Global pharma company Mylan is set to merge with Pfizer’s Upjohn unit and form a new company, called Viatris, but until that happens there remains plenty of interest in the performance of Mylan stock.

Like many drug makers, Mylan’s Q1 performance hasn’t been particularly hindered by the COVID-19 pandemic, with many consumers stocking up on drugs. Investors may also be encouraged by the firm’s agreement to help Gilead manufacture and distribute remdesivir as a COVID-19 treatment in 127 countries.

Thinking of investing in Mylan stock? This guide will explain how to buy Mylan stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Mylan Stock

If you’re looking to invest in Mylan, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is the best place to buy Mylan stock. If you’re inside the US or Canada, we suggest using Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro is a leading trading platform that offers users the chance to invest in Mylon stock by buying the underlying asset or trading CFDs. Whichever route you take, stock purchases on eToro are beautifully simple and competitively priced, with zero commission and no stamp duty.

This broker made its as a social trading platform offering innovative tools like the CopyTrader. This allows you to copy the portfolio and future traders of other investors at the click of a button.

You can open an eToro account with as little as $200, so sampling the eToro experience is relatively affordable. Or, if you’re new to the platform, we recommend starting with the $100,000 demo account and getting to grips with the platform before investing real money.

As well over 800 stocks, eToro also hosts forex, commodities, ETFs and indices. There are a range of payment methods to choose from, including PayPal, and the platform is intuitive and easy to use.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Mylan stock? Points to Consider

It’s always best to do your research before you buy Mylan stock or other pharma assets like Gilead stock or Glaxo stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Mylan business model and share price history

Mylan was founded in 1961 as a drug distributor before developing into one of America’s biggest drug manufacturers over the following decades. Today the firm engages in the development, licensing, manufacture, market and distribution of generic, branded and speciality pharmaceutical products.

Distribution remains at the heart of Mylan’s business model. In recent years the company has focused on globalizing by extending its reach to more than 165 countries and territories via a diversified supply chain and 40 facilities across the globe.

Indeed, Mylan CEO, Heather Bresch, recently noted that the company’s global supply chain experienced “minimal disruption” during the Coronavirus pandemic thanks to this supply chain diversification.

Mylan recently teamed up with Gilead Sciences to help distribute remdesivir as a possible COVID-19 treatment. Mylan’s global infrastructure and experience supplying drugs to developing countries are likely factors in Gilead’s decision to partner with the company.

The firm released its Q1 earnings report on May 10th, reporting first-quarter revenue of $2.62 billion, a 5% increase on Q1 2019, and earnings of $20.8 million, or 4 cents per share.

Overall the results were mixed, showing improved performance year-over-year and indicating that Mylan has avoided any a Coronavirus crisis downturn, but falling a little short of analyst predictions. The company also reaffirmed its full-year 2020 guidance, which anticipated revenue of between $11.5 billion to $12.5 billion.

Mylan stock dividend information

Mylan does not pay a dividend to holders of its common stock.

Mylan stock forecast and prediction

Mylan’s median 12-month target price according to CNN – based on 15 analyst forecasts – is $21.00, with a low target of $16.00 and a high target of $29.00. The median target represents a 29.39% increase on the current price of $16.23.

MarketBeat’s analyst ratings are more optimistic, reporting a median target of $23.96 and a consensus rating of Buy.

How to Buy Mylan Stock on eToro

It’s quick and easy to invest in Mylan stock at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy MYL stock.

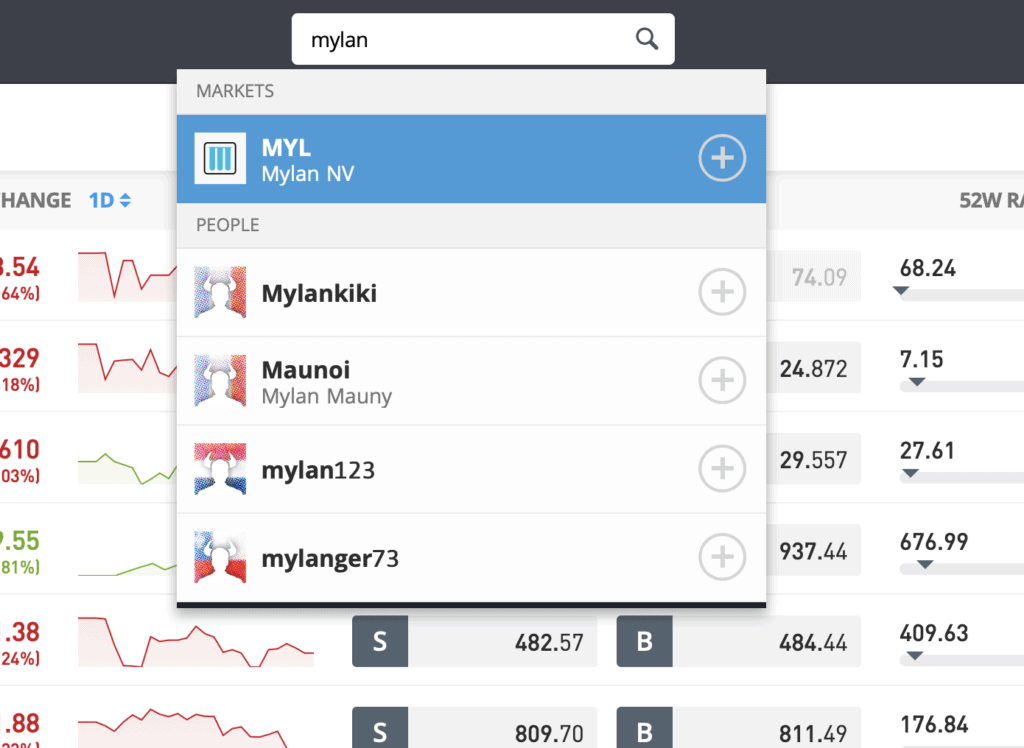

Step 1: Search for Mylan (MYL) Stock

Look up Mylan by typing the ticker symbol MYL into the search box.

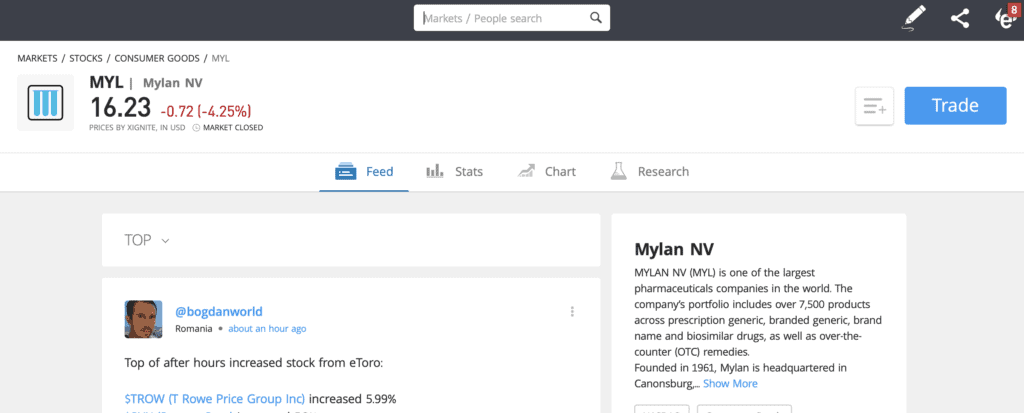

Step 2: Click on trade

Click Trade in the top right corner of the Mylan page.

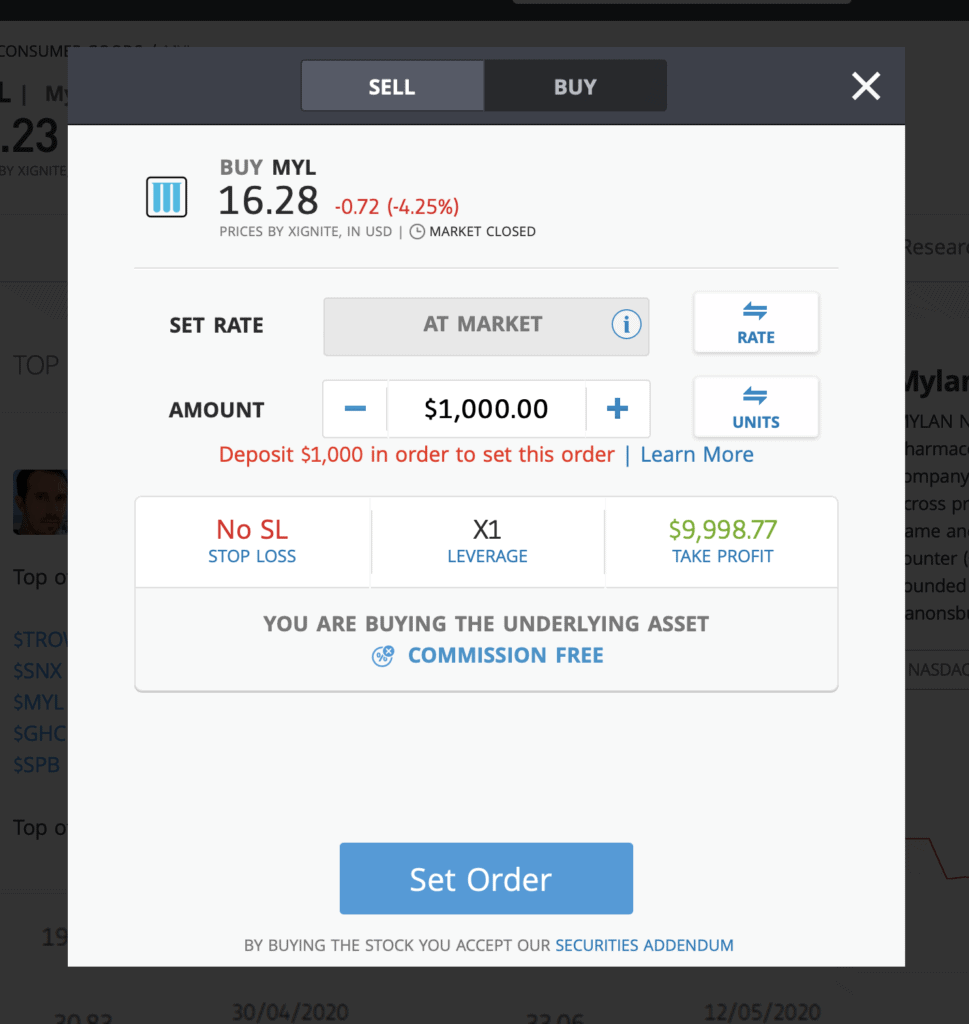

Step 3: Specify ‘Buy’

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade Mylan CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Mylan Stock – Final Thoughts

After solid, if not spectacular, Q1 results, Mylan stock looks like it should offer some upside for investors ahead of the company’s merger with Upjohn later this year. The firm seems confident of its full-year guidance and news of a licensing agreement with Gilead Sciences for remdesivir looks likely to encourage investors.

If you do want to buy Mylan stock, sign up to one of our recommended online stockbrokers. We suggest going with eToro for traders living outside the US, while Stash Invest is the best option if you live in the States.

FAQs

Should I buy Mylan stock or wait?

Overall, we think MYL is Buy stock. Analyst forecasts mostly point to some upside over the coming months and the company appears to have remained stable throughout the Coronavirus crisis.

What are the fees when buying Mylan stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy MYL stock.

Is there a Mylan stock price prediction?

Analysts estimate a median 12-month forecast of $21.00, which represents a 29.39% decrease on the current MYL price of $16.23.

What does the Mylan stock dividend pay?

Mylan doesn’t currently pay a dividend to shareholders.