Zoom’s emergence as the breakout videoconferencing service, just in time to capitalize on rocketing demand during the COVID-19 pandemic, makes it one of 2021’s biggest success stories. Unsurprisingly, such a huge surge in users has seen Zoom stock, well, zoom. While the market has mostly collapsed, Zoom’s share price has risen by more than 50% since February 20th.

Market sentiment isn’t exclusively positive, though, as security fears have dogged Zoom and there is a widely held feeling that it may be overvalued.

Thinking of investing in Zoom stock? This guide will explain how to buy Zoom stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Zoom Stock

If you’re looking to invest in Zoom, we advise creating a stock account with one of our recommended online brokers. For traders outside the United States, our top pick is eToro. If you live in the US or Canada, we recommend you go with Stash Invest.

”1.

” image0=”” pros1=”800+ stocks to buy outright or trade as CFDs” pros2=”Beginner-friendly stock trading platform” pros3=”0% commission on stock trading” cons1=”$5,000 account minimum for CopyPortfolios” cons3=”” cta-label=”Visit eToro Now” cta-url=”https://insidebitcoins.com/visit/etoro-stocks” disclaimer-text=”75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.” paragraphCount=”1″]

Should I Buy Zoom Stock? Points to Consider

Before you buy Zoom stock, you should check out some other options. A great option is to buy Amazon stocks or buy Tesla stocks, but it’s best to do your research. We always recommend taking a closer look at the company fundamentals, historic price movements and forecasts before you invest any money.

Zoom business model and share price history

It’s probably fair to say that many of Zoom’s newfound users didn’t know the company existed just a couple of months ago. After all, Zoom is a relative newcomer to the video conferencing market. While it was already valued at $1 billion in 2017, this fledgling company completed its Initial Public Offering just last year.

Of course, Zoom’s 20-fold surge in daily members in 2021 (it now has more than 300 million users) has a lot to do with a pandemic that has forced vast swathes of the world into quarantine. The moment social distancing kicked in, demand for a free, easy to use videoconferencing service exploded. Alongside a workforce that needed a way to conduct large meetings remotely, Zoom attracted a massive userbase of socially distanced friends and families.

Nonetheless, Zoom’s success is no fluke – there’s a reason it was valued at $1 billion three years ago. It’s quicker, easier and of a higher quality than other videoconferencing products, which is why so many new users have chosen it over the likes of Facetime and Skype.

There are a few ways in which Zoom beats its competitors. For a start, it doesn’t require a sign-up, which means it’s perfect for no-hassle, hastily arranged video calls. Simply send a bunch of invites in the form of an autogenerated link and you’re good to go. It also has the advantage of being able to accommodate up to 100 participants, making large meetings and mass social gatherings a possibility.

Clearly, Zoom was the right product at the right time, but can it maintain its ascendant trajectory? Issues relating to security have arisen and investors will inevitably be wondering if its popularity will last beyond lockdown. The nagging suspicion that it might be a flash in the pan will only be exacerbated by the emergence of copycat products like Facebook’s Messenger Rooms, which enables up to 50 participants.

There’s also the question of Zoom’s freemium model. While this has been instrumental in attracting so many new users during the pandemic, the model must ultimately translate into a decent proportion of paying users.

Zoom stock dividend information

Zoom doesn’t currently pay a dividend to shareholders. It’s too early in the company’s history to say whether this will continue to be the case going forward.

Zoom stock forecast and prediction

After exploding in value during the early part of the Coronavirus pandemic, Zoom stock may struggle to maintain its ascendant momentum. This seems to be the consensus among analysts, as reported by CNN, who estimate a 12-month median target of $122.50 – a 15.98% decrease on the current ZM price of $145.80.

How to Buy Zoom Stock on eToro

It’s quick and easy to invest in Zoom at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy Zoom stock.

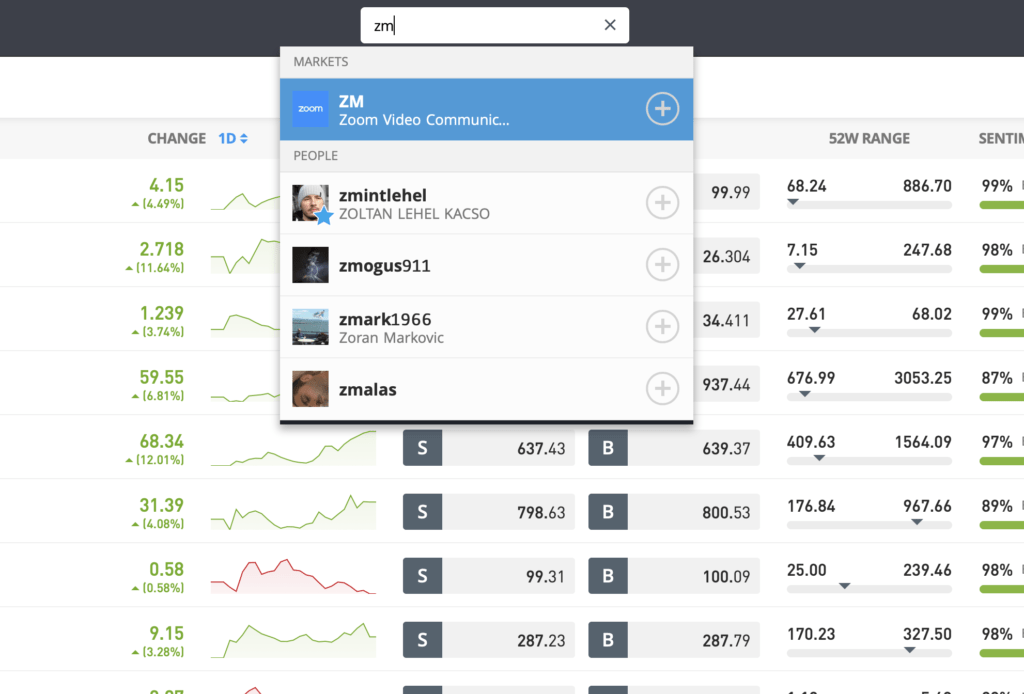

Step 1: Search for Zoom (ZM) Stock

Look up Zoom by typing the ticker symbol ZM into the search box.

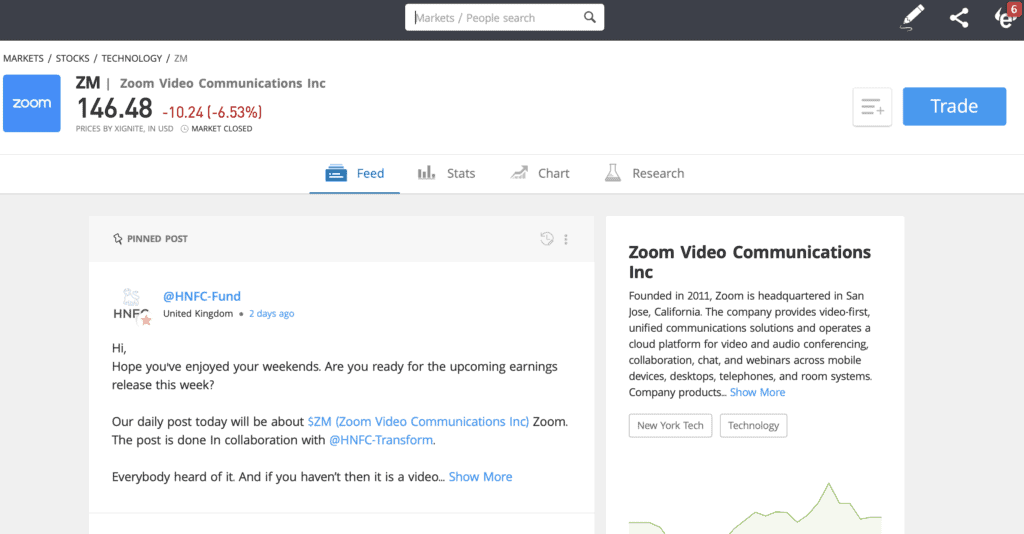

Step 2: Click on trade

Click Trade in the top right corner of the Zoom page.

Step 3: Specify ‘Buy’

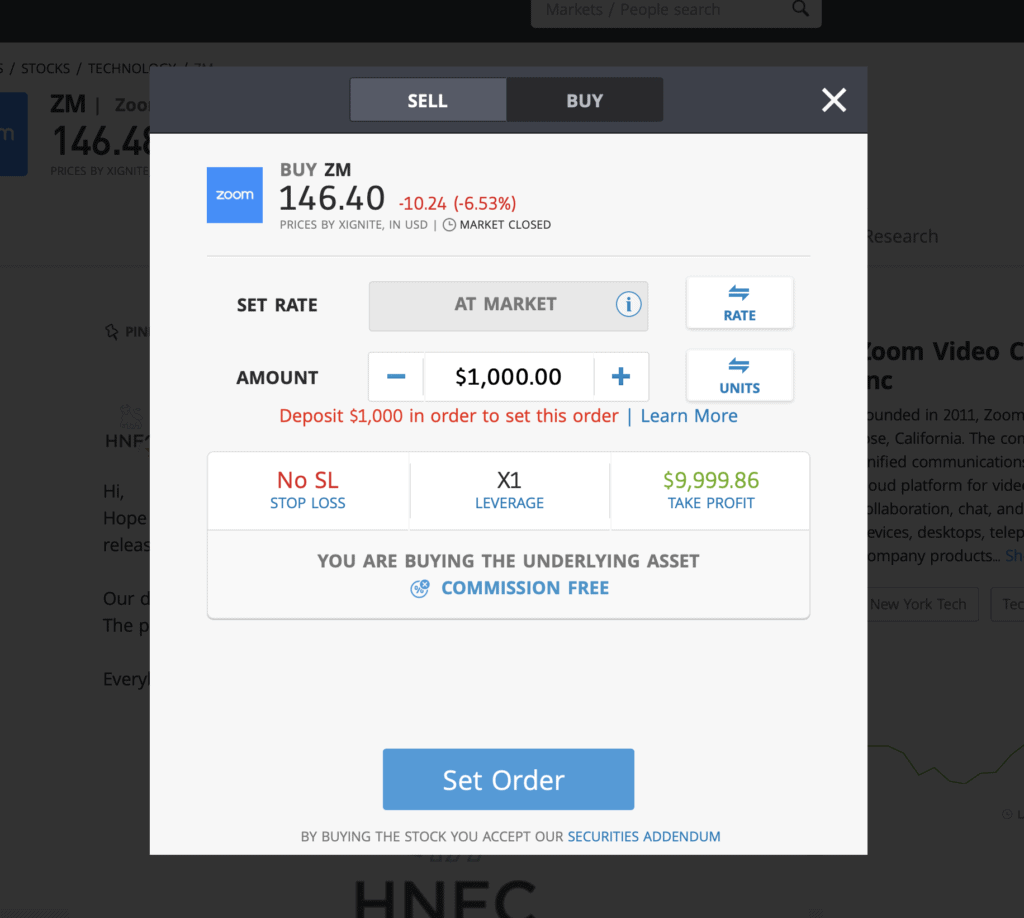

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade Zoom CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Zoom Shares – Final Thoughts

In some respects, Zoom exemplifies the mood of uncertainty that grips the markets right now, as the economic fallout of the Coronavirus crisis remains unclear. The company has undoubtedly been one of the pandemic’s biggest success stories, but it’s hard to work out what its longer-term prospects look like.

Hugely divergent forecasts reflect this uncertainty. So, in the absence of confident estimates, it seems sensible to advise caution.

If you do want to buy Zoom stock, simply sign up to one of our recommended online stockbrokers. Go for eToro if you live outside the US, and if you do live in the States we suggest you choose Stash Invest.

FAQs

Should I buy Zoom stock or wait?

Zoom has exploded in 2021 but there are doubts that new investors will see much upside. Uncertainty seems to be the prevailing sentiment. If you are looking for quick gains and not high-value stock that's volatile, then Zoom may not be the stock for you, but if you're looking longer term and are aware of the risks, then there's no reason you shouldn't consider Zoom stock.

What are the fees when buying Zoom stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that Toro doesn't add a dealing charge or any administrative fees when you buy Zoom stock.

Is there a Zoom stock price prediction?

Analysts estimate a median 12-month forecast of $122.50, which represents a 15.98% decrease on the current ZM price of $145.80.

What does the Zoom stock dividend pay?

Zoom doesn’t pay a dividend to shareholders.