After the a COVID-19 March sell-off, Aphria’s stock rallied impressively in April and options traders appear to be pricing in a big move for APHA shares in the near future. It could be the right time to take a closer look at the Canadian cannabis company and potentially buy Aphria stock.

Thinking of investing in Aphria? This guide will explain how to buy Aphria stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Aphria Stock

If you want to invest in Aphria, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is the best platform on which to buy APHA stock. If you’re inside the US or Canada, our top pick is Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

Best known as the innovative social trading platform that introduced CopyTrader – a feature that allows you to duplicate top traders' positions – eToro has built on its early social trading success and now offers a comprehensive range of services and tools to fit the needs of both long-term investors and day traders.

Whether you’re looking to buy shares in Aphria (APHA) or you’re more interested in speculating on its price fluctuations, eToro is a smart, competitively priced choice with great UX and support Alongside the option to buy Aphria stock directly, eToro also allows you to trade CFDs, meaning you can speculate on prices going down and use leverage to make larger traders.

Pricing is very reasonable, with zero-commission on stock and ETF trading for European clients and no stamp duty for UK customers on stocks purchases. The spreads are also among the most competitive on the market.

A relatively low minimum deposit of $200 means you can get started without stumping up a fortune, and there's a range of deposit methods, including PayPal. You can even trial the experience for free by giving it a spin in the $100,000 free demo mode. eToro is regulated by the FCA, ASIC and CySEC, so it's a very secure patform.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Aphria stock? Points to Consider

It’s always best to do your research before you buy Aphria stock or other cannabis stocks, like Aurora stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Aphria business model and share price history

It’s been a difficult 12-months for a cannabis industry that looked so buoyant in the first quarter of 2019, when pot stocks like Aphria were flying high. Since then, regulatory issues have led to product shortages and supply bottlenecks. APHA’s stock price fell into a steady decline before plummeting to a low of $2.13 in March when the COVID-19 pandemic hit.

In the early stages of the COVID-19 crisis, investors began to worry that the pandemic would impact supply chains and that lockdown measures might damage sales. Neither of these concerns seems to have materialised to a significant extent and April saw an impressive revival, with plenty of investors clearly sniffing a bargain.

Aphria’s stock price shot up 25% in April, peaking at $3.77 on April 15, the day after the company released encouraging third-quarter results that beat Wall Street forecasting. During the quarter that ended Feb. 29, Aphria recorded net revenue of 144.4 million Canadian dollars, up from CA$120.6 million in the same period last year.

Interestingly, Aphria’s German subsidiary CC Pharma was the biggest driver of the revenue increase, contributing net revenue of CA$86.8 million. Aphria acquired the German medical pot distributor last year, in what looks like a smart move to diversify beyond Canada.

Looking ahead, Aphria’s prospects look good and some upside looks very likely given the depths to which the stock fell in 2019. APHA stands apart from most pot stocks thanks to the company’s impressive cash reserves (C$515 million at the end of the last quarter) and positive sales figures. Aphria also seems to be weathering the COVID-19 crisis without better than most. Early indications suggest that the pandemic may even result in a bump in sales.

Aphria stock dividend information

Aphria doesn’t currently pay a dividend to shareholders.

Aphria stock forecast and prediction

Aphria’s median 12-month target price according to CNN and based on 12 analyst forecasts, is $5.68. This represents a 59.16% increase on the current price of $3.57.

MarketBeat’s analyst ratings are more optimistic, reporting a median target of $8.21 and a consensus rating of Buy.

How to Buy Aphria Stock on eToro

It’s quick and easy to invest in Aphria stock at our recommended broker, eToro. Once you’ve registered and deposited into your broker account, follow these simple steps to buy APHA stock.

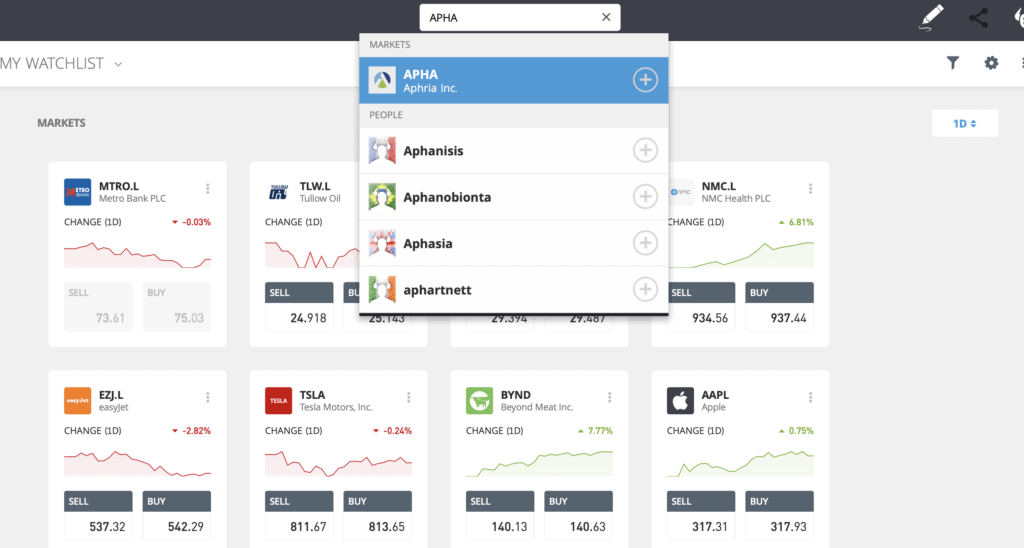

Step 1: Search for Aphria (APHA) Stock

Look up Aphria by typing the ticker symbol APHA into the search box.

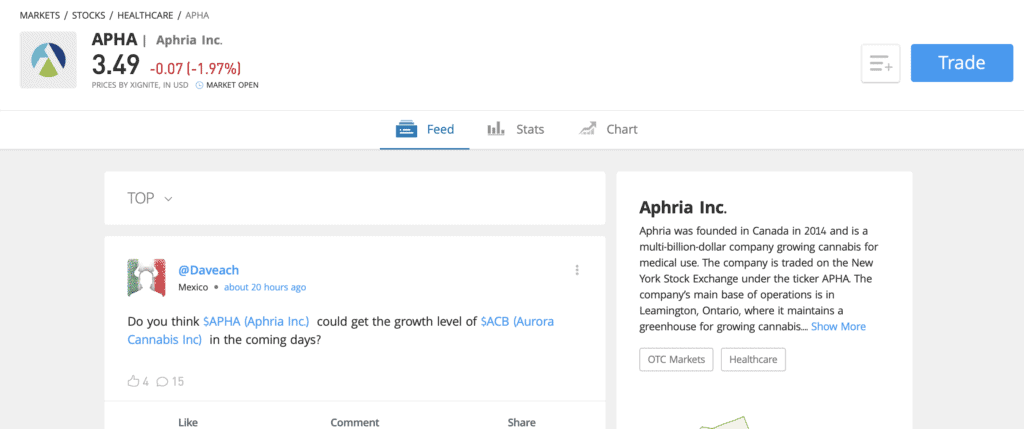

Step 2: Click on trade

Click Trade in the top right corner of the Aphria page.

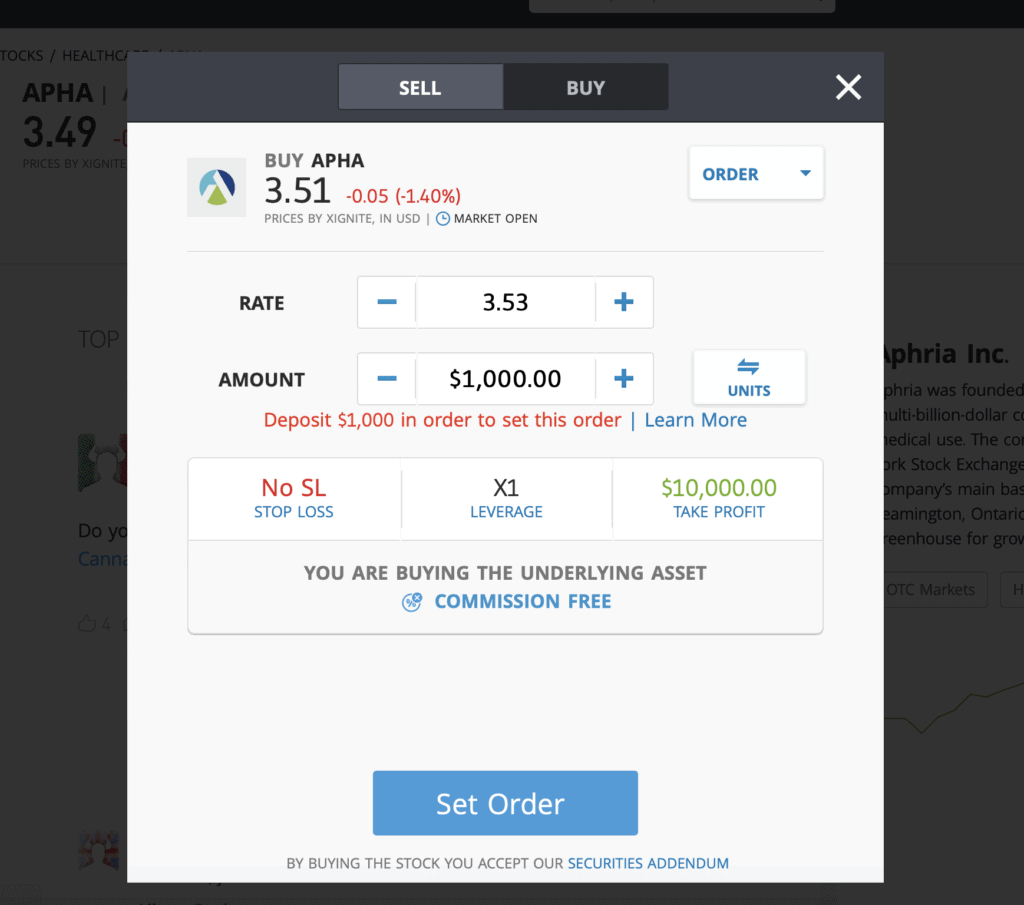

Step 3: Specify ‘Buy’

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade APHA CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Investing in Aphria Stock – Final Thoughts

After a tough 12-months, Aphria is starting to look like a solid prospect. Earnings are consistently strong, the cannabis derivatives market looks set to blow up and regulatory issues are close to being resolved. Given the extent to which APHA stock plummeted, there’s potential for plenty of upside ahead.

If you want to buy Aphria stock today, we recommend registering with one of our recommended stockbrokers. eToro is our pick broker if you’re outside the US, while we recommend US traders sign up to Stash Invest.

FAQs

Should I buy Aphria stock or wait?

Now could be a good time to invest in APHA. While the share price has fallen considerably over the last 12-months, Aphria has performed well and seems relatively unscarred by the Coronavirus crisis. We’re not surprised to see most analysts rating it a solid Buy.

What are the fees when buying Aphria stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy APHA stock.

Is there an APHA stock price prediction?

Analysts estimate a median 12-month forecast of $5.68, which represents a 59.16% increase on the current APHA price of $3.57.

What does the Aphria stock dividend pay?

Aphria doesn't currently pay a dividend to shareholders.