Are you looking to get your hands on AVIVA shares today? If so, we would suggest reading our ultimate guide on how to buy AVIVA stocks. Within it, not only do we give you a step-by-step guide on how to buy the shares, but we’ve also listed our recommended brokers. We’ll also discuss our viewpoints on whether or not AVIVA PLC represents a good investment.

Best U.S. Platform to Buy AVIVA Stocks

If you’re based in the US and wish to buy AVIVA stocks, you’ll need to use an online stock trading broker that gives you access to UK equities. As such, we would suggest regulated US broker Stash Invest. It’s one of the most user-friendly stock trading apps and it’s super-easy to buy shares in AVIVA at the click of a button. Moreover, you only need to deposit $5, so Stash Invest is ideal if you want to start with super-low amounts.

Best Platform to Buy AVIVA Shares outside the U.S

If you’re an investor based outside of the US and wish to buy AVIVA stocks, we would suggest using Webull. The broker lists thousands of equities, and it doesn’t charge any fees or commissions. The SEC-regulated broker also offers a mobile app for those of you that wish to buy stocks on the move.

How to Buy AVIVA Stocks in the U.S.

Never purchased shares online before and need a bit of help? We’ve outlined a handy step-by-step guide below on how to buy AVIVA stocks in the US. Although there are hundreds of brokers active in the US trading space, we’ve decided to show you to process with Stash Invest. This is because it takes just 5 minutes to open an account with Stash, fees are low, and you can easily deposit funds with your US checking account.

Step 1: Create your Stash Invest account

You will first need to head over to the Stash Invest website to open an account. You can also do this via the Stash mobile app, although this is only available on Android and iOS devices. Regardless of which option you go with, click on the ‘CREATE AN ACCOUNT’ button.

Step 2: Fill out your profile

You will now be asked to enter your personal details so that Stash Invest knows who you are. This will include your first and last name, home address, date of birth, and social security number. You will also need to enter your tax status, and provide some contact details. Crucially, you will later need to verify your identity, so make sure your information is entered correctly.

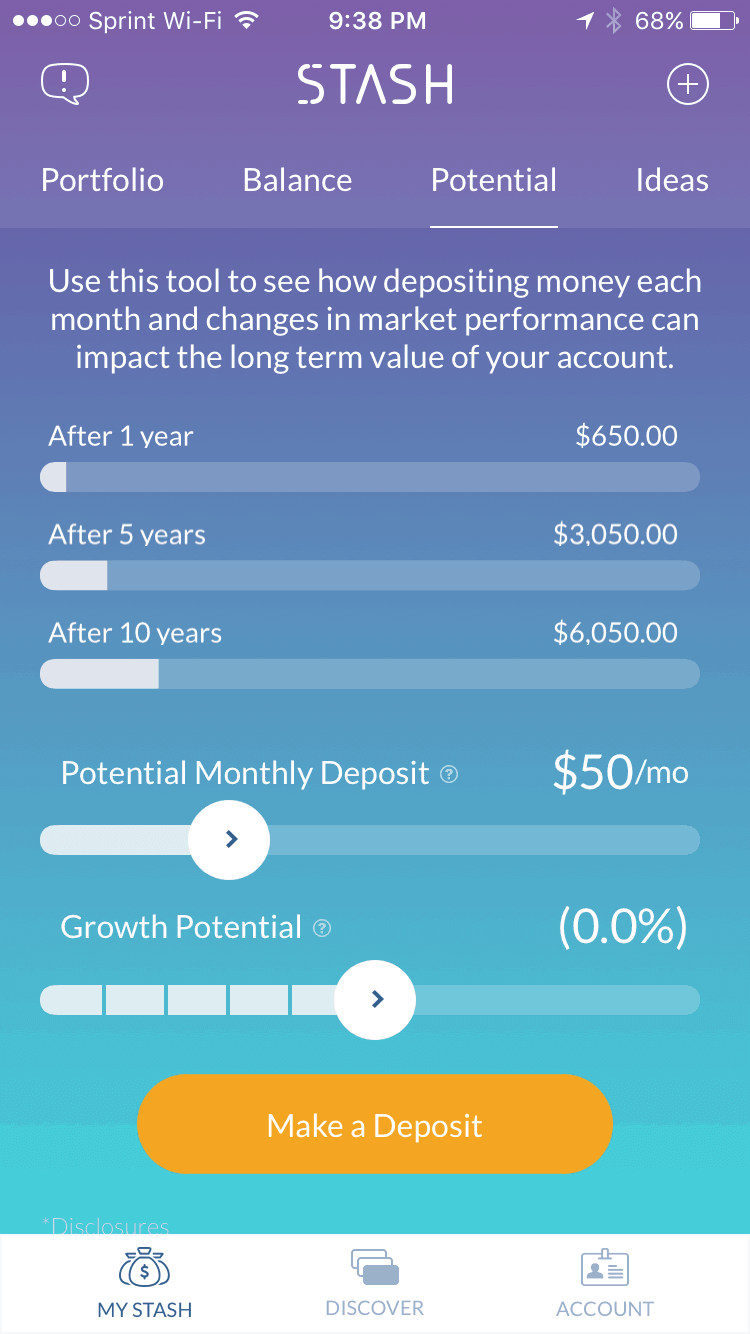

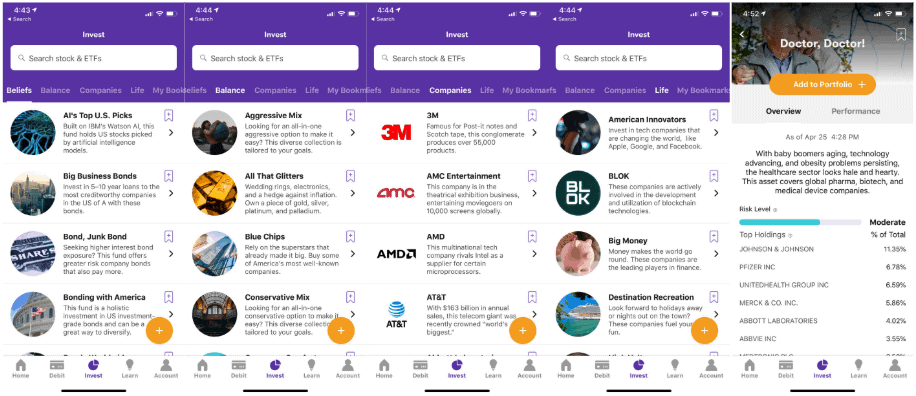

Step 3: Check your investment options

Stash Invest allows you to buy and sell stocks in an automated nature through its robo-advisor feature. In a nutshell, once you have selected your investment preferences (such as only focusing on low-risk stocks), the AI protocol will make investments on your behalf. If you like the sound of this, select which investment plan you want to opt for. If not, you can elect to invest on a DIY basis.

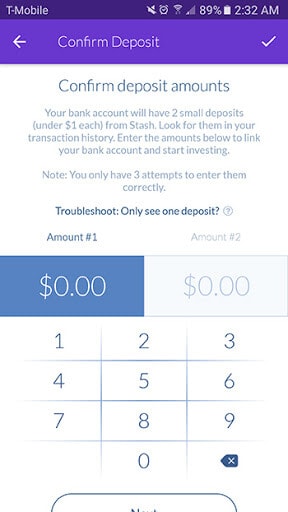

Step 4: Fund your account

You will now be asked to deposit some funds into your newly created Stash Invest account. The only option that you have is to link your US bank account with Stash. This only takes two minutes, and once the account is linked you can deposit funds as and when you see fit.

Step 5: Buy AVIVA stocks

Once you have funded your Stash Invest account, you will then be able to buy AVIVA stocks. The easiest way to do this is to enter ‘AVIVA’ into the search box and click on the result that pops up. You will then need to decide how much you want to invest. This needs to be at least $5.

You also need to decide whether or not you want to choose an entry point. If you do, you’ll need to click on the ‘limit order’ option and then enter the price that you wish the trade to be executed at. If not, simply opt for a ‘market order’ to take the next available price.

How to Buy AVIVA Stocks Outside the U.S.

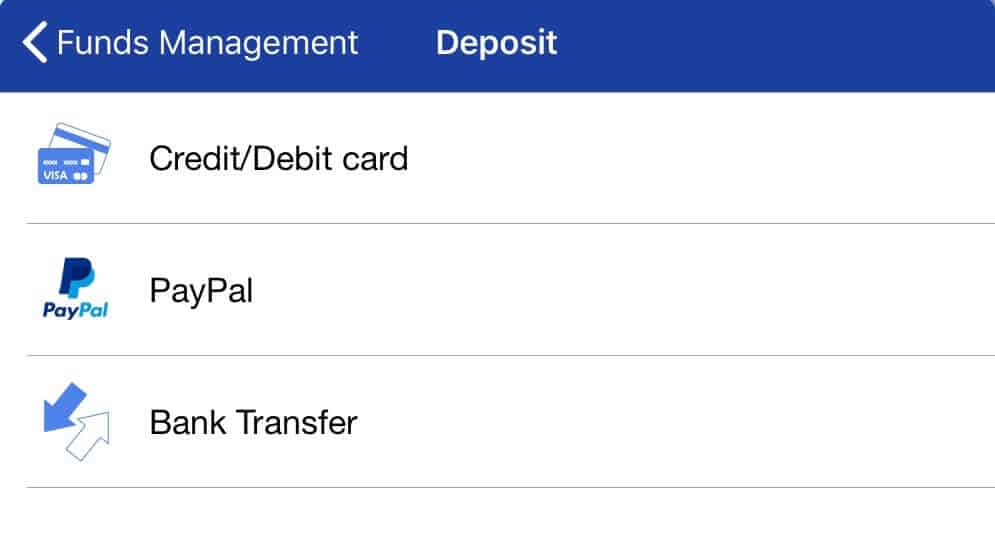

Based outside of the US and want to get your hands on AVIVA stocks today? By using our recommended broker Webull, you can complete the end-to-end investment process is just 5 minutes! This is on the proviso that you have your ID documents to hand and you are happy to deposit funds with a debit/credit card or PayPal. Nevertheless, follow the step-by-step guidelines outlined below to buy AVIVA stocks.

Step 1: Open an Account With Webull

You will first need to visit the Webull website or download the platform’s mobile app. You’ll need to open an account with the broker, so enter your full name, home address, date of birth, and contact details. Webull will also need your national insurance number (if you’re UK based).

Webull will also need to explore how much experience you have when trading online. The reason for this is that the platform offers leveraged products, meaning that you could lose more than you originally invested.

Step 2: Verify Your Identity

Webull will now be required to verify your identity. If you have your passport or driver’s license to hand, simply take a clear picture of it and upload the document. In most cases, Webull will be able to verify your identity automatically.

If Webull is unable to validate your address through its third-party sources, it will ask you to upload a supporting document. This can consist of a bank statement or utility bill.

Step 3: Fund your Account

Once your Webull account has been verified, you can then deposit funds. The good news is that all deposits at the platform are free, and unless you are using a bank account – they are instant too. As such, we would suggest opting for a debit/credit card or PayPal. Just remember, you’ll likely be charged a cash advance fee by the payment issuer if opting for a credit card, which is out of the control of Webull.

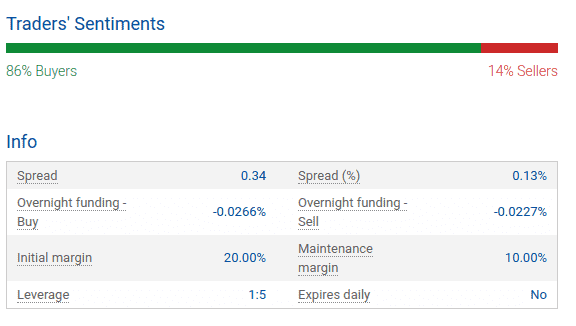

Step 4: Consider AVIVA CFDs

Webull offers stocks and shares in the form of CFDs (Contract-for-Difference). This means that you will benefit from super-low fees, and the ability to buy and sell your AVIVA shares at the click of a button. CFDs also allow you to trade AVIVA stocks on leverage. This means that you can trade with more money than you have in your account. Current ESMA regulations limit this to 5:1 on equities like AVIVA.

Furthermore, opting for the CFD route at Webull will allow you to ‘short’ AVIVA stocks if you think that the price will go down. On the flip side, CFDs do not allow you to receive dividend payments, so do bear this in mind.

Step 5: Buy AVIVA Stocks

If you like the sound of what AVIVA CFDs offer, you can now head straight over to the trading page. Simply enter ‘AVIVA’ into the search box and click on the corresponding result. Next, you’ll need to decide whether you want to place a ‘buy’ or ‘sell’ order.

A buy order means that you think the price of AVIVA will go up, and a sell order means you think the price will decline. You then need to enter the amount that you wish to purchase, and whether or not you want to apply leverage. Finally, you need to set your entry price via a limit order. If you’re happy to take the next available price, select a market order.

About AVIVA

AVIVA is a UK-based institution that specializes in both insurance and pensions. Regarding the former, this covers heaps of insurance products to the consumer marketplace. This includes the likes of home insurance, health insurance, life insurance, and car insurance. And the former – AVIVA offers pensions and retirement funds. Although the company is based in the UK, it also has a presence in other jurisdictions.

Q

Key marketplaces include Ireland, France, and Poland in Europe, Canada, and multiple nations in Asia. Crucially, AVIVA has since expanded into the lucrative Chinese marketplace. In terms of its standing as a public company, AVIVA is listed on the London Stock Exchange. The sheer size of its balance sheet ensures that AVIVA forms part of the FTSE 100 index. At the time of writing in February 2020, AVIVA has a share price of 404.10p. This represents a total market capitalization of £15.8 billion.

Should you Invest in AVIVA?

AVIVA shares have been somewhat volatile over the past couple of decades, which is often the case with large-scale insurance companies. With that said, early investors have not been rewarded for keeping faith in the company since it went public. For example, AVIVA shares were originally priced at 500p in 1995. Fast forward to 2020 and its shares are worth less than its initial listing price at 404.10p. This means that by holding onto the shares for 25 years post-IPO, early backers are looking at a net loss of 19%. When you also take into account the effects of inflation, this is somewhat of a concern.

With that being said, AVIVA has gone through a couple of market surges since it went public. For example, the company hit its all-time high in 1998 at 1,236p per share. This amounts to an increase of 147% from its IPO listing price. AVIVA shares also went through a positive period in 2006, before peaking at 826p. The company hit all-time lows after the financial crisis of 2008, with shares hitting 198p. Although the shares have since recovered, they have remained in a stagnant range of between 380p and 530p since 2014.

Nevertheless, we need to look beyond historical share prices to gauge what the future holds for AVIVA. As such, we would suggest reading through the following pros and cons of investing in AVIVA.

Pros of Investing in AVIVA Stocks

✔️ Recent AVIVA Earnings Were Positive

In terms of the pros, let’s start with the earnings report that AVIVA published in 2019. Firstly, operating profits in the first half of 2019 increased to £1.4 billion, amounting to a rise of 1%. As per the report, this was mainly a result of a strong performance in its general insurance division. Moreover, it was also notable that AVIVA increased its dividend yield to 3%.

With the company paying 9.5p per share, this represents good value for those of you that seek passive income. Zooming into the share performance of AVIVA over the past 12 months, prices have remained largely flat. In fact, shares were priced at 420p 12 months ago, representing a movement of just -4.05% at today’s value.

✔️ Management are Focusing on Cutting Costs

Although it is positive that AVIVA saw operating profits grow by 1%, this is still somewhat stagnant. As such, management at AVIVA is now placing a strong focus on reducing costs in unprofitable divisions. This includes a probable exit from the Asian markets, which at present hasn’t been overly successful for AVIVA.

Moreover, AVIVA has sold a number of smaller subsidiaries that operate within the group, subsequently allowing management to free up some much-needed capital. This became evident in its most recent report, with AVIVA now looking at a Solvency ratio of 194%. This is notable, as management initially set a ratio target of between 150-180%.

✔️ CEO Maurice Tulloch has set a Clear Direction for AVIVA

Maurice Tulloch took over the reins in 2019 as CEO. Tulloch has been at the company for 28 years, so it’s an appointment that pleased shareholders greatly. At the forefront of what Maurice Tulloch is looking to achieve is a re-energization of the company.

This includes key metrics such as reducing the complexities of consumer insurance, and drastically improving the customer experience. While it is too early to assess whether or not CEO Tulloch will manage to take AVIVA to the next level, he’s arguably the right person to lead the way when you take into account his near-on three-decade exposure to the firm.

Cons of Investing in AVIVA

❌ AVIVA Share Price Worth Less Than IPO Listing After 25 years

It is not often that you hear about a publically traded company that is worth less than it was 25 years prior. Unfortunately for shareholders, this is exactly the case with AVIVA. In Layman’s Terms, this means that the company hasn’t grown at all since its 1995 IPO listing. Sure, AVIVA did go through a couple of stock market surges in both 1998 and 2006, but that was short-lived. This can only mean one of two things.

Either AVIVA was heavily overpriced during its initial IPO listing, or it has simply been poorly managed. As such, it remains to be seen whether AVIVA will ever regain its prior all-time high of 1,236p. Crucially, juicy dividends of 3% aren’t anywhere near enough to cover the stagnation of its share price.

❌ International Expansion Hasn’t Gone to Plan

AVIVA operates in multiple jurisdictions, albeit, it has dedicated vast resources into specific markets in recent years. At the forefront of this are the South East Asian and China markets. The latter was initially a key target for AVIVA, although it appears that it will be exiting the region in the coming years.

Moreover, Canada has also resulted in losses for the firm. This was mainly put down to extreme weather and an increase in car insurance claims. With that said, losses of 102.4% in Canada last year is highly alarming. Once again, it potentially points to incompetence from management.

❌ Debt Levels are Still too High

Although it is notable that the management team at AVIVA have put measures in place to reduce operating costs, debt levels are still too high. Furthermore, and perhaps most importantly, much of this debt is attached to less than favourable interest, which is eating away at its cash reserves.

This is likely to be the case for at least the next few years, meaning that further growth could be hindered. This is especially the case when you consider its recent acquisitions of RBC and Friends Life. Ultimately, it might be worth seeing whether or not AVIVA meets its ambitious debt reduction targets before making an investment.

Conclusion

In summary, there’s not too much going right for AVIVA shareholders at present. Crucially, the company now has a lower share price today than it did 25 years ago when the company first went public. Whether that’s a result of poor management or an initial overvaluation remains to be seen. Either way, long-term shareholders have likely lost out by keeping faith in AVIVA.

With that being said, recent earnings were somewhat positive, with AVIVA increasing its operating profits to £1.4 billion last year. This represented a steady increase of 1%. Moreover, the management team have set some rather ambitious targets to reduce debt levels. If successful, this will free up some of the cash it is currently spending on highly unfavourable interest payments.

Nevertheless, if you believe that AVIVA stocks can be bought on the cheap – and you think that the future direction of the company is positive, you can buy shares today at US broker Stash Invest. If you’re not based in the US, we would suggest using Webull.

FAQs

Most online stockbrokers allows you to purchase stocks with a debit/credit card, e-wallet, or bank transfer. .

If you are using a stockbroker that allows you to buy fractional shares in AVIVA, you can normally get started with a minimum investment of just $5 .

AVIVA's all-time high share price stands at 1,236p, which it hit way back in 1998. Based on its current price of 404p, this seems like a distant memory.

No longer want to keep hold of your AVIVA stocks? If so, you can sell them at the current market price with the broker you purchased them from.

Yes, AVIVA is a dividend-paying company, so you'l receive dividends as and when they are distributed. Take note, if you hold AVIVA stocks in the form of CFDs, you won't be entitled to any dividends, as you do not own the underlying asset. What payment methods can I use to buy AVIVA stocks?

What is the minimum number of AVIVA shares that I can buy online?

What is AVIVA's all-time share price?

How do I sell my AVIVA stocks?

Will I get dividends if I buy AVIVA stocks?