making trading more approachable by introducing smart, easy to navigate UX and an interface that mirrored popular social media platforms. There's also the famous CopyTrader tool, which allows you to copy the portfolios of top traders.

These days, eToro is well-established as one of the world’s top trading platforms. offering 800+ stocks to trade or invest in. If you’re interested in Sanofi, you can opt to open a long position and buy the underlying asset or trade Sanofi by utilising CFDs (Contracts for Difference).

This means you can trade on the price movements of the stock without actually buying it. It also opens up the possibility of opening a short position and using leverage to increase the value of your trade.

You can open an account with as little as $200, so sampling the eToro experience is relatively affordable, and there's also a $100,000 demo account. Plus, there’s zero-commission and no stamp duty to pay on stock purchases, so you don’t have to worry about accumulating fees when you invest.

eToro accepts a range of payment methods, including PayPal. If you want to buy Sanofi stock on your mobile, then the eToro app for iOS and Android devices is a great option.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Sanofi stock? Points to Consider

It’s always best to do your research before you buy Sanofi stock or other pharma assets like Gilead stock or Glaxo stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Sanofi business model and share price history

Originally formed in 1973 and headquartered in Paris, Sanofi is well-established as one of the world’s leading pharmaceutical companies. Nonetheless, it’s fair to say that interest in the company has ramped up recently thanks to its position at the forefront of efforts to develop a COVID-19 vaccine.

Sanofi went into 2020 with a strong product portfolio and a pipeline of 85 upcoming drugs. Dupixent, an eczema treatment and the company’s best performing drug, led the way with sales of €679 million (up 135%) in the fourth quarter of 2019. Bottom line: Sanofi was a credible pharma stock going into the Coronavirus crisis.

In recent months the pursuit of a vaccine has undoubtedly taken centre stage. In mid-April, Sanofi announced that it was teaming up with GlazoSmithKline to develop a vaccine.

Sanofi is contributing its S-protein COVID-19 antigen, which provides an exact genetic match to proteins found on the surface of the virus. GSK brings its adjuvant technology, which produces a stronger response to the antigen, meaning a smaller amount of vaccine protein is required for each dose.

Sanofi has also attracted headlines as a producer of hydroxychloroquine, touted by some – most notably US President, Donald Trump – as a potential treatment for COVID-19. But the President’s public enthusiasm for the anti-malarial drug has been met by scepticism. Evidence that hydroxychloroquine is an effective treatment for COVID-19 remains inconclusive.

The company hit the headlines again when, commenting on the vaccine. CEO Paul Hudson said that the US government had “the right to the largest pre-order because it’s invested in taking the risk”. This was later retracted by Sanofi’s chairman, Serge Weinberg, who claimed that Hudson’s words had been distorted. He categorically stated that “there will be no particular advance for any country,”

Like so many stocks, Sanofi’s share price took a battering in March, plunging to a low of $38.02 on the 20th, but has since recovered to $47.81 on May 20.

Sanofi stock dividend information

Sanofi pays out 38.66% of its earnings out as a dividend, which amounts to an annual dividend of $1.21 per share with a dividend yield of 2.53%. The next annual dividend payment will be made to shareholders of record on May 26.

Sanofi stock forecast and prediction

Sanofi’s median 12-month target price according to CNN – based on 19 analyst forecasts – is $55.99, with a low target of $45.95 and a high target of $61.63. The median target represents a 17.12% increase on the current price of $47.81.

MarketBeat’s analyst ratings are similar, reporting a median target of $55.33, but still offer a consensus rating of Buy.

How to Buy Sanofi Stock on eToro

It’s quick and easy to invest in Sanofi stock at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy Sanofi stock.

Keep in mind that Sanofi is listed on NASDAQ with the ticker symbol SNY and the Euronext Paris exchange as SAN.

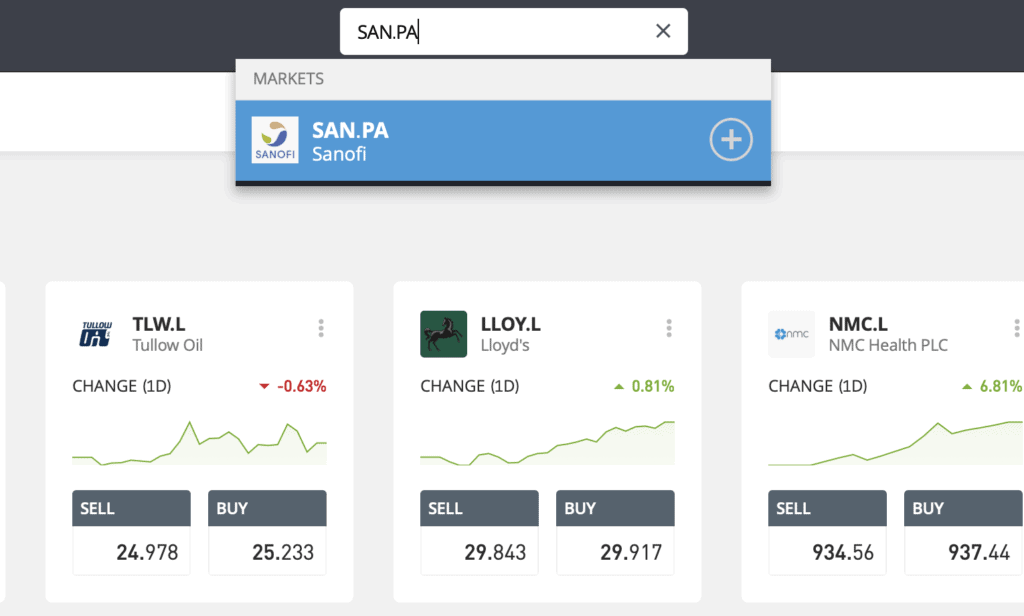

Step 1: Search for Sanofi (SAN) Stock

Look up Abbott by typing the ticker symbol SAN.PA into the search box.

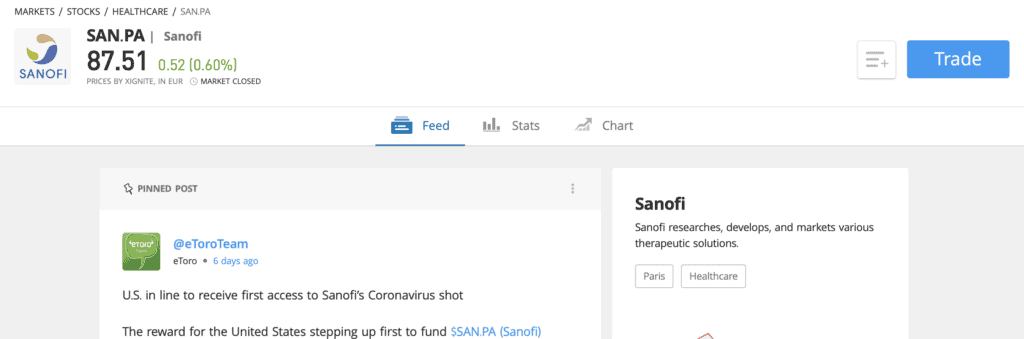

Step 2: Click on trade

Click Trade in the top right corner of the Sanofi page.

Step 3: Specify ‘Buy’

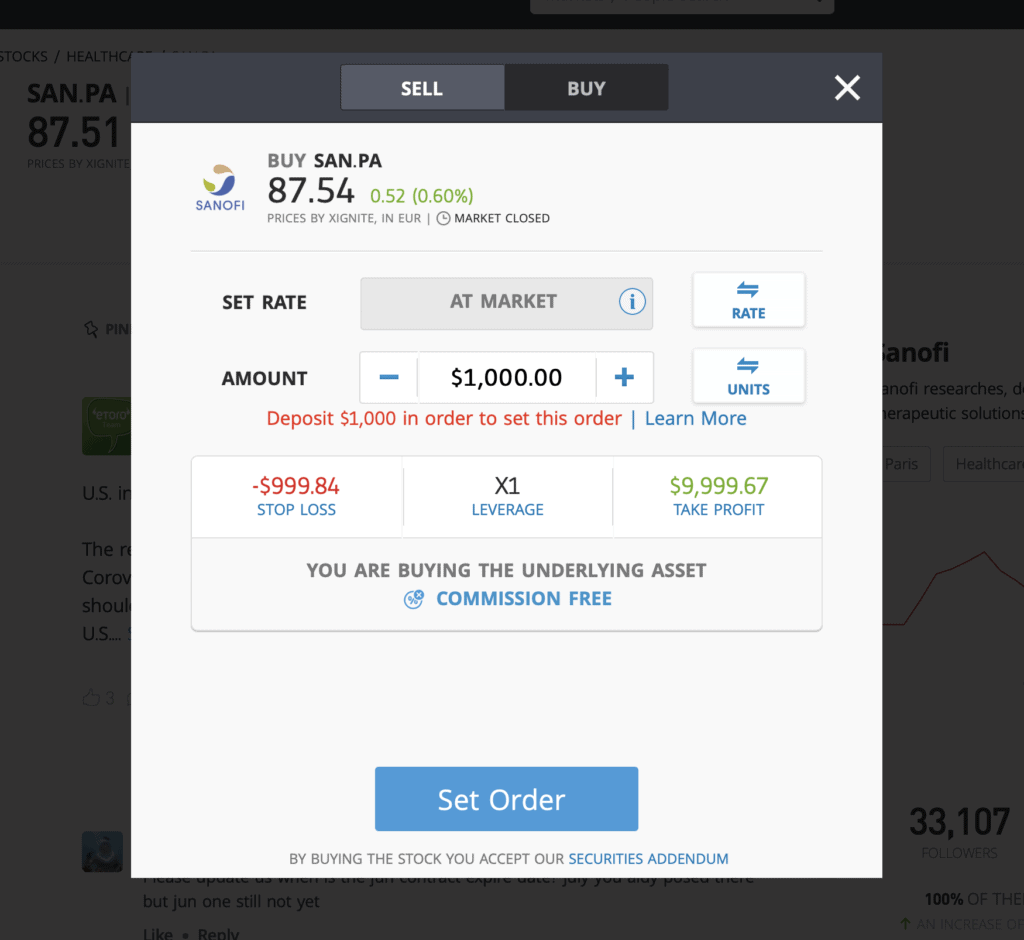

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade Sanofi CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Sanofi Stock – Final Thoughts

If you’re interested in investing in a COVID-19 vaccine candidate, Sanofi looks like a solid choice. The company is stable and profitable and the underlying business model appears to be sound. All things considered, Sanofi is well-positioned to deliver some upside to investors, whether it wins the vaccine race or not. Which makes it a relatively safe bet.

Sanofi’s collaboration with GSK looks like a formidable union and the vaccine project should benefit from testing, regulatory and manufacturing capabilities that aren’t necessarily available to rival vaccine developers.

If you do wish to buy Sanofi stock, we recommend registering with one of our top-rated stockbrokers. eToro is our number one broker if you’re outside the US, while we suggest US traders go with Stash Invest.

FAQs

Should I buy Sanofi stock or wait?

Sanofi’s efforts to produce a COVID-19 vaccine will attract a lot of interest, but we believe a strong drug portfolio and solid earnings make the company a Buy stock, regardless of the COVID vaccine race.

What are the fees when buying Sanofi stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy Sanofi stock.

Is there an Sanofi stock price prediction?

Analysts estimate a median 12-month forecast of $55.99, which represents a 17.12% increase on the current price of $47.81.

What does the Sanofi stock dividend pay?

Sanofi currently pays an annual dividend of £1.21 per share.

A-Z of Stocks