Even before the legalisation of recreational cannabis in Canada in October 2018, money was already pouring into the industry.

With legalisation for medical and recreational use spreading, the interest from both investors and consumers is increasing, and more and more people are now becoming interested in buying cannabis stocks. Read our full guide to find out how to invest in marijuana in 2024.

What Are Cannabis Stocks?

Cannabis stocks are shares in companies that are growing cannabis for the medical and recreational markets and ancillary companies.

Not surprisingly, given Canada’s legalisation of the weed, it is Canadian companies that have been leading the way.

However, more companies are popping up in other jurisdictions as the medical, wellness, food, beverages and recreational markets grow and expectations of future growth rise.

5 Reasons to Investing in Marijuana stocks

1. Hemp is going to be big

A further clarification rounds out the picture. The cannabis family is classified into either Indica or Sativa. The marijuana plant is a member of both but hemp is Sativa-only.

Although it had previous been technically legal to cultivate hemp in the US providing the THC content did not exceed 0.3%, in effect the US 1937 Marijuana Tax Act made it illegal to possess all forms of cannabis thereby hindering cultivation.

Hemp had been cultivated in the US since the seventeenth century as a mainstay of the colonial economy to make ropes, textiles, sacks, canvas and paper.

With the passing of the US Farm Bill in 2018, hemp has again been legalised following its removal from the schedule 1 controlled substances categorisation. Production is expected to take-off rapidly.

However, bear in mind that the US Food and Drug Administration has ruled that hemp products are not allowed to be used for dietary purposes and CBD-infused food and beverages is not legal until later this year.

The CBD hemp market in the US is set to grow to $1.3 billion by 2022 for a five-year compound annual growth rate (CAGR) of 27.2%, according to the Hemp Business Journal. That’s a 300% increase. It could expand even faster than that if established farmers turn to the crop.

Investors should also be aware that the research has only got started in earnest on CBD and THC, and it is pretty much non-existent when it comes to the bulk of the cannabinoids isolated to date. There could be many more yet to be isolated.

2. Legalisation of marijuana

Cannabis legalisation for medical use is spreading and with it the opportunity for cannabis companies.

Recreational use will be slower to be legalised but all the signs point to change as younger generations grow older and more hostile older generations pass away.

The decline in beer drinking in the west among millennials is just one sign of what the future may hold for cannabis.

The addressable market (which we discuss further below) could be as large as $500 billion if the disruption of the medical, food and beverages industries comes off.

3. Wellness, beauty and edibles

Two key growth areas will be in wellness and edibles. CBD is the key active ingredient for all those product types. CBD oils are selling like hot cakes for ailments such as anxiety.

It is also finding its way into topical products for skin health and beauty.

For example, MGC Derma cream is a hit at the luxury outlet Harvey Nichols. The cream is made by Australian medical research company MGC Pharmaceuticals.

Edibles gaining in popularity include Lord Jones Old Fashioned High CBD Gumdrops and To Whom It May CBD Chocolates.

In wellness there is Sträva “Peace and Wellness” Restore Coffee, which can be consumed to “pair alertness with calmness”.

4. Stock prices attractive in small caps and acquisition targets

Admittedly there are some pretty meaty valuations among the top flight cannabis stocks but under the radar there are great risk/reward opportunities among their small-cap peers. Some of the candidates that fit the bill are The Green Organic Dutchman, OrganiGram and Innovative Industrial Properties and are all mentioned in more detail below.

And of course there are cannabis firms that could come to the attention of a deep-pocked suitor eager to get into the space. HEXO is often talked about as a target and is currently in a partnership with brewer Molson Coors.

With the sharp sell-off at the end of October last year, now could be a good time to enter the market before it gets too frothy again.

5. Medical uses – just scratching the surface

The medical marijuana industry’s full potential is very far from being visualised let alone realised.

Put that another way, research has only just started in earnest and with 113 cannabinoids that have been isolated so far, and no doubt many more compounds to be discovered, the possible use cases could mushroom.

In something of an endorsement of the validity of certain cannabis-based treatments as effective, or at least not harmful, last year Sun Life Financial began offering medical marijuana coverage.

Sun Life is one of Canada’s largest insurers and other insurance companies, despite early reticence, have followed in its path to provide cover for medical marijuana treatment.

Best Cannabis Stockbrokers for 2024

Hargreaves Lansdown

How to invest in cannabis on H&L

Opening an account

Hargreaves Lansdown is the UK’s largest investment platform. Its customer service is probably the best in the market.

Step 1: Register

To trade shares on the platform you will first need to register for an account which is a breeze. Provide name, address, employment details

Step 2: Verify identity

Upload a photo of either a passport OR driving licence. Also you will need to a utility bill, bank statement or credit card bill (excluding mobile phone bills) from the last six months

Step 3: Deposit

Transfer a nominal £1 to confirm your bank details.

Step 4: Start trading

There is no minimum trading amount and a demo account is available to learn the ropes and to gain familiarity with the platform layout.

Trading charge

HL has a tiered commission for share-dealing that favours the frequent trader.

Prices for a single trade start at $11.95 but for more than nine trades a month the charge falls to £8.95. If you trade more than 20 times then you will only pay £5.95 per trade.

Toronto stock exchange access

For investors focused on cannabis a key consideration is access to the Toronto Stock Exchange (TSE) where most of the main companies are listed.

HL does provide full access to the TSE.

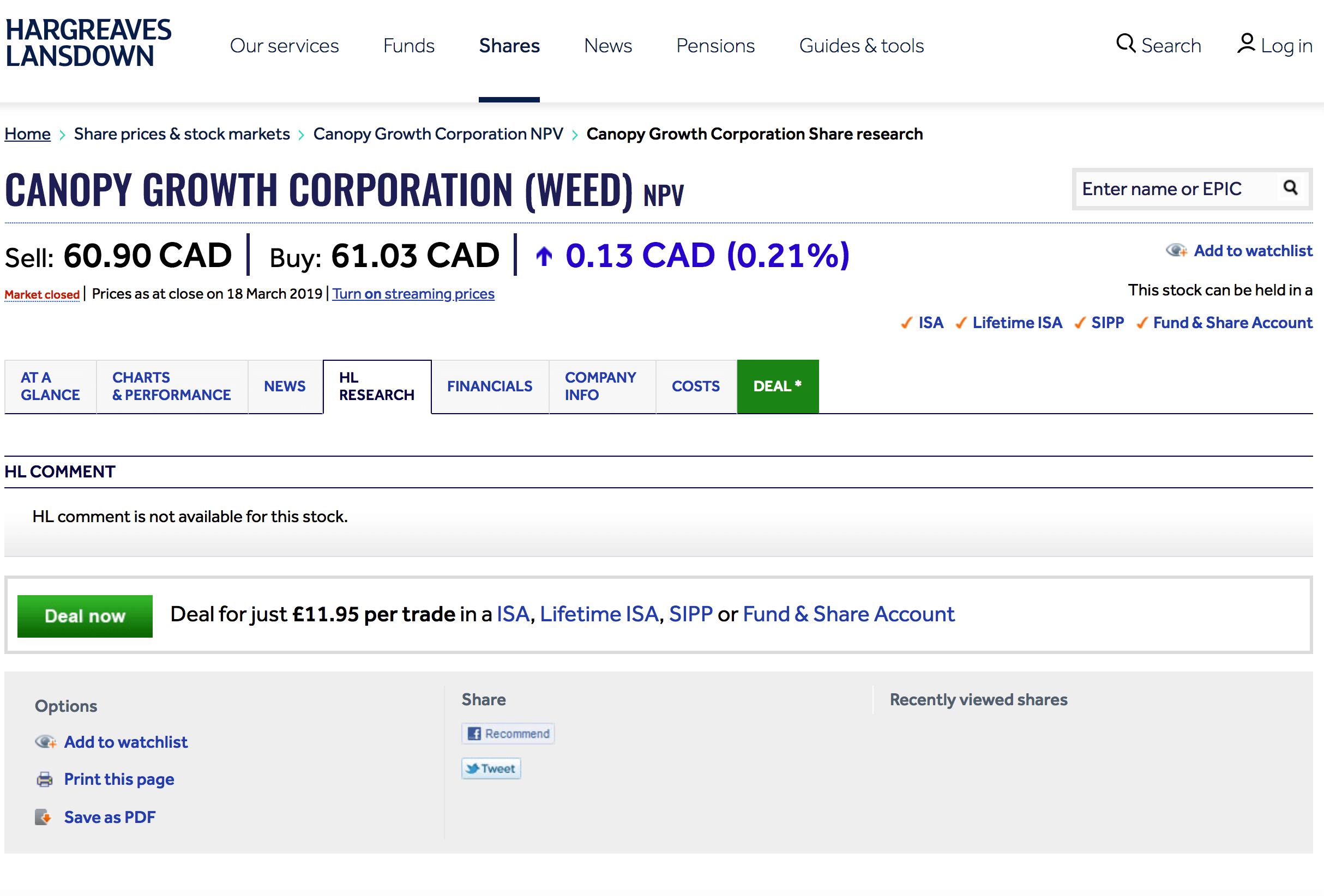

Rated for its easy to use and clearly set out website, in line with this HL clearly shows on the company data pages for Canadian shares that investors can reduce their dividend and interest Canadian tax exposure by filling in and returning the W-8BEN form, and the link to download it.

Although HL does provide full access to the TSE it does not provide dual listings.

So, taking Canopy Growth as an example, while it does show the TSE (WEED) listing it omits the NYSE (CGC) listing.

Foreign exchange

An important consideration when buying overseas shares is exchange rate risk and the charges. If you buy in the local currency of the stock exchange the share is listed on, for example the Canadian dollar, there is no fee until you sell and want to convert back into your own currency. If you buy with your local currency then the exchange rate is paid upfront. HL charges are 1.0% on the first £5,000 tapering lower by 25 basis points per $5,000.

Orders and tools

HL provide market and limit orders. A market order will give you the price when the trade is executed. A limit order will give you the price that you set and is the preferable approach.

All the brokerage accounts reviewed here provide market and limit orders.

it provides both the new and experienced investors with a wealth of educational and research tools and materials.

As an entity regulated by the UK’s Financial Conduct Authority (FCA) investors are protected by the Financial Services Compensation Scheme (FSCS) up to the value of £50,000 per person per firm.

Pros

- Easy set-up

- Access to Toronto Stock Exchange

- UK’s largest broker

- No extra fee to trade international shares

- Foreign Exchange trading charges are competitive

Cons

- No dual listing of cannabis stocks where applicable

IG Group

How to buy marijuana stocks on IG

Opening an account

Those looking for a cheaper trading option could plump for IG Group (formerly IG Index).

The company began as a service for gold trading and grew to become the UK’s largest spread betting platform. These days it also offers stock trading.

Opening an account takes five minutes. Have your bank details to hand.

Step 1: Your knowledge

Fill in a simple form about your trading knowledge.

Step 2: Verify identity

Upload a photo of either a passport OR driving licence. Also you will need to a utility bill, bank statement or credit card bill (excluding mobile phone bills) from the last six months

Step 3: Fund account

Deposit a minimum of £250, or equivalent in other currencies, to start trading.

Trading charge

It is cheaper than market leader Hargreaves Lansdown at £8 a trade, falling to £5 for 10 or more trades a month.

US shares however are $15 to trade plus 2 cents per share commission.

Toronto stock exchange access

The drawback is its lack of access to the Canadian market which will limit investors to the NYSE and Nasdaq.

However, it does provide comprehensive access to both exchange traded funds and contracts for difference products trading (CFDs).

It is also a leading share-betting platform but that is very high risk.

CFDs provide exposure to an underlying stock or other asset class but don’t bestow ownership of it. Because of this they are not recommended for a long-term stock holding although they do provide the opportunity to short (if you think the price is going to fall) a stock.

Foreign exchange

Best available bid / offer exchange rate at time of trade execution, plus a spread of 0.5%, which means this is not a very transparent pricing system

Orders and tools

As far as charting tools goes, IG is best of breed.

You can also practise with a demo account in order to build knowledge and confidence before committing your funds.

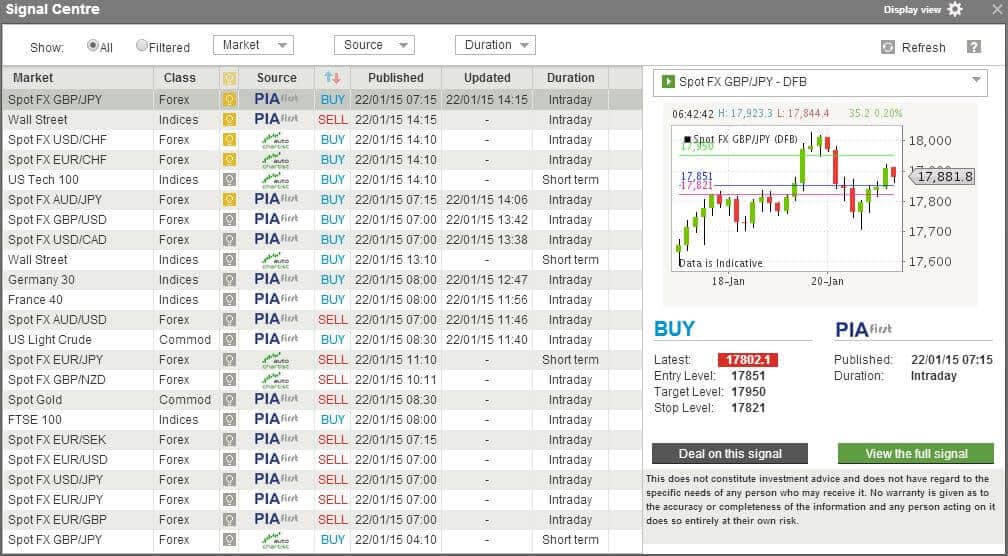

IG has a unique signals service to use with your watchlist and has a wealth of video and written guides.

Pros

- Cheap sharedealing

- Spreadbetting, CFDs available

- Excellent charting tools

Cons

- No Canadian stock exchanges

- Foreign exchange charge not transparent

- Must deposit minimum of £250 to start trading

Interactive Investor

Opening an account

Opening a share trading account is straightforward, with a four-step process.

Step 1: Register

Fill in your personal details.

Step 2: Tax and ID verification

Provide your tax information including your national insurance number.

Step 3: Card verification

Provide your bank account details for debit card verification

Step 4: Fund account

There is no minimum funding amount.

Trading charge

Trades come in at £10, falling to £6 if executing 10 or more trades a month.

Toronto stock exchange access

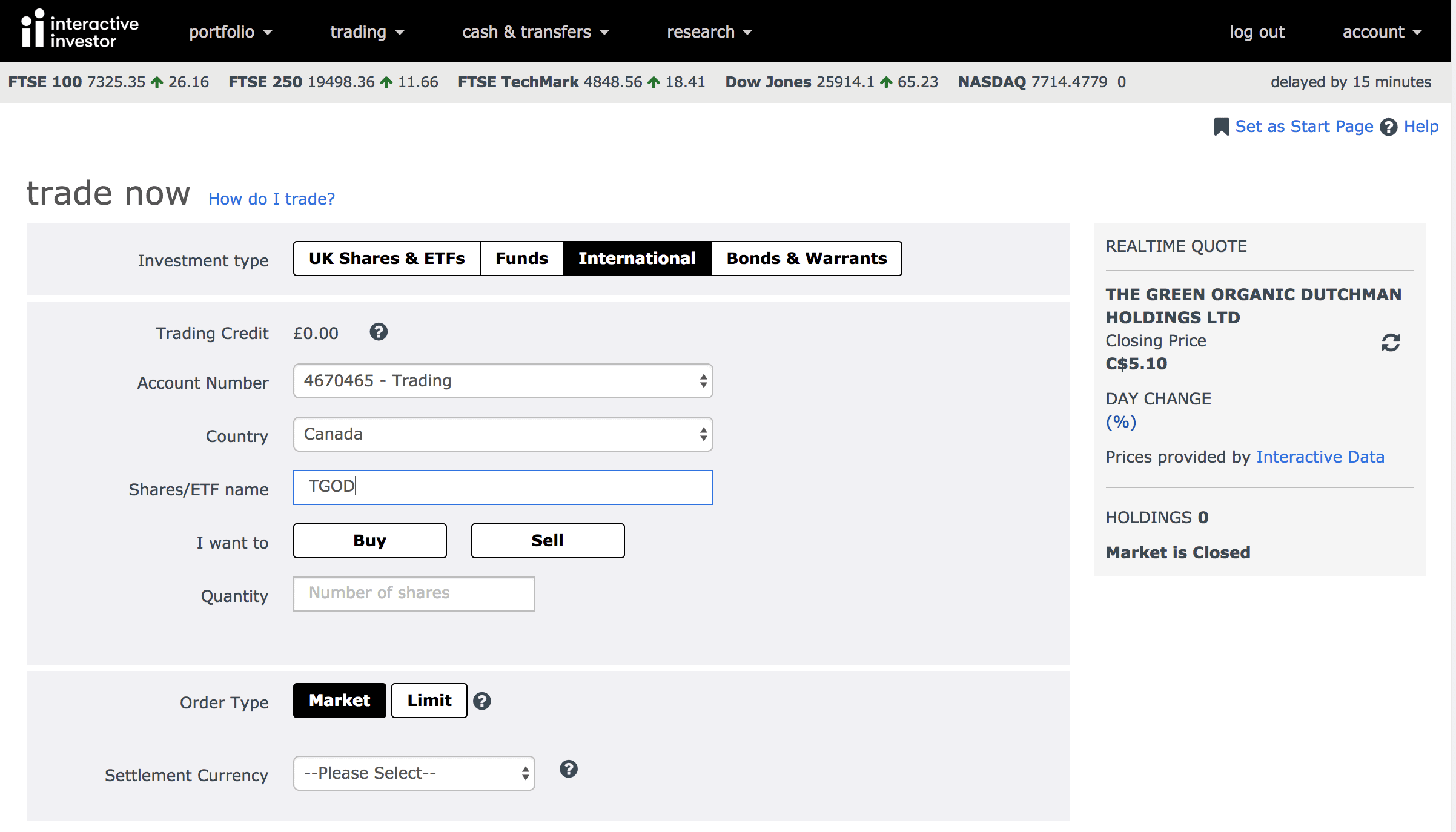

interactive investor provides both the Canadian and NYSE listings of Canadian stocks.

However, for international shares other than the US the cost is £20 per trade or £16 for frequent traders.

Foreign exchange

Interactive Investor’s foreign exchange charge is 1.5% up to £24,999.

Orders and tools

Market and limit orders as well as stop losses.

ii provides excellent research and analysis tools and is the only top broker that maintains a discussion board.

It is the oldest online discussion board in the industry and is useful for getting advice from more seasoned investors or just to see what other investors are talking about.

The research account is free and provides access to the discussion boards.

All of the brokers listed here offer telephone dealing but may charge are substantial amount £40-50 to do so as they push customers to trade online.

Pros

- Full access to Canadian exchanges

- easy sign-up

- First-class research

- Discussion boards

Cons

- £20 to trade Canadian shares

- Poor charting tools

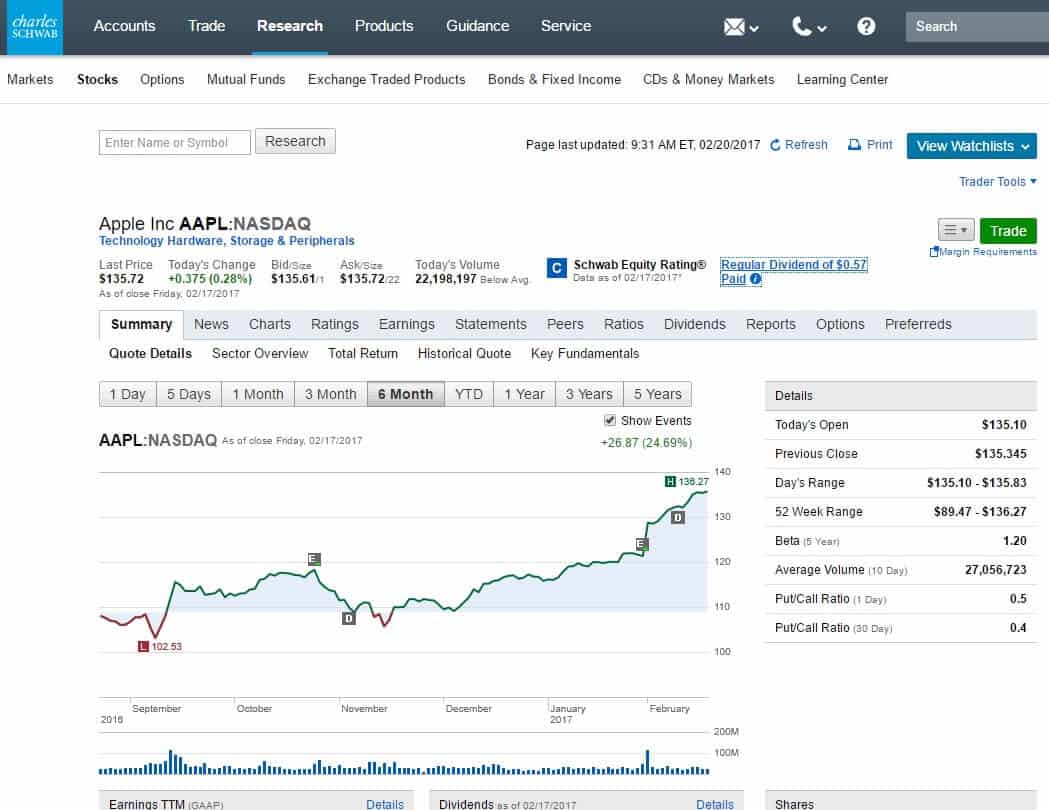

Charles Schwab

Opening an account

Charles Schwab is one of the US’s leading stockbrokers with 10.7 million clients as of December 2017

The standard account is the Schwab One account and the minimum you will need to deposit before you can start trading is $1,000.

It will take about 10 minutes to set up an account.

The process is fairly straightforward.

Step 1: Register

At the outset you will be asked if you want a joint or individual account and if you intend to trade three or more times a month. It is advised to say yes to the latter to get access to its advanced trading tools.

Step 2: Personal details and employment

Then you need to provide your personal information, which means divulging your employment status and annual income and liquid net worth (i.e. potentially available cash for trading) and providing your social security number and drivers licence.

Step 3: Your knowledge

The second screen asks you how you wish to use the account. The Schwab Trading Services part will already be ticked if you answered yes to trading three of more times a month.

Other features are for margin, options and whether you want checking facility and a Visa debit card (Schwab is a provider of banking services as well as brokerage).

Step 4: Verify

The next screen brings up the terms and conditions where you can sign with an electronic signature.

Step 5: Fund your account

Now you are presented with the options for funding the account. That comes down to either connecting an existing bank account or transfer funds from another brokerage account. You can choose to fund the account at a later date if you don’t have your details to hand. Minimum deposit is $5,000.

Trading charge

A single US stock trade costs $4.95.

For Canadian stocks it costs C$14 to trade.

Can trade on margin.

Toronto stock exchange access

You can buy foreign shares using an American Depositary Receipt (ADR), which is a certificate representing the underlying stock.

For amounts over $5,000 it may be better to buy directly from the Canadian exchange where liquidity will be better. This will require a specialised account.

If an ADR is not available for a particular stock you may be able to trade it in the over-the-counter(OTC) market.

Foreign exchange

There is no separate fee for foreign exchange when buying with an ADR.

Orders and tools

All order types are available.

This brokers has some of the best research and charting tools and features in the industry for retail clients.

Pros

- ADR access to Canadian exchanges

- Smooth sign-up

- Good education and research tools

- No separate fee for foreign exchange

Cons

- $5,000 minimum deposit

- Need specialised account to trade in C$

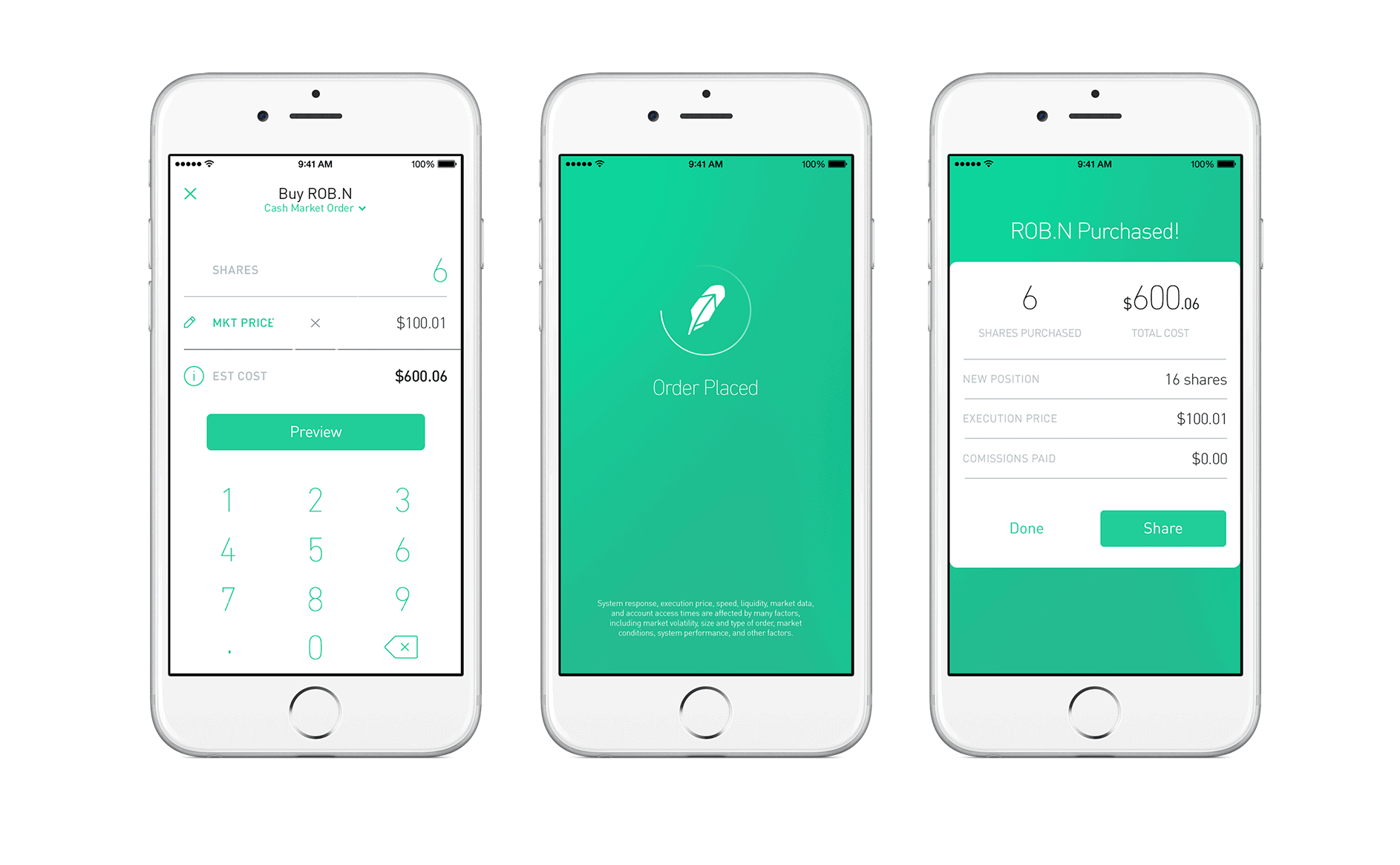

Robinhood

Opening an account

Robinhood is a new entrant to the trading world and has been growing fast among millennials. Its big selling point is commission-free trading.

To get started you will need your social security number, have a legal US residential address, be a US citizen, a permanent resident or have a valid US visa.

Robinhood only accepts applications through the app or website.

Step 1: Register

The first step in the app sign-up process is to provide your phone number, date of birth, address, citizenship.

ID verification is by social security number.

Step 2: Knowledge

Applicants then have to state how experienced an investor they are, from no experience through to “I’m an expert”.

Step 3: Employment

The sign-up journey then asks about employment. You don’t have to provide details – just simply answer yes to employed.

Step 4: Conflicts of interest

You are then asked whether you or a family member are a senior executive or a 10% or more shareholder in a publicly traded company.

That’s followed by one on whether you work for another brokerage.

Step 5: Link your bank account

With the conflicts of interest stuff covered you are through to funding the account. Link your existing bank account and you’re done. It total it takes about 5 minutes, although you will then have to wait for the application to be reviewed.

You will receive an email “within one trading day either confirming your application’s been approved, or asking for a little bit more information”.

If Robinhood needs more info it will likely require uploading documentation. It can then take five to seven days to review the documents and open the account.

Trading charges

There is no commission for trading US stocks.

Margin costs 7.2% or $6 a month for $1,000 borrowed.

To transfer from the account to another brokerage will cost a steep $75.

Foreign exchange

No separate fee for FX but buying a Canadian stock comes with a fee of $35 per trade.

Orders and tools

As with the other brokerage accounts reviewed, you can choose whether to select market order or limit order. Stop losses are also available, as with the other accounts reviewed here.

It is advisable to always use the limit order otherwise using the market order will give you the price you get in realtime, which may differ to what you think you were buying or selling at.

Excellent app user interface but no free trading tools.

Pros

- Commission-free trading in US stocks

- User-friendly app

- ADR access

Cons

- $35 per trade for Canadian stocks

- Lots of hidden charges

Top 10 Performing Cannabis Companies in 2019

The top 10 companies in the field (excuse the pun) ranked by market capitalisation are:

- Canopy Growth (CGC)

- Aurora Cannabis ACB)

- Tilray (TLRY)

- Cronos (CRON)

- Aphria (APHA)

- HEXO (HEXO:CA)

- OrganiGram (OGI:CA)

- CannTrust (TRST),

- Green Organic Dutchman (TGOD:CA)

- TerrAscend (TER:CNX).

Investors need to be aware that the larger companies will have a dual listing, typically on the Toronto Stock Exchange and the New York Stock Exchange or Nasdaq.

The tickers shown here are in the first instance the US exchange if there is such a listing, otherwise the Canadian stock exchange ticker. By way of an example, the largest company by market cap is Canopy Growth, which in the US trades under the CGC ticker but on the Toronto Stock Exchange is listed with the WEED ticker.

Cronos and Tilray trade on the Nasdaq. Canadian companies listed on the NYSE are Canopy, Aurora, Aphria and CannTrust.

Before we go on to look at the different companies’ businesses and financial position, we need to take the time to understand the industry fundamentals.

What to Know Before Investing in Cannabis

Learn the lay of the land before you buy cannabis stocks

In order to be successful in trading commodities, we must first look at the industry as first and foremost a commodity business then we need to understand the base commodity product, which in this case is the marijuana plant.

Its most relevant chemical properties from the vantage of the current state of knowledge in the industry divides into two: CBD and THC.

The first, cannabidiol (CBD), is just one of at least 113 known cannabinoid chemical compounds that have been isolated from the cannabis plant. This is a chemical constituent of the plant devoid or psychoactive properties and is being extracted purely for its health and wellness benefits.

The second, tetrahydrocannabinol (THC), is another of the cannabinoids and is the main psychoactive element of the plant – the part that gives its consumers the high.

We could mention a third, cannabinol (CBN) which does not occur in very large amounts in the plant and also has medicinal uses and is often processed as an oil.

However, THC and CBD are the two dominant compounds, but different varieties of the plant have radically varying amounts of each.

So, for example, the hemp variant has almost no THC (0.3%) but is rich in CBD.

Which Cannabis Stocks to Buy?

Before we delve deeper into the other side of our equation – the current value of cannabis businesses – we need to appreciate how investment from the alcohol and soft drinks companies is impacting valuations.

Canopy Growth (CGC)

Starting with Canopy Growth, it came to the attention of Constellation Brands (ClA), the makers of Corona beer. It initially invested $190 million and took on $150 million of convertible debt to provide it with the option of increasing its investment at a later date. It took that option and much more with a $4 billion investment for a 38% stake in the business in August last year.

Cronos (CRON)

Cronos has attracted a $1.8 billion investment from Altria (MO), the owner of the Marlboro cigarette brand. Altria is now the largest shareholder in Cronos with a 45% stake. Chairman and chief executive Howard Willard commenting on the deal completing of the deal this month said: “Cronos Group is our exclusive partner in the emerging global cannabis category and represents an exciting new growth opportunity for Altria.”

Tilray (TLRY)

Vancouver Island-based Tilray, which saw its price knocked when it released its earnings , is the recipient of $100 million from the world’s largest brewer, Anheuser-Busch InBev (BUD).

Although listed in Canada, Tilray is actually controlled by Seattle-based Privateer Holdings. Tilray/Privateer Holdings also owns cannabis site Leafly, where consumers can find comprehensive information on cannabis products and where to buy them, depending on your country of residence.

Aphria (APHA)

Aphria, based in Ontario, has inked an agreement with wine and spirits company Great North Distributors. Aphria is currently the subject of a hostile bid from Green Growth Brands, headquartered in Tornoto.

Aurora (ACB)

Aurora has signed a licensing deal with Alcanna which is the largest private sector liquor retailer in Canada. The company hired hedge fund manager Nelson Peltz to advise it on its disparate holdings. The market was supportive of the move as their had doubts about an apparently scattergun approach to its acquisitions. Own Bennett an analyst at investment bank Jefferies said: “Peltz should support in ensuring assets are kept that yield most value.” Currently priced at $8.87, Jefferies rates it a buy with a price target of $12

Other high-profile partnerships sees medical-focused HEX enter a joint venture with Molson Coors Brewing Co.

There are some brewers who have so far shunned deals with cannabis companies in favour of striking out on their own. Giant brewer Heineken launched HiFi Hops in July last year and sells at dispensaries in California.

How to Value a Cannabis Stock

Enterprise value of cannabis companies

Now we need to turn to how we value these cannabis companies.

If we take enterprise value and compare it to earnings we can get a fairly sound insight into the financial strength of the various companies.

We can workout enterprise value by adding together the equity value and the market value of debt minus cash on hand. Dividing EV by earnings before interest taxes depreciation and amortisation (EBITDA) will give us a ratio that we can uses to compare the values of the businesses in the sector as well as comparing them against the wider market.

Generally speaking a reading under 10 is considered healthy, although the S&P 500 index in recent years has had an EV/EBITDA of 11 to 14x. Put that another way – the higher the EV/EBITDA the more expensive the stock.

The current median for the cannabis sector is 24x but for some of the highest capitalised firms it is much higher.

Recent analysis crunched by Market Realist shows Cronos on 143x, Aurora 51x,

OK, so you get the picture: cannabis stocks are expensive. But that’s not the half of it. The multiples for Canopy Growth and Tilray come in at 2,861x and 1,750x , respectively.

The Green Organic Dutchman, using Capital IQ data is -30x.

What about some of the other in our top growers table?

Undervalued Cannabis Stocks

Two are trading near or at a significant discount to the peer median. Aphria has a multiple only slightly above 24x (historical average 29x) while OrganiGram is on 14x.

Also trading at a discount so should be on the watchlist are CannTrust (22x), HEXO (22x), Supreme Cannabis (11.2x)

On the earnings front, Canopy Growth’s fiscal 3Q reported a 282% increase in recreational sales to 10,102 kg (2,250kg a year ago) at price per gram of C$7.33 down from $C8.30 a year earlier. Canopy says it has captured around a fifth of the legal market.

Chief financial officer Tim Saunders’s preferred measure of how the company is performing is the estimated earnings before interest, tax, depreciation and amortisation. That reading worsened from –C$5.6 million to C$75.1 million. Sales and marketing costs in addition to administrative costs all served to subtract from the bottom line as brand awareness expenditure rose in preparation for legalisation

The company saw a loss of 38 cents a share.

Sales came in below analyst estimates of 12,782 kg but earned a better price than expected – C$7.33 against consensus estimates (but only from two analysts) of C$6.58 according to FactSet.

Aurora undervalued

Aurora reported a loss of C$237.8 million on net revenue of C$54.2 million. The company invests in other cannabis companies and around two-thirds of the losses are accounted for in the decline in those equity valuations. Revenue increased 400% from C$11.7 a year ago. C$21.6 of revenue came from the Canadian market. The company ships cannabis to 20 countries including the UK in February.

Chief corporate officer Cam Battley said there were problem with producers meeting demand but Aurora “delivered solid execution”.

Margin shrank from 70% to 54% over the previous quarter due to downward pressure on the price of dried cannabis.

Aurora sales were some way behind Canopy’s at 6,999 kg. CNBC’s star stockpicker Janes Cramer thinks the stock is undervalued. Speaking about the Peltz move, Cramer said: “This is the endorsement that Aurora needs to put it in the big time.”

Tilray reports its fourth quarter and full fiscal year end on 18 March. It bought hemp products firm Manitoba Harvest in February for $419 million.

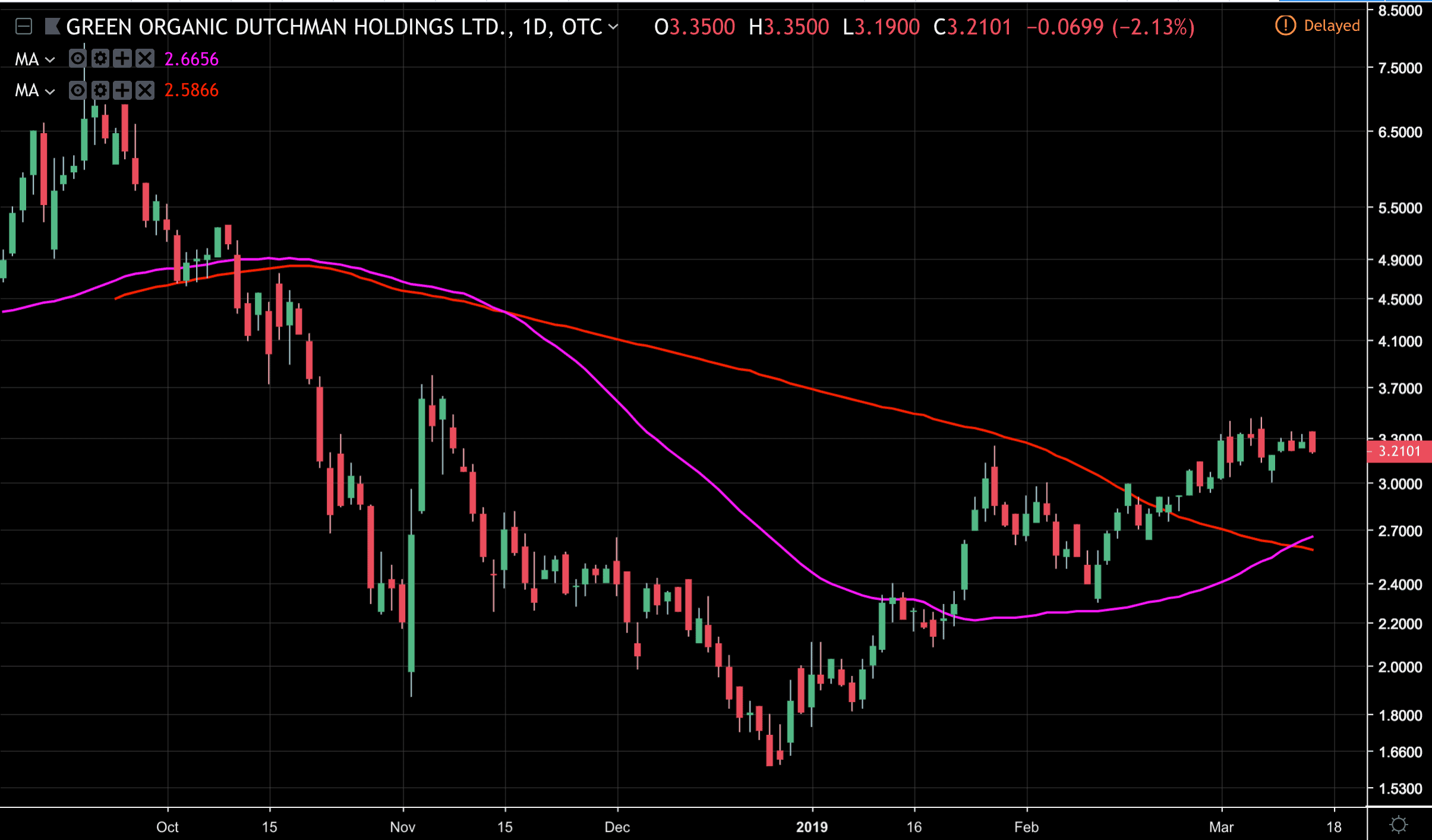

Organic play – The Green Organic Dutchman

Relative small-fry at ninth-place in the market cap valuations rankings is The Green Organic Dutchman (TGOD), published its results for the fourth quarter and fiscal year end on 19 March.

It has $264 million of cash on hand and no debt and is making rapid progress at its Hamilton and Valleyfield facilities.

The company should start seeing revenue in 3Q from Hamilton and 4Q from Valleyfield for a total of 82,000 kg of organic cannabis selling at a 30% premium.

Add in its HemPoland acquisition and the balance sheet should become free cash flow positive.

Also, the list of countries where TGOD is active continues to grow: Canada, Denmark, Jamaica, and has Subsidiaries in Netherlands, Germany, Greece, and Colombia.

In the earnings statement it increased forecasted production to 219,000 kg.

Quoting from the report, TGOD “experienced a loss from operations of $18.1 million ($44.5 million for the full 2018 fiscal year).

Not mentioned in the report, investors should be aware that TGOD has just signed a deal with extraction specialist Valens GroWorks in a smart move to expand CBD production.

According to a company release it will use the cannabinoid resins and distillates to speed up its entry into the organic CBD marketplace. Chief executive Brian Athaide had said he thought the company might show a small profit in its results, but that didn’t happen. Commenting on the earnings statement he said: “The Company has raised substantial capital and grown the team with the addition of deep expertise and exceptionally skilled professionals to both management and our Board.”

The firm has been on an acquisition spree in Latin America, the Caribbean (Jamaica) and Europe and, as the name suggests, it aims to be the largest grower of certified organic cannabis, which it believes will position it to be the go-to supplier of high-quality organic cannabis for medical use.

Other factors:

Verticals

For reasons of quality control and regulation, vertical integration from field (or greenhouse) to shop is a plus given where the industry is in its development. In terms of regulation US states such as Colorado mandate vertical integration of medical marijuana companies

Top buys from that standpoint sees the Aurora names pop up again. Its purchase of Hempco Food and Fiber was seen as something of a coup.

Emerald Health Therapeutics and Abattis Bioceuticals have set up a subsidiary that they jointly own called Northern Vine Labs. It has tentacles in every part of the industry.

However, as the industry matures more specialisation will take place with companies likely moving away from verticalisation.

Real estate investment trust Innovative Industrial Properties is a good safe inverse play on verticalisation in that it does not depend on any one part of the vertical – it rents out space to medical cannabis growers.

New technology

On the technology side there is always the possibility that some innovation could provide a company with a significant competitive advantage and force others to the wall.

UK mining company Highlands (HNR.L) has pivoted into the cannabis industry after discovering an organic gas system for fertilising weed. It has set-up a wholly owned subsidiary in Colorado called Zoetic Organics to utilise the tech.

Science magazine Nature reported in February that researchers has succeeded in re-engineering yeast to produce cannabinoids instead of alcohol. The technology could be used to produce CBD, THC and other cannabinoids that occur naturally in small amounts ,at greater scale much more cheaply.

New capital markets

Expect new capital markets to open. The NYSE is limited by federal law but more US companies a will be coming to market.

Also the City of London, still one of the major global market despite Brexit, will likely see several companies come to market this year.

Among them is European Cannabis Holdings. There’s also Emmac Life Sciences. It is developing medicine for surgery pain relief in a partnership with Imperial College London.

European Cannabis Holdings had previously been connected with private equity investor Andy DeFrancesco who was involved in the furore when Aphria bought Nuuvera for C$425m and members of the Aphria team were accused of having undisclosed interest in the company. As a result Aphria became the target of short sellers.

Cannabis exchange traded funds to buy

And if you can’t decide on the stocks mentioned here then you could buy an exchange traded fund instead. ETFs physically or synthetically replicate an index or the price movement of a share of commodity.

There are five cannabis ETFs to consider.

Horizons Marijuana Life Sciences Index ETF (OTC:HMLSF) – first to launch and largest (C$700m)

Horizons Junior Marijuana Growers Index ETF (HMJR.TO) – replicates the Solactive Junior Marijuana Growers Index – publicly listed small caps in North America. Doesn’t include biopharma. Focuses on small caps so could be a good pick if you already own some of the large caps like Canopy and Aurora.

ETFMG Alternative Harvest ETF (MJ) – US investors access to Canadian sector. Was previously Latin American real estate ETF – largest US-based cannabis ETF

Redwoods Marijuana Opportunities Fund (MJJ.TO) – has a long/short starefegy so active management. Holds 25% cash for flexibility. Control exposure

Evolve The Marijuana ETF (SEED.TO) is aimed at Canadian investors. Can hold 10% in private companies so has the ability to target interesting early-stage companies not accessible to retail investors via public markets.

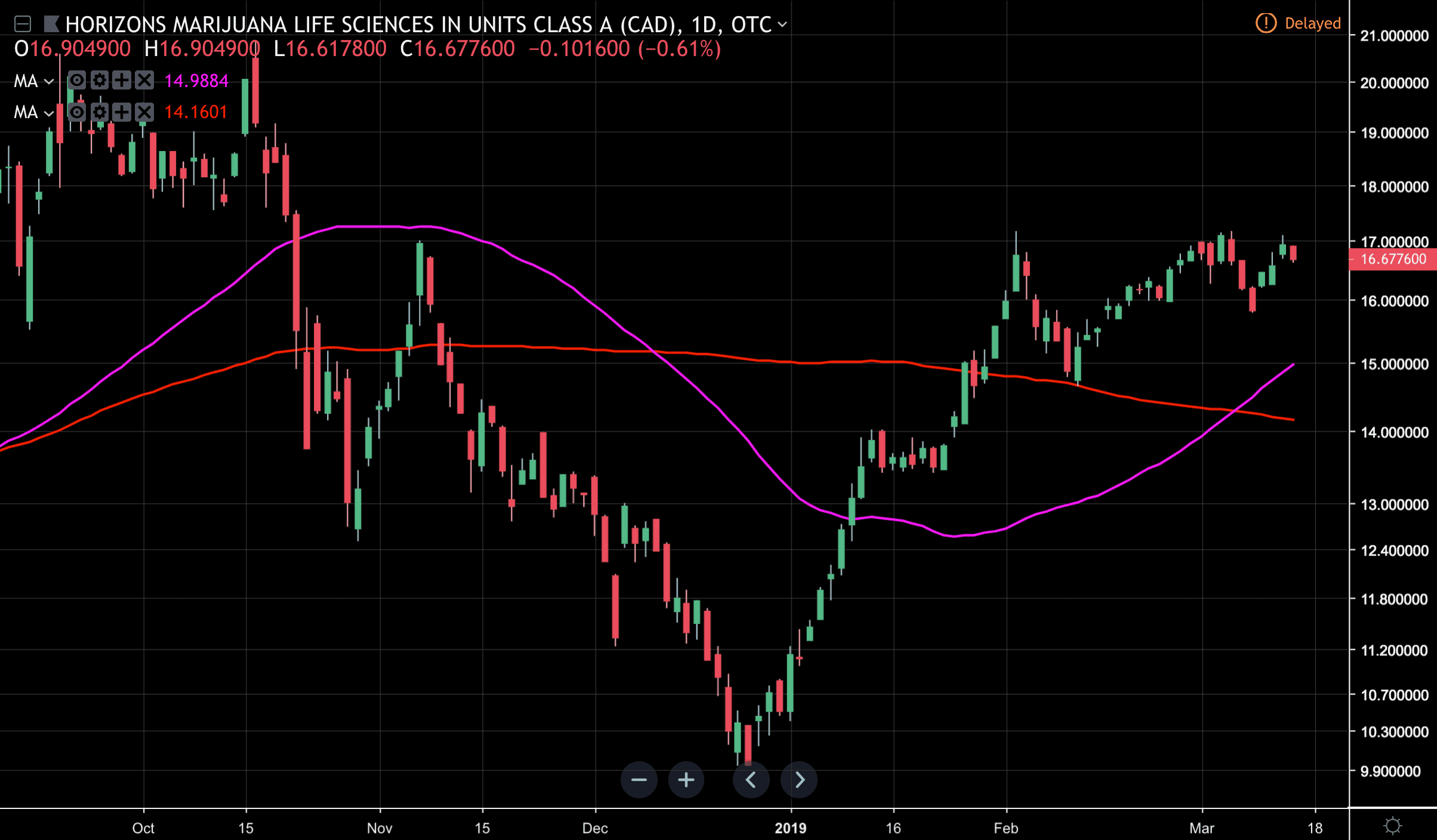

The Horizons Marijuana Life Sciences Index ETF chart below provide a good overview of where the market has been over the past 12 months.

Following a rally after the Canada legalisation there was a ‘buy the rumour sell the news’ moment with the sector selling off.

There has been a recovery since then, although some stocks, such as The Green Organic Dutchman (TGOD) which raced ahead post its initial public offering, still have plenty of ground to make up.

Forecasts for cannabis stocks

Addressable cannabis market – now and in the future

Analysts will make a stab at what those future earnings will look like with discounted cash flow analysis. To do that analysts and investors alike will need to have a handle on the value the current state of the business and what its future addressable market is likely to be.

Let’s begin with the latter – how big is the market?

As you would expect estimates vary considerably for the future size of the cannabis market, with figures ranging from $150 billion (frequently stated by Tilray CEO Brendan Kennedy) to an upper estimate of $500 billion (cited by Bruce Linton, the CEO of Canopy). But both those numbers are on the assumption of widespread legalisation. The higher end of the range makes assumptions about the extent of disruption of big pharma that may be wildly overstated.

The legal market alone is estimated by Grand View Research to see CAGR of 34.6%, to be sized at $146.6 in 2025, with medical research driving the growth as well of course wider legalisation of recreational use.

Near-term estimates suggest the market will hit $32 billion by 2022, according to Arcview Market Research and BDS Analytics. It says legal sales worldwide amounted to $12.1 billion in 2018, up from $9.5 billion in 2017

Drilling down to the country level, New Frontier Data thinks the Canadian market will be worth C$9.2 billion by 2025.

But how are the sale actually going on the ground now that legalization has arrived?

Data from Statistics Canada shows fourth quarter “cannabis-related” sales of $1.6 billion, of which only $573 million was legal and $1 billion was still in the illegal market. With legalisation taking place in October, that data doesn’t capture the full picture in term of legal sales and the supply difficulties meant availability in the retail channels was restrained.

In the US the industry was estimated at $7.3 billion in 2017 expected to reach $24 billion in 2021, with recreational sales, with medical accounting for $13 billion and recreational $11 billion. Those figures comes from The Association of Packaging and Processing Technologies in the US.

Germany, which legalised medical cannabis sales through pharmacies in 2017 is expected to be the largest European market, despite the Dutch head-start with long-established legality in Amsterdam.

If weed was legalised at the federal level in the US the market would mushroom to $50 billion, which compares favourably against 2018 US alcohol sales standing at $253 billion.

The legal markets in North America and Europe are growing at a faster pace than expected as a flood of both THC and CBD products hit the market. Gummies/chews (both THC and CBD), live resin (THC is more concentrated), Vapes (THC and CBD, 2019 marks the first year in which they are more popular than the flower), tinctures (most popular way of ingesting CBD) and lastly chocolate infusion.

The market growth as we have seen sees variable estimates but what isn’t in doubt is that the market is growing fast, with CBD products leading the way.

Beverages and edibles are big opportunities for cannabis companies but others industry are watching, especially the drinks and tobacco businesses.

Which Companies are the Biggest Cannabis Growers in the Industry?

Anyone considering buying cannabis stocks has to begin with who has the most supply.

That requires bottom-up analysis, which in the cannabis industry, whichever way you look at it – medicinal or recreational – means growing capacity.

Here’s an estimate from various sources of the top cannabis firms by growing capacity by 2021-22

| Aurora (ACB) $8bn | 700,000 |

| Canopy Growth (WEED) $21bn | 500,000 |

| Aphira (ACB) $8.8bn | 310,000 (includes MedReleaf acquisition) |

| Tilray (TLRY) $6.8bn | 270,000 |

| MedReleaf (LEAF) $2.4bn | 140,000 (acquired by Aphira in 2018) |

| The Green Organic Dutchman (TGOD) $1.1bn | 202,000 |

| OrganiGram Holdings (OGI.V) $1.2bn | 113,000 |

| HEXO (formerly Hydropothecary) $1.2bn | 108,000 |

| Emerald Health Therapeutics $546m | 125,000 (deal with Pure SunFarms for +25k) |

Cannabis stocks are growth companies, which means profits are small and spending is high, as you would expect in a new industry. They have only just started building up their revenue streams. This means that current valuations are based on expected future revenues and profits.

|

Source: Marijuana Index

Read more:

FAQs

While investing in marijuana companies could come with legal risks, this risk is minimal and it is unlikely that anyone investing in cannabis will face any criminal charges. While directly buying and dealing cannabis may be illegal, investing in cannabis companies is not illegal, therefore should pose no legal risks at the minute.

There is much research required to establish the beneficial effects cannabis has on the human body and how the cannabinoids work. Only one drug – Epidiolex – has so far been approved by the US Food & Drug Administration. It is for the treatment of a rare form of epilepsy called Dravet syndrome and Lennox-Gastaut syndrome, a genetic brain disorder. UK-based GW Pharmaceuticals (GWPH) is the maker of Epidiolex and is listed on Nasdaq. Cannabis can provide pain relief, control fits, suppress tics, help with sleep, anxiety, stopping smoking and much more. It is also being used to treat arthritis and glucoma, but scientific research in all these fields is lacking. Because of prohibition research has so far been limited, so strong evidence, other than anecdotal, has yet to be established in scientific conditions, except in the case of Dravet Syndrome. Long-running and unproven assertions that cannabis can cure cancer continue to circulate, with cannabis oil therapeutic remedies sold to cancer sufferers by scammers preying on the vulnerable. In its CBD form cannabis is finding itself as the active ingredient in wellness and beauty products, beverage consumption and edibles. In jurisdictions where marijuana is legal it is being ingested by vaping, smoking or eating and is of course the best-known use case for the plant.

Canada and Uruguay, having fully legalised recreational cannabis use. However, a number of other countries tolerate recreational use. In the US, prohibition has been lifted in 10 states but crucially is still illegal at the federal level.

The primary industry sectors are biotech, cultivation and retail. However, there are also a number of associated secondary sectors such as agricultural technology, real estate and secondary services in consulting and business development with expertise in packaging, bottling, transportation, branding and so on all in demand. The third tier, or tertiary sector, includes consumption devices, finance tech & media and ancillaries such as hospitality and tourism. Is buying cannabis stocks legal?

What are the health benefits of cannabis?

Where is recreational cannabis legal (or most tolerated)?

What cannabis industry sectors are there?

Comments are closed.