If you are still using your fridge door to post family pictures, you must not be using Samsung appliances. The Samsung fridge door is a giant iPad that acts as your family hub by keeping your calendars, recipes, and emails in sync.

This smart fridge is one example of how Samsung’s semiconductor chips bring intelligence and interconnectivity to our lives. By making its own chips, Samsung can create more innovative features in the home appliances, smartphones, and TVs you use.

Owning production from end-to-end has made Samsung the most powerful family-owned business in South Korea. If you are considering investing in Samsung, the maker of the world’s most popular smartphone, this guide will explain how to buy Samsung stock in 5 simple steps, and evaluate the best Samsung stockbrokers.

We will also analyse Samsung’s stock price and offer expert price forecasts and predictions in order to evaluate whether it will make a good investment.

Best U.S platform to invest in Samsung

Stash Invest has our top spot as best U.S. platform to invest in Samsung. You can get started today with only $5 and their fees are one of the lowest in the market starting at $1 per month only.

Best Platform to Buy Samsung shares outside the U.S.

We’ve found that Webull is the best platform to invest in Samsung due to its reputation, safety, fees, and platform.

How to Buy Samsung Stocks in the U.S.

If you’re U.S. based and want to buy Samsung stocks, we recommend the broker Stash Invest which is an-easy-to-use a banking and micro-investing app that you can use to trade stocks on the go.

Launched in 2015, the app already counts with over 4 million users due to the low minimum deposit required to get started (as little as $5). Stash Invest also only requires a small $1 monthly fee for using its investing and banking services. Read our tutorial below to get started with this broker.

Step 1: Create your account

Enter your email address and password and fill in all the required information. You will then be prompted to download the app which should only take a couple of minutes.

Step 2: Complete your investor profile

The app will ask you to answer questions related to your trading preferences in order to create your investor profile and help you get the best results.

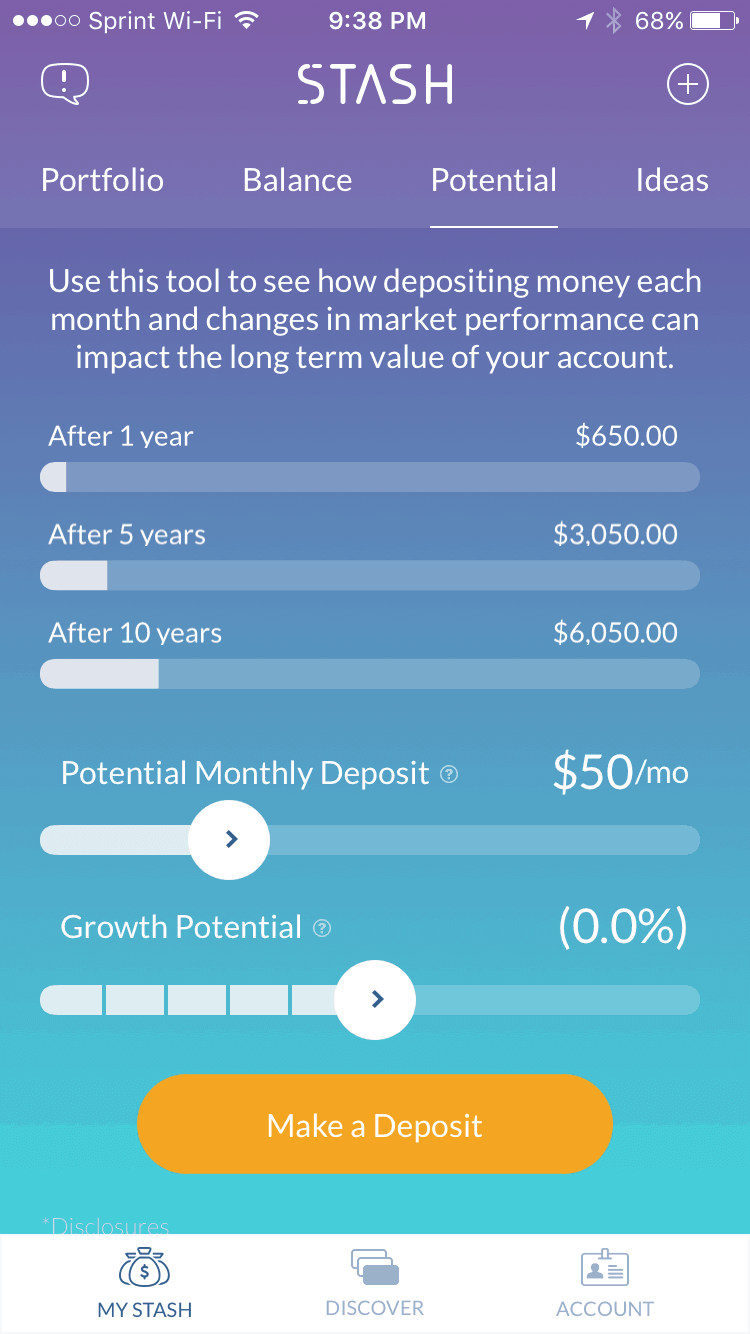

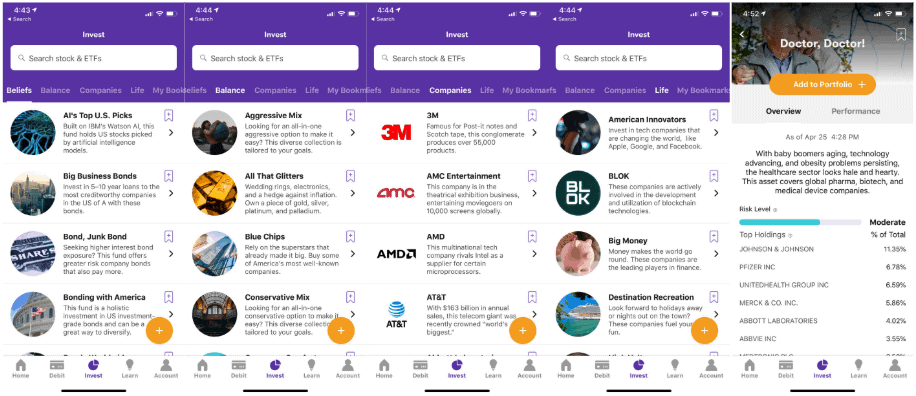

Step 3: Check your investment options

Based on your answers, Stash Invest will give you several investment options. These are easy to understand and will relate to your risk tolerance and investment style.

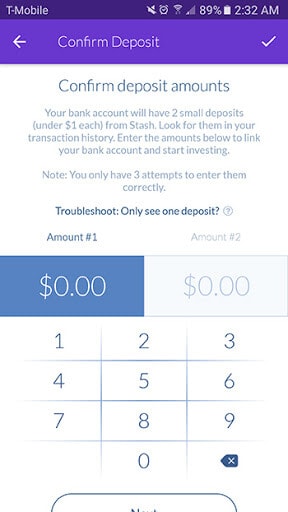

Step 4: Deposit money into your account

Then, simply deposit funds into your account to go towards your Samsung stock purchase. This process is easy-to-do and you can deposit using bank transfer, debit and credit card. Take note that it takes two to three days to deposit money to Stash Invest.

Step 5: KYC & Verification

Verify your identity by providing the needed documents then create a pin number with 4 digits.

Step 6: Buy Samsung stock

Search for the stock, enter the amount you want to invest then click the “Buy” button.

How to buy Samsung Shares outside the U.S.

The best platform for buying Samsung stocks outside the U.S. is the well-reputed broker Webull. Read on to find out how to get started.

Step 1: Open your account

Firstly, click here to open your trading account with Webull. You will be prompted to download the Webull.com mobile app to register. Select between a Demo and Real Money account.

After filling in basic personal information, you will gain access to an unlimited demo account. Before you can trade Samsung stock, you will be prompted to answer a few questions to establish your investor risk profile.

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

Step 3: Verify your identity

Attach and submit proof of identity for verification.

Step 4: Trade Samsung stocks

Webull offers a wide variety of investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. Options are also available for advanced investor. Query Samsung and the price quotes for the stock, as well as put and call options, appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading with this provider. You should consider whether you can afford to take the risk of losing your money.

Recommended brokers in this case are Markets.com or Webull. Or do you seek to make a one-time purchase or long-term investment? In this case, review classic online brokers such as Markets.com

Should I invest in Samsung?

South Korea has a growing middle class whose productivity, with the help of Samsung products, keeps rising. From the smart fridge to the world’s best-selling smartphone, Samsung is helping the world perform its daily tasks more efficiently.

If you invest in Samsung stock, you are investing in a company whose product sales have more than doubled to $243 billion over the decade while its stock has quadrupled. Samsung is connecting these digital products – and our lives – on the cloud.

There is a downside to being the most popular consumer products company. If you buy Apple stocks or buy Tesla stocks, you know well the ups and downs of consumer sales. Samsung did experience sales shortfalls in 2018 but still registered record revenues and profits for the year.

Pros to buying Samsung

Advanced chipmaker

Samsung makes the key building blocks for its products, starting with the most advanced chips. From the best screen resolution to longer battery life, innovation in its semiconductor chips enables innovative products.

While other smartphone makers wait for a 5G market, Samsung is making 5G wireless radio solutions to increase Sprint’s network to snappy 1.5 Gbps speeds. If you want another way to invest in Nvidia stock and the powerful graphic cards for gaming and mining, Samsung will be supplying the transistors to Nvidia.

Market leader in smart home appliances

Supplying its own chips allows Samsung to differentiate itself through design, features, and functionality. A smart refrigerator door that displays who is at the front door when the doorbell rings is an example of that innovation. This edge helped Samsung become the top home appliance seller in the US market in 2018. Impressively, Samsung only spends 5% of every dollar in sales on R&D, versus 20% for competitors Intel and Qualcomm.

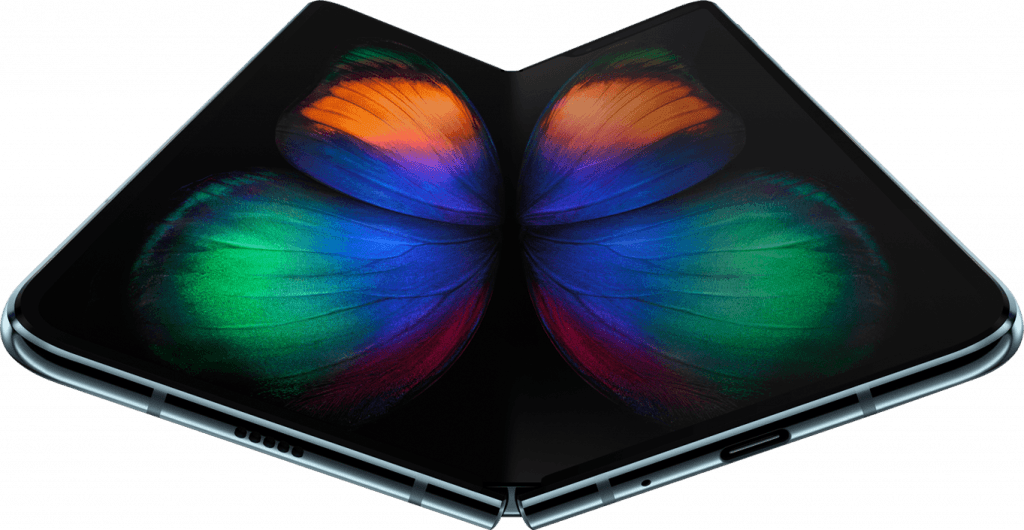

5G has arrived

The rollout of 5G networks will be a revenue growth engine for Samsung. South Korea, Samsung’s largest market, is currently a front runner in deploying 5G. The Samsung Galaxy S10 series, being introduced this spring, includes its first 5G device. The show stopper will be the 7.3-inch Galaxy Fold – a smartphone that unfolds into a tablet.

The Fold will retail for $1,980. If you want to invest in the future of foldable smartphones, Huawei and Apple are also designing them. For a full-fledged foldable PC, buy Microsoft stock. A foldable Surface tablet is being developed.

Cons to buying Samsung stock

Consumer electronics and memory market downturn

Samsung‘s smartphone business is an amazing growth story. A decade ago, Samsung had a 4% market share. Today, 25% of smartphones sold are made by Samsung. But Samsung has put all its chips in one basket. The consumer electronics cycle downturn leads the chip making downturn. Tablet and home appliance sales are also down. Samsung sells the most smartphones to China.

Display sales down

The slowdown in mobile, tablet and home appliances, meanwhile, is causing a slowdown in OLED and LCD display products. Oversupply is also a concern in this market as smartphone display competition heats up.

Patent wars

Samsung settled two major patent disputes in 2018. In February, Samsung and Huawei came to an out-of-court settlement over cellular communications technology. Samsung also settled a seven-year patent dispute with Apple, which initially involved a $1 billion settlement in Apple’s favour.

Though the patent disputes weighed more heavily on investing in Apple stock, since Apple is less diversified. Other legal quagmires include tax evasion and government bribery accusations against Chairman Lee.

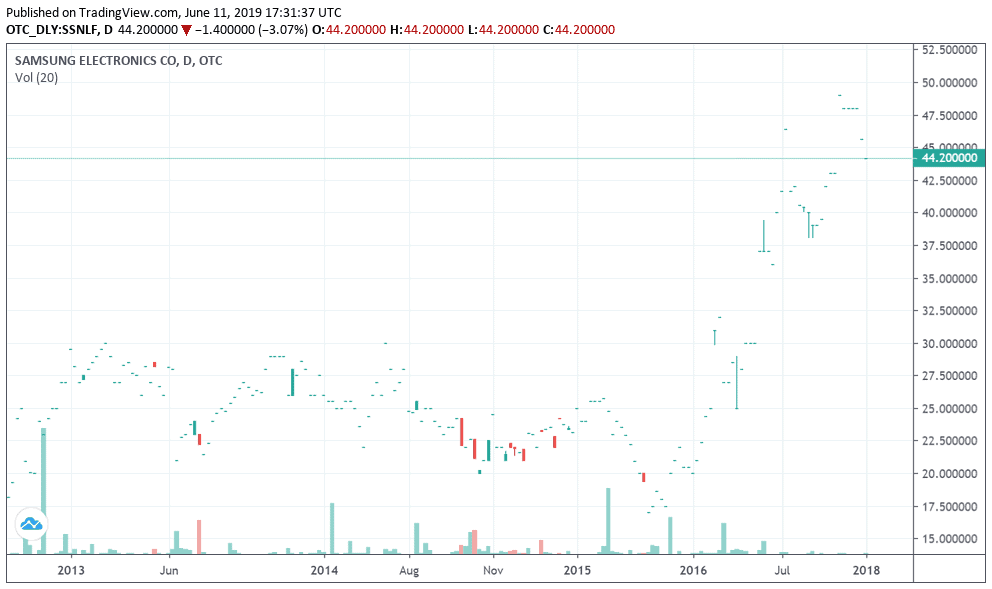

Samsung Stock: Current Prices and Summary

Samsung Group is the largest of South Korea’s powerful chaebols – family-controlled businesses known for their complex layers of affiliated companies. The split of the businesses in the late 1980s allows the market to fairly value each business separately. Samsung Electronics is by far the largest of dozens of subsidiaries.

About 70 percent of SEC’s profits come from the semiconductor business Device Solutions (DS) and the bulk of the rest from the smartphone business, IT & Mobile Communications (IM). Consumer Electronics (CE) is the third division. Before you invest in Samsung stock, you need to know whether the stock is fairly valued by the market compared to other tech stocks. All divisions have high exposure to the cyclical consumer electronics market.

Over the decade, Samsung Electronics’ stock has been outperforming the consumer discretionary industry group in general. Zooming in on its divisions, Samsung’s price-to-earnings ratio of 7–9 percent over the past 24 months is low compared to that of semiconductor competitors Intel at 11.7, Nvidia at 27, and Qualcomm at 34.

In smartphones, Apple and Huawei are priced at 14 and 23, respectively. This comparison shows Samsung shares are undervalued across all its business lines. Before deciding whether to buy Apple stocks, which also appear cheap or Samsung’s, also consider the dividend payouts of the two competitors.

SSNLF stock summary

| Price | $ 170.93 | Daily high | $ 171.44 |

| Volume | 18963658 | Low | $ 169.50 |

| Variation | 12:51 | Opening | $ 169.71 |

| + / -% | 00:30% | Day before | $ 170.42 |

A Brief Overview of the History of Samsung

Samsung was founded near the southern city of Daegu in southern Korea in 1938 as a grocery product producer and distributor by Lee Byung-chul. As the company began to grow, in 1947 Samsung relocated to Seoul — only several hundred kilometers from the now North Korean border.

A year later when Korea divided into communist North Korea and democratic South Korea, Samsung became part of the new democracy. Under the democratic system, Samsung has grown into South Korea’s largest conglomerate. South Korea’s protectionist trade policies and financing for business helped the company expand into textiles, heavy industry, and electronics, among other businesses.

After Lee’s death in 1987, Samsung was divided into four smaller conglomerates. They include electronics, heavy industries and chemicals, financial services, and trade and services.

Samsung Electronics is one of 19 listed companies under the Samsung Group, in addition to 59 non-public companies (Wikipedia). Samsung Electronics grew out of semiconductor and telecommunications businesses started in the 1960s.

In 2018, Samsung surpassed Intel as the world’s largest semiconductor company by revenues with a 15.9 percent market share (Statista). Samsung has top market share in global smartphones and TV displays. In household appliances,it is the leading brand in the US market and in the top 10 globally.

Samsung Shares Forecast 2019–2023

Long-term investors in Samsung will be less concerned about the ups and downs of the semiconductor business. While in the previous five-year period, SEC’s stock performance lagged that of the consumer electronics industry, it has outperformed it by almost 10% over the last three years with a return of 33.2 percent. Smarter chips powering smarter products will drive growth going forward.

2019 – The chips are down

The memory chip cycle runs in four-year peaks and troughs, measured by sales of the top three global memory chip makers – Samsung, SK Hynix and Micron. This sales cycle, which peaked in 2017, is ready to start turning up in the second half of 2019.

A higher average selling price for the new batch of smartphones and tablets and a reduction in expenses will help profits. Though Samsung expects earnings to decline in 2019. Low-to-median stock growth is forecast.

2020 – Memory gains

The memory cycle and sales will be rebounding in 2020. Samsung will be ramping up production of its 5G radio processors as more markets build out 5G networks and start supplying transistors for Nvidia graphics chips.

In consumer electronics, foldable devices will wow consumers. Samsung will introduce new foldable phone models. What’s next? Rollable TV screens will make your tube portable. Median-to-high stock growth is forecast.

2021 – Putting the smarts in the smart home

Demand for memory and OLED products will start to peak in 2020–2021. The smart home race will be on. Do you invest in Google stock, or buy Amazon stocks or Samsung? Samsung’s edge is it also makes the connected smart home appliances.

An upgraded Bixby, Samsung’s Amazon Alexa or Google Voice, will provide new ways of connecting the smart home through artificial intelligence and the cloud. Median-to-high stock growth is forecast.

2022 – R&D ramp up

By 2022, Samsung should be facing a cyclical downturn in its semiconductor and consumer electronics business. The growing smart consumer appliance segment and higher end chips will help cushion this downturn.

2023 – More product innovation

During this forecast, Samsung plans to increase its R&D investment to maintain and strengthen its technology leadership. This includes investments in artificial intelligence for smart appliances and automotive applications, innovations in displays for smartphones, and advances in the components business.

Conclusion

So with triple exposure to the consumer electronics industry, will Samsung ride out this technology cycle? We think Samsung’s 10-year stock performance (17 percent versus 13–14 percent for the top performing consumer technology and semiconductor indices) shows the family-run conglomerate is adept at innovating its way through business cycles.

When you are ready to buy stock, we recommend doing so via a regulated online broker such as Webull if you’re a non-U.S. customer, and Stash Invest for U.S. customers.

FAQs

Samsung Electronics (NASDAQ SSNLF) is a subsidiary of the Samsung Group. The company is in the semiconductor, consumer electronics, and home appliances businesses. Its 2018 revenues were $248 billion. In the late 1980s, the Samsung industrial group was split into four companies – electronics, heavy industries and chemicals, financial services, and trade and services. Samsung Electronics is one of 19 listed companies under the Samsung Group, in addition to 59 non-public companies (Wikipedia). If you want exposure to the global semiconductor and consumer electronics market, invest in Samsung Electronics. The Samsung Group output comprises one-fifth of South Korean exports. Though, today, Samsung Electronics makes up about 80 percent of Samsung Group’s revenues.

Samsung is not listed on a US exchange. In the US, it trades over the counter (OTC) under the symbol SSNLF. In the United Kingdom, it trades as a global depository receipt (GDR) on the London Stock Exchange as SAMSUNG EL.GDR under the symbol SMSN. In Korea, it has traded under the symbol 005930:KS since it went public as Samsung Electronics Manufacturing in 1975. The name was changed to Samsung Electronics Corporation in 1984.

In 2017, Samsung switched from paying a dividend two times per year to paying a quarterly dividend. Samsung has a consistent record of paying an increasing dividend. If you bought Samsung stock OTC in the US or UK, the dividends will be paid to Samsung‘s bank representative in those countries and paid out in the local currency to investors.

Lee Kun-hee is the 77-year-old chairman of the Samsung Group. He is one of three sons of the founder and has a net worth of $16.3 billion. His son, Lee Jae-yong is vice chairman of the Samsung Group. Other second and third generation offspring of the founder head major Samsung subsidiaries and cultural organizations.

You can buy Samsung shares from online stock brokers. Markets.com and Webull are examples of Samsung online brokers providing intuitive trading platforms that make it easy to buy and sell stocks. After signing up online, type in SSNLF ticker, place your order and you will become an owner of Samsung shares. Should I invest in the Samsung Group or Samsung Electronics?

How do I invest in Samsung Electronics?

Does Samsung Electronics pay a dividend?

Does the Samsung family still control the Samsung Group?

Where and how can I buy Samsung stock?

A-Z of Stocks