One of the best ways to manage your investment portfolio is by having an online stock broker. However, with so many contenders to the title of best stock broker, finding the right fit for your needs may be a challenge.

Depending on your investment and trading needs, there are some factors to take into consideration when making your choice. To help you along, we have reviewed some of the top stock brokers in the market based on a number of parameters. These range from your skill level and location to the services supported, costs and everything in between.

On this Page:

Best Overall Stock Broker for 2020

We have zoomed in on the best brokers to buy stocks from based on the criteria the most important to you: level of trading expertise, fees, reputation, and region and found that the following brokers offer the best features overall, for all stock investing style and goals and found eToro and Charles Shwab to offer great services.

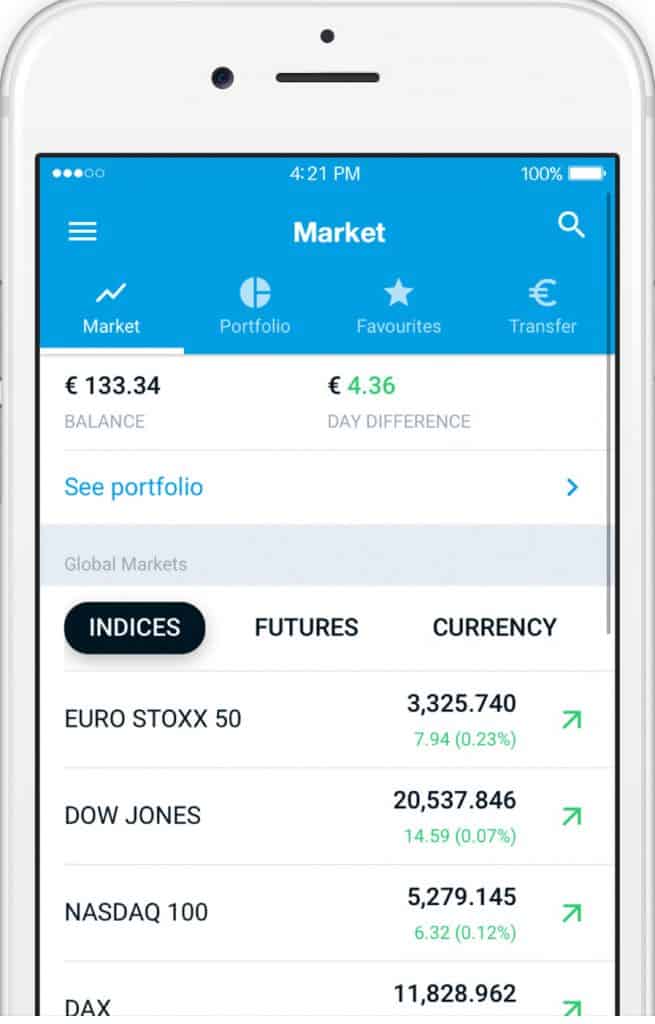

eToro: No commission stock trading

eToro was established in 2007 by entrepreneurs whose objective was to make trading easier for the everyday user.

In 2011, it launched the very first social trading platform with the then novel feature copy trading, which you can learn more about in our eToro review. With this feature, users could copy successful trades from the experts. It added stocks to its assets in 2012, but will start offering real stocks for trading later in the year.

At present, it offers CFDs in addition to ETFs, cryptocurrencies, commodities, indices and shares. In addition to its diversity, what makes it qualify for the above title is its extensive library of tools. Users benefit from access to virtual money accounts, an economic calendar and market analyses among others.

eToro accepts users from all over the world apart from the U.S. and is regulated by a number or authorities in different countries, including FCA, CySEC and ASIC.

Number of available stocks: 800

Platforms: Web and mobile

Fees: Zero-commission stock and ETF trading for European clients (Short or leveraged stock trades are excluded.)

Minimum deposit: $200

Special features: Social trading platform and 24/7 customer support

- Great range of stocks to trade

- 0% commissions

- Copy trading platform

- Not suitable for advanced traders

- Not available to U.S. clients yet

Best online stock broker for U.S. and Canada

Best stock broker account

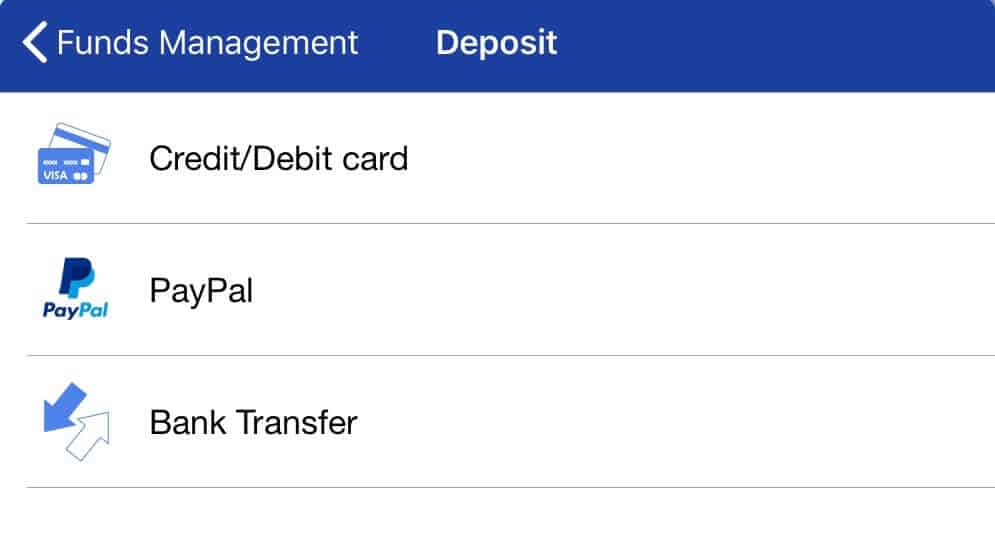

Markets.com

If you are new to the stock market, Markets.com is a great share broker to start with. This broker has won several customer service awards and has a well-stocked education library. You may find their pampering helpful as you learn to buy and sell shares and follow their technical analysis lessons to apply over 100 technical analysis tools available. markets.com is a division of Playtech, a gambling software company listed on the London Stock Exchange. Markets.com, itself, is licensed in Europe by CySEC, and in Africa and Australia.

The trading platform of the official online broker of the Arsenal Football Club is outfitted for the all-round retail trader. The broker offers CFDs on a good range of securities and forex pairs. No fees or commissions are charged and spreads, around 2 pips, are competitive. Signing up for a Markets.com trading account is easy and their trading interface is no frills.

Pros:

- Research, spreads and leverage for day traders

- Demo account

- Low commissions

- Good set of technical analysis tools

Cons:

- Limited order types

- Spreads higher on MetaTrader 4/5

- No guaranteed stop losses

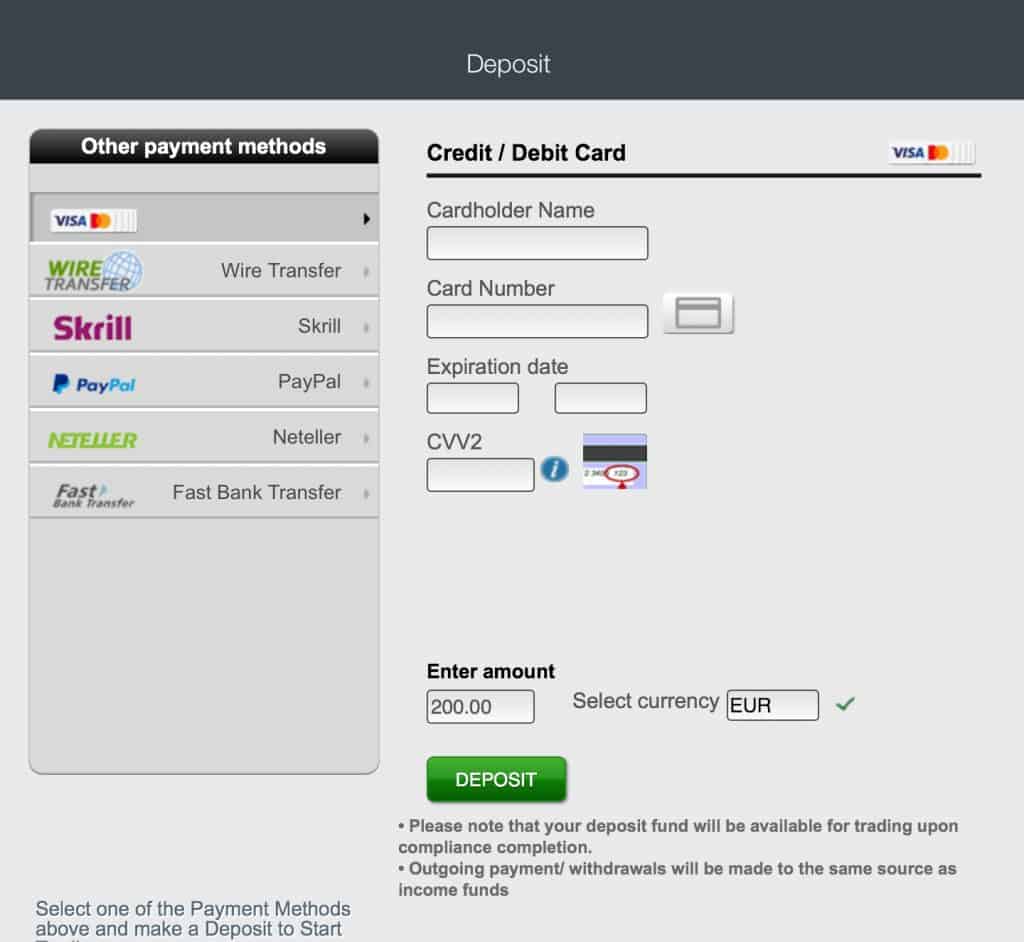

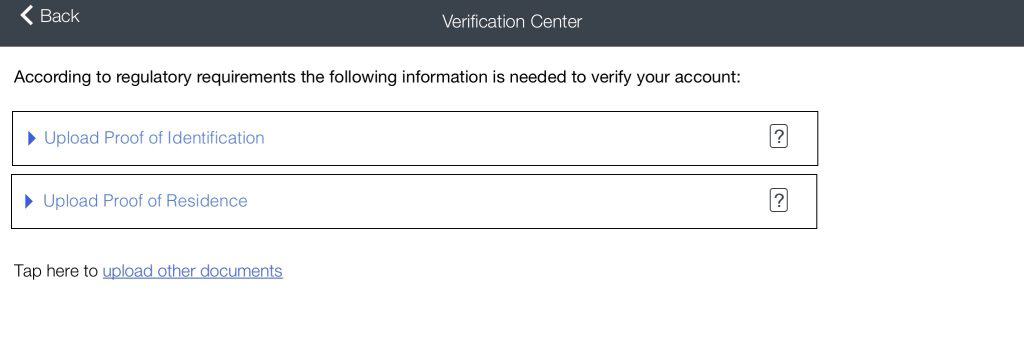

Plus500

Plus500 was designed to provide advanced traders with the tools needed to take their trading to the next level. The fast trading speed, leverage, high order volume and risk management tools (trailing stops and guaranteed stops) the pro trader needs to improve their trading experience are here. The intuitive interface includes over 100 technical indicators. The trader with their own tools, stock data and news will be happy to execute on Plus500. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 for stock trades. The platform was designed for traders who want to trade CFDs on stocks at and sell them immediately at a low cost. Active traders will like this discount platform. The beginner trader may prefer a platform with more trading support and education. No scalping is allowed on this platform and financing fees are high.

Pros:

- FCA regulated

- Listed on the LSE

- Easy to use platform

- Great mobile platform

- High order volume

Cons:

- Credit card fees are lower at some brokers

- Experienced traders only (no fundamental data)

- Only CFD trading

- High financing rates

- No scalping allowed

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money.

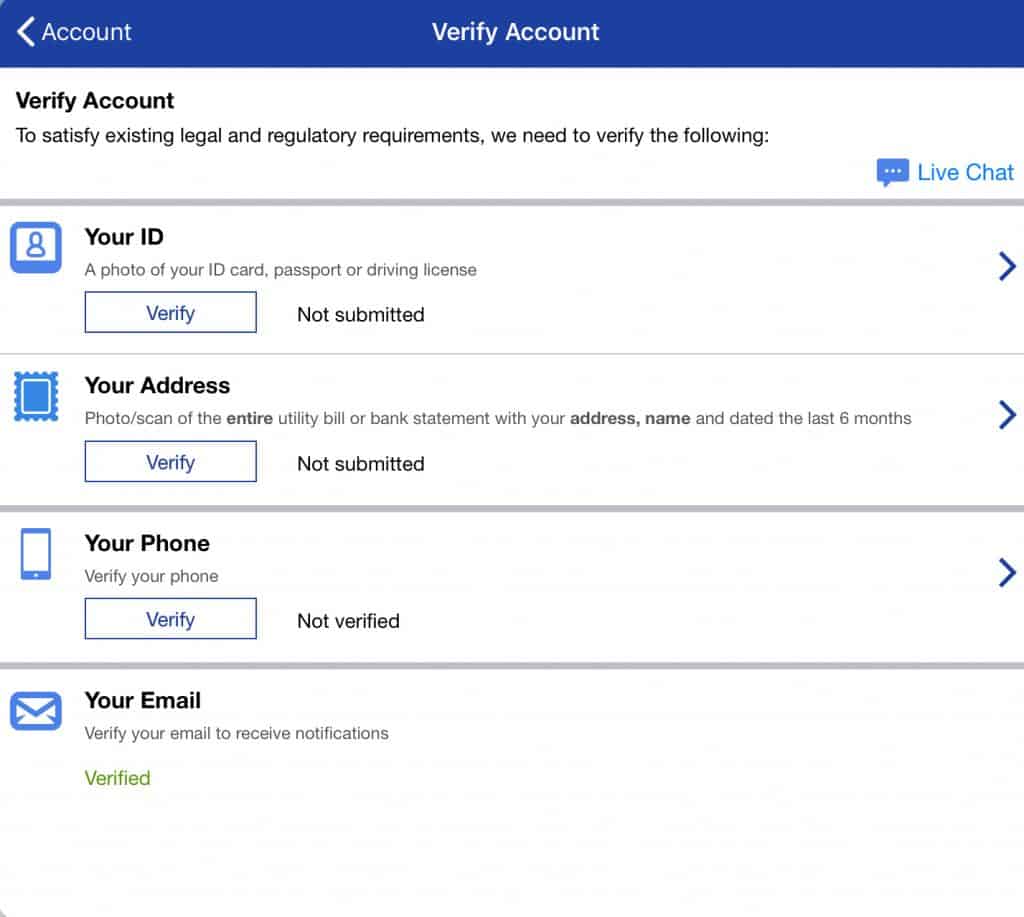

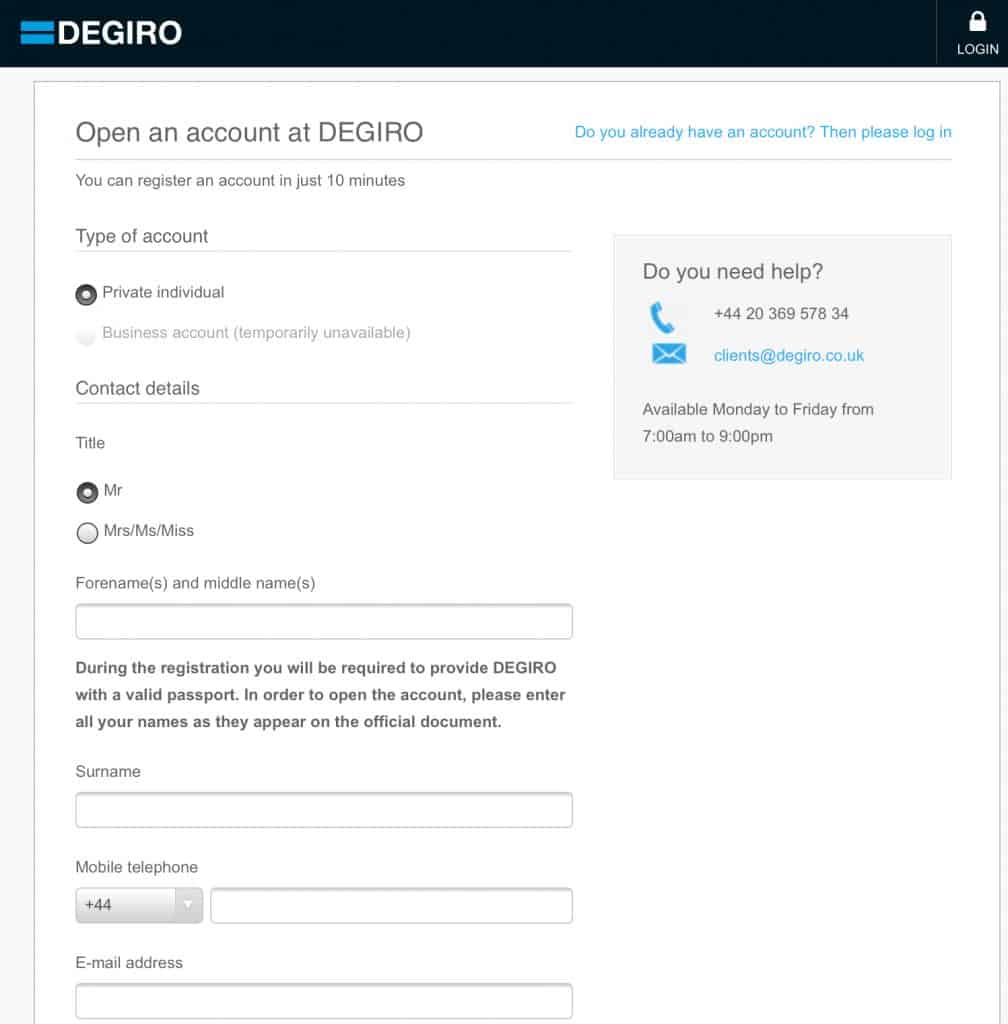

DEGIRO

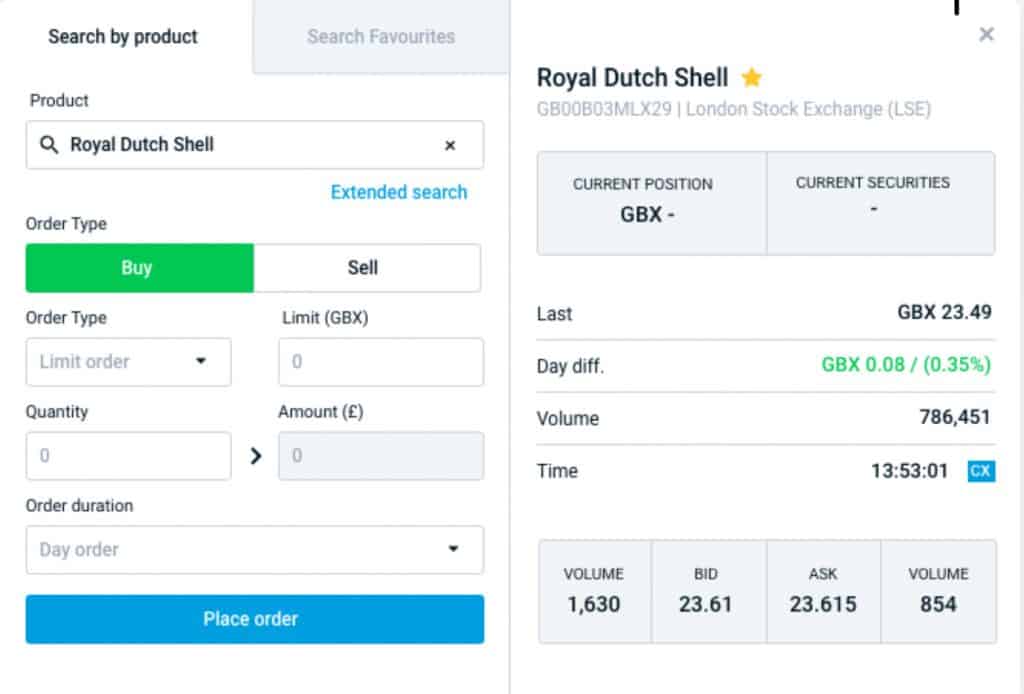

DEGIRO is a low cost discount broker that does not scrimp on its stock trading options. Quite the opposite. While many of its competitors trade mostly CFDs, DEGIRO is a gateway to trade directly on 50 exchanges across 30 countries. If you want value for your money when you buy shares, this is a good place to trade. Shares cost about $2 a trade, the lowest price among discount brokers. When you trade on your domestic stock market the price is discounted further. Plus you get one free ETF trade a month. The broker is regulated by the Dutch AFM and DNB, and in many other jurisdictions around the world. A few frills are missing. Research and education tools are limited. Forex trading is not provided. But if you want to purchase stocks, this is where to shop on stock exchanges around the globe at the best prices around.

Pros:

- Very low fees

- Access to global stock exchanges

- Regulated by Dutch AFM/DNB and other jurisdictions globally

Cons:

- Limited research and education resources

- No forex trading

Best Online Stockbrokers for U.S Customers

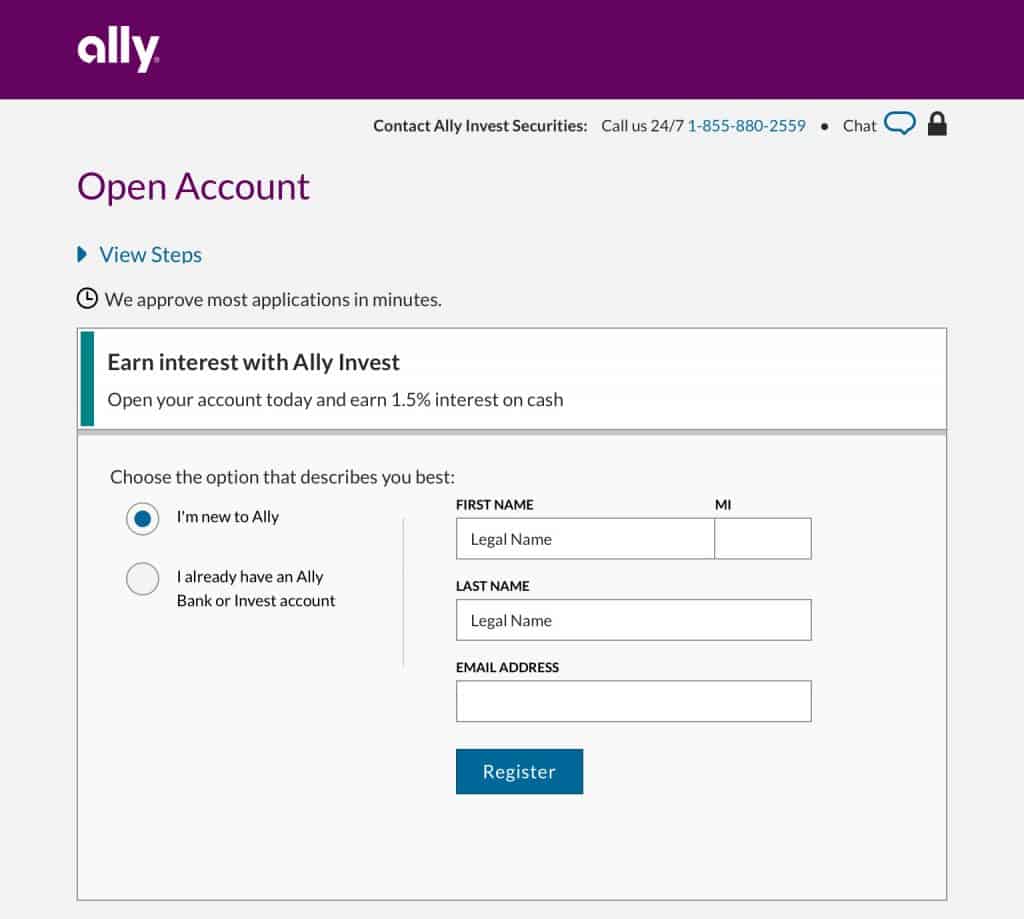

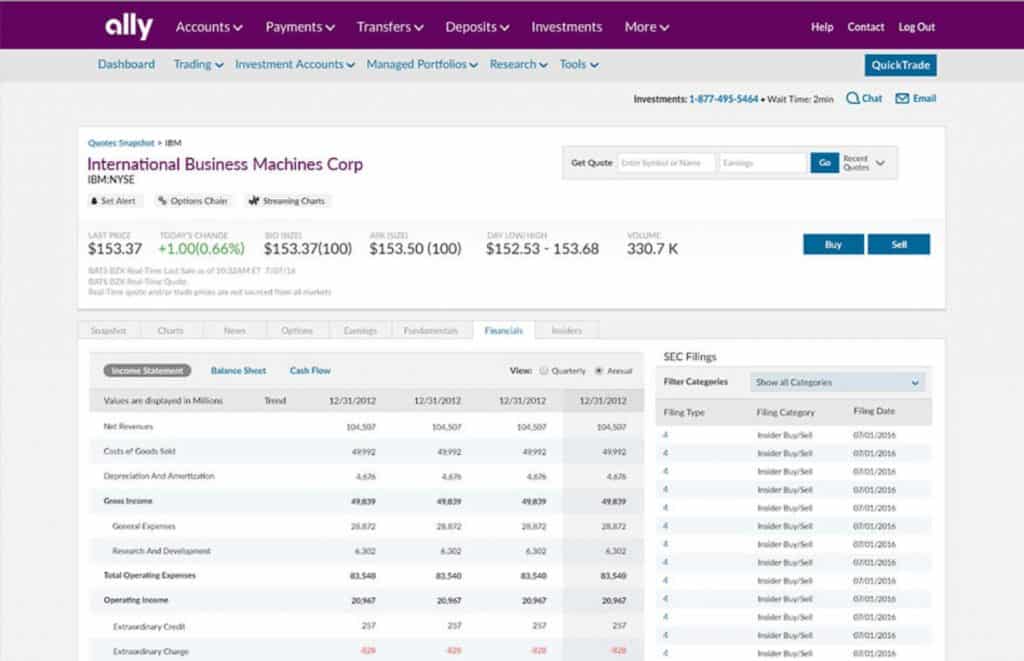

Ally Invest

Ally Invest is part of Ally Financial, the US bank that wants all of your financial services business – insurance, banking and investment – by providing low competitive pricing. Ally Invest delivers on price while still providing a fully featured trading platform to invest in stocks. There is no minimum account requirement at Ally Invest. Sign up, provide proof of identity and fund your account to start trading stocks, options and forex. Stock trades are a flat $4.95 a trade. Mutual funds are $9.95 a trade and option contracts $0.65. Over 100 commission free ETFs are also offered. This discount broker is cheap but not no frills. At no extra charge, you also receive technical indicators, charts, real time pricing data and research. For the options trader, all the basic tools are provided. An options trading bot is even provided. This option scanner makes trades based on your preset parameters. If you make at least 30 trades a quarter or maintain a daily average account balance of $100,000, the stock trading price falls to $3.95. If you do want to use broker-assisted trades, the fee is $20

Pros:

- Low flat fee per trade, lowered for premium customers

- No minimum account balance

- Options trading, analytical tools and trading bot

- Good technical analysis and research tools

Cons:

- ETF choice is limited to one supplier, WisdomTree

- No desktop app – must go mobile

- Broker-assisted trades $20 + commission

ZacksTrade

Zacks Trade provides low-cost trading with the option to upgrade and access the research tools of the pros. Choose across three trading packages to build a highly customizable trading experience. A range of securities are offered for trading – stocks, ETFs, mutual funds, and bonds. Although futures and options are not offered, margin trading is allowed. The minimum balance is $2500 to start to invest in stocks. Here is the real surprise. The trading fees look like discount fees. For stocks and ETFs of more than a dollar, the fee is $0.01 per share with a $3 minimum. And here’s another treat, broker-assisted fees are free.

Withdrawal fees: Investors are allowed one withdrawal from their account every month, with every withdrawal after that raking in a $1.00 fee. Subsequent withdrawals are subject to a $4.00 fee for a check and $10.00 for a wire transfer

Pros:

- Low fees and free broker-assisted trades

- Optional upgrade to workstation and research tools of professional traders

- Margin trading allowed

Cons:

- $2500 minimum account balance

- No futures or options trading

- Average platform speed

Best online stockbrokers for Australia & New Zealand

IC Markets

The IC Markets trading platform is built for the professional forex trader who seeks super fast trading execution and low latency. CFDs can be traded on stocks on the Australia Share trading platforms, Nasdaq, and NYSE. The high volume Aussie trader who wants to execute advanced trading strategies such as hedging and scalping will like IC Markets. These customized strategies can be preprogrammed into trading bots to execute smarter and faster. Tight spreads starting at 0.4 pips and high leverage are offered.

Pros:

- Fast trade execution and low latency

- Tight spreads and high leverage offered

- Hedging and scalping supported

- Automated trading with trading bots

- Islamic trading option

IG Group

For traders down under in Australia or New Zealand, IG is a very established broker offering a licensed gateway to the world’s stock exchanges. Trade stocks directly on the US, UK, Australian, and New Zealand markets, as well as the Asian markets next-door that Australians favour like Japan and Singapore. Basic pricing, stock profile data, and charting by Autochartist is provided for each stock. Research is slim, and includes Reuters news updates and an economic event calendar.

Pros:

- CFDs on 15,000 securities plus direct stock trading

- Direct access to US, UK and Asian (Singapore, Japan) markets

- LSE-listed and regulated broker

Cheapest and free stock brokers

Best Stock Trading Website for Beginners

eTrade

The online broker which introduced the average trader to self directed trading on the Internet still offers the best education for the beginning trader around. E*TRADE has built an extensive education library over the years, from basic trading tips to retirement planning. Daily insights is a good place to go for tips on the trading day ahead. Power E*TRADE has leveraged technology to create a training environment that puts a virtual trainer alongside you, coaching you and providing smileys when a trading opportunity looks profitable.

Pros:

- Large investing and trading education resources

- Virtual trainer to guide you while you trade

- Daily tips to get an edge on the trading day

Best Stockbrokers for Experienced Traders

IC Markets

IC Markets provides an ECN, typically used by professional traders, across all three account types (commissions and spreads vary). The ECN allows traders to directly trade with each other, bypassing market makers who make money by widening the spread. Professional traders appreciate the low latency and execution speeds under 40 milliseconds. Over 50 banks and a dark liquidity pool provide high liquidity.

Pros:

- Fast trade execution and low latency

- Hedging and scalping

- ECN and trading bots

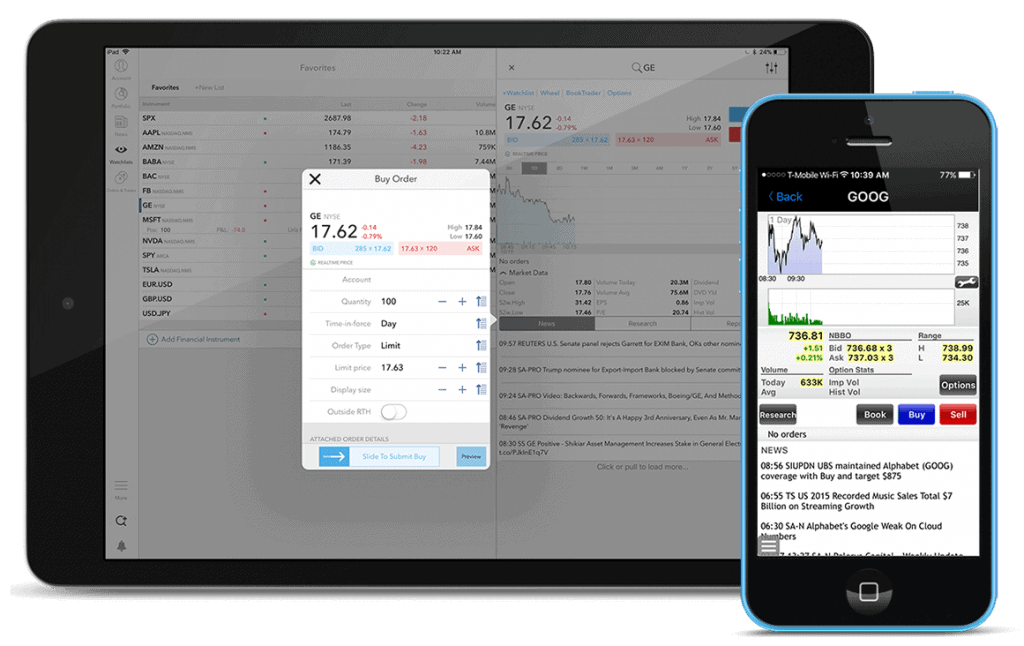

ZacksTrade

The advanced trader can choose to upgrade to the ZacksTrade Pro extensible platform. If you want a professional trader workstation setup or analyst research from the investment banks, advanced features are available for a fee. The platform offers trading bots called scanners for options, ETFs, bonds and other instruments. Sophisticated portfolio development tools with what if analyses are provided.

Pros:

- Upgrade option to ZacksTrade Pro

- Professional, customizable workstations

- Access to research from major investment banks

Best Stockbrokers for Low Fees

DEGIRO

DEGIRO’s low fee trading, at about $2 a stock trade, is taking the European discount brokerage industry by storm. Impressively, for this price traders get access to direct share trading on major stock exchanges around the world. In addition, CFDs, ETFs, funds, bonds, and investment trusts are offered. Research and education resources are sparse, but at this price, you can afford to buy access to your favourite research resources, or you may make do with those freely available on the web.

Pros:

- Very low fee

- Direct share trading on exchanges around the globe

Plus500

The fast trading speed, leverage, high order volume and risk management tools (trailing stops and guaranteed stops) the pro trader needs are here. The intuitive interface includes over 100 technical indicators. The trader with their own tools, stock data and news will be happy to execute on Plus500. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 for stock trades. The beginner trader may prefer a platform with more trading support and education.

Pros:

- Fast trading execution at discount broker prices

- Trailing stops and guaranteed stops

- High leverage for qualified professional traders

80.5% of retail investor accounts lose money when trading CFDs with this provider.

Best Stockbrokers for Reputation

IG Group

IG stands out as an LSE-listed broker that has been in business since 1974 and is licensed in major markets around the world, including in North America, Europe and Asia. The trading layout is fully customizable and includes access to over 100 indicators. Advanced features include real-time tick-by-tick charting, option analysis and backtesting.

Pros:

- CFDs on 15,000 securities plus direct stock trading

- Direct access to US, UK and Asian (Singapore, Japan) markets

- LSE-listed and regulated broker

Best stock broker app

What is a stock broker?

What is a Stock Broker?

An investor, let’s call him Mr. Rich, would call his stockbroker and ask to buy 100 shares of IBM. The broker would then contact his floor trader on the New York Stock Exchange and order him to buy the 100 shares. Today, the online stockbroker has replaced the floor traders with electronic order systems to facilitate trades between his clients and the stock exchanges.

How does an online stock broker work?

What is the difference between share dealing accounts, and stockbrokers?

A share dealing account is used to buy and sell stocks with a view to making an investment return in the future by selling the stock at a profit and/or collecting regular dividends. Dividends are paid out of a company’s profits to shareholders typically on a quarterly basis. A share is a unit of ownership in a publicly listed company. The stockholder makes a profit/loss when the share value increases/decreases relative to the price paid per share.

Stockbrokers act as intermediaries between the stock exchanges where the shares are traded and the buyers and sellers. A stockholder can also short a stock.

When a share dealing account is managed from a retirement or savings account it may be exempt from taxes on gains and losses from the sale of shares.

What to Look for When Choosing a Stock Broker

- Affordable Fees – If you trade frequently, the fees add up, and can eat away at your gains. The number one reason active traders lose money is excessive fees incurred by overtrading.

- Regulatory-Compliant – Most countries have central registration depositories where you can check to see if your broker is licensed or has been subject to disciplinary act.

- High Liquidity – The broker you choose should have a good level of trading volume. On an illiquid exchange, the trader has a lower chance of buying and selling securities at their preferred price. Brokers with low trading volume will have wider spreads. Worst case scenario, you will not find buyers for your securities.

- High Trade Execution Speed – For active traders, trading speed is the most important feature. The price could move several pips in 1 millisecond causing a trading loss. The world’s fastest exchange the London Stock Exchange’s Turquoise platform completes a trade in 400 microseconds.

- Risk Management Tools – Trailing stops and guaranteed trailing stops help minimize losses. More sophisticated risk management tools options, futures and swaps allow traders to make bets on future price movements without purchasing the stock outright.

What to Avoid When Choosing a Stock Broker

- Low Account Security – Always look for a sign of trustworthiness on the website, like the ‘Lock’ icon at the top of the page next to the page URL.

- Limited Technical Analysis Tools – Basic moving average, volatility and volume indicators can provide important price information. Trading bots (expert advisors) can identify price trends and market entry and exit opportunities and execute trades much faster than a human trader.

- Excessive Commissions and Other Fees – Check to see if the broker charges commission. Commissions are the most commonly hidden fees. Withdraw, deposit, overnight and inactivity fees may be charged.

- Variable vs Fixed Spreads – A fixed spread does not fluctuate with prices. The trader has more control over profit and loss outcomes. Variable spreads may tighten in your favour or widen and increase your losses. Check the current and historical spreads of the broker and if the broker guarantees a spread range.

- High Account Minimum – The account minimums featured in this stockbroker survey vary from no deposit to $2500. Accounts with low balances may be subject to a monthly fee whereas those with a high minimum balance may charge lower trading fees and margin interest, or provide other benefits.

Conclusion

Online trading is the only way to invest for most traders. Mobile trading allows you to trade on the go and still have access to your watchlist, alerts and sentiment indicators. This review provides traders at any level the information needed to determine which stockbrokers best align with your investment style and goals. If you are an active trader, go ahead and choose a low cost broker like DEGIRO or Ally Invest. Why pay high trading fees for research and technical tools you may never use? Keep in mind that you can find professional research for free or a low monthly fee on the Internet. If you do see yourself trading alongside the pros in the future, extensible platforms that allow you to upgrade like Zacks Trade and IG Group will meet your current and long-term investment objectives. If you want the reputation and reach in the global stock markets of the big brokers like Merrill Lynch, take a closer look at IG or IC Markets.

How We Rated Stock Brokers

We have user-tested the trading platforms of the stock brokers in this review, surveyed traders and gathered user views online to rate the best online stockbrokers on:

- Trading fees, commissions, and other fees

- Spreads and leverage

- Basic risk management tools (stop losses, guaranteed stop losses)

- Risk management instruments (futures, options, swaps)

- Technical indicators

- Research and news

- Education and training resources

- Trading interface usability and customizability

- Trading platform (MetaTrader, cTrade, proprietary)

- Range of securities traded (CFDs vs direct trading)

FAQs

Which online trading company is best for buying stocks?

All of the stockbrokers we evaluated provide impressive trading platforms at competitive prices. A trader may use the fastest trading platform, Wall Street research and smartest trading bots, but ultimately your trading strategies will determine how profitable your trades are. All told, there may be platforms that beat out eToro in one category or another, but eToro is the leader in social trading. With fees on par with discount brokers, we believe eToro offers among the best value out there.

Why do I need a stockbroker?

Stockbrokers are licensed to buy and sell stocks traded on public stock exchanges. The stock exchanges make up the stock market. Brokers at the exchanges are called market makers because they create a trade market in stock by buying and selling the stock with brokers. These brokers then sell the stocks to investors.

Can I trade stocks without a broker?

Most stocks are bought and sold through an online broker. It is possible to purchase stocks directly from a company. Many companies sell stocks directly to the public through direct stock purchase plans (DSPPs). You can have the company automatically reinvest the dividends through a dividend reinvestment plan (DRIP). This option will never work for the active trader who makes money buying and selling stocks in a short period. Brokers pay stock exchanges high fees to have a ‘seat’ on the exchange and the ability to make a market in certain stocks. Traders must go through the broker channel to trade these stocks.

Can I buy stocks online?

Almost all stocks are sold online today. Stocks used to be bought and sold by placing phone orders to brokers. The Internet allows individual investors to buy and sell stocks directly from the broker trading platform of an online stockbroker. Examples of online brokers are Plus500 and Ally Invest.

What fees do stockbrokers charge?

Trade Commissions - Trade fees are important because they can make the difference between a money-making and money-losing investment portfolio. The number one reason active traders lose money is incurring excessive fees, which offset any trading gains, by overtrading. You will see three types of trading fees cited by brokers. The spread - This is the difference between the price buyers are willing to pay for a stock (the bid) and the price sellers are willing to sell the stock at (the ask). The trading fee - The trading fee may be an all-in cost such as $6.95 a trade, or it may be based on a per share cost, such as .01 cents per trade. When per-share pricing is used, a fixed fee or commission is sometimes added. The commission - This is a percentage of the trade or fees the broker adds to the trade-in cost. Additionally, withdrawal, deposit and nonactivity fees may be charged.

What are stock options?

A stock option is a contract giving the right, but not the obligation, to buy a stock at a predetermined price at a predetermined date in the future. The two main types of options are puts and calls. If you expect the price to fall in the future, you will buy a put – the right to sell the stock. If you expect the price to rise in the future, you will buy a call - the right to buy the stock.

What does it mean to short a stock?

When you buy a stock, you take a long position, expecting the price to rise in the future. However if you expect the price of a stock to decline in the future, you can also profit by taking a short position in the stock. Instead of buying the stock out right, you borrow the shares from a broker and pay interest on the borrowed shares. If you expect Stock A to decline in the future, you borrow 100 shares from the broker and buy an option to sell those shares at $100 at a future date. If the share price falls to $90, you buy the shares for $90 and exercise your option to sell them at $100. You have made $10 per share, minus the interest and commissions.

What are dividends and how are they paid?

A dividend is a payment a corporation makes to distribute some of its profits to investors. A dividend is paid on a per share basis, typically quarterly. An investor who holds 100 shares in a company that pays a $0.10 dividend would receive $10 four times a year in dividend payments. If a company pays a consistent and increasing dividend, it is a sign that the company operates efficiently and is profitable.

What are CFDs?

A contract for difference (CFD) is a contract between a buyer and a seller whereby the buyer pays to the seller the difference between the purchase value of a contract and the price at the contract expiration date.

Do I need live pricing data to trade stocks?

If you are a day trader, you will require live price data to determine when to enter and exit a trade. Market prices constantly fluctuate. Without real time prices, the investor is exposed to higher price risk.

Comments are closed.