Since 2012, Lyft has helped over two billion riders get to their destinations. The number two ride sharing service in the United States commands 29% of rides. It faces stiff competition from Uber, which dominates market share with the traditional taxi-hailing crowd. Taking the high road, Lyft is focusing on higher margin business. It has become the preferred ride sharing service of the Fortune 1000 set and other corporate passengers and is expanding into e-scooter and e-bike rentals. With these new markets, Lyft is transforming from a ride sharing to a transportation network company.

If you want to invest in the cheaper and greener transportation alternatives of the sharing economy, this guide will explain how to buy Lyft stock, evaluate the best Lyft stockbrokers, and assess how its expansion into new transportation markets will affect the stock value.

Best U.S. Platform to Buy Lyft Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in LYFT and found Stash Invest to offer the best platform, lowest fees and most appealing bonus. Click the table below and get started with only $5 today.

Best Platform to Buy Lyft Shares outside the U.S.

When it comes to investors outside the U.S., eToro is undeniably the best platform for investing in LYFT. Trade stocks, ETFs, CFDs and cryptocurrencies with 0% commissions and competitive spreads. Or, copy the trades and portfolios of top performing traders in one click on the leading global social trading platform. Click the link below to start trading with this trusted, regulated broker.

How to buy Lyft stock in the U.S.

The best platform to buy Lyft stocks in the U.S. is Stash Invest. Read below how to get started.

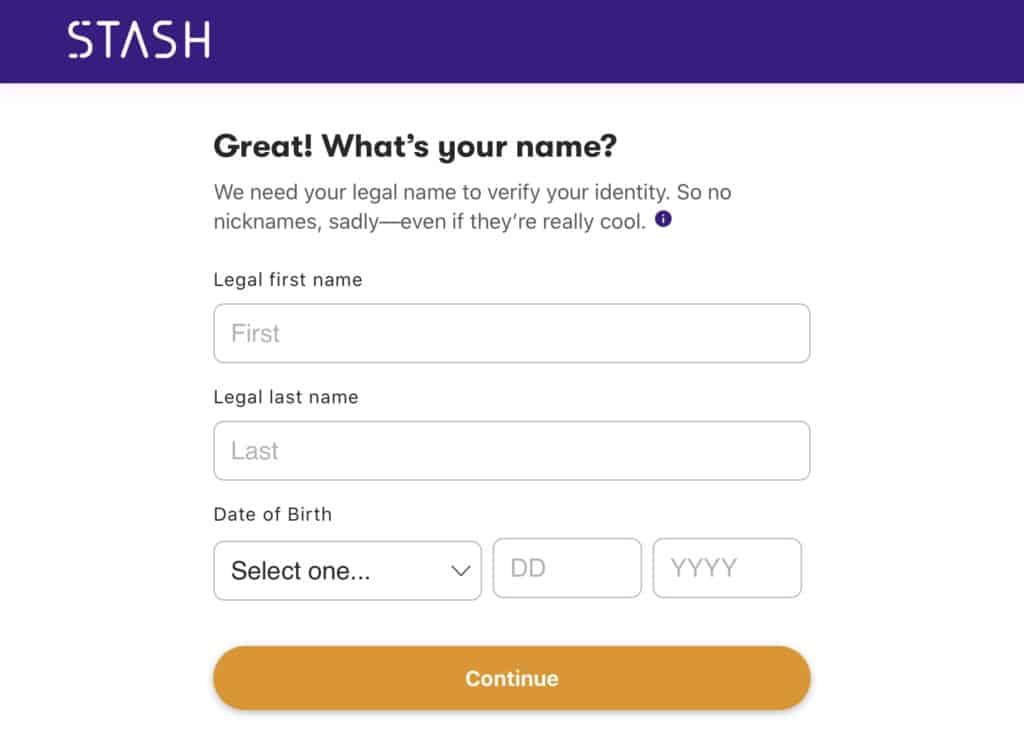

Step 1: Register your account

The first step to invest in LYFT in the U.S. is to sign up to our recommended broker Stash. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile. For ID verification, you will only be asked for your social security number.

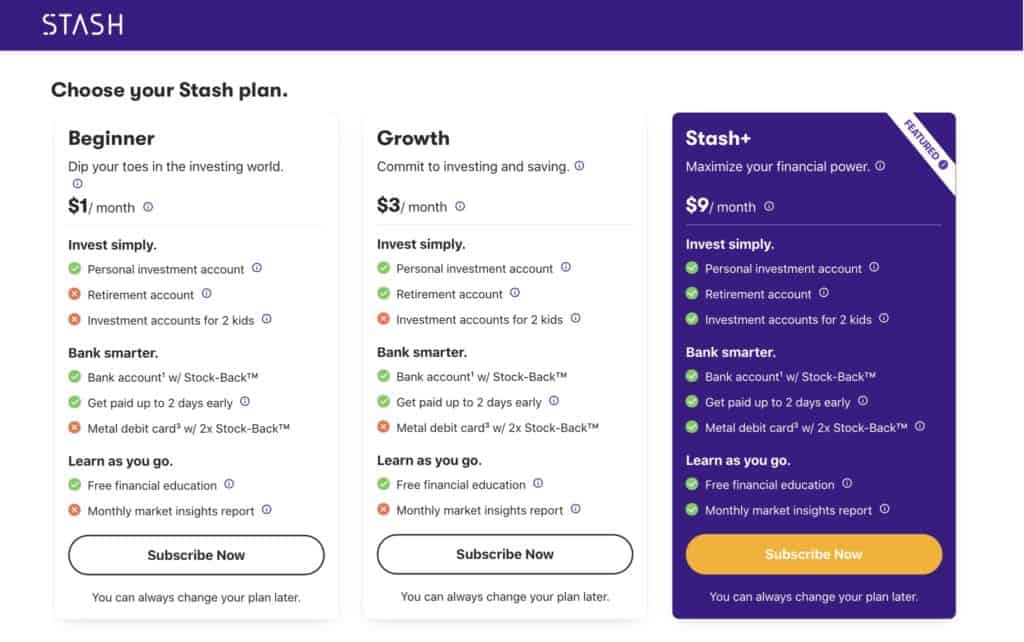

Step 2: Choose a Stash plan

Choose between a Beginner ($1/month), Growth ($3/month), or Stash+ ($9/month) account. All three offer a personal investment account and bank account with Stock-Back™️ rewards and a 2-day early payday. Choose the Growth account to add a Retirement account. Stash+ adds investment accounts for two kids and a debit card with 2x Stock-Back™️. Pay for your monthly subscription via your bank account or debit/credit card.

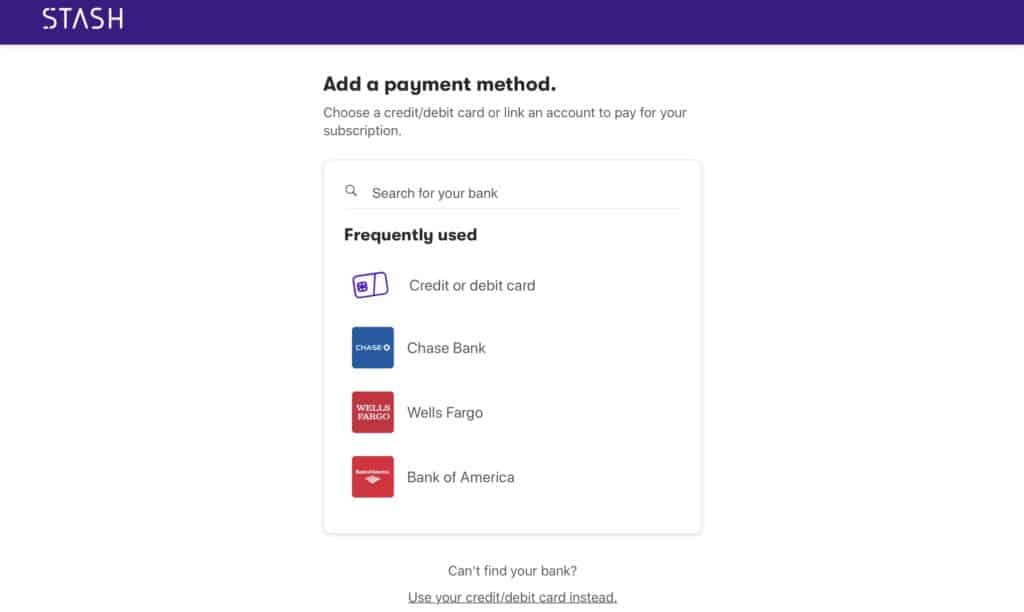

Step 3: Fund your account

Link your bank account and fund your account by wire transfer. Receive $50 to invest when you deposit $300 within 30 days. Optionally, add the Smart-Save feature, which monitors your income and savings patterns and suggests how much to allocate to savings.

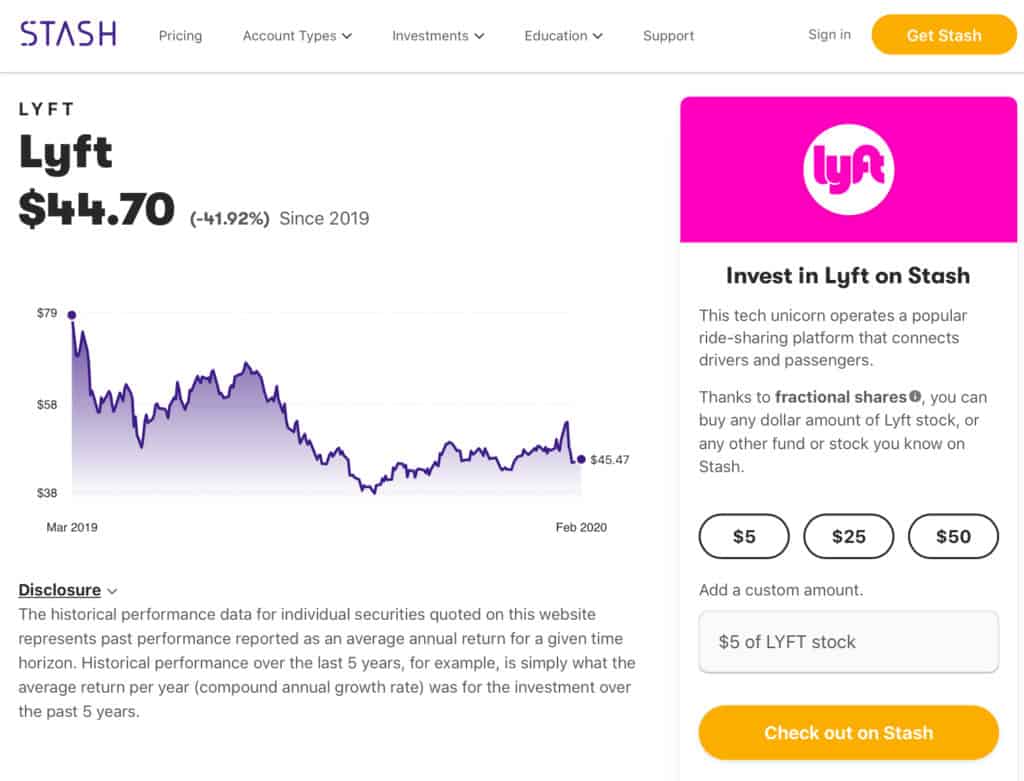

Step 4: Trade Lyft stock

Type the LYFT ticker in the Search box. Enter the fractional share amount you want to invest: $5, $25, $50, or a custom amount. Press Check Out on Stash to pay for the stock trade from your Stash account.

80.6% of retail CFD accounts lose money

How to buy Lyft stock outside the U.S.

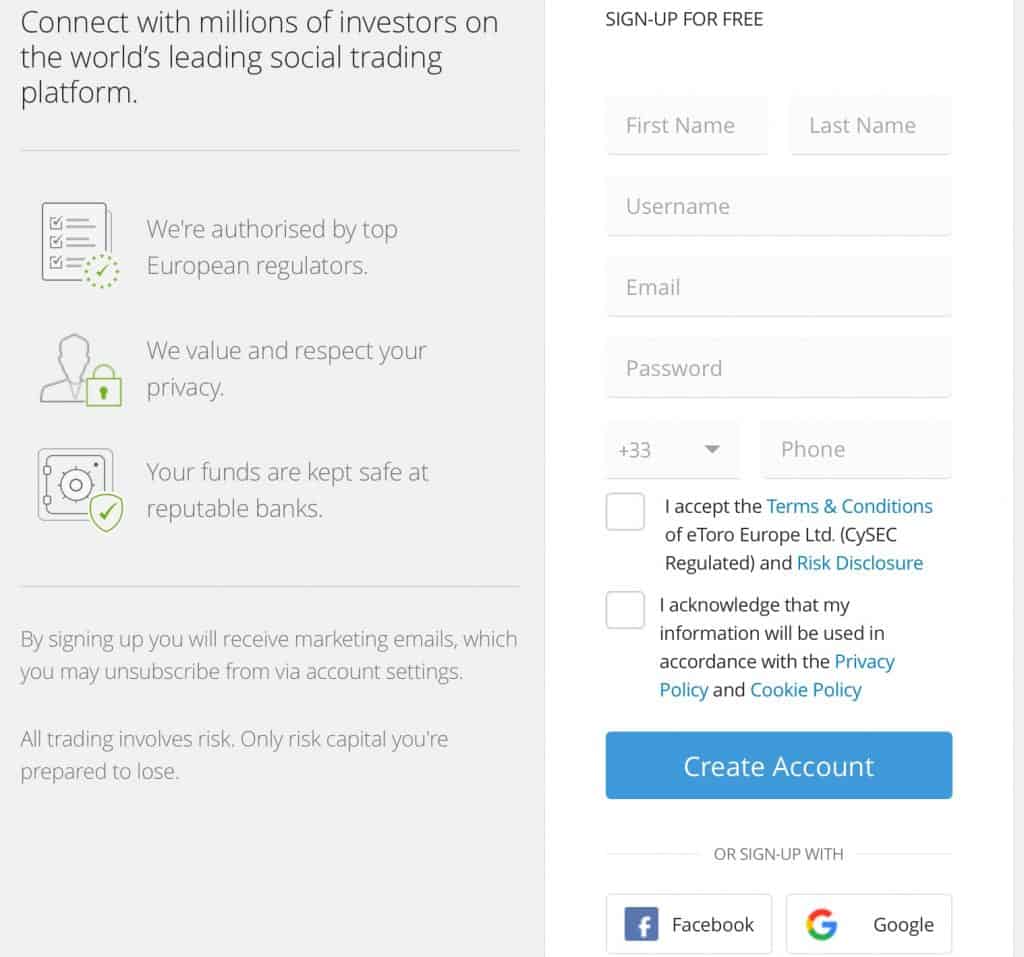

Step 1: Register your account with eToro

The first step to invest in LYFT is to sign up to our recommended broker eToro. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile.

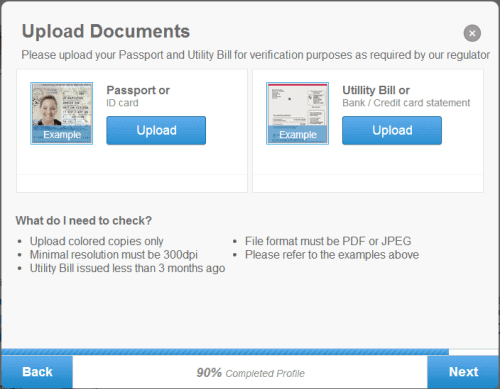

Step 2: Verify your identity

Attach and submit proof of identity for verification.

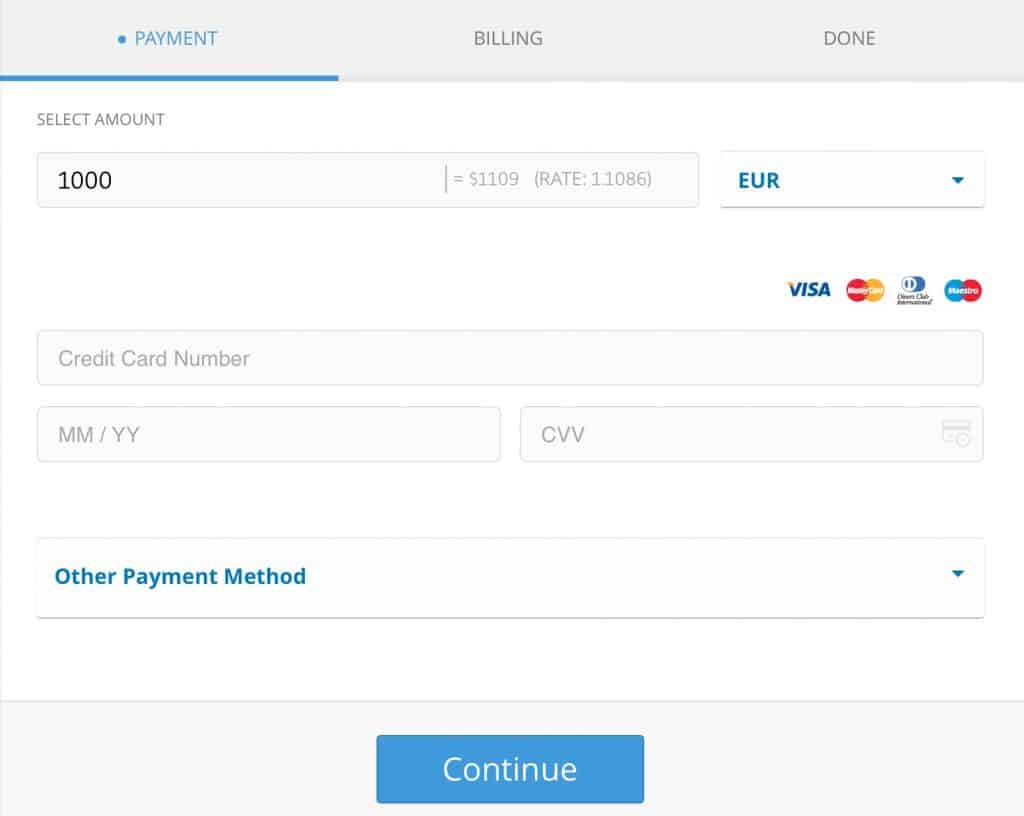

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

Step 4: Trade Lyft stock

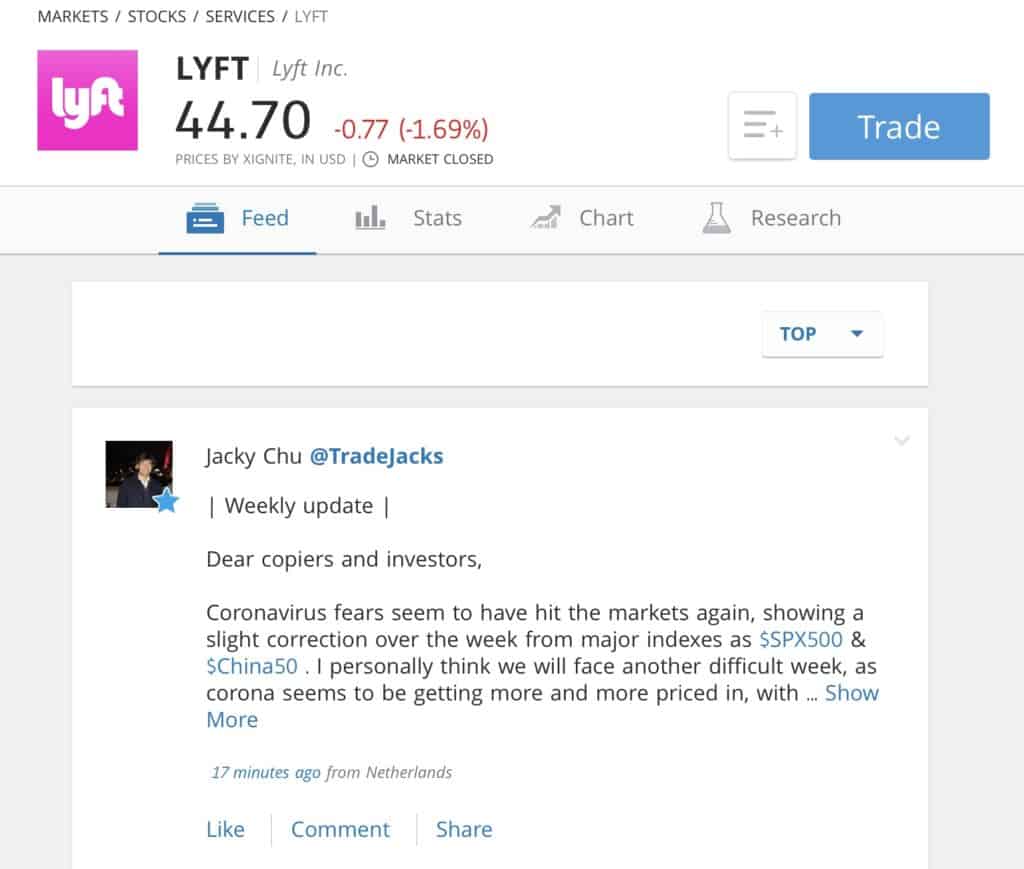

On eToro, you can invest in Lyft through direct trading or social investing. Social investors can choose portfolios to copy based on a risk score assigned to every trader portfolio on a scale of 1–6, 6 representing the highest risk. Here are three ways to invest in Lyft stock on the leading social trading platform.

Step 4A: Place a Lyft stock trade

To buy Lyft shares, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The Lyft stock profile page provides social feeds, stats, charts and research. Social feeds provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

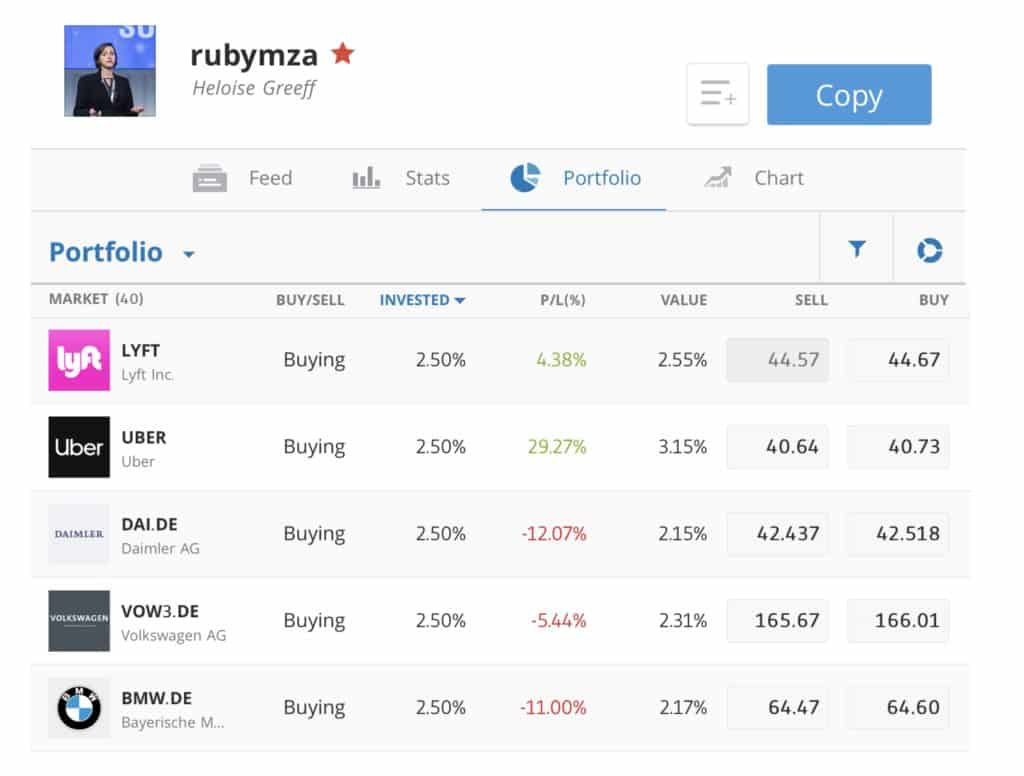

Step 4B: Place a CopyTrader™ trade

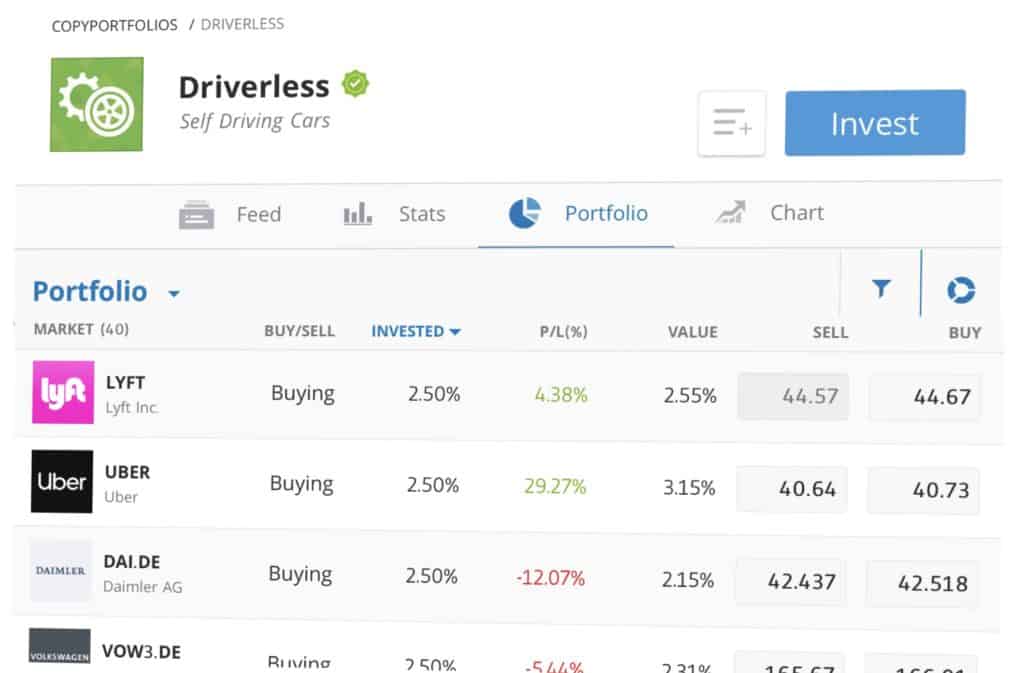

Step 4C: Place a CopyPortfolios™ trade

Choose a portfolio, among dozens of investment themes, that holds Lyft stock. CopyPortfolios™ copies multiple portfolios and traders following that theme. We chose the Driverless portfolio.

Review the risk profile and portfolio performance. Click on Invest. From the Invest box, choose the amount you want to invest and the stop investing limit.

Lyft Stock: Current Prices and Summary

Lyft stock is down 72 percent to $45 since it went public in March 2019, when it closed at its all time high of $78.3. Like Uber, investors have punished ride hailing industry stocks for large losses. Lyft is forecasting profitability in 2021, providing investors an opportunity to buy the stock while it is cheap.

The amount of revenue Lyft generates per share has increased 77 percent to $15.9 in 2019. EBITDA per share, however, declined 282 percent to -$11.40, owing to the high EBITDA loss of $2.6 billion. Though Lyft says losses will decline going forward. Positive margin contribution from ride hailing and improving operating leverage will help offset rollouts of scooters, e-bikes and car rentals in new markets.

What can we expect for the stock price going forward? Analysts have a median LYFT stock price forecast of $63 (high $96 low $35), a 40.1 percent premium over the current stock price of $44.70.

A Brief Overview of the History of Lyft

In 2007, two years before Uber was founded, John Zimmer launched his college carpooling project Zimride with a business partner he found on Facebook, Logan Green. Zimride offered its services to college campuses and connected student drivers and passengers through FacebookConnect. In 2012, Zimride added a ridesharing service called Lyft. A year later, Zimride was renamed Lyft and the carpooling service – now the largest in the US – was sold to the parent of Enterprise Rent-A-Car.

By 2014, Lyft was operating in 60 cities nationwide, which it has since expanded to 644 across North America. True to its roots, Lyft introduced a ride sharing service. Lyft has started to rent electric scooters, bikes and electric bikes and cars. As the ride-hailing business becomes cannibalized by intensifying competition, in 2018, Lyft entered the enterprise market by shuttling patients to and from hospitals. Hotels, airlines, auto repair shops and the Fortune 1000 are now corporate clients. Lyft has partnered with self driving car makers and currently has self driving cars in its fleet in Las Vegas and Arizona. Lyft went public in March 2019 and was valued at 24.3 billion the day of its IPO.

Lyft Shares Forecast 2020–2024

Investors have been tough on the stocks of ride hailing companies reporting losses. They now want to see a clear path to profitability. Lyfts’s earnings losses mounted in 2019, but management says losses have peaked.

On Uber comparisons, Lyft stock took a hit in February when Uber announced it would be profitable on an EBITDA basis (excluding certain expenses to focus on operating profit) in 2020, versus 2021 forecasted by Lyft. But Lyft appears to be moving towards profitability faster than Uber. Uber Rides has ended the year with an operating margin of 24.3 percent versus 13 percent for Lyft. Lyft’s EBITDA losses, excluding certain expenses, improved 28 percent to $679 million whereas Uber’s losses increased 150 percent to $2.7 billion.

Lyft plans on becoming profitable by focusing on “high frequency, high growth and high margin rides.”

2020 – Higher margin transportation alternatives

Lyft continues to add new modes of transportation to its crowdsourcing app. e-bikes and a new generation of scooter started rolling out in different markets across the country at the end of 2019. The ride hailer plans to disrupt the car rental market in 2020 by eliminating the pay-by-mileage model. Mileage is unlimited. Renters receive a $20 ride credit to take them to and from the car rental. Watch out Avis and Hertz! The outlook for Lyft stock is median-to-high.

2021 – Ride hailing usage growth stabilizes

Global ride hailing user growth of 16.1 percent in 2019 will slow between 2020–2023 to 8.3 percent (Statista). Although car ownership is growing, the number of car-free and car-light households is also growing (U.S Census Bureau). Once self-driving cars are in the road and you can program an Amazon Echo smart home system to hail a Lyft or Waymo car to run errands or pick you up at the door, we expect non-car or one-car households to grow at a faster rate. The outlook for Lyft stock is low-to-median.

2022 – Early technology lead in robo-taxis

Lyft has partnered with Waymo in Arizona and Avis in Los Angeles to provide a self-driving car option on its app. Other technology investments are paying off. One third of shared riders are using the Lyft Matching Platform to consider commute time of day, rider frequency and other cost-to-convenience trade-offs to lower fares. With the help of Lyft’s technology and rewards, riders will use more modes of transport across Lyft’s transportation network (e-bikes, car rentals, micro-mobility etc.). The outlook for Lyft stock is median-to-high.

2023 – High value enterprise partnerships

The high margin enterprise business continues to add new partners. Hilton has been added to the major airlines and hotels allowing business travellers to earn points when they use Lyft. The Lyft Pink monthly subscription offers more rewards and discounts for frequent travellers. Chase Card joins Cite Premier Card offering 3x points on travel and cash back on Lyft rides. Israeli ride sharer Gett is using the Lyft platform for its corporate clients in the U.S. The outlook for Lyft stock is median-to-high.

2024 – More sharing in the sharing economy

From 2019–2025, the global ride sharing market is forecast to grow at a CAGR of 7.5 percent to $13 billion (Grand View Research), driven by the growth in mobile smart devices. By creating a green, alternative transportation loop from the residence through to airlines and hotels, Lyft is positioned to be a one-stop shop for the environmentally conscious urbanite. The outlook for Lyft stock is median-to-high.

Should you Invest in Lyft?

It may surprise some to learn that Lyft – not Uber – was the pioneer of ride sharing in 2007. Lyft has remained focused on the North American transportation market. Lyft’s agenda is to reduce car ownership by making crowdsourced travel a cheaper, faster, and easier way of getting around. Lyft plans to increase riders and revenue per rider by providing a platform of transportation options – ride hailing for enterprises, micro-mobility (electric scooters and bikes), public transit, and now car rentals.

The ride hailer’s strategy to provide multi-transport options from one mobile app is gaining traction. In the final quarter of 2019, the number of riders increased 23 percent to 23 million over the year-ago period. Average revenue per rider jumped 23 percent to $44.40. By generating more value per rider, Lyft increased revenues 68 percent to $3.6 billion over 2018.

The ride sharing industry, however, has struggled to become profitable, but Lyft is showing traction here, too. Operating losses have narrowed and Lyft plans to be profitable in 2021 – two years after its March 2019 IPO.

The success of the first year of Lyft’s expanded sharing transport platform indicates high growth potential, but the company also faces challenges.

Pros of investing in Lyft stock

Cons of investing in Lyft

Conclusion

Should you buy Lyft stock? Across business, travel, health and other markets, Lyft is creating synergies through partnerships driven by cross incentives and rewards. Consequently, rider traffic is growing across Lyft’s alternative transport modes. As these partnerships gain momentum, we expect Lyft to continue to add new riders and generate more value per rider.

If you want to buy stock in Lyft, we recommend doing so via a regulated online broker such as Stash Invest if you’re a U.S customer, or eToro if you are outside the U.S.

FAQs

When compared to competitors, LYFT stock appears fairly valued. On a price-to sales basis, LYFT has a P/S of 3.7 versus 4.9 for Uber. In car rentals, HyreCar (HYRE) and YayYo (YAYO), startups renting cars to ride hailing and ride sharing drivers, have a P/S ratio of 3.3 and 1.5, respectively. Market leaders Hertz (HTZ) and Avis (CAR) have a P/S of 0.20 and 0.39, respectively. This low valuation shows the market significantly undervalues the traditional versus online, on demand car rental market Lyft is moving into this year.

Uber is still slightly cheaper than main U.S. competitor Lyft. A trip from the Los Angeles airport to the hip new Edition Hotel in West Hollywood would cost $29 with Uber and $30 with Lyft, but $60 by taxi. Luxury cars are even cheaper with Uber. The same trip in an Uber Black costs $92 versus $96 for Lyft.

When valuing Lyft stock, it is impossible to ignore its main competitor Uber, which has a 70 percent U.S. market share. When Uber announced in February that it would be profitable on an ‘adjusted” earnings basis in 2020 – one year earlier than forecast— Lyft stock fell 3.5 percent. A week later when Lyft’s earnings report beat Wall Street expectations but it reiterated a profitability date of 2021, Lyft stock fell another 5 percent – both stock declines were attributed to comparisons with Uber’s profitability timeline.

Lyft has formed partnerships with autonomous car makers to get an early lead in the market. Riders can order self-driving cars from the Lyft app from Aptiv in Los Angeles and Waymo in Arizona. By mid-2019, Los Angeles riders had ordered over 40,000 paid rides from Aptiv. Uber, in comparison, is testing self-driving cars with human drivers on board and is not yet generating revenues from self-driving cars.

As of January 1, 2020, ride hailing companies operating in California are required to treat drivers as employees, not contractors. This means they will have to pay employment benefits and deduct taxes, which would significantly raise their costs. New York plans to pass a similar law. To avoid having to hire drivers as employees, Uber has changed its app to give drivers more autonomy to manage their rider preferences and fees in order to classify them as contractors. The law is being challenged by Uber, Lyft, Postmates, and other ride hailing companies.

You can buy Lyft shares from online stockbrokers. If you are in the US, you can purchase Lyft shares through Stash Invest. UK-based investors can purchase LYFT shares through eToro. Both online stockbrokers provide intuitive trading platforms that make it easy to buy and sell stocks. After signing up online, type in the LYFT ticker, place your order and you will become an owner of Lyft shares. Is Lyft stock overvalued?

Is the cost of a ride in the U.S. cheaper with Uber or Lyft?

How does Uber’s performance affect Lyft’s stock price?

Is Lyft ahead of its ride hailing competitors on self-driving cars?

How will new gig worker laws for ride hailing drivers affect Lyft’s profitability?

Where and how can you buy Lyft stock?